If your credit score is lower than you want it to be, learning what builds your credit the most can help you prioritize the most important factors in your efforts to boost your score.

What can you do to increase your credit score? What has the biggest impact? How quickly can you expect changes you make to reflect on your credit profile?

There are several different strategies you can use to build your credit quickly, including reducing your credit utilization ratio, using a third-party service like Experian Boost, or becoming an authorized user on someone else’s account.

There are several different strategies you can use to build your credit quickly, including reducing your credit utilization ratio, using a third-party service like Experian Boost, or becoming an authorized user on someone else’s account.In this article, we’re going to take a closer look at what builds your credit the most, the steps you can take to increase your credit score quickly, and the habits you can practice to build your score over time.

Before we can talk about what builds your credit the most, let’s quickly go over how your credit score is calculated. There are several different credit scoring models out there, each of which weighs these factors a bit differently.

In general, though, you can expect that payment history and credit utilization, in that order, are the most important factors when it comes to the health of your credit score.

Sometimes, you don’t have a ton of time to wait around for your credit score to inch up over time. If you’re looking to see some real results right away, consider trying one of the following.

Are you eager to build your credit right away but you’re struggling with the fate of a limited credit history? Starting to build up credit from scratch can be frustrating and time-consuming. After all, you need to be given access to credit in order to build up your credit file, but lenders and creditors are wary of giving out lines of credit or loans to people with thin credit profiles.

One of the fastest ways to build your credit is to use an alternative data service. This is a way to add some positive information about your financial responsibility that usually don’t show up on your credit report.

This service allows users to include their utility and telecom bill payments in their credit reports, potentially raising their score by reflecting timely payments not typically considered in traditional credit scoring models. By leveraging such alternative data services, individuals can see an immediate uptick in their credit score by showcasing responsible payment behavior across various accounts.

Experian Boost can increase your score right away. However, if you choose to use a rent reporting service, how long it takes to see a change in your score depends on the service and your rental history.

It depends.

Using Experian Boost or rent reporting services might have a significant impact on your score or it might not change that much. If you already have a robust and healthy credit history, Experian Boost might not be as beneficial to you as it would be for someone with a thin, imperfect credit score.

One of the most impactful ways to improve your credit score is by reducing outstanding debt.

High credit utilization—the amount of credit used compared to the total credit available—can adversely affect your score. Focusing on paying down credit card balances and other outstanding debts can significantly boost your credit score by reducing this utilization ratio.

Reducing your balances by making payments can help you improve your credit very quickly.

You’ll have to wait for the lower balance to be reported to the credit reporting agencies, but once this information has been passed along you should see improvements in your score.

Paying down your debt and decreasing your credit utilization ratio is one of the most impactful things you can do to positively contribute to your credit score. Your credit utilization is the second most important factor for your score after making your payments on time.

Keeping your balances low is only one of the ways you can improve your credit utilization ratio. The other side of the equation is increasing your credit limit.

Requesting a credit limit increase can positively impact your credit score. If you have a good payment history and responsible credit usage, a higher credit limit can decrease your credit utilization ratio, potentially elevating your credit score. However, it's crucial to use this increase in limit responsibly and not accrue additional debt.

This is another really fast way to see a change in your credit score. As soon as the credit limit increase has been reported to the credit bureaus, your score will be updated to incorporate the new information.

Increasing your credit limit could actually have a pretty big impact on your credit score. However, how much benefit you see is going to depend on the current state of your credit profile.

For example, people with thin credit profiles will probably see a pretty big difference in their score once their limit is raised. Those with a much more established credit history, on the other hand, will likely see much benefit from a credit limit increase.

For those looking to establish or rebuild credit, secured credit cards offer a practical solution.

These cards require a cash deposit as collateral, which typically determines the credit limit. This means that if you put down $500 as a deposit, you’ll usually have a $500 credit limit.

By using a secured card responsibly—making timely payments and keeping balances low or at zero—you can demonstrate creditworthiness, which can translate into an improved credit score over time.

The extent to which a secured credit card will help your credit score depends on your existing credit profile. If you don’t have much credit or your credit is on the lower side, you’ll see more of an impact than if your credit score is already healthy.

Being added as an authorized user on someone else’s credit account can potentially boost your credit score, so long as the primary account holder’s credit history is positive.

This strategy allows you to benefit from another person’s responsible credit usage. At the same time, you’ll want to be cautious before using this strategy, as it won’t help your score if the primary account holder has a troubled credit history.

This is one of the fastest ways you can improve your credit score, assuming the person who added you to their account has a strong credit history. Once the credit account you’ve been added to is reported to the bureau, your credit score will reflect the new, positive information.

It’s possible that becoming an authorized user will have a significant impact on your credit score. However, how much it influences your score depends on your existing profile.

For instance, if you already have established credit but a bunch of derogatory marks on your report, you probably won’t see as much benefit as someone who has a thin credit file. Furthermore, the person who is adding you to their account needs to have a healthy credit profile themselves for it to contribute positively to your credit report and score.

While it might seem counterintuitive, addressing collections accounts can positively impact your credit score.

Negotiating with creditors or collection agencies to settle debts or establish payment plans can prevent further negative impacts on your credit report. Over time, as you address these accounts, their impact on your score diminishes.

Before you run out and make payments on that old collections account, though, it's a good idea to strategize. Just because a collections account falls of your credit report doesn't mean you aren't still legally responsible for repayment. At the same time, making a payment can restart the clock on how many years it will take for the derogatory mark to fall of your report.

Are you trying to get a collection account completely removed from your credit report? Make sure you check out my post about how to delete a collection in exchange for payment.

The answer to this question depends on a number of factors. Some credit scoring models don’t factor in paid collections when calculating your score. For these models, you’ll see a bump in your score as soon as your collections account is marked as paid off.

However, other models do incorporate collections accounts even once they are paid off. Furthermore, if you are disputing a collection account or asking the debt collector to delete the account, you probably won’t see any change for a few months.

How much your score changes after paying off collections is going to vary. Your credit score can be seriously damaged by having an account in collections. If you are able to get the debt collector to stop reporting the account, it could help your score quite a bit.

However, if the account continues to be reported, then the impact you’ll see will depend on the credit scoring model used. VantageScores and more recent FICO models don’t incorporate paid collections into their calculation, but older FICO models will still ding your score if there are paid collections accounts on your profile.

Regularly monitoring your credit report is fundamental to understanding your financial situation.

When you keep an eye on your credit report, you can detect and address any errors or discrepancies that might be negatively impacting your score.

You can use AnnualCreditReport.com to gain free access to your credit report from each of the three major credit bureaus. This is one of the most important things you can do to stay informed about your credit health.

When you notice an error on your credit report, you’ll want to dispute it with the credit bureaus or your creditor right away. When you make a dispute claim with the credit bureaus, they have thirty days to look into the situation and get back to you.

How much this impacts your score depends on the circumstance. If there’s a mark on your credit report saying that you missed payments when this isn’t the case, for example, you can see a big jump in your score.

While there are a number of ways you can increase your score relatively quickly, you might find that none of these solutions offer you much help. In general, it takes time to increase your credit score. If you are willing to put in the work to manage your credit, you can see your score improve over time.

The most important part of your credit score is your payment history. This means that making consistent and punctual payments is one of the best things you can do to keep your score healthy.

Late payments can significantly dent your score, so ensuring on-time payments for all credit cards, loans, and bills is crucial. Setting up automatic payments or reminders can help you stay on track and avoid unnecessary penalties or negative impacts on your credit report.

The second most important part of your credit score is your credit utilization ratio. This is the ratio of your credit card balances to your credit limits.

Keeping your balances low, ideally below 30% of your credit limit according to most experts, showcases that you are a responsible borrower. Paying off balances in full each month not only demonstrates financial discipline but also keeps your utilization rate low, positively impacting your credit score.

Though it’s not the most important factor when calculating your credit score, the length of your credit history matters in determining your creditworthiness.

Closing old accounts can shorten your credit history, which might lower your average account age and subsequently affect your score. Even if you're not actively using old credit accounts, keeping them open can contribute positively to the length of your credit history, benefiting your score in the long run.

A word of warning here, though: if you’re struggling with a spending problem, closing your old accounts might ultimately be the best strategy to avoid getting back into debt. Account age is important for your credit score, but staying out of spiraling debt is more important than having a perfect score.

Another thing you can do to build your score over time is work to diversify your credit portfolio.

At the same time, you don’t want to apply for too many new credit cards or loans at one time. When you do this, lenders can see all of the new hard inquiries on your profile. This can indicate to them that you’re strapped for cash and that you would struggle to pay back any money you borrow.

Assuming that you are applying for new credit in a reasonable way, though, having a mix of credit types can positively impact your score. This means having different types of accounts on your credit report, such as:

Responsible management of various credit accounts showcases your ability to handle different financial obligations, reflecting positively on your creditworthiness.

Building off of the previous point, it’s important to be careful not to apply for too much credit at one time.

Each time you apply for new credit, a hard inquiry is made on your credit report, which can temporarily lower your score. Multiple inquiries within a short period might signal to lenders that you're in financial trouble or a higher-risk borrower, potentially impacting your score negatively. Being selective about new credit applications and spacing them out can help mitigate this impact.

Having a low credit score can have a big impact on your financial opportunities. As you work to build your credit, you might be wondering how possible it is to increase your score by 100 points relatively quickly.

The truth is, how much your credit score will improve using the tactics in this article is going to depend on the current state of your credit report.

If your score is poor right now, making positive changes can have a pretty big impact. The worse your score is, the more a small change will reflect in your score.

So, what builds your credit the most? The answer is that it depends on your current credit profile and financial situation. In general, though, there are a number of tactics available that you can use to have a positive impact relatively quickly.

Some of the things you can do if you want to have the biggest impact on your score include:

When you first start learning about credit scores and credit reports, the whole thing can feel pretty overwhelming. However, it’s worth overcoming the obstacles in your way and gaining a solid understanding of the system. The better your credit profile, the more financial opportunities will be open to you in your life.

Are you on a mission to improve your credit? Are you looking for practical advice regarding how you can build your credit over time? Make sure you check out the rest of our Credit Building Tips blog!

If you’ve been researching applying for a loan, you may have been disappointed to learn that higher interest rates in recent times have led to an increase in loan rejections. Having a cosigner or co-applicant can help increase the likelihood that you’ll be approved for a loan and can even improve the terms you’re offered.

When you choose the right cosigner or co-borrower, your own credit can even be improved as you work to build a positive payment history.

At the same time, taking on a cosigner or co-applicant is a big decision. This isn’t something you’ll want to pursue lightly, both for the sake of your personal relationship with the other individual as well as your financial future.

At the same time, taking on a cosigner or co-applicant is a big decision. This isn’t something you’ll want to pursue lightly, both for the sake of your personal relationship with the other individual as well as your financial future.Let’s take a closer look at what you need to know about cosigners, co-applicants, and co-borrowers to ensure you have all of the most important information before moving forward with your application.

There are important distinctions to be made between the terms “co-borrower,” “cosigner,” and “co-applicant.” You’ll want to make sure you fully understand which type of agreement you are signing on for before putting your name to any loan agreement.

“Co-borrower” and “co-applicant” are often used interchangeably, though one could technically argue that co-applicant is the term used during the application process while co-borrower is the term used once the loan has been approved and funded.

Here is the bottom line:

When someone cosigns a loan, it means that they are adding their name, financial info, and credit history to the loan application of the primary borrower.

By doing this, they are agreeing to take on the legal responsibility of paying back the loan amount (and any extra fees) if the borrower isn’t able to keep up with the payments.

Co-signers provide a guarantee for a loan or lease but typically do not have an ownership interest in the financed item. They're responsible for the debt if the primary borrower or tenant fails to pay. Their primary role is to offer assurance to the lender or landlord regarding repayment but may not have any rights to the property or asset being financed.

Usually, a consumer will seek out a cosigner when they know they’re going to struggle to be approved for a loan based on their own financial information and credit profile.

A co-applicant on a loan is an additional individual that is taken into account when a loan is being underwritten and (hopefully) approved. It’s possible that having a co-applicant will help you improve the odds that you will be approved for a loan. Furthermore, you might be offered more favorable loan terms once the other person’s credit history and financial info are added to the pot.

Co-applicants apply for credit together and are equally responsible for repaying the debt if the loan is extended. They both have ownership rights or benefits from the loan or lease agreement. Both parties' incomes, assets, and credit histories are considered in the approval process. They share equal responsibility for making payments.

It’s important to understand that being a co-applicant (or a co-borrower, for that matter) is not the same as being a co-signer. Cosigners usually aren’t given access to any funds or have anything to do with any collateral related to the loan. Instead, they are just, essentially, back-up if the primary borrower can’t pay back what they owe.

A co-applicant, on the other hand, is equally responsible for the repayment of the loan. For instance, if a husband and a wife apply for a mortgage, they would both be considered “co-applicants.” They both have to make sure they are making their mortgage payments on time, and both benefit from the loan. In this particular example, both spouses would end up being named on the title once the mortgage was fully paid off.

Co-borrower is, basically, another term for a co-applicant. Some people make the distinction that a co-applicant and a co-borrower are the same thing, except that they describe different moments in time in the loan process.

If co-applicants apply for a loan and are approved and funded, they become co-borrowers. With co-borrowers, both individuals' incomes and credit histories are considered in the approval process, and both are equally liable for the loan payments. Unlike co-signers, co-borrowers have an ownership interest in the property.

If someone is a co-borrower, it means that they have access to the loan funds in the same way that the primary borrower does. It also means that they have an equal amount of responsibility for repaying the loan as the primary borrower.

Having a co-signer or a co-applicant can potentially help you build credit. However, this isn’t necessarily a given– whether or not your credit improves, thanks to having another person sign their name to a loan, depends on whether you exhibit responsible habits as a borrower.

If you're the primary borrower and have a co-signer, the co-signer’s strong credit history and responsible financial behavior can positively influence your credit. Timely payments on the loan or lease can improve your credit score.

On the other hand, if you miss payments or default on a loan and you have a co-signer, it negatively affects not only your credit but also the co-signers credit score. Their credit is impacted just as yours is because they are equally responsible for the debt if you stop making payments.

If you have a co-applicant on a loan, both of your credit scores are impacted positively or negatively based on how the loan or lease is managed. Timely payments by both co-applicants can help build both individuals' credit histories, contributing positively to their credit scores. Conversely, missed payments or defaults adversely affect both co-applicants credit scores.

Taking out a loan is a big decision, and approaching someone to sign the paperwork alongside you isn’t something to take lightly. You’ll want to think about the impact it could have on both you and the individual you’re asking to sign on as a cosigner or co-borrower.

There are several reasons you might want to approach someone you know and trust to cosign a loan for you.

There are a number of advantages to having a cosigner, including:

On the other hand, having a co-signer isn’t all sunshine and roses.

There are some potential consequences you’ll want to think about before starting to hunt for the right cosigner, including:

You’ll definitely want to make sure you consider the potential impact on your relationship with your cosigner before choosing to go this route. Money has a way of causing strife in even the strongest of relationships, and you’ll want to make sure you have a clear understanding of how and when the loan will be repaid so that you and the cosigner are able to maintain a positive personal relationship during and after the repayment period.

It can be tempting to become a cosigner to help out someone you care about when they’re looking to gain access to a loan or line of credit. However, it’s extremely important you consider all of the potential implications of this before moving forward.

There are, of course, some obvious benefits to being a cosigner for someone else.

Here are some reasons you might choose to become a cosigner:

Some of the reasons you might not want to cosign a loan include:

If a co-signer doesn’t sound like the right thing for your situation, would a co-borrower or co-applicant be more applicable?

Some of the reasons you might want to apply for a loan with another individual include:

Of course, there are always two sides to every coin. Some of the potential downsides of having a co-borrower include:

Not everyone is going to need a cosigner for a loan. Whether or not having a cosigner could be worth the trouble is going to depend on your particular financial circumstances.

Here are some signs that a cosigner might be useful to you as you work to take out a loan or line of credit:

Finding the right cosigner isn’t a decision you’ll want to rush. Not only is a big decision for you because it impacts your ability to gain approval for a loan and affects the terms your offered, but being a cosigner can also have a big impact on the other individual’s financial life.

For this reason, you don’t want to go around asking everyone you run into whether they’ll cosign on a loan. Typically, cosigners will be parents, family members, close friends, or spouses. The less close you are to a person, the less likely it will be justifiable for them to take on the risk of cosigning your loan.

When you start contemplating who to ask to cosign your loan, you’ll want to keep the following factors in mind:

Finally, before I sign off, let's look at one more question that is frequently asked in relation to cosigning-- what's the difference between an authorized user and a cosigner?

In short, the key difference lies in the level of financial responsibility. An authorized user can use a credit account but isn't liable for payments, whereas a cosigner is legally responsible for repaying the debt if the primary borrower defaults.

Essentially, an authorized user is someone who has been given permission by the primary account holder to use a credit card or account. They have the privilege to make purchases but aren't legally responsible for the debt incurred. The primary account holder maintains responsibility for payments.

To help make the distinction a bit clearer, you might want to become an authorized user on someone else's account in order to improve your credit. On the other hand, you might search for a cosigner if you're looking to add the positive credit history of someone you trust to a loan application in order to improve approval odds or gain access to better loan terms.

Having a cosigner or a co-applicant is a great way to gain access to financial products you otherwise wouldn’t be approved for on your own. Furthermore, it can help you lock down better rates and terms on the loan. If you are able to make regular payments toward the loan after another individual helps you secure it, it can help you build credit through a positive payment history.

At the same time, taking on a cosigner or co-borrower isn’t something you want to take on flippantly. This is a serious financial responsibility that the other individual is agreeing to, so it’s important to make sure they understand what their legal obligations are by signing on to the loan.

Are you working to improve your financial future by improving your credit? If so, make sure you check out our Credit Building Tips blog for more articles and resources to help you on your credit-building journey!

When you have a less-than-ideal credit score, it can mean that you have to pay higher interest rates when you borrow money or that you struggle to even be approved for credit. Considering how important it is to have a solid credit score, it’s worth having a fairly thorough understanding of not just what helps your credit score but also what hurts your credit score.

Though there are a number of different credit scoring models that can be used to calculate your precise score, the most common models consider similar factors including your payment history, credit utilization, credit history length, and more.

Things like missing just one bill payment, keeping high balances on your card, or closing old accounts can all have a negative impact on your score.

Things like missing just one bill payment, keeping high balances on your card, or closing old accounts can all have a negative impact on your score.Let’s dive in and take a closer look at some of the surprising things that can damage your credit score to help you keep your score as high as possible.

Before we can take a look at what hurts your credit score, we first need to explore how your credit score is calculated. By understanding the different factors that influence your credit, you can get a better sense of how to keep your score healthy and high.

There are two primary entities that calculate consumer credit scores (FICO and VantageScore,) both of which have several different models that have been released over the years. Furthermore, there are some industry-specific credit scoring models that might be used by lenders. This means that you don't actually have one sole credit score but potentially several.

Each of these models consists of its own particular formula for calculating consumer credit scores. In general, though, you can expect the following factors to have an impact on your score.

Your payment history is the record of your payments on credit accounts, including credit cards, mortgages, and other loans.

On-time payments positively affect your score, while late payments, defaults, and bankruptcies can have a negative impact.

Your credit utilization is the ratio of your current credit card balances to your credit limits.

Maintaining a low credit utilization ratio (using a small percentage of your available credit) is generally considered favorable for your credit score. Most experts recommend that you keep it below 30%, but the general rule is that lower is always better.

The length of time you've had credit accounts is also considered when determining your credit score.

Generally, a longer credit history shows creditors that you have ample experience managing debt, which reflects favorably in your credit score. This factor usually involves looking at the age of your oldest account, the age of your newest account, and the average age of all your accounts.

Opening several new credit accounts in a short period can be seen as a risk, especially if you don't have a long credit history. Each time you apply for new credit, a "hard inquiry" is made, and this can slightly impact your score.

If you apply for a bunch of different credit cards or loans all at once, it looks to lenders like you might be hard up for cash. This reasonably makes them nervous that you are overextended and going to struggle to actually pay back the money you are borrowing. For this reason, too many new credit accounts can ding your score a bit.

The "types of credit" factor considers the variety of credit accounts you have, such as credit cards, mortgages, installment loans, and retail accounts. Having a mix of different types of credit can be positive for your score. Though your types of credit in use only usually count for about 10% of your score, the positive benefits of having a diversity of credit account types are still worth keeping in mind.

There are also a number of factors that you might expect to impact your credit but actually don’t have any influence over your score. By understanding what doesn’t affect your scores, you can get a better sense of what to prioritize when working to improve your credit.

Some things that won’t help or hurt your credit include:

What else won't impact your credit score? Here are a few other things that might surprise you:

When it comes to maintaining a healthy credit score, knowledge is power. Understanding what hurts your credit score is just as important as understanding what helps your score. After all, even one little slip-up can have a negative impact on your creditworthiness in the eyes of potential lenders.

As discussed above, payment history is a crucial component of your credit score. You might think that it’s not a big deal to miss one payment, but the truth is even one missed payment can damage your score.

Missing even one payment can impact your credit score and have other negative repurcussions. For example, you will likely be charged a late fee and might be saddled with a penalty interest rate. If you continue to miss payments, your account may be referred to a collections agency, which can pursue you for the outstanding debt.

For this reason, it’s essential that you always at least make the minimum payments on your debts. Setting up autopay is a great strategy for ensuring you’re not relying on your memory to pay your bills on time.

If you have decent credit, there’s a good chance you regularly receive pretty enticing credit card offers with some regularity. While there isn’t anything inherently wrong with benefiting from the rewards offered by different credit cards, it’s important to recognize that seeking too much new credit at once can hurt your score.

A hard inquiry, also known as a hard pull, occurs when a lender or creditor checks your credit report as part of their decision-making process for extending credit. This typically happens when you apply for a new credit card or a loan (such as a mortgage, auto loan, or personal loan). A soft inquiry, also known as a soft pull, occurs when someone checks your credit report for a non-credit-related reason. These inquiries do not impact your credit score.

The reason for this is that every new credit application is going to result in a hard inquiry into your account. Your score can temporarily drop if you apply for a number of new accounts in a short span of time, which can be a problem if you’re trying to lock down the best rates and terms for a loan.

Paying off debt can be an incredible, freeing feeling. It’s tempting to close your credit card accounts once you’ve paid your final bill, but it’s a good idea to think twice about this. Closing credit card accounts can hurt your score in a few different ways:

Lots of parents want to help their children in any way they can, and one common method is to co-sign on a loan. Furthermore, it can be tempting to help out a close relative or friend who is struggling to receive a loan on their own.

A co-signer is an person who signs a loan or credit agreement alongside the primary borrower and agrees to take responsibility for the debt if the primary borrower is unable to make the required payments. Co-signers are often used to help individuals who may not qualify for a loan or credit on their own due to a lack of credit history, a less than ideal credit score, or insufficient income.

There’s nothing wrong with co-signing a loan, but it’s important to consider all of the potential consequences before moving forward. If the person you’re trying to help out ends up defaulting, your credit score can suffer. Additionally, mixing money and personal relationships has a tendency to get pretty messy, so make sure you have a clear (written) understanding between the two of you in terms of how you will deal with all of the details of the loan.

Becoming an authorized user on another person’s account can actually be a great way to build credit or improve an imperfect credit score.

An authorized user is a person who is given permission by the primary account holder to use their credit card. While authorized users can use the credit card to make purchases and transactions, they are not legally responsible for the debt incurred.

At the same time, though, you want to be very careful when you sign on as an authorized user, as it won’t do you much good if the primary user keeps high balances or misses payments. In fact, if they aren’t responsible credit users, it can end up hurting your credit.

Having too many credit cards can be stressful, and consolidating your debt through one credit card or loan can be incredibly convenient. At the same time, transferring all of your balances to one card or loan could potentially impact your credit.

Though your credit mix isn’t the biggest factor that impacts your score, it’s still a good idea to have a few different types of accounts in your credit report. The two primary types of credit are revolving and installment.

Revolving credit includes credit cards and HELOCs– essentially, these are lines of credit where you are offered a certain credit limit you can borrow against. Installment loans, on the other hand, involve receiving a lump sum that you pay back over time in regular installments. Examples include student loans, auto loans, personal loans, and mortgages.

Having access to credit can be a great thing, but you definitely don’t want to be maxing out your cards every month. Even if you’re doing a good job making minimum payments on time, you might see your credit score drop if your credit utilization keeps going up, thanks to monthly interest charges increasing your balance.

A little less than a third of your credit score is determined by your “amounts owed,” of which credit utilization is a part. Experts typically recommend keeping your credit utilization at 30% or lower. You can determine your own credit utilization ratio by adding up all of your credit balances and dividing them by your overall credit limit.

While some people struggle with taking on too many new credit cards and damaging their scores through hard inquiries, others stay away from borrowing money to keep themselves free from debt.

While living a debt-free life isn’t a bad thing, it isn’t necessarily a good idea to avoid using credit cards or borrowing money entirely. If the day does come when you want to buy a house or a car, there’s a good chance you’ll want to finance the purchase. Without any credit history, you’re likely going to face an uphill battle in finding someone to lend you the cash.

If you’re considering declaring bankruptcy, it likely means that you have fully exhausted all of the other options on the table when it comes to paying back your debts. While your credit score might not be your biggest concern at the present moment, the truth is it’s worth considering just how damaging bankruptcy can be to your future borrowing options.

There are several different types of bankruptcy, but the two most common types– Chapter 7 and Chapter 13– will show up on your credit report for many years. For Chapter 7 bankruptcy, the negative mark won’t disappear for ten years, while Chapter 13 bankruptcy will stay on your report for seven years.

If you strike a deal with a creditor to pay less than you owe in order to settle, it’s worth knowing that this can impact your credit score. At the same time, in many cases, dealing with your unpaid debt is worth it, even though it can have repercussions for your score.

If your home is foreclosed, this info will stay on your credit report for seven years from the first missed payment date. After bankruptcy, foreclosure is seen as the most serious negative event you can have in your credit file.

If you stop making payments toward your debt or even fall a little behind, your loan or credit account will eventually become delinquent. If your account remains delinquent for a while– usually between 120 and 180 days– the creditor might write your account off as a loss. This is known as a “charge-off.”

You might think that this means you aren’t on the hook for the money you owe anymore, but that, sadly isn’t the case. Instead, the account will likely be sold or assigned to a debt collector, who then tries to get you to fork over what you owe.

Having an account charged off and sent to collections is likely going to hurt your credit score. This information can stay on your credit report for up to seven years.

It’s not just credit card debt and loans you have to worry about when it comes to your credit score. It might seem a bit unfair, but the truth is that paying the child support you owe on time likely won’t help your credit, but failing to make your payments can hurt your score.

Like most other types of negative info, unpaid child support payments can remain on your credit report for up to seven years.

Even if you’re doing absolutely everything right, it’s possible that there is some information on your credit report that is dragging down your score. Errors are not uncommon on credit reports, whether they result from a mistake on the part of the creditor or identity theft.

You shouldn’t assume that everything is hunky dory with your credit report– make a habit of checking it regularly. If you happen to notice an error, you’ll want to start the dispute process right away.

The importance of having good credit can feel pretty abstract until you are actively trying to get a credit card or take out a loan. At the same time, it can be hard to improve your score overnight– building and improving credit typically takes time.

For this reason, it’s a good idea to stay on top of your credit health by avoiding things that can hurt your score and practicing responsible borrowing habits. For more information about how to keep your credit in tip-top shape, make sure you check out our Credit Building Tips blog!

If you have a Discover card, you can access your FICO credit score for free without causing any damage to your credit. Is the FICO score checker on the Discover website accurate, though?

Furthermore, is this the same score that lenders will look at when assessing your creditworthiness?

The short answer is that your Discover FICO score is an accurate representation of your credit score calculated using the FICO 8 model and your TransUnion credit report. However, this isn’t necessarily the same score that lenders will look at when deciding whether to extend your credit or a loan.

The short answer is that your Discover FICO score is an accurate representation of your credit score calculated using the FICO 8 model and your TransUnion credit report. However, this isn’t necessarily the same score that lenders will look at when deciding whether to extend your credit or a loan.Let’s take a closer look at what you need to know about the free FICO 8 score you can receive as a Discover cardholder.

A FICO score is a credit score that is used to assess an individual's creditworthiness. FICO stands for Fair Isaac Corporation, which is the company that developed and maintains the scoring model. This type of credit score is widely used by lenders, such as banks, credit card companies, and mortgage lenders, to evaluate how risky it is to lend money to a particular consumer.

The FICO score is based on information in your credit report, which includes details about your credit history, such as:

Your FICO score is a three-digit number that typically ranges from 300 to 850, with higher scores indicating better creditworthiness.

Your FICO score is calculated using a number of different pieces of credit data that are recorded in your credit report.

The factors that contribute to your FICO score are weighted as follows:

A higher FICO score is generally seen as a positive indicator to lenders, as it suggests that you are more likely to repay your debts on time. This can result in better loan terms, lower interest rates, and access to a wider range of financial products and opportunities. On the other hand, a lower FICO score may lead to less favorable lending terms or even difficulty in borrowing money at all.

It's important to regularly monitor your FICO score and credit report to ensure that the information is accurate and up to date, as errors or inaccuracies in your credit report can negatively impact your credit score. You can obtain your FICO score from various credit reporting agencies.

You are entitled to one free credit report from each of the major credit bureaus annually through AnnualCreditReport.com. Until the end of 2023, you can actually get a free credit report from each bureau once a week from the same site.

FICO scores are generally considered to be accurate and reliable indicators of an individual's creditworthiness. At the same time, there are a few essential points to keep in mind when trying to understand the accuracy of your FICO score:

At the end of the day, credit scores are just one of the pieces of information lenders take into account when assessing your creditworthiness. When you apply for a mortgage, for example, they will usually consider factors including employment history, income, and debt-to-income ratio.

If you have a Discover credit card, you can access your FICO score for free through your online account.

It's important to note that consumer scores you receive from a credit card issuer are, ultimately, limited in their usefulness. At the same time, this doesn't mean it can be a valuable tool as you keep your finger on the pulse of your financial health.

Discover provides you with your FICO Score 8. This is one of the most widely used scoring models. In order. to calculate your score, they use data from your TransUnion credit report.

The score provided by Discover is generally considered to be accurate but with some caveats. This is a FICO 8 score calculated based on your TransUnion credit report and using information from one particular moment in time. Other credit scoring models or the same model using your credit report from a different credit bureau could return different results. Similarly, your credit score is dynamic, meaning that it can change quickly based on newly reported information.

When you take a look at your Discover credit score using their free FICO score checker, you are looking at a calculation that is based on your credit history at a specific moment in time. This means that there's a good chance your credit score will vary from month to month.

When you take a look at your score, it's a really good idea to always glance at the "as of" date.

One of the reasons that this type of free credit score service that credit cards so often offer is so valuable is that it won't hurt your credit score.

There are two different ways to check a credit score-- through a hard inquiry and a soft inquiry.

Soft inquiries, on the other hand, can only be viewed by you on your credit report. These don't impact your credit score. When you check your credit score through Discover's FICO score checker tool, it is a soft inquiry and not a hard inquiry into your credit.

There are tons of things you can do to keep an eye on your financial health, one of which is frequently checking your credit score. There are a number of ways you can access your credit score, including some free and some paid methods.

What's important to know is that the credit score you receive in this way isn't necessarily going to be the same score that a lender will look at when you apply for a loan. For this reason, it can be a great way to keep your finger on the pulse of your credit, but it might not be enough if you're thoroughly auditing your financial situation before applying for a mortgage or a loan.

When we talk about credit scores, we usually discuss them as if each individual has one score that's carved in stone. In reality, though, each of us usually has several different credit scores that change over time as our financial circumstances change.

It's common for individuals to have different credit scores because there are multiple credit scoring models and credit bureaus, and each may use slightly different criteria and algorithms to calculate your credit score.

Here are some key reasons why you might have different credit scores:

FICO scores and VantageScores are both credit scoring models used by lenders and creditors to assess an individual's creditworthiness. At the same time, they are not identical processes, and both scoring models can return different results when an individual's credit score is calculated.

Let's take a look at some of the primary differences between these two scoring models.

FICO scores typically range from 300 to 850, with higher scores indicating better creditworthiness. Most lenders use FICO scores, and they are well-recognized and established in the lending industry.

VantageScores, on the other hand, can have different scoring ranges depending on the version being used. VantageScore 3.0 and 4.0 have a range of 300 to 850, similar to FICO. However, VantageScore 1.0 and 2.0 had a range of 501 to 990. This variation can sometimes lead to confusion when interpreting the scores.

Several factors are taken into account when your FICO score is calculated, including payment history, credit utilization, length of credit history, types of credit used, and recent credit inquiries. Payment history and credit utilization are given significant weight in FICO scoring models.

VantageScores also consider payment history, credit utilization, length of credit history, types of credit, and recent inquiries, but some models can weigh certain factors differently. For some versions of the VantageScore, more emphasis is placed on recent credit behavior and trends in your credit history.

How these two models were developed is also an important distinction between them. The Fair Isaac Corporation developed the FICO scoring model in 1989, which was the first broad-based consumer credit score. FICO has been around for several decades, and its scoring models are widely used by lenders across various industries, including mortgages, auto loans, and credit cards.

VantageScore, on the other hand, is much newer. Developed jointly by the three major credit reporting agencies-- Experian, Equifax, and TransUnion-- it was created as a competitor to FICO scores and has undergone several iterations over time.

Lenders typically use FICO scores when evaluating a borrower's creditworthiness. FICO scores are widely recognized and have been in use for many years, making them the preferred choice for most lenders in various industries, including mortgage lending, auto financing, credit cards, and personal loans.

It's important to understand that there are several versions of FICO scores, with FICO Score 8 being one of the most commonly used iterations. However, some industries and lenders may use different versions of FICO scores tailored to their specific needs. For example, mortgage lenders may use FICO Score 2, FICO Score 4, or FICO Score 5 for mortgage lending decisions.

While FICO scores are the primary credit scores used by lenders, some lenders may also consider other credit scores or factors in their decision-making process. For example, they may use their proprietary scoring models or take additional information into account, such as income and employment history.

Mortgage lenders typically look at your FICO scores when assessing your creditworthiness for a home loan. The specific version of the FICO score that they use can vary, but for mortgage lending, lenders commonly rely on older versions of the FICO score, specifically FICO Score 2, FICO Score 4, or FICO Score 5. These versions are designed to evaluate a borrower's credit risk, specifically for mortgage-related decisions.

This means that the score you see when you look at the score provided by Discover– your FICO 8 score– could be quite different from what the mortgage lender looks at.

FICO Score 8 and older FICO scoring models differ in a few key ways, including how they assess and weigh various factors in your credit history.

Here are some of the main differences between FICO Score 8 and its predecessors:

FICO Score 8 is more lenient in how it treats collections accounts. It doesn't penalize you for paid collections accounts, which means that if you've paid off a collection, it won't have as negative an impact on your score as it might with older FICO models.

Some older FICO models penalize your score for collections accounts regardless of whether they've been paid or not.

Authorized user accounts are incorporated into scoring when the FICO 8 model is used. This allows individuals to potentially benefit from the positive payment history of the primary account holder. Some older FICO models don't include authorized user accounts in the credit history used for scoring.

FICO Score 8 may be less punitive when it comes to high credit card balances. While it still considers your credit utilization (the amount of credit you're using relative to your credit limit), it may not penalize you as severely for high balances compared to some older FICO models.

Another important distinction is that FICO Score 8 incorporates updated information about the way that credit reporting agencies handle public records, such as tax liens, evictions, and civil judgments. It no longer factors in certain types of public records that may be less accurate or complete, potentially benefitting some consumers that have negative information on their credit reports.

Older FICO models might have different criteria for public records, which can impact your score.

Before I sign off, let’s look at some of the most common questions about the free score offered by Discover.

When you use the credit score service available through your Discover account, you'll be looking at your FICO Score 8. As one of the most widely used scoring models according to FICO, this can be a great way to gauge your credit health generally.

When you look at your Discover credit score, you're viewing a calculation that was made using data from your TransUnion credit report. It's important to understand that each of your credit reports can sometimes have different information on them, as not all creditors and lenders report to all three bureaus.

In some circumstances, this can mean that your credit scores calculated from different credit bureaus vary quite a bit. For example, if you defaulted on a credit card debt and this was only reported to Experian, your Experian score might be notably lower than those calculated using your Equifax and TransUnion reports.

There are a number of reasons why you might see some variability in your credit scores.

Here are some of the primary explanations for this:

Tools like the one offered by Discover that allow you to check your credit score for free can be very useful as you keep an eye on your financial health. When your credit score indicates to lenders that you are a low-risk borrower, you’ll be much more likely to be approved for credit and loans as well as better able to snag lower rates.

At the same time, the credit score you see when you use this Discover tool is only one of your many potential credit scores. For this reason, it’s important to watch all three of your credit reports for errors, inaccuracies, or trouble spots that need to be addressed.

Are you working to improve your credit score? Make sure you check out our Credit Building Tips blog for more articles, how-tos, and guides.

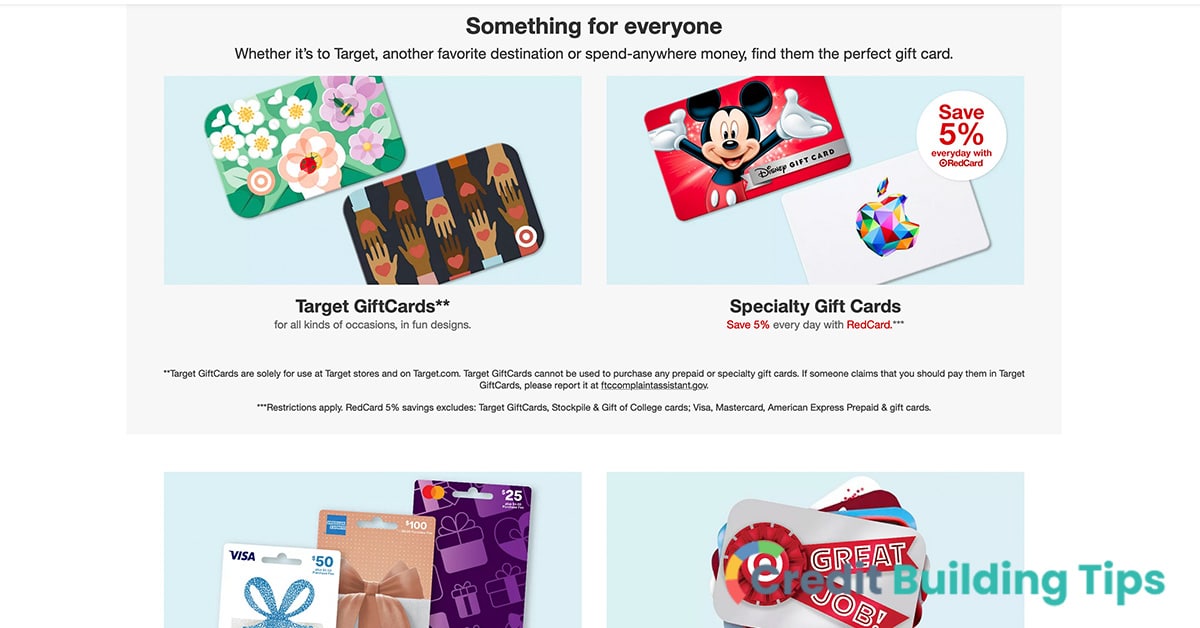

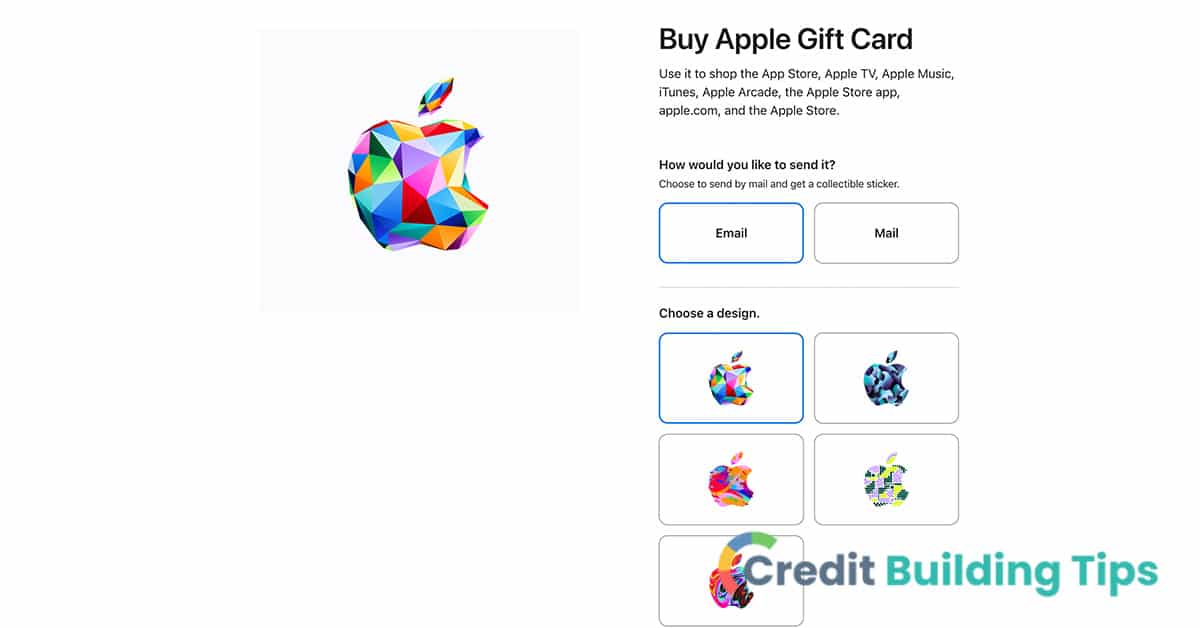

There are few things more distressing than seeing a transaction you don’t recognize on your credit card statement. If it’s clear that someone used your credit card to buy gift cards, you’re probably wondering what steps you need to take next.

Beyond that, though, you might be curious why someone would buy gift cards rather than actual products or services once they got a hold of your credit card information.

Purchasing gift cards is a common strategy by credit card thieves because it’s fairly easy and anonymous to turn gift cards into cash. If you’ve been the victim of this type of identity theft, there are a number of essential steps you’ll want to take right away to ensure you’re not liable for the unauthorized transaction while also protecting your account from further fraud.

Purchasing gift cards is a common strategy by credit card thieves because it’s fairly easy and anonymous to turn gift cards into cash. If you’ve been the victim of this type of identity theft, there are a number of essential steps you’ll want to take right away to ensure you’re not liable for the unauthorized transaction while also protecting your account from further fraud.If someone stole your credit card number and used it to buy gift cards, stick with us to learn what you need to do next.

When someone steals your credit card information and uses it to purchase gift cards without your authorization, it is typically referred to as "credit card fraud.”

Credit card fraud and gift card scams are related but distinct types of financial scams, each involving different methods and objectives. Though you might assume that it is considered a gift card scam to use your credit card to buy gift cards, this falls under the credit card fraud category.

Credit card fraud involves the unauthorized use of someone's credit card or credit card information to make purchases or withdraw funds without the cardholder's consent. The goal is typically to obtain goods or services directly using the compromised credit card.

Thieves may steal physical credit cards, clone cards, or obtain credit card details through data breaches, card skimming, or online hacking. They then use these cards or information to make unauthorized purchases– in some cases, the unauthorized purchase of gift cards.

Credit card fraudsters are usually motivated to commit this type of crime in order to acquire goods or services paid for with the victim’s credit card.

At the same time, you'll also hear about "gift card scams," which is a term that actually encompasses a different type of fraudulent activity than using stolen credit card info to buy gift cards.

Gift card scams involve tricking individuals into purchasing gift cards and providing the scammer with the gift card information or codes. The primary objective is to obtain monetary value in the form of gift cards, which can be used, sold, or converted into cash.

Gift card scams include things like:

Fraudsters have figured out a lot of different ways to steal money using gift cards. Here are some other common types of gift card scams:

Credit card thieves might choose to purchase gift cards using stolen credit card info for a number of reasons, but the general gist is that gift cards provide a relatively easy and convenient way for them to convert stolen credit card information into usable assets while reducing the risk of getting caught.

Here are some of the most prominent reasons credit card thieves might use your card info to buy gift cards:

Discovering that someone has used your credit card to purchase gift cards without your authorization can be distressing, but taking prompt action can help mitigate the situation and protect your financial interests.

Let's take a look at the steps you should take if you suspect unauthorized gift card purchases on your credit card.

Call the customer service number provided on the back of your credit card or on your credit card statement. Let them know about the unauthorized transactions and provide details of the charges, such as the merchant's name, transaction date, and transaction amount.

Another essential step when you realize someone has stolen your card info to buy gift cards (or anything else, for that matter,) is to ask the credit card issuer to place a temporary hold or freeze on your credit card to prevent further unauthorized transactions.

Contacting your card issuer and having them freeze your card can help take a huge weight off your shoulders. You don't have to worry that someone is out there racking up unauthorized charges on your card, giving you some breathing room to deal with the situation and get back on track.

Now that you have placed a hold or a freeze on your card, you'll want to follow the credit card issuer's instructions for disputing the unauthorized charges. They may require you to complete a dispute form or provide additional documentation. Be sure to clearly explain that the transactions were unauthorized and that you did not make the purchases.

If necessary, ask the credit card issuer to cancel your current card and issue a new one with a new card number. This will prevent the thief from making additional unauthorized charges. Furthermore, depending on how they accessed your card info, it helps ensure other people don't get their hands on your card number and details.

Even if you've only noticed one strange transaction on your account, the fact that someone has used your info to buy a gift card without your permission means it's possible other unauthorized transactions have been made.

Carefully review your credit card statements to identify any other suspicious or unauthorized transactions. Report any additional unauthorized charges to your credit card issuer promptly. If one person was able to access your card info, it's possible other transactions were made without your permission.

If you believe your credit card information was stolen, consider filing a police report. This documentation can be helpful in resolving the situation and, in some cases, may be required by your credit card issuer.

Will the police catch the person who used your credit card? The answer is: that it depends. Most experts say you shouldn't hold your breath expecting that law enforcement will be able to track down credit card thieves and fraudsters.

At the same time, the nature of the crime will impact how likely it is for the police to seriously pursue it and even catch the perp. For example, if your physical card was stolen and you have evidence that points toward a suspect, it's a lot more likely anything will come of filing a police report than if your info was stolen online.

It's best to document all communication with your credit card issuer, including dates, times, and the names of customer service representatives you speak with. This way, you can easily reference instructions you were given by customer service reps when discussing the issue with your credit card company over time.

Your hard work isn't done yet-- make sure you keep a close eye on your credit reports for any unusual activity. You can obtain free credit reports from the three major credit bureaus (Equifax, Experian, and TransUnion) annually at AnnualCreditReport.com. For the rest of this year, you can actually get free weekly credit reports.

There are a number of different services you can sign up for to help in your efforts to monitor your credit, including CreditWise, Experian, and Credit Karma.

The next thing you'll want to do is take steps to protect your personal and financial information. This may include updating passwords, enabling two-factor authentication, and being cautious about sharing sensitive information online or over the phone.

The good news is that federal laws protect consumers from liability for unauthorized credit card charges, so you should not be held responsible for fraudulent gift card purchases. However, it's essential to report unauthorized transactions promptly and work with your credit card issuer to resolve the issue as swiftly as possible.

Depending on how quickly you realized that your credit card info was being used by fraudsters to buy gift cards, you might have a little work to do when it comes to cleaning up your credit report. Dealing with the fallout from identity theft can feel totally overwhelming, but the truth is it’s worth taking the necessary steps so you don’t suffer the consequences of bad credit down the road.

In our digital world, there is always some risk that our financial and personal information will end up in the hands of someone with bad intentions. At the same time, you can take several steps to significantly reduce the risk of theft and unauthorized use of your credit cards.

When we make passwords for our online accounts, it’s tempting to prioritize making them easy to remember. However, the easier they are for us to remember off the top of our heads, it usually means it’s easier for fraudsters to figure out what our passwords are. You’ll want to create strong, complex passwords for your online accounts, especially for banking and credit card websites.

- In your effort to make strong passwords, use a combination of letters, numbers, and special characters.

It’s essential that you avoid using easily guessable information like your birthdate or common words in your passwords. You might consider using a reputable password manager to generate and store your passwords securely.

Many credit card companies will let you enable two-factor authentication, which is often abbreviated as “2FA”. Whenever possible, enable 2FA for your online accounts, including your credit card accounts. This adds an extra layer of security by requiring a second form of verification, such as a one-time code sent to your mobile device.

We’re all busy, and it’s easy to simply use our credit cards and let our payments be automatically withdrawn month after month without ever taking a closer look at our account.

The truth is, though, it’s a good habit to regularly monitor your credit card accounts.

- At least monthly, review your credit card statements and online banking activity. As you’re going through the statements, keep an eye out for any unauthorized or suspicious transactions.

You can also set up account alerts to receive notifications of unusual activity on your credit card. Though credit card fraudsters continue to get more sophisticated over time, so do the security measures used by credit card issuers. By signing up for this type of service, you can catch strange and unusual activity right away.

It’s easy to assume that the biggest threats to our credit card info and personal financial info all exist online. However, it’s just as important to protect your physical card.

Keep your physical credit cards in a secure location, such as a wallet or cardholder. Protect your card's PIN by not sharing it and covering the keypad when entering it at ATMs or point-of-sale terminals. It can be a good habit whenever you use your card to double-check that it’s back in its secure spot before leaving a retail store or restaurant.

One essential step to avoiding having your credit card info stolen to be used to buy gift cards is to only provide your credit card information on secure websites. Secure websites will have “https://” as a prefix rather than just “http://.” You should also notice an image of a padlock in the address bar when a website is secure.

- It’s honestly hard to be too cautious online. It’s always best to avoid clicking on suspicious links or downloading attachments from unknown sources in emails and messages, even if it seems completely harmless.

You’ll also want to be cautious when sharing your card information over the phone; always make sure you verify the identity of the caller and the purpose of the call. If someone calls you claiming they’re from a company or institution you trust and are asking you for personal or financial information, it is good practice to hang up and call them back. Use the phone number you have on the back of your credit card or on the institution’s secure website, not from an email you received or a number you are given over the phone.

Another step you can take to avoid credit card fraud is to keep your computer and mobile devices up to date with the latest security updates and patches. It’s also a good idea to use reputable antivirus and anti-malware software to protect against malware and keyloggers.

The ability to access the internet and take care of our important business anywhere is really convenient, but it’s honestly not a good idea to use Public Wi-Fi for online banking or credit card transactions. Avoid making online purchases or accessing sensitive accounts (including banking and credit card accounts) while using public Wi-Fi networks, as they may not be secure.

Fraudsters and identity thieves can sometimes get your information by going through your mail or trash. Make sure you shred or securely dispose of any documents containing your credit card information, such as credit card statements and credit card offers.

Many credit card issuers offer customizable transaction alerts. You can customize these alerts so that you are informed about certain transaction amounts or types– ensuring you’re notified right away of any unusual activity.

If you’ve realized that someone stole your credit card (whether it was the physical card or your information) to buy gift cards, it’s natural to feel distraught and violated. How could someone do something like this? What if it keeps happening?

The truth is, there are people out there who are willing to steal in order to benefit themselves. This is an unfortunate reality, but what we can do is take steps to protect our financial information both IRL and online.

Furthermore, by keeping a close eye on our financial accounts and credit reports, we can catch strange and unusual activity quickly. The sooner we realize that an unauthorized transaction has been made, the sooner we can remedy the situation and protect our accounts from further theft.

Are you working to improve your credit after your identity was stolen? Are you motivated to set up a financial system for yourself that offers you the best possible protection from credit card fraud? If so, make sure you check out the rest of our Credit Building Tips blog for more resources, articles, and guides.