Your credit score is a measure of your ability to pay bills on time and pay off debts you accrue. We all accumulate debts, whether it's from regular usage of a credit card or major purchases like a car loan or home mortgage. Credit is simply a system used by financial institutions to minimize their own risk with lending to people who won't repay that loan.

This is all important information because it can help you understand not just the importance of your credit score, but the limitations of what it covers.

Many people tend to think of their credit score as an all-encompassing measure of their financial responsibility. That's not true. Rather, it's a measure of their responsibility with debt. Many things that you might think should go onto your credit report do not, such as:

So, there are quite a few aspects of your overall financial situation that aren't included in your credit score calculation.

What about overdrafting? On the one hand, overdrafting incurs penalties and fees and can cause other problems, and "not having money" is a pretty strong indicator of an inability to pay debts. On the other hand, there are many reasons why an overdraft might be misrepresentative of a situation. Let's take a closer look.

If you're fortunate enough to have never been in a situation where overdrafting your account is a concern – or if you're down on your luck and facing the possibility for the first time – you might want to know more about it. If you're already familiar with overdrafting (for better or for worse), you can skip to the next section.

Overdrafting is a phenomenon that happens specifically to checking accounts and variations thereof. If you pay for a purchase using a credit card, you then owe the credit company money, which you can pay off all at once or over time. When you make a purchase using an ACH payment from a checking account or using a debit card, you're paying with your own money directly.

Overdrafting is a phenomenon that happens specifically to checking accounts and variations thereof. If you pay for a purchase using a credit card, you then owe the credit company money, which you can pay off all at once or over time. When you make a purchase using an ACH payment from a checking account or using a debit card, you're paying with your own money directly.Credit allows you to make purchases that would be larger than the money you have available and helps you distribute the payments out over time to make them more manageable. If you need to pay $500 for an emergency and you only have $400 in your checking account, you're going to have trouble. With credit, you put the $500 on credit and can pay it off over several months.

Looking back at checking, though; in many situations, a bank will allow for some flexibility. If you have $95 in your checking account and you try to make a purchase for $100, it may be approved. The bank is good for it, after all; they just need to recoup that money from you.

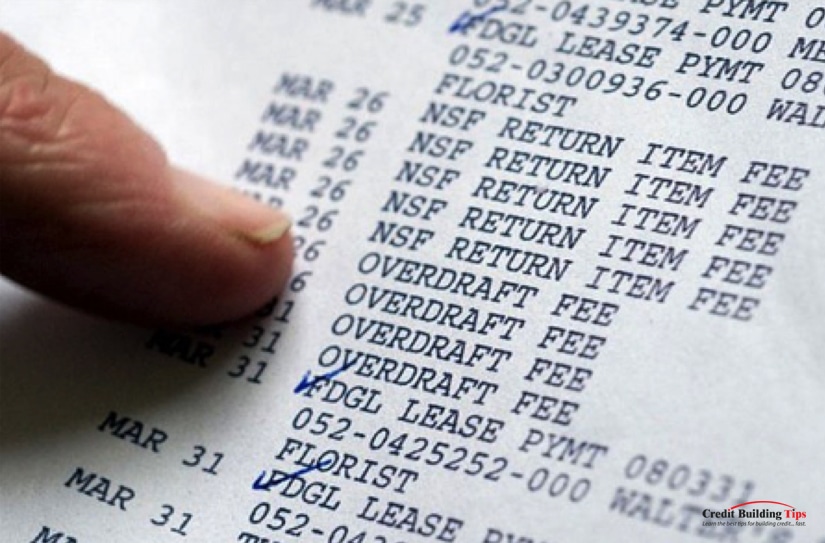

Paying with money you don't have in this manner is called overdrafting. It pushes your bank balance into the negatives and may have other repercussions. Banks do this to avoid issues with denying payments or "bouncing checks," so to speak.

Different banks handle overdrafting in different ways, and many will give you options such as overdraft protection, linked accounts, or hard limits. You may be able to tell your bank to deny any purchase that would overdraft an account. You may tell it to automatically pull the excess money from a linked savings account.

If you expect to pay for a purchase with money you don't have, shouldn't you use a credit card for it? Why is overdrafting allowed in the first place?

Generally, overdrafting offers a grace period. It might be 3/5/7 days, or it might be longer, depending on the bank. It is, essentially, a way to smooth out problems that occur when you're living paycheck to paycheck. If your bills are due on Thursday and your paycheck doesn't come in until Monday, what do you do? Overdrafting allows you to still pay those bills, knowing the money will be in your account within a couple of days.

Overdrafting generally only becomes a problem if your account remains negative for some time or if your financial institution has penalties for going negative.

Overdrafting generally only becomes a problem if your account remains negative for some time or if your financial institution has penalties for going negative.It doesn't really make sense to charge someone a fee for not having money, but here we are.

When you take out a loan or use a credit card to make a purchase, you borrow money from someone and are responsible for repaying it. This activity is tracked on your credit score.

When you make a payment using your checking account, you're not borrowing money from anyone. Thus, checking account activity is generally not reported to the credit bureaus.

When you overdraft your account, you're technically borrowing money from the bank to pay for the purchase, but it's not an official loan agreement. When you bring your account positive again, you automatically settle up with the bank. There's no actual borrowing or loan happening, so this is not reported on your credit score either.

There are, however, several situations wherein an overdraft could affect your credit score.

The first situation is where you simply abandon your overdrawn bank account. Overdraft fees stack up, automatic payments fail, you get in over your head. Mafia enforcers start coming for you, your kneecaps quiver in fear, and you fake your own death to move to Bolivia.

Your bank, unable to find you or get you to pay, decides to wash its hands of the debt. They sell it to a debt collector for pennies on the dollar, and the debt collector begins to pursue you. As part of their Comprehensive Threat Package (Platinum Plan), they report the debt to the credit bureaus. The presence of a debt in collections, regardless of where it came from, is enough to hurt your credit score.

Your bank, unable to find you or get you to pay, decides to wash its hands of the debt. They sell it to a debt collector for pennies on the dollar, and the debt collector begins to pursue you. As part of their Comprehensive Threat Package (Platinum Plan), they report the debt to the credit bureaus. The presence of a debt in collections, regardless of where it came from, is enough to hurt your credit score.Okay, so we're being a little tongue in cheek here. You're not faking your own death over a $5 overdraft, clearly. But, the fact remains; if you fall into any kind of debt for long enough that the debt is sent to collections, the collections agency is highly likely to report it to the credit bureaus so they can apply more pressure to get you to pay.

This is one baked-in bit of unfairness in the credit system, in fact. Operating a checking account for decades with no blemishes will not have even a smidge of positive impact on your FICO score. But, if something goes wrong and an account falls delinquent, it will hurt your score.

Another way in which overdrafting might hurt your credit score is if it causes a cascading failure. A common example is using checks.

If you write a check for money in your account and use that check to pay a bill, but your account overdrafts or falls under the amount of money prior to the check being cashed, the check will bounce. The bill the check was meant to pay doesn't get paid, you fall into late payment status, and eventually into delinquent account status. Fees rack up, and over time, those accounts can also be sold to debt collectors. This will hurt your credit.

If you write a check for money in your account and use that check to pay a bill, but your account overdrafts or falls under the amount of money prior to the check being cashed, the check will bounce. The bill the check was meant to pay doesn't get paid, you fall into late payment status, and eventually into delinquent account status. Fees rack up, and over time, those accounts can also be sold to debt collectors. This will hurt your credit.You don't have to be using checks for this to happen. It largely depends on the bank and the bank's policies for your account. If they will pay your bills and overdraft you more and more, then it sucks for your bank account, but it prevents other accounts from falling delinquent as well. It becomes a sort of sub-prime credit card situation, in a way.

On the other hand, if your bank puts a stop to any new purchases or payment authorizations when you overdraft, those other bills will fail to get paid and can fall into late fees and delinquent status themselves. These all end up reported on your credit score, though it generally takes a couple of billing cycles for this to kick in, assuming you have a grace period active.

Above, one thing we mentioned about the credit system is that there are many kinds of bills that you can pay regularly but which aren't tracked and don't reflect on your credit score. There are, however, many systems you can use that essentially convert those payments into limited credit payments, essentially by giving you a secured, restricted line of credit and setting up automatic payments.

These are called credit builder programs, and they come in many forms. You can read our full rundown at that link.

The benefit to these systems is that they give you credit for paying regular bills that otherwise wouldn't be reported.

The downside is that if you are unable to pay for some reason – like your account falling into overdraft territory – it can fall into late payments and end up reported on your credit score. It's one of the few downsides to using a credit builder program. Credit builder programs only build your credit if you can prove you can repay a loan, obviously.

The downside is that if you are unable to pay for some reason – like your account falling into overdraft territory – it can fall into late payments and end up reported on your credit score. It's one of the few downsides to using a credit builder program. Credit builder programs only build your credit if you can prove you can repay a loan, obviously.Other than these few situations, however, an overdrawn bank account won't actually be reflected on your credit score, as long as you can still manage to pay all of your debts on time.

One thing to note before we close out on this discussion is that even though your credit score doesn't care whether or not you overdraft your bank account, other financial tracking systems do.

In addition to the variety of different non-FICO credit scores, there are systems out there that track your financial activity in much greater detail. They aren't used quite as frequently or in as widespread a set of ways, but they can still be impactful.

There are several different bureaus tracking this data, but the biggest is known as ChexSystems. ChexSystems (no relation to the cereal) tracks your bank and credit union activity in much greater detail, including monitoring things like deposits, spending activity, fraud, unpaid balances, involuntary account closures, and more.

At the same time, all they care about is your deposit accounts – that is, your checking and savings – and they don't pay attention to your debt accounts like your credit cards. The two scores, ChexSystems and FICO, are distinct and track different aspects of your financial situation.

All of this data goes into their proprietary report, which is then used by other banks and credit unions. When you go to open a new bank account, the bank or credit union will generally check your ChexSystems report. If they see a history of irresponsible activity, they may deny you the account.

Note: It's fully possible to take action to clean up your ChexSystems report. Much like your credit report, you can pull your ChexSystems report for free once a year, per government mandate. You can then go through a similar process of disputing incorrect information and other strategies to clean it up. More on that another time, though.

Note: It's fully possible to take action to clean up your ChexSystems report. Much like your credit report, you can pull your ChexSystems report for free once a year, per government mandate. You can then go through a similar process of disputing incorrect information and other strategies to clean it up. More on that another time, though.Some banks have special accounts, usually with stricter limits or fees, which they will offer to people with bad ChexSystems accounts. Others simply won't work with people below a certain threshold. It varies from institution to institution.

So, there you have it. Overdrawing your checking account and ending up with a negative balance won't affect your FICO credit score unless it triggers other issues, like bounced payments for credit accounts. That's not to say they aren't bad, though. You still need to figure out any issues that led to the overdraft in the first place, pay any outstanding bills, and catch up financially. If it's a rare occasion, it probably won't hurt you long-term once you get it sorted out. If you overdraft too frequently, though, you may run into other issues down the road.

Do you have any specific questions about overdrafts pushing your checking account into the negative? We'll do the best we can to answer them, but we need you to ask them, so we know what to discuss next.