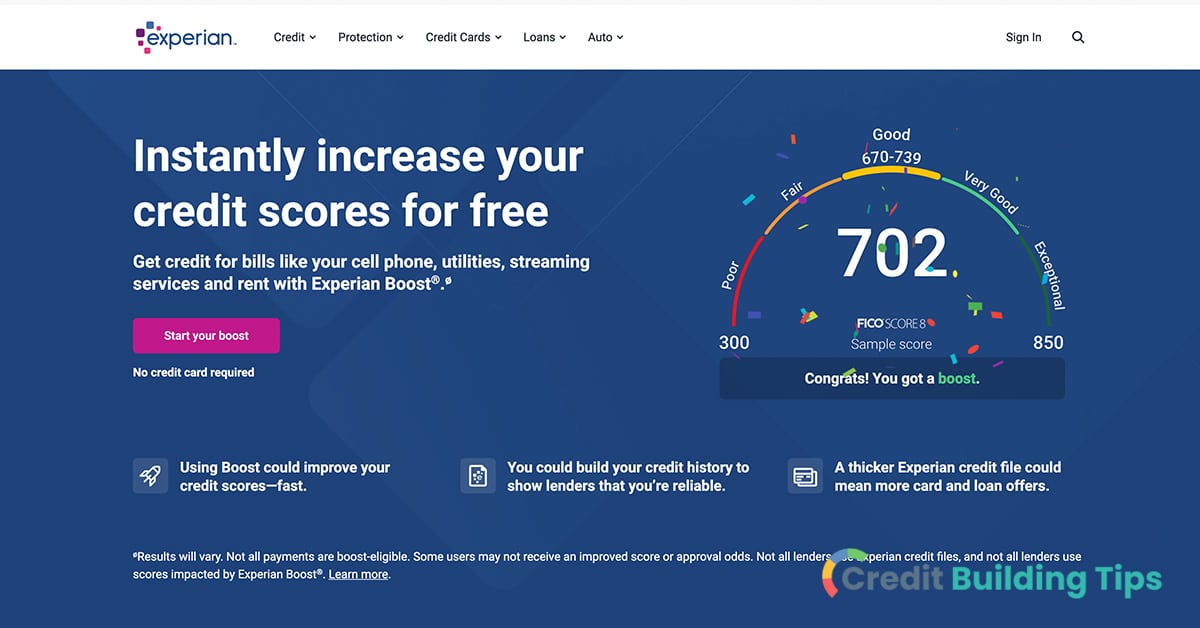

In this post, we'll take a look at how Experian Credit Boost can help build your credit by adding a positive payment history for things like rent, utilities, and subscription streaming services.

The credit system can feel pretty frustrating sometimes-- a person can make regular, on-time payments for a big stack of bills and not receive any recognition for their responsible behavior. Services like Experian Boost can offer a leg up to people with thin credit profiles but years of making bill payments under their belt.

Basically, Experian Boost is a way that you can build your credit history and potentially even instantaneously improve your credit score.

Basically, Experian Boost is a way that you can build your credit history and potentially even instantaneously improve your credit score.Let's take a look at exactly how this service works and whether it's right for you.

Experian Boost is an optional tool you can use to raise your FICO score instantly.

The way this program works is that it allows you to add your positive payment history for things that don't typically show up on your credit report, including rent, utilities, and even subscription streaming services.

Experian Boost is free to use and easy to opt out of if you change your mind. At the same time, you'll have to share your banking and account information with Experian in order to benefit from the service. Before you sign up, it's a good idea to think about whether this is something you feel comfortable with.

According to Experian, the average person that uses Experian Boost will raise their FICO 8 credit score by 13 points.

This credit-building tool can be useful for people who are looking to add a few more points to their credit score and potentially bump them into the next credit bracket.

In addition to helping you increase your credit score instantaneously, Experian Boost offers a number of other free features.

Here are some of the other things you can benefit from when you sign up for this program:

In order to use Experian Boost and gain the benefits of a credit score increase, you have to allow the program to scan your bank account transactions.

By looking at your bank account, Experian Boost will identify rental, cell phone, utility, and streaming payments. They will then include this information in your Experian credit report.

If you're worried that a few missed payments in the past make it so you're not a good candidate for Experian Boost, it's worth noting that they only count positive payment history. This means that missed or late payments for rent, utilities, cell phone service, or streaming services won't hurt your credit score.

The same is not true when it comes to the typical information that shows up on your credit report. If you miss a credit card payment by thirty days or more, for example, a negative mark will show up on your credit report. This will, in most cases, reduce your credit score.

By linking your utility, telecom, and bank accounts to the credit report generated based on your credit history by Experian, you can potentially raise your credit score.

In short, this is letting you get credit for your positive, on-time payments for things like rent, cell service, and utilities. You do have to have at least one active credit account in order to use the service, so it's, unfortunately, not useful to people who are trying to build a credit profile from scratch.

Only certain payments are eligible for Experian Boost, which include:

Your new credit score will be generated instantly once you sign up and link your bills. While it's possible you won't see a change in your credit score after going through this exercise, Experian says that your credit score won't go down when you utilize the service.

Will taking the time to sign up for Experian Boost and link your accounts will result in a higher credit score? The answer is: it depends.

The first important point to make is that using Experian Boost only updates your Experian credit report with your positive payments. This means that if a lender looks at a credit score generated from TransUnion or Equifax, Experian Boost won't be much help.

That being said, Experian says that the most common versions of both the FICO score and VantageScore can be benefited by the service.

Experian Boost is typically most useful for people that don't have a very robust credit history-- i.e., people with a thin credit profile or less than five accounts on their credit report.

The second point is that whether Experian Boost increases your score is going to depend on your particular circumstances.

On the other hand, people who have thin credit profiles might notice a bigger boost when using this program. As a final point, it's important to note that not all payments are eligible for Experian Boost.

The good news about Experian Boost is that, if it does have a positive impact on your score, it will happen in just a few minutes. The sign-up process is relatively simple, and your FICO score will generate quickly after you connect your accounts to your credit file.

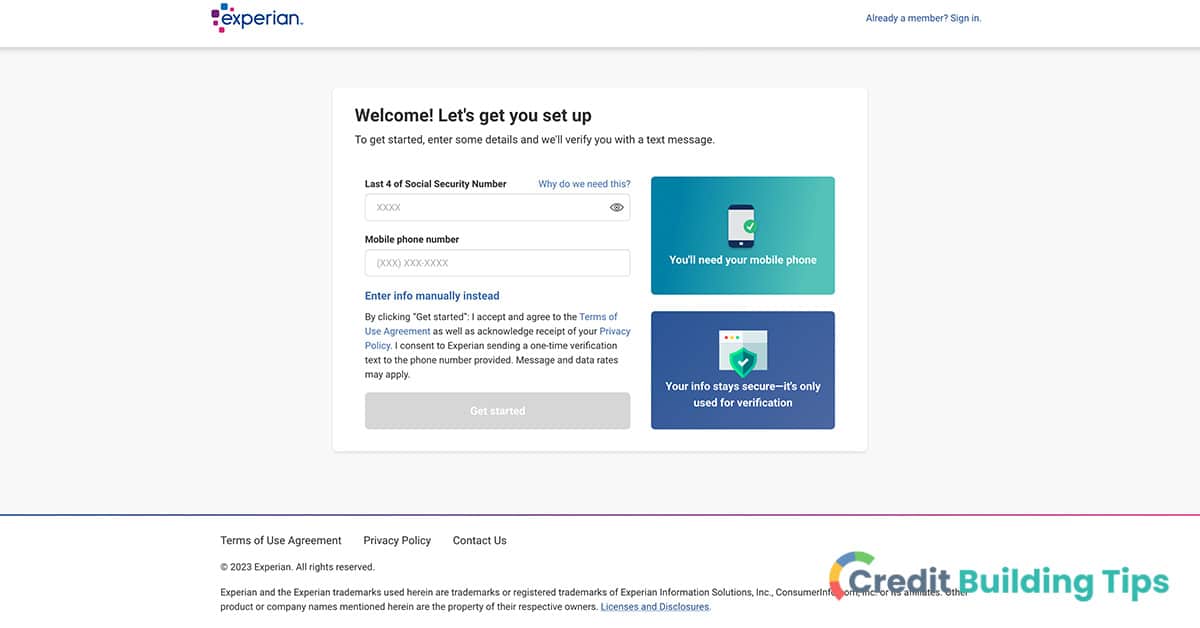

To sign up for Experian Boost, you'll start by going to their sign-up page to create a free Experian account.

From there, you'll follow these steps:

That's it! If you want to take any of your accounts off at a later date, you'll want to sign into your account and navigate to the field titled "Connected Accounts." You can then click "disconnect" for the account you no longer want to show up on your Experian credit file.

Whenever you're signing up for a new service and entering personal information, it's important to understand the pros and cons.

Let's look at some of the things you'll want to know about Experian Boost before you start linking your accounts.

If a lender is using TransUnion or Equifax to generate your credit scores, you're not going to gain any benefit from Experian Boost. For people who are looking to use the service to boost their score before applying for a mortgage or a new credit card, it's important to understand that Experian Boost might not help depending on the credit report a creditor or lender is using.

When you sign up for Experian Boost, you have to link your bank account. This is how they are able to verify that you have made payments on time and add them as tradelines to your credit file.

However, it isn't Experian itself thumbing through your bank statements. They use an intermediary company called Finicity to accomplish this aspect of the process. Before you sign up, it's a good idea to think about whether you feel comfortable letting another company go through your bank account and have access to so much personal information.

If you have excellent credit and a robust credit history, Experian Boost probably isn't worth your time or energy. Even if it does increase your score, five points probably won't offer much in the way of benefits to people with a score of 760 or higher.

Another important thing to consider is that Experian Boost only works with newer versions of the FICO score. Considering that mortgage lenders still generally use older FICO score models, this can mean that it's not worth the effort if your primary purpose is increasing your score before buying a house.

Finally, you'll lose any benefits you gain if you end up opting out of the program. Any extra points you enjoyed will disappear if you aren't actively enrolled.

If you like the idea of Experian Boost but it doesn't quite help you achieve your goals, there are some other options out there. Primarily, you can sign up for another third-party service that helps you boost your score, or you can work to build credit the old-fashioned way.

There are a number of other third-party services on the market that offer similar perks as Experian Boost.

Here are some others you can look into:

Building credit is something anyone can do, but it often takes a bit of time and persistence.

There are a number of things you can do to help increase your scores over time. Here are some crucial steps you can take if you're interested in raising your credit score but don't want to use one of these credit score-boosting services:

Searching for more answers about using Experian Boost? Let's take a look at some of the most frequently asked questions about this credit-building tool.

Experian states that they use bank-level SSL security encryption so that your data is secure and safe. Of course, you are always taking some level of risk when you enter personal and financial information online.

Here are a few tips to ensure you aren't doing more harm than good when using a service like Experian Boost:

If you hand your landlord an envelope of cash on the first of every month, you're not going to be able to benefit from your on-time rent payments through Experian Boost. The same is true if you use a mobile payment transfer app (think Zelle, PayPal, or Venmo), a personal check, or a money order.

In order to have an Experian Boost and benefit from this service, you need to meet the minimum FICO requirements. These are:

If you meet these requirements, then you can use Experian Boost to get your FICO Score.

UltraFICO is another popular service for boosting consumer credit scores, particularly for those who have thin credit files.

This can be useful for people who don't have a FICO score at all or who have a low FICO score. Like Experian Boost, this process works by having you share banking data from your checking, savings, and money market accounts.

By scanning your bank accounts, a number of pieces of information will be collected in order to potentially boost your score, including:

UltraFICO doesn't actually add this information to your credit report. What it does instead is contribute to the calculation of your FICO scores. Since Experian Boost and UltraFICO work in different ways, you can actually use both to help give lenders more information about your creditworthiness.

According to Experian, most people who use their Boost service increase their credit scores instantly.

The people who will benefit the most are those who either:

Only the newer credit scoring models are impacted by the additional information contributed to your report by Experian Boost. This means that the following scoring models can be improved using this service:

If you're looking to add a few points to credit scores generated from your Experian credit report, Experian Boost can be a very useful tool. By letting you add positive payment histories for things like rent, utilities, and streaming services, you might be able to snag a few more points and even get bumped up into the next credit bracket.

At the same time, Experian Boost might not be the right choice for everyone. Those who have robust, long credit histories might not see much benefit from adding their on-time payments using this service. Furthermore, some consumers might not love the idea that they have to give access to their bank accounts to an intermediary service in order to participate.

Whether or not Experian Boost is the right choice for you, taking the time to determine the best way to achieve and maintain a healthy credit score is well worth the effort. Your credit score can have a very real impact on your life, affecting your ability to take out credit lines, buy a house, rent an apartment, and much more.

Are you interested in learning more about how you can improve your credit? Are you searching for more resources to help you become more financially literate? Make sure you check out our Credit Building Tips blog for more useful articles and guides!