Are there such things as "guaranteed approval" credit cards for people with bad credit? Doesn't it sound a little like a pink unicorn?

Well, believe it or not, guaranteed approval credit cards not only exist, but they're designed for people with bad credit!

Well, believe it or not, guaranteed approval credit cards not only exist, but they're designed for people with bad credit!But before you think you've found the answer to all your credit dilemmas, you should know that even a guaranteed approval credit card has a few qualification requirements. They may be minimal, but they're still there.

There are two basic requirements issuers want to see even for a guaranteed approval credit card:

And while these types of cards are intended to help people with bad credit, just how bad can someone's credit be before they don't qualify for one of these cards? FICO considers a score between 300 and 600 as a bad credit score, while VantageScore uses the language of "poor" to indicate a bad credit score. Any number between 500 and 600 is considered a poor credit score, and a number between 300 and 499 is considered "very poor."

Knowing which companies will help "subprime borrowers" is extremely important, as applying for a credit card and getting rejected causes your credit score to drop again.

Along with knowing which companies can provide you with a credit card, even if you have "bad" credit, you need to know your credit score. Now is not the time to stick your head in the sand and hope for the best.

Through 2023, you can request a free copy of your credit report at www.annualcreditreport.com. It takes three easy steps to request credit reports from Equifax, Experian or TransUnion (or all three simultaneously).

You'll be asked a few questions to which only you should know the answer. They're meant to be challenging to help protect you from identity theft. Once you answer the questions, you can download and print your credit report.

On Annual Credit Report's site, they disclaimed,

"Your free annual credit report does not include credit scores."

The primary reason it's important to check your credit report is to make sure all the information on the report that determines your score is accurate.

That's on you. No one will check your report to verify that your identifying information is correct and up-to-date or if a company inputs the wrong information or claims that you owe them money when you really don't.

You can use dispute processes to correct any errors and should do so as soon as you are aware of the mistakes:

It's normal for the two credit scoring models to produce different numbers. Lenders understand this and look beyond the number to what it represents — good, bad, fair, excellent.

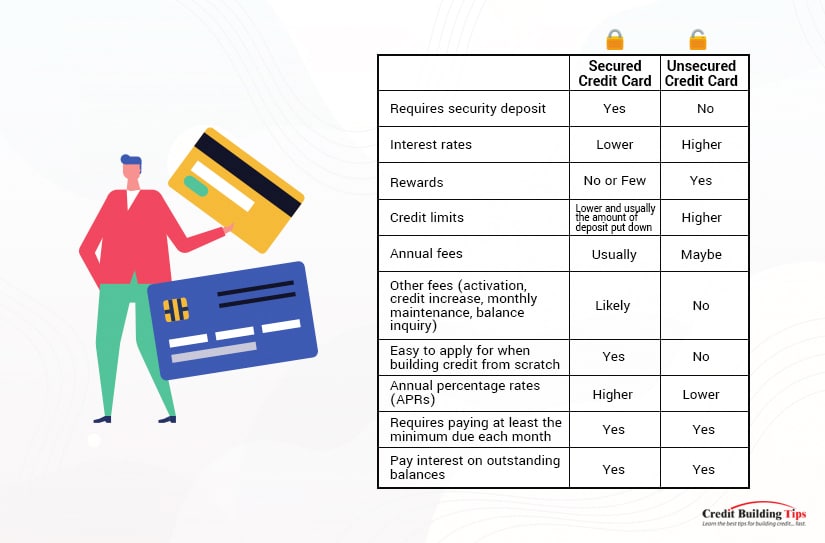

There's a major difference between secured and unsecured credit cards.

Investopedia defines a secured credit card as a "type of credit card that is backed by a cash deposit from the cardholder." With a secured credit card, you pay a cash deposit upfront to guarantee your credit line if you default on any payments.

An unsecured credit card doesn't require collateral as a security deposit to secure it. They're a common type of credit card, but not one that someone with poor credit will likely qualify for.

Once the deposit is in place, a secured credit card acts like any other credit card, although they usually have lower credit limits and more fees than unsecured credit cards do.

In a sense, secured credit cards act like debit or ATM cards, so why are they better than using a debit card or getting cash from an ATM? Technically speaking, a secured credit card still uses credit from the issuer — they just have access to a cash reserve if the user doesn't pay their credit card bill.

A secured card is worth getting because it is a way to build your credit score, whether you have bad credit or no credit due to your age or life circumstances. As long as you continue to pay at least the minimum owing on your card, you'll improve your credit score and may look forward to qualifying for an unsecured credit card without needing to tie up collateral or a cash deposit.

While nothing is truly guaranteed, these are the easiest credit cards to get approved for. Bad credit or no credit is not, on its own, a barrier to getting one of these 12 credit cards.

Secured rating: 4.5

Average approval rate: 85% for the past five years

Credit needed: Poor

Requires: U.S. mailing address, proof of identity, some income

Doesn't require: Credit history, credit check

Annual fee: $35

Regular APR: 20.39% variable

Secured rating: 4.6

Average approval rate: N/A

Credit needed: All scores welcome to apply

Requires: $300 initial refundable deposit (sets your credit limit)

Annual fee: $69

Regular APR: 19.99% variable

Secured rating: 4.7

Average approval rate: N/A

Credit needed: Limited or bad

Requires: A deposit amount that's less than the credit limit you'll be given, credit check with all three credit bureaus

Doesn't require: Credit score

Annual fee: None

Regular APR: 28.49% variable

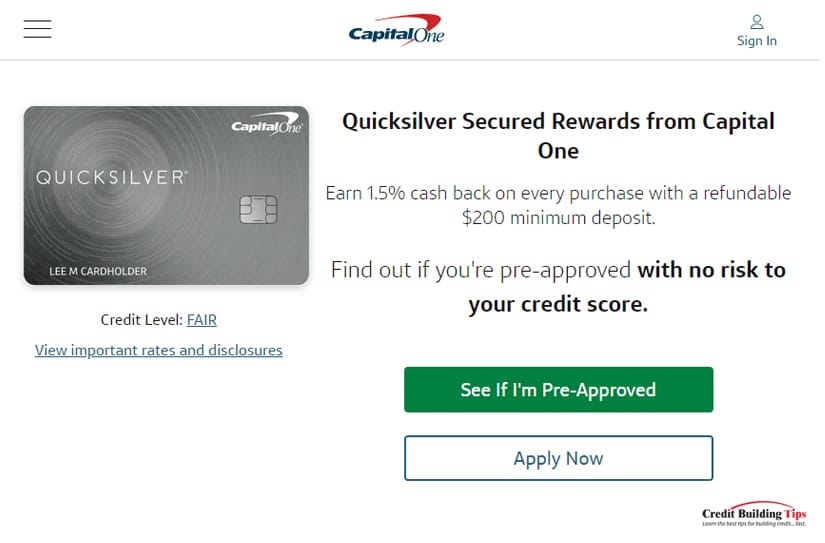

Secured rating: 4.8

Credit needed: Limited, bad

Requires: U.S. mailing address, have a valid SSN, disclosure of total annual income, access to authorized bank account, refundable $200 security deposit to get a $200 initial credit line

Annual fee: None

Regular APR: 28.49% variable

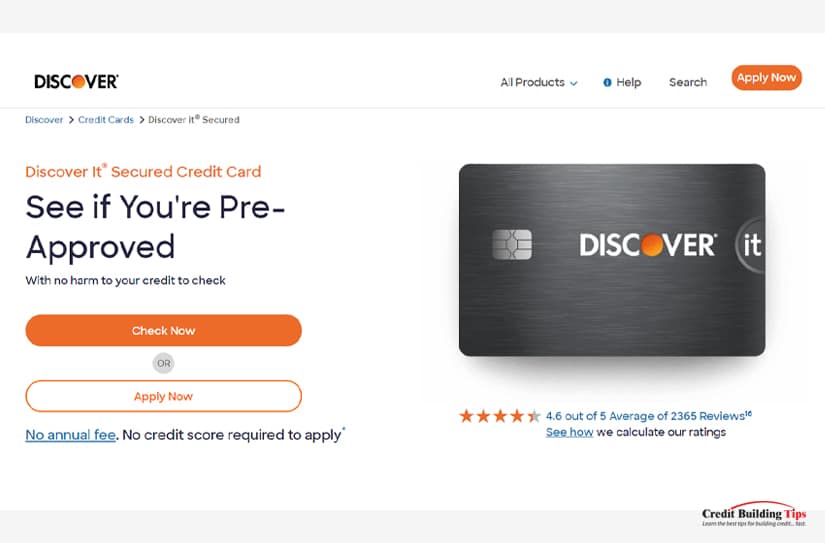

Secured rating: 4.7

Average approval rate: N/A

Credit needed: New or rebuilding

Requires: 10.99% intro APR for six months, minimum refundable $200 security deposit to get a $200 initial credit line

Doesn't require: Credit score

Annual fee: None

Regular APR: 25.99% variable

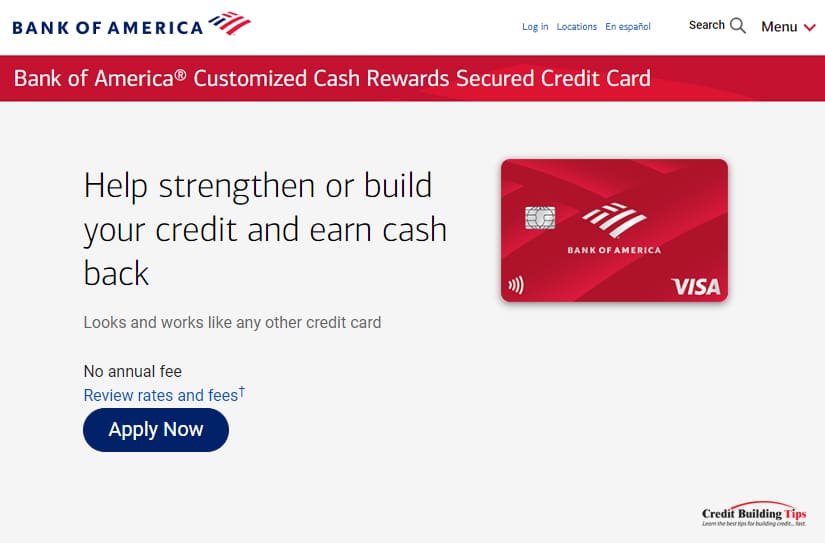

Secured rating: 4.6

Average approval rate: N/A

Credit needed: Bad or limited

Requires: A minimum refundable security deposit of $200 (maximum of $5,000)

Doesn't require: Credit check

Annual fee: None

Regular APR: 25.49% variable

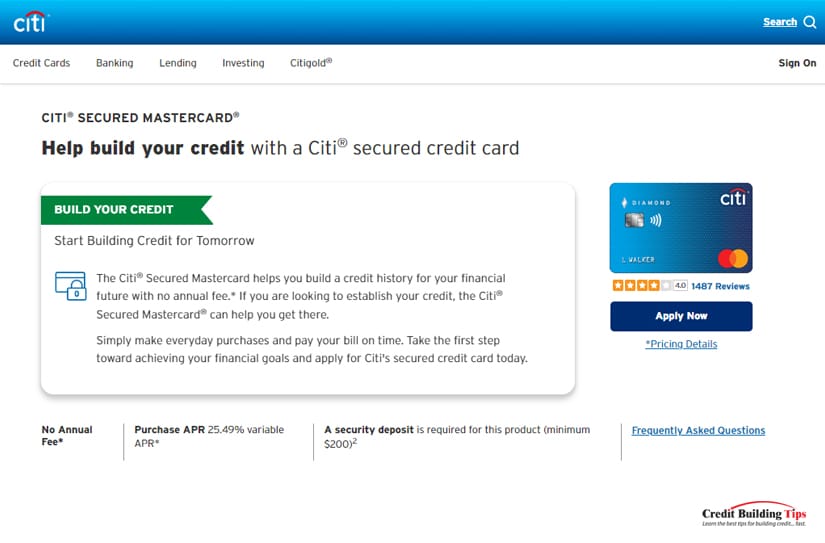

Secured rating: 4.5

Average approval rate: N/A

Credit needed: Limited history, no credit, new to credit

Requires: Minimum refundable $200 security deposit

Doesn't require: Credit check

Annual fee: None

Regular APR: 25.49%

Secured rating: 4.5

Average approval rate: N/A

Credit needed: N/A

Requires: Minimum refundable $250 security deposit

Doesn't require: Credit check

Annual fee: None

Regular APR: 14.99%

Secured rating: 4.5

Average approval rate: None, poor

Credit needed: N/A

Requires: Must be a member of Navy Federal Credit Union, minimum refundable $200 security deposit

Doesn't require: Credit check

Annual fee: None

Regular APR: 18%

Secured rating: 4.5

Average approval rate: N/A

Credit needed: Bad, limited, no credit

Requires: Minimum refundable $200 security deposit

Doesn't require: Credit check

Annual fee: None

Regular APR: 18%

Bad credit rating: 4.3

Average approval rate: N/A

Credit needed: Fair, good or previous bankruptcy

Requires: Minimum refundable $200 security deposit

Doesn't require: Credit check

Annual fee: $0 - $99

Regular APR: 24.9%

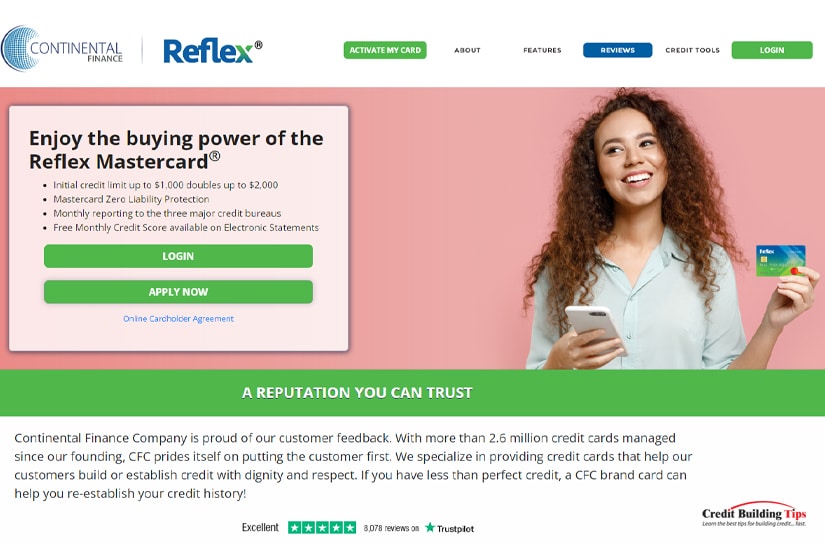

Bad credit rating: 4.4

Average approval rate: N/A

Credit needed: Bad, fair, or no credit

Requires: See terms

Doesn't require: Credit check

Annual fee: See terms

Regular APR: 24.99 - 29.99% variable

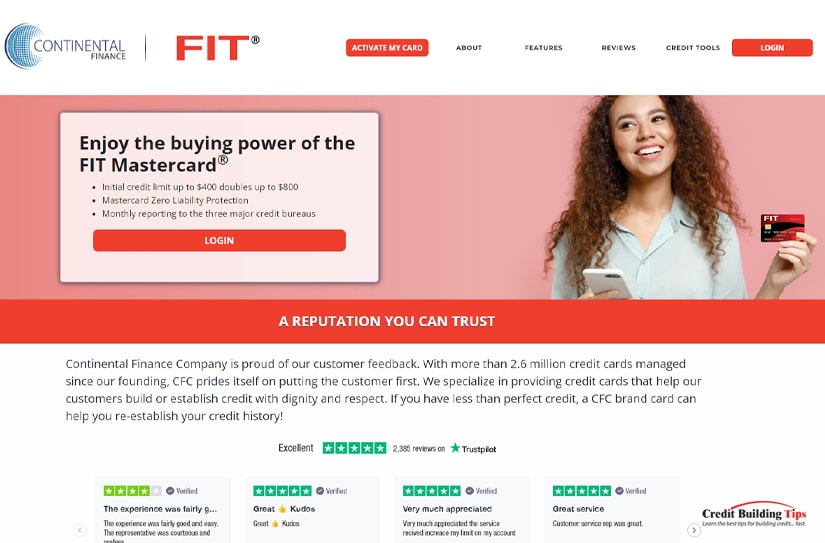

Bad credit rating: 4.3

Average approval rate: N/A

Credit needed: Bad, poor, fair

Requires: See terms

Doesn't require: Credit check

Annual fee: See terms

Regular APR: 29.99%

In general, no credit is better than having bad credit. But when it comes to qualifying for loans or a credit card, these issues put you in a difficult position. If you find a loan or credit card company that will lend you money, you'll likely have a higher interest rate with less attractive borrowing terms.

Even with these similarities, bad credit and no credit are two different problems, requiring different strategies to overcome them.

Bad credit is usually defined by one or more of these behaviors: late payments, collection accounts, bankruptcies, charge-offs, or other damaging items. Bad credit behavior is reflected in bad credit scores of less than 600 for FICO and VantageScore.

According to FICO Score, the average credit score is currently 716, and 15.5% of Americans have a score below 600.

According to FICO Score, the average credit score is currently 716, and 15.5% of Americans have a score below 600.

No credit is when someone has never applied for a loan, credit card, or financing before and has zero credit history. It's hard to develop a credit score when one is "credit invisible" and doesn't meet the minimum requirements for a FICO or VantageScore credit score.

In the eyes of lenders, bad credit is seen as worse than no credit. No credit means you're an unknown quantity, while bad credit means you're a known quantity with a history of credit management mistakes.

We've alluded to some ways to fix bad credit above, but let's be clear about four ways you can fix bad credit and turn a low credit score into a higher one that will give you more opportunity to borrow money with fewer penalties.

Here are the four ways you can fix bad credit:

So, while you can get a credit card even with bad credit, we'll keep encouraging you to move forward by repeating the last bit of advice: develop good credit habits. Do the work to pay your bills on time, every time.

You'll not only improve your credit score, but you'll also sleep better. And the world will offer you more opportunities to expand your horizons.

You'll not only improve your credit score, but you'll also sleep better. And the world will offer you more opportunities to expand your horizons.Do you have any questions about any of these listed credit cards or anything else credit-related? If so, be sure to drop us a comment down below, and we'll get to answering any of your potential questions as soon as possible!