CareCredit has this to say about itself,

"We do something very simple at CareCredit:

We help people get the care they want for themselves and their families."

The card is intended to be used to pay for healthcare expenses that aren't covered by insurance and works similarly to a standard credit card. The CareCredit card is issued by Synchrony Bank, one of the 10 largest credit card issuers in the States, and will show up on your credit report as "SynchronyBank/CareCredit."

Synchrony Financial is a consumer financial services company. Its company headquarters are in Stamford, CT, and it got its start in 1932, during the Great Depression. The company is the largest provider of private-label credit cards in the country.

Some of the brands and cards that have partnered with Synchrony include:

Synchrony Bank uses all three major credit bureaus — Equifax, Experian, and TransUnion — to assess your creditworthiness. Their CareCredit credit card is "designed for your health and wellness needs" and lets you buy from 250,000+ healthcare providers in the U.S, including:

Let's talk about the CareCredit card, how to apply, and what kind of credit score is required for eligibility.

Let's talk about the CareCredit card, how to apply, and what kind of credit score is required for eligibility.There's an easy and fast way to see if you prequalify for CareCredit:

The average credit card score you'll need to have in order to qualify for and register for a CareCredit card is at least 620. This credit score is considered "fair," and some people have even qualified for the card with a score of 600.

The average credit card score you'll need to have in order to qualify for and register for a CareCredit card is at least 620. This credit score is considered "fair," and some people have even qualified for the card with a score of 600.Considering that the two lowest possible credit score ranges are 300-570 (poor) and 580-669 (fair), the CareCredit is one that almost everyone has a shot at getting approved.

Other criteria that impact your chances of qualifying for the card include the following:

When applying for the CareCredit card, you'll need to supply your:

There's no annual fee if your application is accepted. The card's interest rate is 26.99%, and the minimum interest charge is $2.

Although the CareCredit card is a convenient way to pay medical bills and healthcare expenses, there are some downsides you need to be aware of. Remember how earlier in this post, we said, "The card is intended to be used to pay for healthcare expenses that aren't covered by insurance and works similarly to a standard credit card?"

Similarly, this card is not the same as a credit card.

Similarly, this card is not the same as a credit card.CareCredit doesn't calculate your payments in the same way as other credit cards do. According to their site, there are two common scenarios for "making payments using each of the promotional financing options available."

The first scenario is "No interest if paid in full within 6, 12, 18, or 24 months." That's for a promotional period on "qualifying" purchases over $200. You'll need to make minimum monthly payments, and if you don't pay the charge off in full within the promotional period time, you will be charged 26.99% interest on the remaining balance.

If, for example, you make a purchase of $874.00 on a 12-month interest-free promotional period, in order to avoid paying interest, you will need to make sure that you pay at least $72.83 each month. That way, your account balance at the end of the 12-month period will be $0.

If you simply make the minimum monthly payment of $14.00, you'll be left with $706.00 owing and will now be charged 24.99% interest on this remaining balance until it is paid in full.

And that's just for this single purchase.

Purchases of $1,000 or more may be eligible for a 24-month period with a lower interest rate of 14.90%, a 36-month period at 15.90%, or a 48-month period at 16.9%. Purchases of $2,500 or more could be eligible for a 60-month period with a 17.9% APR.

The "deferred interest/no interest if paid in full" promotional offers only apply if you pay the entire balance in full by the end of the promotional period. Many people get caught in a trap of mistakenly thinking they won't need to pay any interest as long as they continue to make the minimum monthly payments.

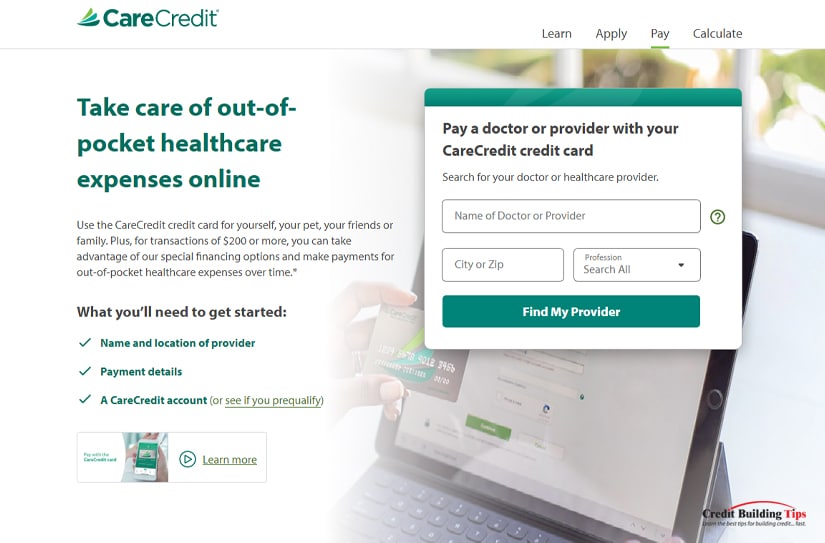

You can pay online for a medical visit by searching for your doctor or healthcare provider by name. This can be the provider's office or a billing address on their invoice.

Enter the city or zip where you received treatment as well the type of service from the drop-down menu of provided professions:

The site will search for your provider and ask you for your payment details and CareCredit account. You'll also need to provide the outstanding balance due, an invoice number or patient id, and the date of service. Prompts will move you through the process.

Once you review the information you've submitted, you'll get a confirmation email, as will your provider. Within two business days, the transaction should appear on your CareCredit account.

The company has set up limits on how much you can pay and how often you can pay a specific provider within a specific timeframe. If you pay more than the accepted limit, you'll see an error message on your screen.

Not every medical clinic or doctor will accept the CareCredit card. Only providers who have registered with the company will accept your card. If you can't find your provider, you can refer them to join CareCredit.

If you're using your CareCredit card to pay for goods at one of their partner retail stores, you can simply use it the same way you'd use a credit or debit card.

The CareCredit card is accepted at major retail stores like:

CareCredit lets you pay your card statement in several ways. You can:

If you worry your payment may be late, call the office at 1-866-893-7867 before the payment due date, as Synchrony may be able to offer you choices that fit your needs.

The best way to make a CareCredit card work for you is the same as the best way to make any credit card work. Pay your statement balance in full — every single time, and you'll not only maintain your credit rating, but you'll also improve it!

Think about paying at least half if you can't pay the full balance. If that's simply not possible, pay as much as you can. Make sure you pay at least the required minimum monthly payment on time. If you miss the payment date, you'll be charged late fees of up to $41 plus interest on the unpaid balance.

If you can only make a minimum payment every month, it will take a long time to pay off your debt, and you will inevitably waste a lot of money on interest fees. This will also negatively affect your credit score.

Check your monthly statement as soon as it arrives in the mailbox or your inbox. It's good to make sure the statement aligns with the receipts you've collected over the month.

If you don't recognize some of the charges, you'll want to contact the company that issued the charge. If that doesn't clear up the mystery, contact the credit card company immediately.

You may be the victim of identity fraud. Or you may find out that you're still paying for a subscription you no longer use that still's taking automatic payment from your account.

Credit can be tremendously helpful in today's financial world, but only if you use it wisely and well. Having good credit is the best way to take advantage of lower interest rates and work towards qualifying for a future home mortgage or other major expense.