If your credit score is lower than you want it to be, learning what builds your credit the most can help you prioritize the most important factors in your efforts to boost your score.

What can you do to increase your credit score? What has the biggest impact? How quickly can you expect changes you make to reflect on your credit profile?

There are several different strategies you can use to build your credit quickly, including reducing your credit utilization ratio, using a third-party service like Experian Boost, or becoming an authorized user on someone else’s account.

There are several different strategies you can use to build your credit quickly, including reducing your credit utilization ratio, using a third-party service like Experian Boost, or becoming an authorized user on someone else’s account.In this article, we’re going to take a closer look at what builds your credit the most, the steps you can take to increase your credit score quickly, and the habits you can practice to build your score over time.

Before we can talk about what builds your credit the most, let’s quickly go over how your credit score is calculated. There are several different credit scoring models out there, each of which weighs these factors a bit differently.

In general, though, you can expect that payment history and credit utilization, in that order, are the most important factors when it comes to the health of your credit score.

Sometimes, you don’t have a ton of time to wait around for your credit score to inch up over time. If you’re looking to see some real results right away, consider trying one of the following.

Are you eager to build your credit right away but you’re struggling with the fate of a limited credit history? Starting to build up credit from scratch can be frustrating and time-consuming. After all, you need to be given access to credit in order to build up your credit file, but lenders and creditors are wary of giving out lines of credit or loans to people with thin credit profiles.

One of the fastest ways to build your credit is to use an alternative data service. This is a way to add some positive information about your financial responsibility that usually don’t show up on your credit report.

This service allows users to include their utility and telecom bill payments in their credit reports, potentially raising their score by reflecting timely payments not typically considered in traditional credit scoring models. By leveraging such alternative data services, individuals can see an immediate uptick in their credit score by showcasing responsible payment behavior across various accounts.

Experian Boost can increase your score right away. However, if you choose to use a rent reporting service, how long it takes to see a change in your score depends on the service and your rental history.

It depends.

Using Experian Boost or rent reporting services might have a significant impact on your score or it might not change that much. If you already have a robust and healthy credit history, Experian Boost might not be as beneficial to you as it would be for someone with a thin, imperfect credit score.

One of the most impactful ways to improve your credit score is by reducing outstanding debt.

High credit utilization—the amount of credit used compared to the total credit available—can adversely affect your score. Focusing on paying down credit card balances and other outstanding debts can significantly boost your credit score by reducing this utilization ratio.

Reducing your balances by making payments can help you improve your credit very quickly.

You’ll have to wait for the lower balance to be reported to the credit reporting agencies, but once this information has been passed along you should see improvements in your score.

Paying down your debt and decreasing your credit utilization ratio is one of the most impactful things you can do to positively contribute to your credit score. Your credit utilization is the second most important factor for your score after making your payments on time.

Keeping your balances low is only one of the ways you can improve your credit utilization ratio. The other side of the equation is increasing your credit limit.

Requesting a credit limit increase can positively impact your credit score. If you have a good payment history and responsible credit usage, a higher credit limit can decrease your credit utilization ratio, potentially elevating your credit score. However, it's crucial to use this increase in limit responsibly and not accrue additional debt.

This is another really fast way to see a change in your credit score. As soon as the credit limit increase has been reported to the credit bureaus, your score will be updated to incorporate the new information.

Increasing your credit limit could actually have a pretty big impact on your credit score. However, how much benefit you see is going to depend on the current state of your credit profile.

For example, people with thin credit profiles will probably see a pretty big difference in their score once their limit is raised. Those with a much more established credit history, on the other hand, will likely see much benefit from a credit limit increase.

For those looking to establish or rebuild credit, secured credit cards offer a practical solution.

These cards require a cash deposit as collateral, which typically determines the credit limit. This means that if you put down $500 as a deposit, you’ll usually have a $500 credit limit.

By using a secured card responsibly—making timely payments and keeping balances low or at zero—you can demonstrate creditworthiness, which can translate into an improved credit score over time.

The extent to which a secured credit card will help your credit score depends on your existing credit profile. If you don’t have much credit or your credit is on the lower side, you’ll see more of an impact than if your credit score is already healthy.

Being added as an authorized user on someone else’s credit account can potentially boost your credit score, so long as the primary account holder’s credit history is positive.

This strategy allows you to benefit from another person’s responsible credit usage. At the same time, you’ll want to be cautious before using this strategy, as it won’t help your score if the primary account holder has a troubled credit history.

This is one of the fastest ways you can improve your credit score, assuming the person who added you to their account has a strong credit history. Once the credit account you’ve been added to is reported to the bureau, your credit score will reflect the new, positive information.

It’s possible that becoming an authorized user will have a significant impact on your credit score. However, how much it influences your score depends on your existing profile.

For instance, if you already have established credit but a bunch of derogatory marks on your report, you probably won’t see as much benefit as someone who has a thin credit file. Furthermore, the person who is adding you to their account needs to have a healthy credit profile themselves for it to contribute positively to your credit report and score.

While it might seem counterintuitive, addressing collections accounts can positively impact your credit score.

Negotiating with creditors or collection agencies to settle debts or establish payment plans can prevent further negative impacts on your credit report. Over time, as you address these accounts, their impact on your score diminishes.

Before you run out and make payments on that old collections account, though, it's a good idea to strategize. Just because a collections account falls of your credit report doesn't mean you aren't still legally responsible for repayment. At the same time, making a payment can restart the clock on how many years it will take for the derogatory mark to fall of your report.

Are you trying to get a collection account completely removed from your credit report? Make sure you check out my post about how to delete a collection in exchange for payment.

The answer to this question depends on a number of factors. Some credit scoring models don’t factor in paid collections when calculating your score. For these models, you’ll see a bump in your score as soon as your collections account is marked as paid off.

However, other models do incorporate collections accounts even once they are paid off. Furthermore, if you are disputing a collection account or asking the debt collector to delete the account, you probably won’t see any change for a few months.

How much your score changes after paying off collections is going to vary. Your credit score can be seriously damaged by having an account in collections. If you are able to get the debt collector to stop reporting the account, it could help your score quite a bit.

However, if the account continues to be reported, then the impact you’ll see will depend on the credit scoring model used. VantageScores and more recent FICO models don’t incorporate paid collections into their calculation, but older FICO models will still ding your score if there are paid collections accounts on your profile.

Regularly monitoring your credit report is fundamental to understanding your financial situation.

When you keep an eye on your credit report, you can detect and address any errors or discrepancies that might be negatively impacting your score.

You can use AnnualCreditReport.com to gain free access to your credit report from each of the three major credit bureaus. This is one of the most important things you can do to stay informed about your credit health.

When you notice an error on your credit report, you’ll want to dispute it with the credit bureaus or your creditor right away. When you make a dispute claim with the credit bureaus, they have thirty days to look into the situation and get back to you.

How much this impacts your score depends on the circumstance. If there’s a mark on your credit report saying that you missed payments when this isn’t the case, for example, you can see a big jump in your score.

While there are a number of ways you can increase your score relatively quickly, you might find that none of these solutions offer you much help. In general, it takes time to increase your credit score. If you are willing to put in the work to manage your credit, you can see your score improve over time.

The most important part of your credit score is your payment history. This means that making consistent and punctual payments is one of the best things you can do to keep your score healthy.

Late payments can significantly dent your score, so ensuring on-time payments for all credit cards, loans, and bills is crucial. Setting up automatic payments or reminders can help you stay on track and avoid unnecessary penalties or negative impacts on your credit report.

The second most important part of your credit score is your credit utilization ratio. This is the ratio of your credit card balances to your credit limits.

Keeping your balances low, ideally below 30% of your credit limit according to most experts, showcases that you are a responsible borrower. Paying off balances in full each month not only demonstrates financial discipline but also keeps your utilization rate low, positively impacting your credit score.

Though it’s not the most important factor when calculating your credit score, the length of your credit history matters in determining your creditworthiness.

Closing old accounts can shorten your credit history, which might lower your average account age and subsequently affect your score. Even if you're not actively using old credit accounts, keeping them open can contribute positively to the length of your credit history, benefiting your score in the long run.

A word of warning here, though: if you’re struggling with a spending problem, closing your old accounts might ultimately be the best strategy to avoid getting back into debt. Account age is important for your credit score, but staying out of spiraling debt is more important than having a perfect score.

Another thing you can do to build your score over time is work to diversify your credit portfolio.

At the same time, you don’t want to apply for too many new credit cards or loans at one time. When you do this, lenders can see all of the new hard inquiries on your profile. This can indicate to them that you’re strapped for cash and that you would struggle to pay back any money you borrow.

Assuming that you are applying for new credit in a reasonable way, though, having a mix of credit types can positively impact your score. This means having different types of accounts on your credit report, such as:

Responsible management of various credit accounts showcases your ability to handle different financial obligations, reflecting positively on your creditworthiness.

Building off of the previous point, it’s important to be careful not to apply for too much credit at one time.

Each time you apply for new credit, a hard inquiry is made on your credit report, which can temporarily lower your score. Multiple inquiries within a short period might signal to lenders that you're in financial trouble or a higher-risk borrower, potentially impacting your score negatively. Being selective about new credit applications and spacing them out can help mitigate this impact.

Having a low credit score can have a big impact on your financial opportunities. As you work to build your credit, you might be wondering how possible it is to increase your score by 100 points relatively quickly.

The truth is, how much your credit score will improve using the tactics in this article is going to depend on the current state of your credit report.

If your score is poor right now, making positive changes can have a pretty big impact. The worse your score is, the more a small change will reflect in your score.

So, what builds your credit the most? The answer is that it depends on your current credit profile and financial situation. In general, though, there are a number of tactics available that you can use to have a positive impact relatively quickly.

Some of the things you can do if you want to have the biggest impact on your score include:

When you first start learning about credit scores and credit reports, the whole thing can feel pretty overwhelming. However, it’s worth overcoming the obstacles in your way and gaining a solid understanding of the system. The better your credit profile, the more financial opportunities will be open to you in your life.

Are you on a mission to improve your credit? Are you looking for practical advice regarding how you can build your credit over time? Make sure you check out the rest of our Credit Building Tips blog!

If you’ve been researching applying for a loan, you may have been disappointed to learn that higher interest rates in recent times have led to an increase in loan rejections. Having a cosigner or co-applicant can help increase the likelihood that you’ll be approved for a loan and can even improve the terms you’re offered.

When you choose the right cosigner or co-borrower, your own credit can even be improved as you work to build a positive payment history.

At the same time, taking on a cosigner or co-applicant is a big decision. This isn’t something you’ll want to pursue lightly, both for the sake of your personal relationship with the other individual as well as your financial future.

At the same time, taking on a cosigner or co-applicant is a big decision. This isn’t something you’ll want to pursue lightly, both for the sake of your personal relationship with the other individual as well as your financial future.Let’s take a closer look at what you need to know about cosigners, co-applicants, and co-borrowers to ensure you have all of the most important information before moving forward with your application.

There are important distinctions to be made between the terms “co-borrower,” “cosigner,” and “co-applicant.” You’ll want to make sure you fully understand which type of agreement you are signing on for before putting your name to any loan agreement.

“Co-borrower” and “co-applicant” are often used interchangeably, though one could technically argue that co-applicant is the term used during the application process while co-borrower is the term used once the loan has been approved and funded.

Here is the bottom line:

When someone cosigns a loan, it means that they are adding their name, financial info, and credit history to the loan application of the primary borrower.

By doing this, they are agreeing to take on the legal responsibility of paying back the loan amount (and any extra fees) if the borrower isn’t able to keep up with the payments.

Co-signers provide a guarantee for a loan or lease but typically do not have an ownership interest in the financed item. They're responsible for the debt if the primary borrower or tenant fails to pay. Their primary role is to offer assurance to the lender or landlord regarding repayment but may not have any rights to the property or asset being financed.

Usually, a consumer will seek out a cosigner when they know they’re going to struggle to be approved for a loan based on their own financial information and credit profile.

A co-applicant on a loan is an additional individual that is taken into account when a loan is being underwritten and (hopefully) approved. It’s possible that having a co-applicant will help you improve the odds that you will be approved for a loan. Furthermore, you might be offered more favorable loan terms once the other person’s credit history and financial info are added to the pot.

Co-applicants apply for credit together and are equally responsible for repaying the debt if the loan is extended. They both have ownership rights or benefits from the loan or lease agreement. Both parties' incomes, assets, and credit histories are considered in the approval process. They share equal responsibility for making payments.

It’s important to understand that being a co-applicant (or a co-borrower, for that matter) is not the same as being a co-signer. Cosigners usually aren’t given access to any funds or have anything to do with any collateral related to the loan. Instead, they are just, essentially, back-up if the primary borrower can’t pay back what they owe.

A co-applicant, on the other hand, is equally responsible for the repayment of the loan. For instance, if a husband and a wife apply for a mortgage, they would both be considered “co-applicants.” They both have to make sure they are making their mortgage payments on time, and both benefit from the loan. In this particular example, both spouses would end up being named on the title once the mortgage was fully paid off.

Co-borrower is, basically, another term for a co-applicant. Some people make the distinction that a co-applicant and a co-borrower are the same thing, except that they describe different moments in time in the loan process.

If co-applicants apply for a loan and are approved and funded, they become co-borrowers. With co-borrowers, both individuals' incomes and credit histories are considered in the approval process, and both are equally liable for the loan payments. Unlike co-signers, co-borrowers have an ownership interest in the property.

If someone is a co-borrower, it means that they have access to the loan funds in the same way that the primary borrower does. It also means that they have an equal amount of responsibility for repaying the loan as the primary borrower.

Having a co-signer or a co-applicant can potentially help you build credit. However, this isn’t necessarily a given– whether or not your credit improves, thanks to having another person sign their name to a loan, depends on whether you exhibit responsible habits as a borrower.

If you're the primary borrower and have a co-signer, the co-signer’s strong credit history and responsible financial behavior can positively influence your credit. Timely payments on the loan or lease can improve your credit score.

On the other hand, if you miss payments or default on a loan and you have a co-signer, it negatively affects not only your credit but also the co-signers credit score. Their credit is impacted just as yours is because they are equally responsible for the debt if you stop making payments.

If you have a co-applicant on a loan, both of your credit scores are impacted positively or negatively based on how the loan or lease is managed. Timely payments by both co-applicants can help build both individuals' credit histories, contributing positively to their credit scores. Conversely, missed payments or defaults adversely affect both co-applicants credit scores.

Taking out a loan is a big decision, and approaching someone to sign the paperwork alongside you isn’t something to take lightly. You’ll want to think about the impact it could have on both you and the individual you’re asking to sign on as a cosigner or co-borrower.

There are several reasons you might want to approach someone you know and trust to cosign a loan for you.

There are a number of advantages to having a cosigner, including:

On the other hand, having a co-signer isn’t all sunshine and roses.

There are some potential consequences you’ll want to think about before starting to hunt for the right cosigner, including:

You’ll definitely want to make sure you consider the potential impact on your relationship with your cosigner before choosing to go this route. Money has a way of causing strife in even the strongest of relationships, and you’ll want to make sure you have a clear understanding of how and when the loan will be repaid so that you and the cosigner are able to maintain a positive personal relationship during and after the repayment period.

It can be tempting to become a cosigner to help out someone you care about when they’re looking to gain access to a loan or line of credit. However, it’s extremely important you consider all of the potential implications of this before moving forward.

There are, of course, some obvious benefits to being a cosigner for someone else.

Here are some reasons you might choose to become a cosigner:

Some of the reasons you might not want to cosign a loan include:

If a co-signer doesn’t sound like the right thing for your situation, would a co-borrower or co-applicant be more applicable?

Some of the reasons you might want to apply for a loan with another individual include:

Of course, there are always two sides to every coin. Some of the potential downsides of having a co-borrower include:

Not everyone is going to need a cosigner for a loan. Whether or not having a cosigner could be worth the trouble is going to depend on your particular financial circumstances.

Here are some signs that a cosigner might be useful to you as you work to take out a loan or line of credit:

Finding the right cosigner isn’t a decision you’ll want to rush. Not only is a big decision for you because it impacts your ability to gain approval for a loan and affects the terms your offered, but being a cosigner can also have a big impact on the other individual’s financial life.

For this reason, you don’t want to go around asking everyone you run into whether they’ll cosign on a loan. Typically, cosigners will be parents, family members, close friends, or spouses. The less close you are to a person, the less likely it will be justifiable for them to take on the risk of cosigning your loan.

When you start contemplating who to ask to cosign your loan, you’ll want to keep the following factors in mind:

Finally, before I sign off, let's look at one more question that is frequently asked in relation to cosigning-- what's the difference between an authorized user and a cosigner?

In short, the key difference lies in the level of financial responsibility. An authorized user can use a credit account but isn't liable for payments, whereas a cosigner is legally responsible for repaying the debt if the primary borrower defaults.

Essentially, an authorized user is someone who has been given permission by the primary account holder to use a credit card or account. They have the privilege to make purchases but aren't legally responsible for the debt incurred. The primary account holder maintains responsibility for payments.

To help make the distinction a bit clearer, you might want to become an authorized user on someone else's account in order to improve your credit. On the other hand, you might search for a cosigner if you're looking to add the positive credit history of someone you trust to a loan application in order to improve approval odds or gain access to better loan terms.

Having a cosigner or a co-applicant is a great way to gain access to financial products you otherwise wouldn’t be approved for on your own. Furthermore, it can help you lock down better rates and terms on the loan. If you are able to make regular payments toward the loan after another individual helps you secure it, it can help you build credit through a positive payment history.

At the same time, taking on a cosigner or co-borrower isn’t something you want to take on flippantly. This is a serious financial responsibility that the other individual is agreeing to, so it’s important to make sure they understand what their legal obligations are by signing on to the loan.

Are you working to improve your financial future by improving your credit? If so, make sure you check out our Credit Building Tips blog for more articles and resources to help you on your credit-building journey!

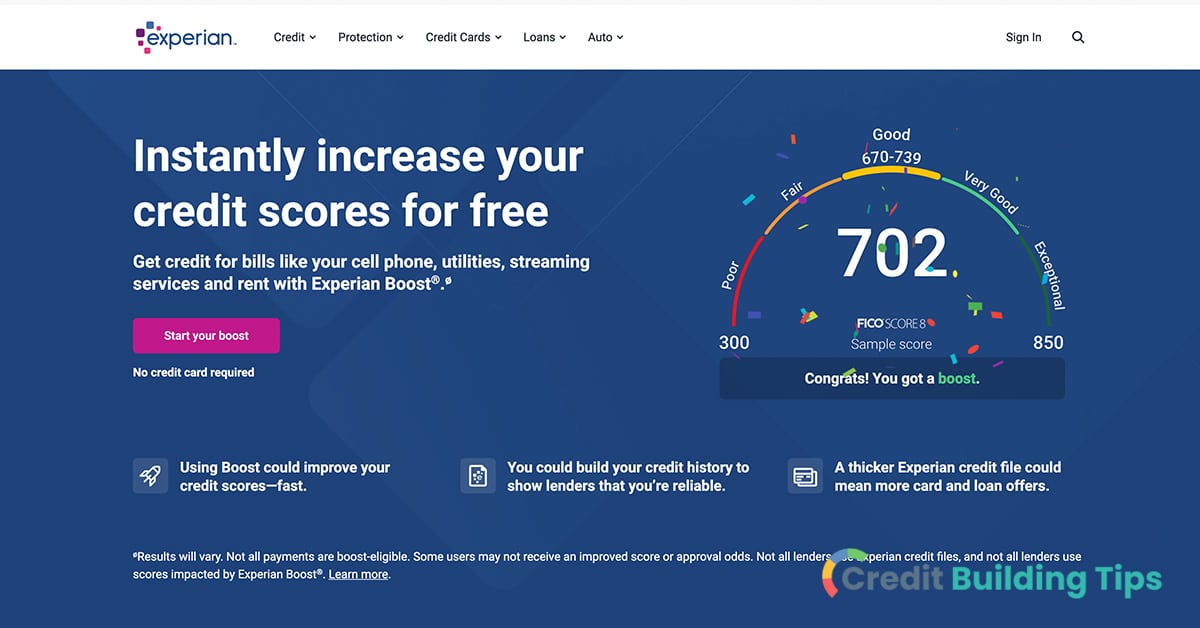

In this post, we'll take a look at how Experian Credit Boost can help build your credit by adding a positive payment history for things like rent, utilities, and subscription streaming services.

The credit system can feel pretty frustrating sometimes-- a person can make regular, on-time payments for a big stack of bills and not receive any recognition for their responsible behavior. Services like Experian Boost can offer a leg up to people with thin credit profiles but years of making bill payments under their belt.

Basically, Experian Boost is a way that you can build your credit history and potentially even instantaneously improve your credit score.

Basically, Experian Boost is a way that you can build your credit history and potentially even instantaneously improve your credit score.Let's take a look at exactly how this service works and whether it's right for you.

Experian Boost is an optional tool you can use to raise your FICO score instantly.

The way this program works is that it allows you to add your positive payment history for things that don't typically show up on your credit report, including rent, utilities, and even subscription streaming services.

Experian Boost is free to use and easy to opt out of if you change your mind. At the same time, you'll have to share your banking and account information with Experian in order to benefit from the service. Before you sign up, it's a good idea to think about whether this is something you feel comfortable with.

According to Experian, the average person that uses Experian Boost will raise their FICO 8 credit score by 13 points.

This credit-building tool can be useful for people who are looking to add a few more points to their credit score and potentially bump them into the next credit bracket.

In addition to helping you increase your credit score instantaneously, Experian Boost offers a number of other free features.

Here are some of the other things you can benefit from when you sign up for this program:

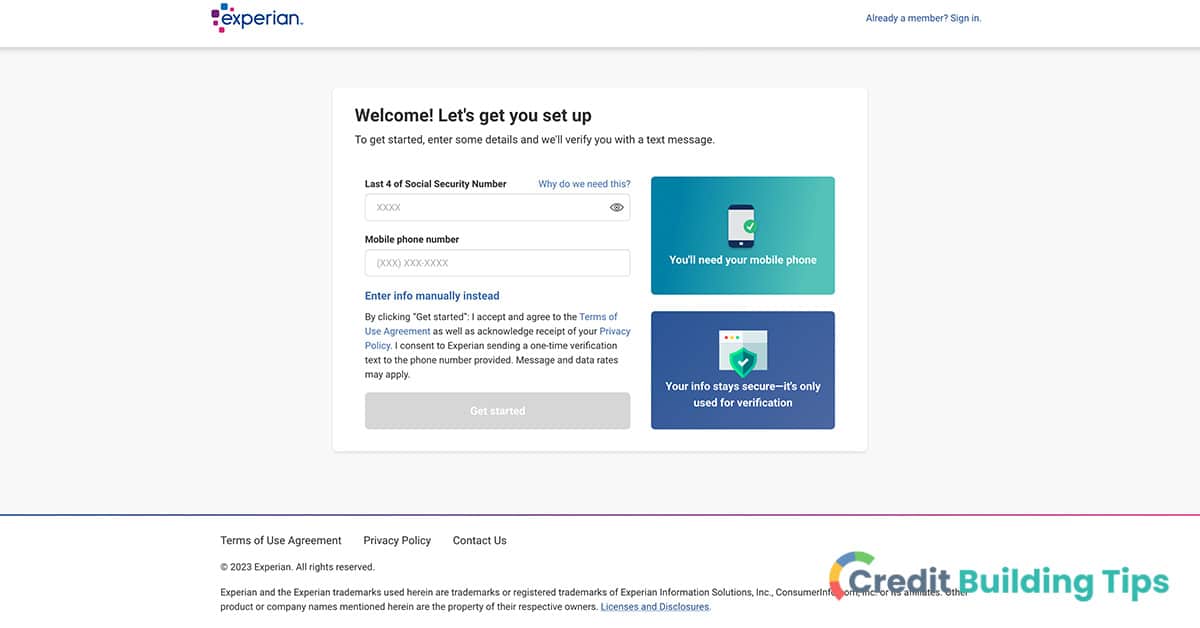

In order to use Experian Boost and gain the benefits of a credit score increase, you have to allow the program to scan your bank account transactions.

By looking at your bank account, Experian Boost will identify rental, cell phone, utility, and streaming payments. They will then include this information in your Experian credit report.

If you're worried that a few missed payments in the past make it so you're not a good candidate for Experian Boost, it's worth noting that they only count positive payment history. This means that missed or late payments for rent, utilities, cell phone service, or streaming services won't hurt your credit score.

The same is not true when it comes to the typical information that shows up on your credit report. If you miss a credit card payment by thirty days or more, for example, a negative mark will show up on your credit report. This will, in most cases, reduce your credit score.

By linking your utility, telecom, and bank accounts to the credit report generated based on your credit history by Experian, you can potentially raise your credit score.

In short, this is letting you get credit for your positive, on-time payments for things like rent, cell service, and utilities. You do have to have at least one active credit account in order to use the service, so it's, unfortunately, not useful to people who are trying to build a credit profile from scratch.

Only certain payments are eligible for Experian Boost, which include:

Your new credit score will be generated instantly once you sign up and link your bills. While it's possible you won't see a change in your credit score after going through this exercise, Experian says that your credit score won't go down when you utilize the service.

Will taking the time to sign up for Experian Boost and link your accounts will result in a higher credit score? The answer is: it depends.

The first important point to make is that using Experian Boost only updates your Experian credit report with your positive payments. This means that if a lender looks at a credit score generated from TransUnion or Equifax, Experian Boost won't be much help.

That being said, Experian says that the most common versions of both the FICO score and VantageScore can be benefited by the service.

Experian Boost is typically most useful for people that don't have a very robust credit history-- i.e., people with a thin credit profile or less than five accounts on their credit report.

The second point is that whether Experian Boost increases your score is going to depend on your particular circumstances.

On the other hand, people who have thin credit profiles might notice a bigger boost when using this program. As a final point, it's important to note that not all payments are eligible for Experian Boost.

The good news about Experian Boost is that, if it does have a positive impact on your score, it will happen in just a few minutes. The sign-up process is relatively simple, and your FICO score will generate quickly after you connect your accounts to your credit file.

To sign up for Experian Boost, you'll start by going to their sign-up page to create a free Experian account.

From there, you'll follow these steps:

That's it! If you want to take any of your accounts off at a later date, you'll want to sign into your account and navigate to the field titled "Connected Accounts." You can then click "disconnect" for the account you no longer want to show up on your Experian credit file.

Whenever you're signing up for a new service and entering personal information, it's important to understand the pros and cons.

Let's look at some of the things you'll want to know about Experian Boost before you start linking your accounts.

If a lender is using TransUnion or Equifax to generate your credit scores, you're not going to gain any benefit from Experian Boost. For people who are looking to use the service to boost their score before applying for a mortgage or a new credit card, it's important to understand that Experian Boost might not help depending on the credit report a creditor or lender is using.

When you sign up for Experian Boost, you have to link your bank account. This is how they are able to verify that you have made payments on time and add them as tradelines to your credit file.

However, it isn't Experian itself thumbing through your bank statements. They use an intermediary company called Finicity to accomplish this aspect of the process. Before you sign up, it's a good idea to think about whether you feel comfortable letting another company go through your bank account and have access to so much personal information.

If you have excellent credit and a robust credit history, Experian Boost probably isn't worth your time or energy. Even if it does increase your score, five points probably won't offer much in the way of benefits to people with a score of 760 or higher.

Another important thing to consider is that Experian Boost only works with newer versions of the FICO score. Considering that mortgage lenders still generally use older FICO score models, this can mean that it's not worth the effort if your primary purpose is increasing your score before buying a house.

Finally, you'll lose any benefits you gain if you end up opting out of the program. Any extra points you enjoyed will disappear if you aren't actively enrolled.

If you like the idea of Experian Boost but it doesn't quite help you achieve your goals, there are some other options out there. Primarily, you can sign up for another third-party service that helps you boost your score, or you can work to build credit the old-fashioned way.

There are a number of other third-party services on the market that offer similar perks as Experian Boost.

Here are some others you can look into:

Building credit is something anyone can do, but it often takes a bit of time and persistence.

There are a number of things you can do to help increase your scores over time. Here are some crucial steps you can take if you're interested in raising your credit score but don't want to use one of these credit score-boosting services:

Searching for more answers about using Experian Boost? Let's take a look at some of the most frequently asked questions about this credit-building tool.

Experian states that they use bank-level SSL security encryption so that your data is secure and safe. Of course, you are always taking some level of risk when you enter personal and financial information online.

Here are a few tips to ensure you aren't doing more harm than good when using a service like Experian Boost:

If you hand your landlord an envelope of cash on the first of every month, you're not going to be able to benefit from your on-time rent payments through Experian Boost. The same is true if you use a mobile payment transfer app (think Zelle, PayPal, or Venmo), a personal check, or a money order.

In order to have an Experian Boost and benefit from this service, you need to meet the minimum FICO requirements. These are:

If you meet these requirements, then you can use Experian Boost to get your FICO Score.

UltraFICO is another popular service for boosting consumer credit scores, particularly for those who have thin credit files.

This can be useful for people who don't have a FICO score at all or who have a low FICO score. Like Experian Boost, this process works by having you share banking data from your checking, savings, and money market accounts.

By scanning your bank accounts, a number of pieces of information will be collected in order to potentially boost your score, including:

UltraFICO doesn't actually add this information to your credit report. What it does instead is contribute to the calculation of your FICO scores. Since Experian Boost and UltraFICO work in different ways, you can actually use both to help give lenders more information about your creditworthiness.

According to Experian, most people who use their Boost service increase their credit scores instantly.

The people who will benefit the most are those who either:

Only the newer credit scoring models are impacted by the additional information contributed to your report by Experian Boost. This means that the following scoring models can be improved using this service:

If you're looking to add a few points to credit scores generated from your Experian credit report, Experian Boost can be a very useful tool. By letting you add positive payment histories for things like rent, utilities, and streaming services, you might be able to snag a few more points and even get bumped up into the next credit bracket.

At the same time, Experian Boost might not be the right choice for everyone. Those who have robust, long credit histories might not see much benefit from adding their on-time payments using this service. Furthermore, some consumers might not love the idea that they have to give access to their bank accounts to an intermediary service in order to participate.

Whether or not Experian Boost is the right choice for you, taking the time to determine the best way to achieve and maintain a healthy credit score is well worth the effort. Your credit score can have a very real impact on your life, affecting your ability to take out credit lines, buy a house, rent an apartment, and much more.

Are you interested in learning more about how you can improve your credit? Are you searching for more resources to help you become more financially literate? Make sure you check out our Credit Building Tips blog for more useful articles and guides!

When you want to take out a loan or get a new credit card, lenders will look at your credit history to determine your creditworthiness. If you have a thin or non-existent credit history, you might be wondering how you can build a credit history faster than usual.

The best way to think of your credit history is as a record of all of your credit activity. This includes how many credit accounts you have, whether you have a history of on-time payments, and how much debt you have. Additionally, one of the factors that influences your credit score is the age of your credit accounts.

If you're trying to beat the calendar and build credit history faster than is typical, there are two primary things you can do: become an authorized user on an old, well-established account or use a third-party service to add on-time rent and utilities to your credit report.

If you're trying to beat the calendar and build credit history faster than is typical, there are two primary things you can do: become an authorized user on an old, well-established account or use a third-party service to add on-time rent and utilities to your credit report.When neither of these is an option, and you have a thin credit profile, you might consider applying for a secured card, a credit builder loan, or a store credit card. In this article, we'll look at what you need to know about building your credit history to help you achieve your financial goals.

Your credit history is the record of how you have managed your finances and debt over time. Essentially, this is an account of how able you have been to repay the debts you have. This shows up on your credit report, which recounts the number and types of credit accounts you have held.

The following information is recorded in your credit report about your credit accounts:

Credit reports also include information about any collections, liens, judgments, or bankruptcies.

All consumers can access their own credit history through their credit reports. Typically, you can receive a free credit report from all three of the credit reporting agencies through AnnualCreditReport.com once a year. However, due to the economic uncertainty that resulted from the pandemic, consumers can access free credit reports weekly through December 2023.

Your credit history is important because potential creditors will use this information to determine whether they are willing to extend credit to you. This includes creditors such as credit card issuers and mortgage lenders.

Beyond that, the information in your credit history is also used to determine your credit scores. Here are some of the situations where your credit history might come into play:

If you have a good credit history, it means that you have demonstrated that you routinely pay your bills on time and are not saddled with large amounts of debt. To potential creditors, a good credit history means that you are a lower-risk borrower.

Having a good credit history means you have a history of making on-time payments and maintaining low debt balances.

This means that it's easy to be approved when you apply for loans. On top of that, it means you'll be offered lower interest rates for the loans and credit you're approved for.

On the other hand, having a bad credit history means that you are carrying a lot of outstanding debt and don't regularly pay your bills on time.

Having a bad credit history means having a history of missed or late payments, carrying large balances, or struggling with significant financial events like bankruptcies, collections, or liens.

There are a number of different factors that can contribute to a bad credit history. These include:

When you have a bad credit history, it can make it hard to be approved for credit cards or take out loans. Beyond that, the loans and cards you are offered will typically mean dealing with high-interest rates. If your credit history doesn't show you have been a responsible borrower, it can also mean that you have to pay security deposits for things like car rentals, apartments, and cell phones. To make matters even worse, you'll also find your car insurance premiums are higher than if you have a good credit history.

Even if you have been exceptionally financially responsible for your entire life, having a short or nonexistent credit history can make it very difficult to qualify for loans or lines of credit.

This is because your credit history is an important part of how lenders can trust that you are a responsible borrower. When your credit history is brief or doesn't exist at all, lenders don't have as much information as they typically want to make a decision about loaning you money.

The length of time that the accounts on your credit reports have been open is one of the factors that impact your credit scores. You can check the length of your credit history by taking a look at your credit report.

The length of your credit history is worth about 20% of your VantageScore credit score and 15% of your FICO Score credit score.

There are three primary factors that go into calculating the length of credit history category within your FICO credit score:

The older your credit history is, the better when it comes to your credit score.

When lenders are reviewing loan applications, they'll take a close look at your credit history. The longer your credit history is, the lower risk you appear as a borrower, so long as that history displays on-time payments and responsible credit usage.

Beyond using your credit history to determine whether or not to approve your application, lenders use your credit history for two purposes:

As mentioned above, your credit history can also be used by employers, insurance companies, landlords, and utility companies to make a more informed decision about you.

According to a study from FICO, one of the major credit scoring model companies, people who have exceptional credit scores (think 800 or higher) have an average credit age of a little over ten and a half years.

That being said, you don't need to have had credit accounts open for more than a decade to have good credit. You can receive a FICO credit score once you have at least one credit account on your credit report for roughly six months. During this period, the payment history needs to have been updated at least once to be eligible for a FICO score.

For a VantageScore credit score, your account might only need to be on your credit report for a month or two in order to qualify.

It's worth noting, though, that other information can have a bigger impact on your credit score than simply having a thin credit file or a young credit report. For this reason, the biggest priority should be avoiding missed or late payments and keeping a low balance on your cards in relation to your credit limit.

Most people simply exert some patience when it comes to building credit history. As they continue to make payments on time and keep their accounts in good standing, the average age of their credit will typically start increasing over time.

However, if you're motivated to build a credit history faster than is typical, there are a few things you can do. These include:

Let's take a closer look at why each of these steps can help you build credit history faster than usual.

In a recent post, I discussed at length how you can build credit by becoming an authorized user on someone else's account. If you have a thin or non-existent credit history, this can really give you a leg up when it comes to the length of credit history used to calculate your credit score.

There are a few things to keep in mind before you run out looking for someone to add you as an authorized user, though.

First of all, you want to make sure that the credit card issuer actually reports authorized users to the credit bureaus and not just the primary account holder. If they don't also report authorized users, being added to their account won't do your credit report any good.

Secondly, you'll want to be very certain that the rest of the account's credit history is positive before you're added as an authorized user. In particular, you should verify that the payment history and credit utilization on the account are positive before becoming an authorized user.

Another tactic you can use to increase the length of your credit history faster than usual is to add alternative data to your credit report.

Your credit report often won't display things like mobile phone bills, rent payments, or utility bills. If you haven't had a credit card or taken out any loans, this can mean that you have little to no credit history even though you've been responsibly paying bills for years.

In order to potentially add years to your credit history, you might consider using a third-party service that will add eligible accounts to one or more of your credit reports if you are adding eligible accounts. That has been open for several years. This can give you a real leg up when it comes to increasing the length of your credit history.

If you want to add your rent to your credit report, here are some of the paid third-party services you can use:

All of the above services can be initiated by renters.

There are additional services that can be used if property managers or landlords are willing to opt in. In some cases, renters might actually be enrolled automatically when they rent a new place. If you're currently moving, you can ask your new landlord whether or not they use any of the following services, many of which are typically free for renters:

Utility providers usually aren't required to report payment histories to the three primary credit bureaus in most states. This means that you will usually only see a utility account on your credit report if the account is delinquent.

There are a number of reasons that utility companies are disincentivized from reporting to the credit bureaus, with the two primary reasons being:

If you want your history of on-time utility payments to contribute to your credit history, there are a few services you can use:

Closing a credit card can end up damaging your credit for two primary reasons:

At the same time, it's important not to blindly follow the commonly spouted advice that you shouldn't ever close your credit accounts.

There are several very good reasons why you might want to close an account that might outweigh the negatives, including:

All that being said if the only reason you're considering closing an account is that you don't particularly need it, stop and think about whether or not you should keep it open for the sake of your credit history.

On top of being wary of closing old accounts, you also want to be thoughtful before opening a new account. The reason for this is that it can reduce the average age of your credit.

Of course, credit age is only one of many factors that impact your credit score. If you are primarily concerned with increasing your credit, it's possible that opening a new account will ultimately help more than it hurts by increasing your total credit limit and reducing your credit utilization ratio. It's worth noting, though, that the hard pull the creditor will run when approving you for a new card can temporarily reduce your credit score.

Starting from scratch with credit can feel pretty frustrating. On the one hand, you need credit accounts in order to build credit. On the other, lenders and creditors likely won't extend credit to you or offer you loans when you don't have a credit history.

Luckily, there are a number of things you can do to break free from this conundrum. Here are some options:

If you're just opening your first credit card account right now, it can be frustrating to realize just how long it takes to build good credit history. However, there are a few things you can do to increase the age of your credit accounts on your credit reports. The two primary things you can do are:

If neither of these are options and you have yet to establish any credit, here are some things you can do to start building credit in addition to becoming an authorized user or adding rent and utilities to your report:

Are you working to boost your financial literacy and ensure your credit allows you as many opportunities as possible down the road? Make sure you check out our Credit Building Tips blog for more useful resources.

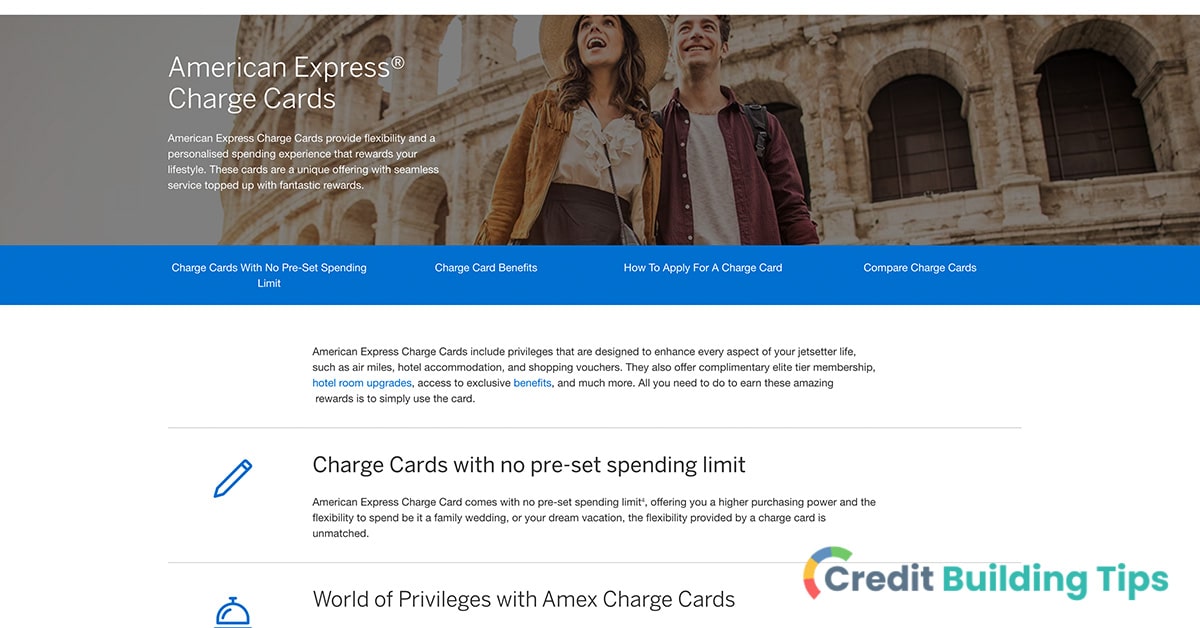

Working to increase your credit score is a worthwhile endeavor-- it makes it easier and cheaper to borrow money, helps you achieve low insurance rates, and can even impact your ability to rent an apartment or get a job. In this article, we'll look at whether American Express helps build your credit score any more than other credit card issuers.

American Express is unique in that it is the only major issuer that still offers financial products that are similar to charge cards. Charge cards aren't identical to credit cards and, therefore, can impact your credit scores in a different way.

Credit cards are a great way to build credit and increase your credit score when you use them responsibly. Whether you use an American Express credit card or a charge card, it's worth understanding how you can use them to build a strong, healthy credit profile.

Credit cards are a great way to build credit and increase your credit score when you use them responsibly. Whether you use an American Express credit card or a charge card, it's worth understanding how you can use them to build a strong, healthy credit profile.Let's dive in and take a look at what you need to know about building your credit score using American Express charges or credit cards.

American Express is a credit card company that issues both traditional credit cards as well as charge cards to consumers. If you are considering applying for an Amex card, it's worth understanding that these two financial products are not identical.

Traditional charge cards have no preset spending limit and require that you pay off the balance in full every month. This is opposed to traditional credit cards, which have a credit limit and allow you to carry a balance from month to month at the cost of being charged interest.

American Express is the only major card issuer that still offers charge cards to consumers.

That being said, the concept has evolved over time in order to allow some customers to "Pay Over Time" for eligible purchases.

Some of the charge cards offered by Amex include:

There are also a few retailers that offer charge cards, most of which are chain gasoline companies. With these cards, you can only make purchases within the brand. Though they are similar to charge cards in some ways, many will allow consumers to carry a balance on the card. There are also some charge card options for small businesses, including the Capital One Spark Cash Plus.

You can build credit using both credit cards and charge cards. However, their different structures mean they don't impact your credit in the same way.

A credit card issuer, including American Express, will check your credit when you apply for either a charge card or a credit card. They won't just do a soft pull of your credit-- they will run a hard inquiry.

Unlike soft inquiries, hard inquiries will be viewable by those who pull your credit report for up to two years. Though this can have a slight negative impact on your credit score, the effect is usually minor and diminishes over time.

One major factor that impacts your credit score is your credit utilization ratio. This is a metric that compares how much available credit you have to how much credit you are using at a given time.

When you use a credit card, your credit utilization rate will be determined by comparing the statement balance of your account at the time of reporting to your preset credit limit. The lower your credit utilization rate is, the better, as it shows lenders and creditors that you are a responsible borrower.

Since charge cards don't have a credit limit in the same way credit cards do, it makes it very difficult to determine a credit utilization ratio. The two major credit scoring models, VantageScore and FICO, don't incorporate charge card accounts when they are calculating your credit utilization. Some older scoring models, however, will still account for charge cards when running this calculation.

You can work to build a strong credit profile by making on-time payments for both credit cards and charge cards.

With credit cards, you only have to make the minimum monthly payment in order to have your payments reflected positively on your credit report. Of course, if you only pay the minimum monthly payment, you will incur interest charges unless you are still in the promotional introductory period for a 0% APR card.

With traditional charge cards, however, you are required to pay the balance in full every month. That being said, some Amex charge cards will allow you to pay overtime for eligible products, making them more like a hybrid between a charge card and a credit card.

If you fail to make a payment by more than 30 days, it will show up as a late payment mark on your credit report. This can remain on your credit file for seven years. Payment history is a significant part of your credit score, which is why it is important to make payments on time every month.

American Express issues plenty of traditional credit card options, but they are unique in being the only major issuer that still offers charge cards to consumers.

These cards also tend to come with a bunch of perks, potentially including things like:

If you're considering one of the American Express financial tools that have features similar to charge cards, it's worth understanding how they can impact your credit.

Oftentimes, you'll hear the words "credit card" and "charge card" used interchangeably. The truth is, though, there are some distinct differences between the two that are worth understanding.

When you're making a purchase, charge cards and credit cards work exactly the same way. Merchants won't need a special card reader to process your payment when you use a charge card, nor will you struggle to use your charge card online.

There are two significant differences between charge cards and credit cards that are important to understand:

If you don't pay off the full balance of your charge card every month, it can have a number of potential consequences, including:

Charge cards will usually have a substantial annual fee. The reason for this is that the issuer doesn't make any money off the interest because cardholders are expected to pay the balance in full each month.

There are a number of different factors that charge cards can impact that influence your credit scores.

These include:

However, they won't be factored into your credit utilization rate by FICO or VantageScore because they don't have a preset spending limit.

What this means is that charge cards do not have as significant an impact on your credit score as credit cards do.

This can be either a good thing or a bad thing, depending on what your needs are. Spending a big chunk of money using a charge card won't likely have as much of a negative impact on your credit scores as if you spent the same money on a credit card. On the other hand, you won't benefit from spending little on a charge card because it's not factored into your credit utilization.

Charge cards will usually have a lesser impact on your credit score than credit cards. This is because your credit utilization ratio is a major factor that influences your credit score. Without a preset spending limit, charge cards don't count toward this metric.

You can use both credit cards and charge cards to build credit. If you maintain low balances, though, a credit card will have a greater positive impact on your credit score than a charge card.

That being said, your payment history is the most important factor when it comes to your credit scores. Just because charge cards have a lesser effect than credit cards, it doesn't mean they have no effect at all. Making charge card payments on time will help your credit score, just like it will positively impact your score to make credit card payments on time.

Both credit cards and charge cards can help you increase your credit score if you use them responsibly. American Express is one of the major card issuers in the U.S., and using one of their cards can certainly help you build credit if you make payments on time and maintain a low balance.

That being said, you shouldn't expect to build credit with an American Express credit card any faster than with a card from another issuer. Credit cards, in general, are a very useful tool for building credit.

The reason that credit cards can help you build credit is that they will typically report the activity on your account to the three major credit bureaus.

These national credit bureaus-- Equifax, Experian, and TransUnion-- use the information that credit card companies report to create your credit reports. Your credit reports are the resources that are used to calculate your credit scores.

Opening a credit card or becoming an authorized user are both ways you can start building credit with a credit card. If you have a thin credit profile and don't have the option to become an authorized user, there are a few options to help you start building credit with a card:

How you use your credit card will be an essential factor in how it impacts your credit. The most important things when it comes to responsible credit card usage are:

Your payment history is the most important factor when it comes to calculating your credit scores. Every month, you will want to make sure you make at least your minimum payment on time.

If you don't pay your credit card bill on time, you will most likely be charged a late fee. If your card has a promotional interest rate or an introductory rate, you'll probably lose this privilege when you miss a payment date. If you miss the payment by 30 days or more, you'll start racking up negative marks on your credit profile that damage your credit scores.

It can be hard to remember to pay credit card bills on time, and even one slip-up can be costly for your credit and for your wallet. For this reason, the best thing to do is to set up autopay on your account so that the minimum monthly payment is at least always covered. Of course, you'll need to make sure there are sufficient funds in your linked account to ensure the payment goes through.

Though making the minimum monthly payment is essential, it's ultimately best to pay as much of your balance as you can every month. Otherwise, interest charges will start stacking up, and you'll struggle to keep your utilization rate low.

As mentioned earlier, your credit utilization is the balance on your credit card relative to the credit limit on the card. This is another significant factor used to calculate your credit scores.

When it comes to your credit utilization ratio, experts suggest you keep it under 30%. However, lower is always better when it comes to credit utilization. For the best possible credit scores, try to keep it under 10%.

You want to keep your credit utilization ratio as low as possible for the sake of your credit score. Maintaining a low balance is how you can achieve this. Of course, how low you need to keep your balance has to do with what your credit limit is. Using $500 of credit for a card with a $ 1,000 credit limit is a very different story than using the same amount of credit on a card with a $10,000 credit limit, for example.

If you want to keep your reported balance low for your credit score, you'll want to make your credit card payments before your statement period ends. Usually, it's advised that you pay the balance 21 to 25 days before the due date on the account.

American Express credit cards and charge cards can both help you build credit if you use them responsibly. However, charge cards tend to have a lesser impact on your credit scores because the major credit scoring models don't incorporate charge cards into your credit utilization ratio. This can be either a good or bad thing depending on how you plan to use your charge card.

If you are interested in building credit, the bottom line is that responsible credit usage is more important than which particular credit card issuer you receive a card from. An American Express credit card will be just as useful as another credit card with identical terms, assuming you make your payments on time and keep your balance low.

Understanding the world of credit can feel pretty overwhelming at first, but increasing your financial literacy is a task that is well worth the effort. By learning how you can build credit and increase your score, you can open up new and beneficial financial opportunities for yourself down the road.

Are you searching for more resources to help you as you work to increase your credit? Make sure you check out our Credit Building Tips blog.

If you have bad credit or little credit, you're probably finding yourself in a bit of a pickle. You need to be extended credit in order to build credit, but few are willing to lend you credit because your credit profile is poor or nonexistent. If this describes your situation, you might be wondering if becoming an authorized user helps build your credit.

The answer is: it depends.

Becoming an authorized user can potentially benefit your credit score if the primary holder of the account is a responsible borrower. On the other hand, there is also the potential that authorized user status won't change your credit score at all or even lower your score.

Becoming an authorized user can potentially benefit your credit score if the primary holder of the account is a responsible borrower. On the other hand, there is also the potential that authorized user status won't change your credit score at all or even lower your score.There are some situations where becoming an authorized user can be a very useful tool for building credit. At the same time, it's not a flippant decision you want to make. Let's take a look at what you need to know about becoming an authorized user.

Before you run and ask a family member to add you as an authorized user, it's worth understanding that there are three potential outcomes for your credit when you become an authorized user:

Given the fact that becoming an authorized user can potentially have no effect or even a negative effect on your credit, you might be wondering if this is an avenue worth pursuing.

To determine whether it makes sense for you, you'll want to consider the following two factors:

The credit card issuer or lender will need to report the account in question to the credit bureaus in order to become an authorized user to impact your credit. Your credit score won't budge one way or the other if they aren't reporting to Equifax, Experian, and/or TransUnion.

If the lender or issuer does report to the credit bureaus, the next important question is whether or not activity on the account will help or hurt your credit. The primary account holder and you, as the authorized user, must practice responsible credit habits in order to receive a beneficial boost to your credit.

By being added to another person's credit account, an authorized user can potentially enjoy a boost to their credit score and file. When the primary account holder has a good credit history and responsibly uses credit, authorized users can benefit from this positive credit activity.

For example:

On the other hand, if the original cardholder is missing payments, maxing out their cards, and getting calls from debt collectors, the credit of the authorized user can suffer. For this reason, it's essential to make sure you're attaching your own credit profile to the account of an individual that makes responsible borrowing decisions.

Does becoming an authorized user seem like a promising way for you to build and boost your credit? Let's explore some basic questions about the process and how you can use authorized user status to your advantage.

If you're the authorized user on another person's credit card account, it means that you have permission to make purchases on their account. In order to become an authorized user, the primary account holder needs to sign off on the authorization. You'll then usually get your own credit card with your own name on it that's linked to the main account.

In most cases, authorized users won't get a bill every month. Instead, these will go to the primary account holder. Authorized users, therefore, usually need to set up their own payment agreement with the original cardholder.

When you're added as an authorized user, the credit account will usually show up on your credit reports. This can help improve your credit if the main account holder pays their bills on time and keeps a low account balance.

There are some credit cards that have a special feature just for accounts with authorized users, though. In these cases, the bill will note which purchases were made by the authorized user, so its easier to divvy up the bill.

Technically, anyone can become the authorized user of another individual's credit card if the original cardholder gives it the green light. In most cases, though, authorized users are family members or close friends of the primary account holder.

It's useful to keep this in mind when you're thinking about who you could ask to be added as an authorized user. When someone allows you to be an authorized user on their account, they are attaching their own credit profile to yours. This means that even if you practice perfect credit habits, your credit can get dragged down by late payments, charge-offs, and other derogatory marks associated with the account.

When you're thinking about becoming an authorized user to build credit, one question that will quickly come to mind is who you should ask.

Since your spending behavior can impact the credit of the primary account holder, authorized users are usually attached to the accounts of close family members or trusted friends.

This isn't a question you'll want to take lightly. Adding yourself to the right person's account can have its benefits, but choosing the wrong person can mean your credit is actually harmed rather than helped.

Here are the primary considerations you'll want to keep in mind when deciding who to ask:

Beyond that, it's important to recognize that becoming an authorized user is a responsibility that can impact the relationship you have with the primary account holder. For example, if you don't stick with the payment plan the two of you agreed on, this can create tension and strain.

There aren't any laws that outline a minimum age at which an individual can gain authorized user status. At the same time, most banks are going to have their own policies about the minimum age of authorized users.

Here are the minimum authorized user age requirements for some of the major credit card issuers in the US, along with the information needed to be added to an account:

The credit limit on the particular card you are an authorized user for will also apply to you-- the purchases of both you and the primary account holder can't amount to more than the credit limit.

However, some card issuers will allow the primary account holder to set spending limits for authorized users. This means that you might not have access to the full credit limit depending on the credit card issuer and whether the main cardholder decides to limit your spending.

Even if there isn't a way to limit authorized users spending via the card issuer, it's a good idea to have a conversation about this with the main account holder. Coming to a clear agreement about how much credit you have access to each month can help ensure your authorized user status doesn't lead to tension and strife in your relationship.

The steps are quite simple if you already know who you'd like to ask to become an authorized user.

The first step is to talk to the relative or trusted friend that you are hoping will add you as an individual authorized to use their account. You'll want this person to have good credit and practice healthy credit habits.

Before going through the trouble of being given authorized user status on a card, make sure the credit card issuer will report authorized users to the credit bureaus. In some cases, people with authorized user status don't have their information sent to the credit reporting agencies.

If they agree, they can contact the credit issuer to set you up with authorized user status. It's worth noting that not all card companies will report authorized users' activity to the credit bureaus. To make sure you can actually benefit from being an authorized user, ask the main cardholder to verify this information with the bank.

Usually, only the primary account holder will receive the bill and is the one solely responsible for making payments. If they don't pay their bills on time, this can negatively impact both of your credit scores.

The last thing you want is for there to be any confusion about who's paying for what. If you're planning on using available credit each month with the card, make sure you talk to the original cardholder about if and how you will pay them back. Check with them to see if they have autopay set up or otherwise have a secure payment plan in place.

I can't stress enough just how important it is to communicate clearly with the primary cardholder. If there is any uncertainty about how much you can spend each month or how you'll deal with repayment, you'll want to have a conversation about these things ASAP.

An authorized user doesn't actually have to use the card to receive the benefits to their credit profile. In some cases, the primary account holder might be more comfortable if you don't have access to their credit limit. Whatever arrangement you agree to, make sure there is a clear understanding between the two of you to ensure this process doesn't strain your relationship.

As we've discussed above, becoming an authorized user in itself won't necessarily increase your credit score. Here are some things to keep in mind to ensure that adding the account to your credit report is a positive move for your financial well-being:

Usually, the primary account holder will give you access to their credit limit when you're added as an authorized user. It's important to have a conversation with the original cardholder about how much you will spend each month and honor the agreement you've made with them. If you rack up a big balance on the card, it could mean they start accruing interest on the account or struggle to pay the bill on time. This is obviously undesirable for a number of reasons, including the fact that it could negatively impact your credit.

Whether you're responsible for paying part of the bill or the primary account holder is the one making the payment, it's essential that the bill for the account is paid on time every month. Even one or two missed payments can ding your credit score.

You can check your credit report for free using AnnualCreditReport.com. This is a site created by the three major credit bureaus and authorized by Federal law.

The new account won't show up right away-- how long it takes for it to appear depends on when the credit card issuer reports to the bureaus.

Check your report regularly to keep an eye out for any errors or inaccuracies to ensure your credit profile is in tip-top shape.

Being an authorized user can be a useful tool for building your credit profile. At the same time, there are risks involved that you'll want to know about before making a decision. Let's check in with both the benefits and drawbacks to help you make an informed choice.

Is it really worth becoming an authorized user? The answer depends on your own credit profile and a number of other factors.

In general, though, the most substantial benefits of being an authorized user are:

Becoming an authorized user isn't always a good idea. Beyond that, it can be a big decision for the primary account holder to decide to add someone else to their account.

Let's look at some of the cons of becoming an authorized user or allowing someone to be an authorized user on a credit card.

Finally, let's take a look at some of the most common questions I receive about using authorized user status to build credit.

When you're trying to figure out how to build credit, you may have also come across the term "co-signer." Co-signers and authorized users aren't the same thing, but they both are useful tools you can use to help you start your credit history when your credit profile is thin.

Here are some of the primary differences between these two options:

When you become an authorized user, you're being added to an existing account. When you apply for a loan with a co-signer, you're requested to open a brand new account in your own name. The co-signer is "signing on" to say that they will foot the bill if you don't pay up.

Another concept that is similar to that of an authorized user is the joint account.

Joint account holders have more responsibility than authorized users. When you open a joint account with someone else, you are legally responsible for repaying the debt.

It's more difficult to be approved as a joint account holder than as someone authorized to use another person's count. The process will be basically identical to the one you'll go through if you apply for a card on your own.

Joint accounts are most frequently used by spouses that combine their finances. Authorized user status, on the other hand, is more common as a way for parents that are trying to help their kids build credit.

After reading through this guide, you might feel like this isn't the best choice as a credit-building method. Whether you don't want to risk screwing up a relationship over credit card payments or you don't know anyone trustworthy enough to ask, you'll be glad to know there are some other options on the table.

If your primary goal is building your credit score, consider these alternatives:

When someone you know and trust adds you as an authorized user on their account, it can help you build credit so long as they are responsible for a borrower-- aka paying their bill on time and keeping a low balance. Attaching yourself to another person's credit card account can potentially create relationship issues if you don't set clear ground rules and communicate openly. So long as you are able to reach an agreement that you are both comfortable with, though, becoming an authorized user can be a great way to add positive information to your credit profile.

The state of your credit can have a big impact on your life-- impacting everything from which house you can buy or apartment you can rent to the interest rates you pay on your credit cards.

For more information about how you can increase your credit score and clean up your credit report, check out our Credit Building Tips blog!

If you've recently been approved for a credit card and your credit limit is $300, you might be wondering how much you should spend.

The first answer is never to spend more than you can afford to pay back! The second answer, though, has to do with maintaining a healthy (aka low) credit utilization ratio.

One factor that influences your credit score is your credit utilization ratio, which compares how much credit you're using to how much you have in total. Using the general advice that you should keep your utilization at 30% or lower, you'll want to spend no more than $90 on a $300 limit card.

One factor that influences your credit score is your credit utilization ratio, which compares how much credit you're using to how much you have in total. Using the general advice that you should keep your utilization at 30% or lower, you'll want to spend no more than $90 on a $300 limit card.At the same time, many different factors might make you decide to spend more or less than this amount. Let's look at what you should know about credit limits and utilization to help you decide how much to spend.

If you have a $300 credit limit on your credit account, how much should you spend if you want to maintain a good credit score?

Credit experts generally advise that you should keep your credit utilization ratio at 30% or lower.

Your credit utilization ratio is a percentage that represents how much money you're using on your credit accounts compared to how much credit has been extended to you.

However, if you want to have immaculate credit, some suggest that you keep your credit utilization ratio in the single digits.

The total amount of money you are authorized to charge to a credit account by a credit card issuer is your credit limit.

Both new purchases and balance transfers are included in your credit limit. On top of that, any other transactions- that draw from your credit line-- like cash advances-- are also included.

If you have an annual fee for your credit card, this will also be charged against your credit limit.