When incorrect information shows up on your credit report, the next step is to open a dispute with the credit bureau that is displaying the error. This opens an investigation, which normally takes about thirty days.

During this time, the account in question will likely show a "dispute comment." This is an indication that there is currently a dispute under investigation.

Dispute comments usually shouldn't be a problem, but sometimes mortgage lenders will want them removed because they will temporarily mask the account from being calculated as a part of your credit score. Additionally, you might want a dispute comment removed because it is making your credit score artificially low.

Dispute comments usually shouldn't be a problem, but sometimes mortgage lenders will want them removed because they will temporarily mask the account from being calculated as a part of your credit score. Additionally, you might want a dispute comment removed because it is making your credit score artificially low.Removing dispute comments isn't always a good idea, so it's important to determine whether or not it will be advantageous to you. You can ask credit bureaus to remove dispute comments by calling them and talking to a representative or sending a letter via mail or fax.

Anytime you file a dispute regarding one of the accounts that appear on your credit report, an investigation into the claim will begin. This is the case whether you question the validity of an account or information about an account with the credit bureaus or with a debt collector.

These investigations usually take about thirty days to be completed. During this time, the account will be marked on your credit report as “disputed.”

Your right to dispute information on your credit report is outlined in the Fair Credit Reporting Act (FCRA). In this Act, companies that provide information to credit bureaus have:

“...specific legal obligations, including the duty to investigate disputed information.”

Since there will be a period of time after you file a dispute and before the investigation is over, this comment serves to indicate that there is a dispute or disagreement regarding specific information that is found on your credit report. In most cases, dispute comments are added when a consumer believes that certain information is incomplete, inaccurate, or misrepresented.

If you are looking at your credit report and you see a dispute comment, there are two primary forms it can take:

This first type of dispute comment means that there is an active investigation underway after a dispute has been filed. When applying for a home loan, lenders will usually want to see these notes removed before determining whether to approve you for a mortgage and, if so, what rates and terms to offer. This is because the account won’t be factored into your credit score via FICO credit scoring models.

If the second type of dispute comment appears, it means that a resolution has been reached after the completion of the investigation. This particular type of dispute comment won’t be something that bothers lenders, as the account will once again be incorporated into your credit score calculation.

Are you ready to improve your credit score and clean up your credit report? Check out our guides to credit repair hacks, credit repair services, and repairing your credit after you're the victim identity theft.

Removing a dispute comment isn’t always necessary and isn’t always favorable. In the next section, we’ll discuss when you should and should not ask for dispute comments to be removed from your credit report. In this section, however, we’ll look at the steps you need to take to have a dispute comment removed, assuming that you have already decided that this is the right course of action.

The fastest way to have dispute comments removed from your credit report is going to be calling the credit bureaus. Though this can be frustrating as it often means sitting on hold for a while, you’ll find that it’s a much quicker way of going about it than sending a letter through the mail.

Here are the numbers and subsequent menu items to select that you’ll want to try in an effort to speak with an actual human:

If these numbers don’t work, your next best bet will be pulling your free credit report from AnnualCreditReport.com, which is a site authorized by Federal Law and put together by the three main credit bureaus. On each of your credit reports, you should be able to find a phone number that you can call in addition to a personal credit report ID number.

Once you have someone on the phone, you’ll want to tell them that you want to have a dispute comment removed from some of your accounts. If you are doing so because you are pending mortgage approval, mention that the lender has asked you to do so in order to move forward with your home loan.

If you’d prefer to write the credit bureaus rather than call them, you will want to enclose a copy of each of the following with a letter sent via certified mail or fax:

Here are the addresses you can use to mail your request to have a dispute comment removed:

The fax numbers for each credit bureau are not listed on their website, which means you might need to call and confirm the current and correct fax number to use. Given this, you might find that simply dealing with deleting the dispute comment over the phone is the quickest way to resolve the issue.

You might think that it’s always a good idea to remove dispute comments from your credit report, but this isn’t necessarily the case.

There are really only two reasons that you should go through the trouble of asking the credit bureaus to remove dispute wording from your credit report:

If you have derogatory marks on your credit report, it can really make it difficult to get approved for a loan with good rates and terms. If it's time to clean up your credit report, take a look at our guides to removing charge offs, removing collections, removing hard inquiries, removing evictions, and removing 30-day late payments from your credit report.

It isn’t always easy to know whether or not removing dispute comments will increase your credit scores. However, if you know that the account is in excellent standing, you might want to remove the dispute comment if you are currently applying for a loan or line of credit.

That being said, it’s possible that the account is increasing your score in one way and decreasing your score in another, leaving you with a net neutral result when removing the dispute comment. It can be pretty tricky to figure out whether an account is going to help or hurt your score, so you’ll want to proceed with caution.

If you’re applying for a home loan, there’s a chance that your mortgage program might require that dispute comments are removed before the process can be completed.

The four most common mortgage programs out there are:

Each of these programs is going to have its own unique underwriting rules. The underwriting rules for each respective program are going to govern things like:

In many cases, mortgage loan programs will allow some types of dispute comments to remain on a credit report. For example, FHA loans don’t require that dispute comments are removed from medical accounts and accounts with zero balances. Additionally, dispute comments don’t have to be removed for an FHA loan if the total balance of these accounts in dispute is less than $1000.

When the digital version of your credit report is run through the automated underwriting service run by your loan program, it’s possible that dispute comments won’t trigger an alert regarding a disputed account.

In some cases, you might find that it is a better option to switch loan programs rather than to remove dispute wording on your credit report. Once the account is unmasked, it's possible that it will drop your credit score enough that you will no longer qualify for the loan program you were initially approved for.

Before we sign off, let's take a closer look at the answers to some commonly asked questions about credit report dispute comments.

Credit report disputes can indirectly impact your credit score. FICO credit scoring systems will not take accounts that are actively in dispute into consideration when calculating your score. Even though the dispute comment will show up on your report, the entire account will not be used to help determine your score.

Depending on the status of the account, this could mean that your credit score is artificially lower or higher than it would be if the account was factored in. Until the comment is removed, FICO credit scoring models will not incorporate the account into their calculations.

If you are applying for a home loan, a lender will often be able to see that there is a dispute comment on your report and will know that this is impacting your true credit score. They will, therefore, likely want the comment to be removed before making a decision about your loan so that they know they are viewing an accurate credit score.

Dispute comments will usually stay on your credit report until the investigation has been completed and the dispute has been resolved. At the point that the dispute is resolved, the information on your credit report will be updated accordingly if necessary.

That being said, sometimes a credit report will indicate in a comment that there had been a dispute in the past and the dispute has been resolved. In this case, these comments won't mask the account for the purposes of calculating your FICO score.

How long it takes to remove a dispute comment from your credit report is going to vary. If you are able to talk to a representative from the credit bureaus on the phone, you might find that the dispute comment has been removed in as little as four business days. If you choose to contact the credit bureaus via fax or snail mail, it might take as long as thirty days.

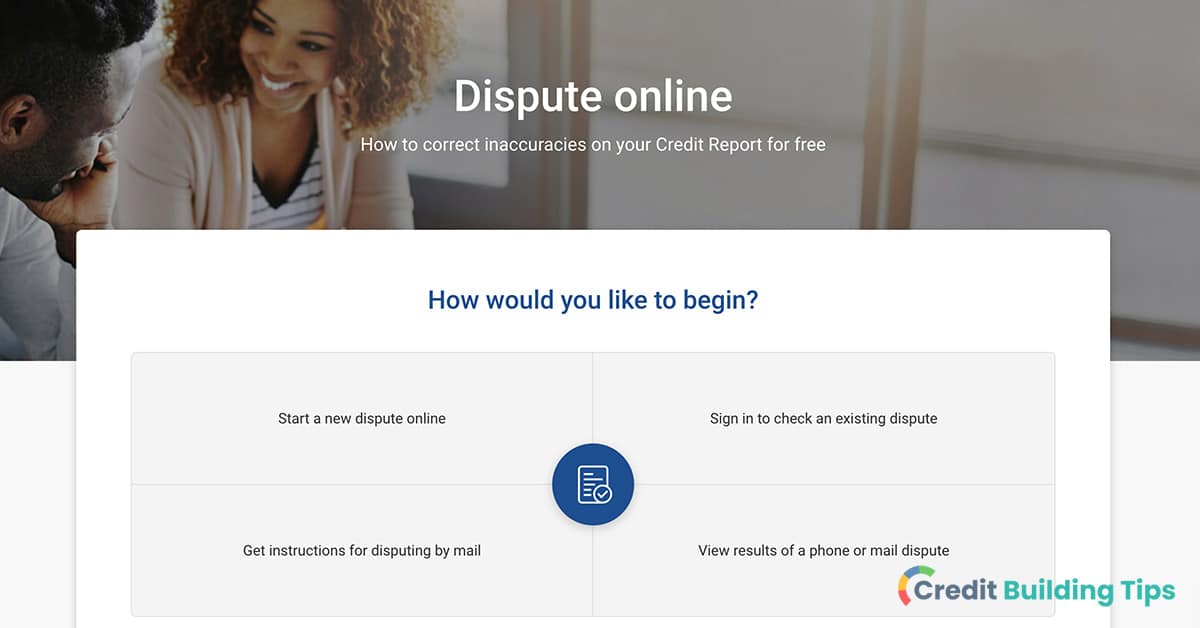

Anytime you find inaccurate information on your credit report, you can dispute it with the credit bureau. All of the credit bureaus have online portals that you can use to dispute information, making the process simple and easy to get started.

It's worth noting that there are certain items on your credit report that aren't disputable. Though it is within your legal rights to dispute credit report information, some info is maintained "as a matter of factual record." Though it is possible under some circumstances, you usually cannot remove information that is factually correct.

The outcome of a dispute could impact your credit, but the dispute itself should have no effect on your credit.

For example, let's say a late payment showed up on your credit report, but you did actually pay on time. If you dispute the information and it is corrected, it will probably help your credit score.

If you are disputing personal information such as the name or address that appears, though, this won't impact your credit score.

The nature of the information that is being disputed will impact the results of the dispute. Once the dispute has been resolved, an outcome description might be added to your credit report.

If you are filing a dispute that is related to your personal information, it can result in:

If you are filing a dispute that is related to accounts, inquiries, or bankruptcy, it can result in the following:

Improving and building your credit might not sound like your idea of a good time, but you might get a bit more excited about it when you realize how much money it could save you and the financial opportunities it can open up for you.

Cleaning up your credit report and boosting your credit score can end up saving you tens of thousands of dollars in interest over your lifetime, as you'll end up receiving much more favorable rates and terms when you borrow money.

Beyond that, credit scores and reports can be taken into account when you apply for an apartment, a job, or insurance. When you consider just how impactful your credit is on the practical realities of your life, it's worth taking the time and putting in the effort to improve your credit.

Are you ready to begin the journey of cleaning up your credit report and boosting your credit score? Make sure you take a look at all of the resources on our Credit Building Tips blog.