Your credit score is a rating of your financial reliability, and it's used by all sorts of different institutions to make decisions that affect your future and your lifestyle.

If you're trying to improve your credit score, you may have asked yourself, "Is there a limit to how good my credit score can be?" According to Experian, the short answer to this question is that while there are reports of individual credit scores as high as 990, the official highest possible credit score in the US is 850. But before we get into what exactly determines your FICO score and why it matters, let's take a step back and look at the big picture on credit scores in general.

It's a numerical score in a certain range, so the question is, is it possible to cap it? Can you hit the maximum possible credit score if you're very good at managing credit for years?

Let's dig in!

The FICO score is the credit score you're likely most familiar with. It's the one everyone thinks of when they think of credit score, even if they don't really know much about credit in the first place. FICO is the score tracked by the major credit bureaus, Experian, Equifax, and TransUnion.

There are, however, other credit scores and scoring systems, and a whole host of other credit bureaus, but we'll get to that in a bit.

The FICO score is the Fair Isaac Corporation's scoring system. Fair Isaac was formerly known as Fair, Isaac, and Company, founded by Bill Fair and Earl Isaac back in 1956.

Want a glimpse into Big Brother? The Fair Isaac Corporation is a data analytics company, and the FICO score was their hidden, secret way of rating and ranking people based on their financial history. The FICO score itself wasn't actually developed and made public until 1989, just 33 years ago.

Note: That's not to say that credit tracking is truly that new. The first credit reporting organizations sprang up in the late 1830s in response to the Panic of 1837, which started the Great Depression. It's just FICO in its current form that's only a few decades old.

Note: That's not to say that credit tracking is truly that new. The first credit reporting organizations sprang up in the late 1830s in response to the Panic of 1837, which started the Great Depression. It's just FICO in its current form that's only a few decades old.It shocks a lot of younger people to realize that the credit score system didn't exist before the 90s and that it's not really a thing outside of North America. Some other countries have credit scoring systems, but nothing quite the same as the U.S. model. Anyway, that's beside the point.

While FICO the company created and developed the analytics algorithms behind the FICO score, it's the job of the credit bureaus to aggregate the data and report on it accurately.

Another fun fact: while we think of credit as being managed by the big three credit bureaus – Experian, Equifax, and TransUnion – there are many more. It's just that those three are the national credit bureaus, while others are smaller companies with less range.

Another fun fact: while we think of credit as being managed by the big three credit bureaus – Experian, Equifax, and TransUnion – there are many more. It's just that those three are the national credit bureaus, while others are smaller companies with less range.Additionally, none of this is tracked by the government. Credit scores and credit reports are entirely managed by private companies, though the government has put regulations in place to ensure fair and accurate reporting, like the Fair Credit Reporting Act.

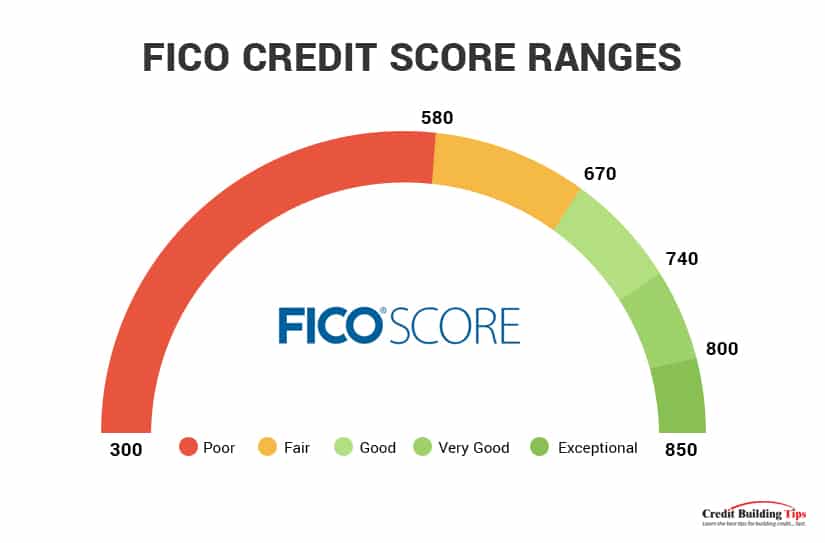

Back to FICO. The FICO score is the most widely-used score, and it is a numerical rating between 300 at the lowest and 850 at the highest. Therefore, for a FICO score, the highest possible score is 850.

Is it possible to get a perfect 850?

The answer is yes. In fact, the FICO company itself says that around 1% of people have a perfect 850 score.

The answer is yes. In fact, the FICO company itself says that around 1% of people have a perfect 850 score.There's no one sure-fire way to have a perfect credit score. It takes time, continued effort, smart decisions with your money, and a little luck. FICO itself says that the people with a perfect score share certain traits, such as:

So, if you're aiming for a perfect score, it's going to take quite a long time. Any late payments need to fall off your report, so it's at least seven years to wait. A long credit history is required, so virtually no one under the age of 38 (since 13 is the youngest you can be made an authorized user on a credit card and start your credit history.)

Luckily, a perfect score isn't necessary for anything but bragging rights. Anything over 720 or 750 is considered Excellent and will get you anything you need that checks credit.

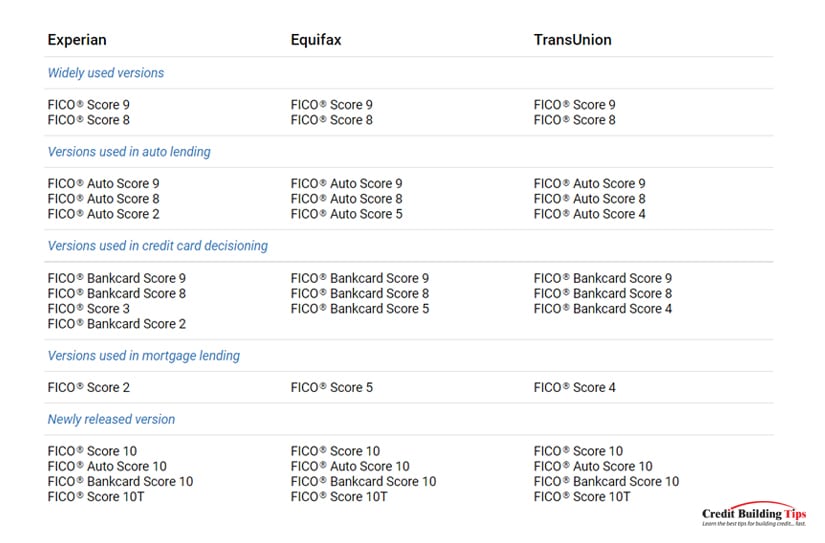

Did you know that each credit bureau has its own way of calculating your score? Every breakdown of the FICO score out there is a generalization; each credit bureau uses its own proprietary algorithm. While similar, these are slightly different, so your score can vary between different bureaus.

The perfect score for these is still 850, but you might not be able to reach it on all the different credit bureaus at once. Equifax reporting 850 doesn't mean TransUnion also reports it. Again, though, anything over 720 is good enough.

FICO also provides a range of other scores, mostly centered around specific industries. These scores are tailored to different banks and different purposes. There are 49 different scores provided by FICO and potentially hundreds more from other sources.

These are generally narrower, more tailored scores that focus on a specific kind of financial deal.

For example, there are:

So, a mortgage lender might not be looking at your full FICO score; they'll be looking at a tailored score that focuses on key metrics that indicate suitability for a mortgage. You could have a perfect general FICO score, but your FICO Mortgage score could be lower.

We cannot reiterate enough, though, that the variance between them won't be so major as to be worth worrying over. Any score above 720 or so is good enough, regardless of your narrower goal.

FICO was created by the Fair Isaac Company and is reported by the credit bureaus. However, the credit bureaus also teamed up to create a competing score. After all, why should they do all the legwork for someone else's algorithm when they can use the same data to generate their own score instead?

Of course, FICO is so engrained in modern financial dealings that they can't just do away with it. So, now the bureaus offer both FICO and VantageScore.

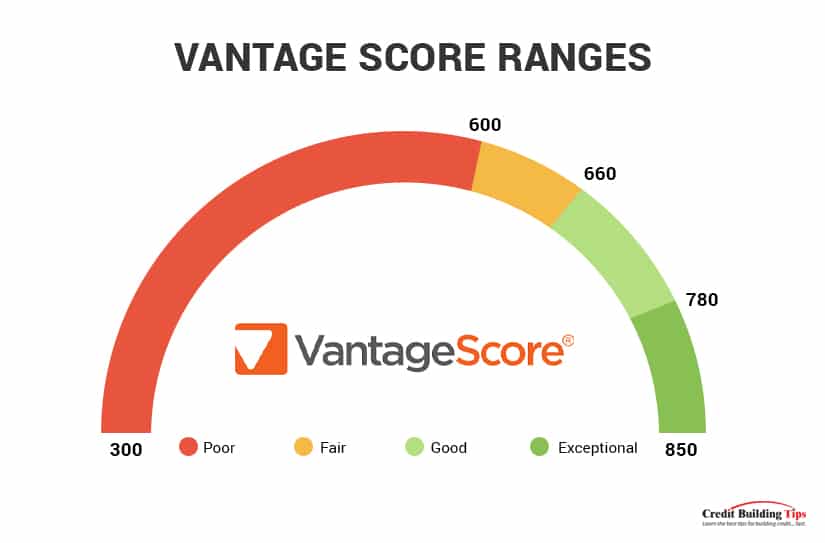

VantageScore is an alternative credit scoring system. When it was invented, it used a different numeric scale, ranging from 501 to 990. Since this disparity was confusing and unnecessary, however, the modern version of VantageScore (released in 2006) uses the same 300 to 850 system as FICO, so they're more directly comparable.

While both FICO and VantageScore monitor the same metrics, they weigh them differently. Thus, your two scores can be different, despite your financial situation remaining the same. The two scores are similar enough now that having anything over 750 on both of them is good enough.

Above, we mentioned that the big three reporting agencies – Equifax, Experian, and TransUnion – are not the only three. In fact, there are at least four more, with other players operating in regional geographic areas or in certain industries.

Other credit reporting bureaus include:

Many of these use what is known as Alternative Data, which includes things like utility bills and telecom bills.

One common way to build credit via a Credit Builder Program is to open a new line of credit and use it for bills that aren't normally reported. If you pay for electricity, gas, water, internet, or TV (or even things like Netflix) regularly, great! However, FICO and VantageScore don't care. For whatever reason, these transactions aren't classified as "important enough" to be counted the same way loans, mortgages, and other payments are.

But, if you pay those same bills via a credit card and pay off the credit card immediately, it counts because paying off a debt on a credit card is tracked. Why the disparity? That's just how the reporting has worked.

Many of these alternative credit reporting bureaus will harvest and use information about utilities and other payments, removing this loophole. After all, there's no reason why regularly paying your power bill shouldn't benefit you.

Of course, there are some forms of "alternative data" that aren't relevant but may be used by certain agencies. These include things like social media activity, psychometric data, and smartphone meta data. An example of how these may be used (and how it goes wrong) is China's Social Credit system.

It's impossible to run down every single alternative credit score. They all vary and use different scales.

It's impossible to run down every single alternative credit score. They all vary and use different scales.One example is the Connect (PRBC) score. Their score operates on a point scale from 100 to 850, but it's stretched and squished in a weird way. To FICO, anything under 600 is considered poor, but only scores under 500 are "very poor" and likely to get you denied credit. Meanwhile, anything over 720 is excellent.

With Connect, anything under 600 is poor enough to get you denied credit, while anything over 750 is excellent. This essentially makes the score less nuanced while encouraging a more gamified experience of building it (when you have a very low score, it's much easier to raise it because each point is a smaller gap). Of course, relatively few lenders actually use this score for anything, so unless you're applying for loans to buy furniture or something similar, it's not going to matter.

Alternative credit scores take two forms.

One form is generally just meant to be FICO or VantageScore, but with more attention paid to other bills that matter, like rent and utilities. They add a little nuance and give many people a way to build credit when they can't otherwise afford something like a mortgage or a car loan.

The purpose of these alternative credit scores is to put pressure on the primary credit bureaus to start recording and caring about this information. It's more of a social and political movement than it is a viable alternative score to rely on for financing.

The other way these alternative credit scores are used is as a way for small-time lenders to filter and justify lending to individuals with sub-prime credit on the FICO or VantageScore ratings. If you have sub-prime credit, most traditional lenders will either have extortionate terms or won't lend to you at all. However, small-time lenders like credit unions or stores and retailers might use an alternative score to take a closer look.

For example, Connect's score shows more nuance between someone with a score of 200 and a score of 500, even though on FICO, both people might have a score in the 400-range. These small-scale lenders can then choose between these two individuals with more reliability.

So, alternative credit scores can be useful as a narrative device and useful for people with sub-prime credit, but most others don't have to care about them.

When we're talking about the perfect 850 on FICO or VantageScore, we have to wonder, is it worth pursuing at all?

The answer is not really. If you want to push yourself to the point where you have immaculate financial habits and your score is as good as you can get it, then, by all means, pursue it. However, if you're only looking for the best interest rates and loan terms, anything over 750 or 800 is going to be fine.

The answer is not really. If you want to push yourself to the point where you have immaculate financial habits and your score is as good as you can get it, then, by all means, pursue it. However, if you're only looking for the best interest rates and loan terms, anything over 750 or 800 is going to be fine.Realistically, there's no difference between the loan offer you'll get with a credit score of 800 versus the one you'll get at 850.

If your credit score is under 700, work on improving it. If your credit score is above 720, there's not much need to push for higher, and if it's above 800, you pretty much don't need to worry about it. A perfect score is worth bragging rights, but the tangible effect on your life is going to be minimal at best compared to what it was at 800-849.

What do you think? Is it worth caring about a perfect score, and if so, how would you go about earning it? Be sure to leave all your thoughts down in the comments section below! I'd love to hear what you think! Additionally, if you have any questions or concerns about anything involving credit scores, be sure to leave those as well! I'd be more than happy to answer any of your questions, clear up any concerns you may be having, and assist you however I possibly can!