One of the most recent surveys reports that 77% of Americans are anxious about their financial situation regarding money, credit, and debt. So stressed, in fact, that 43% feel tired, 42% find it hard to concentrate at work, and 41% don't sleep as well. All because of money.

Unfortunately, when you're stressed, the study also shows that you are less likely to:

Falling behind on your bills or debts makes matters even worse. And if you find you have debts in "collections," the knots in the pit of your stomach can lead to ulcers. Not good.

Let's discuss how collections work, what happens when you have a collection on your credit score, and how to fix it.

Having a debt in collections is, unfortunately, one of the "most serious negative items that can appear on your credit report," according to Credit Karma.

If you have a debt and still haven't been able to pay it for 120 to 180 days after the due date, your original creditor may send the debt to a collection agency. Some of the most common types of debt are credit card debts, mortgages, car loans, and student loans.

If you have a debt and still haven't been able to pay it for 120 to 180 days after the due date, your original creditor may send the debt to a collection agency. Some of the most common types of debt are credit card debts, mortgages, car loans, and student loans.Once a debt is handed over to a collections agency, you can expect to hear from them sooner rather than later. They operate on the premise that the earlier they track you down, the better their chance of collecting the overdue money.

Collection agencies get paid by getting the debt paid. In other words, they get paid for results. That's why the industry has such a bad rap. They don't get paid to help you, so there is no incentive to work with you or even to work with the law if they can get away with it.

Payments on your credit report that are 120 days overdue will lower your credit score more than a payment that is 30 days overdue. And having more than one debt transferred to collections also impacts your credit score.

According to Rob Rader, President at Top Choice Consultants LLC, it's helpful to know what matters when it comes to any collection debt.

He says:

"The biggest hit to your credit score will occur when that first collection account reports. Each additional collection will have more of a marginal impact. As long as the collection agencies are not continuing to update the account every month, the score impact will lessen over time."

The date a collection debt is listed on the credit report matters significantly. The more recent, the more negative the impact is on your score. Bizarrely, this is true even if you pay off the collection agency debt.

Rader lists an example where a debt was defaulted on five years ago but only now was it sold to a collection agency. The credit bureau then lists the "open date" as the current year.

Again, this matters because the more recent, the more damaging. And in 99 times out of 100, paying the debt off will not make a difference to your score. It will stay the same until seven years from the date of your first missed payment with the original creditor.

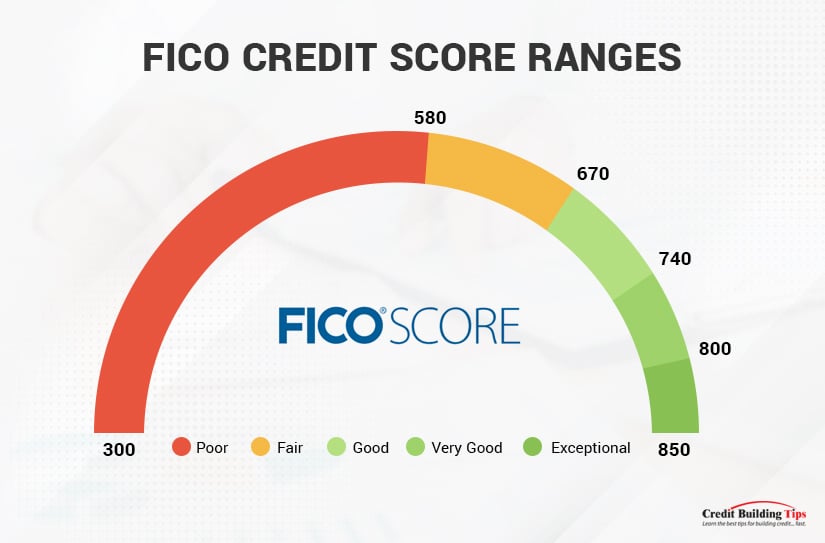

FICO Scores consider a good credit score somewhere between 670 and 739, a fair credit score from 580 to 669, and a poor credit score from 300 to 579.

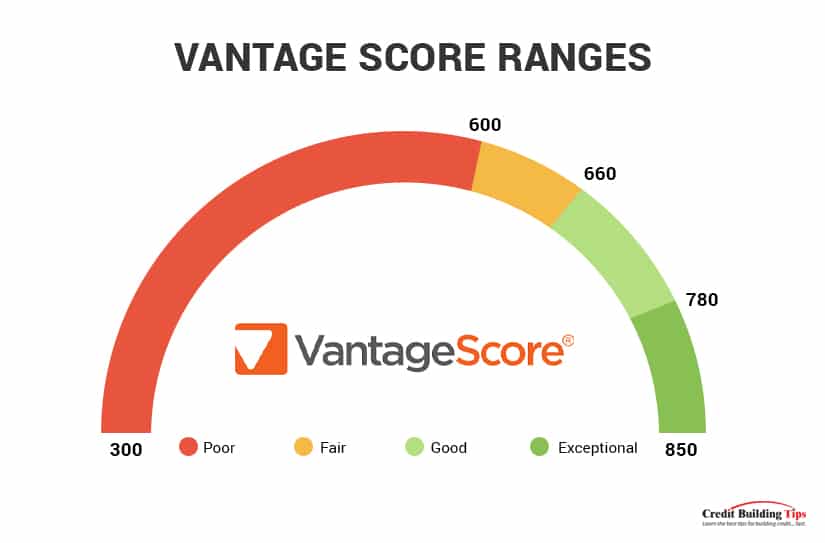

VantageScore has a slightly different scoring system. They consider a good credit score between 700 to 749, a fair credit score from 650 to 699, a poor credit score from 550 to 649, and a very poor credit score from 300 to 549.

To have a very good credit score with FICO, your number will have to be between 740 and 799. An exceptional credit score for FICO is between 800 and 850. Vantage Score considers an excellent credit score to be between 750 to 850.

It's important to understand the factors that make up the respective scores, as this impacts how many points a collection causes your score to drop.

With FICO, they determine the scores by assigning values to percentages:

VantageScore uses "influential" language to calculate what weighs more and less in their credit scoring:

There's not always a clear-cut answer to the question, "how many points does a collection drop my credit score." There are other factors to consider apart from how much your debt figure is and how long your debt has been in collections.

It does matter if this is the first time you have had an unpaid debt go to a collections agency. If you have a high score of 700, the first time you have an unpaid debt that gets sent to a collection agency, you can expect your credit score to drop over 100 points. Sometimes.

If your score is less than 700, it can drop even more.

The amount of the collection debt doesn't seem to change how many points your credit score can drop. Whether your debt is $200 or $100,000, your credit score drops by the same number of points.

You may think there's no good news when it comes to your credit score plus collections debt, but it is possible to have a 700 credit score even with a collections remark on your report. It's not common, but still possible.

Remember, a credit score of 700 is considered to be in the middle of the good range for FICO and at the lower end of the good range for VantageScore.

Lisa Goh, the CFO of Sensible Dollar, reports that there are over 50 scoring models that are used for FICO scores. No wonder it seems so elusive to understand how credit bureaus come up with their credit score numbers and what yours might be.

Credit bureaus use algorithms to determine your score. Each algorithm starts with a perfect 850, which is the highest possible credit score and only 1.6% of all credit-holding Americans have this score.

Not that you need to have a perfect score to "hit the pinnacle of what [lenders] care about." A score above 760 or 780 will get you the same treatment as if you had a score of 850. The national average FICO score hit a record high of 703 in 2019.

Your perfect starting score of 850 then gets points taken off for "every circumstance that, according to the algorithm, is less than ideal." Circumstances such as payment history, the length of credit history, and other information.

So, if it's possible to still attain a 700 credit score with a debt in collections, what factors come into play?

According to Goh, the contributing factors are:

Collections that are less than $100 won't significantly impact your credit score, and some score models will disregard them altogether. Having said that, if your debt in collection is over $100, your credit score will be impacted, possibly severely.

Collections that are less than $100 won't significantly impact your credit score, and some score models will disregard them altogether. Having said that, if your debt in collection is over $100, your credit score will be impacted, possibly severely.In a nutshell, if the most lenient scoring model is used that weighs more heavily on your credit history, the collections are almost at the seven-year mark where they will disappear from your credit report, and you only have one which has been settled; you may still see a credit score of 700 on your report.

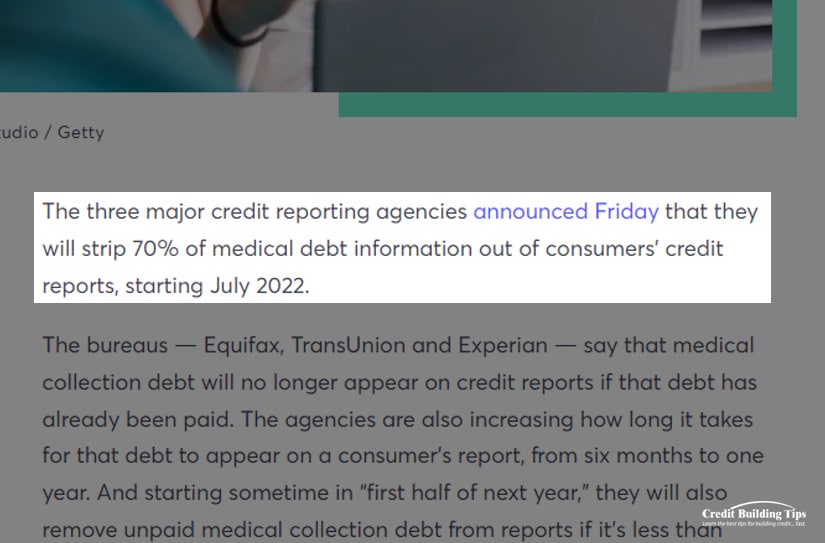

CNBC reported that two-thirds of medical debt in the U.S., effective July 1, 2022, will no longer be included on consumer credit reports. Equifax, TransUnion, and Experian went back to "strip" the debt information out of the reports.

There's also an increase in how long it takes for medical debt to show up on someone's credit report. Before, it was six months; now, it's one year.

And sometime in the first six months of 2023, they'll also eliminate unpaid medical collection debts from reports if the debt is under $500. This will be a significant help to the 1 in 10 Americans who carry medical debt over $250

The Consumer Financial Protection Bureau reported that as of spring 2021, 58% of bills that had been sent to collection agencies were medical bills. They also found that medical collections were "less predictive of future payment problems than other debt collections," like mortgages or car loans.

Once a medical debt goes to collections, it will affect your credit score. Up until now, these debts would stay on your credit report for up to seven years, even if you paid them off. The new rule will now remove them if they are paid off.

"Some of the newer FICO and VantageScore algorithms report that they disregard paid medical collections and place a lower emphasis on unpaid medical debt compared to other types of debt." This statement was given by Ted Rossman, a senior industry analyst at Bankrate.

He went on to say there "seems to be an acknowledgment that medical care is essential and should not be penalized by the credit bureaus."

Remember the study we talked about at the beginning of this article? The one that said 77% of us are anxious about our financial situations? The Mind Over Money study didn't end there.

Once they discovered how stressful the topic of finances is to most people, they asked them to do a short mindset-shifting exercise. The exercise asked people to think about long-term goals. They didn't have to think for a long time, as little as a few seconds.

You might be as surprised as I was to learn that thinking more about the big picture caused this same 77% of stressed Americans to be:

The study's outcomes are so powerful you may want to practice these smart Money Mindset tips to lower your stress, make better financial choices and see your credit score rise!

Giving makes you feel good. It's been linked to the release of oxytocin, a hormone that "induces feelings of warmth, euphoria, and connection to others." Giving elicits feelings of gratitude which is integral to happiness, health, and social bonds. A wide range of research, including the book Why Good Things Happen to Good People, finds that giving to others results in better health.

Giving comes back to you. Whatever you can afford to give — a little money, a little time, a little service, you'll find yourself in a better place and in better spirits. And maybe your credit score will start to reflect that.