The lower your credit score, the harder you'll find it to get loans, financial deals, and approval for accounts. It's a vicious circle; the worse your score, the harder it is to manage money, and the less flexibility you have, with fewer options available to you.

Financial institutions of various kinds have implemented a variety of different methods to help improve your credit score. Among those options is a secured credit card.

Financial institutions of various kinds have implemented a variety of different methods to help improve your credit score. Among those options is a secured credit card.You likely have some questions about these credit cards, so let's go through and answer them!

With a normal credit card, you apply and are approved by a bank based on your credit score and history. They are, essentially, the bank letting you borrow money (up to a certain limit), with terms allowing you to repay it over time. It's simple in concept, but the terms of a credit card make things more complicated. Different credit cards have different limits, there are usually rewards programs (like cash back, points of some kind, or frequent flyer miles) attached, and they may have different grace periods, interest rates, and repayment terms.

Secured credit cards are, by contrast, much simpler. They still work roughly the same way; you apply for a card, and a bank approves you.

There are numerous differences, though.

The biggest difference, though, is the security deposit. It's what makes the credit card "secured" in the first place.

The security deposit is a lump sum of money you give to the bank to put on hold. It's a prerequisite for a secured credit card. Most secured credit cards start around $200, though some are closer to $99 on the low end or as much as $500 on the high end. Typically, the higher the deposit, the better the terms and the lower the interest rate.

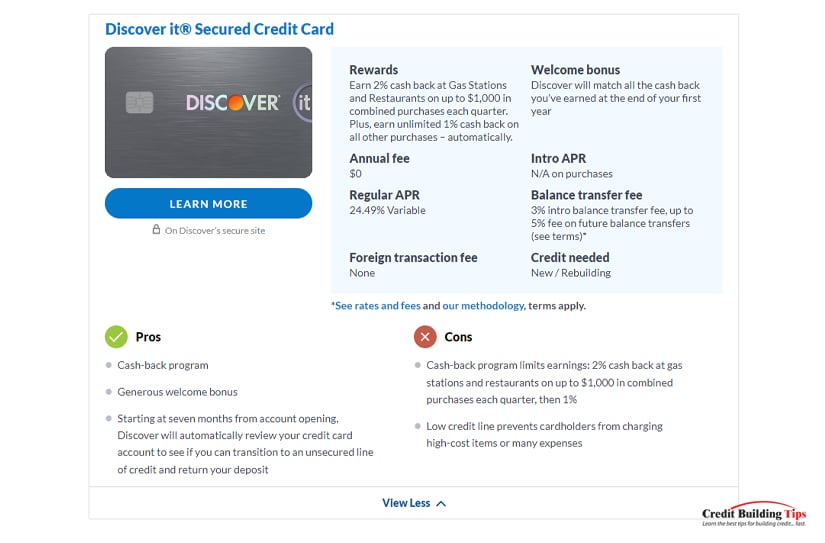

The security deposit is a lump sum of money you give to the bank to put on hold. It's a prerequisite for a secured credit card. Most secured credit cards start around $200, though some are closer to $99 on the low end or as much as $500 on the high end. Typically, the higher the deposit, the better the terms and the lower the interest rate.You can see some examples of secured credit cards and their terms here.

Some people view a secured credit card as a form of debit card or prepaid card because you have to put money into it to get it. That's not quite accurate, though. You don't use that money to pay for your purchases. Instead, it's a form of security for the bank so they're not stuck with a negative balance.

Usually, the deposit is 1:1 to your credit limit, at least initially. You put $200 into a security deposit and get a secured credit card with a $200 limit. Then, you can buy things up to $200 on the card and pay them off over time. If you end up defaulting on the credit card, the bank has your money to cover it, so they don't assume much risk. "Secured" in the name of the card refers to security for the bank, not for you.

Your money isn't lost, though. Most secured credit cards have some mechanism for retrieving the money. Sometimes, it's simply refunded to you if you close the account. Other times, as you use the card and pay it off appropriately, the security deposit is slowly applied to purchases to reduce your costs or even slowly refunded to you over the course of months.

Obviously, all of this varies depending on the issuing financial institution and the terms of the specific secured credit card you're looking into.

How do you pay for the things you buy?

If you pay in cash or use a cash-equivalent debit card, your transactions aren't reported to the credit bureaus. As such, they don't earn you any benefit to your credit score. A credit card, as we all know, is a line of credit and is thus reported. Maintaining an account in good standing and carrying as low a balance as possible (preferably zero) helps build your credit score.

A secured credit card is still a credit card. Therefore, purchases made using a secured credit card – and the payments made to pay them off – are reported to the credit bureaus. Making payments on a secured credit card will gradually raise your credit score. Additionally, having lines of credit and a good debt-to-income ratio will benefit you as well.

Why not just use a regular credit card instead of a secured card? Well, as many of you likely know firsthand, you probably can't get one if your credit score is low enough.

The biggest benefit of a secured credit card is that, because of the security deposit, banks and financial institutions are much more likely to offer them to people with lower credit scores. The security deposit helps mitigate some of the risk the bank would otherwise assume.

Moreover, after using a secured credit card appropriately for a while, you may be able to "graduate" to an unsecured card without having to close your card and open a new line of credit. This maintains continuity in accounts, which is beneficial since "age of credit accounts" is a credit calculation factor. Banks like this because you've already proven you can stay financially solvent with the secured card, and you stick with them to give them your business.

There's one all-important question left to answer, and that's "how much will a secured credit card help?" If you're talking about five points here, that's barely anything and might not be worth the effort. On the other hand, if it can rocket your credit score up 200 points, you'd be jumping at the chance.

The truth is, it's highly variable.

Keep in mind that the more blemishes there are on your credit report, the harder it will be to raise your credit score until you deal with them. That's why we always recommend pulling your credit report, checking for errors to get them removed, negotiating to have accounts in collections removed, and employing other strategies to mitigate the damage.

If you're interested in using a secured credit card to improve your credit score, here's how.

The first thing you need to do is some research. While most secured credit cards are fairly similar, they are not all created equal. There are many different cards with different terms. Figure out what you can afford as a security deposit; a higher deposit will get you a higher credit limit, and a higher credit limit improves your debt-to-income ratio (as long as you don't carry a balance), so it's generally more beneficial. However, make sure you don't try to take on more than you can afford; jeopardizing your ability to pay off your credit will only make your credit score worse.

Once you've picked a card, apply. Since secured credit cards are usually aimed at people with low credit scores, many banks will either have very broad terms or won't check your credit score at all. If they don't check, they likely check something else, like the ChexSystems Report. Some of the stricter or better cards will be hard to gain approval for, but most secured cards will be open to you as long as your expectations are reasonable.

The key to building your credit with a secured credit card is to avoid carrying a balance. Treat it as you would cash; only make purchases you can afford, and pay them off immediately. Carrying a balance does not improve your credit score, and the interest charges will make it harder to keep paying it off.

While you're working to improve your credit score using a secured credit card, you can also try out additional strategies. For example, you can get credit builder loans without a credit check, and paying those off (if you can afford them in the first place) is another good avenue for improving your score.

After you've been using your secured credit card for several months, keeping it paid off effectively, you can contact the issuer and request a higher credit limit. A higher credit limit makes your debt-to-income and credit utilization ratios look better, especially if you continue with reasonable spending. Note, though, that this only works if you don't start using it as an excuse to spend more money and carry a balance.

After about a year of using a secured credit card effectively, your credit score will have gone up, and, more importantly, you will have proven to the issuer that you have financial responsibility. You can often request a graduation from your secured card to an unsecured card. This maintains your existing account but allows you to transition to a card with added benefits, such as a rewards program, a higher limit, and a lower interest rate. Once you've done this, congratulations! You've made it and can leave secured credit cards behind.

After reading today's article, do you have any questions about secured credit cards, how they work, or how they may be able to boost your credit score? If so, please feel free to reach out and ask your questions at any time! We'd be honored to assist you on your credit-building journey however we possibly can!