If you have a Discover card, you can access your FICO credit score for free without causing any damage to your credit. Is the FICO score checker on the Discover website accurate, though?

Furthermore, is this the same score that lenders will look at when assessing your creditworthiness?

The short answer is that your Discover FICO score is an accurate representation of your credit score calculated using the FICO 8 model and your TransUnion credit report. However, this isn’t necessarily the same score that lenders will look at when deciding whether to extend your credit or a loan.

The short answer is that your Discover FICO score is an accurate representation of your credit score calculated using the FICO 8 model and your TransUnion credit report. However, this isn’t necessarily the same score that lenders will look at when deciding whether to extend your credit or a loan.Let’s take a closer look at what you need to know about the free FICO 8 score you can receive as a Discover cardholder.

A FICO score is a credit score that is used to assess an individual's creditworthiness. FICO stands for Fair Isaac Corporation, which is the company that developed and maintains the scoring model. This type of credit score is widely used by lenders, such as banks, credit card companies, and mortgage lenders, to evaluate how risky it is to lend money to a particular consumer.

The FICO score is based on information in your credit report, which includes details about your credit history, such as:

Your FICO score is a three-digit number that typically ranges from 300 to 850, with higher scores indicating better creditworthiness.

Your FICO score is calculated using a number of different pieces of credit data that are recorded in your credit report.

The factors that contribute to your FICO score are weighted as follows:

A higher FICO score is generally seen as a positive indicator to lenders, as it suggests that you are more likely to repay your debts on time. This can result in better loan terms, lower interest rates, and access to a wider range of financial products and opportunities. On the other hand, a lower FICO score may lead to less favorable lending terms or even difficulty in borrowing money at all.

It's important to regularly monitor your FICO score and credit report to ensure that the information is accurate and up to date, as errors or inaccuracies in your credit report can negatively impact your credit score. You can obtain your FICO score from various credit reporting agencies.

You are entitled to one free credit report from each of the major credit bureaus annually through AnnualCreditReport.com. Until the end of 2023, you can actually get a free credit report from each bureau once a week from the same site.

FICO scores are generally considered to be accurate and reliable indicators of an individual's creditworthiness. At the same time, there are a few essential points to keep in mind when trying to understand the accuracy of your FICO score:

At the end of the day, credit scores are just one of the pieces of information lenders take into account when assessing your creditworthiness. When you apply for a mortgage, for example, they will usually consider factors including employment history, income, and debt-to-income ratio.

If you have a Discover credit card, you can access your FICO score for free through your online account.

It's important to note that consumer scores you receive from a credit card issuer are, ultimately, limited in their usefulness. At the same time, this doesn't mean it can be a valuable tool as you keep your finger on the pulse of your financial health.

Discover provides you with your FICO Score 8. This is one of the most widely used scoring models. In order. to calculate your score, they use data from your TransUnion credit report.

The score provided by Discover is generally considered to be accurate but with some caveats. This is a FICO 8 score calculated based on your TransUnion credit report and using information from one particular moment in time. Other credit scoring models or the same model using your credit report from a different credit bureau could return different results. Similarly, your credit score is dynamic, meaning that it can change quickly based on newly reported information.

When you take a look at your Discover credit score using their free FICO score checker, you are looking at a calculation that is based on your credit history at a specific moment in time. This means that there's a good chance your credit score will vary from month to month.

When you take a look at your score, it's a really good idea to always glance at the "as of" date.

One of the reasons that this type of free credit score service that credit cards so often offer is so valuable is that it won't hurt your credit score.

There are two different ways to check a credit score-- through a hard inquiry and a soft inquiry.

Soft inquiries, on the other hand, can only be viewed by you on your credit report. These don't impact your credit score. When you check your credit score through Discover's FICO score checker tool, it is a soft inquiry and not a hard inquiry into your credit.

There are tons of things you can do to keep an eye on your financial health, one of which is frequently checking your credit score. There are a number of ways you can access your credit score, including some free and some paid methods.

What's important to know is that the credit score you receive in this way isn't necessarily going to be the same score that a lender will look at when you apply for a loan. For this reason, it can be a great way to keep your finger on the pulse of your credit, but it might not be enough if you're thoroughly auditing your financial situation before applying for a mortgage or a loan.

When we talk about credit scores, we usually discuss them as if each individual has one score that's carved in stone. In reality, though, each of us usually has several different credit scores that change over time as our financial circumstances change.

It's common for individuals to have different credit scores because there are multiple credit scoring models and credit bureaus, and each may use slightly different criteria and algorithms to calculate your credit score.

Here are some key reasons why you might have different credit scores:

FICO scores and VantageScores are both credit scoring models used by lenders and creditors to assess an individual's creditworthiness. At the same time, they are not identical processes, and both scoring models can return different results when an individual's credit score is calculated.

Let's take a look at some of the primary differences between these two scoring models.

FICO scores typically range from 300 to 850, with higher scores indicating better creditworthiness. Most lenders use FICO scores, and they are well-recognized and established in the lending industry.

VantageScores, on the other hand, can have different scoring ranges depending on the version being used. VantageScore 3.0 and 4.0 have a range of 300 to 850, similar to FICO. However, VantageScore 1.0 and 2.0 had a range of 501 to 990. This variation can sometimes lead to confusion when interpreting the scores.

Several factors are taken into account when your FICO score is calculated, including payment history, credit utilization, length of credit history, types of credit used, and recent credit inquiries. Payment history and credit utilization are given significant weight in FICO scoring models.

VantageScores also consider payment history, credit utilization, length of credit history, types of credit, and recent inquiries, but some models can weigh certain factors differently. For some versions of the VantageScore, more emphasis is placed on recent credit behavior and trends in your credit history.

How these two models were developed is also an important distinction between them. The Fair Isaac Corporation developed the FICO scoring model in 1989, which was the first broad-based consumer credit score. FICO has been around for several decades, and its scoring models are widely used by lenders across various industries, including mortgages, auto loans, and credit cards.

VantageScore, on the other hand, is much newer. Developed jointly by the three major credit reporting agencies-- Experian, Equifax, and TransUnion-- it was created as a competitor to FICO scores and has undergone several iterations over time.

Lenders typically use FICO scores when evaluating a borrower's creditworthiness. FICO scores are widely recognized and have been in use for many years, making them the preferred choice for most lenders in various industries, including mortgage lending, auto financing, credit cards, and personal loans.

It's important to understand that there are several versions of FICO scores, with FICO Score 8 being one of the most commonly used iterations. However, some industries and lenders may use different versions of FICO scores tailored to their specific needs. For example, mortgage lenders may use FICO Score 2, FICO Score 4, or FICO Score 5 for mortgage lending decisions.

While FICO scores are the primary credit scores used by lenders, some lenders may also consider other credit scores or factors in their decision-making process. For example, they may use their proprietary scoring models or take additional information into account, such as income and employment history.

Mortgage lenders typically look at your FICO scores when assessing your creditworthiness for a home loan. The specific version of the FICO score that they use can vary, but for mortgage lending, lenders commonly rely on older versions of the FICO score, specifically FICO Score 2, FICO Score 4, or FICO Score 5. These versions are designed to evaluate a borrower's credit risk, specifically for mortgage-related decisions.

This means that the score you see when you look at the score provided by Discover– your FICO 8 score– could be quite different from what the mortgage lender looks at.

FICO Score 8 and older FICO scoring models differ in a few key ways, including how they assess and weigh various factors in your credit history.

Here are some of the main differences between FICO Score 8 and its predecessors:

FICO Score 8 is more lenient in how it treats collections accounts. It doesn't penalize you for paid collections accounts, which means that if you've paid off a collection, it won't have as negative an impact on your score as it might with older FICO models.

Some older FICO models penalize your score for collections accounts regardless of whether they've been paid or not.

Authorized user accounts are incorporated into scoring when the FICO 8 model is used. This allows individuals to potentially benefit from the positive payment history of the primary account holder. Some older FICO models don't include authorized user accounts in the credit history used for scoring.

FICO Score 8 may be less punitive when it comes to high credit card balances. While it still considers your credit utilization (the amount of credit you're using relative to your credit limit), it may not penalize you as severely for high balances compared to some older FICO models.

Another important distinction is that FICO Score 8 incorporates updated information about the way that credit reporting agencies handle public records, such as tax liens, evictions, and civil judgments. It no longer factors in certain types of public records that may be less accurate or complete, potentially benefitting some consumers that have negative information on their credit reports.

Older FICO models might have different criteria for public records, which can impact your score.

Before I sign off, let’s look at some of the most common questions about the free score offered by Discover.

When you use the credit score service available through your Discover account, you'll be looking at your FICO Score 8. As one of the most widely used scoring models according to FICO, this can be a great way to gauge your credit health generally.

When you look at your Discover credit score, you're viewing a calculation that was made using data from your TransUnion credit report. It's important to understand that each of your credit reports can sometimes have different information on them, as not all creditors and lenders report to all three bureaus.

In some circumstances, this can mean that your credit scores calculated from different credit bureaus vary quite a bit. For example, if you defaulted on a credit card debt and this was only reported to Experian, your Experian score might be notably lower than those calculated using your Equifax and TransUnion reports.

There are a number of reasons why you might see some variability in your credit scores.

Here are some of the primary explanations for this:

Tools like the one offered by Discover that allow you to check your credit score for free can be very useful as you keep an eye on your financial health. When your credit score indicates to lenders that you are a low-risk borrower, you’ll be much more likely to be approved for credit and loans as well as better able to snag lower rates.

At the same time, the credit score you see when you use this Discover tool is only one of your many potential credit scores. For this reason, it’s important to watch all three of your credit reports for errors, inaccuracies, or trouble spots that need to be addressed.

Are you working to improve your credit score? Make sure you check out our Credit Building Tips blog for more articles, how-tos, and guides.

There are few things more distressing than seeing a transaction you don’t recognize on your credit card statement. If it’s clear that someone used your credit card to buy gift cards, you’re probably wondering what steps you need to take next.

Beyond that, though, you might be curious why someone would buy gift cards rather than actual products or services once they got a hold of your credit card information.

Purchasing gift cards is a common strategy by credit card thieves because it’s fairly easy and anonymous to turn gift cards into cash. If you’ve been the victim of this type of identity theft, there are a number of essential steps you’ll want to take right away to ensure you’re not liable for the unauthorized transaction while also protecting your account from further fraud.

Purchasing gift cards is a common strategy by credit card thieves because it’s fairly easy and anonymous to turn gift cards into cash. If you’ve been the victim of this type of identity theft, there are a number of essential steps you’ll want to take right away to ensure you’re not liable for the unauthorized transaction while also protecting your account from further fraud.If someone stole your credit card number and used it to buy gift cards, stick with us to learn what you need to do next.

When someone steals your credit card information and uses it to purchase gift cards without your authorization, it is typically referred to as "credit card fraud.”

Credit card fraud and gift card scams are related but distinct types of financial scams, each involving different methods and objectives. Though you might assume that it is considered a gift card scam to use your credit card to buy gift cards, this falls under the credit card fraud category.

Credit card fraud involves the unauthorized use of someone's credit card or credit card information to make purchases or withdraw funds without the cardholder's consent. The goal is typically to obtain goods or services directly using the compromised credit card.

Thieves may steal physical credit cards, clone cards, or obtain credit card details through data breaches, card skimming, or online hacking. They then use these cards or information to make unauthorized purchases– in some cases, the unauthorized purchase of gift cards.

Credit card fraudsters are usually motivated to commit this type of crime in order to acquire goods or services paid for with the victim’s credit card.

At the same time, you'll also hear about "gift card scams," which is a term that actually encompasses a different type of fraudulent activity than using stolen credit card info to buy gift cards.

Gift card scams involve tricking individuals into purchasing gift cards and providing the scammer with the gift card information or codes. The primary objective is to obtain monetary value in the form of gift cards, which can be used, sold, or converted into cash.

Gift card scams include things like:

Fraudsters have figured out a lot of different ways to steal money using gift cards. Here are some other common types of gift card scams:

Credit card thieves might choose to purchase gift cards using stolen credit card info for a number of reasons, but the general gist is that gift cards provide a relatively easy and convenient way for them to convert stolen credit card information into usable assets while reducing the risk of getting caught.

Here are some of the most prominent reasons credit card thieves might use your card info to buy gift cards:

Discovering that someone has used your credit card to purchase gift cards without your authorization can be distressing, but taking prompt action can help mitigate the situation and protect your financial interests.

Let's take a look at the steps you should take if you suspect unauthorized gift card purchases on your credit card.

Call the customer service number provided on the back of your credit card or on your credit card statement. Let them know about the unauthorized transactions and provide details of the charges, such as the merchant's name, transaction date, and transaction amount.

Another essential step when you realize someone has stolen your card info to buy gift cards (or anything else, for that matter,) is to ask the credit card issuer to place a temporary hold or freeze on your credit card to prevent further unauthorized transactions.

Contacting your card issuer and having them freeze your card can help take a huge weight off your shoulders. You don't have to worry that someone is out there racking up unauthorized charges on your card, giving you some breathing room to deal with the situation and get back on track.

Now that you have placed a hold or a freeze on your card, you'll want to follow the credit card issuer's instructions for disputing the unauthorized charges. They may require you to complete a dispute form or provide additional documentation. Be sure to clearly explain that the transactions were unauthorized and that you did not make the purchases.

If necessary, ask the credit card issuer to cancel your current card and issue a new one with a new card number. This will prevent the thief from making additional unauthorized charges. Furthermore, depending on how they accessed your card info, it helps ensure other people don't get their hands on your card number and details.

Even if you've only noticed one strange transaction on your account, the fact that someone has used your info to buy a gift card without your permission means it's possible other unauthorized transactions have been made.

Carefully review your credit card statements to identify any other suspicious or unauthorized transactions. Report any additional unauthorized charges to your credit card issuer promptly. If one person was able to access your card info, it's possible other transactions were made without your permission.

If you believe your credit card information was stolen, consider filing a police report. This documentation can be helpful in resolving the situation and, in some cases, may be required by your credit card issuer.

Will the police catch the person who used your credit card? The answer is: that it depends. Most experts say you shouldn't hold your breath expecting that law enforcement will be able to track down credit card thieves and fraudsters.

At the same time, the nature of the crime will impact how likely it is for the police to seriously pursue it and even catch the perp. For example, if your physical card was stolen and you have evidence that points toward a suspect, it's a lot more likely anything will come of filing a police report than if your info was stolen online.

It's best to document all communication with your credit card issuer, including dates, times, and the names of customer service representatives you speak with. This way, you can easily reference instructions you were given by customer service reps when discussing the issue with your credit card company over time.

Your hard work isn't done yet-- make sure you keep a close eye on your credit reports for any unusual activity. You can obtain free credit reports from the three major credit bureaus (Equifax, Experian, and TransUnion) annually at AnnualCreditReport.com. For the rest of this year, you can actually get free weekly credit reports.

There are a number of different services you can sign up for to help in your efforts to monitor your credit, including CreditWise, Experian, and Credit Karma.

The next thing you'll want to do is take steps to protect your personal and financial information. This may include updating passwords, enabling two-factor authentication, and being cautious about sharing sensitive information online or over the phone.

The good news is that federal laws protect consumers from liability for unauthorized credit card charges, so you should not be held responsible for fraudulent gift card purchases. However, it's essential to report unauthorized transactions promptly and work with your credit card issuer to resolve the issue as swiftly as possible.

Depending on how quickly you realized that your credit card info was being used by fraudsters to buy gift cards, you might have a little work to do when it comes to cleaning up your credit report. Dealing with the fallout from identity theft can feel totally overwhelming, but the truth is it’s worth taking the necessary steps so you don’t suffer the consequences of bad credit down the road.

In our digital world, there is always some risk that our financial and personal information will end up in the hands of someone with bad intentions. At the same time, you can take several steps to significantly reduce the risk of theft and unauthorized use of your credit cards.

When we make passwords for our online accounts, it’s tempting to prioritize making them easy to remember. However, the easier they are for us to remember off the top of our heads, it usually means it’s easier for fraudsters to figure out what our passwords are. You’ll want to create strong, complex passwords for your online accounts, especially for banking and credit card websites.

- In your effort to make strong passwords, use a combination of letters, numbers, and special characters.

It’s essential that you avoid using easily guessable information like your birthdate or common words in your passwords. You might consider using a reputable password manager to generate and store your passwords securely.

Many credit card companies will let you enable two-factor authentication, which is often abbreviated as “2FA”. Whenever possible, enable 2FA for your online accounts, including your credit card accounts. This adds an extra layer of security by requiring a second form of verification, such as a one-time code sent to your mobile device.

We’re all busy, and it’s easy to simply use our credit cards and let our payments be automatically withdrawn month after month without ever taking a closer look at our account.

The truth is, though, it’s a good habit to regularly monitor your credit card accounts.

- At least monthly, review your credit card statements and online banking activity. As you’re going through the statements, keep an eye out for any unauthorized or suspicious transactions.

You can also set up account alerts to receive notifications of unusual activity on your credit card. Though credit card fraudsters continue to get more sophisticated over time, so do the security measures used by credit card issuers. By signing up for this type of service, you can catch strange and unusual activity right away.

It’s easy to assume that the biggest threats to our credit card info and personal financial info all exist online. However, it’s just as important to protect your physical card.

Keep your physical credit cards in a secure location, such as a wallet or cardholder. Protect your card's PIN by not sharing it and covering the keypad when entering it at ATMs or point-of-sale terminals. It can be a good habit whenever you use your card to double-check that it’s back in its secure spot before leaving a retail store or restaurant.

One essential step to avoiding having your credit card info stolen to be used to buy gift cards is to only provide your credit card information on secure websites. Secure websites will have “https://” as a prefix rather than just “http://.” You should also notice an image of a padlock in the address bar when a website is secure.

- It’s honestly hard to be too cautious online. It’s always best to avoid clicking on suspicious links or downloading attachments from unknown sources in emails and messages, even if it seems completely harmless.

You’ll also want to be cautious when sharing your card information over the phone; always make sure you verify the identity of the caller and the purpose of the call. If someone calls you claiming they’re from a company or institution you trust and are asking you for personal or financial information, it is good practice to hang up and call them back. Use the phone number you have on the back of your credit card or on the institution’s secure website, not from an email you received or a number you are given over the phone.

Another step you can take to avoid credit card fraud is to keep your computer and mobile devices up to date with the latest security updates and patches. It’s also a good idea to use reputable antivirus and anti-malware software to protect against malware and keyloggers.

The ability to access the internet and take care of our important business anywhere is really convenient, but it’s honestly not a good idea to use Public Wi-Fi for online banking or credit card transactions. Avoid making online purchases or accessing sensitive accounts (including banking and credit card accounts) while using public Wi-Fi networks, as they may not be secure.

Fraudsters and identity thieves can sometimes get your information by going through your mail or trash. Make sure you shred or securely dispose of any documents containing your credit card information, such as credit card statements and credit card offers.

Many credit card issuers offer customizable transaction alerts. You can customize these alerts so that you are informed about certain transaction amounts or types– ensuring you’re notified right away of any unusual activity.

If you’ve realized that someone stole your credit card (whether it was the physical card or your information) to buy gift cards, it’s natural to feel distraught and violated. How could someone do something like this? What if it keeps happening?

The truth is, there are people out there who are willing to steal in order to benefit themselves. This is an unfortunate reality, but what we can do is take steps to protect our financial information both IRL and online.

Furthermore, by keeping a close eye on our financial accounts and credit reports, we can catch strange and unusual activity quickly. The sooner we realize that an unauthorized transaction has been made, the sooner we can remedy the situation and protect our accounts from further theft.

Are you working to improve your credit after your identity was stolen? Are you motivated to set up a financial system for yourself that offers you the best possible protection from credit card fraud? If so, make sure you check out the rest of our Credit Building Tips blog for more resources, articles, and guides.

If you need fast access to cash, you might have found a number of online loan and line of credit providers that say you can have money deposited to your account the same day you're approved. One such company is CreditFresh, which advertises that they offer "a flexible way to borrow." So, is Credit Fresh legit, or is it a scam?

The answer to this question depends on what you mean by "scam."

CreditFresh is a legitimate company that offers personal lines of credit to consumers. However, this is a particularly expensive way to borrow money. If you're not careful, you could end up spending a tremendous amount on interest.

CreditFresh is a legitimate company that offers personal lines of credit to consumers. However, this is a particularly expensive way to borrow money. If you're not careful, you could end up spending a tremendous amount on interest.While it might be useful in a bind when you have no other options, there are generally better, less expensive ways to borrow money. In this article, we'll take a look at everything you need to know about CreditFresh and borrowing money with less-than-ideal credit.

CreditFresh is a company that provides lines of credit through its partnership with a number of financial institutions.

They work with a number of different Bank Lending Partners, including:

When you submit a request for credit using CreditFresh, the line of credit could originate from one of the above-listed banks or another one of their partners.

CreditFresh offers lines of credit to consumers with low credit scores that need to get their hands on some cash fast. While this might seem like a lifesaver if you're in a bind, it's important to understand the costs of borrowing money in this way.

CreditFresh markets the line of credit they offer as straightforward and transparent. It's important to understand the potential costs of borrowing money in this way versus other options.

Any time you're borrowing money, there are a lot of important questions to ask. One key question is: what's the true cost?

In the fine print on CreditFresh's own website, they go so far as to state that borrowing from them is an incredibly costly way to gain access to some cash:

"A Line of Credit through CreditFresh is an expensive form of credit and should not be used as a long-term financial solution."

Though it's difficult to find information on CreditFresh's site about their interest rates, other sources state that the APR for a line of credit starts at 65%.

For the purposes of comparison, the average credit card interest rate as of September 2023 is 24.45%, which is historically quite high, according to Lending Tree.

Already, this should send up some red flags. 65% is an incredibly high interest rate, and that's just where rates start. According to one source, the interest rates are typically under 200% for a line of credit from CreditFresh, which is a recipe for spending an outrageous amount of money during the repayment of the loan.

Is CreditFresh just a scam? Or is it a legitimate company?

CreditFresh is, in fact, a legitimate company that offers lines of credit to consumers through its partnership with various financial institutions.

Don't stop reading just yet, though. Just because CreditFresh isn't a complete scam doesn't mean taking out a line of credit from them is a good idea.

By targeting consumers with low credit scores who need access to cash fast, CreditFresh is taking on a lot of risk. The way that they justify this amount of risk is by charging incredibly high-interest rates for these credit lines.

A little later in the article, we'll talk about the pros and cons of taking out this type of line of credit as well as some alternative options on the table.

First, we'll take a closer look at a recent class action lawsuit that was proposed against CreditFresh regarding concerns surrounding a data breach that occurred in the spring of 2022. Even if the company is technically "legit," the type of activity outlined in the complaint might leave you to think twice about taking out a line of credit from this company.

Another important piece of information you'll want to consider when you're thinking about working with CreditFresh is that a class action lawsuit was proposed against them not long ago due to a data breach.

The proposed class action lawsuit claims that the company didn't protect the personal information of consumers adequately from access by unauthorized parties. The defendant in the proposed suit is Propel Holdings, Inc., which uses the CreditFresh name to offer lines of credit through First Electronic Bank, CBW Bank, and other partners.

The data breach is said to have occurred in February or March 2022. Allegedly, the following information was exposed to both customers and prospective customers:

The lawsuit claims that CreditFresh could have taken reasonable steps to prevent the breach. Consumers who had their information exposed now "face years of constant surveillance of their financial and personal records, monitoring, and loss of rights," according to the complaint.

If you need quick access to cash, it's easy to start making compromises. You might tell yourself that borrowing money at an exorbitant interest rate isn't a big deal because you'll pay it back quickly, or maybe you don't even think about the interest rate because you're in such a desperate financial situation.

The truth is, though, it's ultimately best to steer clear of this type of borrowing option. There are other more affordable alternatives that could help you get the money you need now without threatening your future financial stability. This is true even if you have bad credit-- you just might need to shop around or get creative.

There are lots of online loan providers these days, some of whom will consider borrowers with poor credit scores. You might be able to increase the likelihood that you'll be approved by offering additional information, such as any outstanding debts you have and your employment status.

Another way to gain access to money with a bad credit score is to consider adding a co-applicant who has a stronger credit history.

A secured loan is a way to borrow money for a lower interest rate by putting up an asset as collateral. These types of loans often have less strict credit requirements, but you run the risk of losing the asset if you miss too many payments.

A vehicle can often be used as collateral through online lenders. However, if you apply for a secured loan through a credit union or bank, the collateral usually needs to be an investment or savings account.

Though it can be frustrating and embarrassing to ask your loved ones for a loan, it's possible that this will ultimately be the more financially wise choice if your only other option is a high APR line of credit.

It's important to understand how money can quickly complicate relationships with people, no matter how close you are. For this reason, it's important to hammer out the details of the loan on paper in the form of a contract. Make sure you record how much money you're borrowing, any terms of repayment, and the process through which you'll pay them back.

Lots of credit unions will offer personal loans in small amounts. These loans typically start around $500. When you're working with a local credit union, there's often more leeway in terms of qualification than when you're trying to get a loan from a large, national financial institution.

For example, they might take other information into consideration beyond your credit score, such as your history with the credit union as a member. Personal loan rates are also capped at 18% under federal credit union cap rates.

Are you trying to get access to a line of credit quickly because your bills are getting to be too much to handle? It's possible that setting up payment plans instead of borrowing money could offer the relief you need.

A number of utility companies and creditors will give you the option to fill out hardship forms in order to request an extension. At the end of the day, these entities just want to collect the money they're owed, and they are often more willing to work with you than you might initially expect.

Another option is applying for a loan with a nonprofit lender. There are some organizations, such as the Capital Good Fund, that accept borrowers who have no credit history or thin credit profiles. This particular nonprofit offers emergency loans up to $1,500 and doesn't have a minimum credit score requirement.

The rates for this type of loan can be much more favorable than with for-profit lenders like CreditFresh. For example, the Capital Good Fund offers rates between 5% and 16%.

Payday alternative loans are small loans that some federal credit unions offer. With longer repayment periods and much more reasonable rates than typical payday loans, this type of loan is much less likely to trap you in a cycle of debt.

The National Credit Union Administration created this type of loan program back in 2010. You don't necessarily have to have good credit in order to get a payday alternative loan-- the more important factors include your ability to repay the loan and your income.

If you just need a little extra money to cover your costs until your next paycheck, another option is a cash advance app.

There are a number of popular apps of this type, including:

These apps can be really useful when you're in a pinch, but the truth is they are also a very expensive way to borrow money. Though the associated fees-- whether fast-funding fees or subscription fees-- are very high when weighed against the amount of money you can receive in this manner.

For this reason, cash advance apps are best used in true emergency situations.

At the end of the day, it costs money to borrow money. If you keep finding yourself in a situation where you don't have enough cash to pay for the things you need, you might consider figuring out a way to earn some extra income.

There are lots of ways you can get your hands on cash quickly if you're willing to be a little creative. You probably have some stuff you don't use anymore that could be sold on Craigslist, Facebook Marketplace, or eBay, or maybe you could start a side gig as a rideshare driver. Whether you start hanging signs in your neighborhood offering lawn mowing services or pick up some extra cash babysitting for the neighbor, you don't have to be limited to the income you earn from your day job.

Before I sign off, let's take a look at some commonly asked questions about CreditFresh and other ways to borrow money fast when you don't have great credit.

CreditFresh has been a company since 2019 and provides lines of credit to consumers in roughly half of the states in the U.S. This is a company that specializes in providing fast funding to people with low credit scores. While this might seem like a great deal when you're in a bind, the business model ultimately relies on charging extremely high interest rates in order to justify the risk of lending to consumers who aren't considered particularly creditworthy.

If you apply for a line of credit through CreditFresh and you're approved, your credit limit will range somewhere between $500 and $5000.

There are a number of different factors that are considered to determine your credit limit. You can potentially become eligible for increased credit limits or reduced billing cycle charges based on your payment history.

One of the main selling points of a line of credit through CreditFresh is how quickly the funds can become available to you.

You will typically receive the funds the same day if you are approved and request a draw before 3:30 pm Eastern time during the business week.

If you're approved and request a draw at another time, the funds will show up the next business day.

It's important to remember that your own bank and bank's policies can impact when funds are made available to you.

CreditFresh markets itself as a company that provides clear and transparent disclosures about the cost of borrowing. At the same time, they don't make it clear what interest rates they charge-- other sources state that the APR starts at 65% (which is incredibly high.)

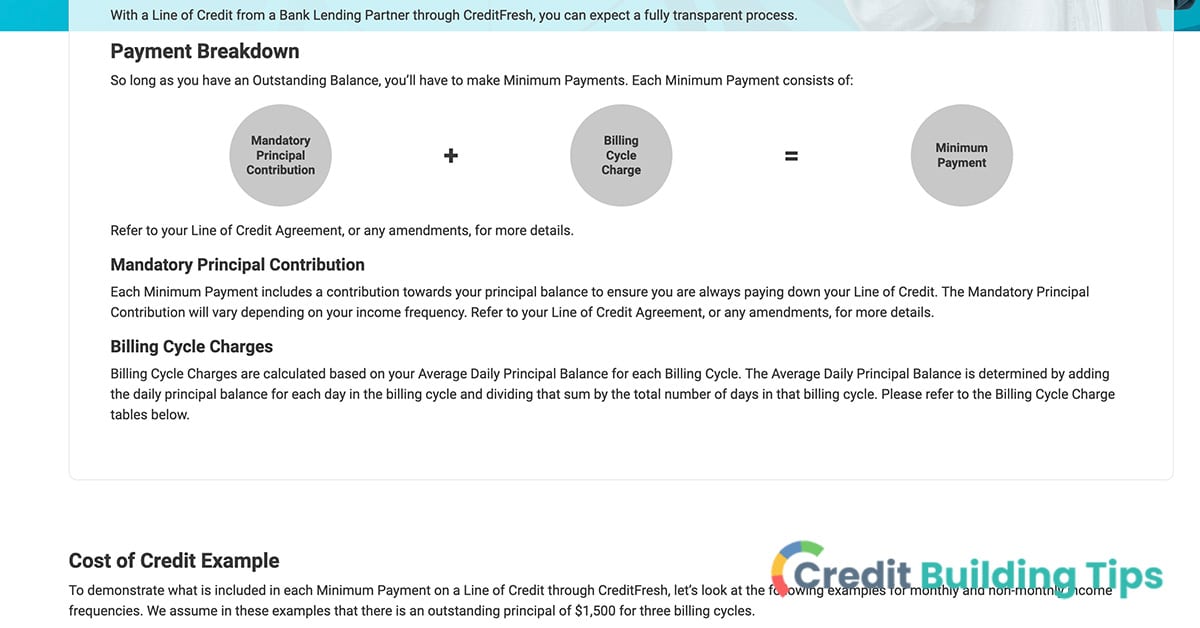

If you have an outstanding principal balance with CreditFresh, you'll have to pay both the billing cycle charges and a mandatory principal contribution as a part of your minimum payment.

When you take out an installment loan or another type of personal loan, you receive a lump sum of money. You then begin repaying the loan over a period of time with additional interest and, potentially, fees. These payments are made in a scheduled manner, typically monthly.

Taking out a line of credit, on the other hand, offers you a credit limit which you can borrow against. This is a revolving line of credit rather than a lump sum loan, meaning that borrowers can draw on their credit line, repay what they owe, and continue to redraw, assuming they have credit available.

There are a few requirements you'll have to meet in order to request a line of credit through CreditFresh.

In order to apply, you must:

As you can see, the bar is pretty low in terms of being able to request a line of credit. There is no minimum credit score disclosed by CreditFresh, but given the nature of the financial product, it is clear they are marketing to people with poor credit scores.

No, you can get a CreditFresh line of credit if you live in certain U.S. states.

These are:

When you have a CreditFresh line of credit, your account status will be reported to TransUnion. TransUnion is one of the three major credit reporting bureaus in the United States. The information that is reported by CreditFresh to TransUnion can be incorporated into your credit score calculation and impact your credit score.

While CreditFresh is a legitimate company, that doesn't necessarily mean opening a line of credit with them is going to be the best financial decision. Offering lines of credit to people with bad credit and charging exorbitant interest in order to deal with the risk, borrowing money from a company like this is quite expensive compared to other potential options on the table.

While there are a few things you can do to quickly boost your credit score, the truth is that it can take a while to improve an imperfect credit file. If you think you might need to take out a loan or get a new credit card down the road, it's a good idea to start thinking about cleaning up your credit report sooner rather than later.

Are you looking for resources to help you out as you work to improve your credit score? Make sure you check out our Credit Building Tips blog for more articles and guides.

Paying off your credit card can feel like a big weight off your shoulders. How long does it take for your payment to reflect in your available balance, though? Will you be able to use your credit card the same day you make a payment?

The answer is it depends.

If you had available credit before your payment, there's no problem using your card on the same day you pay it off so long as you don't exceed your available credit. If your card was maxed out, it could take several days for the payment to process and for the credit to become available to you.

If you had available credit before your payment, there's no problem using your card on the same day you pay it off so long as you don't exceed your available credit. If your card was maxed out, it could take several days for the payment to process and for the credit to become available to you.If your credit card and your bank account are from the same financial institution, it's possible that your available credit will be updated instantaneously. When money has to be transferred between banks, though, the process typically takes a few business days.

If you've used almost all of your credit limit and you just made a payment toward your card, you might be wondering how quickly you'll be able to use your card for a transaction.

The answer to this question is going to depend on a number of different factors.

The first thing you'll want to know about is the Truth in Lending Act and how it dictates the way that card payments work. According to this Act, credit card issuers have to send you your statement at least 21 days before your payment due date. Furthermore, they must set a cutoff time when they need to receive your payment-- 5 p.m. or later. It's worth noting that if you plan on paying your credit card bill in person at a branch of the financial institution and that branch closes earlier than the cutoff time, the payment will only be considered on time if you pay before the branch closes.

If you paid your bill in a timely manner, you should probably see that your payment is credited on the same business day. If you didn't make the payment before the stated cutoff time, it will likely appear the next business day. At the same time, the fact that the payment is credited doesn't necessarily mean that your balance will be updated. Usually, the payment needs to be processed before it is reflected in your balance.

When you go to make your credit card payment, it's easy to think that the funds should show up immediately once you click "pay."

Sometimes, though, your available credit limit won't change right away. On top of that, it might not show that the funds have been debited from your checking account immediately.

The fact that there's a time delay during the card payment process can be pretty stressful and frustrating. For example, you might be worried that your payment hasn't gone through and that you'll be subject to late fees. Beyond that, you might be waiting to free up some available credit so you can use your card for a purchase.

The truth is, that your credit card payment will likely process practically instantaneously if the bank account and credit card account are through the same bank. However, if you're paying between institutions, there's going to be a bit of lag between the two.

When you're dealing with two different institutions, you can typically expect the transaction to be completed up to three business days after you've made an online payment. If you sent your payment through the mail, it will probably take longer than that.

How many days it will take for your available credit to be updated after payment depends on a number of factors. In most cases, though, you can expect that the credit will be available in one to three business days.

The answer is: that it depends.

If you have maxed out your credit card and are making a payment on the due date, you might have to wait a few days before you have more available credit.

However, if you still have available credit before you make your payment, there is no issue at all with using your card. The transactions you make will end up as a part of the next billing cycle, not as a part of the billing cycle you're currently paying a bill for.

In order for your credit card payment to be considered on time, it simply needs to be submitted by the due date. This means that it doesn't have to be fully processed by the due date-- you simply have to send the payment through.

Once your card issuer acknowledges that you've made the payment, your payment will be credited. Your payment should typically be credited the same business day if you make your payment by a certain time on a business day-- often 5 p.m.

For payments made after this cutoff time or on a non-business day will usually be credited the next business day.

For your credit card payment to fully process, it might take up to three days. However, your payment typically only needs to be submitted by the due date in order to be on time.

What exactly is the difference between a payment being credited and processed?

When you pay off your credit card, it's natural to expect that you should be able to start using it again right away. It can be disconcerting to say the least, to see that there isn't any credit available after you've initiated a large payment.

There are a number of different reasons this could occur. If you have only recently made the payment, the most likely reason is that the payment hasn't finished processing. It may take a few business days for your available credit to reflect the payment that you made.

It's also possible that the credit card issuer has put a hold on your account, which can happen for a number of different reasons. For example, a company might put a hold on the account if:

Delays in available credit can also occur if:

If it seems like there is no good reason for your available credit to still be zero after making a payment, contact your card issuer and ask for an explanation. They will likely be able to get you more information about why this is happening or let you know what steps to take if it does appear to be a mistake of some sort.

It's totally reasonable to want your payment to post quickly. On the one hand, you might want to make sure that there is enough money in your bank account to cover the cost and are therefore interested in the payment occurring sooner rather than later. On the other hand, you might be hoping to free up some available credit so you can continue to use your card.

However, there are a few things you can do to try and make the process go as fast as possible.

Before I sign off, let's take a look at some of the most common questions I receive about making credit card payments.

The best time to pay your credit card bill depends on your circumstances, your financial situation, and your goals.

For instance, if you don't usually use more than 30% of your credit limit and you always pay off the balance in full every month, the timing isn't particularly important so long as you make your payment by the due date.

One of the reasons why it can be beneficial to pay early is that credit card issuers will report to credit bureaus on different dates-- typically around the time of your statement closing date. If you want to make sure your credit score is as healthy as possible, paying before the reporting date can help ensure your credit utilization ratio is on the lower end.

Your credit utilization ratio is one of the main factors in your credit score. The lower your credit utilization, the better. This is a metric that compares the amount of credit available to you to the balance you are currently carrying.

If you want to avoid paying any interest on your credit account, you'll want to pay your bill in full every month on or before the due date.

It's worth noting that you lose your grace period on new purchases if you are carrying a balance from month to month. This is true even for small balances. What this means is that all of your transactions will start accruing interest immediately until the full balance has been paid off.

It's no secret that it's important to pay your credit card bill on time. However, some people say that it's worth going the extra mile and making your payment early. Is this really worth it, and, if so, what are the benefits?

There are a few reasons you might make your credit card payment early.

Whether it's better to pay your bill early or on the due date really has to do with your own financial situation and goals. The most important thing is to make sure the bill is paid by the due date. Otherwise, it can seriously damage your credit score while also leaving you paying a late fee and interest.

Whenever possible, it's a good idea to pay off your credit card balance in full.

When you have a credit card balance carried over from month to month, it can:

Of course, it isn't always possible to pay off your credit card in full every month. In general, though, it's best to put as much money towards it as you can every month. Any amount you can put toward the bill will help to reduce how much-compounded interest you are saddled with.

When you have a large amount of credit card debt you're trying to get a handle on, it's a good idea to trim your discretionary spending and create a strict budget. This will help you find extra money to put towards your bill every month, allowing you to get out of debt faster and reduce the total cost of borrowing.

It's worth noting that there are other ways to borrow money that can be much less expensive than credit cards, such as a personal loan.

If you've been dealing with credit card debt and you've finally paid it off, you might be wondering whether you should just take a pair of scissors to that small plastic rectangle. The truth is, it's generally a good idea to keep your cards open after you've paid your debt unless they have a large annual fee. The reason for this is that closing your account could mean that your credit score goes down, as it can raise your credit utilization ratio.

Ultimately, one of the best things you can do once you've paid off your credit card debt is to start using the money you've been putting toward your card bill and building an emergency fund. According to a study from the Federal Reserve, 40% of Americans would struggle to find the money to pay for a $400 emergency expense. That's a pretty scary place to be, and building an emergency fund can help ensure you don't get caught in a financial pickle.

It's generally recommended that your emergency fund consists of at least three to six months of living expenses. Anything is better than nothing, though, and you might find it's a good goal to save $500 for an emergency fund to begin with.

Whether or not you can use your credit card on the same day you make a payment is going to depend. If you have plenty of available credit before you make your payment, using it on the same day won't be a problem at all so long as you don't try to spend more than what is available to you.

On the other hand, if your card is maxed out and you just made a payment, you might not be able to use it the same day. How quickly credit is made available to you depends on your bank and your credit card issuer. If your credit card and bank account are from the same financial institution, the payment might be processed instantaneously, and the credit will be made available right away.

Are you working to build a greater understanding of credit and credit cards to ensure you have as many financial opportunities as possible down the road? If so, you're in the right place!

Make sure you check out the rest of our Credit Building Tips blog for more resources, guides, and articles to help you improve your credit.

When a portion of your wages is being directly taken out of your paycheck to repay a debt, it's known as wage garnishment. Considering that this process can take a seriously negative toll on your finances, you probably have a lot of unanswered questions. One of the most common things people ask me about wage garnishment is "How long can a creditor garnish my wages?"

While statutes of limitations found under state law often limit how much time a creditor has to take legal action against you for an unpaid debt, these don't apply to how long wage garnishment can continue for.

Wage garnishment will typically continue until the debt has been repaid. This means it can go on for ten years or even longer, depending on the amount you owe and how long it takes you to pay it in full.

Wage garnishment will typically continue until the debt has been repaid. This means it can go on for ten years or even longer, depending on the amount you owe and how long it takes you to pay it in full.At the same time, there are some options on the table if wage garnishment is causing you serious financial hardship. Your choices will depend on the type of debt and a number of other factors.

Yes, a creditor can garnish your wages in some instances. For some types of debts, including child support and alimony, unpaid income taxes, and federal student loan debts, a court order is not necessary for money to start being taken from your paycheck.

For most other types of debt, though, the creditor will need to:

There are a number of different types of debts that could result in wage garnishment through a court order.

Some examples of debts that creditors can pursue in this way include:

In order to begin garnishing wages, creditors typically have to sue you and receive a money judgment and court order in their favor. Creditors won't be able to immediately garnish your wages for most types of debt, such as medical bills and credit card bills.

That being said, some creditors don't have to go to court before they start taking money from your paycheck. There are special rules for three types of debt because they are viewed as important enough to ensure the debt can be collected.

These types of debt are:

There is automatically a wage withholding order included in child support orders. Your wages can, therefore, be garnished when you're ordered to pay child support without the court needing to take any additional action. If you fail to pay either child support or alimony obligations, a wage garnishment order against you can also be obtained.

It's worth noting that the wage garnishment limits for alimony and child support are significantly higher than for things like credit card debt or unpaid bills. The limits for wage garnishment for child support under federal law are:

If you've fallen behind on your payments by twelve weeks or more, the cap on your garnishment can be increased by another five percent.

The federal government can also start garnishing your wages without needing to get a court order if you owe back taxes. Your deduction amounts and the number of dependents you have will impact the percentage of your income the IRS can garnish.

In addition to the federal government having this right, state and local governments can also collect unpaid taxes through wage garnishment. State law will dictate how much they can garnish from your paycheck.

Known as an "administrative garnishment," money can be taken directly from your paycheck if you fall behind on your federal student loan payments. The limit on this type of garnishment is 15% of whichever of the following is the lesser amount:

There are a number of circumstances that will lead to the end of wage garnishment. If one of the following occurs, payments for your debt will no longer be taken directly out of your paycheck:

There are federal limits on how much money can be taken from your disposable income when your wages are being garnished.

A certain percentage of your disposable income can be garnished by creditors in some circumstances. Disposable income refers to any money that you have left over after necessary deductions like Social Security and taxes.

The limits for wage garnishment are based on the type of debt. It's worth noting that some states utilize the federal guidelines, while others impose their own. For this reason, it's a good idea to look at what the guidelines are in your state if you're interested in learning how much of your wages can be garnished.

Here are the federal limits on the percentage of disposable income that can be garnished by a creditor:

If you have an unpaid debt that is several years old, you might be wondering if the creditor can still try to get a wage garnishment order against you. Though debts typically only disappear until they're paid and generally don't expire, many states do have statutes of limitations on how long a creditor has to sue you in order to try and collect the debt.

Some debts don't have a statute of limitations, however, including federal student loans.

Federal law dictates that, for ordinary garnishments, a certain portion of your earnings are exempt from wage garnishment. The amount of your income that is exempt is whichever is greater of the two following options:

These rules apply to consumer debts and other ordinary garnishments but don't apply to taxes, familial support, or bankruptcy.

While there are some states that follow the guidelines outlined by the federal government, others have set larger limits to the amount of a person's income that can be garnished through this process. Some states have even prohibited consumer debt wage garnishment. In the following states, your wages can't be garnished for consumer debts:

If a creditor receives a court judgment against you that orders your wages to be garnished, they can continue to do so until the debt has been repaid.

Wage garnishment typically continues until a debt has been fully paid off. This means that it will not automatically stop after a certain number of years.

When you fail to make payments on a student loan that has been funded by the U.S. Department of Education, you might receive a document known as a notice of wage garnishment. You have thirty days to challenge the garnishment or arrange for a repayment plan. If you don't do this, the garnishment will go into effect and will not end until the debt has been paid off.

Yes, wage garnishment can continue for seven years, ten years, or longer. How long you continue to have wages garnished from your paychecks depends on how long it takes for you to pay off the debt in full.

There are a number of things you can do to try and end wage garnishment when you aren't able to settle or pay the debt. We will take a look at your options in the next section.

There are several options on the table if you are motivated to stop a creditor from garnishing your wages under federal law as well as under each state's law.

You might be able to protect some of your wages under your state's laws in certain circumstances. To do this, you'll need to file a claim of exemption with the court in your state. This is a process that entails asking for the creditor's garnishment to completely or partially stop.

Most types of wage garnishments will be immediately stopped when you file for bankruptcy. The reason for this is that there is an "automatic stay order" that will go into place at the time that you file. However, depending on the outcome of the case, this might only be temporary.

Depending on whether you file for Chapter 7 or Chapter 13 bankruptcy, the way the debt will be dealt with varies.

Of course, filing for bankruptcy isn't a decision you want to take lightly. It's also important to understand that several types of debts can't be discharged through bankruptcy. Here are some of the ways that bankruptcy can negatively impact your finances and your life:

Creditors don't need to get a judgment against you before they start taking money directly from your paycheck for certain types of debt, including unpaid taxes and student loan debt. You typically cannot discharge this type of debt through bankruptcy.

If you want to stop the garnishment of your wages for tax debt, there is a process you can go through to negotiate your unpaid tax bill with the IRS.

For student loan wage garnishments, you can request a hearing to challenge the garnishment. There are a number of reasons you might choose to request a hearing, including:

If you are able to pay off the debt in part or in full, that might be the best option for stopping wage garnishment. There are two primary ways you can do this:

Creditors are motivated to recoup the money they are owed, and often would rather receive less money now in a lump sum than the full amount in smaller payments over time.

What this means is that you could be in a good position to settle the debt. You might find that the creditor will be willing to accept a smaller amount of money than the full balance of your debt if you are able to pay it now.

If you are able to come up with the money to pay off the settled amount, you will no longer have to deal with your wages being garnished. Of course, make sure that you receive the deal in writing from the creditor before making the payment.

If you don't stop the debt in some other way or settle the debt, the creditor will likely continue to take money directly from your paycheck. Every time they garnish your wages, the total balance that you owe will be reduced.

That being said, it's important to note that you'll likely also have to pay interest for many types of debt. Depending on your state's laws, the amount of money you owe in interest could vary from 2% to 18% in addition to the principal you owe.

If there is a significant interest rate attached to your debt, this can make it take a lot longer to pay off in full.

Before I sign off, let's take a look at some common questions I receive about wage garnishment.

If you are feeling overwhelmed by the fact that your wages are being garnished, it can be useful to know whether or not you're finding yourself in a unique situation. The truth is, there are more people out there getting their wages garnished than you might initially think.

According to the ADP Research Institute, 7% of employees in their study (which looked at 12 million individuals) had their wages garnished in 2016. This percentage increased to 10.2% for employees between the ages of 35 and 44.

The most common types of debt that individuals are dealing with when they have their wages garnished are:

It's worth noting that there are actually two different types of garnishments to be aware of:

Wage garnishment is when your employer is legally required by a creditor to give them part of your earnings in order to repay what you owe.

Nonwage garnishments, on the other hand, occur when a credit gains access to your bank account. These are also known as bank levies.

As a part of the wage garnishment process, you do have some rights. In most states in the U.S., however, the responsibility to be aware of these rights and exercise them falls on you.

Here are some things you'll want to be aware of if your wages are being garnished or you believe you are in danger of having your wages garnished:

When your wages are being garnished for an unpaid debt, this process will typically continue until the debt has been fully repaid. Though it is difficult to stop wage garnishment once the creditor receives a court order, it isn't impossible. There is often a fairly short window for challenging wage garnishment, so it's important to act quickly once you have received notice.

You also might be able to file an exemption claim depending on the type of debt and the state you're in. It's possible that you'll have to respond to an exemption challenge from your creditor or go to court to present your case.

It is typically best to find an experienced attorney or other expert legal guidance when trying to stop wage garnishment. The truth is, there's a lot of variation between states when it comes to wage garnishment regulations, and they're often quite complicated.

Wage garnishment can have a significant impact on your current and future finances. Not only are you dealing with a reduction of income that can make it even harder to make ends meet, but it can also have a negative effect on your credit scores. Though your wage garnishment won't necessarily show up on your credit report, the series of missed payments that led to the garnishment will.

Are you interested in cleaning up your credit report and setting yourself up for a better financial future? Are you searching for resources to help you on your journey to improve your credit? If so, make sure you check out the rest of our Credit Building Tips blog!

Your credit score doesn't just have an impact on your ability to get a new credit card or take out a loan. It can also make it harder to find an apartment. In this article, we'll tackle the topic of renting with bad credit but high income.

Having bad credit can make your apartment search more difficult, but you'll find it's easier to score the perfect place if your income is high and you have money saved in the bank.

There are a number of tactics you can use to rent when you make good money but don't have great credit. These include looking for landlords that don't run credit checks, offering to pay several months' rent up front, and proving your income and savings to prospective landlords.

There are a number of tactics you can use to rent when you make good money but don't have great credit. These include looking for landlords that don't run credit checks, offering to pay several months' rent up front, and proving your income and savings to prospective landlords.If you're stressed about finding an apartment with imperfect credit, don't worry. Through some combination of the following strategies, you should be able to sign a new lease in no time.

It's common for potential landlords to take a look at your credit before signing a lease. If you have a high income and are capable of making rent payments but your credit has seen better days, this can be a pretty frustrating reality.

The reason that landlords will commonly check the credit of applicants is that they want to know how likely it is that renters will pay their rent on time, every time.

Your credit history can, therefore, make a big difference in whether or not you score the apartment of your dreams. It's a good idea to check your own credit so you can get a sense of what potential landlords will see when you apply.

They will typically also scrutinize your:

There are a number of different ways that landlords will check your credit, and some will also run a background check. This means that they will probably also be searching for any criminal history or history of evictions.

If your credit is bad but you bring in a healthy salary every month, you have some options. There are a number of strategies you can use to score the apartment of your dreams even when you don't have a pristine credit history.

Thinking about buying instead of renting? Check out our posts about the credit score you need to buy a mobile home, how your credit score impacts the size of your home loan, and whether it's bad to get a new credit card before buying a house.

Perhaps one of the easiest things you can do to rent an apartment with bad credit, regardless of your income, is to look for rentals that don't require a credit check.

How easy it is to find a landlord who won't want to run a credit and background check is going to depend on your location. In some areas where most properties are owned by bigger landlords, for example, you might struggle to find any owners who won't want to look at your credit. In places where there isn't as big of a rental market and smaller landlords, though, you might have better luck.

In general, if you want to avoid a credit check during your apartment hunt, you should look for the following:

Typically, the following types of landlords or properties will require a credit check:

Another thing you can do to find an apartment when your credit is poor is to work with a real estate agent. They'll know the ins and outs of your local market and likely have a good sense of which properties won't require a credit check.

In some markets, it's very common to work with a real estate agent to find a rental.

This typically comes at a cost-- you usually have to pay a finders fee once you sign a lease. This is commonly a percentage of the rent you'll pay for a year. Depending on the rental rate, this can be a substantial amount of money, so you'll want to make sure you understand the fees before signing on with a real estate agent.

When you have a low credit score, it is an indication that you have not practiced responsible borrowing habits. This can be a red flag to landlords who simply want to rent to people who will pay on time and not cause any trouble.

If you have a high income, though, you might be able to show this to a prospective landlord in a way that will help alleviate their doubts about your trustworthiness as a renter.

You might also show them that you have access to a large credit line to help give them a little more peace of mind.

If you have a substantial amount of money saved up, it can be useful to prove this to potential landlords in addition to your high income.

In the best-case scenario, you'll be able to show that your savings account has enough money to cover move-in costs plus three months of rent.

Sometimes, people have bad credit because they have been truly irresponsible as borrowers. In other cases, though, there is a totally understandable reason for a lower-than-ideal score.

If you want to rent an apartment that requires a credit check, it's a good idea to be upfront and honest with the landlord. Having bad credit doesn't mean you're a bad person or a bad tenant, and landlords know this. If you can explain what happened that led to your credit hiccup, they might be willing to work with you.

Depending on the rental market you're in, it might be appropriate to send a letter of explanation along with your application, or it might be better to talk to the landlord in person.

You can also take the time to show your potential landlord that you are actively working to improve your credit. If you send a letter of explanation, you can discuss the concrete steps you're taking and prove that your credit score is already on the rise.

Perhaps one of the most effective strategies you can use to rent an apartment when you have a high income but bad credit is to offer to pay more than just the standard first month, last month, and security deposit.

One of the reasons landlords are skeptical of renting to people with bad credit is they're worried the tenants will miss rent payments. When this happens, landlords are still on the hook for mortgage and operating costs, which puts them in a financial bind. Beyond that, tenants who continuously miss rent payments might end up causing a legal nightmare if the landlord has to pursue an eviction.

If you offer to pay more up front, such as three months' rent on top of the standard first month/last month/security deposit, it will show the landlord that you are financially capable of paying the rent. It also lets them know that you're serious about renting the place and motivated to prove yourself as a good renter.

Beyond that, paying more upfront gives the landlord a bit more protection. They expect to generate a certain amount of income through rent, and knowing that you're paid through the first several months can make them more confident in your ability to pay on time.

Another option on the table is to find a co-signer. Also sometimes called a guarantor, a co-signer is a person that is agreeing to foot the bill if you don't pay your rent on time.

Since this is a pretty big commitment on the part of the co-signer, this role is typically played by a parent or close family member. In order for a co-signer to be useful, they will need to have good credit and, ideally, very good credit. Additionally, they will need to hand over proof of income as a part of the application process.

Landlords will often want to see that co-signers have an income that is at least 80 times the monthly rent.

Before you start looking for a co-signer, it's important to consider the potentially negative implications of this type of partnership. Mixing family and money can be a tricky business, and if you fail to pay your rent and your co-signer is forced to take responsibility for it, there's a good chance it will cause tension and strife. You never want to take on a co-signer for something you can't reasonably afford, so this is something you'll want to consider seriously before going this route.

Finally, another step you can take to score an apartment with bad credit but a high income is to consider renting with a co-tenant. Of course, it's essential that this co-tenant has good credit; otherwise, it won't help you prove your case as a responsible renter.

Not everyone is thrilled by the idea of living with a roommate, but this can be a good option if none of the others are working for you. You can save money by splitting your housing costs with another person while you work to build your credit. With attention and dedication, you'll eventually be able to rent a place of your own.

Credit scores and credit reports can feel pretty abstract a lot of the time, but the truth is that they can have a huge impact on the quality of your life. If you want to rent an apartment, for example, having bad credit can make the search much more difficult and limit your options.

That being said, having bad credit with a high income does give you some advantages compared to having bad credit with a low (or no) income. With some money coming in every month and money in the bank, you'll likely find there are some landlords out there who are willing to work with you.

If you're thinking about renting an apartment soon, but you're worried about your bad credit, it's a good idea to start working to build your credit now. For more resources about how to improve your credit and open up more financial opportunities for yourself in the future, make sure you check out our Credit Building Tips blog.

If your credit card account is paid off in full and you initiate a refund, how does it work? What happens if you get a refund on a credit card with a 0 balance?

Credit card refunds don't work in the same way as cash or debit card refunds because it's actually the card issuer that paid the merchant or vendor, not you. This means that you won't receive the refund in cash, but instead as a credit to your account.

If you have paid off your balance in full before a refund is issued, you will have a negative balance on your account. The next time you make a purchase using your card, this credit will be used first. If the refund is for a substantial amount of money or you don't intend to use that credit card again, you might be able to ask for the money to be sent as a check.

If you have paid off your balance in full before a refund is issued, you will have a negative balance on your account. The next time you make a purchase using your card, this credit will be used first. If the refund is for a substantial amount of money or you don't intend to use that credit card again, you might be able to ask for the money to be sent as a check.Let's take a closer look at what you need to know about credit card refunds and what to expect when you have a negative balance on your account.

If you buy something using a credit card and then later return it, you won't be able to get your money back in cash. What will happen instead is that you'll receive a credit on your account. The credit that you'll receive will be equal to the amount of the original purchase.