Deciding whether to open a new credit card before buying a house can be tricky. On the one hand, a new credit card can give you access to additional funds and rewards; on the other hand, opening a new card can also negatively impact your credit score.

In this blog post, we will look at both sides of the argument to help you decide if opening a new credit card before buying a house is the right decision for you.

In this blog post, we will look at both sides of the argument to help you decide if opening a new credit card before buying a house is the right decision for you.When you apply for a mortgage loan, the lender will closely scrutinize your credit report. They assess your income, including any additional income, such as from investments or rental properties. The lender will also analyze your debt-to-income ratio to ensure you can afford to make the payments on the loan. The lender may also verify your income and employment information.

In addition to the credit report, lenders usually want to see bank statements and list assets such as cash, stocks, bonds, and investments. It's important to have enough assets to cover closing costs and reserves for mortgage payments.

A 20% down payment is typically recommended, but some conventional loans have lower down payment requirements. And if you're applying for a government-backed loan, you may not need a down payment at all.

Financial institutions dig deep into your credit report and consider the following:

It's important to be aware of all the factors lenders look at when evaluating a loan application. Make sure that you have a good understanding of your finances so that you can increase your chances of being approved for a mortgage loan.

While managing a new credit card well is one of the best ways to build good credit, applying for and opening a new account causes your credit score to take a dip. That's due to the "hard inquiry" that comes when a credit card company reviews your credit report and score to see if you're a good risk for them to extend you credit.

Hard inquiries (or pulls) only temporarily affect your credit score. Within a few months, your score should return to what it was before the hard inquiry.

FICO, a credit scoring company, looks carefully at how many recent pulls show up on your credit report. Not only how recently but also how many credit cards you may have applied for in a short amount of time. Applying and opening a few cards at the same time can be seen as risky behavior and may cause a mortgage lender to view you with caution.

The length and average age of your credit history are other factors that contribute to your credit score. New accounts lower the average age of all your accounts. This factor makes up 15% of your credit score.

Your credit utilization is an important factor in your credit score — 30%. The total amount of your credit card balances are referred to as "revolving credit." Your credit utilization ratio is determined by adding up all the revolving credit you currently have and dividing that number by the total credit available to you.

It's best to try to keep this number under 30% at all times. Doing so will cause mortgage lenders to look more favorably on your application. For instance, if your total available credit is $9,000, but you have only used $2,700 before paying off your credit card statement, your credit utilization is 30%.

It's best to try to keep this number under 30% at all times. Doing so will cause mortgage lenders to look more favorably on your application. For instance, if your total available credit is $9,000, but you have only used $2,700 before paying off your credit card statement, your credit utilization is 30%.Opening a new credit card with an additional $4,000 credit limit but keeping the total of your revolving credit to $2,700 will cause your credit utilization ratio to drop to 21% — even better as far as mortgage lenders are concerned.

New types of loan accounts can add diversity to your "credit portfolio" and cause your credit score to improve. Although it only accounts for about 10% of your credit score, having a mix of revolving credit cards and installment loans can help increase your score.

The biggest factor in your credit score is always how consistently and fully you pay your bills — your credit history. This accounts for 35% of your score and can make the biggest difference in whether your credit score is excellent, good, or fair.

Unfortunately, it takes a few billing cycles for a new credit account to increase your score before it recovers from the dip a hard inquiry causes.

When applying for a mortgage in the United States, having a good credit score is essential. A credit score is a three-digit number that indicates how reliable a borrower is and affects the interest rate you can get. Generally, the higher your credit score, the better the interest rate and loan options available to you.

The minimum credit score requirements vary depending on the type of loan you are applying for:

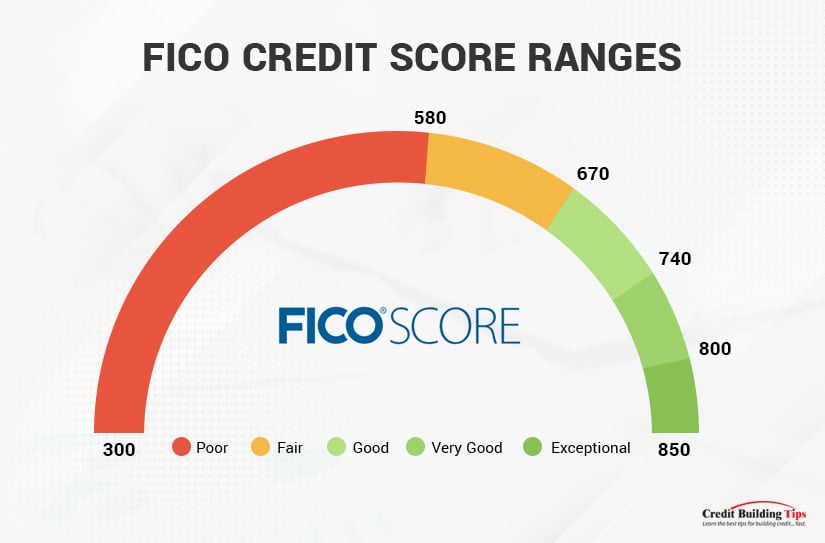

It is important to note that there is a difference between a FICO® Score and a Credit Score. A FICO® Score is an algorithm used by most mortgage lenders to determine your creditworthiness. It ranges from 300 to 850 and is based on information such as payment history, amount of debt owed, length of credit history, types of credit used, and recent inquiries into your credit.

A Credit Score is a numerical representation of your creditworthiness and is used by lenders to assess your ability to repay debts. In order to increase your chances of getting approved for a mortgage, it is important to raise your credit score before you apply. This can be done by paying off any outstanding debt, making sure bills are paid on time, and not applying for too much credit at once.

Other considerations when buying a house include factors such as your debt-to-income ratio (DTI), loan-to-value ratio (LTV), income, and assets. It is also important to understand the costs associated with getting a mortgage, such as closing costs and origination fees.

Having a good credit score when buying a house is essential. It is important to understand the different loan types, the difference between a FICO® Score and a Credit Score, and other factors that can affect your ability to qualify for a mortgage. Raising your credit score before applying can help you get the best terms possible on your loan.

Generally, there are five credit score ranges that lenders use to decide:

Credit ranges don't start at zero, the lowest credit number possible is 300, and the highest number is 850:

When you apply for a new credit card, it can take a few points off your credit score. This isn't a huge amount of damage by itself, but if you are frequently applying for new cards, it can add up quickly and do a lot of damage to your credit score.

This is particularly concerning for credit card "churners," or people who frequently open and close accounts to take advantage of promotional offers.

According to Dan Green, publisher of TheMortgageReports.com, "Churning cards could affect your scores by 100 points or more." Even a difference of just a few points can bump up the rate you get by as much as a percentage point, and that can cost you thousands over the life of the loan.

Green advises, "Opening a store credit card may save you 10% today, but, long term, it could cost you thousands." Applying for multiple credit cards at once also counts against your credit score, so this is something to avoid doing when preparing to buy a house.

If you've just applied for a new credit card, it's best to wait a few months before applying for a mortgage. The reason is that opening up a new line of credit can negatively impact your credit score, which lenders take into account when reviewing your mortgage application.

If you've just applied for a new credit card, it's best to wait a few months before applying for a mortgage. The reason is that opening up a new line of credit can negatively impact your credit score, which lenders take into account when reviewing your mortgage application.

Lenders also need to see that you have a steady and reliable repayment history with the new credit card account. If you have opened a new credit card account and are planning to apply for a mortgage soon, it's important to make sure you're making your payments on time each month. Even one missed payment can have a negative effect on your credit score.

When it comes to getting a mortgage, lenders will look at both your credit score and repayment history. It's important to show lenders that you are responsible for your credit and that you can handle the payments associated with a mortgage.

So if you've recently applied for a new credit card account, it's best to wait until you have at least three to four months of payment history before you apply for a mortgage. This will give you a chance to build up your credit score and show lenders that you are reliable with your payments. It will also give you time to adjust your budget and ensure that you are financially prepared for the additional costs of owning a home.

Although applying for a new credit card before buying a house may make some people nervous, it doesn't necessarily mean your mortgage application will be denied. As Craig Coffey, former head of marketing and eBusiness for Wells Fargo Home Mortgage, states: "Every loan, borrower, and situation is different, and creditworthiness isn't determined based on a single factor."

In some cases, borrowers may be able to explain a recent change to their credit profile to their lender. However, it is still important to exercise caution when using a new credit card. Adding charges to the new credit card could drive up the debt-to-income ratio, making it harder to qualify for a loan.

Ultimately, the fewer changes made to personal finances until the mortgage is secured, the better. However, if you have recently opened a new credit card account, you should not be worried as long as you can explain your circumstances to the lender. The lender can review your entire financial profile to determine whether you are qualified for the mortgage.

Using your new credit card responsibly while waiting for approval on your home purchase is also important. Keeping your balance low, always making payments on time, and only charging what you can afford are all essential steps to ensure that you don't overburden yourself financially before taking out a large loan like a home mortgage.

While having an additional source of credit may result in slightly higher interest rates in certain scenarios, it does not necessarily mean that your mortgage application will be denied. As long as you demonstrate financial responsibility by maintaining low balances and paying off any debts you do incur, there shouldn't be any issues with obtaining a home loan.

If you recently applied for a new credit card, it's likely that you'll start receiving offers in the mail from lenders eager to finance your mortgage. It's important to remember that these offers are contingent upon you passing the lender's credit score and other criteria. Although it may be tempting to accept one of these offers, it's important to remember that it could end up costing you more in interest if you don't shop around for the best deal.

It's important to take a step back and consider all of your options when shopping for a mortgage. Lenders want you to take out the loan with them and will often offer incentives and special terms to make sure you do.

However, the best way to ensure you get the best deal is to shop around and compare different lenders. The goal is to get a loan with a low-interest rate, favorable repayment terms, and minimal fees.

It's also worth considering whether you're getting the best deal possible with the lender who issued your credit card. Many lenders offer preferred rates or special discounts if you open a new credit card account before applying for a mortgage. If this is the case, it may be beneficial to take advantage of those offers before looking elsewhere.

Finally, remember that while opening a new credit card account can help you secure better rates on your mortgage, it can also hurt your credit score if you fail to make payments on time or end up carrying large balances. Make sure you understand the implications of taking out new credit cards before you commit to any loan agreement.

For more information on how to achieve excellent credit over time in order to qualify for a mortgage or any other type of loan, contact us, and we'll be happy to help!