When you search the question "Is Rocket Credit Scores legit" on Google, you end up with a lot of mixed results. Some forums report that this is undoubtedly a scam, while others state that it's a service offered by the legitimate company Rocket Money Inc.

So, which is it?

It appears that there may have been a website-- www.rocketcreditscores.com-- that was used as a part of a potential scam. This site is no longer active, though. On the other hand, there is a real company called Rocket Money (owned by the same company as Rocket Mortgage) that offers a personal finance app. One of the features of this app is helping you keep track of your credit score.

It appears that there may have been a website-- www.rocketcreditscores.com-- that was used as a part of a potential scam. This site is no longer active, though. On the other hand, there is a real company called Rocket Money (owned by the same company as Rocket Mortgage) that offers a personal finance app. One of the features of this app is helping you keep track of your credit score.Let's take a look at what you should know about accessing your credit scores using Rocket Money's service.

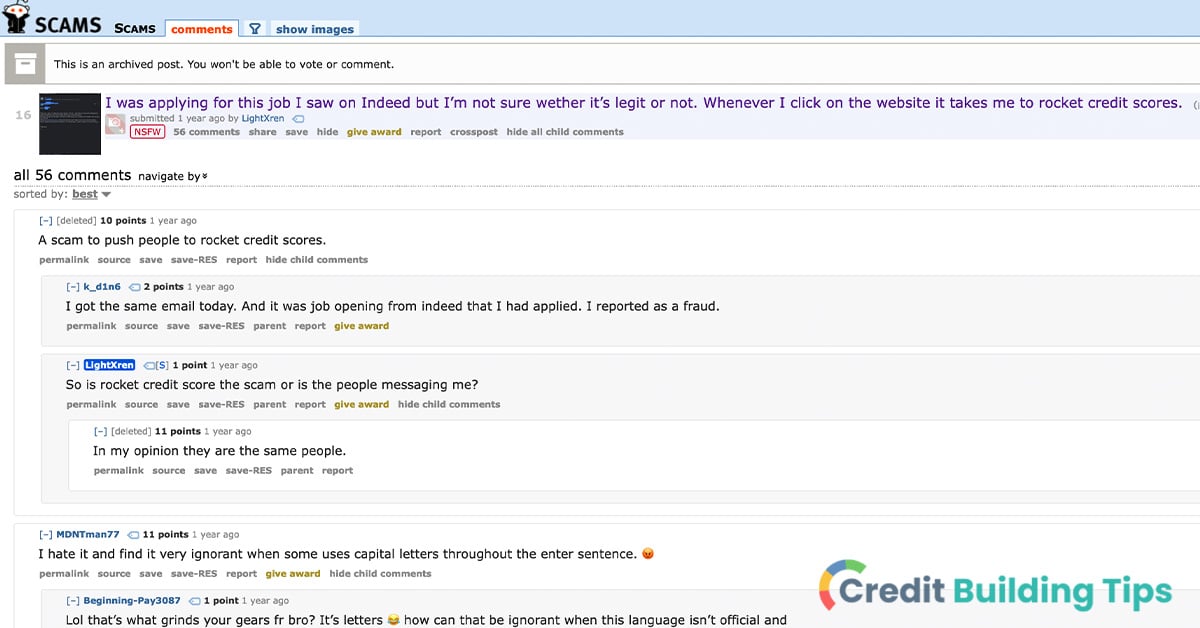

When you search for 'Rocket Credit Scores' using a search engine, you'll find all kinds of disconcerting information.

On Reddit and other forums; you'll find posts from people regarding job and apartment applications where they are asked to fill out an application on RocketCreditScores.com.

From the screenshots of the communications posted, it's clear that something fishy is going on. Littered with grammatical errors and spelling mistakes, scammers appear to have been posting too-good-to-be-true job posts, apartment listings, and houses for sale. They would then ask applicants to fill out an application that required them to pay one dollar, presumably allowing the scammers to access personal and financial information from unassuming individuals.

People who responded to the posts all made it very clear-- these types of listings are scams intending to steal people's sensitive information or money. They can use personal and financial information to commit credit card fraud or other forms of identity theft.

There have been Federal Trade Commission cases against individuals and companies running this type of scam. Schemers will advertise properties that they don't own and ask applicants to pay deposits, and direct them to credit score sites that they must pay for. While it isn't uncommon for landlords to run a background check and pull a credit report for potential tenants, you don't want to ever enter information into a site the landlord directs you to. You should also always be wary if they refuse to tell you the address of of the house or apartment.

If by 'Rocket Credit Scores' you mean www.rocketcreditscores.com, a link you've received in a suspicious email, the answer is no. This is not legit, and you shouldn't enter any personal information into this form. The job or apartment that is being advertised is almost certainly not real, and entering your information could result in identity theft and fraud.

On the other hand, if you're asking about the credit score monitoring service offered by Rocket Money, Inc., the answer is yes.

Whether or not this is the best way to monitor your credit is another question that we'll look at in the next few sections.

You're likely familiar with Rocket Mortgage, the largest non-bank mortgage lender in the United States.

Though the company started off as just a mortgage lender, they've grown into an entire ecosystem of companies. With an umbrella company known as Rocket Companies, the following businesses are a part of the Rocket family:

So, the short answer is that Rocket Money is related to Rocket Mortgage but not a part of the same company. The easiest way to understand it is to say that they exist within the same ecosystem of businesses.

Now that we've gotten that out of the way, what exactly is Rocket Money?

Here are some of the advertised features of the app:

The Rocket Money app can be found on both the Apple store and the Google Play store. With 256-bit encryption storing data and securely linked accounts using Plaid, this is billed as a secure and safe personal finance app.

While the app is free, there is also a Premium plan. You can sign up for their seven-day free trial in order to test it out, but after that, it costs between $3 and $12 a month. This is a sliding scale payment model where you can pay what you believe to be fair, though you'll want to keep in mind that $3 and $4 plans require paying for a whole year rather than giving you the option to pay per month.

It's perfectly reasonable to want to make sure that the credit score you see will be accurate before signing up for a service.

The reality is, though, that you actually have several different credit scores. This means that, depending on the site or service you use to check in with your credit score, you might find that your score varies.

There are a number of different factors that influence potential variations in your scores, including:

Rocket Money uses your Experian credit report and the VantageScore 3.0 scoring model in order to calculate your credit score.

As a counter-example, another popular site-- Credit Karma-- will offer your VantageScore 3.0, but based on your Equifax and TransUnion credit reports. If you use the free credit score service offered by Experian, they use your Experian credit report and calculate your score based on FICO Score 8 model.

This means that your score can come back slightly different from different services depending on the scoring model and credit reports information is being pulled from.

The answer to this question is going to depend on what you're looking for. There are lots of companies that offer free credit score monitoring, including credit card issuers.

It's worth noting that your credit score and your credit report are two different things-- you won't find your credit score on your credit report.

To check your credit scores, you can look in a number of different places:

Rocket Money is really best for people that are interested in reducing spending and creating a budget. Other popular apps of this type include Mint and Simplifi. Probably the most notable feature that makes it stand out from other apps and service is its bill negotiation feature. (For the record, Mint does now offer a bill negotiation feature in partnership with Billshark.)

Using this feature, you can upload a copy of your bill, and Rocket Money will let you know if they think you can get a better price. With the Premium Plan, they can also try to recoup bank fees.

Beyond that, though, Rocket Money isn't necessary just to have access to your credit score. If you're interested in the app because of its additional features, though, the fact that it also gives you your credit score in the same place is convenient.

The benefits of using the Rocket Money app include the following:

On the other hand, some of the drawbacks include:

Before I sign off, let's take a look at some of the most commonly asked questions about Rocket Credit Scores, the Rocket Money app, and credit score scams.

To access a number of the most appealing features offered by Rocket Money, you have to buy the Premium Plan. There is, however, a seven-day trial you can sign up for to determine whether it's the right thing for you.

The cost operates on a sliding scale, with costs ranging from $3 a month to $12 a month. On the lower end of the scale, you have to pay for a full year at once rather than paying a month at a time.

Yes, the app formerly known as TrueBill is now called Rocket Money. Truebill announced the name change in June 2022. It had previously already become a part of Rocket Companies in late 2021.

As receiving a free credit score from legitimate online services like Credit Karma, Credit Sesame, and Rocket Money becomes more common, so do credit score scams.

To protect your personal and financial information, make sure to follow the following tips:

If you've been directed to www.rocketcreditscores.com in response to a rental, real estate, or employment inquiry, it's best to stay away. It appears that this site may have been used as a part of a scam to obtain people's personal and financial information.

On the other hand, if you're wondering if the Rocket Money app is a safe way to monitor your credit score, the answer is yes. Of course, you're always taking some risks when using digital tools to track your financial information because of the risk of data breaches and so on. That being said, the Rocket Money app is released by a legitimate, reputable company.

Keeping an eye out for potential scams is absolutely essential in this day and age. Scammers and fraudsters are becoming increasingly sophisticated in their tactics. Having someone steal your identity can wreak havoc on your finances and credit report, so it's important always to be wary of sites that are asking for private, sensitive information.

Whether you're rebuilding your credit after being the victim of identity theft or you're on a mission to boost your credit score, you're in the right place. Be sure to check out our Credit Building Tips blog for more valuable resources.