Are you trying to improve your credit score but have been held back by an eviction notice on your credit report? If so, you are not alone.

An eviction can be a major obstacle to building a strong credit history and can stay on your credit report for up to seven years.

An eviction can be a major obstacle to building a strong credit history and can stay on your credit report for up to seven years.However, there are ways to remove the eviction from your credit report and get your credit back on track. In this blog post, we'll discuss the step-by-step process of how to remove evictions from your credit report.

You may not even know that there's an eviction notice on your credit report until you need to find a new place to rent. Even then, it may not occur to you that your credit report is telling your prospective landlord about your difficulties with a past landlord.

If you do think you may have an eviction notice on your credit report, the first step is to check your credit score and review your report.

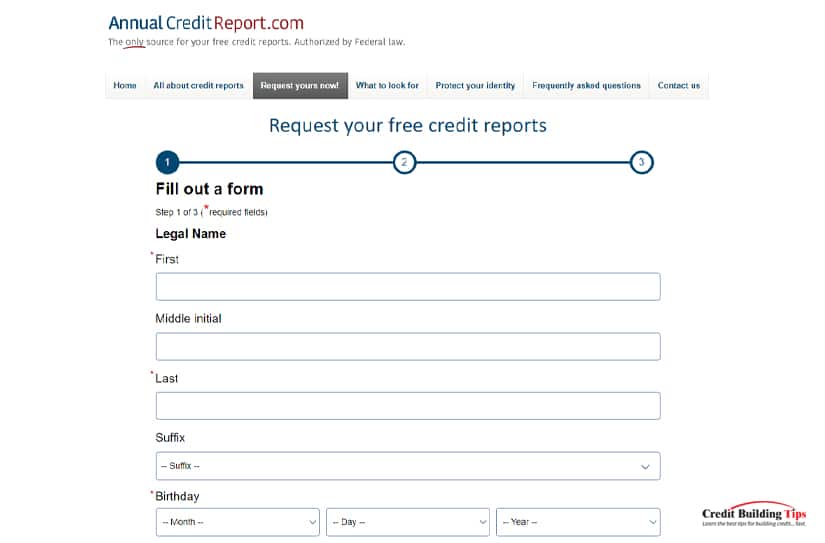

If you do think you may have an eviction notice on your credit report, the first step is to check your credit score and review your report.It's a good idea to get a copy of your credit report from each of the three major credit bureaus — Equifax, Experian, and TransUnion — as they often contain different information.

An eviction notice can appear in several places on your credit report. To find out if you have an eviction notice, you'll want to look for the notice under the section that lists "Public Records." Here, you'll be able to see whether you have any unpaid evictions or judgments listed on your report.

If you have an eviction notice on your credit report, it can significantly lower your credit score. It can also prevent you from renting a home or apartment. Fortunately, you can take steps to remove an eviction notice from your credit report.

It's important to know that even if you paid off the eviction in full, it might still appear on your report for up to seven years. Once you've determined whether or not you have an eviction notice on your credit report, you can take the necessary steps to get it removed.

Landlords may evict tenants for many reasons. The most common reason is failure to pay rent. Tenants are legally obligated to pay rent on time, and if they do not, they may be subject to eviction.

Other reasons include violations of the rental agreement, engaging in illegal activities in the unit, damaging the property, or nuisance behaviors like loud music or partying late into the night. Eviction may also occur if the tenant does not comply with local or state laws related to health and safety. Finally, a landlord may choose to evict a tenant due to personal differences.

Landlords must also follow strict procedures when attempting to evict tenants. It's important to understand that each state has different regulations regarding evictions, so it's essential to familiarize yourself with your local laws if you are concerned about being evicted.

A few resources are available for renters who want to better understand the laws surrounding evictions in their state. Every state has its own laws and rules when it comes to evictions, and these can be found online at various state government websites.

To find out more information, renters should visit their state's website to read through the different eviction statutes. The National Conference of State Legislatures provides an overview of state-by-state eviction laws on its website.

It is important to note that some states have limited rights for tenants when it comes to evictions. For example, some states don't allow for tenant counterclaims or defenses, while others may require landlords to offer a settlement agreement before evicting a tenant.

Additionally, renters should familiarize themselves with the Fair Housing Act, which is the federal law that protects tenants from discrimination based on race, color, national origin, religion, sex, familial status, or disability. It's important to know your rights under this law as well as any state-specific laws regarding evictions.

Many legal aid organizations across the country provide assistance and legal advice to tenants who are facing eviction. Legal aid organizations are typically staffed by volunteer lawyers and paralegals who are experienced in tenant-landlord law and can help tenants better understand their rights in relation to evictions.

The amount that an eviction report on your credit report lowers your credit score will depend on several factors. Generally, an eviction report can cause a drop in your credit score of up to 100 points or more.

This can be especially damaging for people with low credit scores. Additionally, the more recent the eviction report is, the more it can affect your score. It is important to keep in mind that credit scores are not static and can change over time as you make positive financial decisions, such as paying bills on time and reducing debt.

If you find out that you have an eviction report on your credit report, it is essential to contact the landlord who reported the eviction and ask them to remove the report from your credit file. If the landlord agrees, then the eviction report will be removed from your credit report, and your credit score should begin to improve.

It's possible that a landlord or management company may have reported an eviction to the credit bureaus without obtaining a court judgment. If this happens, it can still appear on your credit report and negatively impact your score.

If they fail to do this, then the tenant may have the right to challenge the eviction in court. If an eviction order is issued against the tenant, it will show up on their credit report as a negative item, thus lowering their credit score.

Even if the landlord refuses to remove the eviction report, there are still steps you can take to improve your credit score, such as making sure that all of your other debts are current and up-to-date.

The steps you'll need to follow in order to remove an eviction notice from your credit report differ depending on whether the report is accurate or inaccurate. Making sure the eviction notice is accurate is as easy as checking your credit report, as we mentioned above.

Go here to get a free copy of your credit report from the three credit bureaus and find out whether or not there are any eviction notices on your report.

If you find an eviction notice on your credit report, but you know it shouldn't be there, there are a few things you can do to fix the situation.

1. If the eviction is incorrect, you should contact the landlord or property management company and ask them to provide written documentation that the eviction never happened. You should also obtain a copy of your rental agreement if possible. This can be used as proof that you were never legally evicted.

2. Once you have gathered all of this information, you should contact the three major credit bureaus and file a dispute letter.

3. The credit bureau will then investigate the claim and contact the landlord or property management company for further evidence. If the eviction is found to be inaccurate, it should be removed from your credit report.

Make sure all the information on your report is accurate, including the dates and amounts involved. Include supporting documentation, such as a copy of your lease agreement and any court documents. If the information is inaccurate, contact the creditor involved and ask them to correct any mistakes.

You'll need to attach copies of the documentation of payment, such as a copy of the check you sent, bank statements, or a receipt from the landlord. The credit bureau will investigate and determine if the eviction was due to an honest mistake or a valid one.

4. If the dispute is successful, the creditor must update the records with the correct information and notify all three credit bureaus (Equifax, Experian, and TransUnion) of the change. Once updated, any late payments associated with the eviction should no longer appear on your credit report, and your score should improve accordingly.

5. If the credit bureau denies your dispute or fails to investigate, you can contact a consumer law attorney and ask for assistance. A lawyer can help you understand how to navigate the legal system and determine whether or not you may be able to get the eviction removed through legal action.

An attorney may be able to help you dispute the eviction notice more successfully or even sue the landlord if necessary if you feel like the eviction was done unfairly or illegally. They can guide you through the process of suing the landlord for damages related to unfair treatment.

6. Contacting a credit repair agency may also be worthwhile if you need help disputing the eviction. These companies often deal with credit errors and can help you correct them quickly.

Unfortunately, sometimes eviction notices are accurate and do appear on your credit report. Even if this is the case, you can do a few things to make things better.

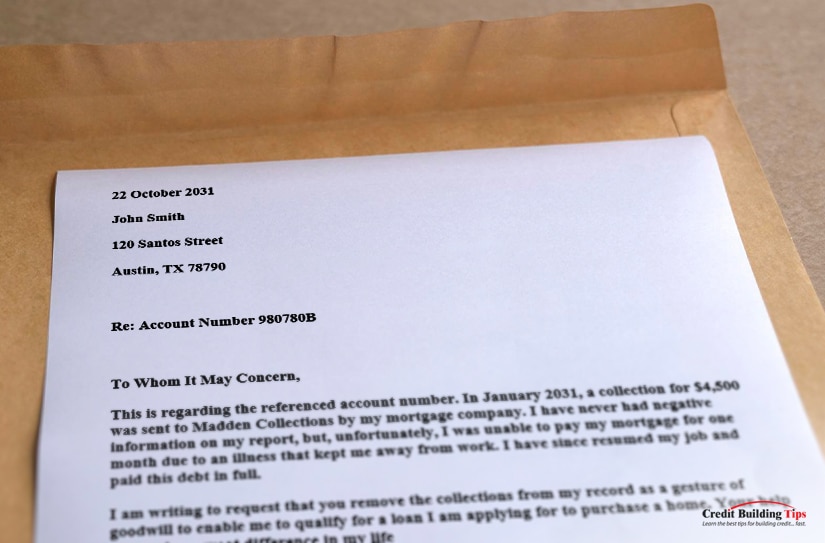

One way to remove an eviction from your credit report is through a goodwill letter. This involves writing to the landlord or management company and asking them to remove the eviction notice on your credit report. They may or may not be willing to accept this request, but if they do, then they must update the records accordingly and alert the credit bureaus.

However, even if the creditor agrees to delete the negative items from your report, the account itself will still appear on the report. Therefore, it is best to use this method only if you feel confident that you can prove the account was handled incorrectly.

You may be able to work out a repayment plan with the landlord who evicted you in order to have the eviction notice removed from your credit report.

You may also be able to get the eviction notice removed from your credit report by making on-time rental payments for at least 12 months after the eviction.

While sending a dispute letter helps when the information on your credit report is inaccurate, you can also send a letter to each credit bureau that provides evidence that you had a good reason for being evicted and/or that the eviction was not your fault.

For example, if you were evicted due to an inability to pay rent due to a sudden job loss or another unexpected financial difficulty, you can provide documentation of the event to the credit bureau.

One of the best places ways to get help with your credit report is to contact a credit counseling agency or a credit repair company.

These organizations can provide valuable insight into what you need to do in order to remove the eviction notice from your credit report. They may even be able to negotiate with the landlord or collection agency that reported the eviction.

Finally, if you're unable to get a valid eviction notice removed from your credit report, make sure to focus on other aspects of your credit report that show responsible financial behavior.

A good payment history, a low debt-to-income ratio, and a steady income can help offset an eviction notice and improve your credit score over time.

You may need to work a little harder to find a landlord or property management company willing to overlook an eviction notice on your credit report. In the U.S., the Fair Credit Reporting Act states that landlords cannot deny a tenancy based solely on a tenant's credit report. However, if there is an eviction on your record, landlords are allowed to take that into consideration.

It is important to note that some states have laws protecting tenants from being denied a rental because of an eviction, so research your state's ruling on this issue.

One option is to provide additional documentation, such as pay stubs or bank statements showing that you are financially stable and responsible. You should also be prepared to explain the circumstances of the eviction, such as extenuating financial hardships or other mitigating factors.

It helps to provide references from past landlords and employers that can vouch for you as a tenant. You may also consider finding a cosigner for the rental agreement with strong credit who can agree to pay the rent if you cannot do so. Also, try searching for a "second chance" apartment complex that is more lenient about credit checks and allows renters with evictions.

Finally, if you're having trouble understanding how credit works and how to repair your credit score, subscribe to our free credit-building tips newsletter. You'll get information, guides, and tutorials on how to fix your bad credit, increase your credit faster than you realized possible, and even achieve a high credit score.