We've all been there — you want to apply for a credit card. Whether it's your first application or your 21st, it's easy to wonder what the criteria are for properly reporting your income.

While it may be easy to pull out your Form 1040 (if you have one), that figure rarely describes the entirety of the allowable income you may have received throughout the year. The more income you can list on your credit card application, the higher the credit line you'll likely qualify to be approved for.

But in order to properly report income — declaring everything you can legitimately include without adding in non-allowable "income" can be confusing. In this post, we're going to look at what precisely you can and cannot include.

But in order to properly report income — declaring everything you can legitimately include without adding in non-allowable "income" can be confusing. In this post, we're going to look at what precisely you can and cannot include.Summary:

Let's get started!

When it comes to properly listing your income when applying for a credit card, the U.S. government has some opinions. Also known as Acts or Law.

A detailed explanation of what banks may consider income to determine credit card eligibility can be found in the Consumer Financial Protection Bureau's (CFPB) official interpretation of 12 CFR Part 1026, specifically in its Comment for 1026.51 Ability To Pay.

In a nutshell, banks (credit issuers) must follow the government's guidelines when considering income and assets in order to give or increase credit. Part of the comment reads, "a card issuer [must] consider a consumer's ability to make the required minimum periodic payments under the terms of an account based on the consumer's income or assets and current obligations."

The bank is charged to look for "current or reasonably expected income" when calculating if and how much credit they may advance to a potential card user. The card issuer needs to have confidence that if they extend you credit and you use that credit to purchase an item or service, you'll be able to pay it back.

The bank is charged to look for "current or reasonably expected income" when calculating if and how much credit they may advance to a potential card user. The card issuer needs to have confidence that if they extend you credit and you use that credit to purchase an item or service, you'll be able to pay it back.

The government also makes a distinction between applicants who are between 18 and 21 and those who are 21 and older. For the short window of time before your 21st birthday, you may only include income that you "personally and independently make."

However, you can also report "the residual amount from scholarships and other financial aid (not student loans) after paying tuition and other college expenses." You can also include the monies from any "regular allowances" you receive.

The CARD Act of 2009 tightened up any loopholes that may get young adults into trouble by mandating that "borrowers under 21 must have an independent ability to make the minimum required payments or have a cosigner who is 21 years or older and who agrees to become liable for the debt on the account."

Obviously, the first and most meaningful "income" you can report on your credit card application is the amount of your paycheck. But there's still a lot of room for interpretation when it comes to understanding how and what kind of income you can report.

Regular employment income — full-time, part-time or casual, salaried, freelance, or a side hustle. If your hard work earned money, it can be reported as income. This also includes any:

If you have a joint account with your spouse or partner, you can use their income on your credit card application. If a state or local statute "grants you an ownership interest in another person's income, you can usually use that person's income…" on your application.

Any rental income from properties you own can be reported on your credit card application, even if it's for intermittent holiday rentals. If you get periodic or regular payments for expenses such as subletting a room in your home, you can also consider the money you collect income on your application.

There seems to be some disagreement on whether unemployment funds count as income. The best rule of thumb we found is "if the IRS counts it as income, so will the credit card issuers." Unemployment payments are "taxed as income by the IRS," so you should be able to report these payments as income.

Other assets that can be reported as income include:

It's important to report your income correctly when applying for a credit card because this can help determine your creditworthiness and the type of card you are eligible for. The information you provide on the application is used by lenders to assess your ability to make payments on the card.

If you report an income amount that is too low, lenders may not approve your application or may offer you a card with a lower limit and higher interest rate. On the other hand, if you report an income amount that is too high, lenders may be suspicious of your application or offer you a higher limit than you can actually afford.

Reporting an accurate income also helps protect you from potential identity theft. If someone were to steal your identity and apply for a credit card using false information, their creditworthiness might be based on your reported income. This could result in them obtaining a credit card with a much higher limit than they could manage, putting you at risk of being liable for any unpaid debt.

In addition to knowing what income you should include in your application, you also need to know what income you shouldn't include. In this sense, you should avoid reporting:

The bottom line for staying on the right side of the law comes down to three simple guidelines:

Credit card issuers don't expect you to know down to the penny the exact amount of your next year's stated income will be. They're simply looking for your honest and best estimate of your current income. Or what your expected income will be.

It's never a good idea to overreport your income. If the credit card company suspects your stated income is inflated, they might ask for a financial review of your application.

You'll then be required to submit documentation to prove that your income figures are accurate. Types of proof of income documents include:

If you don't provide the information or they find you've exaggerated your income claims, they can reject your application, reduce any current credit lines, close your accounts, or, if you report "false or nonexistent income," you could be fined. Or worse.

Read the application carefully and report in good faith.

The regulations that address which types of income and assets are allowable in determining creditworthiness are directed towards the banks, not the individuals applying for credit.

That's why you'll find the questions banks ask about your income on a credit card application can vary from one bank to another or even one card to another. You'll need to carefully read the application to ensure you're giving the bank the information they're asking for!

For instance, some applications want to know your gross income, while others are interested in your net income. The difference between these different calculated incomes is significant.

Gross income is the amount of money you make before deductions. Deductions can be income tax withholding, retirement plan contributions, employee benefit costs, etc. If you make $60,000/year, your gross monthly income would be $5,000 (60,000 divided by 12).

Your net income is the amount of money you make once all deductions have been made. You'll be able to see on your Form 1040 your gross monthly income of $5,000 and then an itemized list of each deduction, followed by a smaller total. That's your net income.

Some credit card companies may request that you provide your most recent W2 form to prove your income. Others may require that you provide copies of your pay stubs or a letter from your employer verifying your income. Still, other credit card companies might ask for bank statements or tax returns in order to verify your income.

No matter which method of reporting your income is requested by the credit card company, it is important to ensure that you provide accurate and up-to-date information. Some credit card companies may ask you to provide proof of income that is older than one year, so make sure to have the appropriate documentation on hand in case it is required.

Be aware that some credit card companies might use an automated system to review your income information that will use algorithms to verify the accuracy of your reported income and the consistency of your financial records. That's why it is important to make sure that all the information you provide is accurate and up-to-date.

Q: What if I've just been laid off?

A: If you've just been laid off but expect that you'll be employed again shortly, you may use your previous income to apply for a credit card. The key is that you have a "reasonable expectation of employment."

Q: What is irregular income?

A: Having an irregular income simply means you don't get the same amount of money each time you get paid. Self-employed, project-based, or commission-based jobs are all examples of irregular income.

This should not impact your reported income on a credit card application, as most issuers are looking for your annual income, not month-to-month.

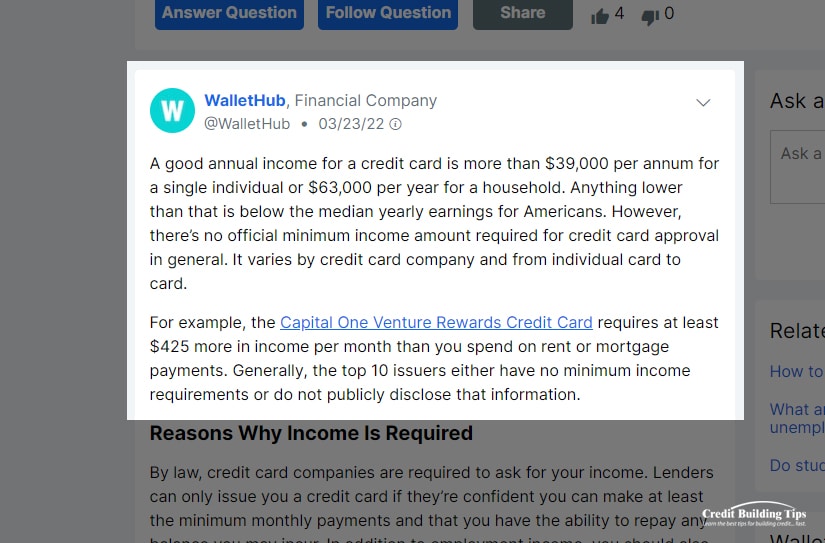

Q: What's considered a "good income" for a credit card application?

A: The more income you can report, the higher your potential credit limit will be, but there's no set or minimum of income that guarantees you qualify for any particular credit card.

Having said that, WalletHub recommends a good annual income is "more than $39,000 per annum for a single individual or $63,000 per year for a household." They also note that this figure varies depending on the credit card company.

Credit card issuers are looking at whether you can afford the minimum payments on a credit card. If your disposable income can assure the issuer you will be able to make these minimum payments, you should qualify for a credit card, even if it has a low credit limit.

Q: What if I don't have any income — can I still apply for a credit card?

A: As long as you have some income (not tied to a job) coming in, credit card issuers will consider your application. They'll also look carefully at your credit history, credit score, and any existing debt.

Q: My income is low. What can I do to improve my chances of qualifying for a credit card?

A: If your income is too low, you may find it difficult to qualify for a credit card. To give yourself every chance of successfully applying for a card, check these things off your to-do list to make sure you give yourself every chance:

Q: What other factors besides my income will affect my credit card application?

A: Besides your income, your credit score is an important consideration when banks look at your credit card application. The top five factors that determine your credit score are:

Do you have any other questions about reporting income on your credit card application? Let us know in the comments below if we missed anything on this topic, and we'll be sure to add it!