You may be surprised to learn that many Americans currently have issues with their credit scores — and it's not their fault.

In August of this year, CBS News reported that Equifax:

"Admitted last week that it misreported some consumers' credit scores."

Over three weeks this spring, the credit bureau sent out incorrect scores for consumers who were applying for mortgages, car loans, and credit cards.

The Wall Street Journal pushed back against Equifax's CEO, Mark Begor, when he said,

"The impact is going to be quite small, not something that's meaningful to Equifax."

He described the issue as a "flub," while the WSJ found that according to bank executives and others "familiar with the errors," the company provided inaccurate credit scores on millions of U.S. consumers.

A Florida woman who experienced the "flub" and found her car loan to be "substantially pricier" is now part of a lawsuit that's seeking class-action status against Equifax. Nydia Jenkins was pre-approved for a car loan in January, but it was denied in April because her credit score was off by 130 points.

Ms. Jenkins then had to buy a car from a different dealership that charged her a much higher interest rate. Her pre-approved rate would have had her paying $350 each month for the car loan, but the new rate has her paying $544 each month. That adds up to about $2,352 more each year she has the loan.

LendingTree surveyed more than 1,000 U.S. consumers to see whether they thought their credit scores "accurately reflect their financial responsibility." On the report, 42% of Americans said their credit scores stopped them from getting some type of loan.

Shockingly, 44% of Gen Zers don't know their credit scores, and 25% don't know how to find out what it is. The survey also found that, overall, 19% of all Americans don't know their credit score, and 12% admit they don't know how to check it.

Shockingly, 44% of Gen Zers don't know their credit scores, and 25% don't know how to find out what it is. The survey also found that, overall, 19% of all Americans don't know their credit score, and 12% admit they don't know how to check it.While you may or may not be one of those millions affected by the spring's problems, it certainly makes a good case for checking your credit report for errors and dealing quickly with any you find.

Not all errors are widescale as the ones I talked about above. Sometimes they're a result of simple human error. Credit files can get mixed up, data entries can be mistyped, names misspelled, or a furnisher falls behind in updating their system.

Sometimes, errors on your credit report are a sign of identity theft. If there's an account on your credit card or a loan application you don't recognize, don't wait to contact the credit bureau to investigate.

Fortunly recently posted two concerning statistics that should wake all Americans up:

If the first basic step is to check your credit score number, the next step is to check your report for any errors. And if you do find an error or two? That's where 611 dispute letters come to the rescue.

A credit report dispute letter is well-named. It's just what it sounds like — a letter you send that tells the credit bureau you don't agree with one of the items on your report.

A credit report dispute letter is well-named. It's just what it sounds like — a letter you send that tells the credit bureau you don't agree with one of the items on your report.You can send the letter directly to the credit bureau (they're also called credit reporting agencies) or to the data furnishers that gave the information to the bureau in the first place.

You can choose to send a credit report dispute letter through an online form, but experts recommend that you print a physical copy and send it through the U.S. postal system. For the price of a stamp, you get these two advantages:

The Federal Trade Commission (FTC) recommends you send your letter by certified mail and ask for a return receipt. That way, you have indisputable proof the credit bureau or data furnishers received your letter.

There are three types of credit report dispute letters. You can send a general dispute letter — simple and easy. This type of letter shows the mistake made, provides proof, and asks the bureau to fix the mistake.

Then there are the numbered credit dispute letters — 609, 611, and 623. Each of these letters references a different section of the Fair Credit Reporting Act (FCRA). The act was created in 1914 to make sure Americans had the following rights:

Not surprisingly, a 611 credit report dispute letter references Section 611 of the FCRA. Just like a 609 credit report dispute letter references Section 609 and a 623 credit report dispute letter references Section 623 of the FCRA. They're all variations on a theme.

You can think of a 611 credit report dispute letter as a second state letter. You learned about a 609 credit report dispute letter in this earlier post. If you don't get the answer you wanted from the 609 letter, a 611 letter is your second kick at the can.

You can think of a 611 credit report dispute letter as a second state letter. You learned about a 609 credit report dispute letter in this earlier post. If you don't get the answer you wanted from the 609 letter, a 611 letter is your second kick at the can.

After you write the initial 609 letter asking the credit bureau to verify an item on your credit report, they'll get back to you with one of two responses. The hoped-for response is, "Oops, our mistake. We will correct it, and the error will no longer affect your credit score." End of the correspondence.

If they respond by letting you know they checked the information and believe no error was made, you can write them a second letter. A 611 letter of dispute.

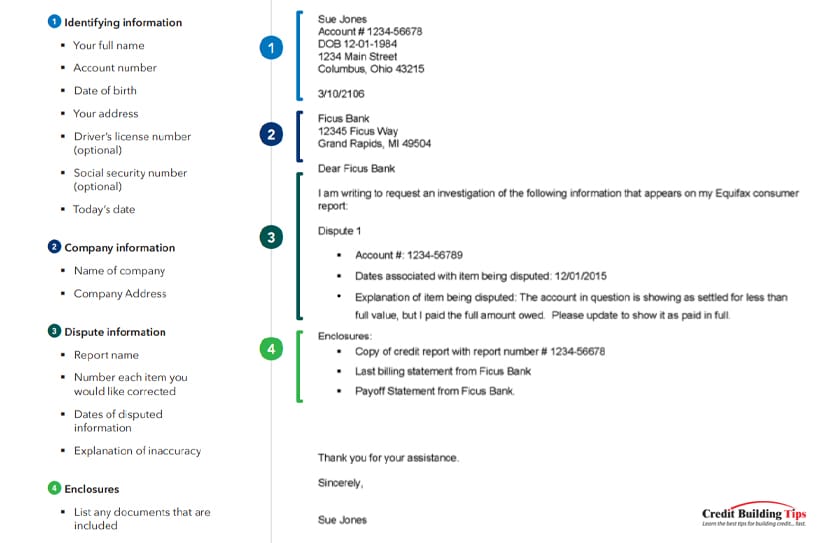

A 611 credit report dispute letter needs to include four specific parts:

1. Your identifying information:

2. The company information you're making a dispute against:

3. Dispute information:

4. Enclosures:

It's also good to know that along with sending a 611 letter to your credit bureau, you can also send a copy with the same information to the company that gave the wrong information to the bureau. For instance, if your credit report lists wrong information from your bank, landlord, or cell phone company, you could (and probably should) send them a duplicate of what you've put together to send to the credit bureau.

Make sure to keep all original paperwork. Mail one copy to the credit bureau and one copy to the furnisher. Don't forget to pay extra money to send both packages by certified mail and ask for a return receipt.

I've given you the snail mail addresses of the three main credit bureaus before, but here they are again:

Equifax Information Services LLC

P.O. Box 740256

Atlanta, GA 30374Experian

P.O. Box 4500

Allen, TX 75013TransUnion LLC

Consumer Dispute Center

P.O. Box 2000

Chester, PA 19016

Each of these credit bureaus provides an online link to download a dispute form but remember that the FTC recommends you go the extra mile and print out and mail your dispute letter with all the supporting documentation.

Another helpful tip is to dispute one error at a time. If you find a large number of errors, you may want to group them into bundles and space out the disputes.

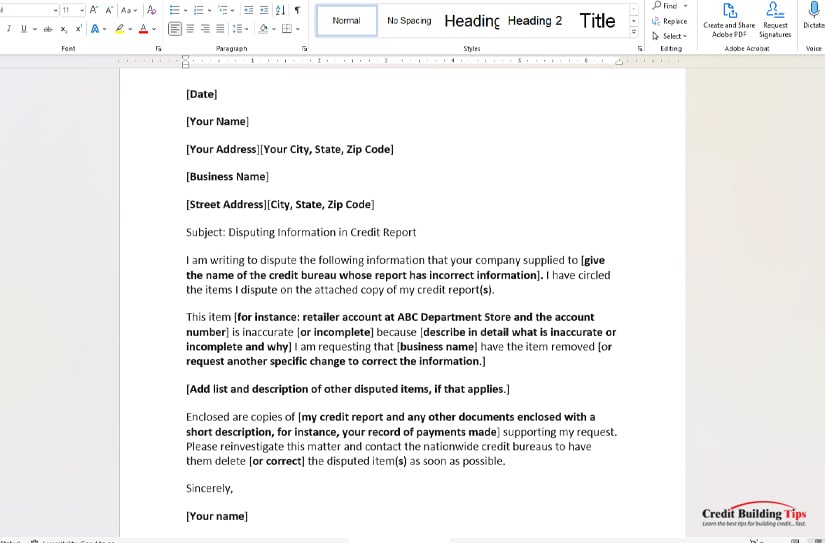

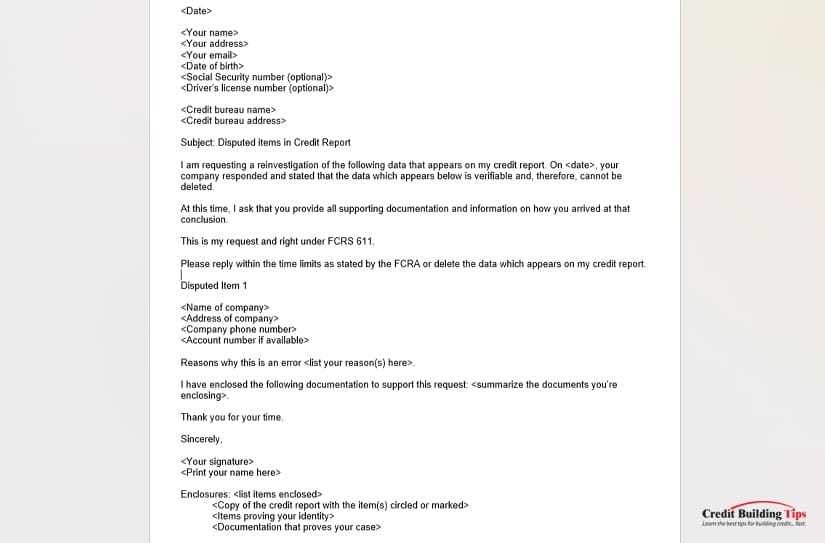

Here's a template we found on Debt.com that anyone can use for a simple 611 dispute letter:

<Date>

<Your name>

<Your address>

<Your email>

<Date of birth>

<Social Security number (optional)>

<Driver's license number (optional)><Credit bureau name>

<Credit bureau address>Subject: Disputed items in Credit Report

I am requesting a reinvestigation of the following data that appears on my credit report. On <date>, your company responded and stated that the data which appears below is verifiable and, therefore, cannot be deleted.

At this time, I ask that you provide all supporting documentation and information on how you arrived at that conclusion.

This is my request and right under FCRS 611.

Please reply within the time limits as stated by the FCRA or delete the data which appears on my credit report.

Disputed Item 1

<Name of company>

<Address of company>

<Company phone number>

<Account number if available>Reasons why this is an error <list your reason(s) here>.

I have enclosed the following documentation to support this request: <summarize the documents you're enclosing>.

Thank you for your time.

Sincerely,

<Your signature>

<Print your name here>Enclosures: <list items enclosed>

<Copy of the credit report with the item(s) circled or marked>

<Items proving your identity>

<Documentation that proves your case>

Once the credit bureau receives a 611 letter, they are required by law to

"Conduct a reasonable reinvestigation to determine whether the disputed information is inaccurate and record the current status of the disputed statement, or delete the item from the file…"

In other words, if you ask them to check again, they must do so. And they need to do it free of charge within 30 days of receiving your letter. They're entitled to a 15-day extension if they get new information that's relative to their investigation.

If, after the reinvestigation, the disputed claim is found to be:

The credit bureau has no choice but to promptly:

Go online, and you'll see vendors selling these types of letters and bragging they're a loophole that will let you play the system. Nothing can be further from the truth.

The FCRA protects its consumers' right to question whether there's an error on their credit report. If an error is found or the information provided to credit bureaus and furnishers cannot be verified, they must remove it.

If the credit bureau can provide the information to show an item on your credit report is legitimate, they are under no obligation to remove it. Any legitimate item will stay on your credit report until enough time has passed and it falls off.

You are far better served to work hard on repairing your credit report by paying your bills on time, paying your credit card balances strategically, and asking for higher credit limits, than trying to play the system over fake negative items.

These three strategies are considered "highly influential" in raising your credit score by Nerd Wallet. While they include six other ways to improve your credit fast, these three help you the most.

Paying your bills on time is the "largest scoring factor in FICO and VantageScore credit scoring systems." If you find you can't make a payment and the time drags on over 30 days, call your creditor and let them know. Make arrangements with them for how soon you can pay and ask them if they would not report the missed payment to the credit bureaus.

Strategically paying your credit card balances is linked to your credit utilization. Develop the discipline to use less than 30% of your credit card's limit — lower is even better. You can manage this by keeping an eagle eye on your credit card and paying off the balance once you see you're getting close to the 30% utilization cut-off line.

Ask for higher credit limits to repair your credit score. Your credit utilization ratio will drop if you receive a higher credit limit and don't add to your credit balance. Your credit utilization ratio will drop if you receive a higher credit limit. Don't spend the extra credit limit!

Please let me know if you have questions in the comments about how to fix your credit, build your credit, or do anything credit-related! I'm here to help you eliminate your debt and improve your credit.