Even the most financially savvy of us may find ourselves in a position where we get behind on paying our bills. Sometimes the cost can simply result in paying extra interest we hadn't counted on, but sometimes the cost is higher.

Urban Institute reports that roughly 77 million American adults have a credit file with some level of debt in collections. On average, they owe $5,178.

Urban Institute reports that roughly 77 million American adults have a credit file with some level of debt in collections. On average, they owe $5,178.If you haven't made at least the minimum payment to a particular creditor or lender, the first step will often be to have an in-house collections representative contact you. Not just once or twice but multiple times.

If you don't respond to this in-house representative and don't make a payment within three to six months, the issuer may pass your debt on to a third-party collections agency.

According to CNBC Select, there are currently 7,060 collection agencies in the U.S.

"A collection agency is a company hired by lenders, creditors, medical providers, and federal and local governments to get you to pay or make arrangements to pay what you owe them," Shelley-Ann Eweka, a wealth management director at TIAA, told CNBC Select.

Typically, the original creditor either sold the debt to a "debt buyer" or turned it over to a collection agency. The goal of a collections agency is to get the money.

The strategies they may use to get you to pay your debt can be one or all of the following:

Debt.org says there are three phases to a typical debt collection process:

So, how do you avoid being sent to collections?

If you do find yourself in debt and in need of help, most major credit card companies now offer customer assistance and recognize the toll the Coronavirus pandemic has taken on Americans, and are willing to extend grace.

Here are a few potential solutions to avoid debt collectors:

If you're not able to pursue any of these options, dealing with a debt collection agency may be inevitable. Here's what you can expect.

If you simply can't satisfy your debt before it's turned over to a collection agency, you should know your rights when it comes to dealing with an agency.

Debt collection agencies have a bad reputation because they cannot only contact you through every communication system available but also take debt settlements to civil court. A 2020 study from Pew Charitable Trust reports the number of debt collection lawsuits jumped from 1.7 million cases in 1993 to 4 million cases in 2013.

The study also reveals that "less than 10 percent of defendants in debt collection lawsuits from 2010 to 2019 had counsel, while nearly all plaintiffs did." Moreover, in the last decade, courts favored more than 70% of lawsuits by awarding default payments to the plaintiff.

In essence, most people who deal with a collections agency are taken to court, and most of these court cases favor the collection agency.

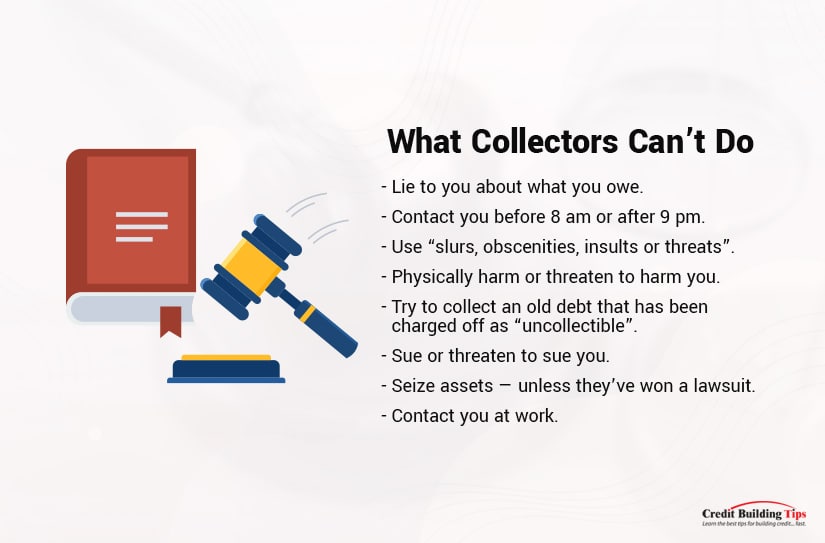

In essence, most people who deal with a collections agency are taken to court, and most of these court cases favor the collection agency.Thanks to the Fair Debt Collection Practices Acts, there are restrictions on what a collector can do to get you to pay your debts.

They may not:

The Association of Credit and Collection Professionals (ACA International) represents the majority of U.S. collection agencies (approximately 3,200), requiring them to obey all laws and regulations. The organization also has its own codes of ethics and operations.

The ACA requires its members to "treat consumers with consideration and respect" and "communicate with consumers with honesty and integrity." It also restricts collectors from engaging in "dishonorable, unethical or unprofessional conduct … likely to deceive, defraud, or harm a consumer."

If a collection agency is harassing you, you can report them to the Attorney General's office in your state or the Federal Trade Commission. You can also sue them in state court.

If a collection agency is harassing you, you can report them to the Attorney General's office in your state or the Federal Trade Commission. You can also sue them in state court.Suing a collections agency in court isn't easy, and you should hire an attorney to represent you. You'll have one calendar year from the date of any violation on the collection agency's part to file a lawsuit.

Andrew Katzman took his debt collectors to court and won $1,700 to compensate him for the harassment he endured. Even though the debt was because of a communication breakdown between the hospital and his insurance carrier and had been resolved, the collections agency continued to harass him.

In Andrew's case, he kept getting phone calls for four months after the issue was settled. The collections agency had him on auto-dial and called him after he let them know the issue was resolved. He requested they stop calling, but they didn't, and he estimated the phone rang twice a day.

Unfortunately, even paying off an account that's gone to collections doesn't immediately improve your credit score. What it does accomplish is "end the harassing phone calls and collection letters, and it will prevent the debt collector from suing you."

Stilt is an organization focused on providing credit to immigrants and the underserved. They say having a collection on your credit report can lower your credit score by approximately 110 points. If your score had been in the "fair" category, it might drop down to the "bad" category.

Even after paying your debt, you'll need to wait until your debt score reaches its limitations period before it recovers. This period can last up to seven years before it disappears fully from your credit score.

Even after paying your debt, you'll need to wait until your debt score reaches its limitations period before it recovers. This period can last up to seven years before it disappears fully from your credit score.The good news is that the more time passes after you pay your debt, the less influence it will have on your credit score.

Although your credit score may not jump up immediately, other significant ways resolving this debt will benefit you include:

The FICO 9 scoring methodology is only being phased in gradually, but most lenders are poised to start using them. In this latest version of the FICO score, medical bills will be given less weight, and debts in collections will be entirely ignored.

Knowing that even paying off your collection debt in full doesn't automatically boost your credit score isn't the last word on the subject. There are other ways you can eliminate collections accounts from your credit score.

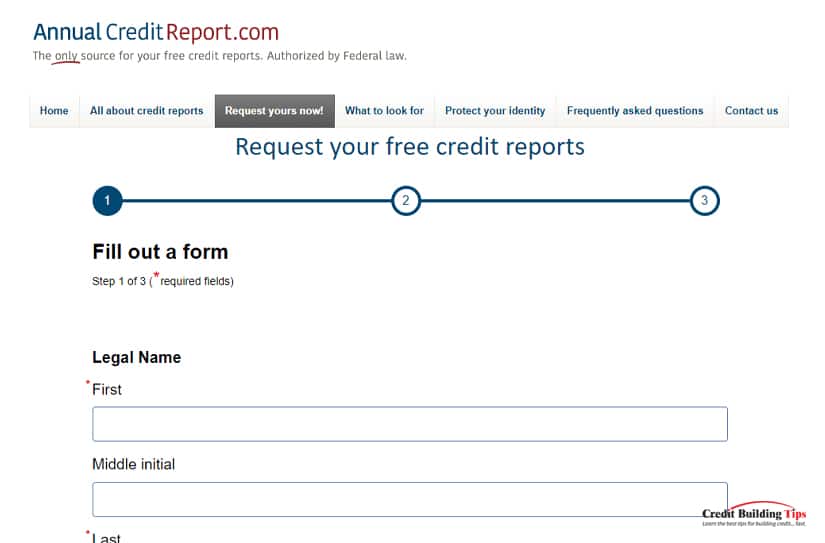

1. Order credit reports from Experian, TransUnion, and Equifax.

The first step to take is a look at your current credit report. These three credit bureaus extended the time they're allowing Americans to check their credit report for free. You now have until December 31, 2023, to get a weekly update through the Annual Credit Report website.

2. Write a statement of explanation to explain your circumstances. Adding a statement of explanation to your credit report can be viewed by potential lenders when they are checking your account and may be helpful in opening up a dialogue between you.

Don't waste this opportunity by writing something that excuses why your account has been sent to a collections agency. Lenders aren't impressed by the "my dog ate my homework" type of excuse. Rather, an explanation about how you lost your job due to a COVID-related or other natural or declared disaster may change the lender's perspective on your trustworthiness.

It's important to remember to ask the credit bureau to remove this statement after the delinquent account in question isn't on your credit report. Leaving the statement after the account has been removed may raise unnecessary questions in a potential lender's mind.

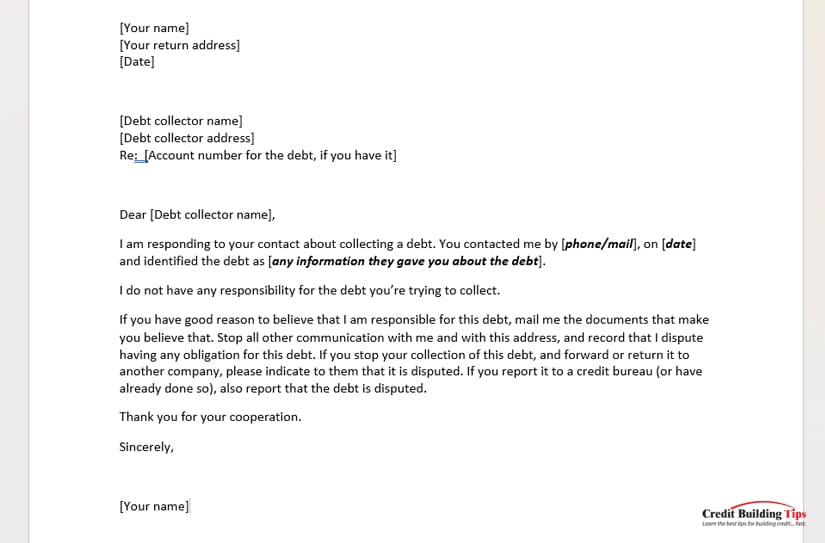

3. Dispute any errors. This is an important step to take if you want more information about the collections agency's claim or if you don't think you owe the money. The Consumer Financial Protection Bureau has a list of sample letters you can use to deal with debt collectors.

They note that if you use any of their sample letters, it's crucial to do so right away after the initial contact is made by a collections agency. As well, it's important to keep copies of any letters you send and receive.

4. Send a pay-for-delete letter. This is a way to "heal" your credit score by bartering with the collection agency. If you are prepared to pay your debt to them, you can offer payment in full in exchange for a "pay-for-delete" letter.

Credit Repair suggests you include the following information in this type of letter:

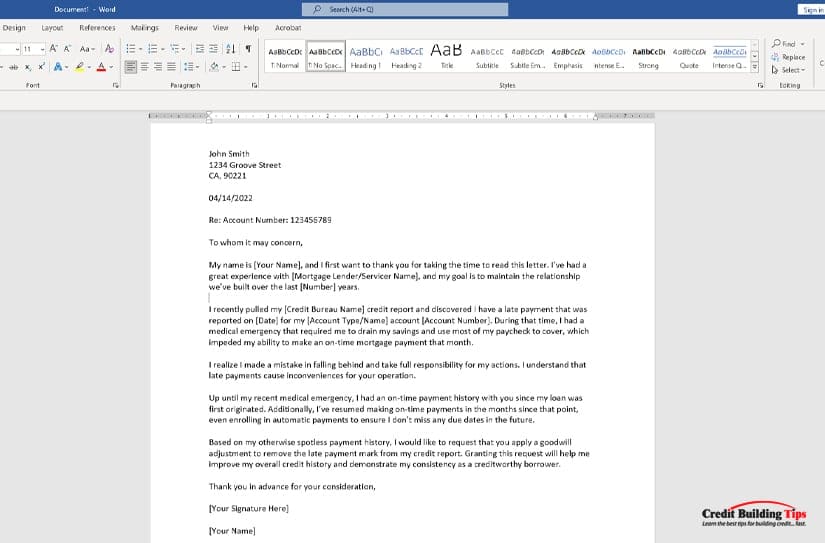

5. Ask for a goodwill letter. A goodwill letter is a written request to one of your creditors asking them to remove a negative mark on your credit report out of the goodness of their hearts.

While they suggest you not get your hopes up that this tactic will work, they also say it doesn't hurt to ask. A goodwill letter is your attempt to connect emotionally with creditors.

6. Get professional help. Sometimes you're in too deep and just need a helping hand. Contact the National Foundation for Credit Counseling (NFCC) and ask to work with a nonprofit credit counselor.

It's in your best interest to settle any outstanding debts as quickly as possible. Paying or settling collections will end the harassing phone calls and collection letters and keep the debt collector from suing you.