When credit bureaus refer to accounts on your credit report, they call them "credit tradelines." There are three different types of tradelines that can show up on your report-- revolving accounts, installment loans, and open accounts.

How long do tradelines stay on your credit report? How does it affect your credit when a new tradeline is added or removed from your file?

Tradelines will usually stay on your credit report for seven to ten years after they have been closed, and will remain on your credit report so long as they are open and active.

Tradelines will usually stay on your credit report for seven to ten years after they have been closed, and will remain on your credit report so long as they are open and active.How long a credit tradeline stays on your credit report depends on a number of factors. If you need a refresher about what exactly a tradeline is, skip down to the next section of the article.

Tradlines will stay on your credit report for at least seven years if not longer.

Any open and active accounts will have tradelines on your credit report. Once an account is closed, how long it remains on your report depends on whether it was closed in good standing.

When you close an account in good standing, the tradeline will usually stay on your credit report for ten years. However, it is ultimately up to each reporting agency to decide how long tradelines are maintained.

When an account is closed in bad standing, it will stay on your credit report for seven years.

There are a few exceptions to this rule– for instance, negative tradelines might remain on your credit report for ten years if they were resolved via certain types of bankruptcy.

Essentially, accounts in good standing will stay on your credit report longer than accounts in bad standing once they are closed. This means that your past positive history will have an impact on your scores and file for a longer period of time than your past negative history.

The credit bureau has a term for an account on your credit report– a credit tradeline. There are three different types of tradelines that you’ll want to be familiar with:

Each of your credit accounts will have a separate “tradeline” on your credit report. These include detailed info about your payment history as well as the nature of the account.

It’s important that the information in your tradelines is accurate because it is used to determine your credit score.

There are a number of important elements you’ll want to know when it comes to your tradelines if you’re hoping to build and maintain a healthy credit profile, including:

Understanding this information can help you make more informed financial decisions in order to keep your tradelines positive as well as boost your credit score and establish a good credit history.

You can learn more by reading our comprehensive guide to how tradelines work.

Every account that you have is considered a single credit tradeline. Whether you are up to date with your payments or behind, whether it’s a solo account or a joint one, or whether the account is open or closed, each one is considered its own credit tradeline.

There are three categories that tradelines can fall into: revolving accounts, installment loans, and open account. Let’s take a closer look at each of these.

A revolving account is a particular type of credit account that offers a borrower a maximum limit. Credit cards and lines of credit are both examples of revolving accounts.

Where does this name come from, you ask? These accounts are known as “revolving” because the following information can continue to change as you make both purchases and payments:

Installment loans are accounts where you borrow a fixed amount of money from a lender and follow fixed terms during repayment. Student loans, personal loans, auto loans, and mortgages are all considered installment loans. However, some credit experts believe that mortgages should exist in their own fourth category.

Open accounts are accounts that are payable in full when the consumer receives something of value, such as merchandise. These aren’t nearly as common for individuals and are more common on business credit reports.

Ready to start improving your credit score and reports? Check out our guides to removing late payments incurred during the pandemic, removing evictions from your credit report, opening a new credit card, and hiding credit card utilization.

Both the weight and elements of tradelines are going to be different between each category. For instance, your credit score will most likely be much more impacted by falling behind on an auto loan or mortgage as opposed to missing a credit card payment.

Another important difference is that revolving account tradelines will include both your credit limit and utilization. This information isn’t something that will appear for an installment loan tradeline.

There is a tone of information given with each tradeline. The reason for this is in order to help lenders and creditors minimize risk when they make lending decisions.

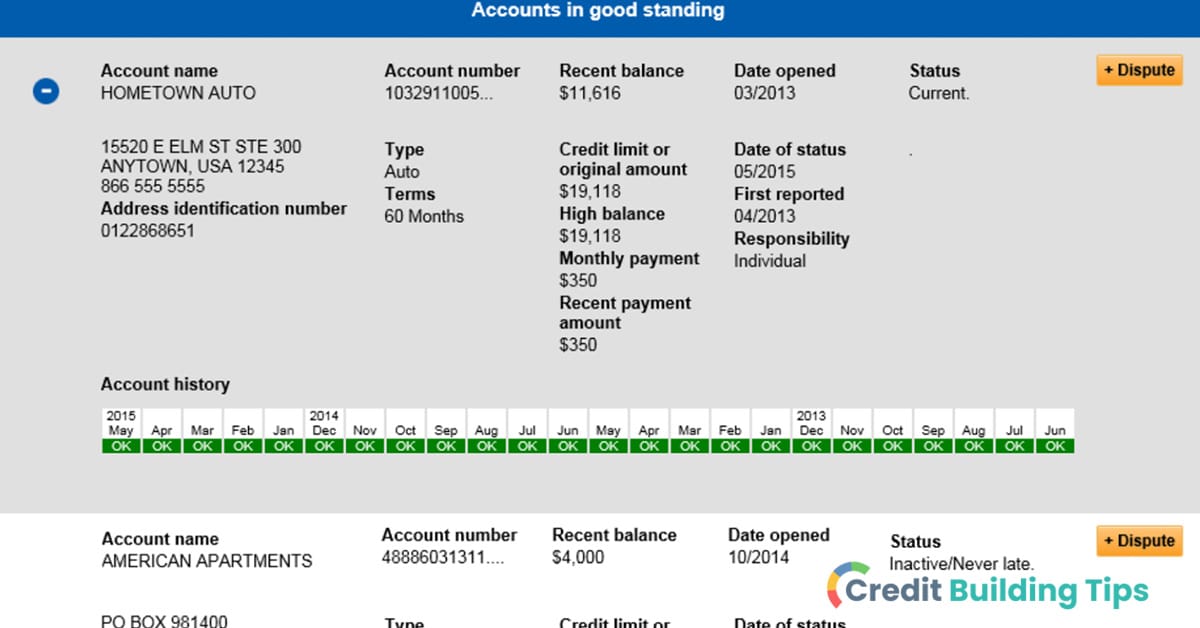

Some of the information you might find under a credit tradeline include:

Lenders and creditors are the ones that determine the information they provide in tradelines, so you might find that some tradelines or some specific information don’t show up on your reports.

Your credit score is calculated using the information in your credit tradelines. Actually, in order to even have a credit score you need at least one tradeline that’s been active during the prior six months.

Your score is calculated using each element of every tradeline on your report. That being said, they aren’t all incorporated with the same amount of weight.

For instance, using the FICO scoring model, your payment history has a bigger impact on your credit score than the types of accounts you have.

When you apply for a loan or line of credit, creditors and lenders have free rein in terms of which details they use in order to gain a greater understanding of your financial situation. For example, you might be less likely to be approved for an installment loan if the lender sees that you have received a number of late payment marks on your credit report recently.

On the other hand, a series of late payments a few years back might be seen by a lender as evidence of a previous setback that won’t affect their lending decision because the consumer has remained current on all of their accounts for several years.

Removing a tradeline from your credit report can sometimes have an impact on your credit scores, but what type of tradeline it is and whether you were just an authorized user or the owner can impact whether or not it has any influence on your score.

Your credit credit score can be affected by closing a revolving credit account for a few different reasons.

The first is that your credit utilization ratio will increase because you lose the available credit limit on the account. A higher credit utilization ratio is a sign of risk to creditors and lenders, because it means you’re using a higher percentage of the credit that is available to you.

Ideally, you want to keep your credit utilization ratio below 30% and the lower is usually the better.

The second is that the average age of the accounts on your credit report can be lowered by closing a credit card account, which is one of the factors used to determine your score. That being said, an account in standing will stay on your report for about ten years, which means this shouldn’t be cause for immediate concern.

When you close a credit card account, you might notice that your scores decrease initially but then rebound in a few months so long as you maintain a positive payment record. It’s generally advised not to close a credit card account if you are planning on applying for financing or other credit in the next several months.

Paying off installment loans can lower your credit score. This might seem a bit unfair at first, but you’ll be glad to know that this is typically only a temporary reduction.

Our credit scores can change on a day-to-day basis as we add and subtract money from the loans and debts that we have. When you take out an installment loan, you agree to a specific interest rate and pay-off terms. This includes the date on which you will need to have completely paid off the loan. According to the loan agreement, you will make monthly payments of a certain amount.

It can contribute to your positive credit score and credit mix when you make on-time monthly payments to your installment loan. When your loan is paid off in full and you are no longer making monthly payments, this can lead to a slight temporary reduction in your scores.

That being said, assuming that all else is well with your credit file and you have other accounts with positive payment histories, your score should recover rather quickly.

You can learn more about whether installment loans can help rebuild bad credit in this guide.

A "credit tradeline" sounds more complicated than it is-- it's simply just the term that credit bureaus use to refer to each account that you have established with a lender or creditor.

There are three national credit reporting agencies-- Equifax, Experian, and TransUnion. You can get a free copy of your credit report from each credit bureau from AnnualCreditReport.com, a site authorized by Federal law.

When you look at your credit report, you can see detailed information about each account under each tradeline. This includes both your positive and negative payment history.

The information that is found in your tradelines is used to calculate your credit score. Lenders can look at these details as a part of deciding whether or not they feel it is risky to lend you money.

Tradelines will remain on your credit report as long as they are open and active, and then will stay on your credit report for at least seven years after the accounts have been closed. Accounts with positive histories usually stay on your report for ten years, while accounts with negative histories will stay on your report for seven years in most cases.

Considering how important the information is in your tradelines, you can see why it's so vital to regularly review your credit report to make sure that all of the info listed is accurate. If you're on a mission to improve your credit file, make sure you check out our credit building blog.