There are a ton of different ways to build and repair your credit. Some of them take years of hard work. Some of them require legal proceedings. Some of them benefit from charisma and a humble outlook. Most of them require sound financial habits.

A few, though, are automated or, at the very least, streamlined to make the credit repair processes they use easier. These are the credit repair software/apps/programs, and they're accessible to pretty much anyone.

The question is, which credit repair program should you use? Well, first, you need to know:

Credit repair software is, broadly speaking, a computer program that helps you take the actions necessary to improve your FICO credit score.

Credit repair software is, broadly speaking, a computer program that helps you take the actions necessary to improve your FICO credit score.No computer program can do anything truly unique. That is, there's no hidden secret that you need a program to do. Rather, they help you in a variety of ways, such as:

These are all things you can do on your own, of course, but trying to tackle your credit report when you're already in dire financial straits, especially if you don't really know what you're doing, can be a huge source of stress and anxiety. Not to mention that if you do it wrong, you can end up worse than where you started.

Of course, there are also credit repair companies out there who will do all of this for you, full service. We've created a full rundown of the pros and cons of that over in this post, but the main drawback is simply the cost. If you're already struggling to maintain your financial status and your credit is poor, paying someone for an expensive credit repair service may not be the most comfortable thing to afford right now.

Credit repair software is basically a framework and a semi-automated way of handling the tasks necessary to improve your credit. They give you a step-by-step guide to follow, can handle some of the processes automatically and are a cheaper way of doing it than hiring a credit repair agent.

Convinced? If so, here are the ten best credit repair software programs you can try out.

Pricing: $39/month and $99/mo plans

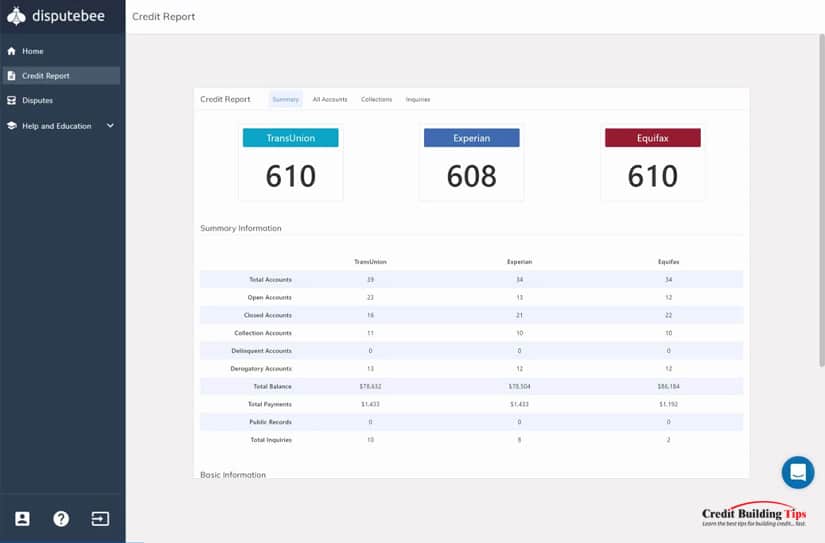

Pricing: $39/month and $99/mo plansDisputeBee is one of the more fully automated credit repair programs. To use it, you pull your credit report from one of the three bureaus and then import it into their program. They walk you through how to do that if you haven't done it before, too.

Once your report has been imported, they scan through it and look for items that might be viable to dispute. They will then automatically generate a dispute letter to send to the bureau and all the information you need to print and mail it; you just need to supply the stamp.

As you receive replies from the bureaus, you upload them to the system, and it will track your progress. Depending on the responses, they may generate further letters for you to send, or they may mark a line item as verified and indisputable.

This piece of software will cost you $39 per month. I like that it's one of the low cost DIY credit repair options on this list as some of these programs are hundreds of dollars.

Pricing: $19.95/month, $24.95/mo, and $29.99/mo plans

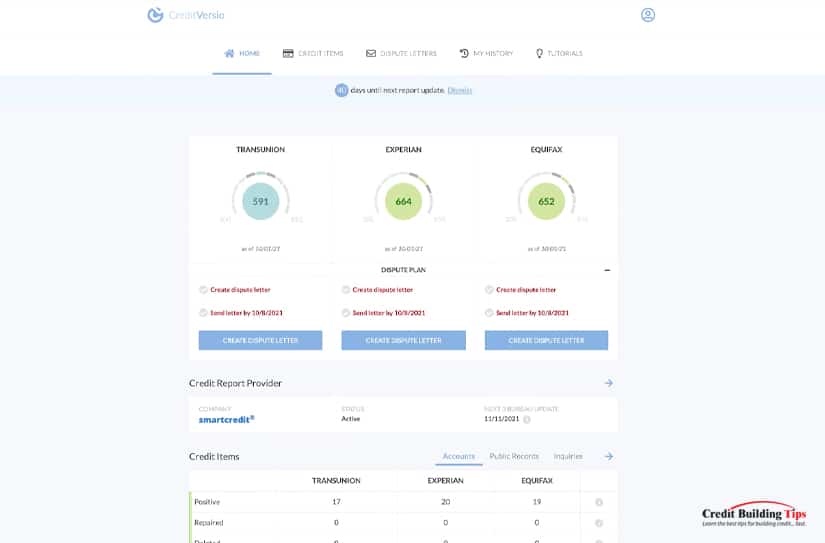

Pricing: $19.95/month, $24.95/mo, and $29.99/mo plansCredit Versio links to all three of your credit reports from the three bureaus and prepares what they describe as "an aggressive dispute strategy" to help dispute and remove items from your credit report. Since they pull your credit reports on your behalf (rather than as a third party), it also doesn't count as a hard inquiry, as some other options might.

Their library of dispute templates will handle pretty much any kind of blemish on your credit and will dispute late payments in the most effective ways for each. If you don't want to just blindly follow its recommendations, they also offer a library of coaching information and courses you can take to improve your understanding and financial literacy.

They also offer three different plans, for $20, $25, and $30 per month, respectively. They essentially vary only in the number of updates to your credit report they pull and the amount of identity theft insurance they offer.

Pricing: $97 one-time payment to download

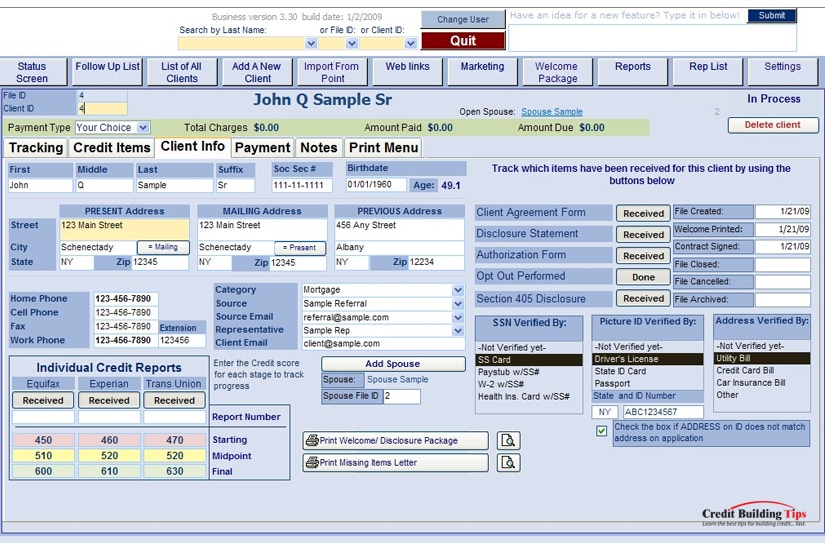

Pricing: $97 one-time payment to downloadThis is one of the oldest credit repair programs available, and it's still around because it's at least reasonably effective. Don't worry about how dated the website looks; it tells you everything you need to know.

It functions in basically the same way as the others, by identifying items on your credit report and giving you dispute letters to send to the bureaus to fight them. However, unlike other options on this list, it's not a monthly fee for a program; it's a one-time purchase that costs you $97. It's also not limited in the number of users you can run through it, so if you want to help a partner or family member with your copy of the software, you can do so.

Pricing: $199.95 one-time payment to download

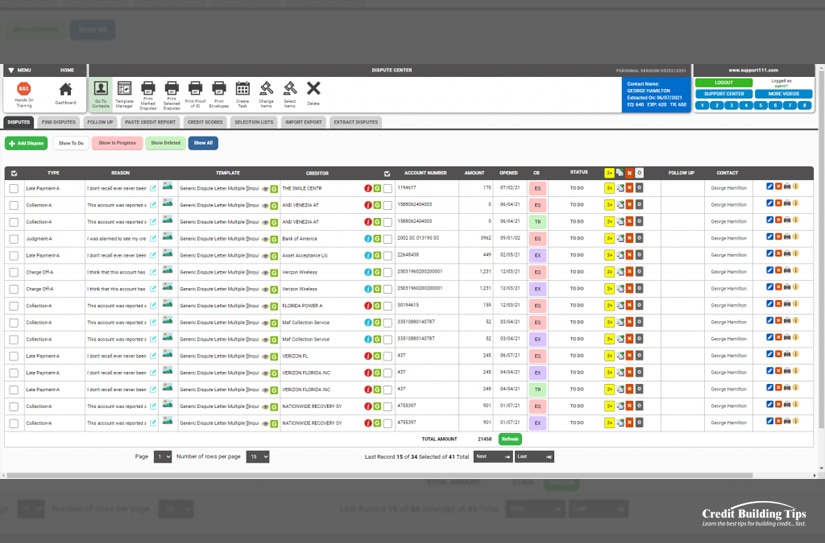

Pricing: $199.95 one-time payment to downloadDespite the generic name, this program is another long-running instance of credit repair software. They import your credit report, you clarify data as necessary, and they generate a guide for you to follow to repair your credit. They also offer tutorials and courses to help you build your credit in other ways.

For the most part, this program is the same as the others in function. They have a dispute tracker and a template library for letters to send, as well as recommendations of who to send them to and what to send. They also have a calendar to manage it all.

This program has a "regular price" of $400 but is usually on sale for $200. It's also not a monthly fee but rather a one-time purchase, like Credit Repair Magic before it.

Pricing: $399 one-time payment to download

Pricing: $399 one-time payment to download

This is another of the older credit repair platforms, having been in operation for at least the last 16 years. They do the same thing as the rest, but they have a couple of benefits. For one thing, their platform is fully bilingual with English and Spanish coverage. For another, their license is a lifetime purchase. While it's expensive – it will cost you $400 when it's on sale – you can access and use it any time for as long as the program exists and can function on modern computers. They also offer the ability to use their platform in service to others if you want to create your own credit repair business once you're done repairing your own credit.

Pricing: Free plan, $16.70/mo Ultimate plan, and $39.99/mo Premium plan.

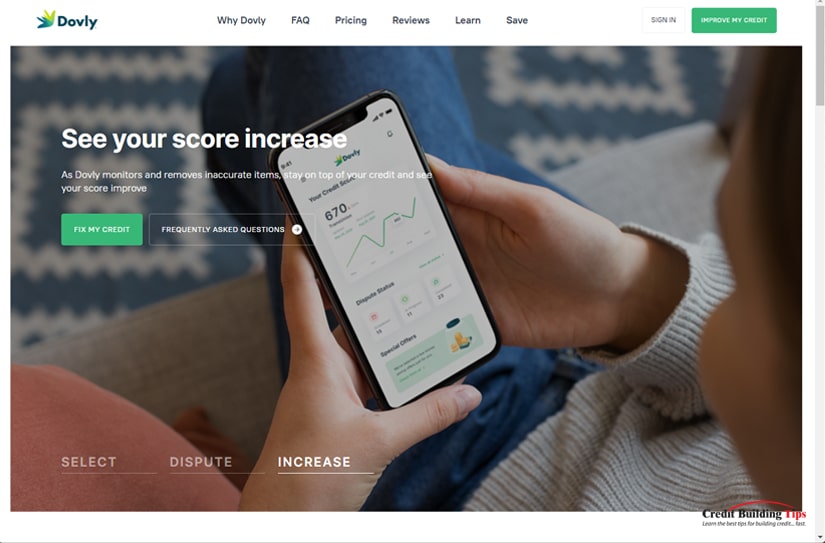

Pricing: Free plan, $16.70/mo Ultimate plan, and $39.99/mo Premium plan.One of the more modern applications on this list, Dovly bills itself as a fully automated credit repair program. They do a soft pull of your credit report (rather than a hard pull that can hurt your score), and then you go through and select the items that you want to dispute. This way, they don't accidentally dispute something good or waste time disputing something that has already been verified. Then, you sit back and watch it work. They handle all of the dispute letters and filing and monitor your score to report back how well it's working.

Dovly has three plans. The free plan is just that – free – and offers one dispute, per month, with TransUnion. It's not much, but it's better than nothing. The Premium plan is $40 per month and allows you up to three disputes per month with all three bureaus (Equifax, Experian, and TransUnion). They also offer identity theft insurance and a few other perks. They also have an "ultimate" plan that only costs $9 per month but requires a full-year purchase. As an added bonus, if they can't raise your score within 90 days, you can get your money back.

Unfortunately, this is about it for credit repair programs. There are a few others out there, but they're aimed at people looking to create a credit repair business, or they've been retired and are no longer available. As such, the rest of this list is filled with ways to help you out but aren't strictly credit builder programs.

Pricing: Free

Pricing: FreeCredit Karma is one of the better-known score tracking platforms, and Money is a program they offer in partnership with SeedFi. Essentially, they create credit builder loans through SeedFi. When the loan is paid off after enough monthly payments, the money is deposited into a spending account with Credit Karma directly, which you can then use as normal money.

Since the credit builder loan is paid up front and managed behind the scenes, and since it's usually for small values, it's easy to handle and easy to keep rolling. Plus, you can monitor your score through Credit Karma quite easily. It's quite cheap and easy to build your credit this way, though it doesn't do anything to fix your bad credit or dispute previous blemishes. You'll have to use one of the other platforms on this list or simply do it yourself.

Pricing: $14.99 per month

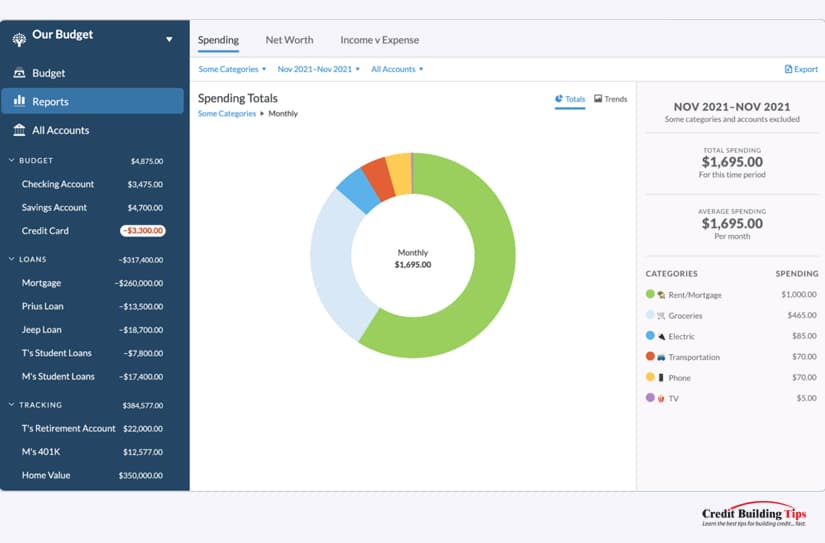

Pricing: $14.99 per monthNo matter how much you work to build your credit, if you don't have sound financial habits, you're going to fall back into poor credit sooner or later. That's why one of the best things you can do is build strong financial spending discipline, and the best way to do that is with a budget you can manage and stick to.

You Need A Budget (or YNAB) is a cloud-based budget program you can access from your phone. It links to your bank account and can pull data to track your expenses, both regular and irregular. It helps you save money, which you can use to manage your debts and pay off outstanding loans, and then put towards investments and other planning. It also helps you gain a better picture of your current spending, so you know where all that money is going.

Pricing: Free

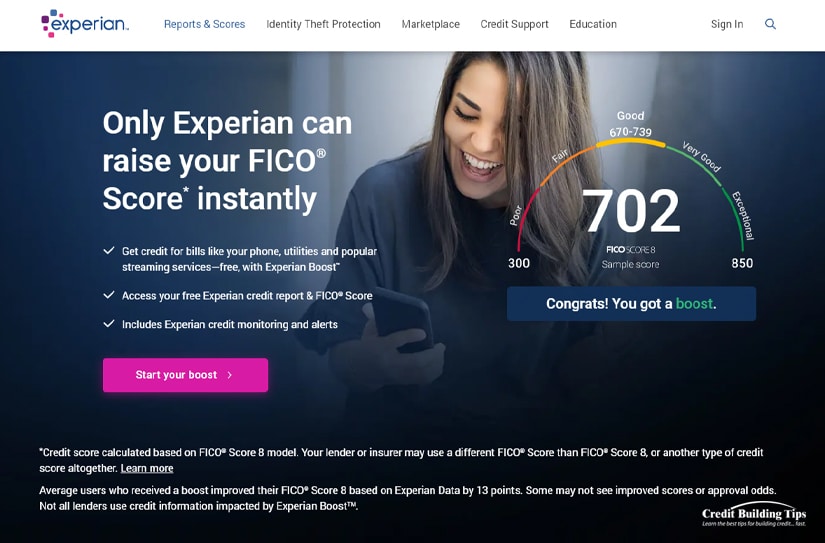

Pricing: FreeExperian Boost is unique in that it is offered directly by one of the three credit bureaus. It's also not as much a credit repair program as a credit builder program. It works by enrolling your various bills into credit reporting. You'll earn credit for paying bills like Netflix and your ISP or Phone bills on time, which normally would only happen if you used a credit card to pay them.

There are a few downsides to this. First of all, it only reports to Experian, so it won't necessarily affect your score with the other agencies. It's also a minor boost – only around 1-15 points on average. On top of that, it doesn't do anything to dispute or remove possible errors on your credit report. All it does is report some extra bills to show that even if you've had some financial trouble in the past, you're still capable of paying at least some things.

Oct 7, 2022 Update: The TurnScor.com website is no longer loading. We checked their social media pages to see if there is any indication that they went out of business, but we could not find anything. For now, we've removed the link to their website. We'll post an update as soon as we hear more.

Oct 7, 2022 Update: The TurnScor.com website is no longer loading. We checked their social media pages to see if there is any indication that they went out of business, but we could not find anything. For now, we've removed the link to their website. We'll post an update as soon as we hear more.TurnScor is a somewhat older player on the credit repair stage, though that doesn't mean they're out of date. They're essentially an interactive guide on a web application that helps you pull your credit report and file dispute letters. They don't actually do anything automatically, though; they're more like an interactive training program.

One possible downside to TurnScor is that they recommend using Flash, which has been deprecated and no longer functions. It's unclear whether or not they've updated their program to function without it or if one of their methods for training videos simply no longer works.

These credit repair programs are popular choices but didn't quite make this list because they are primarily intended for credit repair businesses that manage many clients. Still, they may be helpful to some of you, and we wanted to give them a chance to shine:

Who knows; perhaps after you've improved your credit, this will inspire you to start a credit repair business and help others!

The question you may have after reading all of this is whether or not these programs are really worth it. The truth is, it depends on you. Some people simply rebel against the idea of working with credit bureaus, and if they can click a button to have some letters ready to print and mail, then it's way easier than trying to do it all on your own.

On the other hand, none of these programs do anything you can't do yourself. There are plenty of dispute letter templates available for free online, it's easy to pull your credit report and identify issues, and the addresses you need to send documents to are public knowledge. It just takes a little more legwork. Is it worth it to spend a few bucks and do it faster? That's up to you.