When a collections account appears on your credit report, it generally stays there for seven years starting from the date the account first went delinquent. This is true even if you end up paying off the account in full.

Having collections accounts on your credit report can make you seem like a risky borrower to lenders and creditors, so you might be wondering how you can remove collections from your report before the seven year period is over.

If the collections account is on your credit report in error, you'll want to dispute the account with either the credit bureaus or the debt collector. If the account is accurate, you can ask for a goodwill deletion from the debt collector or original creditor.

If the collections account is on your credit report in error, you'll want to dispute the account with either the credit bureaus or the debt collector. If the account is accurate, you can ask for a goodwill deletion from the debt collector or original creditor.Having a collections account on your credit report can reflect negatively on you when lenders or creditors pull your credit report. The newest versions of VantageScore and FICO credit scoring models now ignore paid collections, but a lot of lenders still use the older models that do incorporate paid collections when calculating your score.

For this reason, many people want to remove collections accounts from their credit reports before the seven year period is over. Here are the steps you’ll want to take in the effort to clean up your credit file.

The first thing you’ll want to do is gather information about the debt in question. There are two places you’ll want to look for this information:

Collect all of the documents you have on the account that is in collections, including your payment history as well as the age of the debt. If possible, it can be useful to also find a personal banking statement that displays the date that you made your last payment toward the debt.

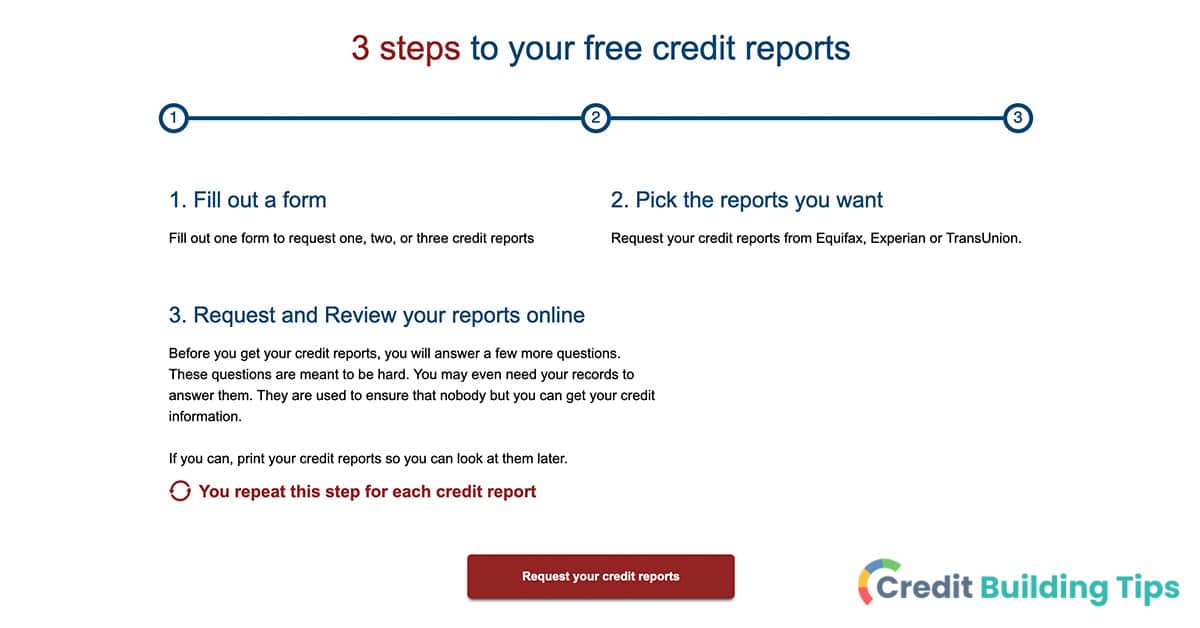

Now that you’ve pulled your own records together, print out your credit reports from each of the major credit reporting agencies– Experian, Equifax, and TransUnion.

Look at each individual credit report and highly any difference you find between them. These reports aren’t always precisely identical, as a lot of lendors and creditors only report to one or two bureaus rather than all three.

Are you wondering how to get your credit reports? You can have free access to your credit reports under Federal Law. The quickest way to get your report is to use AnnualCreditReport.com, which is offering free weekly online credit reports for the rest of 2023. This site is authorized by Federal law.

Once you have your credit reports in hand, verify the following details:

Once you have looked at your own records and your credit reports, you might find that the collections account shouldn’t be on your reports. Maybe it is completely incorrect, or perhaps it has been seven years since it went delinquent and it therefore should no longer be on your report.

There are two primary parties that could have made an error: the credit bureaus or the debt collector.

If there is a collections account on your report that is older than seven years since the delinquency date, you’ll want to file a dispute with any credit bureau that is still listing the account on your report.

Other mistakes that credit bureaus can make include showing a paid account as unpaid or listing an account that you don’t recognize.

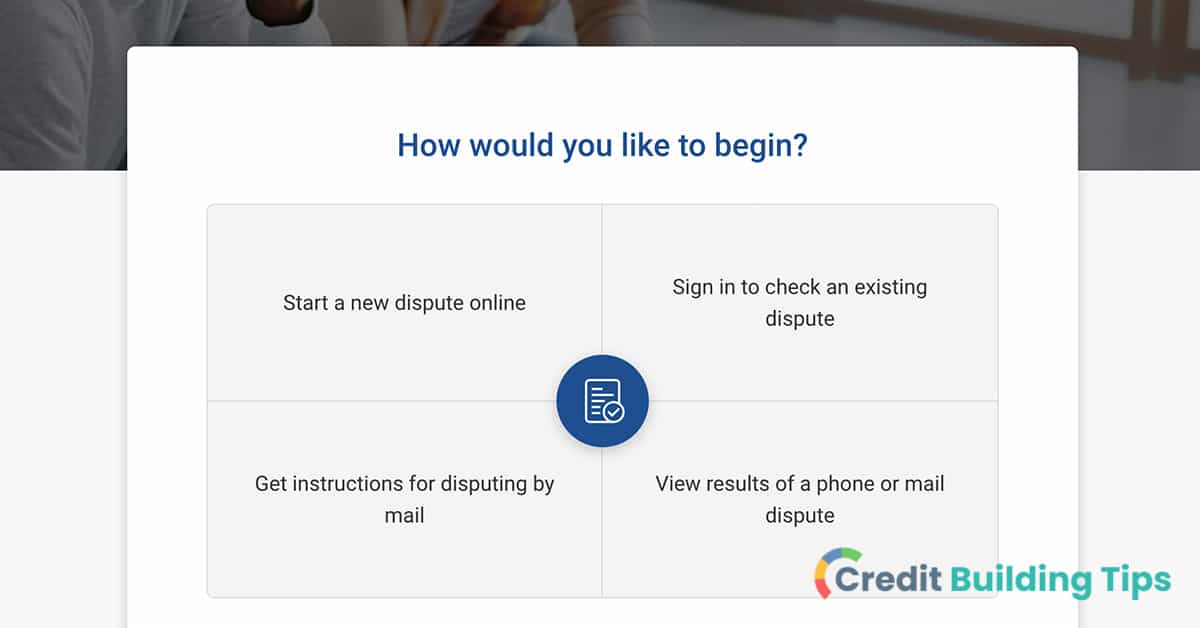

You’ll then need to gather documentation that supports your case and file a dispute with the credit bureaus that have made the error. You can do this by phone, by mail, or online, and the bureau must respond to you within thirty days.

Disputing credit report errors won’t harm your score and filing a dispute is free. You can file a dispute through the mail, by phone, or online.

If you believe that the debt collector has made the error rather than the credit bureau, the first thing you’ll want to do is to ask the debt collector to validate the debt. They should then send you a debt validation letter, which includes information about the original creditor, the amount you owe, and more.

If the debt collector is unable to validate the debt, it should be removed from your credit reports.

If the account listed on your credit report is legitimate and it is accurately reported as a paid account, there are still some steps you can take to have it removed.

You can contact the original creditor or the collections agency that is handling debt collection to ask them for a “goodwill deletion.”

You can send creditors and/or debt collectors a “goodwill letter” that explains why you were unable to repay the debt on time and requests that the negative mark is removed from your credit reports.

In your goodwill letter, you can explain why you would like the debt removed and the circumstances that led to your debt being paid late. For example, you might tell them that you are going to apply for a mortgage and that you would like the mark removed from your credit report.

It’s worth understanding that neither creditors nor debt collectors are obligated to remove an account from your credit report. That being said, it doesn’t hurt to ask. You will be in a much better position to make your case if you have had a strong payment history since you paid off the debt.

If you remove the account from your credit report through a goodwill letter, any late payments on your reports that preceded the debt going to collections will still appear.

Did you experience an event or circumstance that had an impact on your ability to repay a debt you owed? This article goes over what you need to know about sending a hardship letter to creditors.

If all of your efforts still haven’t resulted in the account being removed from your credit reports, the only thing you can do is wait for it to fall off. Most negative information is removed after seven years have passed starting from the first date of delinquency.

The first date of delinquency refers to the first date that your delinquent accounts are reported to the bureaus. This means that the information will be removed from the first reporting date, not the date the debt went into collections.

It’s worth noting that an account falling off your credit report doesn’t necessarily mean that you don’t need to pay the debt. A creditor can still pursue payment if the statute of limitations hasn’t passed and can even take you to court in an effort to receive the payment.

Laws governing the statute of limitations on debt are found at the state level, meaning that how long a creditor has to pursue an unpaid debt varies between states. It’s important that you learn what your responsibility is under the law of your state.

Pay-for-delete is an agreement that you can sometimes strike with creditors or debt collectors where you agree to pay a portion of the debt or the debt in full in exchange for the account being removed from your credit report.

There is no guarantee that sending a pay-for-delete letter will result in the outcome you’re looking for, but it can be worth a shot. It’s important to proceed with caution– make sure you receive something in writing from the debt collector and make sure that they agree to remove both the account and late payment information.

Creditors are technically not supposed to remove accurate information from credit reports, but it isn’t exactly illegal for them to do so either. Pay-for-delete agreements exist in a legal gray area.

Your claim must be addressed within thirty days when you dispute an error with a credit bureau or request that a debt collector remove a paid account from your report. If the credit bureau, debt collector, or creditor agreed to remove the mark from your reports, it’s generally a good practice to look at your credit reports after thirty days have gone by to verify that the changes you requested were made.

Are you looking for more information about improving your credit? Check out our guides to hiding credit card utilization, removing evictions from your credit report, opening a new credit card, and removing late payments incurred during the pandemic.

When you don’t pay a debt that is due for a period of time, it can be sent to collections.

Thirty days after a debt is due and unpaid, it can be reported as delinquent to the credit bureaus. You will receive notices about the unpaid debt and potentially even phone calls from the creditor in an effort to collect payment.

The creditor will give up on trying to collect the debt after a period of time without payment– usually 120 or 180 days. This doesn’t mean you’re off the hook, though.

At this point, they might choose to sell your debt to a debt collection agency. This is when you start receiving notices from collection agencies– through the mail, over the phone, via text, or through email. Essentially, a third party has purchased the right to collect your debt and you are still responsible for paying it.

Collections accounts will usually stay on your credit reports for seven years after the date that the account first went delinquent. This is true even if you have already paid the account in full. At this point, the account will show us with a “paid” status.

Since there are a number of different factors that influence your credit scores, there isn’t a simple answer to this question. Unfortunately, your score won’t change much even if you pay off the debt in order for the status to move from “unpaid” to “paid.”

Somewhat counterintuitively, paying off an old collections account can actually further impact your score by activating the accounts again. It’s a good idea to check with your lender to figure out what the best course of action is for you if you’re considering paying off the debt in order to take out a loan.

How your score is impacted is also influenced by the type of debt in collections. For example, medical collections aren’t given as much weight in the most recent iteration of the FICO scoring model.

It’s worth understanding that the newest FICO and VantageScore models don’t take paid collection accounts into consideration when calculating your score. At the same time, many lenders still use old models that do factor in paid collections accounts.

When there is a collections account on your credit report, it can be quite distressing. This can be the case whether the information reported is accurate or if you believe that it is an error.

If you know that the collection account on your credit report is legitimate, it's understandable to want to have it removed. After all, it can have a negative impact on your credit score and make you seem like a risky borrower to potential lenders. The truly frustrating thing is that this can be the case even if you've paid the debt off in full.

For collections accounts that you've already paid, you can try sending a goodwill letter to the debt collector and see if they will be willing to remove it from your account. If the account hasn't been paid yet, you can try and negotiate for a pay-for-delete agreement. They aren't obligated to work with you in these ways, but it doesn't hurt to ask.

If the collections account is inaccurate, you will want to dispute the claims with the credit bureaus that reported them. You can do this online, over the phone, or through the mail.

Fixing bad credit and rebuilding your credit can feel overwhelming, but it doesn't have to be. For more information about improving your credit files, check out our credit building blog.