PayPal is one of the largest non-bank financial institutions available to consumers around the world. Though they have had their ups and downs over the years, they are used and trusted by millions of people, and many of those people take advantage of the various financial offerings PayPal opens to its users.

One such offering is PayPal Credit. Despite not being a bank, PayPal offers lines of credit to users who qualify. Who qualifies, and are there any other details you should know?

PayPal Credit is a revolving line of credit, meaning it functions just like a credit card.

Where most credit cards are backed by a common bank, PayPal's credit card is backed by Synchrony Financial.

Synchrony Financial is a bank that was started in 1932, as a GE-branded bank offering credit to people during the Great Depression in order to purchase GE appliances. It remained a GE-branded bank until 2014, when the lending arm was spun off into Synchrony Financial.

Today, Synchrony Financial is the largest bank offering private label credit cards. That is, credit cards that aren't attached to a bank like Capital One, Bank of America, or a simple Visa without branding. Store-brand credit cards like those offered by Amazon, Lowe's, Gap, and Verizon are all Synchrony cards.

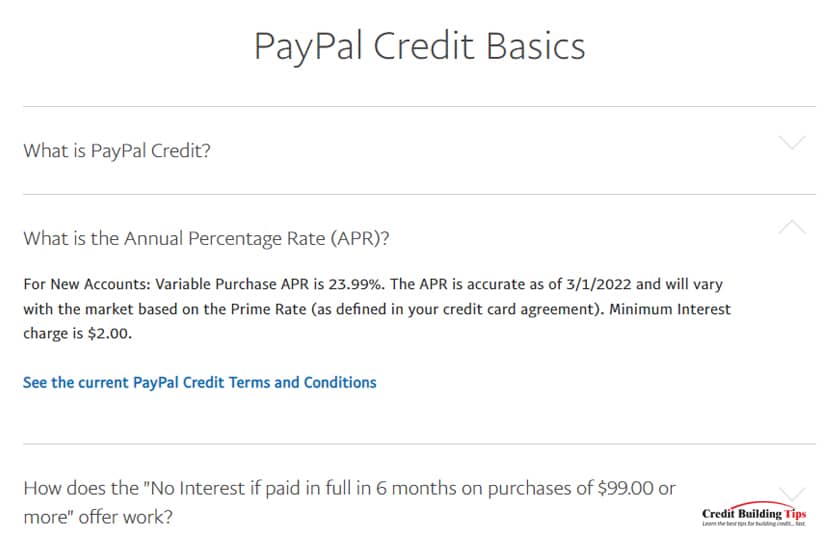

APR – the Annual Percentage Rate, or interest rate of a card – is somewhere around 24%. The specific number changes over time as a reflection of the markets. You can find the specific rate in the PayPal Credit FAQ, found here.

Is this a good APR?

Not really. The definition of a "good" APR is anything at or below the industry average. Currently, the industry average is closer to 16%, meaning PayPal's APR is higher than average.

Not really. The definition of a "good" APR is anything at or below the industry average. Currently, the industry average is closer to 16%, meaning PayPal's APR is higher than average.It's unclear whether or not individuals with a higher credit score, or those with greater usage of PayPal, will have a better rate. Given that they mentioned a rate in their FAQ and make no mention of it varying, and that many customers are reporting a 23.99% APR, it seems unlikely.

Additionally, PayPal Credit has a minimum interest charge of $2.

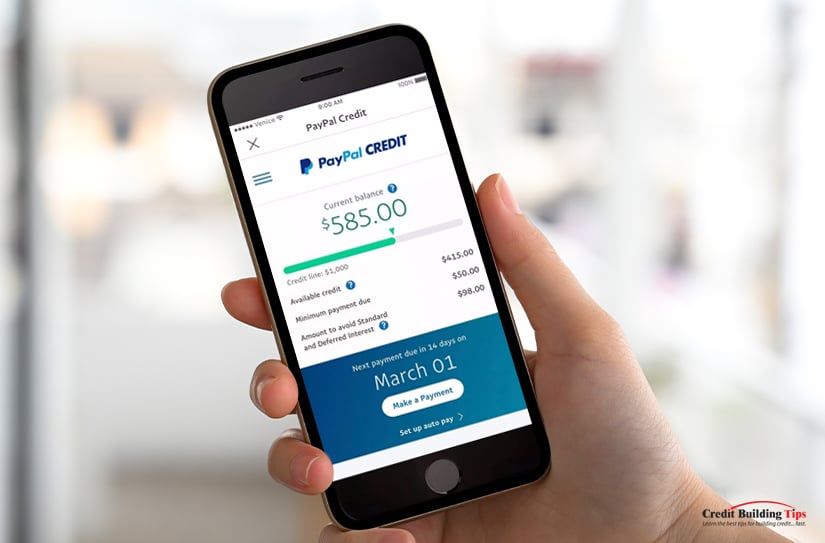

Like all credit cards, PayPal credit has a limit on individual lines of credit. This limit varies based on your credit score and starts at a meager $250. This means it's very easy to open a line of credit with a large purchase and immediately have a high credit utilization percentage. Depending on the rest of your credit report, this can have a detrimental effect on your credit score, at least until you pay off the purchase.

PayPal does not seem to mention the upper bound on their lines of credit, but according to an interview with their VP of consumer credit here, the upper limit is $20,000. Relatively few people will want or need such a high limit, of course.

The determination of what your credit limit will be involves your history of activity with PayPal, your credit score and report, your annual post-taxes income, and other credit factors that PayPal does not disclose.

To increase your credit limit, you will need to call PayPal and request an increase, whereupon they will review your account situation and determine if and how much of an increase you qualify for. Additionally, Synchrony Financial will occasionally increase credit limits for users they deem to qualify for one as part of an automatic process to foster further use and engagement with their cards.

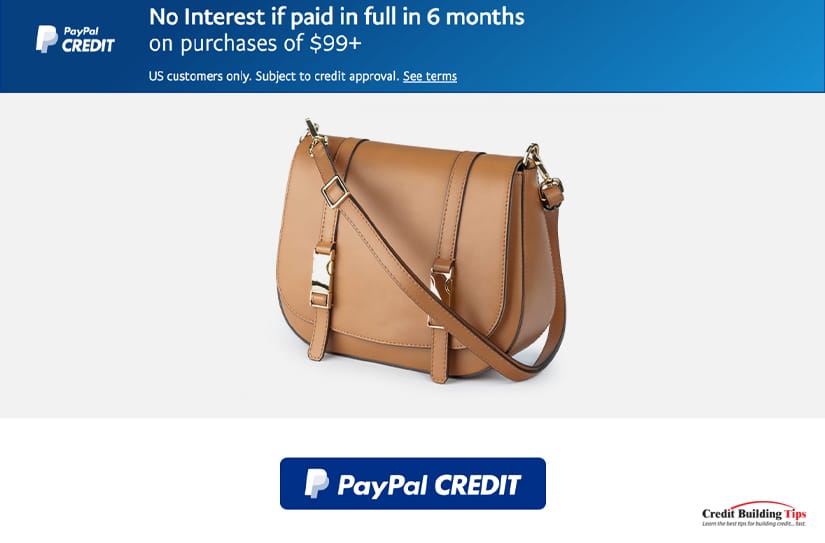

One of the main draws PayPal offers people is an offer wherein any purchase of $99 or more made with PayPal Credit will have 0% interest for six months. If the purchase you make is paid off in full within six months, you will not be charged any interest.

However, if there is any balance at all remaining after six months, any interest you would have owed will be added to your balance. This can be a very large amount of money relative to your remaining balance, especially for larger purchases. Interest remains calculated based on the balance you have each month, the interest is merely waived if you pay the principal in full.

This is not an introductory offer; that is, it doesn't simply apply to the first large purchase you make. It applies to any purchase over $99 you make with PayPal credit. For some, this is a compelling draw; for others, it's a trap. Exercise due caution when relying on lower payments and interest-free repayment.

PayPal does not publicly disclose the minimum credit score necessary to qualify for a PayPal Credit line. However, numerous polls and interviews online indicate that the minimum is 600. Anyone under 600 is considered sub-prime by PayPal and will not qualify for a line of credit, though PayPal's automated systems will still likely make the offer to check.

PayPal does not publicly disclose the minimum credit score necessary to qualify for a PayPal Credit line. However, numerous polls and interviews online indicate that the minimum is 600. Anyone under 600 is considered sub-prime by PayPal and will not qualify for a line of credit, though PayPal's automated systems will still likely make the offer to check.As with most lines of credit, the higher your credit score is, the more you'll be able to access higher credit limits, and the lower your interest rate may be. It's unclear how much of an effect it will have right away, other than whether or not you qualify.

For the best terms, most people recommend at least 700.

A minimum credit score is not all that will be necessary to qualify. PayPal also considers your existing debt, credit utilization, and even your income to determine whether or not you qualify. The process is fast and automated – it's designed to work mid-purchase – but it still asks for specific information and authorization to check your credit report.

A balance transfer is a way of shifting debt from one credit line to another. Essentially, you use a credit card to pay off a different credit card. This is usually used to move a balance from a high-interest credit card to a lower-interest credit card or potentially to consolidate debts across several lines into one line.

To avoid being exploited, many credit cards will have special terms for balance transfers, including a requirement to pay off a chunk of the balance being transferred (up to 3-5%) in order to transfer it.

PayPal credit does not offer balance transfers. Of course, since PayPal credit also does not have an introductory 0% interest rate and indeed has a very high interest rate in the first place, there's little reason to want to transfer a balance to PayPal in any case.

PayPal credit does not offer balance transfers. Of course, since PayPal credit also does not have an introductory 0% interest rate and indeed has a very high interest rate in the first place, there's little reason to want to transfer a balance to PayPal in any case.Likewise, PayPal does not allow you to transfer a PayPal balance to another line of credit. You are only allowed to pay for PayPal credit purchases using funds in your PayPal account or in your bank account that is linked to PayPal. It is, in effect, an isolated line of credit tied solely to PayPal.

Yes. PayPal credit has late fees if you fail to make a payment on a balance. The fees are currently $30 if you have not had a late payment in the past six months or $41 if you have.

That said, PayPal cuts you some slack if your balance is low; they won't charge you a late fee greater than your outstanding balance. So, if you only have $20 on your credit line and are late in paying it, the late fee will be no greater than $20. Some people report that they simply won't charge a late fee, but PayPal doesn't state this outright.

PayPal Payment Security is essentially an insurance policy for your credit line.

It is an optional, additional purchase you can make whenever you make a large purchase using your PayPal credit. Payment Security costs $1.66 for every $100 of balance on your line of credit. This is calculated and charged as part of your minimum payments each month.

What does it do?

If you encounter a qualifying life event that makes you unable to pay your minimum payments or your overall balance, PayPal will either cover your minimum payments or will waive the balance on your line of credit, up to $10,000. This is a way to protect you from late fees, a hit to your credit report, and undue expenses in certain circumstances.

If you encounter a qualifying life event that makes you unable to pay your minimum payments or your overall balance, PayPal will either cover your minimum payments or will waive the balance on your line of credit, up to $10,000. This is a way to protect you from late fees, a hit to your credit report, and undue expenses in certain circumstances.Qualifying life events are unemployment, hospitalization, leave of absence from work, disability, nursing home care, terminal illness, and loss of life.

If you suffer from one of these, you (or your next of kin, in the case of the lost life event) will need to contact PayPal and file for payment security. The claim will be processed, and appropriate action will be taken to alleviate the financial strain caused by your PayPal balance and minimum payments.

The full terms of the agreement can be found here.

As with any line of credit, PayPal Credit has the potential to both help and hurt your credit score.

Often, PayPal Credit will initially hurt your credit score. This is because the credit balance is low. Here's a scenario:

Imagine that you have one credit card with a $1000 limit and $300 on it. This is a 30% credit utilization, which is the highest that can still be considered good.

Now, you want to make a $200 purchase and open a PayPal Credit line to do it. PayPal gives you a $250 credit limit.

With this new purchase and new line of credit, you now have a total balance of $500 and a total credit limit of $1250. You are now at 40% credit utilization, which is considered worse than 30%. This will, in all likelihood, hurt your credit score by a couple of points.

It's not a meaningful drop, but it's still a drop. It will recover as you pay off your debts, of course. And, like any line of credit, if you fail to make payments on time or you stop making payments entirely, your account will fall into delinquency, and your credit score will be harmed for it.

In the past, PayPal didn't report to the credit bureaus. However, today they do, and they report to all three of the FICO bureaus; Experian, Equifax, and TransUnion.

In the past, PayPal didn't report to the credit bureaus. However, today they do, and they report to all three of the FICO bureaus; Experian, Equifax, and TransUnion.On the other hand, PayPal Credit can potentially help your credit score as well. This is because, as a line of credit, it helps you work towards a lower credit utilization percentage. It also helps you generate a history of on-time payments.

When it comes down to it, whether or not PayPal credit will help or hurt your score depends on you; it's no different than any other credit card in that respect.

Truthfully, if you're looking to build your credit, you can find much better options. PayPal's lack of introductory offer, the risk of a massive unexpected interest liability with their no interest for six months deal, and their high APR are all potential issues.

Truthfully, if you're looking to build your credit, you can find much better options. PayPal's lack of introductory offer, the risk of a massive unexpected interest liability with their no interest for six months deal, and their high APR are all potential issues.There are better ways to build credit, there are better credit cards (even for those with sub-prime credit), and there are better credit cards for those with higher credit scores as well.

The primary advantage to using PayPal Credit is simply that it's attached to PayPal, and PayPal is already an incredibly convenient, accepted-everywhere form of paying for something, particularly online. PayPal credit mostly just allows you to use PayPal in offline venues where a credit card works but not an online payment processor. The fact that it's easily linked to your PayPal account and any bank accounts linked to PayPal is icing on the cake.

PayPal credit isn't exploitative any more than any credit program. Nor is it particularly egregious. It's simply a credit line with a high APR and not particularly favorable terms. If you want to use it and you're aware of the risks of unexpected interest, it's not a bad card to get. However, if you're serious about improving your credit score and using beneficial lines of credit, there are much better options available to you.

After reading all about PayPal credit and how it works, do you have any questions about it? Was there anything that we mentioned today that you'd like any additional information on? If so, please feel free to reach out and contact us at any time! We'd be more than happy to assist you in all things credit-related however we possibly can!