There's no single thing called a "credit builder program"; instead, there are a handful of different financial and non-financial programs you can enroll in to boost your credit. Some of them work, some are minimal in their impact, and some are scams.

How do you know which is which? What should you pursue?

Let's dig in!

Credit builder programs generally fall into a few categories.

While they each work a bit differently, they are all designed to help individuals boost their credit score by establishing a pattern of on-time payments to creditors.

To see how these all work, let's talk about them in greater detail.

Let's start with credit-building loans.

You take out a loan for X amount of money at Y% interest with a typical loan. You make payments over time, showing your reliability and improving your credit score. You also pay interest, which can be steep over time. However, it's also a risk; you use the money from the loan to buy something, and you have to come up with the funds to repay it.

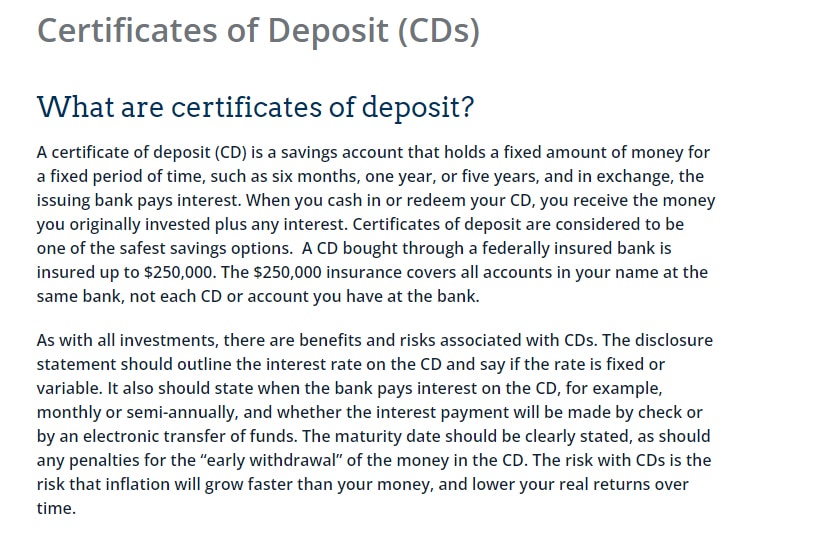

When you take out a loan with a credit builder loan, you aren't given the money. Instead, the money is put into a short-term savings or investment account, like a Certificate of Deposit (CD), where it can earn some interest.

Then, for the duration of the loan's terms, you make payments towards the loan. Making regular payments towards a loan builds your credit, and since the loan values are usually small (often under $1,000), the payments are easy to make, and the hit to your credit utilization is low.

So, wait. If you're paying a company to hold money in a savings account in your name, how do you benefit, other than your credit score? Well, when you finish paying off the loan, the loan's value is returned to you. The savings account/CD is cashed out and given to you.

You end up building your credit, and the only costs are:

Because the company controls the money the entire time you're making payments, it's no risk to them, so they're much more willing to issue these loans to people with bad or no credit, unlike a typical financial institution. And, because you aren't given the money until you fully pay off the loan, there's no temptation to splurge and waste the money, then fall off the wagon in paying.

A credit builder loan is often a short-term loan, though some servicers offer them up to 10-year terms. Making regular payments on a credit builder loan can potentially increase your credit score between 25 to 75 points.

A credit builder loan is often a short-term loan, though some servicers offer them up to 10-year terms. Making regular payments on a credit builder loan can potentially increase your credit score between 25 to 75 points.Typically, a debit card is tied directly to your bank account and pulls money immediately in an ACH transaction when you pay for a product or service. Money is transferred immediately, with no need for a line of credit, interest calculations, monthly payments, or any other trappings of a credit card.

Since debit cards require you to have the funds on hand, it's essentially just like cash. The transaction isn't reported to the credit bureaus because it doesn't say anything about your ability to handle credit, just cash on hand.

Unlike credit cards, you can't go into debt with a debit card (unless you overdraft your account, which the financial institution typically disallows). It doesn't count as part of your credit utilization.

A reported debit card is a twist on this concept. It works like a debit card, linking to your bank account and only allowing you to buy things if you have the money on hand. However, it also works like a credit card by putting the transaction on a line of credit to be repaid.

The difference is the repayment terms. With a credit card, your debts are tallied up, and you're issued a monthly bill for part of the overall balance, while any remaining balance accrues interest. With a reported debit card, your transactions are due for repayment within 24 hours, and the money is debited from your account automatically.

This strategy is no different from monitoring your credit card and paying off any outstanding balance every day or week. However, doing so with a credit card requires you to have the discipline to do so and the funds on hand if you make a purchase beyond what you have available in your bank account. With a reported debit card, you can't buy anything you don't have the money on hand to pay for.

In exchange for the tighter limitations on buying with the card, your reported debit card is reported to the credit bureaus. And, since the card requires you to have the money to pay it off before you use it, it's low-risk to the issuer, so they're willing to issue it to individuals with poor credit.

These debit cards can boost your score anywhere from 5 points to a whopping 100 points, depending on your initial credit score and how frequently you use the card.

These debit cards can boost your score anywhere from 5 points to a whopping 100 points, depending on your initial credit score and how frequently you use the card.Consider all of the bills you have to pay regularly to survive.

Sure, some of these aren't essential – nobody needs a Netflix subscription to survive – but they're usually bills that you regularly pay, on time, every month. Why shouldn't that be reported to the credit bureaus? It's proof that you can pay a regular monthly bill, on time, with no delinquency issues.

Any of these can be reported to the credit bureaus, but it's usually the responsibility of the company issuing you the bills. It's also expensive for those companies, and a company like Netflix or your property manager/landlord doesn't want that added expense for no benefit to them. Thus, those bills are never reported.

Unfortunately, you cannot self-report your own bills. Only officially-designated "data furnishers" can report bills. That's where bill reporting services come in.

Unfortunately, you cannot self-report your own bills. Only officially-designated "data furnishers" can report bills. That's where bill reporting services come in.Bill reporting services come in two forms.

1. The first is usually for rent. You give the rent reporting company read-only access to your bank account, so they can scan your bank statements for rent payments and report those payments to the credit bureaus. They can generally report up to the last two years of rent payments immediately, which can be a massive boon of up to 40 points of credit score growth near-immediately.

There may be some restrictions, however. You need to have a valid rental agreement for these services to verify your payments, and they may not be able to confirm if you pay in cash, even if you withdraw the cash regularly. They're verifying a specific transaction, after all.

You can also enroll in ongoing reporting, usually for a minor (under $5) monthly fee.

2. The second form of bill reporting works for other bills, like your utilities or your entertainment.

They work by, essentially, issuing you a heavily-limited credit card. You switch your payment method on those services to the credit card, and the credit card charges you for the bills every month just like if you were paying the bills as you typically would. The only difference is where your money is going and where the money is coming from that Netflix or your utility company sees.

Because it's technically a credit card, it builds your credit by showcasing credit utilization and regular payments reported to the credit bureaus. They also generally don't charge interest because you're guaranteed to pay off your balance every month, or they stop paying your bill for you.

Unlike rent reporters, bill reporting doesn't reach back and report historical payments, so you need to enroll and use the service on an ongoing basis. Thus, your credit growth will build over time but starts small.

If you have low credit or no credit, it can be tough to get started. Many credit issuers will either not give you the time of day or will only offer you programs with extremely steep interest rates or very unfavorable terms.

Credit building programs take advantage of loopholes or structures in payments that:

As such, they can help you if you're in a position to use them.

There are always downsides, though.

You "take out a loan" with a credit-building loan, but you don't get the money until you're done paying it off. So, you're essentially just paying money for nothing except a boost to your credit score. It's an added bill that may not be feasible to support if you're already tight on cash.

Reported debit cards require you to use them properly, though if you already use a debit card, there are no real drawbacks.

Bill reporting also tends to be limited in that it can only report certain kinds of bills, so you have to have those bills first. Rent reporting won't work if you've spent time homeless, pay your rent informally, or don't have an official rental agreement.

These are all more favorable to you than many other forms of building credit. Unlike secured credit cards, you don't have to worry about the risk of going into debt, and you don't need the sizable up-front payment. Unlike becoming an authorized user on someone else's card, you don't have to have a friend willing to risk their credit for you.

The truth is, these programs work. How well they work depends on the program you use, your existing credit, and other factors that might be suppressing your credit. Many people will see a jump of anywhere from 20 to 100 points, depending on those various factors.

The truth is, these programs work. How well they work depends on the program you use, your existing credit, and other factors that might be suppressing your credit. Many people will see a jump of anywhere from 20 to 100 points, depending on those various factors.These are some of the best options for improving your credit quickly and effectively. You need to make sure you're financially able to keep up with the payments and pay the small fees associated with using the services. Rent reporting, for example, might charge you $2-5 per month. It's minuscule, but it's still essential.

Please give them a look. There are dozens of companies providing these services today, so you have plenty of choices. Find the ones that work best for you. Whether you're having trouble securing a mortgage or trying to get your first credit card, these credit builder programs can be a huge help to prove to the credit bureaus that you're capable of making on-time payments.

Do you have any questions about any specific credit building program? Are you thinking of trying one of these credit-building programs, or have you used any of them in the past? Please let me know! I'd love to get a conversation started on this subject for the benefit of everybody reading and working to boost their credit score.