Your credit score is made up of five primary factors. You've probably seen this breakdown before:

Most of these can be controlled, but one stands out: the length of credit history.

Building credit happens over time, and the longer your credit history, the better. Except, that's not purely true, or young people would never have good credit, and older people would have better credit as a baseline.

The length of your credit history accounts for roughly 15% of your score calculation, but that's not a very helpful description. You know that credit history is important but not what makes a good credit history.

The length of your credit history accounts for roughly 15% of your score calculation, but that's not a very helpful description. You know that credit history is important but not what makes a good credit history.So, how long is long enough? What is a "good" length for your credit history? Is there a cap? Let's dig in.

Did you know that there's a minimum age to have a credit score?

Technically, the minimum age is 18 throughout the U.S. in order to start gaining credit. That's because you have to be 18 to open up lines of credit, qualify for loans, and have your own major assets in your own name.

Technically, the minimum age is 18 throughout the U.S. in order to start gaining credit. That's because you have to be 18 to open up lines of credit, qualify for loans, and have your own major assets in your own name.There are exceptions, though. If you're younger than 18, you can still be added as an authorized user on someone else's credit card (usually your parents') and start building a credit history earlier. There's technically no minimum age here, but most credit card companies will limit it to 16 or so.

Sometimes you can have a longer credit history if a credit reporting bureau started tracking you erroneously. This can happen both out of mistakes and due to identity theft. Unfortunately, the added benefit of a slightly longer history here isn't going to outweigh the issues caused by identity theft, at least until you get them figured out.

There's also a minimum length for how long of a credit history you have before you even get assigned a credit score.

Contrary to what some people believe, you don't get a credit score immediately.

The minimum age for a credit history is six months. That is, if you open a credit card on your 18th birthday, it will be six months after your birthday before you are assigned a score based on credit factors.

The minimum age for a credit history is six months. That is, if you open a credit card on your 18th birthday, it will be six months after your birthday before you are assigned a score based on credit factors.It won't be a great score since you don't have a mixture of credit scours or a long history of on-time payments, but it will be a starting score.

Credit scores are highly variable and easily influenced when they're relatively new. That's because there's so little data to them, so even small changes can have an outsized effect on the whole.

Just like how if you have $1, giving you a quarter will be a significant increase in money, but if you have $100, a quarter is barely anything.

The "training wheels" period for credit scores is around 2-4 years. That is, you have to have been building credit for 2-4 years before your score starts to reach a point where it settles down and becomes somewhat harder to influence.

The "training wheels" period for credit scores is around 2-4 years. That is, you have to have been building credit for 2-4 years before your score starts to reach a point where it settles down and becomes somewhat harder to influence.We say "somewhat" harder here because your credit score is always relatively easy to influence if you know what you're doing and take the right actions. This entire website is predicated on teaching you how to do exactly that, after all.

Before two years of credit history, you don't have a lot established. Creditors looking at your credit history can't see a long line of on-time payments because you haven't had a score long enough to even be making payments.

Each factor in a credit score has an "ideal" or "best" range to hit. For example, the number of late payments should be zero, and the percentage of utilized credit should be under 30%.

So, is there a "best" point for the age of your credit history? Yes and no.

Most people consider a credit history to be fully matured at around ten years. That means you can't get a "perfect" score on your credit history until you're at least 28 years old, assuming you started from scratch at age 18. Obviously, this can be lowered slightly if you took advantage of loopholes like being an authorized user at 16.

Some creditors will say seven years is good enough, as well. That means the youngest feasible age to have a "mature" credit score is 23, assuming you started early. On average, though, this is relatively uncommon.

Another age-related factor you might have heard before is that negative marks and blemishes on your credit report will drop off after seven years.

This is a little tricky to conceptualize, and it won't affect everyone. It's specifically for delinquent accounts and the report on your credit history that payments were missed.

This is a little tricky to conceptualize, and it won't affect everyone. It's specifically for delinquent accounts and the report on your credit history that payments were missed.For example, say that you miss a single payment on a car loan, and it's late by over 30 days. You then pay it, but the blemish remains; you were reported to have missed a payment. That blemish hurts your credit, but if your overall credit report is positive, it won't be devastating.

Unfortunately, it will take seven full years from the date of that account becoming delinquent for that blemish to fall off of your credit report. For a single missed payment, that's pretty obnoxious. That's why many people recommend trying out a goodwill letter, asking your loan servicer to remove that blemish from your credit report in light of the rest of your credit history.

This gets a little more complex if your account falls delinquent for a longer period. Say you miss three payments in a row, putting your account 90 days delinquent. If you then bring the account up to current, paying off that debt, those blemishes will stay on your report.

When, though, do they fall off? "Luckily," it's the date when the account first fell delinquent. So, the date at which the first payment was labeled late, plus seven years, all of those late payments will fall off. That can be a (very) slight boon to your credit score, letting slightly more recent blemishes fall off along with older blemishes.

This only works if it's a single instance, however. If you miss three payments, bring your account up to current, then six months later, miss another payment, the seven-year erasure will only remove the original string of blemishes and not the more recent one.

What if you completely abandon the account and it goes to collections? When the seven-year mark of the original delinquency is reached, the entire account, along with any accounts it was sold to as collections, will be removed. This is beneficial in that a delinquent account is removed, but it's also detrimental in that an old credit account is removed from your history, collectively making the age of your credit history lower.

This is why, if an account falls to collections, many people will consider trying a "pay for delete." A pay for delete is a negotiation with a debt collector. In it, you offer to pay some portion of your debt in exchange for the debt collector removing the blemish from your credit report. The debt collector makes money because they likely bought your debt for pennies on the dollar, and it's no benefit to them to punish you after you pay them, so many will accept these terms rather than have to hound you for years until they can no longer pursue a debt.

"If your account has been current ever since, the status will change to show "never late" when the last series of late payments falls off, and the account will appear as positive. However, if the account was never brought current, then the entire account will be removed seven years from the original delinquency date." – Jennifer White, via Experian.

One thing to note is that this isn't all-or-nothing. A delinquency will fade in impact the older it is until it finally falls off your credit history. Thus, you generally don't see a massive improvement when a late payment falls off your report because the negative impact of it has gradually faded over the years up to that point.

Another important age-related factor for your credit history is how old the accounts you maintain are. Generally, the older an account is, the better, especially with lines of credit like credit cards. A credit card that is one year old won't be necessarily as representative of your credit performance as a credit card that is six years old, with a similarly positive history of on-time payments and low utilization.

Credit bureaus will generally consider the average age of your accounts rather than just the age of the oldest. This is why opening several lines of credit in a short time can be indicative of something negative and can impact your score.

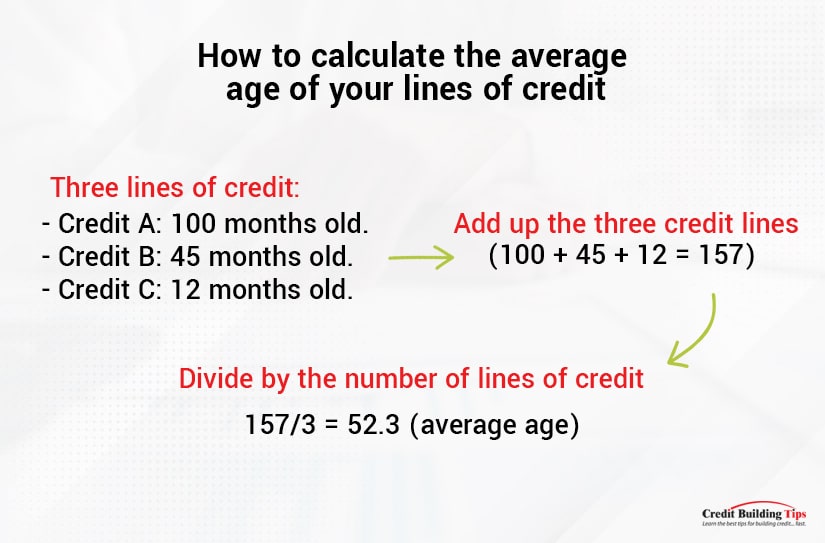

To calculate the average age of your lines of credit, simply take the average of each line's age. For example, if you have three lines of credit:

You add up the three (100 + 45 + 12 = 157) and divide by the number of lines of credit (three in this case, so 157/3 = 52.3, for an average of a little over 4 years old) to get your average age.

This is why it's generally recommended to keep an older line of credit around, even if you don't frequently use it. Setting it to auto-pay a few small bills and forgetting about it helps build credit passively, simply out of age and a history of on-time payments and low utilization.

This is why it's generally recommended to keep an older line of credit around, even if you don't frequently use it. Setting it to auto-pay a few small bills and forgetting about it helps build credit passively, simply out of age and a history of on-time payments and low utilization.It's also important to keep your older lines of credit active. There are two reasons for this.

The first is that inactive accounts can, sometimes, be charged fees for being unused. This is relatively rare today, but some credit cards and other lines of credit, when left idle, might charge service fees or other charges just to be kept open. Luckily, this has been banned in the USA since 2009, so it shouldn't be a problem unless you're dealing with international creditors.

The second is that dormant accounts are often simply closed out by creditors. After a period of inactivity – usually at least a year, though it varies by creditor – they may simply close your account. In addition to losing any accrued rewards or benefits, you also lose that account's history on your credit report; rather than an old, active account, you have a closed account, which is worth significantly less.

Truthfully, this is one of the least important factors to concern yourself with when you're trying to improve your score.

Why?

Well, it's simple: you can't speed up time. No matter what you do (short of traveling near the speed of light), you can't alter the flow of time. Your credit history's length will grow at a rate of one day per day, one year per year, and you can't really change that.

Well, it's simple: you can't speed up time. No matter what you do (short of traveling near the speed of light), you can't alter the flow of time. Your credit history's length will grow at a rate of one day per day, one year per year, and you can't really change that.The only thing you need to concern yourself with is keeping older accounts in good status and keeping lines of credit around as long as they benefit you. You may want to think twice about closing out an old credit card if it's acting as an anchor for the average age of your credit accounts, but that's not the credit history length metric at all. Remember, there are two different age-related metrics in your credit report.

Start building credit as early as you can, but otherwise, don't worry that much about it. If you're still young, just remember that you'll be building credit over time. If you're already older, chances are you've built up your history already, and the age factor is already as good as it can be.

If you ever have questions or concerns about anything credit related, please feel free to drop me a line at any time! I'd be more than happy to answer any of your potential questions and assist you on your credit building journey however I possibly can!