Many people Google online to find out why their credit score isn't changing.

CRedit (Reddit's credit subreddit) is a forum where people can post their questions and get answers from the general public, which may or may not be the ideal way to get solid financial advice.

I found a question from last year where someone posted:

"I have been paying off a decent portion of my credit card since the start of 2021 (at least a few hundred/month and a few thousand here and there), but my credit score does not budge at all and stays at 712 on Credit Karma/TransUnion. I recently also got a new credit card and am waiting for its statement to potentially change my credit score as well, but I don't understand what is happening and if my credit score is stuck or something."

Seven helpful readers weighed in with comments and questions of their own that ran the gamut:

"Check your FICO scores."

"Utilization has no month-to-month memory in current FICO score models, so your score will improve as you lower your credit card balances, dropping your revolving utilization %."

"Man, I feel like we need a sticky at the top of the sub explaining the differences between FICO and Vantage score for those who don't know the difference."

"Paying down balances usually helps, but the totality of the report also matters, which is why it's also important to know what is on your report in order to determine how the scores may increase."

Umm. If they weren't clear before they asked their question, I'm not sure they're any clearer now. Let me see if I can help here.

If you're asking why your credit score hasn't changed or moved in months, there are probably a couple of pieces to your question. Let's start with:

A: Knowing how your credit reports get updated could be helpful here. Lenders (credit card companies, car loan companies, mortgage lenders, and any other company lending you money) usually update your account information about once a month or at least every 45 days.

A: Knowing how your credit reports get updated could be helpful here. Lenders (credit card companies, car loan companies, mortgage lenders, and any other company lending you money) usually update your account information about once a month or at least every 45 days.They send the new information to the nationwide credit reporting agencies: Equifax, TransUnion, Experian, and Innovis.

Although lenders typically submit information every month to 45 days to credit reporting agencies, updates aren't necessarily done in real-time. If the lender is behind with their updates, there can be a significant time delay. But probably not months.

A: If you don't ask a loan company to lend you money and you have the same credit cards and pay them off each month without fail, your score will stay the same because nothing has changed.

A: If you don't ask a loan company to lend you money and you have the same credit cards and pay them off each month without fail, your score will stay the same because nothing has changed.If you miss a payment but overall have a good credit history, it's not likely to change or lower your score. But the same is true if you have several negative factors on your credit report, then a single positive action, like making a full payment, may not change or boost your score.

Suppose enough time has passed for the credit reporting agency to have reasonably updated your report, and your activity has been relatively constant. In that case, your score may stay the same because of your lenders.

Building your credit score takes time because lenders look for a long-term pattern of dependable payments. They look at your whole report, not just whether the credit score number is high or low.

That's good news because if you continue to make payments consistently, lenders can see what type of a borrower you are every month.

Some lenders look for diversity in credit reports. If you've just had one credit card for years and paid it faithfully, your score will stay the same. While that's good, what's even better is for your score to increase so you can be considered a good risk when it comes time to borrow more money, for example, when you want to purchase a house.

When it comes to credit scores, what you really want is a stable high score.

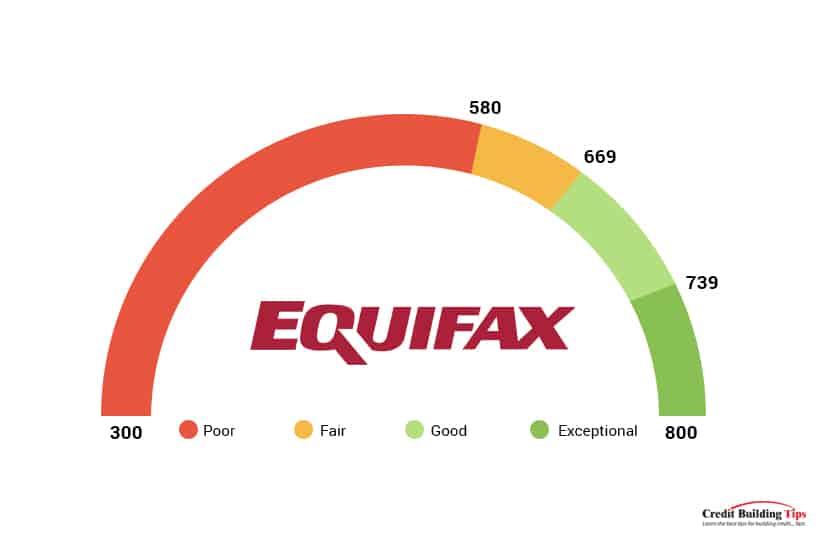

Equifax considers credit scores between 580-669 as fair, 670-739 good, 740-799 very good, and 800 and up as excellent.

Equifax considers credit scores between 580-669 as fair, 670-739 good, 740-799 very good, and 800 and up as excellent.So, if your credit score is 740 or higher and it hasn't changed or moved in months, you've got nothing to worry about. A credit score above 740 lets you "make a lower down payment, get a more attractive interest rate and save on private mortgage insurance."

A credit score above 800 gets you the best credit cards, mortgages, and competitive loan rates. The best credit cards let you earn generous rewards on groceries and dining out. CNBC chose the American Express® Gold Card as the best rewards card.

To finance new purchases or get out of debt with a balance transfer card, you'll also have to have excellent or at least very good credit.

If your credit score is lower than 739 and it hasn't changed or moved in months, you can do things to get it going in the right direction.

Making or missing payments is the number one factor when it comes to calculating your credit score. Payment history accounts for 35% of your FICO score — more than any of the other four factors.

How you've managed your credit accounts is the factor used by 90% of top lenders. Research has shown that payment history tends to be the "strongest predictor of the likelihood that you'll pay all debts as agreed to."

While a few late payments aren't going to automatically lower your credit rate, get into the habit of paying on time all the time. Set up payment alerts on your calendar and when possible, set up automatic withdrawals from your bank account to the account holder.

This works best when the payment is a consistent amount each month, like with a car payment. If the account can vary significantly over the course of a payment schedule, this may be harder to manage on a monthly budget.

This may be a little trickier to wrap your head around, but you'll appreciate how important it can be when you consider that this factor accounts for 30% of your credit score. Together, this and your payment history have the biggest impact on your score.

Popular wisdom suggests that you use only 30% of the credit you qualify for. If you were to Google "how much of my credit limit should I use," you'll get about 1,230,000,000 results. I didn't check all of them, but most sources agreed that using 30% or less of your credit limit is the best way to maintain a good or excellent credit score.

Some experts suggest that you should aim for less than 10%. Financial expert John Ulzheimer, formerly of FICO and Equifax, told CNBC:

"Less than 10% is much more doable [than the 1% of healthy utitlization], and it will serve your scores well. [It] is great for both FICO and VantageScore's scoring systems."

Keep your credit utilization ratio as low as possible, or at least under 30%. If your total credit limit for all credit accounts is $20,000, your total credit balance debt shouldn't exceed $6,000. Or, if you want to follow a financial guru's advice, keep your total credit balance debt under $600.

It may sound, on the face of it, impossible to increase your credit history. That's like saying, "Be older than you are." But when it comes to moving your credit card forward faster, there are ways to increase your credit history.

I previously outlined what a tradeline is and how to make them work for you. Getting two or three "seasoned" tradelines can help you quickly jump to a higher credit score if your current score is less than ideal.

When you apply for a mortgage, a line of credit, a credit card, or a personal loan, the lender will want to check your credit report to see if you're a good risk. Checking your credit report for these types of loans is considered a "hard inquiry" or "hard pull" and can negatively affect your credit score in the short term.

While the inquiry will stay on your credit report for two years, it will usually only impact your credit for a few months. This isn't typically a big deal, but limiting the times your request triggers a hard inquiry is a good way to keep your score from moving in the wrong direction.

You'll want to show lenders and credit scoring models that you can manage more than one type of debt.

Rather than only having a credit card, a mortgage, or a personal loan, it will provide a more well-rounded look into how you handle money and whether you can keep on top of multiple types of debt repayments.

With different scoring models used in the industry, it's not unheard of for your credit score to change even when nothing has changed on your credit report. And that's because there are two types of credit scoring models.

Essentially, scoring models use either a statistical or judgmental scoring analysis. There are more credit scoring models than just these two, but they all tend to fall into one of two categories. Because of these scoring models, the end credit scores can differ.

You can appreciate how your credit score can differ depending on whether an "averaged-out" model is used or an "individual experience" model is used.

Another reason your credit score could drop even if nothing changes on your credit report is human error. Your credit report and resulting score are input by real people who can mistype, misread or simply mess up.

If you think that's happened to you, there's a simple fix. It's called "sending a 609 dispute letter," which simply asks to see all the information in your credit file. I wrote a helpful post on this, along with an easy-to-follow template and all the information you need for where to send it and what to expect.

If your credit score seems stuck and you need to move the score in the right direction quickly, here are ways to raise your credit score. The post by Sarah Edwards at SoloSuit outlines six ways to raise your score. Use one or two for a modest raise, or combine as many of these as possible to give yourself a powerhouse 40 points raise.

The six ways mentioned are:

Managing your credit score is one integral way of managing your wealth. Even if you don't consider yourself "rich," there are so many good reasons to eliminate debt and improve your credit.

With good credit, you'll move into a position where you can start to think about investing in real estate and other ways to have your money make money. For now and for your future.

And maybe the most important reason of all to work hard at getting a good, very good, or even excellent credit score is the peace it helps bring. Life is challenging on many fronts, but it can be a little less challenging without the extra burden of carrying unnecessary debt. And a lot better.