If your credit is low, your finances are a mess, and it feels like you're struggling to tread water at the bottom of a well, it can feel hopeless every time a new bill comes in. It's expensive to be poor, penalties layer on top of penalties, and the problem seems insurmountable.

What if you could call up someone and have them come in to fix your credit? What if, by hiring a third-party service, you could improve your credit score, get your debts under control, and simplify everything to make it infinitely easier to manage?

What if you could call up someone and have them come in to fix your credit? What if, by hiring a third-party service, you could improve your credit score, get your debts under control, and simplify everything to make it infinitely easier to manage?That's the idea behind a credit repair agency. The question is, does it really work? Let's dig in.

A credit repair agency is, generally, a for-profit company that works to help you fix your credit with a few specific kinds of actions they take.

What they claim they can do is nearly unlimited. They will claim they can handle and remove things like:

Where "remove" means "get them removed from your credit report."

Since having negative marks on your credit report brings down your score, having them removed can bring your score back up.

Can a credit repair agency actually do this? Well, it's questionable.

Can a credit repair agency actually do this? Well, it's questionable.If there's incorrect information on your credit report, such as information that doesn't apply to you, or that was caused by identity theft, or is otherwise false, it can be disputed and removed. On the other hand, if the negative marks on your credit report are legitimate, they shouldn't be able to be removed. Something like a Goodwill Letter may be able to help remove a blemish from an otherwise good credit report, but it won't help if you have a history of late or missed payments.

A credit repair agency isn't doing anything special. Every step they take is something you can do yourself; you just need to know how to do it. Usually, it just means pulling your credit report (which is free once a year from Annual Credit Report), reviewing it for anything that is incorrect, and sending dispute letters to the credit bureaus to fix or remove the incorrect information.

Of course, if seeing your credit report is overwhelming, your bills are piling up, and you have no time between work and childcare to even consider spending the time on it, maybe paying someone else to do it for you could be worthwhile.

Therein lies the rub; you still have to pay a credit repair agency to handle the work for you. If you're already in a tough financial situation, adding another expense with no guarantee of it helping your overall finances isn't a great idea.

It's also worth mentioning that some promises a credit repair agency makes might not be accurate.

Credit repair sounds like an enticing service, and it's not entirely without merit.

In short, a credit repair agency will generally send out letters to request verification of debts owed (which is part of the debt dispute process and can legitimately have some debts wiped due to incomplete records). They will also get incorrect information removed or corrected.

In short, a credit repair agency will generally send out letters to request verification of debts owed (which is part of the debt dispute process and can legitimately have some debts wiped due to incomplete records). They will also get incorrect information removed or corrected.However, they may also simply send these letters for every debt and every derogatory mark on your credit report, which not only makes the individuals who have to work with your credit report irritated, it isn't likely to be very effective. Moreover, it can eliminate any good will you would be able to utilize with a goodwill letter at another time.

In 1996, the federal government passed the Credit Repair Organizations Act, or CROA, which sets forth guidelines for what a credit repair agency can and cannot do. Credit repair agencies must comply with this law; otherwise, they are in violation of federal law. Of course, that doesn't stop scammers, but it offers you some recourse to at least verify that a credit repair agency is legitimate.

According to the law, an agency must:

So, credit repair agencies can be legitimate, as long as they comply with federal law. Additionally, Georgia has state laws that apply further penalties and make operating a violating credit repair agency a misdemeanor. You can read more about that here.

As long as you hire a good, compliant, and effective credit repair agency, you can see several tangible benefits.

First and foremost, the people working for a credit repair agency are experienced, whereas you aren't. They know what they're looking for when they pull your credit report. They have templates and letters ready to go; all they need to do is fill them out with the appropriate information and send them to the right agencies.

A trained credit expert can identify which items on your credit report are legitimate, which are potentially open to removal, and which are likely to be incorrect and thus disputable. They handle the disputes, they know what evidence to present, and they know how to do it all while complying with legal requirements for credit interactions.

A credit repair agency likely already has dedicated connections to people within the credit agencies and the major financial institutions. If you have debts with small credit unions, they might not have established relationships, but they probably work with the big banks, credit bureaus, and even major debt collectors on a regular basis. These connections can be leveraged in your favor.

Once the repair agency has done what they can for you, they may be able to offer you advice on how to further build and repair your credit. Of course, you don't necessarily need an agency to do that. After all, you're reading this on a site called Credit Building Tips, and you didn't pay to access it; I also have plenty of other guides on how you can build your credit in a variety of different ways. Plus, I'm always available if you want to ask a question. Just drop me a line or leave a comment!

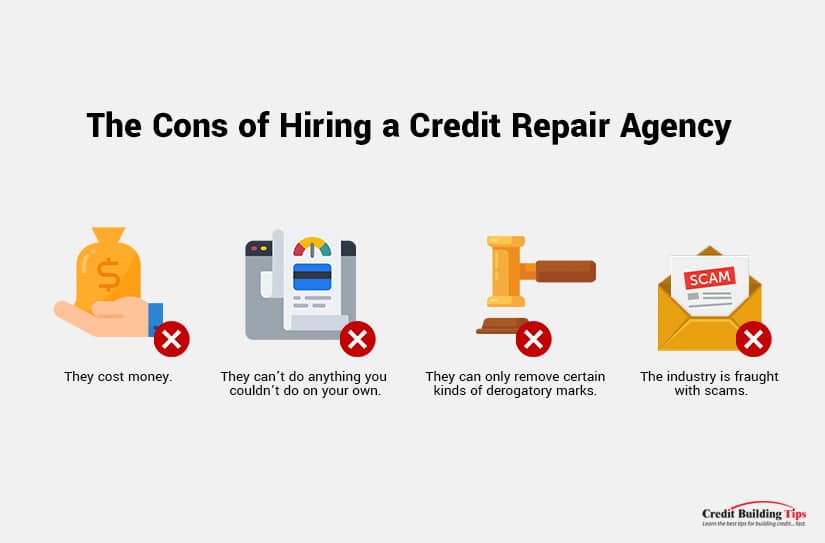

While credit repair agencies can benefit your credit in some situations, there's only so much they can do for you, and there are a few major drawbacks to using such a service.

The biggest issue with a credit repair agency is the fees they charge. Depending on your financial situation and the amount of work they need to do, these can get pretty expensive. I've seen companies charge a fee of anywhere between $30 and $500 per line item they get removed from your report. They may also charge a retainer per-month to keep their services going. It can get very expensive, very quickly. Not only does this put further financial strain on your current situation, but it can also make it even harder to keep paying your existing debts.

Since a verification or dispute letter has a minimum of the legally-mandated 30 days (plus transit time for mail) to process, you're looking at a minimum of 1-2 months (and often much more) for these services, plus fees for every line item on your credit report. It can add up very quickly.

Everything that a credit repair agency can do is something you can do on your own. You can send dispute letters, you can pull your credit report and analyze it, you can consolidate debts, you can send debt verification letters to collection agencies; it's all available to you, by law, for free. A credit repair agency smooths out the process by having templates ready to go, but they aren't doing anything unique or exclusive to their service.

Credit repair agencies have to operate within the bounds of the law. That means there's only so much they can do. If you've been the victim of identity theft and have a bunch of incorrect information on your report, they can dispute and remove it. If a legitimate error has led to reports of late payments or delinquent accounts that don't actually exist, they can get them removed. If a debt was incorrectly sold to a collector and can't be verified, it can be removed.

But, any legitimate negative marks on your credit report, like real late or missed payments or debt sent to collections, can't generally be removed. And, once it is verified, it closes further doors that could potentially be used to remove it down the line.

Perhaps the worst part of credit repair as an industry is that, despite the federal laws regulating it, there are still many companies offering illegal services. These can range from "jamming" to identity theft on your behalf to simply charging you for nothing or even generating fake reports to show improvement that doesn't actually exist.

What is jamming? Jamming is when an agency sends repeated requests to verify debts, over and over, even if it has been verified before. If a lender or bureau fails to verify within 30 days as specified by the Fair Credit Reporting Act, the debt or demerit can be removed from your report, even if it's legitimate. By essentially spamming these agencies, they "keep trying" until they get the result they want, hoping that bureaucracy or delays in paperwork run out the 30-day window.

What is jamming? Jamming is when an agency sends repeated requests to verify debts, over and over, even if it has been verified before. If a lender or bureau fails to verify within 30 days as specified by the Fair Credit Reporting Act, the debt or demerit can be removed from your report, even if it's legitimate. By essentially spamming these agencies, they "keep trying" until they get the result they want, hoping that bureaucracy or delays in paperwork run out the 30-day window.It can be very difficult to spot scams ahead of time, as well, so you need to remain vigilant and be familiar with the laws governing credit repair agencies if you intend to hire one.

You have two main options if you don't want to go with a credit repair agency.

The first is to do the legwork yourself. It's tedious, it's time-consuming, and it's stressful, but it's free and can repair your credit if you do it right. Of course, that's why I've started this blog; to compile as much information as I can to help everyone reading this build and repair their credit score.

The second is to use a Credit Counseling Organization instead. A credit counselor is generally a non-profit organization that can analyze your full financial situation and:

Repairing your credit can be tricky, especially if you have no idea where to begin. That's why I've been building this blog and why I'm always available to offer advice. If you have questions, want to know about a particular strategy, or just need general credit repairing or building help, feel free to leave a comment or drop me a line. I'd be more than happy to assist you on your credit building journey however I possibly can!

The single most significant factor in calculating your credit score is your payment history. Making up 35% of your FICO score, payment history is a value assigned to how well you've been able to repay your debts. Do you make your payments on time? Have you made them on time for months, years, or decades?

An isolated incident can still be devastating. According to FICO's credit damage data:

"…one recent late payment can cause as much as a 180-point drop on a FICO score, depending on your credit history and the severity of the late payment."

Considering that the FICO score goes from 300 to 850 – a 550-point range – a drop of nearly 200 points is enormous. Now, sure, that's the worst-case scenario. A person with a perfect credit score who suddenly drops a payment and misses it for 90+ days will see a huge hit. People with lower starting credit and only a couple of late payments won't see as significant an impact. Even still, though, it has the potential to be very damaging.

No wonder people will take any opportunity to try to alleviate that drop. That's where a goodwill letter comes into play.

What is a goodwill letter? It's a letter that you write to your creditor asking them if they can waive reporting a late payment to the credit bureaus.

If the creditor accepts, they don't inform the credit bureau of the late payment, and your credit score doesn't take a hit.

The idea of a goodwill letter is to appeal to the empathy of the decision-makers who work for your creditor. You appeal to them based on your past payment history, a demonstration of temporary hardship, and a genuine plea to have the mark removed from your credit report. It is, in essence, an apology and a promise not to let it happen again.

The idea of a goodwill letter is to appeal to the empathy of the decision-makers who work for your creditor. You appeal to them based on your past payment history, a demonstration of temporary hardship, and a genuine plea to have the mark removed from your credit report. It is, in essence, an apology and a promise not to let it happen again.A goodwill letter works on several levels.

Goodwill letters don't always work. However, negative marks stay on your credit report for up to seven years, so it's always worth a shot sending the letter and ask if they can remove it. You don't lose anything for trying, after all.

A goodwill letter is helpful in certain circumstances, but it's not always necessary.

First of all, if there's a negative mark on your credit report, your first step is to verify that it's legitimate. Sometimes, messages get mixed up, payments get lost or misattributed, or computer systems mishandle your information. If an issue is reported on your credit report but not a real one, a goodwill letter isn't the correct response. Instead, you should dispute the information with the credit bureaus. You challenge the validity of the issue, and upon investigation, it will be removed if it's inaccurate.

So, for example, in a case of a genuine mistake or identity theft, you can get damage to your credit reversed. However, for legitimate late payments disputing the validity of the issue isn't going to help.

A goodwill letter is also unnecessary if your late payment isn't very late. Generally, companies won't report a late payment to the credit bureaus until it is at least 30 days late. If you've missed your payment deadline by a week but afterward you immediately pay it, you won't see that late payment reported to the credit bureaus. You may get a strike with your creditor. You may have to pay the penalty, lose a bonus or introductory rate, or otherwise deal with a fee according to the rules of the creditor, but you won't see damage to your actual credit score.

A goodwill letter is generally the best option if you have a single late payment that you missed for over 30 days but less than 90 days and when you have since both paid the outstanding bill and resumed regular payments. In other words, it works best for one-time, isolated incidents.

Will a goodwill letter work? After all, creditors are usually large banks, and they have so many millions of customers that they don't necessarily have to care about you. What incentive do they have to keep you around, assuming you're not a business-level or millionaire-level customer?

The truth is, goodwill letters only work some of the time. It varies a lot depending on many factors, including:

Goodwill letters can be effective in cases of technical issues and personal issues. For example, suppose your auto-pay was somehow turned off, and you didn't notice a technical error with the creditor's computers failing to process a payment. In that case, a goodwill letter can potentially eliminate reporting the late fee.

If you don't have your car for transportation, you may lose your job, which would jeopardize your ability to pay your bills, so you accepted the action that was most likely to keep you financially solvent. Similarly, if you had a brief but temporary financial hardship – a significant unexpected expense between paychecks, you can explain it and potentially get a waiver. For example, say you had a flat tire and needed to pay to get a new tire, which pushed your bank balance low enough you couldn't pay your bill until your next paycheck, which forced the bill into late payment status.

Whether or not a goodwill letter works is often up to the whims of chance. There's no formalized process across the industry.

Note: Some creditors will make public statements that they will not accept goodwill letters, usually citing the Fair Credit Reporting Act requiring them to report accurate information. It never hurts to try, and many of these creditors will still accept a goodwill letter. It's always worth a shot; the worst that they can say is no.

Note: Some creditors will make public statements that they will not accept goodwill letters, usually citing the Fair Credit Reporting Act requiring them to report accurate information. It never hurts to try, and many of these creditors will still accept a goodwill letter. It's always worth a shot; the worst that they can say is no.Remember that a goodwill letter is an emotional appeal to the individual capable of making decisions regarding your account. You'll need to keep that in mind as you craft your letter and focus on the hardship that made it impossible to make your payment on time (with the steps you're taking to resolve it).

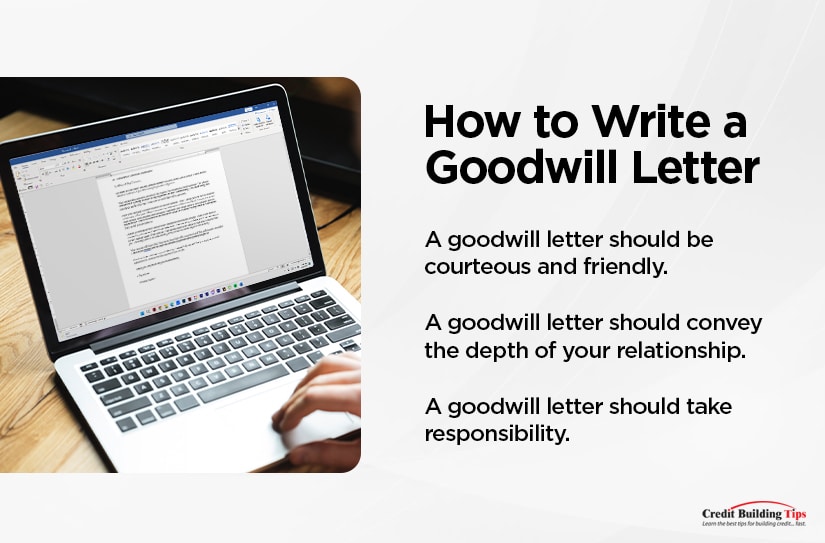

A goodwill letter needs to be well-written and compelling to have any chance of success. It's an emotional appeal. Thus, there are some things it needs to contain and others it should not.

A goodwill letter should be courteous and friendly. The number one thing every goodwill letter needs is a positive attitude. Your credit score is serious business, and you may be feeling desperate or angry. However, you should avoid blaming the people who work for the creditor in question. Even if the issue is on the creditor's end, getting angry about it – specifically when that anger is directed at someone uninvolved with the matter – will only hurt your chances.

A goodwill letter should convey the depth of your relationship. If you've been banking successfully with this creditor for 15 years, say as much. Any deeper, happier, or more successful business-customer relationship will work in your favor. Creditors will often value their long-term customers and may be more willing to cut you some slack, especially when they can quickly look up your past payment history and see that this is a one-time incident.

A goodwill letter should take responsibility. In the end, your late payment is (usually) your fault. It may be unintentional, or it may have been a calculated risk in a time of financial hardship, but it's still a bill you were responsible for paying that you did not pay. Personal responsibility is a big part of a goodwill letter.

Note: if the reason your payment didn't go through is legitimately not your fault – such as when the creditor's computer systems broke or they didn't auto-debit your account as they should have, you may be able to get the issue sorted out with a phone call to support rather than a goodwill letter. After all, when it's genuinely their error, they are responsible for solving it.

Note: if the reason your payment didn't go through is legitimately not your fault – such as when the creditor's computer systems broke or they didn't auto-debit your account as they should have, you may be able to get the issue sorted out with a phone call to support rather than a goodwill letter. After all, when it's genuinely their error, they are responsible for solving it.Shifting the blame away from you when it's your fault looks juvenile and immature and makes your goodwill letter less likely to be accepted.

A goodwill letter should present a compelling argument. Present the facts of your case and why a higher credit score is required of you. For example, you might explain a scenario wherein you had to make the tough decision to let your account lapse after an unexpected medical issue or other expense. Present the length of your relationship with the creditor, your history of on-time payments, and any other supporting evidence. You're making the best of a bad situation and asking forgiveness.

Suppose you need a higher credit score for getting a mortgage or car loan; present that information to the creditors to support your case. After all, if the creditor can help you lower your other bills, you're less likely to experience delinquency again.

If all of the above seems tricky to compose, you can always use a template. The question is, should you?

Templates are great for people who don't have the writing chops to craft something themselves. However, it's always possible that using a standard template could hurt your chances. Remember, the people who receive these letters often receive dozens or hundreds of them, and when they see the same template repeatedly, they may no longer see it as genuine.

That's why we've created this template. It's a unique template – not copied from other sources online – and since we're a smaller site, it probably hasn't been used very often. If you use it, let us know; we may be able to edit it periodically to keep it fresh. That said, here's a template you can consider using.

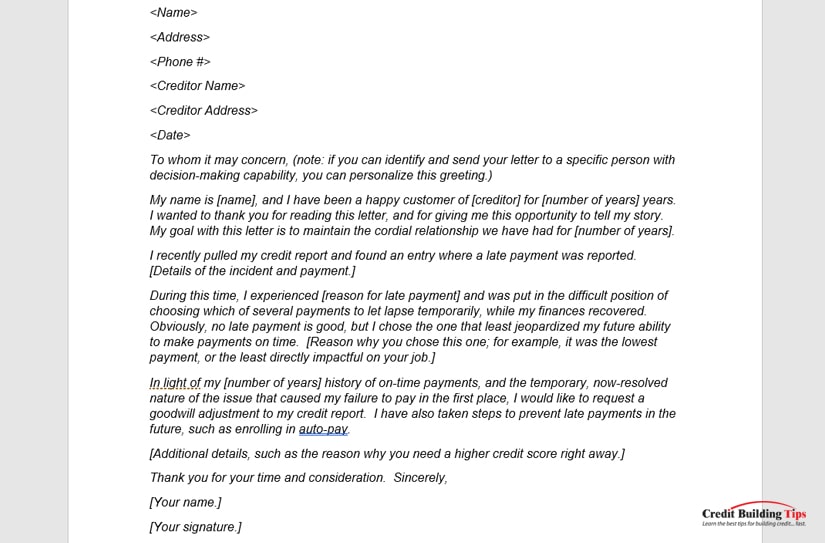

Remember, this should be in letter format. You should have your name, return address, and contact information in the upper left.

To whom it may concern, (note: if you can identify and send your letter to a specific person with decision-making capability, you can personalize this greeting.)

I wanted to thank you for reading this letter and giving me this opportunity to tell my story. My name is [name], and I have been a happy customer of [creditor] for [number of years] years. My goal with this letter is to maintain the cordial relationship for [number of years].

I recently pulled my credit report and found an entry where your company reported a late payment. [Details of the incident and payment.]

During this time, I experienced [reason for late payment] and was put in the difficult position of choosing which of several payments to let lapse temporarily while my finances recovered. No late payment is good, but I chose the one that least jeopardized my future ability to make payments on time. [Reason why you chose this one; for example, it was the lowest payment or the least directly impactful on your job.]

In light of my [number of years] history of on-time payments and the temporary, now-resolved nature of the issue that caused my failure to pay in the first place, I would like to request a goodwill adjustment to my credit report. I have also taken steps to prevent late payments in the future, such as enrolling in auto-pay.

[Additional details, such as why you need a higher credit score right away.]

Thank you for your time and consideration. Sincerely,

[Your name.]

[Your signature.]

Have I convinced you about the benefits of submitting a goodwill letter? Do you have any questions for me? Please drop your questions in the comments below, and I'll do my best to point you in the right direction! I'm happy to help, and your questions (and my answers) are bound to help others as well!