What's a credit card nickname, and why would you want one?

We're not talking about the synonyms for the actual credit card itself. People refer to credit cards as "plastic money," "charge plate," "bank cards," or simply "plastic." These terms can also refer to a debit card, but in the main, when someone uses one of these terms, they're referring to their credit card.

The nicknames we're talking about in this article are the ones you give your cards to distinguish one from the other as you use them. With credit card nicknames, you can easily identify which card is which and make sure you're using the right one for the right purpose.

The nicknames we're talking about in this article are the ones you give your cards to distinguish one from the other as you use them. With credit card nicknames, you can easily identify which card is which and make sure you're using the right one for the right purpose.Credit cards are identified by the 16-digit account number (15 digits for American Express), and for most of us, this number isn't one we find easy to memorize, along with the expiry date and CVV.

Most people assume the number on their credit card is the same as their account number. While the two are linked, they're not identical, which you will notice when you receive your credit card statement or view it online.

Forbes Advisor warns that "the sad truth is that credit card numbers get stolen all the time." They recommend using caution at all times. Giving your credit card a nickname is a great way to disguise the card numbers from anyone peeking over your shoulder as you input the number into a field while you're shopping online.

Credit card nicknames are names that you assign to your credit (or debit) cards for easy reference. By creating nicknames for your cards, you can easily remember which cards have what features and benefits. This can be especially helpful if you have multiple credit cards from different banks or if you're trying to keep track of your spending.

These nicknames are also a great way to differentiate between personal and business cards. For instance, you may have a "Personal Chase" and a "Business Chase," or a "Grocery Visa" and an "Eating Out Visa." With nicknames like these, it's easy to recall which card is for which purpose.

A credit card nickname is a user-defined identifier useful in distinguishing among multiple credit cards kept on file for use when you're shopping online, giving someone your number over the phone, or filling out online forms. Think of assigning a nickname to your credit card as a way to avoid mixing up which card you want to use for a particular purchase.

A "preferred name" for your credit card refers to banks allowing their users to assign a name that's not their legal name to their credit, debit, or banking accounts. One example is using your preferred name Bill when your legal name is William.

A timely example of this concerns the transgender community. Seventy percent of transgender people don't have banking documents or IDs showing the names they choose to be known by in their everyday lives. Almost 33% told the National Center for Transgender Equality they were denied services when trying to use "outdated" documents.

While the process of getting your name changed on a credit card takes work, it's not especially difficult. Once you have all your documents in order, the change can happen easily — as long as you're patient and prepared.

A credit card nickname doesn't change the name of the account holder; it simply changes how the card is described as you use it.

As the card's user, you can assign a description or name to any and all of your credit cards and use it as the card's unique ID. For most people, remembering a nickname is much simpler than remembering the string of numbers that make up your credit card account.

Digital wallets and applications will often ask you for a nickname you want to create or have already assigned to your credit card. You're not required to have a nickname, and if you choose not to, the app will just default to the last four digits of your account as an identifier.

While we can't give you a one-size-fits-all list of instructions on how to add a nickname to your credit card, we can give you a general idea of how to do this. The exact instructions will vary from website (or app) to website, but this should help give you a good idea of the process.

The first step you'll need to do is save your cards to your device. You'll be asked for the following:

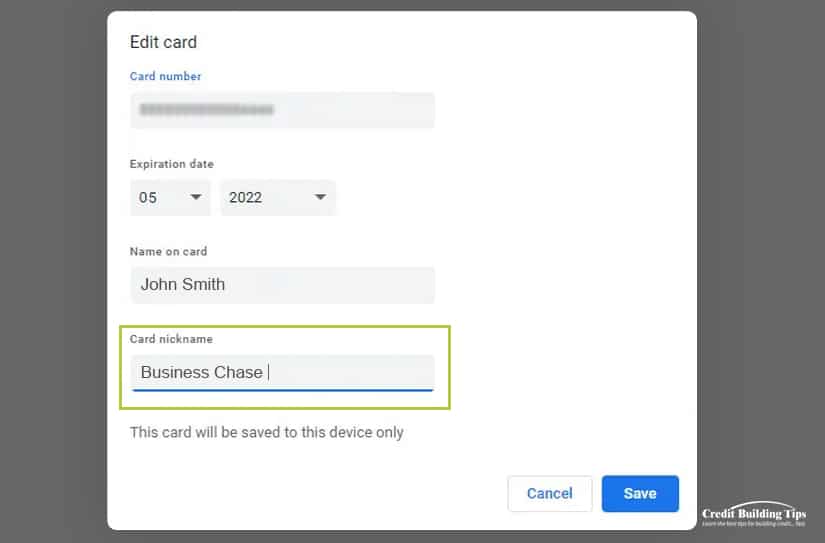

Once you've filled in the information (correctly to make sure your card works), some sites will automatically prompt you to give your card a nickname. If you get this prompt, you'll want to click on it. If you don't automatically get this prompt, you will need to input your payment settings.

Choose the card to which you want to assign a nickname. It's worth double and triple-checking at this point as it will create problems for your book balancing if you mix up which card gets what nickname!

A dialogue box will pop up, and you'll get to type in the nickname you want to use. Once that step is completed, click the "Save" button.

Rinse and repeat for every card you want to give a nickname.

Next time you want to buy something, you can simply click on the nickname of the card you want to use. Easy and convenient!

If you want to edit a nickname, you can search your payment settings, click on them and locate the "Edit" button's dialogue box to change the name. If you don't want to use the card, you can also search your payment settings, click on them and locate the "Delete" button's dialogue box to take the card off your account.

No, not all vendors let you assign a nickname to your credit cards when you use them to make a purchase.

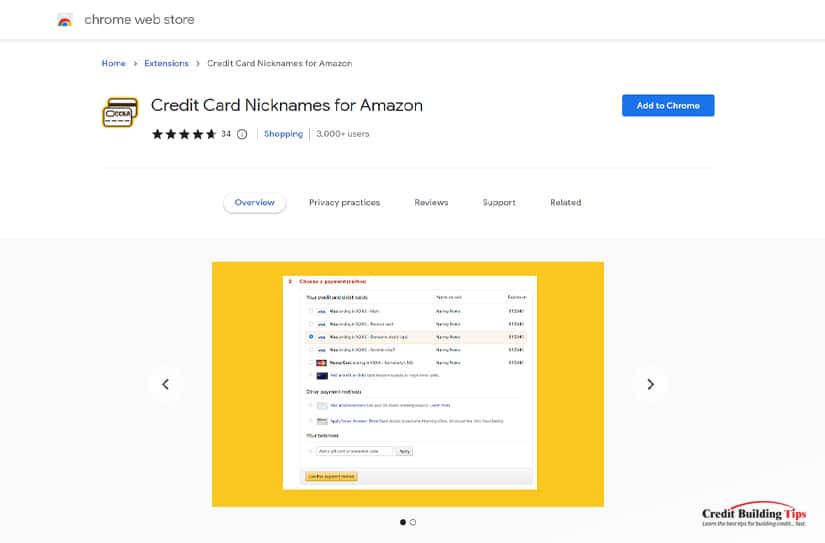

No, not all vendors let you assign a nickname to your credit cards when you use them to make a purchase.Amazon, for instance, doesn't (yet) have a way to let you assign nicknames to your credit cards if you have more than one stored on your account. However, according to The Big Tech Question, there is a browser extension that lets you create a workaround for this.

The first step is downloading and installing "the Credit Card nicknames for Amazon browser extension." You can find it on the Chrome Web Store, and it works with Google Chrome, Microsoft Edge, Vivaldi, and other web browsers based on the "Chromium engine."

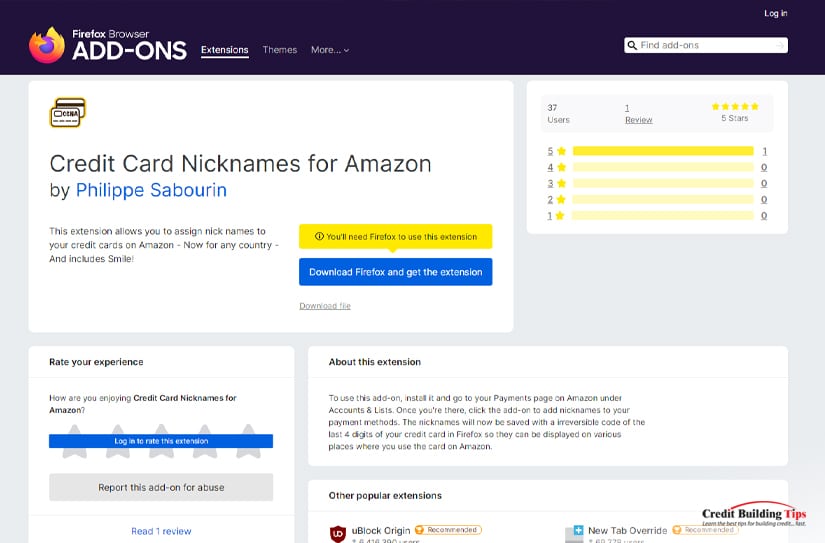

Using Firefox? Here's their browser extension. Unfortunately, there doesn't appear to be a version for Macs using Safari.

After you install the extension in your browser, go to your Amazon checkout card and click on the small credit card icon at the top of the browser window. You may need to expand the window in order to see the icon.

Now when you're asked to select a payment card, you'll have an opportunity to create a nickname for every payment card you have on file. Before you assign a nickname to the card, you should see just the last four numbers of the card.

Now when you visit your checkout, your available cards will be displayed along with a text label showing your nickname. Note that while this workaround works for the Amazon website, it doesn't carry over to the Amazon apps.

Choose a nickname that's easy to remember. While few people can remember (correctly, at least) their 16+ credit card numbers, the point of assigning a nickname is to make it easy to remember. But if your credit card nickname is too obscure, you may not recognize which card it is connected to when you go to pay.

There are a couple of ways to distinguish one credit card from another. You can identify your card by its network:

If you own more than one of the same cards issued by the same network, you could add more details, such as the types of rewards or benefits the card gives you:

Alternatively, you can give your credit card a nickname that identifies how you use it:

Another way to make sure that you can quickly and easily identify your cards is by utilizing visual cues. If there's a picture on the card, use that as a basis for your nickname. For example, if you have a card with a beach scene on it, you might call it "Beach Getaway."

Some databases won't let you input spaces or special characters or may have a limit to how many characters you can use in the field set up for nicknames. If you've developed a system to help you remember multiple nicknames, you may encounter an issuer who won't create one with a special character or number.

When setting up a password, it's generally considered more secure to include upper and lower case letters, numbers, and symbols, as this greatly increases the possible combinations of your password.

Good advice for creating a strong password includes the following:

Using nicknames can also help you track your spending more effectively. Since each nickname will be associated with a specific card, you'll be able to easily identify where your purchases came from and how much you've spent on each card.

This can be especially helpful if you have one credit card for your personal expenses and one for your business. At the end of each month's credit cycle, you'll be able to quickly see how many business expenses you have as opposed to the total of personal expenses you've incurred during the time frame.

Assigning a nickname to your credit cards is one way to help protect yourself from someone stealing your card information and using it for themselves. But today's savvy thieves and hackers continue to come up with creative ways to work around the best security measures created, like chip and pin technology.

Along with assigning your card a nickname, here are some other ways to protect yourself from identity theft and from someone using your card for their purchases:

Spyware can be installed on your computer without you even knowing about it. Opening or downloading a file from an unfamiliar email or website is one way hackers can compromise your credit card without it leaving your wallet.

Phishing emails are sent out for just this purpose. A link that's clicked on one of these emails can automatically let the hacker view your keystrokes and "read" your account number as you shop online.

That's all they need to access your credit card number and use it. Always verify the legitimacy of anything you download and consider buying and installing antivirus software.

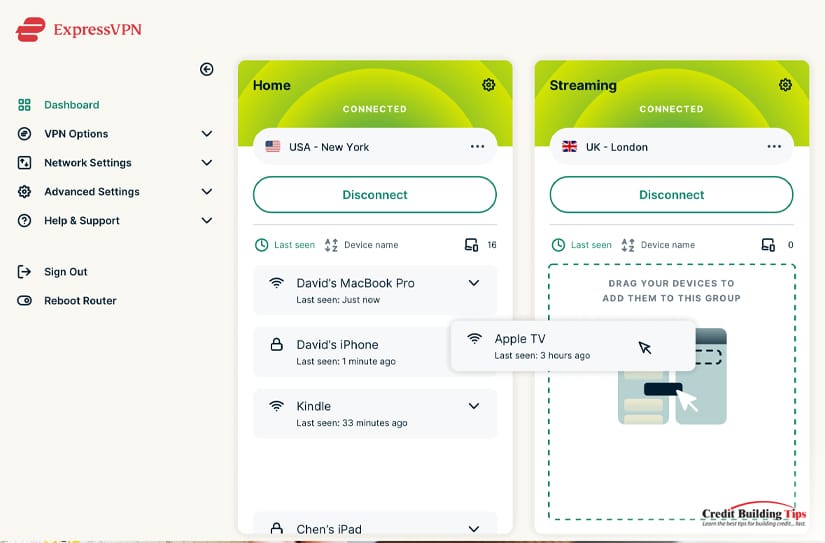

Using public Wi-Fi networks can also put your online security at risk. These types of networks often allow someone to monitor your screen and see your account information or sensitive documents. You'll have no idea this has happened until purchases are made by someone that's not you.

The best protection against this is to install a Virtual private network. A VPN is a subscription service that "encrypts your activity on the internet and keeps your identity hidden while browsing."

Installing new updates to your operating systems will keep your OS, apps, and browser up-to-date. Almost all updates include security fixes in an effort to help keep hackers from accessing your system. As well, continue to review your security settings and make sure to prevent websites from tracking your movements.

Shutting down your computer overnight is a simple way to lower your visibility to hackers. They tend to look for targets that are available, and turning off your computer breaks any connections a hacker may have set up with your computer. This makes it less worthwhile for someone to try to break in and steal your information.

In the same vein, backing up your computer, while it doesn't protect your computer, can be critical if your information is compromised and destroyed. This lets you re-establish and rebuild your data more quickly.

Looking for more ways to protect your credit rating? Subscribe to our blog, and you'll get helpful information and tips on how to stay out of debt and become financially healthy.