If you're curious where you stand in relation to the average amount of debt Americans have as individuals or how we're doing as a country, I've put together these facts and figures from various sources.

You may want to sit down before I tell you the latest numbers of personal debt in the United States in 2021.

According to the United States Census Bureau, the average American debt each U.S. adult carries is $58,604. Seventy-seven percent of Americans have at least some type of debt.

According to the United States Census Bureau, the average American debt each U.S. adult carries is $58,604. Seventy-seven percent of Americans have at least some type of debt.Before you fall off your chair, let's just clarify the definition of debt. The simplest definition of debt is when you owe money - to anyone and for any reason.

Most of us who have debt have agreed on terms of repayment with specific amounts paid for a specific period until the debt is repaid. Usually, interest is added to the debt to make it worthwhile for the lender to lend you the money. Maybe not if it's a loan from mom and dad, but usually.

The most common types of debt in America are:

Still from the United States Census Bureau, the average American debt per household in the four categories I listed above is shown below:

| Type of Debt | Debt Total | Average Debt per Household |

| Any debt | $14.96 trillion | $158,209 |

| Mortgage | $10.44 trillion | $202,454 |

| Student loans | $1.57 trillion | $58,112 |

| Auto loans | $1.42 trillion | $31,142 |

| Credit card debt | $787 billion | $14,241 |

| Other | $421 billion | — |

For most of us, paying for some type of housing is our biggest monthly expense. Whether paying rent or a mortgage, a larger part of your monthly paycheck goes to ensuring you have a roof over your head.

Back to the U.S. Census Bureau. They report that Americans with a mortgage make a median monthly payment of $1,595. Mortgages make up 70% of all American debt, which should be a bit of comfort. Of all the debts you can carry, having a mortgage on a piece of land and home still has a great return on investment. It's a debt that most often gives back.

Fifty-one point five million American households carry a mortgage. That translates to 42% of all households with an average mortgage debt of $202,454.

As of last summer, the latest numbers on the total student loan debt sit at $1.57 trillion. If we average this astonishing number out, this means each student owes an average of $38,792 that will need to be repaid once they graduate.

Student loans account for 11% of the country's total debt and are currently the fastest-growing type of debt in the States. To give you some perspective, this type of debt has grown at almost 157% since the Great Recession of 2007-2009.

The impact of this weight on young adults can't be overstated. Many graduates say that their student loans keep them from buying a home (40%) and even considering investing in their retirement (47%). Twenty-one percent even wait to get married because of their student loan debt burden.

Thirty-seven percent of Americans can't afford to buy a car without getting a loan. That translates to about 45.4 million households that carry this extra debt. As of last year, the total American auto loan debt is $1.42 trillion.

Experian reports that the average monthly car payment is $577 for new vehicles and $413 for used ones. The average total car loan debt per household is $31,142.

The potential of never getting out of debt is greatest when we use credit cards and don't pay them off in full each month. Eight out of ten American adults report having at least one credit card, and 45% of these carry a balance over to the next month.

Just over 55 million households have this kind of debt, and the average credit card debt per household is $14,241. The total in America now has hit $787 billion in credit card debt.

While you won't qualify for a mortgage, student loan, or car loan unless you show you have the resources to repay the loan, credit cards don't require the same proof. Almost all mortgages, student loans, and car loans are set up with automatic payment withdrawals, which ensures your debt gets paid down without you needing to choose whether or how much of the payment you will make.

With credit cards, you can decide to make the minimum payment or only pay a portion of the monthly statement. Unfortunately, whatever you don't pay will accrue interest — an average of 17.13% will get added to your next statement on the unpaid portion.

If you do the math on the average interest and the total amount Americans owe in credit card debt. Credit card companies can look forward to making about $134.81 billion on interest alone.

And if you're one of the 52% who carries debt and pays interest on your cards, you're part of contributing to that $134.81 billion dollars.

Released at the beginning of this year, Ace Bagtas wrote an article called 15+ Statistics on Average Debt in the U.S., using figures gathered from the last three years.

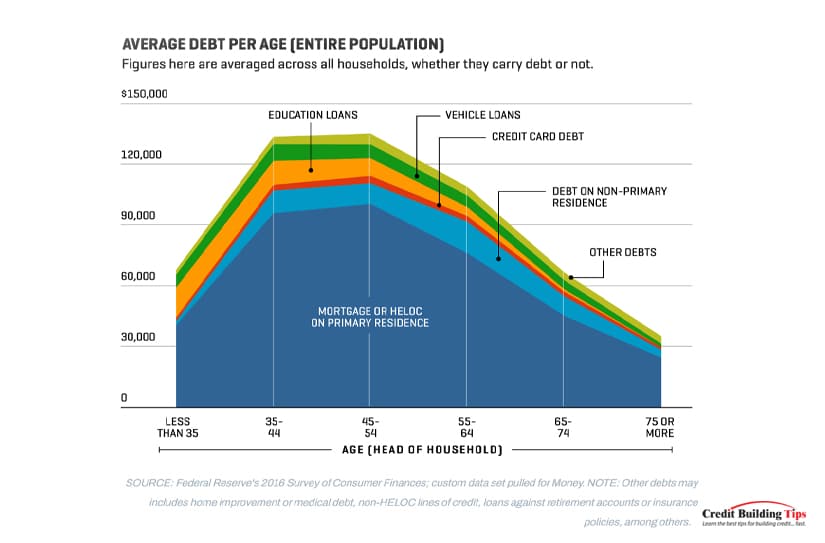

Based on the average American figures:

No matter how the numbers are crunched, with 77% of Americans carrying some kind of debt, it's probable that you're one of them. Of course, some debt is better than others, and some debt can lead to problems.

When you have debt, it's hard not to worry about how you're going to make your payments or how you'll keep from taking on more debt to make ends meet. The stress from debt can lead to mild to severe health problems, including ulcers, migraines, depression, and even heart attacks. The deeper you get into debt, the more likely you will face health complications.

Debt can feel free when you're in the rush of buying something, and all it takes is a swipe of your credit card or the scribbling of your signature on a loan document. That's an obvious illusion, even though it can be a powerful one. Unless you have an interest-free loan or a zero percent APR credit card, you will pay hundreds if not thousands of dollars for the privilege of borrowing money.

Any time you take out a loan or buy something you can't pay for immediately, you are borrowing from your future. You hope you'll earn enough in the future to pay for something you bought in the past, and if that something doesn't appreciate in value, you may experience severe buyer's regret when you're still paying years after you've used up what you bought.

The more debt you accumulate, the higher your monthly payments will be, and the less you'll have available to spend on anything else, like vacations or (more importantly) funds for your retirement.

On a personal level, debt can put pressure on your household finances and create a lack of financial security for your family. This is especially true if you're not on the same page as your spouse and find yourself arguing over spending habits.

Getting out of debt may sometimes feel like climbing out of a deep dark hole, but there are tips on how to start climbing.

Every journey starts with the first step, even getting out of debt:

While some financial strategies suggest taking a portion of your income and investing it in a well-balanced, long-term investment rather than paying off your mortgage, that's the only strategy I think works when it comes to managing debt.

For the other types of debt — student and car loans and credit card debt — consider changing your thinking about debt altogether.

When you rely on credit, your ceiling is your credit limit. Once you hit it, you can't spend any more. So you stop. You need to change this.

Your spending limit needs to be the money you actually have in your checking account. Once it's gone, then you shouldn't spend any more. Once you refine your spending plan and learn to follow it, you should be able to always keep a buffer of $500 to $1,000 in your checking account.

That may be a big goal if you're facing a lot of debt, but it is truly one you can reach. And your biggest reward will be the feeling you have once you do, and you're one of the 23% of Americans who are debt free!