If you haven't heard the term "tradelines" before, sit back, grab a cup of coffee and let me tell you precisely what they are, how they work, how you can use them, and whether doing so is legal.

The simplest way to explain a tradeline is:

It is a record of activity for any type of credit extended to a borrower and reported to a credit reporting agency. Tradelines are created on a borrower's credit report to track all the account activity. A tradeline is established for every line of credit or debtor's account, such as a mortgage, car loan, student loan, credit card, or personal loan.

It is a record of activity for any type of credit extended to a borrower and reported to a credit reporting agency. Tradelines are created on a borrower's credit report to track all the account activity. A tradeline is established for every line of credit or debtor's account, such as a mortgage, car loan, student loan, credit card, or personal loan.Basically, a tradeline is a record-keeping mechanism that tracks the activity of borrowers on their credit reports. Each and every credit account has its own tradeline.

Borrowers can, and usually do, have multiple tradelines on their credit reports. Each one represents the individual borrowing accounts for which they've been approved.

That's the long and short of what a tradeline is and why we have them. So far, they don't sound that complicated or important, right?

Tradelines can contain different data points that give information about the creditor, the lender, and the type of credit being provided. Things like:

It starts to get interesting when you learn that the information included in your tradelines is used to calculate your credit scores. And that's really where your ears should perk up and dial in.

Your credit score is a summarized snapshot of your creditworthiness, used to determine whether lenders will be willing to lend to you. Factors considered include how many tradelines you have and the types and lengths you've had, good or bad. New tradelines can be used to influence and boost your score.

Your credit score is a summarized snapshot of your creditworthiness, used to determine whether lenders will be willing to lend to you. Factors considered include how many tradelines you have and the types and lengths you've had, good or bad. New tradelines can be used to influence and boost your score.

A good credit score gives you access to reasonable interest rates, faster loan approvals, and suitable insurance policies. Unfortunately, nearly 70 million Americans suffer from bad credit because fixing your credit score takes time and self-control.

When you apply for credit, your lender will want to "pull" your credit score as part of their approval process. Your FICO score is made from the information listed on each trade line associated with your name.

These scores are calculated using many different pieces of credit data in your credit report.

The data is grouped into five categories, each with a pre-determined percentage of weight given:

A fairly recent addition to calculating your credit trustworthiness is a predictive score that looks at how likely you'll go bankrupt in the next two years. This is called a Bankruptcy Navigator Index (BNI), and this number might be the reason you're turned down for a loan or mortgage, even if your FICO score is healthy.

A fairly recent addition to calculating your credit trustworthiness is a predictive score that looks at how likely you'll go bankrupt in the next two years. This is called a Bankruptcy Navigator Index (BNI), and this number might be the reason you're turned down for a loan or mortgage, even if your FICO score is healthy.You can't look at your BNI as it's not included in your credit report. The BNI was developed by Equifax and is an internal score that is only available to lenders.

Equifax describes the difference between consumers who have bad credit and one who they feel are facing bankruptcy in the next 24 months as:

"Delinquent consumers have moderate financial difficulty, which is often a long-term chronic behavior. They manage credit poorly and occasionally miss payments, sometimes with multiple missed payments leaving to collection efforts and write-offs.

Consumers heading into bankruptcy are in severe financial difficulty. They make smaller payments on their credit cards. They tap into their line of credit to make their installment loan payments. They shop for additional credit cards, a new line of credit, and consolidation loans.

Eventually, they reach their limit on their cards and lines of credit. They are forced to declare bankruptcy; however, their delinquency score remains satisfactory because they have not missed payments."

So, if you have poor or even worse credit, obviously, you'll want to find ways to boost your credit score.

You should review your credit report:

Because your score changes as your accounts change, it's important to keep an eye on your tradelines.

There's an important distinction between two types of tradelines: primary and authorized user tradelines. When you personally open an account, you have a primary tradeline. When you are added to someone else's account, you're an authorized user of that tradeline.

Adding primary tradelines to your credit report and keeping these lines of credit healthy is the best way to build a credit history and boost your credit rating. As the only responsible party, you must make at least minimum payments for every cycle where repayment is due.

But here's the catch. Suppose you don't have proof that you would be a reliable borrower. In that case, it's almost impossible for lenders to view you as responsible, and it becomes hard to qualify for free primary tradelines.

But don't despair. If you're one of the 70 million Americans who suffer from bad credit, there is a way to improve your credit score. Get more tradelines and keep them healthy.

Let me be clear here. I'm not suggesting you get more tradelines and neglect repaying the amounts owed. I'm suggesting (and assuming) you want to repair or start building your credit rating and could use a lift on doing so more quickly than just killing yourself to pay off your loans.

Let me be clear here. I'm not suggesting you get more tradelines and neglect repaying the amounts owed. I'm suggesting (and assuming) you want to repair or start building your credit rating and could use a lift on doing so more quickly than just killing yourself to pay off your loans.Depending on how deeply you are buried in debt, it could take years to repair your credit score. In the meantime, you won't have access to reasonable interest rates, faster loan approvals, and suitable insurance policies.

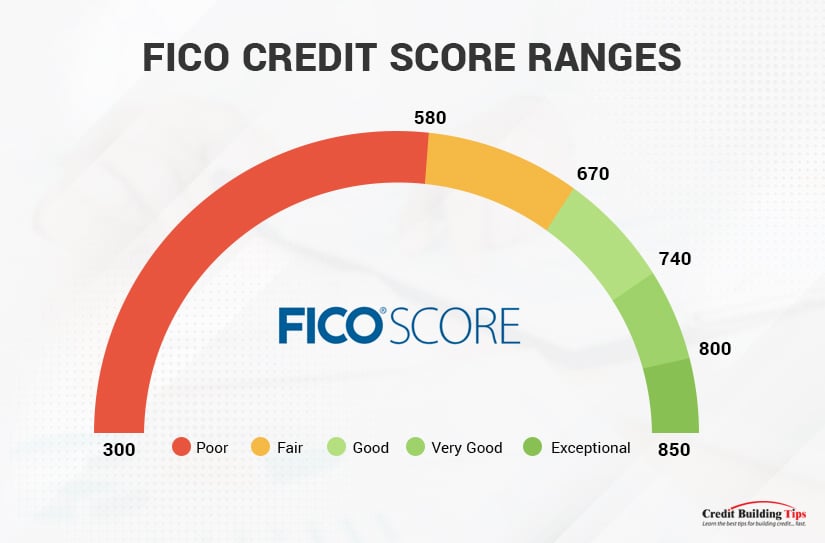

Once you learn your FICO credit score, you can see which one of the five grades your score would give you:

Getting two or three "seasoned" tradelines can help you jump to a higher credit score in a month if your credit score is less than ideal.

Having good tradelines on your account can improve your rating within 25-30 days.

The first and most important thing to remember when you're looking to buy primary tradelines is to make sure you buy from reputable tradeline companies. Credit Repair Expert lists the five best tradeline companies of 2022 in one of their recent blog posts and writes extensively on how they compare to each other.

Any reputable tradeline company should have these qualities:

If they don't tick off all the boxes on the list above, stay away from them!

While buying primary tradelines is a great way to improve your credit score quickly, it doesn't come without drawbacks.

Don't buy accounts that are in default. Even though by turning over the account to a collection agency, the lender lets the account become available to transfer to a new owner, buying a tradeline with a bad history is not helpful.

Don't buy accounts that are in default. Even though by turning over the account to a collection agency, the lender lets the account become available to transfer to a new owner, buying a tradeline with a bad history is not helpful.

Be cautious about opening a line of credit with a particular store or business to improve your credit score. While it's perfectly safe and legal to do this, you'll usually have to pay sizeable annual fees, and your credit score could take a temporary hit for opening an account.

Be cautious about opening a line of credit with a particular store or business to improve your credit score. While it's perfectly safe and legal to do this, you'll usually have to pay sizeable annual fees, and your credit score could take a temporary hit for opening an account.Even more important to consider is if the account only works at one specific business, will you actually make regular purchases there? If you don't and your card sits at a zero balance, you're damaging your score as a credit agency views this as an inactive account.

If you find buying fast, safe, and price-conscious primary tradelines tough, you may want to look at authorized user tradelines. They're basically a way to rent a primary user's credit history. Doing this can let you up your credit score in a short amount of time.

Not only are you renting the ability to buy things on credit, but you are also renting the previous payment history and account characteristics.

While there's some controversy about whether buying primary or authorized user tradelines is better, Mike at Superior Tradelines makes a compelling case for why buying authorized user tradelines is better.

He describes buying seasoned tradelines as being a legal credit hack. But one that only works well when used correctly.

Opening a joint account (piggybacking) is probably the best way to add authorized user tradelines to your credit report. This became legal between family members when the ECOA was passed.

But not everyone has a family member with good credit or the willingness to share their credit with them. That's when the federal government stepped in to allow non-family members to piggyback on a primary user's account as long as they had permission to do so.

If you start to look more closely at the idea of using tradelines, you'll often come across the term "seasoned" tradelines. This term refers to the age of the tradeline.

How long you've had the tradeline — the credit account age — is used to grade your credit score. It takes two or more years for a tradeline to mature enough to be called "seasoned." That may be longer than you have to wait.

That's why buying seasoned tradelines is more valuable than getting your hands on "immature" tradelines.

You can either buy authorized user tradelines or share a family member or friend's good credit. Of course, both ways have pros and cons, but in the end, I recommend you buy them from a trusted professional.

Although you'll pay for the privilege of buying an authorized user tradeline, the peace of mind you get from dealing with a company with the experience of knowing what you need and how to help you get it is immeasurable.

Not to mention, dealing with a professional eliminates any potential risk to your family and friend relationship. No good credit is worth it if the cost is the relationship of your closest support network.

Protect yourself by doing your homework on the company you are considering buying from. You want to look for a professional and legitimate company that is:

Here's what the heavy hitter, The Finance and Economics Discussion Series, Division of Research & Statistics and Monetary Affairs from the Federal Reserve Board in Washington, D.C. has to say about authorized user tradelines:

"...these numbers appear to indicate that the practice of piggybacking credit can increase credit scores to an economically significant extent if the account to which a nonprime borrower is being added is of sufficiently high quality. Furthermore, it appears that a large fraction of borrowers, particularly borrowers with thin or short credit histories, can obtain substantially higher credit scores as a result of this practice. This suggests that the practice of piggybacking credit offers the substantial potential to increase the credit scores of individuals added as authorized users on existing accounts and consequently to enhance their access to credit at lower costs."

Ultimately, having good credit comes from making more than you spend and not spending what you don't have. Paying your bills on time and not allowing your debt to others to rack up are all ways you can control your credit rating and be someone who lenders will look at favorably.

Ultimately, having good credit comes from making more than you spend and not spending what you don't have. Paying your bills on time and not allowing your debt to others to rack up are all ways you can control your credit rating and be someone who lenders will look at favorably.And in the meantime, if you need to do some repair work, consider how tradelines can help you get back on track.