Having a place to live is an essential part of modern life. Unfortunately, it can be distressingly difficult to lock down a home. The cost of housing is rising every year, and banks are hesitant to repeat the subprime mortgage crisis that led to the 2007 recession, so they're pickier than ever about the mortgages they offer.

That means your credit score is more important than ever when it comes to securing a home loan.

That means your credit score is more important than ever when it comes to securing a home loan.The question is, what credit score do you need? Is 650 good enough?

First, let's look at the lowest options. Credit scores range from 300 to 850.

Typically a rating scale might look like this:

Of course, this scale is just a general impression of what your credit score means. There are many factors that go into your credit score, and anyone considering lending you a lot of money – like a home loan – will take a closer look to see why your credit score is low, not just that it's low.

Is there a minimum credit score necessary to get a home loan?

In actuality, there is, but it's a little lower than you might expect. It also depends on the kind of loan you're after.

In actuality, there is, but it's a little lower than you might expect. It also depends on the kind of loan you're after.A conventional mortgage from a bank typically requires a credit score of about 620 or 630. Requirements vary depending on the financial institution; some are more flexible than others.

Mortgages from credit unions may have a higher requirement, but since credit unions are often more local institutions, they may be more willing to work with you as a member of the community. On the other hand, since they carry more risk to themselves proportionally, they might not.

VA loans usually have a lower credit score requirement, around 580. Of course, to qualify for a VA loan, you must have the relevant military service requirements.

FHA loans are the most available of the lot, and they may be able to offer a home loan for those with credit scores as low as 500. These loans have strict limits on their size and terms, though, so they aren't ideal for most people.

So, as a simple answer: can you get a home loan with a credit score of 650? Almost certainly. Nearly every lender will offer you a home loan, though the terms might not be the best possible they could offer.

So, how does your credit score affect your home loan? Several ways, actually.

The first is your classification. Above, we mentioned the subprime lending crisis, but what is subprime? It's another scale for credit scores.

It looks like this:

Subprime essentially means that your credit score falls under the range where mortgage lenders feel comfortable in your ability to repay the loan they offer you. Subprime loans often require higher down payments and have less favorable terms than prime and super-prime loans.

During the mortgage crisis, banks felt invincible and readily offered mortgages to borrowers with subprime credit, fully aware that if many of those borrowers defaulted, the banks would be bailed out. Banks also leveraged these loans as a form of securities investment, further muddying the waters. Eventually, the bubble burst, and it all collapsed in a subprime meltdown, with dramatic repercussions.

As the saying goes, "once bitten; twice shy," so now banks are more hesitant to offer loans to people with subprime or lower credit scores. It's not impossible, but it's more difficult.

Luckily, at a credit score of 650, you are above the range of subprime and in the acceptable range. You won't be getting the best rates, but neither will you be denied a loan in most cases.

Your credit score primarily affects three things about your home loan.

The first is whether or not you're eligible at all. People with a credit score in the subprime range can still get home loans, but they will have unfavorable terms. People with credit scores under 580 will be very limited in what they can access, if they can access anything at all. With a credit score of 650, you should be eligible to get a home loan from most financial institutions that offer them, though some credit unions may not offer you a loan.

The second is what kind of down payment you need to offer up. Generally, most conventional loans will ask for about 3% of the total value of the loan as a down payment. FHA loans ask for 3.5% on average. "Jumbo" loans, and loans offered to subprime and lower credit scores, usually ask for higher down payments, up to 10% of the value of the home.

The higher the down payment, the lower the total principal of the loan, so even if the interest rate is higher, it's not quite as much money as it could be.

Some VA loans don't ask for any down payment, but again, they have more restrictions.

The third factor influenced by your credit score is the interest rate you'll be asked to pay, at least initially. Mortgages can be fixed-rate or variable rate, and variable rate loans change from time to time. Your initial rate will be lower the better your credit is.

Banks use interest rates to ensure that they get as much money repaid as possible, as quickly as possible, in case you end up defaulting on your loan. It helps them minimize the loss and make more money off of you as you continue to pay. Charging people with poor credit more money to exist may not be a sensible strategy from a community-focused point of view, but to banks, with their bottom lines as the driving factor, it makes sense.

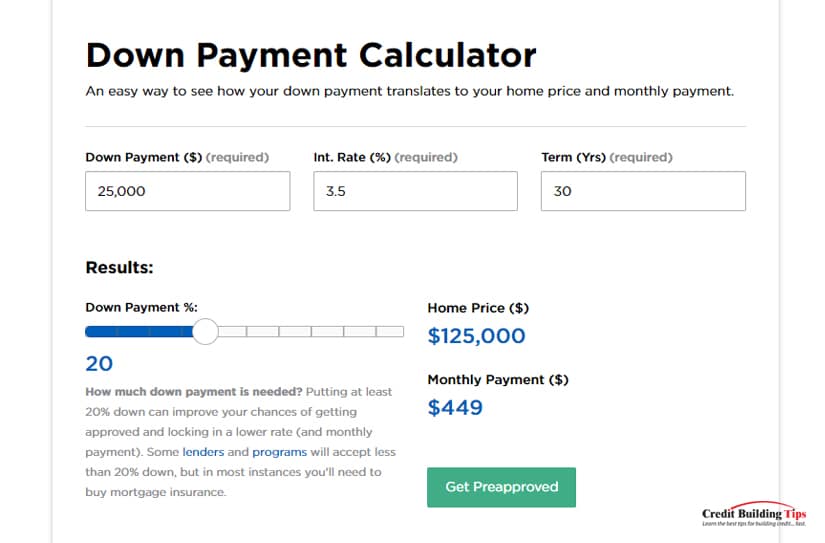

Many sites, such as NerdWallet here, offer housing payment calculators. These calculators allow you to specify numbers for principal, interest rates, and down payments, to get an idea of what your home loan might look like. They don't factor credit score into the mix because credit score doesn't directly impact your loan, just the terms the bank will offer.

With a credit score of 650, you'll be well above the threshold necessary for a 10% down payment and can typically get away with a lower down payment. Your interest rates will be higher than the best possible terms, but they won't be exceptionally bad. For example, you might have an interest rate of around 3.5%, rather than something closer to 5% if your credit score was closer to 620.

Your credit score is an important part of your eligibility for a home loan, but it doesn't tell the whole story.

Your credit score is made up of several factors:

You may notice that some aspects of your financial situation are not represented in your credit score. For example, nowhere in your credit score does it report on whether or not you have a job or how good or stable your job is. Likewise, it doesn't track or report on how much you have saved in a savings account, in investments, or otherwise.

Lenders will often look at things like your debt-to-income ratio, your bank statements and assorted assets, and other signs of financial stability beyond your credit score and credit report to calculate and offer you a loan.

As you might expect, having more assets and having a better, more stable job are going to make you look less risky to the lender than not having those things.

If you have a credit score of about 650, should you work to improve your score before applying for a home loan, or is it good enough?

The truth is, while 650 is "fine" for a home loan, it's still not the best. Improving it is always going to be a good thing.

The truth is, while 650 is "fine" for a home loan, it's still not the best. Improving it is always going to be a good thing.If you can take your credit score from 650 to 670, you'll likely reach a better bracket of offers and will see better terms on your home loans. If you can push all the way up to over 700, or even up to 740+, you'll be able to reach Super Prime status and will get the best possible offers (contingent on other factors, of course.)

Buying a home is a major decision, and it stands to reason that you should take the time to lay the groundwork and prepare as best you can. However, we also recognize that the housing market is on a historic, meteoric rise, and it's possible that you'll be priced out if you wait too long. Thus, you have three options.

Obviously, the third option is impossible to predict and may not ever actually happen. And regardless of which of the three options you want to pursue, you should be working to improve your credit score.

If you want to boost your credit score quickly, you have a handful of good actions you can take.

Before any major purchase or loan application, you should pull your complete credit report and review it. Make sure you don't have any signs of identity theft and that there are no issues on your report. If there are, dispute them, and wait to apply for a mortgage until the dispute is settled.

Reducing your debt-to-income ratio by paying off debts will put you in a better position to get a higher score and a better loan. Start with the debts with the highest interest rates because they're the ones that are most expensive over time. You may also consider consolidating credit balances and refinancing lines of credit for better interest rates.

A goodwill letter is a letter you send to a lender asking them to, out of the goodness of their heart, forgive a late payment and remove it from your credit report. You can read all about what they are and how they work – as well as how to send them – in our post on the subject here.

Credit builder programs are generally short-term loans and other kinds of credit meant specifically to help you build up a payment history and a better debt-to-income ratio to boost your credit score. They can be quite effective when done right.

With a few months or up to a year of effort, you may be able to get your credit score up into the Prime or even Super Prime area, especially if you're already starting at 650. It's well worth the effort before applying for a home loan, but a score of 650 will not disqualify you from getting a mortgage, so make the choice that makes sense for your needs and financial situation.

Do you have any questions about getting a home loan with an acceptable credit score of around 650, or lower? Or do you, perhaps, have any questions about getting a home loan, in general? If yes to either of these questions, please let me know! I'd love to provide you with any needed knowledge and assist you however I can!