Credit card owners have to keep track of two important dates, and it's extremely easy to get them confused or not know what they mean. Financial literacy is important, so we're doing our part to help keep you educated about everything from the most basic info to advanced financial strategies. This one is, of course, on the more basic end of the spectrum.

The two dates are the closing date and the due date. What are they, and why are they important?

Credit cards operate on a billing cycle. The specific length of a billing cycle varies from credit card issuer to issuer. However, to avoid undue confusion and to enforce standardization, the government requires that the billing cycle be consistent, with no more than four days of variance. This is mostly just to allow for the difference in lengths of months.

Thus, you will often end up with billing cycles from the first of one month to the first of the next month, or from the first Monday of one month to the first Monday of the next month, and so on.

The day at which a billing cycle ends is the closing date for that billing cycle. At this point, your outstanding balance is calculated, and you are sent the billing statement for your credit card.

The day at which a billing cycle ends is the closing date for that billing cycle. At this point, your outstanding balance is calculated, and you are sent the billing statement for your credit card.Any charges and payments made and any interest added to your account on ongoing balances are calculated. Your minimum payment is calculated and sent to you in your billing statement.

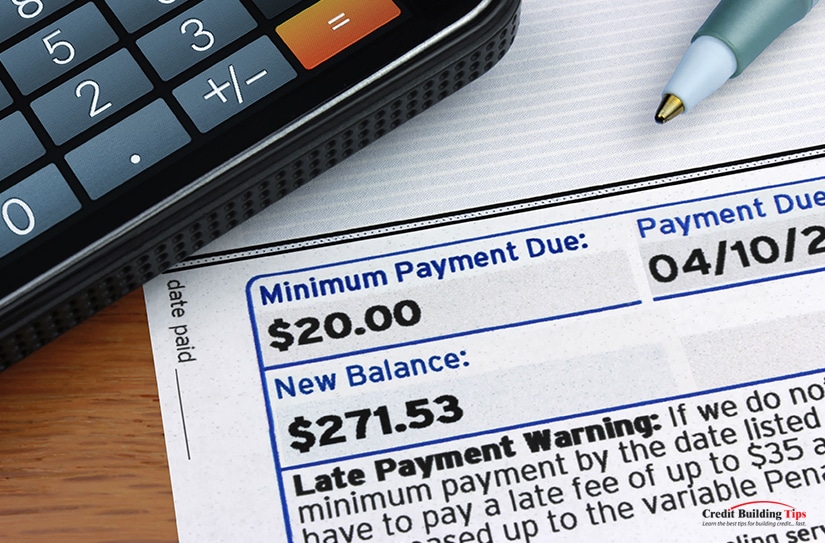

As you might expect, the due date is the date at which your credit card expects to receive money. You can, of course, pay any time earlier, including immediately after making a purchase on your credit card.

The due date is the date at which your account may be considered late and where interest will accumulate on the balance on your card.

The due date is the date at which your account may be considered late and where interest will accumulate on the balance on your card.Due dates are generally around three weeks after the closing date for your credit card. The exact amount of time varies from issuer to issuer.

According to The Balance, the time between them for major issuers is:

Many of these are "up to" or "minimum of," but the grace period is somewhere around three to four weeks. During this time, interest is not added to accounts in good standing.

The due date is generally much more flexible than the closing date of a credit card. Closing dates need to be regular for the computer programs to properly calculate interest rates and payment minimums, and to issue statements to the people who have balances to pay. Due dates, however, can involve flexibility with grace periods and payment terms that work as a benefit for account holders in good standing.

Grace periods are not legally-mandated, but every major credit card issuer offers one of around the same amount of time. This time allows you to receive your credit statement, determine how much you can afford to pay towards it (if you're paying somewhere between the minimum payment and the full balance), wait for a paycheck to clear, and potentially reach out to negotiate terms if you're in dire financial straits.

Your credit card grace period is the time between the closing date and the due date.

Your credit card grace period is the time between the closing date and the due date.For individuals whose accounts are in good standing, the grace period is generally interest-free. Interest on your balance is calculated either if you miss the payment or when the next billing cycle closes. Interest is also calculated on outstanding balances when you are paying the minimum, but won't kick in until the end of the grace period or the following billing cycle. These terms can vary depending on the issuer and the specific credit card, as well.

What is most interesting is that grace periods are not required. However, if your credit card company chooses to offer a grace period – and almost all of them do – federal law mandates that it must be at least 21 days.

"Although credit card issuers are not required to offer a grace period, those that do must provide a minimum of 21 days under federal law. That means cardholders will have at least three weeks to pay off any purchases they made during a billing cycle, and if they do, they can avoid interest." – US News.

Some credit cards offer much longer grace periods, up to as much as 55 days. It's often considered a benefit for account holders in good standing to go longer without interest accruing on their balances.

Grace periods are harder to find on credit cards specifically created and issued to people with subprime credit. It's yet another way that financial institutions insulate themselves from risk from individuals whose credit indicates a lower chance of paying their bills. Along with lower credit limits and higher interest rates, these are reasons why you should strive to raise your credit as much as you can. Please, check out the rest of our blog if your credit is low to find more tips for raising your credit quickly and with a minimum amount of effort and expense.

It's also worth mentioning that you can lose your grace period if your account falls out of good standing. Conversely, if you bring your account back into good standing, your issuer may restore your grace period. As with most things, these will likely be defined in the terms of use for your credit card, but you can always call your credit issuer to ask for their policies in plain English if reading the fine print is too much for you.

Generally, when you apply for and are approved for a credit card, the credit card company sets your closing and due dates based on their policies and the date you opened the card. There's often no fixed date where everyone has to pay, though many credit card companies pick simple days to track, like the first of the month or the first Wednesday of the month.

Can you change these days? The answer is: maybe.

Sometimes, you can talk to your credit card company and ask them if you can change the due date for your credit card. Depending on your account's standing, length of history, and other factors, they may or may not be willing to entertain the idea. Generally, if you can make a good argument such as "the due date is right before my paycheck date," you may be able to persuade them to push it back a few days or a week to ensure you're more consistently able to pay your credit card bills.

You can also negotiate other aspects of your credit card, such as interest rates and credit limits. That's outside the scope of this post, however.

Closing dates may or may not be fixed, and it will, again, depend on the issuer. Some are stricter about their terms than others. However, it never hurts to call them up and ask about shifting terms, just in case. The longer your account has been in good standing, the more likely they are to cut you some slack.

When paying off your credit card balance, you have a lot of options and flexibility.

The truth is, any time you can pay your credit card bill before the due date is fine. There are minor benefits to paying earlier or proactively, but the biggest, most important thing is to not miss your due date. That's when late payments happen, when penalties and interest kick in, and when you may need to consider something like a goodwill letter to remove a blemish from your credit report.

The truth is, any time you can pay your credit card bill before the due date is fine. There are minor benefits to paying earlier or proactively, but the biggest, most important thing is to not miss your due date. That's when late payments happen, when penalties and interest kick in, and when you may need to consider something like a goodwill letter to remove a blemish from your credit report.

In general, the best advice for using a credit card is to always treat it as if it's a debit card and only make purchases that you can afford to pay in full. Credit card limits are best used as buffer and emergency leeway in the case of an exceptional emergency or large purchase that would otherwise take several months to save for. Of course, whatever method you use that works for you is fine, so long as you don't fail to pay your balance and you are aware of the detrimental effect of interest accruing on outstanding balances.

One common belief is that, to build credit, you need to have an ongoing balance on your credit card.

The truth is, this is not true. Carrying a balance on your credit card increases your credit utilization, even if it's only a small percentage. The more credit utilization you have, the lower your credit score can be in that category.

The truth is, this is not true. Carrying a balance on your credit card increases your credit utilization, even if it's only a small percentage. The more credit utilization you have, the lower your credit score can be in that category.Meanwhile, carrying a balance runs the risk of accruing interest and fees, especially if you don't frequently use the credit card and accidentally miss a payment. It's a lot of additional work to maintain for no benefit whatsoever.

It is always better to pay off your credit card debt than to let some of it ride if you don't have to.

Some people might fear that they may have a fee for letting their credit cards go unused. Such fees, called dormancy fees, are illegal in the United States and have been for quite some time. The worst that can happen is that a credit card issuer might view an unused credit card as unnecessary and, if it's left unused indefinitely, close it. Generally, they will send you notice of their intent to close the account ahead of time, so you can start to use it again to keep it alive.

Do you have any other questions about credit card mechanics, terminology, or optimization? What about how they interact with your credit score? We're here to help you out, educate you on the best way to manage your credit cards and credit score, and help pave the way for you to achieve a high credit rating and credit report. Everyone deserves a financial opportunity, and often, all it takes to get there is a little knowledge.

If you have any specific questions or concerns, feel free to ask them in the comments. We'll do what we can to answer, educate, and even write whole guides on the subject, as relevant. We're here to help, but we can only do that when you let us know what you need. Let our tips help guide you to a great credit score! We greatly look forward to assisting you on your credit building journey however we possibly can!