It's always a little heart-stopping when you check your credit report and see your score has dropped by 100 points. Why does this happen, what does it mean, and what can you do about it?

There are many factors that can contribute to a drop in your credit score. While it's not uncommon for your credit score to drop some, if you experience a large plummet, it's good to understand this could be due to one big reason or a combination of several smaller ones.

While a 10 or 20 point drop may not necessarily negatively affect whether you would qualify to borrow money or get a new credit card, a drop of 100 points almost certainly would.

While a 10 or 20 point drop may not necessarily negatively affect whether you would qualify to borrow money or get a new credit card, a drop of 100 points almost certainly would.And if this credit score drop happens at the same time you are in the process of buying a house and need to get a conventional mortgage, a 100-point drop could disqualify you. You need a minimum credit score of 620 to qualify for a conventional mortgage.

If your credit score had been 700 (a "good" score according to FICO and "prime" according to VantageScore) and your score dropped by 100 points, you wouldn't qualify for any conventional mortgage, and your interest rates would be significantly higher.

There's also a difference between a gradual decline in your credit score and a quick (and significant) drop in the number. If your score drops by 100 points quickly, it's usually because you were more than 90 days late paying one of your bills.

Your payment history accounts for 35% of your overall credit score. The factors that make up this payment history include:

Missing a credit card payment has an immediate effect on your credit score. If you are more than 30 days late paying a bill, lenders will report you to one or all three of the credit bureaus. FICO will drop a "very good" or "excellent" credit score by 63 to 83 points and a "fair" credit score by 17 to 37 points.

The penalty is even higher if you are 90 days late in making a credit card bill payment. Your "excellent" credit score will drop by 113 to 133 points, and your "fair" credit score will drop by 27 to 47 points. The higher your credit score before the missed payment, the greater the penalty will be.

Missing or making a late payment can drop your credit score by 17 to 133 points.

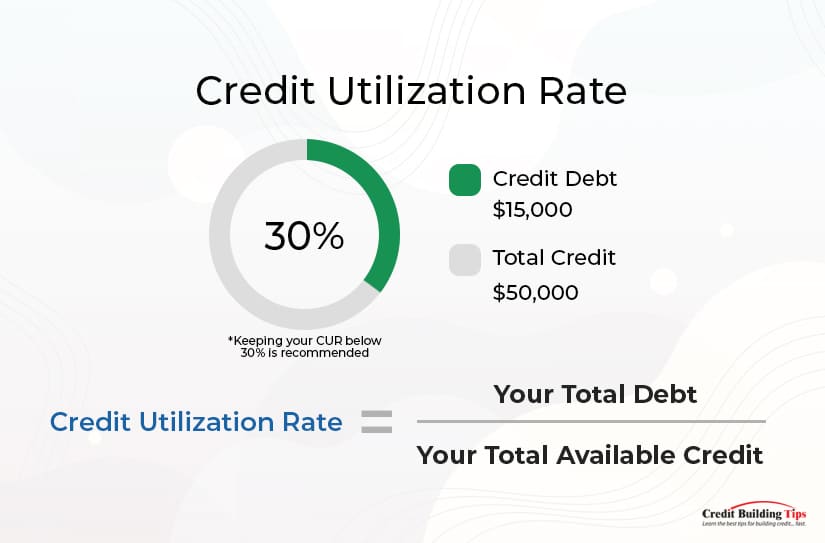

Your credit utilization rate (CUR) measures how much credit you use compared to how much is available to you. Keeping your CUR below 30% is recommended, and some experts even urge a lower 10% to protect your credit score.

For example, let's say you have a total of $50,000 in credit available between three or four credit cards. You owe $17,000 on one card, $8,000 on another, and $3,400 and $1,200 on the others; your total credit utilization ratio is calculated at 59%.

That's much higher than the recommended 30%. Your per-card credit utilization rate changes the percentages and informs you which credit card you should aggressively work towards paying down without adding more charges.

Although you owe more on the first card than the second one, your per-card credit utilization rate suggests that paying down the $8,000 owing on your card will help lower your credit score faster than paying down the $17,000 owing on the first card.

A change in your credit utilization rate can impact your credit score by up to 30%.

Late payments or bankruptcies can leave a negative "mark" on your credit report. These marks can indicate that you failed to keep your agreement to pay back a loan, your account was sent to collections, you declared bankruptcy, or you had a civil judgment or a tax lien made against you.

These derogatory marks can stay on your credit report for seven years (longer if the mark is due to bankruptcy). They'll damage your credit score, but you can work to mitigate the damage by making minimum payments on time on each account, only applying for new credit if you absolutely need to, and keeping your balances low.

While seven years is a long time for your credit score to be negatively impacted, if you take the steps listed above, your credit score should start to improve.

Having a negative mark on your credit report will definitely drop your credit score, but due to the secret and proprietary way credit bureaus make this calculation, it's impossible to know by how much.

You might think paying off debt will increase your credit score, but that's not always true. It is true when it comes to credit card debt, but paying off your student loan, auto loan, or mortgage will actually cause your credit score to fall.

The reason is that student or auto loans and mortgages are considered "installment" debts, where you pay an agreed-upon amount every month until the debt is paid out. Once the debt is paid back or retired, you'll have one less credit account in your name.

The types of credit accounts you have makes up 10% of your credit score. Ideally, you'll have a mix of accounts with some retail and credit cards, home loans, and installment loans. Making the last payment on your car or student loan is a reason to celebrate, but it will also cause a temporary dip in your credit score.

The length of your credit history is also considered when credit bureaus calculate your credit score. This accounts for 15% of your score; the longer you've made payments on time and in full, the better your score will be.

For this reason, you don't want to unnecessarily close an older credit card account, even if you no longer use it regularly. Closing accounts can actually hurt your credit score. You want as high a credit limit as possible, and long-standing closing accounts lower the credit limit that's available to you.

You might consider closing the account if you no longer use a credit card that charges you an annual fee. But before you do, check with the credit card company to see if they'll issue you a "no annual fee" card or upgrade you to an unsecured card. That way, you'll still benefit from the card's credit limit but not shell out money each year for the privilege.

When you apply for a new credit card, the card issuer will want to check your credit risk with a hard inquiry or "hard pull."

Applying for credit cards is an important step in establishing and building credit and worth the dip in your credit score a hard inquiry will cause if you pay off your credit statement in full by the due date.

By checking if you qualify for a new card by using issuers' preapproval or prequalification offers, you can reduce the number of hard pulls on your credit report. Another tip to protect your credit score is not to apply for several credit cards at the same time. By waiting a few months between applications (or even more if you already have a lower score), your overall score won't drop significantly.

Applying for a new loan or credit card will generally drop your credit score by five to 10 points.

It's bad enough when you fall behind on your bill payments, and this negatively impacts your credit score. What's worse is if the credit score drops due to errors on the part of the credit bureau. Credit files can get mixed up, and information is input incorrectly or not input in a timely manner.

Last month I wrote about incorrect scores that Equifax sent out in the spring. Equifax described the issue as a "flub" even though millions of U.S. consumers were provided with inaccurate credit scores, and one Florida woman found her credit score to be off by 130 points.

If you see an error on your credit report, you should deal with it as soon as possible. You can send four types of "dispute" letters to address the issue: a general dispute letter or a 609, 611, or 623 dispute letter.

The first step to disputing information on your credit report can be handled by a general dispute letter; if that doesn't fix the issue, you can then send a 609, then a 611, then a 623 dispute letter until you get the issue dealt with. Ultimately, the Fair Credit Reporting Act (FCRA) is on the consumer's side and will help you if needed.

Inaccuracies on your credit report can drop your credit score — sometimes dramatically.

In 2021 the Federal Trade Commission reported the total number of identity theft reports at a whopping 1,434,676. More women than men were victims, and the age group with the highest number of victims were those aged 30-39.

Loans and credit card fraud were the top types of identity theft. Only government documents and benefits showed a higher number of identity theft. According to TransUnion, 19 people are victimized by identity theft every minute.

Identity theft works like this: A fraudster would apply for new credit, max out the credit card and fail to make payments. Every credit inquiry could take 10 - 20 points off your score. The increase in credit card debt will hurt your score. Missed payments will have the biggest impact.

Fraud from identity theft can ruin your credit score.

The bad news is that nothing is permanent in credit. Your credit score can be fair to good one day, and then the next time you check, it may have dropped significantly due to your spending and bill-paying behavior or forces outside your control.

The good news is also that nothing is permanent in credit. Your credit score can be lower than you like, but by applying good money-managing habits, you can overcome and build up your credit over time.

Before you start to lose sleep about a "sliding credit score," keep these points in mind:

Fluctuations are normal. Credit scores are calculated by a series of criteria on a variety of factors and are never truly constant. Paying bills a little late, applying for a new credit card, or changing your credit utilization rate all contribute to your higher or lower score.

That's not to say that a 40-point drop shouldn't grab your attention or a 100-point drop should prompt you to take immediate action, but there's a normal rhythm to your score going up or down. What's more important than stressing about these ups and downs is recognizing the difference between a "natural rhythm" and a red flag.

Don't stress until you need to. Timing is everything, and until you apply for a loan, mortgage, or credit card, the number doesn't really affect your life and finances.

While you always want to work towards maintaining at least a good credit score, especially pay attention in the six months before you may need to apply for some type of loan or credit card. If your credit score is too low, you run the risk of not qualifying for a loan or getting charged higher interest rates than necessary.

Your credit report means more than your credit score. Credit reports detail your bill payment history, current loans, debt load, and other financial information. They list where you live and where you work, plus whether you've been sued, arrested, or have filed for bankruptcy.

You want to keep an eye on your credit report and make sure the information shown is accurate. Credit card bureaus are not infallible, and it's important to regularly check your credit report for any mistakes or inaccuracies that will negatively impact how lenders see you.

If you're experiencing a downward drop in your credit score, make sure to check your credit report and see if any of the eight issues are relevant to you.

Facing up to what's happening is the first step towards fixing the problem. And fortunately, with diligence and discipline, even a poor credit score can be turned into a good or excellent one.