Figuring out how to remove a 30-day late payment from your credit report isn’t anyone’s idea of a good time– once a creditor has reported a late payment to one or more of the credit agencies, it can be difficult to get removed if you did, in fact, miss making the payment by more than thirty days.

The first question to ask is whether the late payment on your credit report is an error or if it’s accurate.

Removing a 30-day late payment from your credit report is simple if it was an error-- you'll need to contact the credit bureau, your creditor, or both to have it removed. Unfortunately, it isn't always possible to remove a late payment if it is accurate.

Removing a 30-day late payment from your credit report is simple if it was an error-- you'll need to contact the credit bureau, your creditor, or both to have it removed. Unfortunately, it isn't always possible to remove a late payment if it is accurate.In this article we'll explore what to do if the late payment was an error, strategies you can try if it is an accurate mark on your credit, and more.

When a lender reports that you paid a bill late to the credit bureaus, a late payment is reported on your credit report. There are two different ways that this can occur:

If the late payment is the result of an error on the part of the lender or the credit bureau, it isn’t too difficult to have it removed from your credit report. You will need to file a dispute that explains the mistake and demands that the late payment on your report be removed.

However, it can be much more difficult to get a late payment removed from your credit report if you did actually make a late payment. Not only can it be a frustrating process, but it can be quite time-consuming. Even so, there is no guarantee that you will succeed in your attempts.

For help cleaning up your credit report, check out these four simple ways you can remove derogatory marks from your credit.

If the lender was correct in reporting your late payment, there are a number of steps you can take to try and get it removed from your report. The reality is, though, that your chances of having a late payment removed from your credit report aren’t great if you don’t have a compelling argument (with evidence) for why it should be removed.

If you realize that your payment was late before it ends up showing up on your credit report, you’ll want to get on the phone with the lender as soon as humanly possible. They might be willing to help you resolve the issue before they report it to the credit bureau. This is particularly true if this is the first time you’ve ever missed a payment with the lender.

When you missed a payment and the creditor has already reported it to the credit bureaus, you can try sending them a letter that explains why the payment wasn’t made on time. Commonly referred to as a “goodwill letter,” this is your opportunity to formally explain why you believe the payment should be removed from your case.

It’s worth understanding that lenders aren’t required to remove late payments from your report if they were accurate. Considering the impact it can have on your credit, though, it’s still worth trying.

You might find that your creditor is willing to help you out, particularly if you can provide proof that supports circumstances such as one or more of the following scenarios:

It’s really easy to get stressed out and frustrated when you’re trying to get a 30-day late payment removed from your credit report. The truth is, though, you have a much better chance of receiving the outcome you’re looking for if you are nice and cordial.

When writing your goodwill letter, here are some things to keep in mind:

You’ll want to include the following information in a goodwill letter:

It’s possible that your creditor will update your credit report after they receive your letter. However, a common response from lenders is that they aren’t legally allowed to remove accurate information from a consumer’s credit report.

Mistakes aren’t uncommon on credit reports, which is why it’s a good idea to regularly review your credit reports. If you find an inaccurate 30-day late payment on your report, you can ask the credit bureau to prove that the late payment is correct. If it’s found to be a mistake, you can request that it is removed.

When it’s clear that the late payment was a mistake, removing the mark from your credit shouldn’t be too difficult. Under the Fair Credit Reporting Act (FCRA), you are entitled to request substantiation and that the late payment be taken off your report if it is found to be an error.

There are two ways that you can request that an inaccurate 30-day late payment is removed from your credit report.

The Consumer Financial Protection Bureau advises that you contact both the company that provided the information to the credit reporting agency as well as the credit reporting company.

You’ll want to start by disputing the error with the credit reporting company that generated the error on your report– either Equifax, Experian, or Transunion.

You should explain why the late payment is an error including copies of documents that help to substantiate your dispute.

You can use this template provided by the Consumer Financial Protection Bureau to draft your letter.

The following information should be included in your dispute letter:

It can be prudent to send your letter by certified mail and ask for a return receipt. This way, you will know with certainty that the appropriate credit reporting agency received your letter.

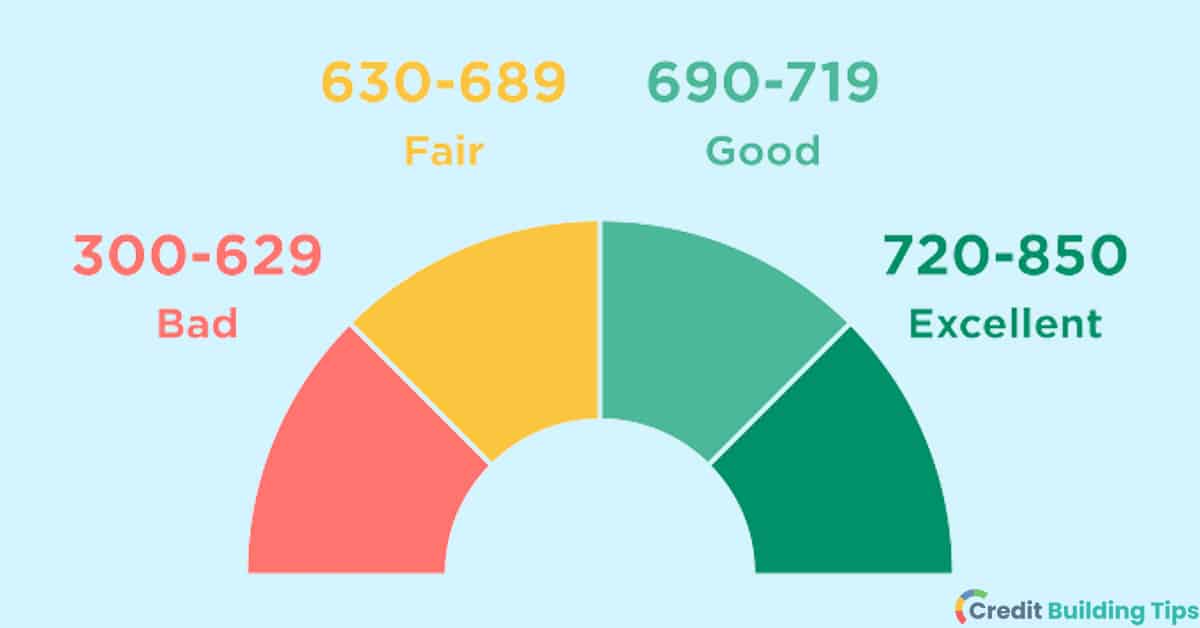

Lenders and creditors use your credit scores to help predict how likely it is that you’ll make your payments on time before they lend you money. When you think of it this way, it makes sense that missing a payment would end up having a negative impact on your score.

Even so, it’s pretty frustrating to realize that your credit score dropped because of one bad mark on your credit report.

Even just one 30-day late payment can have a negative impact on your credit scores. The most influential factor in calculating your score is payment history.

Once a late payment is reported to the credit bureaus, it will drop your credit score and it will stay on your report for seven years. At that point, it will drop off from your credit report automatically.

There are a number of different factors that influence how a late payment will impact your credit score. These include how late your payment was, how often you’ve made late payments, and how recently the late payment was reported to the credit bureau.

While there are many factors that determine your credit score, one single late payment can reportedly drop your credit score by anywhere between 90 and 180 points.

If you are able to make a payment before 30 days have passed, you most likely won’t see it show up on your credit report. However, once 30 days have gone by, lenders will most likely report it.

These late payments get categorized as 30-day late payments, 60-day late payments, 90-day payments, and so on. This sequence will continue until the creditor deems the debt uncollectable (aka resorting to a “charge-off.”)

The later you make your payment, the more severe the impact will be on your credit scores.

Did you recently notice a significant drop in your credit score? This guide look at the multitude of factors that can contribute to reduction in your score.

Though it’s frustrating to have your credit scores go down due to a 30-day late payment, it shouldn’t be life-shattering if it only happens one or two times. If you have late payments on a number of different loans, though, or you regularly pay your bills more than 30 days late, you’ll find that the impact it has on your credit score is much greater.

The impact of late payments will decrease over time, and how recent information is a meaningful factor for the scoring models. However, that doesn’t mean it isn’t worth fighting to remove late payments that are a few years old, as they still have a negative influence on your scores.

If you realize that you missed a payment, the best possible course of action is to make the payment before thirty days have passed from the original due date. If you do this, there’s a good chance the late payment won’t have been reported to the credit agency yet.

If there’s already a mark on your credit report, though, it, unfortunately, won’t be automatically removed once you pay it off.

Are you negotiating with a creditor or a debt collector to pay off your debt? Make sure you read this guide to payment and installment plans first.

In most cases, a late payment won’t show up on your credit report for at least thirty days after the due date has been missed. However, it’s worth understanding that, in the case of credit card companies, there is a lot of flexibility when it comes to reporting payments that are late.

Credit card companies can choose when they report late payments and how often they report them. If you make a payment a few days late, it might never get reported to a credit bureau.

It can be frustratingly difficult to get a late payment removed from your credit report if you did actually make your payment more than 30 days late after the due date. Any late payments that you can’t successfully remove from your report will stay there for seven years until they fall off your credit report.

Though this can be discouraging, this doesn’t mean your credit scores are doomed to be terrible or that you can’t borrow money for the next seven years.

Are you trying to improve your credit and you're wondering if opening a new credit card will help? This post goes over everything you need to know about how opening a new credit card impacts your score.

If you’ve run out of options when it comes to removing the late payment from your credit report, it doesn’t mean that you’re doomed to a bad credit score forever. The late payment will have a gradually less severe impact as time goes on and it gets older. Additionally, you can focus on deliberately building your credit score back up.

What could your credit score look like if you were very good at managing your credit over the course of years? Take a look at the highest possible credit score and whether it's possible to achieve this maximum score.

First things first, you’ll want to make sure that you don’t miss another due date. You might choose to sign up for auto-payments to help make this easier, or build the habit or sending your payments a few days early to make sure you don’t miss one.

Another thing you can do is make sure you keep your credit utilization rate on the lower end. It’s ideal to stay under 30%. This is the ratio between how much credit has been extended to you and how much you are using.

When you're desperate to build your credit back up, it's easy to get tempted by credit repair company offers that promise to work miracles for your credit. Make sure you read this post about the pros and cons of hiring a credit repair agency before making any decisions.

If your credit score has been problematically damaged by late payments and other negative marks on your credit report, you might worry that you won’t be able to borrow money when you need to. There are still ways you can borrow money with poor credit, but you’ll always want to be skeptical as there are many predatory lenders out there that will lend money to people with bad credit in exchange for outrageous interest rates and fees.

Depending on the type of loan you’re applying for, a co-signer could help. A co-signer is a person that joins in on a loan application and promises to pay back the loan if you aren’t able to make the payments on time. Of course, this is a risky proposition for the co-signer, as their credit could end up being damaged if make payments late.

Late payments can stay on your credit report for seven years, so it's important to have a system in place to avoid making payments after the due date. If you already have a mark on your credit report for a 30-day late payment, these are the steps you can take to try and remedy the situation:

If you're motivated to improve your credit score, make sure you check out the rest of our credit building blog.