If your credit is low, your finances are a mess, and it feels like you're struggling to tread water at the bottom of a well, it can feel hopeless every time a new bill comes in. It's expensive to be poor, penalties layer on top of penalties, and the problem seems insurmountable.

What if you could call up someone and have them come in to fix your credit? What if, by hiring a third-party service, you could improve your credit score, get your debts under control, and simplify everything to make it infinitely easier to manage?

What if you could call up someone and have them come in to fix your credit? What if, by hiring a third-party service, you could improve your credit score, get your debts under control, and simplify everything to make it infinitely easier to manage?That's the idea behind a credit repair agency. The question is, does it really work? Let's dig in.

A credit repair agency is, generally, a for-profit company that works to help you fix your credit with a few specific kinds of actions they take.

What they claim they can do is nearly unlimited. They will claim they can handle and remove things like:

Where "remove" means "get them removed from your credit report."

Since having negative marks on your credit report brings down your score, having them removed can bring your score back up.

Can a credit repair agency actually do this? Well, it's questionable.

Can a credit repair agency actually do this? Well, it's questionable.If there's incorrect information on your credit report, such as information that doesn't apply to you, or that was caused by identity theft, or is otherwise false, it can be disputed and removed. On the other hand, if the negative marks on your credit report are legitimate, they shouldn't be able to be removed. Something like a Goodwill Letter may be able to help remove a blemish from an otherwise good credit report, but it won't help if you have a history of late or missed payments.

A credit repair agency isn't doing anything special. Every step they take is something you can do yourself; you just need to know how to do it. Usually, it just means pulling your credit report (which is free once a year from Annual Credit Report), reviewing it for anything that is incorrect, and sending dispute letters to the credit bureaus to fix or remove the incorrect information.

Of course, if seeing your credit report is overwhelming, your bills are piling up, and you have no time between work and childcare to even consider spending the time on it, maybe paying someone else to do it for you could be worthwhile.

Therein lies the rub; you still have to pay a credit repair agency to handle the work for you. If you're already in a tough financial situation, adding another expense with no guarantee of it helping your overall finances isn't a great idea.

It's also worth mentioning that some promises a credit repair agency makes might not be accurate.

Credit repair sounds like an enticing service, and it's not entirely without merit.

In short, a credit repair agency will generally send out letters to request verification of debts owed (which is part of the debt dispute process and can legitimately have some debts wiped due to incomplete records). They will also get incorrect information removed or corrected.

In short, a credit repair agency will generally send out letters to request verification of debts owed (which is part of the debt dispute process and can legitimately have some debts wiped due to incomplete records). They will also get incorrect information removed or corrected.However, they may also simply send these letters for every debt and every derogatory mark on your credit report, which not only makes the individuals who have to work with your credit report irritated, it isn't likely to be very effective. Moreover, it can eliminate any good will you would be able to utilize with a goodwill letter at another time.

In 1996, the federal government passed the Credit Repair Organizations Act, or CROA, which sets forth guidelines for what a credit repair agency can and cannot do. Credit repair agencies must comply with this law; otherwise, they are in violation of federal law. Of course, that doesn't stop scammers, but it offers you some recourse to at least verify that a credit repair agency is legitimate.

According to the law, an agency must:

So, credit repair agencies can be legitimate, as long as they comply with federal law. Additionally, Georgia has state laws that apply further penalties and make operating a violating credit repair agency a misdemeanor. You can read more about that here.

As long as you hire a good, compliant, and effective credit repair agency, you can see several tangible benefits.

First and foremost, the people working for a credit repair agency are experienced, whereas you aren't. They know what they're looking for when they pull your credit report. They have templates and letters ready to go; all they need to do is fill them out with the appropriate information and send them to the right agencies.

A trained credit expert can identify which items on your credit report are legitimate, which are potentially open to removal, and which are likely to be incorrect and thus disputable. They handle the disputes, they know what evidence to present, and they know how to do it all while complying with legal requirements for credit interactions.

A credit repair agency likely already has dedicated connections to people within the credit agencies and the major financial institutions. If you have debts with small credit unions, they might not have established relationships, but they probably work with the big banks, credit bureaus, and even major debt collectors on a regular basis. These connections can be leveraged in your favor.

Once the repair agency has done what they can for you, they may be able to offer you advice on how to further build and repair your credit. Of course, you don't necessarily need an agency to do that. After all, you're reading this on a site called Credit Building Tips, and you didn't pay to access it; I also have plenty of other guides on how you can build your credit in a variety of different ways. Plus, I'm always available if you want to ask a question. Just drop me a line or leave a comment!

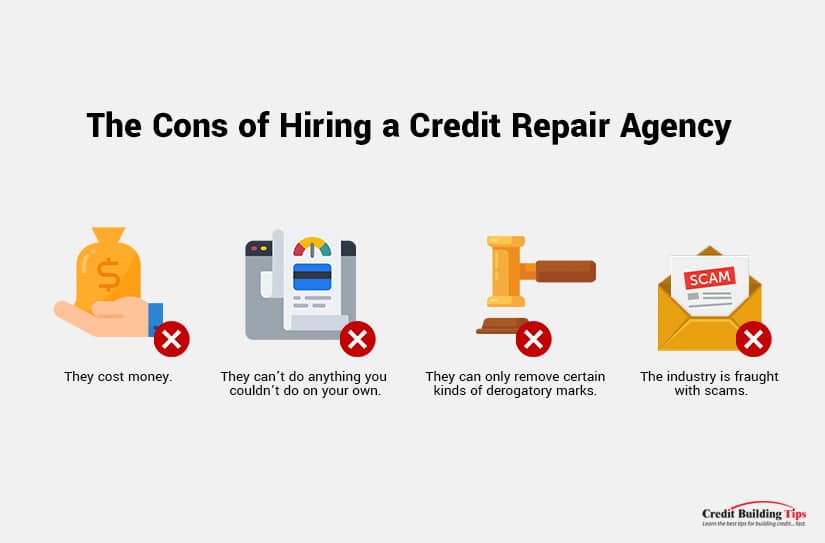

While credit repair agencies can benefit your credit in some situations, there's only so much they can do for you, and there are a few major drawbacks to using such a service.

The biggest issue with a credit repair agency is the fees they charge. Depending on your financial situation and the amount of work they need to do, these can get pretty expensive. I've seen companies charge a fee of anywhere between $30 and $500 per line item they get removed from your report. They may also charge a retainer per-month to keep their services going. It can get very expensive, very quickly. Not only does this put further financial strain on your current situation, but it can also make it even harder to keep paying your existing debts.

Since a verification or dispute letter has a minimum of the legally-mandated 30 days (plus transit time for mail) to process, you're looking at a minimum of 1-2 months (and often much more) for these services, plus fees for every line item on your credit report. It can add up very quickly.

Everything that a credit repair agency can do is something you can do on your own. You can send dispute letters, you can pull your credit report and analyze it, you can consolidate debts, you can send debt verification letters to collection agencies; it's all available to you, by law, for free. A credit repair agency smooths out the process by having templates ready to go, but they aren't doing anything unique or exclusive to their service.

Credit repair agencies have to operate within the bounds of the law. That means there's only so much they can do. If you've been the victim of identity theft and have a bunch of incorrect information on your report, they can dispute and remove it. If a legitimate error has led to reports of late payments or delinquent accounts that don't actually exist, they can get them removed. If a debt was incorrectly sold to a collector and can't be verified, it can be removed.

But, any legitimate negative marks on your credit report, like real late or missed payments or debt sent to collections, can't generally be removed. And, once it is verified, it closes further doors that could potentially be used to remove it down the line.

Perhaps the worst part of credit repair as an industry is that, despite the federal laws regulating it, there are still many companies offering illegal services. These can range from "jamming" to identity theft on your behalf to simply charging you for nothing or even generating fake reports to show improvement that doesn't actually exist.

What is jamming? Jamming is when an agency sends repeated requests to verify debts, over and over, even if it has been verified before. If a lender or bureau fails to verify within 30 days as specified by the Fair Credit Reporting Act, the debt or demerit can be removed from your report, even if it's legitimate. By essentially spamming these agencies, they "keep trying" until they get the result they want, hoping that bureaucracy or delays in paperwork run out the 30-day window.

What is jamming? Jamming is when an agency sends repeated requests to verify debts, over and over, even if it has been verified before. If a lender or bureau fails to verify within 30 days as specified by the Fair Credit Reporting Act, the debt or demerit can be removed from your report, even if it's legitimate. By essentially spamming these agencies, they "keep trying" until they get the result they want, hoping that bureaucracy or delays in paperwork run out the 30-day window.It can be very difficult to spot scams ahead of time, as well, so you need to remain vigilant and be familiar with the laws governing credit repair agencies if you intend to hire one.

You have two main options if you don't want to go with a credit repair agency.

The first is to do the legwork yourself. It's tedious, it's time-consuming, and it's stressful, but it's free and can repair your credit if you do it right. Of course, that's why I've started this blog; to compile as much information as I can to help everyone reading this build and repair their credit score.

The second is to use a Credit Counseling Organization instead. A credit counselor is generally a non-profit organization that can analyze your full financial situation and:

Repairing your credit can be tricky, especially if you have no idea where to begin. That's why I've been building this blog and why I'm always available to offer advice. If you have questions, want to know about a particular strategy, or just need general credit repairing or building help, feel free to leave a comment or drop me a line. I'd be more than happy to assist you on your credit building journey however I possibly can!