When it comes to credit card utilization, you may wonder if it's possible to hide your usage from creditors and lenders. It's important to understand the impact of credit utilization on your credit score and whether it's possible to hide your utilization from your creditors.

Credit utilization is a metric that measures the amount of available credit you have used up relative to your total credit limit. It is an important factor in determining your overall creditworthiness and plays a major role in determining your credit score.

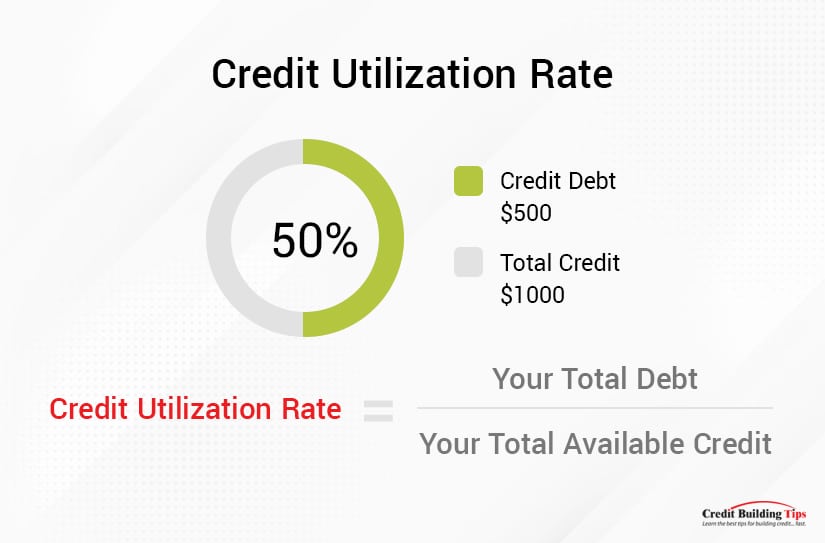

Your credit utilization ratio is calculated by dividing your total amount of revolving credit (such as credit cards) by your total available credit limit. To calculate it, you'll need to add up all your current credit card balances and divide it by the sum of all your credit limits.

Your credit utilization ratio is calculated by dividing your total amount of revolving credit (such as credit cards) by your total available credit limit. To calculate it, you'll need to add up all your current credit card balances and divide it by the sum of all your credit limits.For example, if you have a credit card with a limit of $1,000 and you currently owe $500, your credit utilization would be 50%.

The higher your credit utilization ratio, the worse your credit score will be. Generally, it's recommended that you keep your credit utilization ratio at or below 30%. Keeping your credit utilization ratio low can help you improve your credit score. It's important to keep an eye on your credit utilization ratio and take steps to reduce it if it gets too high.

It is important to monitor your credit utilization because it can significantly impact your credit score. If you're utilizing too much of your available credit, lenders may be less likely to approve you for new lines of credit or loans due to their concerns about your debt burden. On the other hand, having a low credit utilization ratio indicates to lenders that you are a responsible borrower who can manage your finances well.

Your credit score takes both your total credit limit and the amount you've used into account when determining your credit score. The amount of credit you use is known as your credit utilization ratio. Your credit utilization ratio is the amount of debt you have relative to your total credit limit. A higher credit utilization ratio suggests that you are using more of your available credit, which can have a negative impact on your credit score.

It's important to keep in mind that your creditors report your total available credit limit and the amount of debt you're carrying. This means that if you have a large credit limit and only a small amount of debt, your credit utilization ratio will be lower, and your credit score will be better. However, if you have a smaller credit limit and a larger debt, your credit utilization ratio will be higher and can negatively impact your score.

The best way to ensure that your credit utilization ratio does not have a negative impact on your score is to keep it below 30% of your total available credit limit. Doing this will help ensure that you get the best possible score, regardless of whether your creditors take into account your total credit limit or only the amount you've used.

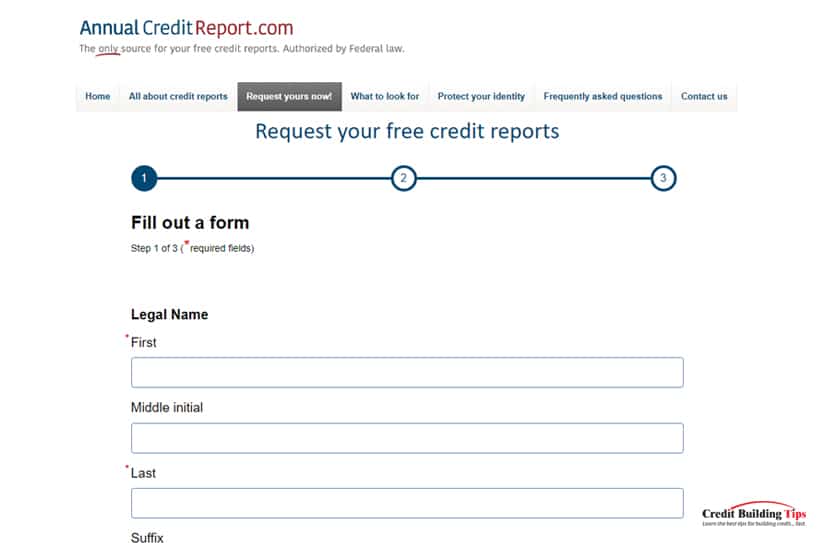

Before you start to put to use the tips we'll share with you below, you will want to be aware of your current credit card utilization ratio.

You can do this in one of four ways:

On the face of it, it may seem dangerous and even illegal to try to hide your credit card utilization from your creditors. You could end up being flagged for fraud or deception, and it could also severely damage your credit score.

But try Googling "Tips to Hide Your Credit Card Utilization," and your search page will be flooded with "tips, hacks, tricks, and secrets" on how to do just that.

We're not in any way recommending you attempt to lie or deceive the tax department (or any department) with information that is untrue, but there are legitimate ways to manage your credit card utilization that will reduce your utilization ratio, which will then help to improve your credit scores.

We're not in any way recommending you attempt to lie or deceive the tax department (or any department) with information that is untrue, but there are legitimate ways to manage your credit card utilization that will reduce your utilization ratio, which will then help to improve your credit scores.We've found 11 simple and effective ways you can manage your spending in order to lower your credit utilization.

Spending less can be a challenge, but it's a necessary step if you want to lower your credit utilization ratio. Here are some tips to help you on your way:

By using your debit card for purchases, you are only using the amount of money you have in the bank. This helps keep your debt-to-income ratio low and keeps your credit utilization low. You can use your debit card to pay off smaller debts that you may have with other creditors. This can help to lower your overall debt-to-income ratio, which can help to improve your credit score.

Paying your credit card in full every month is one of the best ways to lower your credit utilization ratio and improve your credit score. When you pay off your balance in full each month, you're not utilizing any of your available credit. That means your utilization ratio is zero, which is ideal for a strong credit score.

But if you do end up using some of your available credit each month, paying your balance in full can still help. Every time you make a payment, it reduces the amount of credit you have left to use. For example, if you use $500 of your $1,000 credit limit, then make a payment of $500, you now have a utilization ratio of $0/$1,000 (or 0%). This helps to keep your utilization ratio low, which is good for your credit score.

Paying down your credit card balance more than once a month can also help to lower your credit utilization ratio. This is because when you pay down your balance, the amount of money you've used to pay off your balance is taken into account.

By paying down your balance more than once a month, you can pay off more debt at once. For example, if you have a balance of $1,000, and you make two payments of $500 each during the month instead of one payment of $1,000 at the end of the month, then your credit utilization ratio will be lower because you will have a lower balance outstanding on your card.

Strategically paying your credit card debts can be a great way to lower your credit utilization ratio and improve your credit score. To do this, you'll want to pay off your highest balance cards first or prioritize paying off cards with the highest interest rate.

This will directly impact your credit utilization ratio because you'll be reducing the amount of credit that is being used compared to the total amount of credit you have access to.

One of the quickest and easiest ways to lower your credit utilization ratio is to apply for a new credit card. A higher credit limit can positively impact your credit utilization ratio, as it increases the amount of available credit you have. This will lower the ratio and can result in a higher credit score.

When you apply for a new card, be sure to look for one with an attractive rewards program, other benefits, and a reasonable annual fee. Make sure the interest rate is low and that you understand the terms and conditions of the card before signing up.

A variation on applying for a new credit card to lower your utilization ratio is to ask your current credit card company to raise your credit card limit. It's important to remember that it's not always easy to get your credit limit increased, especially if you have a low credit score. However, if you can increase your credit limit, it can be a great way to reduce your credit utilization ratio and, in turn, boost your credit score.

When it comes to your credit utilization ratio, one of the most important things you can do is to keep your unused credit cards open. This is because closing an unused card can harm your ratio. Your total credit limit will be reduced, which means that even if you don't use the card, you are still being penalized for having a high credit utilization ratio.

When you don't use a card, the amount you owe on it will remain at zero, which won't be considered when calculating your credit utilization ratio. As a result, your credit utilization ratio will stay lower. The longer you keep the card open, the better your score could become, as you'll show lenders that you are able to manage credit responsibly over an extended period of time.

Getting a temporary personal loan to pay off your credit card balances can effectively lower your credit utilization ratio. This is because the loan will reduce the amount of total debt you have outstanding, meaning that your ratio of credit card debt to total available credit will decrease.

It's important to note that taking out a loan to pay off your credit card balances should only be done as a last resort. Before doing so, consider other options, such as consolidating your credit card debt or transferring your balances to a card with a lower interest rate. Additionally, ensure that you are able to meet the repayment terms of the loan and avoid any late payments, as this could negatively impact your credit score.

Another way to potentially lower your credit utilization ratio is by asking for a statement balance rather than a current balance. Your credit utilization is calculated based on the amount of credit you've used compared to your total credit limit.

By requesting a statement balance, you're asking the creditor to report the amount due at the end of the billing cycle, not the amount that's currently due. This means that if you've already paid off most of the amount you owe or if the statement balance is significantly lower than the current balance, this will help reduce your credit utilization.

Transferring your balance to a low-interest credit card is our last tip for ways to lower your credit utilization ratio and help improve your credit score. By transferring your balance, you're essentially increasing your total credit limit while keeping your amount of debt the same. This, in turn, lowers your utilization ratio and can increase your credit score.

It's important to note that transferring a balance is not without risks. Balance transfers typically come with fees, and you will need to make sure that the new interest rate on the new card is lower than the old one before making a move. Some creditors may also report the balance transfer as a new account, which could negatively affect your score. It's best to weigh the pros and cons of transferring your balance carefully before making any decisions.

As always, if you're looking for ways to improve your credit scores as fast as possible, I'm here to help!