Did you know there are nearly 40 credit reporting agencies in the U.S.? But you've probably only heard of three of them as they're the ones regularly, and almost exclusively, referred to when talking about credit bureaus.

The three main credit reporting agencies are TransUnion, Experian, and Equifax.

They collect information on how Americans manage their financial obligations and then sell that information to lenders and credit-scoring companies. Lenders and credit-scoring companies then use that information to determine whether someone is a good loan or credit card candidate, how much they can safely loan them, and what interest rate they should offer.

While there's no need to keep these three agencies on your contact's "favorites" list, it is good to know how to get in touch with them if the need arises.

As you'll read below, each credit reporting agency has an extensive database. Forbes Advisor puts the number at approximately 220 million U.S. consumers. Whenever you apply for a loan or a credit card, it's "almost a given" that the lender will look at the credit reports compiled by at least one of these agencies.

They gather the lion's share of information about individuals and businesses from "data furnishers." These include lenders, banks, credit card issuers, collection agencies, and others. They can also gather information from public records and from data aggregation companies like Public Access to Court Electronic Records (PACER) and LexisNexis.

Equifax was founded in 1899 and is the oldest of the big three credit bureaus. It's currently headquartered in Atlanta, GA, and has approximately 11,000 employees. Their strongest presence in the U.S. is in the south and midwest, and they operate or have investments in 24 countries.

They collect and "aggregate" information on over 800 million consumers and more than 88 million businesses around the world. In addition to collecting credit and demographic data, they also sell credit monitoring and fraud prevention services to customers.

Equifax is a publicly owned company (stock ticker symbol EFX), and Better Business Bureau currently gives them an A rating. In spite of this rating, they've come under scrutiny for violating the FCRA.

TransUnion was founded 54 years ago, and its headquarters are located in Chicago, IL. Like Equifax, they are a publicly owned company, and as of 2021, reported having 10,100 employees. It's reported to be the smallest of the big three credit agencies.

The latest numbers from TransUnion say they have a consumer credit database of 1 billion consumers in 30+ countries. Their global customer base extends to over 65,000 businesses, and they offer more than 3 billion updates per month from data providers.

The largest shareholders of TransUnion stock (stock ticker symbol TRU) are Goldman Sachs and Advent International. They have an A- on their Better Business Bureau rating but have also dealt with lawsuits and government penalties relating to credit-reporting practices over the years.

Experian is the youngest of the big three credit agencies, founded in 1996 in Dublin, Ireland. They're an American-Irish multinational data analytics and consumer credit reporting company. Their U.S. headquarters are located in Allen, TX, and they have over 20,000 employees in 43 countries.

Experian was created when the "now-defunct British retailer GUS acquired TRW Information Services — the largest U.S. credit bureau at the time." Since then, Experian has expanded around the globe, with operational hubs in England, Brazil, and California.

Its business focuses on credit, marketing, consumer services, and analytics. Experian tracks information on consumers, businesses, insurance, motor vehicles, and "select lifestyle characteristics."

Publicly owned (stock ticker symbol is EXPN.L), they have the lowest Better Business Bureau rating at B+. Experian has also experienced its fair share of legal woes, with consumers reporting outrage over a hard-to-cancel monthly subscription service that was offered as a "free credit report."

Even worse, 60 Minutes aired a segment about the number of errors on American credit reports. The news show interviewed three former Experian employees who described their experiences of company policies restricting them from fully investigating consumer disputes.

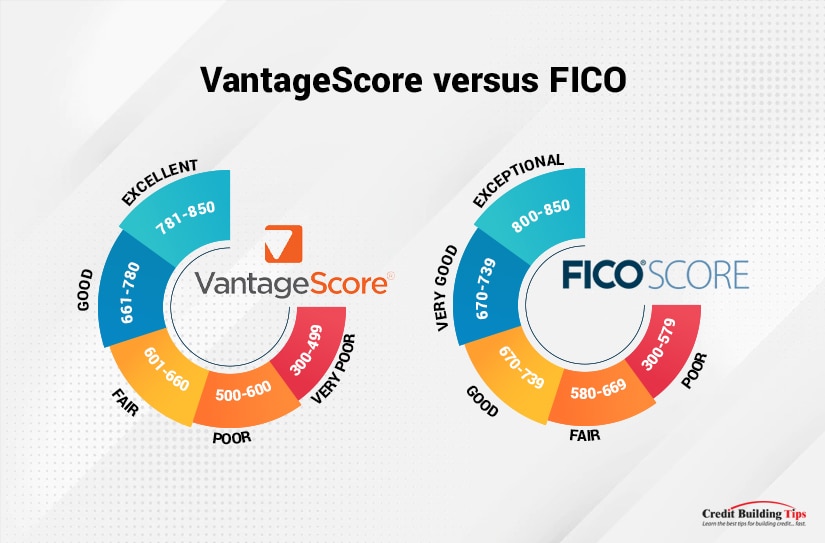

Before 2006, credit scores were generated by the Fair Isaac Corporation (FICO). In order to compete with FICO, TransUnion, Equifax, and Experian joined forces to create VantageScore. The first VantageScore model — 1.0 — could score 15 million more people than FICO had previously done.

In 2022, the latest tri-bureau credit scoring model is VantageScore 4.0. This version added features that let the model score 37 million more U.S. adults than was possible previously.

FICO and VantageScore use the same range for credit scores — 300 to 850- but they use different calculations to determine your credit score. FICO uses five categories of information and designates lending risk as poor, fair, good, very good, and exceptional. VantageScore uses six categories of information and designates lending risk as very poor, poor, fair, good, and excellent.

Many people view checking their credit report like they would view going to their doctor. They only think about making a doctor's appointment when something is wrong. Most of us don't consider regular medical checkups necessary unless we have an ongoing health concern.

We'd like to suggest you think about reading your credit reports more as you think about going to your dentist. Most people make regular dental appointments to have their teeth cleaned to ensure their mouth stays healthy, and so we're aware of any issues before they become major ones.

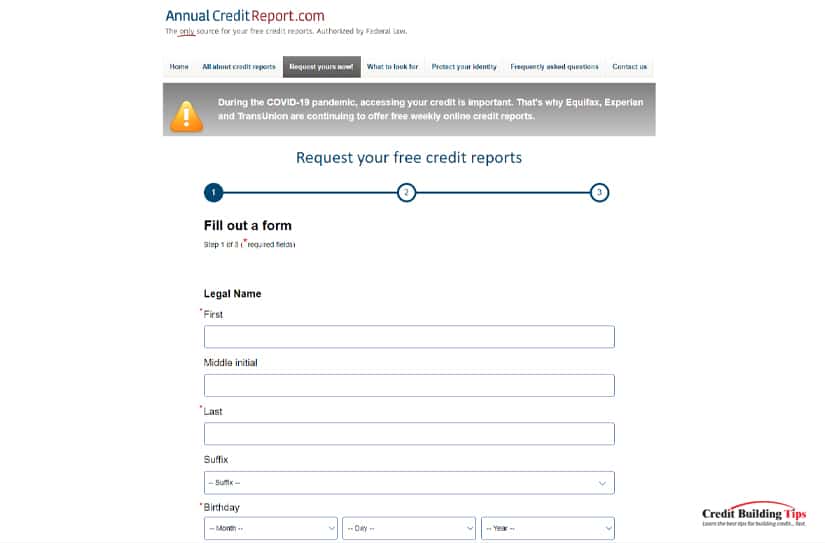

Regularly checking your credit report is one good way to be aware of the health of your finances. The government seems to agree, as they offer you a free copy of your credit report every year. Due to the COVID-19 pandemic, they're offering free weekly online credit reports through December 2023.

Three important reasons to check your credit report regularly are:

According to Alvenetta Wilson, Business Office Technology professor at San Jacinto College, one of the biggest misconceptions people have about credit bureaus is that:

"There's no reason to check their credit often if they have decent credit because the credit bureau produces accurate information."

Unfortunately, if you further research the history of the three main credit bureaus, you will find several instances of data breaches, lawsuits, fines, and even, in some cases, charges by the U.S. Department of Justice for sales to identity thieves.

Most recently, a Tennesse woman brought a lawsuit against all three credit bureaus, alleging the companies violated the U.S. Fair Credit Reporting Act. TransUnion, Equifax, and Experian all marked the woman as "deceased" on credit reports they created and then sold to third parties.

The complaint charges that these credit bureaus:

"Violated the FCRA by failing to follow reasonable procedures to assure the maximum possible accuracy of the information they reported about our client, which led to the companies falsely claiming our client was deceased."

The woman has disputed the inaccurate information since September 2021. Frustratingly, "all three companies allegedly lack the procedures to confirm a consumer is deceased even when the consumer communicates directly with them."

Hopefully, this will help you see how checking your credit reports might be worthwhile. An important part of becoming and staying financially healthy is knowing what's on your credit report and how to deal with any errors and possible fraud.

While it's impossible to walk through the front door of any of these offices, we've found as many ways as possible for you to contact and communicate with Equifax, TransUnion, and Experian.

Website: Equifax

Mailing address:

Equifax Information Services LLC

P.O. Box 740241

Atlanta, GA 30374-0241

Note: If you are mailing any type of dispute letter to Equifax, make sure to send it by certified mail and get a return receipt. If you are asked to include supporting documents, make copies, and don't send the originals. Unless you're specifically asked to. Then make a copy for yourself and send the original.

Note: If you are mailing any type of dispute letter to Equifax, make sure to send it by certified mail and get a return receipt. If you are asked to include supporting documents, make copies, and don't send the originals. Unless you're specifically asked to. Then make a copy for yourself and send the original.Phone number: 1-866-640-2273

Calls to this number are answered by a real person, and a call-back is available. The best time to call is 9:05 am, with an average wait time of 20 minutes.

Call center hours are:

9:00 am to 9:00 pm (E.T.) Monday through Friday

9:00 am to 6:00 pm (E.T.) Saturday and Sunday

Email: My Equifax

Website: TransUnion

Mailing address:

TransUnion

P.O. Box 1000

Chester, PA 19022

Note: If you are mailing any type of dispute letter to TransUnion, make sure to send it by certified mail and get a return receipt. If you are asked to include supporting documents, make copies, and don't send the originals. Unless you're specifically asked to. Then make a copy for yourself and send the original.

Note: If you are mailing any type of dispute letter to TransUnion, make sure to send it by certified mail and get a return receipt. If you are asked to include supporting documents, make copies, and don't send the originals. Unless you're specifically asked to. Then make a copy for yourself and send the original.Phone number: 1-800-916-8800 (Customer service)

Calls to this number are answered by a real person, and a call-back is available. The best time to call is 8:15 am, with an average wait time of 22 minutes.

Call center hours are:

8:00 am to 11:00 pm (E.T.) Monday through Friday

8:00 am to 5:00 pm (E.T.) Saturday and Sunday

1-833-806-1626 (Tech support)

Call center hours are:

8:00 am to 9:00 pm (E.T.) Monday through Friday

8:00 am to 5:00 pm (E.T.) Saturday and Sunday

Social: @AskTU (Facebook)

@Ask T.U. (Twitter)

Private messages or D.M. center hours are:

5:00 am to 12:00 pm (E.T.) Monday through Sunday

Website: Experian

Mailing address:

Experian

P.O. Box 2104

Allen, TX 75013-0949

Note: If you are mailing any type of dispute letter to Experian, make sure to send it by certified mail and get a return receipt. If you are asked to include supporting documents, make copies, and don't send the originals. Unless you're specifically asked to. Then make a copy for yourself and send the original.

Note: If you are mailing any type of dispute letter to Experian, make sure to send it by certified mail and get a return receipt. If you are asked to include supporting documents, make copies, and don't send the originals. Unless you're specifically asked to. Then make a copy for yourself and send the original.Phone number: 1-714-830-7000 (Best toll-free number)

Calls to this number are answered by a real person, and a call-back is available. The best time to call is 8:15 am, with an average wait time of 21 minutes.

1-800-493-1058 (Customer service department)

1-866-617-1894 (Membership questions)

Call center hours are:

7:00 am to 8:00 pm (E.T.) Monday through Friday

7:00 am to 7:00 pm (E.T.) Saturday and Sunday

Online: Dispute online

Order an Experian Credit Report

This service will cost up to $12 (plus tax) for a one-time Experian credit report, plus you can dispute online for free.

Order an Experian CreditWorks Basic report

This service is free from Experian and will give you an Experian credit report every 30 days on sign-in and basic Experian credit monitoring, and you can also dispute online for free.

Email: support@experiandirect.com

Other:

Experian Corporate Headquarters

475 Anton Blvd

Costa Mesa, CA 92626

1-714-830-7000Experian Corporate Headquarters

955 American Lane

Schaumburg, IL 60173

1-224-698-5600

Social: Experian Facebook

@Experian (Twitter)

Experian, Equifax, and TransUnion aren't the only credit reporting agencies out there. There are many other companies that provide credit reports of various sorts. Most have picked a niche for themselves, from rent and utility tracking to monitoring checking accounts and insurance behaviors.

Here's a quick glimpse of the alternative credit bureaus and what information they track.

Background checks:

Banking:

Histories:

Identity protection analytics:

Medical records:

Motor vehicle records:

Public information:

If you think you might be the victim of identity theft, you should contact your local law enforcement, your state attorney general, and/or the Federal Trade Commission (FTC). The FTC also has helpful information on how to protect yourself against identity theft.

Website: www.ftc.gov/idtheft

Mailing address:

Consumer Response Center

600 Pennsylvania Avenue NW

Washington, DC 20580

Phone number: 1-887-IDTHEFT (1-877-438-4338)

Website: www.naag.org/naag/attorneys-general/whos-my-ag.php

You can visit this website to see a list of all 50 U.S. states, plus the District of Columbia, American Samoa, Guam, the Northern Mariana Islands, Puerto Rico, and the U.S. Virgin Islands attorney generals' contact information.