When your credit score is low, and you need to gain approval for a loan – like a car loan or a mortgage – you are probably looking for any way you can to build your credit quickly.

There are all manner of credit builder programs available, some better than others, but many of them share one common issue: they're an added financial burden. A credit builder loan is taking out money for the sole purpose of repaying it, for example. You're just adding an extra bill to pay for a credit bump, but you don't get anything tangible to improve your life immediately.

It makes sense, then, that you might start looking for ways to build your credit that also get you something. Financing a new phone is one such idea.

The question is, does it work?

These days, smartphones are nearly indispensable. The little pocket computers are powerful for all manner of benefits, including task scheduling, calendar management, banking, payments, and much more. They can even make phone calls! Statistically, half of you reading this post are probably doing so on a mobile device of some kind.

At the same time, many smartphones are quite expensive. The latest Google Pixel is $600, and the Pro is $900. The latest iPhone is $700 with a Pro starting at $1,000 with the higher end models landing around $1600. The latest Samsung is similarly expensive. Many people, especially those living paycheck to paycheck, can't afford to pay full price up-front for a new phone.

Of course, phone manufacturers and cell carriers know this, so they all offer a variety of different ways to spread out the costs. You can trade in an older device for a discount, you can add the cost of the phone as monthly payments on top of your cell phone plan, or you can even finance the phone.

Financing the phone usually happens in one of three different ways.

Retail financing usually works by asking you to open a credit card, often with the store itself. Apple offers the Apple Card, retail outlets like Best Buy and Amazon have their own credit cards, and so on.

Credit cards are credit cards, and they are almost always reported to the credit bureaus. Of course, many of these credit cards are limited. They may, for example, offer 0% interest on a cell phone purchase, but an incredibly high interest rate if you use the card for other purchases. They're meant to be opened to buy the phone or some other piece of flagship technology from the manufacturer, and then either closed or let to lie when the purchase is done.

Cell carriers – the people you're paying to have access to cell service, like T-Mobile or Verizon – often offer their own forms of financing for phones. The phones they offer may be slightly cheaper than buying an "unlocked" phone, or they may have their own added software or even a slightly-customized operating system to customize the phone experience for that carrier.

Carrier financing usually involves signing a contract and paying in installments, usually for 24 or 36 months. The cost of the phone is divided across your monthly bill, so your bill contains charges for both the device and your usage of the service. Since this isn't a line of credit, it is usually not reported to the credit bureaus.

On the other hand, these options are usually a bit cheaper than other financing choices, especially if you're working with one telecom for your household. Bundling multiple phones together, or even your cell service along with your TV and internet service may allow you access to cheaper pricing than everything individually would cost.

Services like Affirm and AfterPay are third-party services that vendors may offer. They're technically known as "point of sale installment loans" and function similarly to loans. You "buy" the phone at the time of purchase, taking out a loan with this third-party service to pay for it. The vendor has their money and is no longer involved; the loan is with the BNPL service provider.

Though these services operate as loans, they generally do not report to the credit bureaus, so they don't affect your credit. It depends a lot on the provider. For example:

Of course, this all depends on the vendor to offer one of these services; many do not.

If you've read up on how credit scores work, you know that taking out lines of credit, paying regularly, and keeping your debt-to-income ratio low can all help boost your credit score. However, it's all dependent on one thing: whether or not the loan/credit and activity is reported to the credit bureaus.

Most options for financing a cell phone are not reported to the credit bureaus. Of the three options, only the first – opening a vendor credit card – is likely to be reported. Only a few of the buy now, pay later services report activity, so you would have to shop around to find a vendor that uses the service, and that you trust to make a large purchase, which can be a tall order.

This means that financing a cell phone can boost your credit score, but only if you're able to open a credit card with the store. This isn't always possible.

This means that financing a cell phone can boost your credit score, but only if you're able to open a credit card with the store. This isn't always possible.When you apply for financing for a store line of credit, the credit provider will analyze your financial situation and will decide whether or not to approve you. If your current credit situation is poor, they are just as likely to deny you a line of credit as they are to accept you, and if they do accept you, they may offer extremely risky terms.

Conversely to the above, financing a cell phone has the potential to hurt your credit score. This can happen in several ways.

1. Failure to make payments.

As with any line of credit, loan, or financing plan, if you fail to make payments on time, that failure is likely to have negative repercussions. At the very least, you'll rack up interest and fees. In some cases, you may violate the terms of the loan and lose benefits like 0% interest. You may be able to try to get these removed with a Goodwill Letter, though it's never guaranteed to work.

And, of course, if you fail to pay your loan, you will go into default, and your debt will likely be sold to a collection agency. That agency will be more than happy to report to the credit bureaus to leverage additional pressure to force you to pay what you can. In fact, with some of the buy now, pay later financing plans, they only report if you fail to pay. This means the potential benefit to your credit is nil, while the potential downside is significant.

2. The hard credit check for approval.

You may have heard that a hard pull of your credit report can hurt your credit score. Here's a quick lowdown:

Realistically, a hard credit pull for a phone is unlikely to really harm your credit score, and the brief dip will go away relatively quickly if it even happens. However, if you're financing multiple pieces of technology in a short time, multiple hard pulls can hurt more.

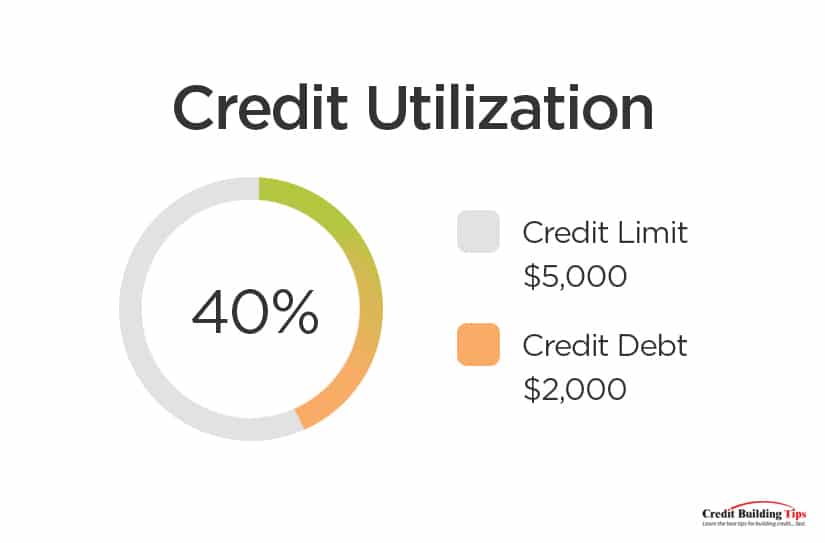

3. A worse credit utilization ratio.

Depending on how the loan or line of credit is formed, it can make your credit utilization look worse.

For example, say you have one credit card with a $4,000 limit and $1,000 in debt on it. That's a 25% credit utilization, which isn't bad. If you then finance a cell phone for $1,000, you're opening a line of credit with a $1,000 limit and using $1,000 of it; that puts your totals at $5,000 of limit and $2,000 of utilization, which is 40% utilization; much worse.

Debt to income ratio is also relevant here. The more debt you have relative to your income, the worse your financial situation looks. Taking out financing on a cell phone increases debt, so unless your income went up as well, your ratio looks worse.

If you need a cell phone and you don't want to finance one, you have a few options.

For one thing, you can look for a cheaper phone. Often, manufacturers have smaller, less fully-featured phones available for lower prices, or they may sell the previous generation of phones at a discount. You can get a slightly older model, or a non-flagship model, often for half the price or less.

You can also buy a used phone. This carries the risk of the phone already wearing out some of its lifespan, so you'll need to replace it sooner than you otherwise would, but it can carry you through a tight time or still work out to be cheaper in the long run.

Some brands of cell phones are also cheaper across the board. However, an off-brand cell phone may have compatibility or usage issues, which need to be considered depending on what you need your phone to do for you.

If you're just looking for ways to boost your credit and are now convinced that financing a cell phone is not a good way to do it, you have plenty of options.

It's entirely possible to raise your credit score quickly, especially if your current score is relatively poor. Taking the right actions and being smart with the money you have available can have a dramatic impact.

Financing a cell phone is usually not a great option, simply because most of the available methods to do so don't report to the credit bureaus unless something goes wrong. It can be beneficial if you need a cell phone and can't afford to buy one in cash, but it's not likely to help your credit score outside of certain specific situations.

If you have any additional questions about financing anything, whether it's technology, furniture, or anything else, simply drop us a line. Our goal with this blog is to answer your questions, so we highly encourage you to ask them. Drop us a comment, send us a message, and make sure to subscribe to our newsletter for more great credit building tips! We would love to assist you on your credit building journey by answering any of your potential questions or clearing up any concerns you may have to the best of our ability!