Having a debt in collections can wreak havoc on your credit scores.

In some cases, it is possible to delete a collection from your credit report in exchange for payment.

If you're trying to delete a collection account from your credit report, you can contact the collection agency and see if they will be willing to delete the account in exchange for full or partial payment of the debt.

If you're trying to delete a collection account from your credit report, you can contact the collection agency and see if they will be willing to delete the account in exchange for full or partial payment of the debt.Though this type of action is discouraged by credit bureaus, it is possible in some cases to have this type of derogatory mark removed from your report in some cases.

If you are interested in a pay-for-delete arrangement with a debt collector, the first thing you will want to do is contact them via the phone or through a pay for delete letter.

Opinions regarding whether it's a good idea to attempt to pay to delete a collection vary widely, which we'll get into later. The steps you will want to take if you want to take this course, though, are as follows:

In exchange for full or partial payment, debt collectors will sometimes promise to change the classification of your account on your credit reports.

If a debt collector does agree to remove the marks from your credit report, you will want to request a letter for them stating that they will adjust your credit report. Collections agencies are primarily focused on collecting the debt they are owed, and have been known to say whatever they need to in order to receive payment.

For more information about improving your credit score, take a look at these four simple ways you can remove derogatory marks from your credit report.

If you have a debt in collections and you want it taken off of your credit report, you can propose a deal with the debt collector: you’ll pay off the account if they will update your credit report to remove the account.

This is known as ‘pay for delete.’

Before you get excited about having this negative mark taken off your credit report, it’s worth understanding that these agreements are quite rare. Credit reporting bureaus go out of their way to discourage attempts to take information off of reports that is accurate.

The reason for this is that creditors and lenders are legally obligated to report information that is both accurate and complete to the credit agencies.

That being said, creditors do have some leeway to choose to not report information. Beyond that, the Fair Credit Reporting Act doesn’t explicitly prohibit pay for delete. This means that there’s a chance a debt collector will be willing to strike a pay for delete deal.

When an account is sent to collections, it usually stays on your credit report for seven years. Accounts get less harmful to your credit the older they get, but they will still be present on your report for seven years until they “drop off.”

If you want to propose a pay for delete arrangement with a debt collector, the first thing you’ll want to do is either give the collection agency a call or submit a pay for delete letter, which is a formal request letter.

If you write a letter rather than calling, you’ll want to clearly state your offer– that you want to pay off either all or part of the debt in question and, in return, you’d like the debt collector to delete the account from your report.

At this point, you’ll have to wait to see whether the collection agency is willing to take the deal. If they do agree, it’s a good idea to ask for written confirmation of the agreement before making the payment. Since the pay for delete letter doesn’t really hold any weight legally, you could otherwise end up in a situation where you make the payment but still have the account on your credit report.

Though pay for delete is a tempting solution to a frustrating problem, there are some reasons you might not want to go this route. Here are some things to consider before calling the collections agency and trying to broker a deal:

Even if you aren't able to get the mark removed from your credit report, there are still steps you can take to increase your credit score. Check out these articles about opening a new credit card, using second chance credit unions, credit repair software programs, and getting a secured credit card to boost your credit score. Before hiring a credit repair agency, make sure you read the pros and cons of credit repair services.

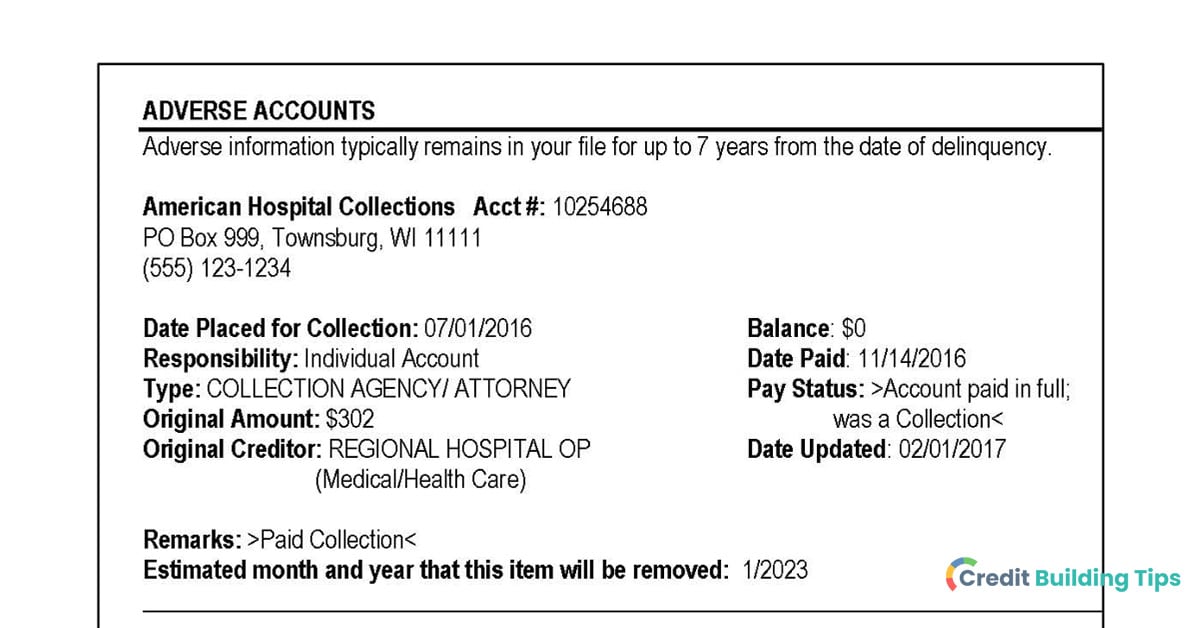

If you have a debt in collections that showed up on your credit report and you pay it off, it will stay on your credit report but be recorded as a paid collection.

Many people mistakenly believe that if they pay their debt in full, the mark will be removed from their credit report automatically.

Unless the collections agency agrees to fully delete the account rather than update the status to 'paid,' it will remain on your credit report for seven years.

Even if they do agree to these terms, it can be difficult to actually enforce a pay for delete agreement, as a pay for delete letter isn't legally binding.

If you're on a mission to achieve the highest credit score you can, check out this post about the maximum possible score.

If you are late making payments to creditors, it can have a negative impact on your credit score. If an account is so delinquent that it was sent to a debt collector, though, it can have much larger repercussions for your credit score.

By some accounts, having a debt sent to collections can mean your credit score dropping around 110 points. How many points you’ll lose depends on a number of different factors, but you’ll lose more points the higher your score was to begin with.

Your overall credit profile will have an impact on how much a pay for delete will help your score. If you only have one debt in collections and they are willing to delete it from your credit report in exchange for payment, you might see your score increase once it is removed. However, if you get one derogatory mark removed but you have several other debts in collection, it probably won’t make much of a difference for your score.

Some experts have been sounding the alarm recently, spreading the word that pay for delete is becoming outdated as a method of dealing with a collection account on your credit report.

One of the reasons for this is that some of the latest credit scoring models-- particularly FICO 9 and VantageScore 3.0-- don't factor in collections accounts that have been paid in full.

What this means is that, while the account still appears on your credit report, it doesn't have nearly as much of a negative impact as it would using older models or if you hadn't paid off the debt.

However, not all creditors use these new scoring models. For example, most mortgage lenders use a model that considers all collections accounts.

At both the federal and state level, credit bureaus, debt collectors, and lenders are all highly regulated. What this means is that you are granted certain rights as a consumer.

If you and the collections agency are negotiating a payment plan for your outstanding debt, make sure you take a look at this guide to installment plans and payment plans.

Understandably, consumers that are interested in a pay for delete arrangement typically have a lot of unanswered questions. Let's look at some of the most commonly asked questions about this method of credit repair to help you make the right decision.

In some cases, it can be difficult to determine who exactly owns your debt. You’ll want to try the following tactics if you need to track down the right collections agency:

If the original creditor hasn’t yet sold the debt to a collections agency, you’ll want to contact the creditor to try and arrange a ‘pay for delete’ deal. If they have already sold it, you might find that the original creditor is willing to reclaim the debts. They aren’t obligated to do this, though, so there’s no certainty that they will agree.

It is not illegal to send a pay for delete letter. That being said, the concept of pay for delete does exist in a legal gray area, as debt collectors often have contracts with the credit bureaus that explicitly prohibit them from deleting information from a credit report that is accurate.

Collection agencies do not have any legal obligation to remove information from your credit report. They also cannot remove information that was entered by the original creditor.

There are mixed perspectives about whether it is a good idea to try and and broker a deal with a collections agency to have your derogatory mark deleted in exchange for payment.

On the one hand, it's possible that the debt collector will agree to this and follow through on their end of the deal.

On the other, though, they might not actually remove the debt once they receive payment, and there is little recourse consumers have in this situation because pay-for-delete letters aren't enforceable.

Additional considerations include the fact that newer credit scoring models don't even take paid collections account into consideration when calculating your score and that a debt collector might not have the power to fully remove an account from your credit report if it was submitted by the original creditor.

Let's break down the possible outcomes in a slightly simpler way:

If you can't get the collections account deleted from your credit report even once its paid off, all hope is not lost. Instead, you'll want to focus your energy toward rebuilding your credit. For more information about how to improve your credit score, check out our credit building blog.