If your credit score has seen better days, you might be struggling to get a loan, rent an apartment, or qualify for a credit card.

To help improve your chances as an applicant, credit repair services will often promise to help boost your credit score. These are companies that will review your credit reports and act on your behalf to address any negative items with the credit bureau.

Credit repair services will help you dispute incorrect information on your credit report in exchange for a fee-- usually a monthly fee ranging from $20 to $150. There can be additional charges for these services, including start-up fees and cancellation fees.

Credit repair services will help you dispute incorrect information on your credit report in exchange for a fee-- usually a monthly fee ranging from $20 to $150. There can be additional charges for these services, including start-up fees and cancellation fees.It's important to understand that there are scammers out there masquerading as credit repair services, so you'll want to learn about the red flags to watch out for. Additionally, it's worth noting that credit repair services don't have magical abilities to clean up your credit report-- everything they do is something you can do for yourself for free.

Credit repair services help you come up with a plan you can use to repair your credit and will act on your behalf in order to dispute inaccurate information.

Essentially, these companies can help you remove errors or other incorrect marks on your credit report that are damaging your score. What they can't do, however, is remove accurate information.

Some of the types of items that a credit repair service can remove include:

You'll often find that credit repair companies will offer extra features for additional fees, such as:

In many cases, these extra services aren't worth the steep fees that are charged.

If your credit is less than ideal and you want to improve your score, the concept of credit repair services might sound too good to be true.

The truth is, though, that a credit repair company isn't going to be able to help you remove accurate information from your credit report.

For instance, if you have a high credit utilization ratio, several late payments, or other derogatory marks, credit repair services won't be able to help if the information is correct.

Did you overdraw your bank account and you're worried it's going to ding your credit? Check out this article to learn more about whether a bank overdraft affects your credit score.

When shopping around for credit repair companies, you'll find that they all tend to have their own pricing structure. Typically, though, they sell packages of services and charge fees monthly.

In addition to the monthly fee, some companies charge enrollment or set-up fees as well as fees when you cancel the service. You can find some companies that will offer a money-back guarantee, but this isn't always the case.

It's common for companies to have policies that essentially require you to stay signed up for several months.

For example:

Only you can decide whether or not it's worth the cost to hire a credit repair company, but it's important to note that pretty much anything a credit repair service can do for you, you can do for yourself.

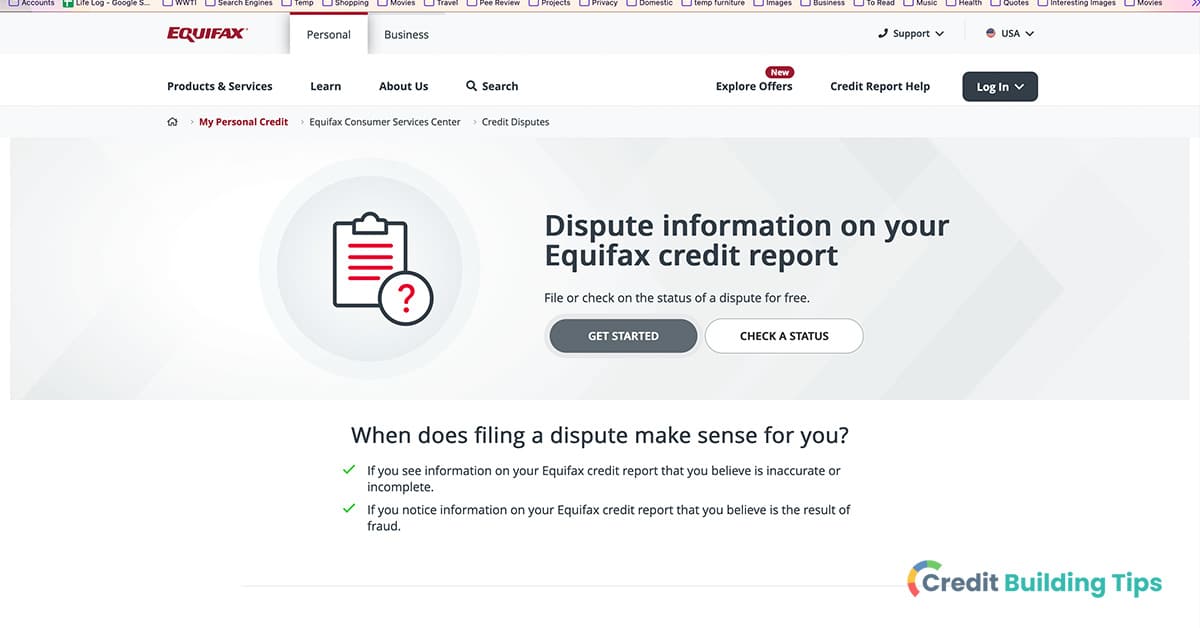

To do so, you'll want to follow these steps:

Was your identity stolen and it took a serious toll on your credit file? This guide goes over how to repair your credit after ID theft and fraud.

The idea of paying someone to repair your credit report can seem a bit too good to be true at first, and there are certainly companies out there that make promises they simply won't be able to keep. Here are some of the most commonly asked questions about credit repair companies to help you determine whether paying for one of these services is the right choice for you.

It can take several months to start seeing results after you've signed up for a credit repair service. The length of time it takes for your credit to be fully repaired can be six months or even longer.

It's also possible that the inaccuracies you had fixed will end up showing up on your credit report again down the road, so you'll still want to keep an eye on your report.

You can find credit repair companies that operate nationally, while others only offer their services in certain states.

Depending on the package of services you purchase from a credit repair company, you also might receive credit monitoring services. This means that they will keep an eye on your credit report for any changes that could potentially stem from fraudulent activity.

Are you trying to improve your credit health? Check out these posts about removing charge-offs, collections accounts, hard inquiries, evictions, and 30-day late payments from your credit report.

Unfortunately, scammers can be attracted to the field of credit repair. There are plenty of legitimate companies out there, but you'll want to be on your toes when choosing one to make sure you aren't sending money to a party that has no interest in helping you.

There are a number of things you'll want to watch out for when seeking credit repair services.

According to the Consumer Financial Protection Bureau, some of the signs of a credit repair scam include:

It's important to understand that pretty much anything a credit repair company can do for you is going to be something you can do for yourself. They don't have magical abilities to fix your credit report, but they do have experience going through the dispute process and otherwise engaging with the credit bureaus.

Additionally, there is still some work you will have to do on your own, even if you hire credit repair services.

All that being said, some consumers find that it is worth the money to have credit repair companies take on some of the work of disputing inaccurate information on their credit reports.

While credit repair and credit counseling services might sound kind of similar, they are actually two very different services.

Credit counseling is tailored to your specific situation and consists of receiving financial advice from a credit counselor. They will also be able to offer you resources that give you the information you need to improve your financial situation. Consumers will typically seek credit counseling when they need advice on how to get themselves out of debt.

Your credit profile will not be wiped clean by a credit repair company. Legitimate negative information on your reports, such as bankruptcy, default, or late payments, will age off your reports after a certain number of years, depending on the nature of the mark.

Here is how long it takes for specific information to fall off of your report:

Credit repair services are only able to dispute incorrect information on your credit report. Some services might offer to send a goodwill letter to your creditor or debt collector on your behalf in order to ask them to remove the derogatory marks. However, creditors and debt collectors are not obligated to honor these requests.

Unfortunately, we can't just wipe the slate clean and start over with our credit reports. What we can do, though, is take actions that help to improve our credit scores.

Some of the things you can do to rebuild your credit include:

Believe it or not, it can actually hurt your score to open a new credit score-- at least immediately. It will, eventually, start to help your credit score.

This is because the credit card company will run a hard pull of your credit when you apply, which can ding your credit.

However, you'll soon start to appreciate the benefits of having a new card because your credit utilization ratio will drop, which is a metric where lower is always better. Making up roughly 30% of your FICO score, giving yourself a more advantageous credit utilization ratio can be a fairly quick way to boost your credit score.

Whether or not it's worth the cost to hire a credit repair service is something that only you can decide. It's important to be diligent when choosing a credit repair service, though, as there are definitely scammers out there that make lofty promises and don't return any results.

Beyond that, remember that credit repair companies cannot delete correct information from your credit report. They can only dispute incorrect information with the credit bureaus on your behalf. In some cases, they might also send goodwill letters to debt collectors on your behalf to attempt to have accurate negative accounts removed, but there is no guarantee that this effort will be successful.

If you don't want to take the time or deal with the headache of interacting with the credit bureaus when there's an error on your report, you might find that it's worth it to pay a credit repair company. That being said, you might find that the money is better spent going toward your debt and that you can actually handle the disputes on your own without paying start-up fees, monthly fees, and cancellation fees.

Are you ready to improve your credit score and make yourself a more appealing borrower to lenders? Make sure you check out our credit building tips blog for more resources to help you boost your credit and clean up your report.