When you pull your credit report, seeing something you don't understand or recognize is always a bit disconcerting. After all, this is supposed to be a report of all of your credit activity, so you would expect everything on your report to be intelligible.

If you're looking at your credit report and you see a term or account that doesn't make sense, you might be worried that something has gone wrong. One common question we receive is what 'updated tradeline' means on your credit report and whether this is a good or a bad thing.

"Tradeline" is simply the term used in the credit industry to describe an account on a credit report. When your report says 'updated tradeline,' it simply indicates that some sort of change has occurred that led to one or more of the credit bureaus to correct or update information on your report.

"Tradeline" is simply the term used in the credit industry to describe an account on a credit report. When your report says 'updated tradeline,' it simply indicates that some sort of change has occurred that led to one or more of the credit bureaus to correct or update information on your report.In many cases, an updated tradeline shouldn't be cause for concern. However, it's always worth taking a closer look to make sure that the activity being reported didn't result from identity theft or fraud.

When your credit report says 'updated tradeline,' it simply means that some sort of change has occurred with one of your accounts, and one or more of the credit bureaus is therefore updating the information.

A tradeline is the term used in the credit industry to refer to the accounts that appear on your credit report. Examples of tradelines include personal loans, credit card accounts, and mortgages.

There are several different possible reasons that you could see a message indicating an updated tradeline on your report, including:

There are a number of ways that an updated tradeline can influence your credit score. The nature of the update is going to be important when considering how it might change your score.

Before we look at some potential ways that updated tradelines can change your credit scores, it's important to remember that several factors go into calculating your scores. Depending on your particular credit history and profile, in addition to the nature of the updated information, an update to one of your tradelines could have a very noticeable effect on your credit, or it could have little to no effect.

Here are some examples of how an updated tradeline could impact your score depending on the nature of the updated information:

Tradeline alerts are notifications that communicate updates or changes to your credit report's tradelines. You can use this tool to proactively monitor your credit report and accounts.

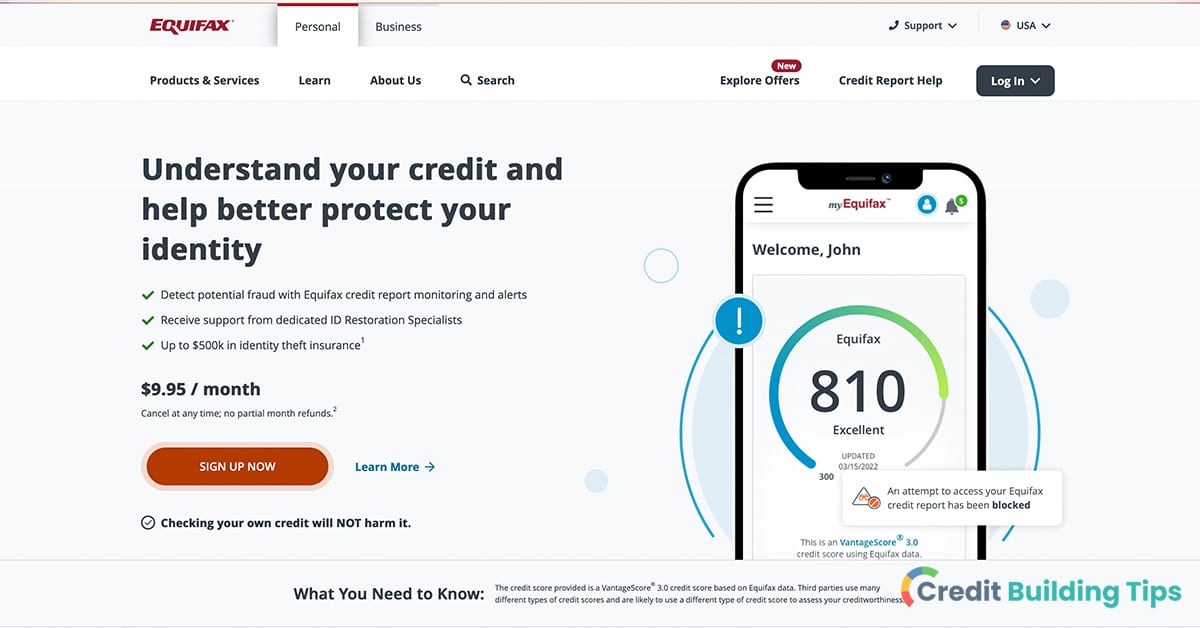

You can set up tradeline alerts through the credit bureaus or through credit monitoring services. Anytime there is a change on one of your tradelines, such as a payment update, a new account opening, delinquency, or a change in your credit limit, you can receive an alert through one of the following:

Staying vigilant and aware of any major changes in your credit file is important, and signing up for tradeline alerts can help you do just that. When you know that something significant has changed on your credit card, you can detect potentially fraudulent activities, promptly address any inaccuracies, and take any necessary steps to manage your credit responsibly.

Each credit bureau has its own process and format for updating credit report tradelines. Therefore, you can expect there to be some variation in the information provided by each credit bureau. In general, though, updated tradelines will include the following details:

Depending on the reporting practices of the creditor or lender, the frequency of tradeline updates can vary quite a bit.

Here are some general points regarding tradeline update timing to help you get a sense of when you should expect a tradeline will be updated:

There are a number of reasons a new tradeline might appear on your credit report. The most common explanations for a new tradeline showing up are:

Considering the potential for identity theft and credit fraud, it's vital that you pay attention to new tradeline alerts or at least regularly check your credit report.

Understanding the details of your credit report can be tricky, so let's take a minute to go over some basic information about tradelines and updated tradelines that appear on your credit report.

Every account that you own appears on your credit report as a single credit tradeline. This is true regardless of whether the account is open or closed, your payment is current or past due, or you are the sole owner or a joint owner of an account.

That being said, there are three different categories that tradelines can fall into.

Examples of revolving accounts include lines of credit or credit cards.

Revolving accounts involve being alloted a credit line that can be accessed in an ongoing manner, which payments minus interest and feed charged opening up credit to the account holder. Examples of revolving accounts credit cards, home equity lines of credit (HELOCs), and lines of credit.

Since the available credit, balance, and payment due are all regularly changing as you make payments and purchases, these are known as revolving accounts.

Examples of installment loans include auto loans, mortgages, student loans, and personal loans.

Rather than having a credit limit that you can continue to borrow from and pay back as with revolving credit accounts, installment loans involve borrowing a fixed amount of money and repaying the debt on fixed terms.

Installment loans are loans where a fixed amount of money is borrowed that is paid back according to a fixed schedule and terms. Examples include personal loans, student loans, auto loans, and mortgages.

While many experts lump mortgages in with other installment loans, some prefer to classify home loans as their own separate, fourth category of tradeline.

Open accounts are not common for individuals and are instead more often used by businesses.

Also known as an account payable by the bearer, open accounts are mostly used in the business world and aren't normally going to show up on an individual's credit report.

These involve an account that is payable in full when the buyer receives merchandise or a specific item of value.

To some extent, how much weight a credit tradeline carries depends on the type of tradeline.

For example:

It's also worth noting that your credit limit and utilization will be included in a credit card tradeline, while this information won't be present for an auto loan tradeline.

When you see a note or receive a notification that says a tradeline has been updated, it simply means that the info on your credit report in relation to a specific account has been altered to reflect the most recent accurate details.

At the same time, there is always the possibility that the credit bureau or your creditor has made a mistake and is reporting inaccurate information. Beyond that, there's also the possibility that someone else has gotten a hold of your personal information, and activity on your accounts is indicative of identity theft or fraudulent behavior.

For this reason, it's very important to regularly check your credit report and keep an eye out for errors or anything that seems off. You can take a look at our guides to removing 30-day late payments, evictions, hard inquiries, and collections from your credit report to help you in your quest to clean up your credit report.

Building credit is something that is best tackled slowly over time, but there are some ways to quickly boost your credit and improve your chances of being approved for a loan, credit card, or another new tradeline. For more resources about cleaning up your credit report and increasing your credit score, check out our Credit Building Tips blog.