Having a debt in collections can wreak havoc on your credit scores.

In some cases, it is possible to delete a collection from your credit report in exchange for payment.

If you're trying to delete a collection account from your credit report, you can contact the collection agency and see if they will be willing to delete the account in exchange for full or partial payment of the debt.

If you're trying to delete a collection account from your credit report, you can contact the collection agency and see if they will be willing to delete the account in exchange for full or partial payment of the debt.Though this type of action is discouraged by credit bureaus, it is possible in some cases to have this type of derogatory mark removed from your report in some cases.

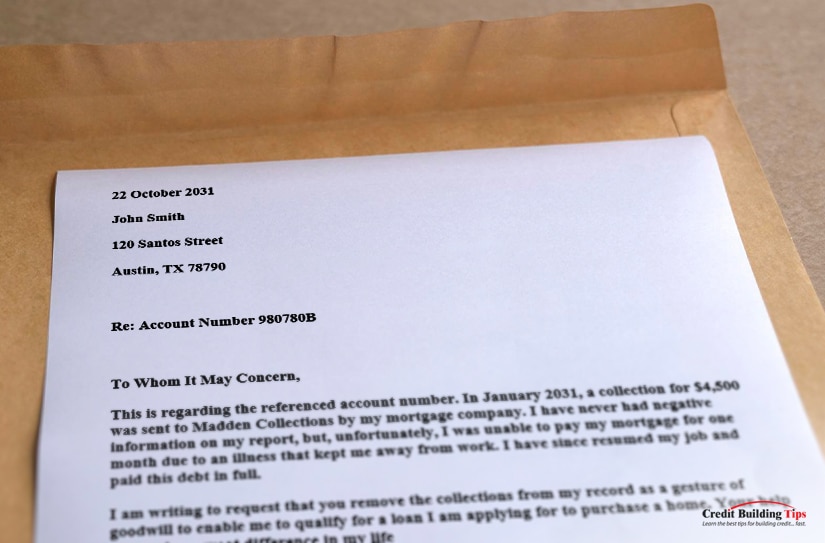

If you are interested in a pay-for-delete arrangement with a debt collector, the first thing you will want to do is contact them via the phone or through a pay for delete letter.

Opinions regarding whether it's a good idea to attempt to pay to delete a collection vary widely, which we'll get into later. The steps you will want to take if you want to take this course, though, are as follows:

In exchange for full or partial payment, debt collectors will sometimes promise to change the classification of your account on your credit reports.

If a debt collector does agree to remove the marks from your credit report, you will want to request a letter for them stating that they will adjust your credit report. Collections agencies are primarily focused on collecting the debt they are owed, and have been known to say whatever they need to in order to receive payment.

For more information about improving your credit score, take a look at these four simple ways you can remove derogatory marks from your credit report.

If you have a debt in collections and you want it taken off of your credit report, you can propose a deal with the debt collector: you’ll pay off the account if they will update your credit report to remove the account.

This is known as ‘pay for delete.’

Before you get excited about having this negative mark taken off your credit report, it’s worth understanding that these agreements are quite rare. Credit reporting bureaus go out of their way to discourage attempts to take information off of reports that is accurate.

The reason for this is that creditors and lenders are legally obligated to report information that is both accurate and complete to the credit agencies.

That being said, creditors do have some leeway to choose to not report information. Beyond that, the Fair Credit Reporting Act doesn’t explicitly prohibit pay for delete. This means that there’s a chance a debt collector will be willing to strike a pay for delete deal.

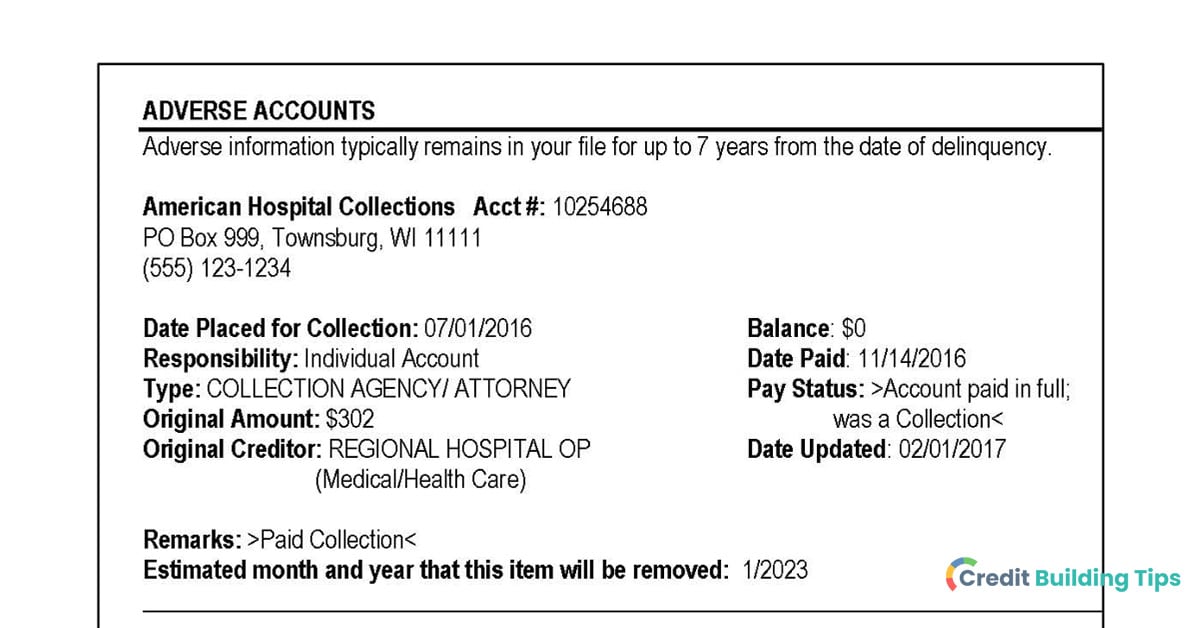

When an account is sent to collections, it usually stays on your credit report for seven years. Accounts get less harmful to your credit the older they get, but they will still be present on your report for seven years until they “drop off.”

If you want to propose a pay for delete arrangement with a debt collector, the first thing you’ll want to do is either give the collection agency a call or submit a pay for delete letter, which is a formal request letter.

If you write a letter rather than calling, you’ll want to clearly state your offer– that you want to pay off either all or part of the debt in question and, in return, you’d like the debt collector to delete the account from your report.

At this point, you’ll have to wait to see whether the collection agency is willing to take the deal. If they do agree, it’s a good idea to ask for written confirmation of the agreement before making the payment. Since the pay for delete letter doesn’t really hold any weight legally, you could otherwise end up in a situation where you make the payment but still have the account on your credit report.

Though pay for delete is a tempting solution to a frustrating problem, there are some reasons you might not want to go this route. Here are some things to consider before calling the collections agency and trying to broker a deal:

Even if you aren't able to get the mark removed from your credit report, there are still steps you can take to increase your credit score. Check out these articles about opening a new credit card, using second chance credit unions, credit repair software programs, and getting a secured credit card to boost your credit score. Before hiring a credit repair agency, make sure you read the pros and cons of credit repair services.

If you have a debt in collections that showed up on your credit report and you pay it off, it will stay on your credit report but be recorded as a paid collection.

Many people mistakenly believe that if they pay their debt in full, the mark will be removed from their credit report automatically.

Unless the collections agency agrees to fully delete the account rather than update the status to 'paid,' it will remain on your credit report for seven years.

Even if they do agree to these terms, it can be difficult to actually enforce a pay for delete agreement, as a pay for delete letter isn't legally binding.

If you're on a mission to achieve the highest credit score you can, check out this post about the maximum possible score.

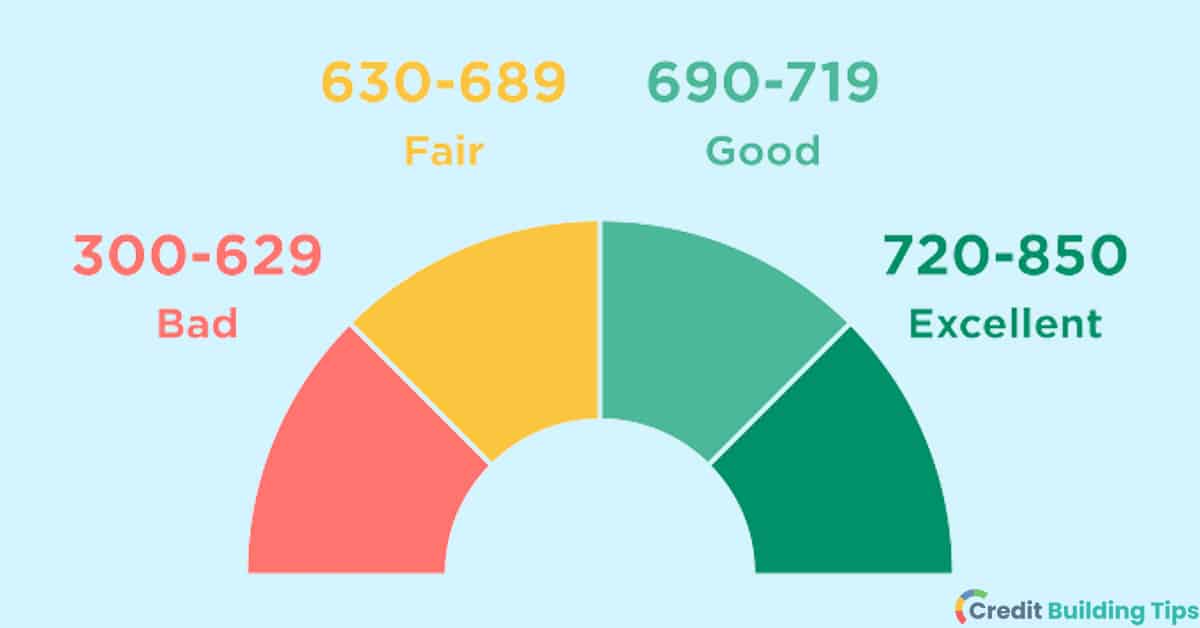

If you are late making payments to creditors, it can have a negative impact on your credit score. If an account is so delinquent that it was sent to a debt collector, though, it can have much larger repercussions for your credit score.

By some accounts, having a debt sent to collections can mean your credit score dropping around 110 points. How many points you’ll lose depends on a number of different factors, but you’ll lose more points the higher your score was to begin with.

Your overall credit profile will have an impact on how much a pay for delete will help your score. If you only have one debt in collections and they are willing to delete it from your credit report in exchange for payment, you might see your score increase once it is removed. However, if you get one derogatory mark removed but you have several other debts in collection, it probably won’t make much of a difference for your score.

Some experts have been sounding the alarm recently, spreading the word that pay for delete is becoming outdated as a method of dealing with a collection account on your credit report.

One of the reasons for this is that some of the latest credit scoring models-- particularly FICO 9 and VantageScore 3.0-- don't factor in collections accounts that have been paid in full.

What this means is that, while the account still appears on your credit report, it doesn't have nearly as much of a negative impact as it would using older models or if you hadn't paid off the debt.

However, not all creditors use these new scoring models. For example, most mortgage lenders use a model that considers all collections accounts.

At both the federal and state level, credit bureaus, debt collectors, and lenders are all highly regulated. What this means is that you are granted certain rights as a consumer.

If you and the collections agency are negotiating a payment plan for your outstanding debt, make sure you take a look at this guide to installment plans and payment plans.

Understandably, consumers that are interested in a pay for delete arrangement typically have a lot of unanswered questions. Let's look at some of the most commonly asked questions about this method of credit repair to help you make the right decision.

In some cases, it can be difficult to determine who exactly owns your debt. You’ll want to try the following tactics if you need to track down the right collections agency:

If the original creditor hasn’t yet sold the debt to a collections agency, you’ll want to contact the creditor to try and arrange a ‘pay for delete’ deal. If they have already sold it, you might find that the original creditor is willing to reclaim the debts. They aren’t obligated to do this, though, so there’s no certainty that they will agree.

It is not illegal to send a pay for delete letter. That being said, the concept of pay for delete does exist in a legal gray area, as debt collectors often have contracts with the credit bureaus that explicitly prohibit them from deleting information from a credit report that is accurate.

Collection agencies do not have any legal obligation to remove information from your credit report. They also cannot remove information that was entered by the original creditor.

There are mixed perspectives about whether it is a good idea to try and and broker a deal with a collections agency to have your derogatory mark deleted in exchange for payment.

On the one hand, it's possible that the debt collector will agree to this and follow through on their end of the deal.

On the other, though, they might not actually remove the debt once they receive payment, and there is little recourse consumers have in this situation because pay-for-delete letters aren't enforceable.

Additional considerations include the fact that newer credit scoring models don't even take paid collections account into consideration when calculating your score and that a debt collector might not have the power to fully remove an account from your credit report if it was submitted by the original creditor.

Let's break down the possible outcomes in a slightly simpler way:

If you can't get the collections account deleted from your credit report even once its paid off, all hope is not lost. Instead, you'll want to focus your energy toward rebuilding your credit. For more information about how to improve your credit score, check out our credit building blog.

If you've been evicted in the past or you are currently dealing with an eviction, learning how to get an eviction removed from your credit report is likely on your mind.

You'll be glad to know that the actual eviction itself won't show up on your credit report. In the past, the public record of a judgment against you in a civil suit (like an eviction) would show up on your credit report, but this is no longer the case. If your landlord sends an outstanding debt you owe to collections, though, this will show up on your report and impact your credit.

Even though the actual eviction itself won't show up on your credit report, it will show up on your tenant screening report and background checks.

Even though the actual eviction itself won't show up on your credit report, it will show up on your tenant screening report and background checks.Let's look at what you need to know to clean up your records.

A common misconception is that getting evicted will show up on your credit report. The actual eviction itself will not appear on your credit report or impact your credit score.

In the past, the following related actions could be reported to the credit agencies:

That's right-- the actual act of eviction will not show up on your credit report. Until recently, legal judgments against you would appear on your credit report as well as any debts you have in collections. Nowadays, you don't have to worry about judgments showing up on your credit report, but any unpaid rent that goes to collections will appear on your report.

If you were evicted for non-payment and you still have an outstanding debt with your landlord, they might choose to sell your debt to a collection agency.

If your debt goes to collections, it will appear on your credit report. This negative mark on your credit report can decrease your credit scores and stay on your credit report for seven years.

Having a less than ideal credit score can have a major impact on your ability to rent an apartment, borrow money, and your ability to grow wealth over time. Make sure you check out these five ways you can raise your credit score instantly.

Though the eviction itself won't be recorded on your credit report, that doesn't mean it can't have negative consequences for you. This is because your eviction will show up on tenant screening reports and background checks, which are not the same as credit reports.

Your credit report is a statement containing information regarding your current credit situation and credit activity.

On your credit report, the following types of information can be found:

Though there is a ton of information about you in your credit report, some personal and financial details won't show up. These include your income, education, marital status, and bank account details.

A tenant screening report can be used by landlords to make decisions about potential tenants. Multiple sources are used to create these reports, including credit reports, rental history, and more.

Any of the following information can be found in a tenant screening report:

While the actual eviction won't show up on your credit report, it will show up on your tenant screening report.

If your landlord took you to court and won a civil suit against you, it would be recorded in the public record and, in the past, would show up on your credit report.

Historically, the following events can lead to a "public record" showing up on your credit report:

As of July 2017, though, the new reporting standards for public records actually resulted in the removal of nearly half of tax liens and all civil judgments from consumer credit reports.

In many cases, public records with negative information will stay on your credit report for somewhere between seven and ten years. These days, the only public record that will show up on your credit report is filing for bankruptcy.

Did you file for bankruptcy in the past and you're wondering whether your credit will improve after it falls off? This guide tells you everything you need to know.

If you've noticed an error regarding public records on your credit report, you can dispute these errors through the appropriate credit bureau. If an old judgment is still on your credit report, contact the credit bureau to dispute it.

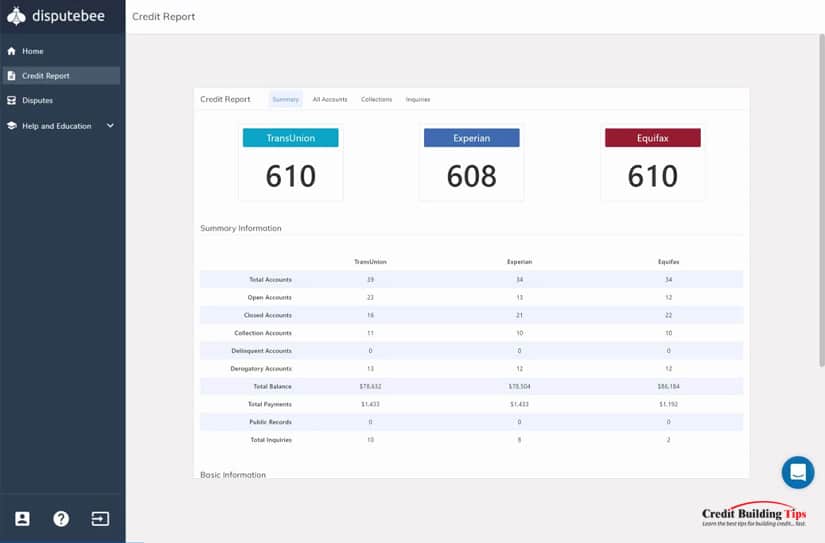

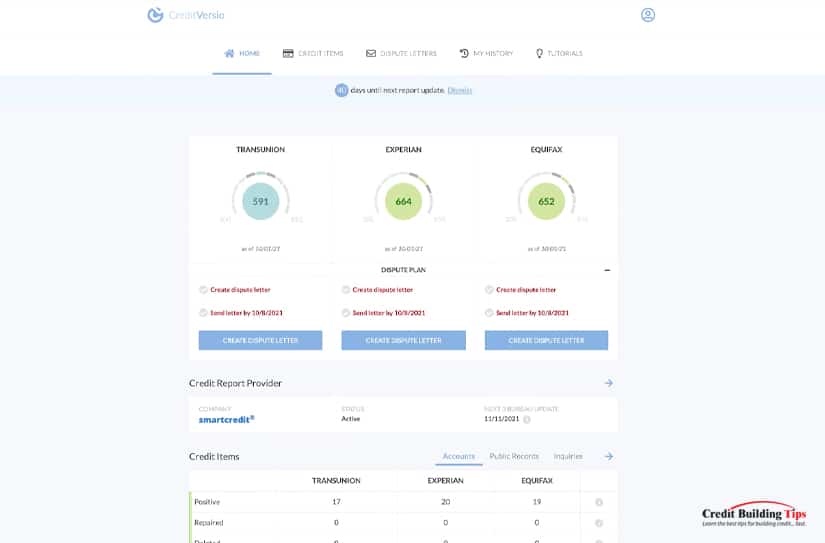

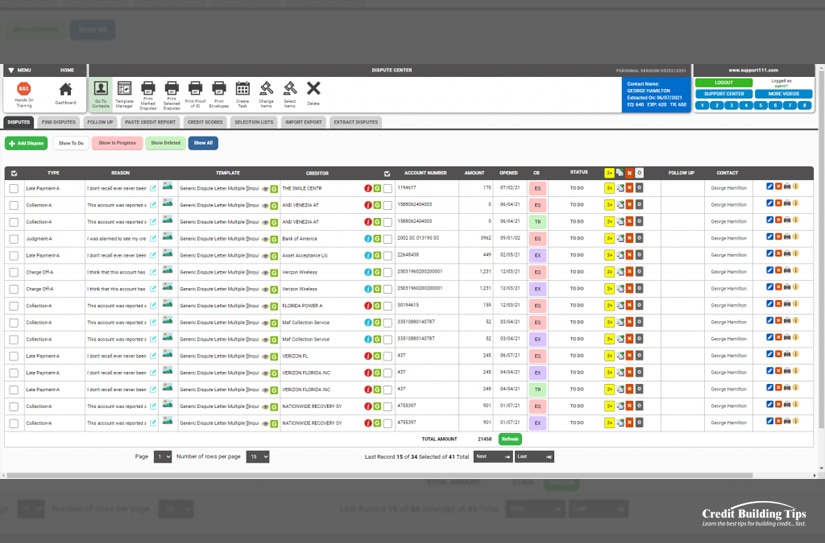

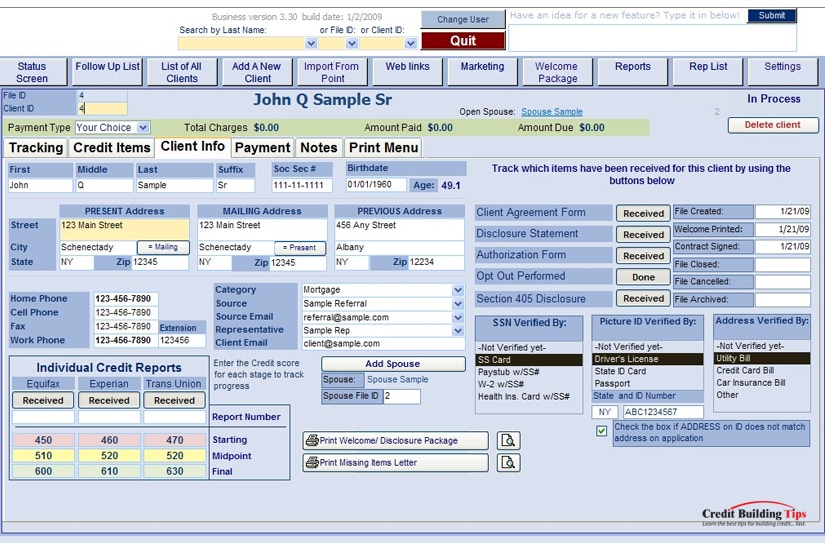

If you're working to improve your credit, you might me interested to learn about some of the credit repair software programs that can help to streamline the credit repair process.

If your unpaid rent was sent to a collections agency and it's damaging your credit, there are a few things you can do.

You'll want to take a look at both your credit reports and your own records to figure out how an outstanding debt is impacting your credit.

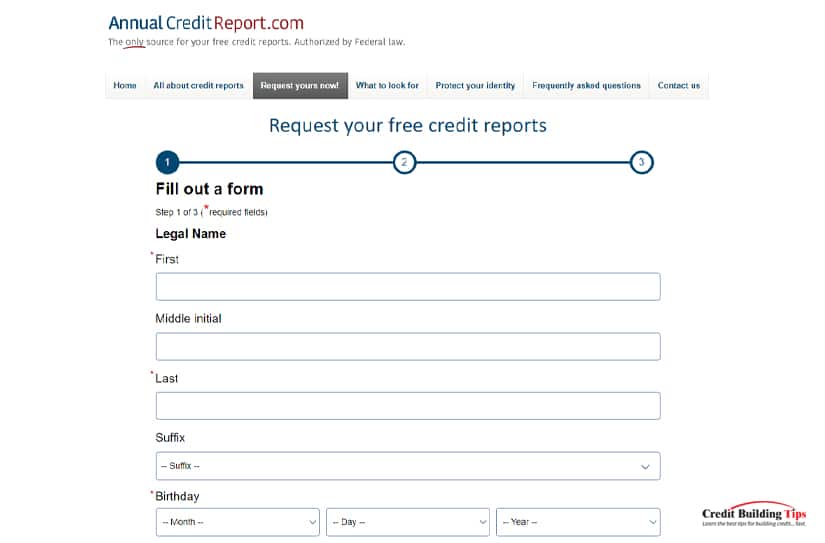

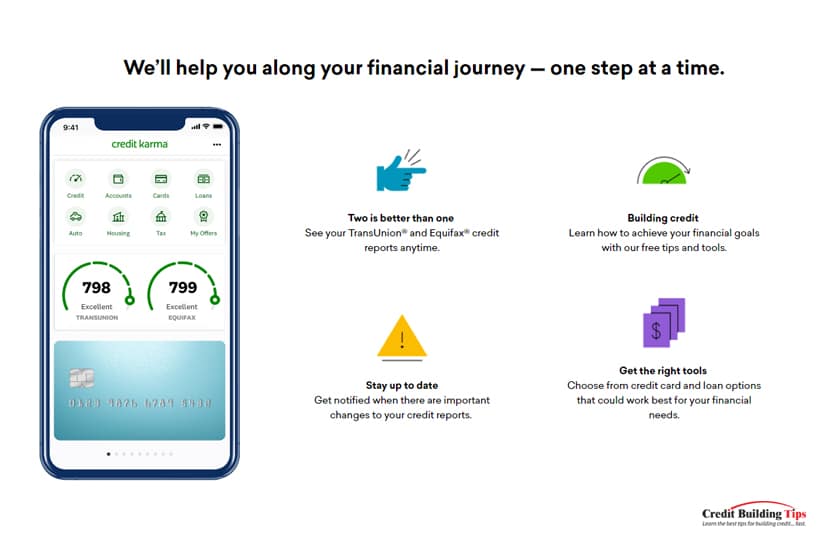

Gather all of the information you have about payments you've made to your landlord or to the debt collector. You'll want to request your credit report from all of the major agencies-- Experian, Equifax, and TransUnion-- to see if the debt appears on all three.

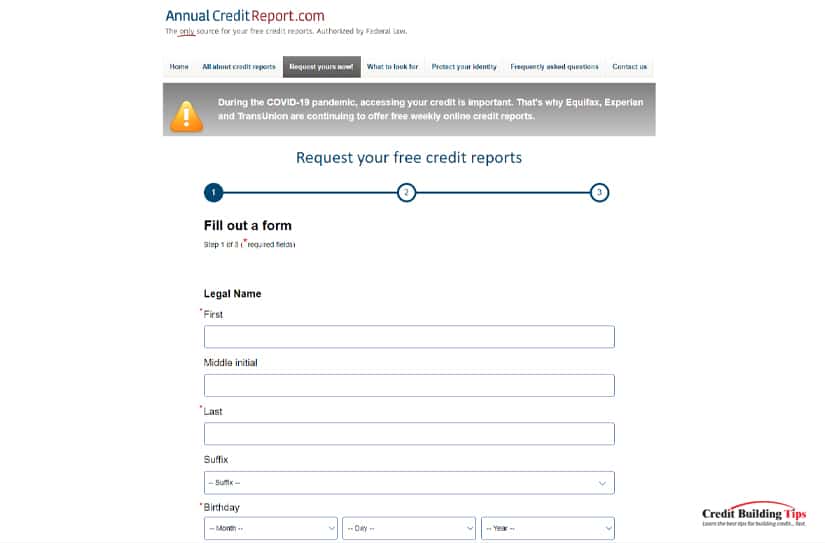

You can use AnnualCreditReport.com to request your credit reports from all three of these credit bureaus.

If you believe that a collections account is on your report in error, you'll want to dispute it. You can file a dispute through the mail, on the phone, or online with the credit agencies.

Before you hire a credit repair agency to help improve your credit, read the pros and cons of credit repair services.

If the debt is correct but has been paid in full, you can ask the creditor for a goodwill deletion. While they have no obligation to do this, it doesn't hurt to ask. If you have a good track record of making payments on time, this can help your case.

It is also possible to try and broker a deal with the debt collector, stating that you will pay off the debt in exchange for the mark being removed from your credit report. If they agree to this, make sure you get them to send you the arrangement in writing.

If you are trying to improve your credit through every possible avenue, use this guide to goodwill letters to help you understand what your chances of success are.

If the collections agency has agreed to the goodwill deletion, make sure you follow up after the fact. You'll want to wait about thirty days and then pull your credit reports again to make sure that the account has been removed.

For more information about cleaning up your credit report, check out our recent post about four simple ways to remove derogatory marks on your credit.

Are you shooting for the moon when it comes to repairing your credit? Learn about the maximum possible credit score here.

If you believe that your eviction is going to show up on your tenant screening records, you're likely wondering if there's anything you can do to remove it from your record.

Let's take a look at the different steps you can take depending on your circumstance.

The first thing you'll want to do is determine whether your eviction is showing up on your tenant screening record.

If your property manager or landlord actually started the legal process of eviction against you, it will create a public record. Since judgments against you are no longer supposed to show up on your credit report, you will want to look for this information on your tenant screening report.

You can access a tenant screening report for yourself by requesting one from a tenant screening agency. If you are currently looking for an apartment, you can ask the property manager at rental you're interested in what agency they use.

Are you wondering how your credit score is going to impact your ability to rent a new place? This article looks at the credit score you'll need to rent a house or an apartment.

There are different laws surrounding eviction in every state. If you think that you were wrongfully evicted, you'll want to check in with the landlord tenant laws of your state and, in some cases, your municipality.

If you can prove that you didn't violate the lease and shouldn't have been evicted or that the property manager didn't follow the proper procedures outlined in the law, you might be able to have the eviction removed from your public record by petitioning the court.

You will want to pay any outstanding balances you have that are related to your eviction-- if they are legitimate, of course. If you don't have the funds to pay the debt in full, the collection agency or property manager might be willing to negotiate with you.

It's possible that they will agree to setting up a payment plan or settling the debt for less than the original amount.

If your unpaid rent has been sent to collections, it will stay on your credit report even after you've paid it in full or negotiated a settlement.

Before you make your payment, you can ask your property manager or the collection agency to request that the account be removed from your credit report if you pay in full. It's important to get this agreement in writing rather than relying on a verbal agreement.

If your property manager still owes the debt or is able to reclaim it, you can ask them to remove the eviction from your tenant screening report in return for a settlement or paying the debt in full. You will also want to make sure you receive this agreement in writing.

If your property manager or the collections agency agrees to remove derogatory marks from your credit report or tenant screening report, you'll want to follow up after the fact and make sure they actually do so.

If you found any inaccuracies or errors on your tenant screening record, you can contact the company you used to generate the report to dispute them. You'll want to have proof on hand that substantiates your claim that the report is not accurate, such as the documents exchanged between you and the debt collector when you agreed on a settlement or paid your rental debt.

There are few things as stressful as dealing with an eviction, and this is only magnified when it impacts your ability to borrow money, rent an apartment, or otherwise try and move forward with your life.

The good news is that evictions and civil judgments against you will not show up on your credit report.

The bad news is that any outstanding debts that have been sent to collections will show up on your credit report. Beyond this, your eviction and any judgments against you will show up on your tenant screening report.

If an eviction or a debt is showing up on either your credit report or your tenant screening report and you believe it is an error, you can dispute the error and have your reports adjusted. That is, so long as you can prove that the information was inaccurate.

While there are no guarantees, it's possible that you will be able to have the eviction removed from your tenant screening report and your debt removed from your credit report in exchange for payment. If you strike an agreement with an agency in this way, you'll want to make sure you get it in writing.

If you're motivated to improve your credit, make sure you check out the rest of our credit building blog.

Figuring out how to remove a 30-day late payment from your credit report isn’t anyone’s idea of a good time– once a creditor has reported a late payment to one or more of the credit agencies, it can be difficult to get removed if you did, in fact, miss making the payment by more than thirty days.

The first question to ask is whether the late payment on your credit report is an error or if it’s accurate.

Removing a 30-day late payment from your credit report is simple if it was an error-- you'll need to contact the credit bureau, your creditor, or both to have it removed. Unfortunately, it isn't always possible to remove a late payment if it is accurate.

Removing a 30-day late payment from your credit report is simple if it was an error-- you'll need to contact the credit bureau, your creditor, or both to have it removed. Unfortunately, it isn't always possible to remove a late payment if it is accurate.In this article we'll explore what to do if the late payment was an error, strategies you can try if it is an accurate mark on your credit, and more.

When a lender reports that you paid a bill late to the credit bureaus, a late payment is reported on your credit report. There are two different ways that this can occur:

If the late payment is the result of an error on the part of the lender or the credit bureau, it isn’t too difficult to have it removed from your credit report. You will need to file a dispute that explains the mistake and demands that the late payment on your report be removed.

However, it can be much more difficult to get a late payment removed from your credit report if you did actually make a late payment. Not only can it be a frustrating process, but it can be quite time-consuming. Even so, there is no guarantee that you will succeed in your attempts.

For help cleaning up your credit report, check out these four simple ways you can remove derogatory marks from your credit.

If the lender was correct in reporting your late payment, there are a number of steps you can take to try and get it removed from your report. The reality is, though, that your chances of having a late payment removed from your credit report aren’t great if you don’t have a compelling argument (with evidence) for why it should be removed.

If you realize that your payment was late before it ends up showing up on your credit report, you’ll want to get on the phone with the lender as soon as humanly possible. They might be willing to help you resolve the issue before they report it to the credit bureau. This is particularly true if this is the first time you’ve ever missed a payment with the lender.

When you missed a payment and the creditor has already reported it to the credit bureaus, you can try sending them a letter that explains why the payment wasn’t made on time. Commonly referred to as a “goodwill letter,” this is your opportunity to formally explain why you believe the payment should be removed from your case.

It’s worth understanding that lenders aren’t required to remove late payments from your report if they were accurate. Considering the impact it can have on your credit, though, it’s still worth trying.

You might find that your creditor is willing to help you out, particularly if you can provide proof that supports circumstances such as one or more of the following scenarios:

It’s really easy to get stressed out and frustrated when you’re trying to get a 30-day late payment removed from your credit report. The truth is, though, you have a much better chance of receiving the outcome you’re looking for if you are nice and cordial.

When writing your goodwill letter, here are some things to keep in mind:

You’ll want to include the following information in a goodwill letter:

It’s possible that your creditor will update your credit report after they receive your letter. However, a common response from lenders is that they aren’t legally allowed to remove accurate information from a consumer’s credit report.

Mistakes aren’t uncommon on credit reports, which is why it’s a good idea to regularly review your credit reports. If you find an inaccurate 30-day late payment on your report, you can ask the credit bureau to prove that the late payment is correct. If it’s found to be a mistake, you can request that it is removed.

When it’s clear that the late payment was a mistake, removing the mark from your credit shouldn’t be too difficult. Under the Fair Credit Reporting Act (FCRA), you are entitled to request substantiation and that the late payment be taken off your report if it is found to be an error.

There are two ways that you can request that an inaccurate 30-day late payment is removed from your credit report.

The Consumer Financial Protection Bureau advises that you contact both the company that provided the information to the credit reporting agency as well as the credit reporting company.

You’ll want to start by disputing the error with the credit reporting company that generated the error on your report– either Equifax, Experian, or Transunion.

You should explain why the late payment is an error including copies of documents that help to substantiate your dispute.

You can use this template provided by the Consumer Financial Protection Bureau to draft your letter.

The following information should be included in your dispute letter:

It can be prudent to send your letter by certified mail and ask for a return receipt. This way, you will know with certainty that the appropriate credit reporting agency received your letter.

Lenders and creditors use your credit scores to help predict how likely it is that you’ll make your payments on time before they lend you money. When you think of it this way, it makes sense that missing a payment would end up having a negative impact on your score.

Even so, it’s pretty frustrating to realize that your credit score dropped because of one bad mark on your credit report.

Even just one 30-day late payment can have a negative impact on your credit scores. The most influential factor in calculating your score is payment history.

Once a late payment is reported to the credit bureaus, it will drop your credit score and it will stay on your report for seven years. At that point, it will drop off from your credit report automatically.

There are a number of different factors that influence how a late payment will impact your credit score. These include how late your payment was, how often you’ve made late payments, and how recently the late payment was reported to the credit bureau.

While there are many factors that determine your credit score, one single late payment can reportedly drop your credit score by anywhere between 90 and 180 points.

If you are able to make a payment before 30 days have passed, you most likely won’t see it show up on your credit report. However, once 30 days have gone by, lenders will most likely report it.

These late payments get categorized as 30-day late payments, 60-day late payments, 90-day payments, and so on. This sequence will continue until the creditor deems the debt uncollectable (aka resorting to a “charge-off.”)

The later you make your payment, the more severe the impact will be on your credit scores.

Did you recently notice a significant drop in your credit score? This guide look at the multitude of factors that can contribute to reduction in your score.

Though it’s frustrating to have your credit scores go down due to a 30-day late payment, it shouldn’t be life-shattering if it only happens one or two times. If you have late payments on a number of different loans, though, or you regularly pay your bills more than 30 days late, you’ll find that the impact it has on your credit score is much greater.

The impact of late payments will decrease over time, and how recent information is a meaningful factor for the scoring models. However, that doesn’t mean it isn’t worth fighting to remove late payments that are a few years old, as they still have a negative influence on your scores.

If you realize that you missed a payment, the best possible course of action is to make the payment before thirty days have passed from the original due date. If you do this, there’s a good chance the late payment won’t have been reported to the credit agency yet.

If there’s already a mark on your credit report, though, it, unfortunately, won’t be automatically removed once you pay it off.

Are you negotiating with a creditor or a debt collector to pay off your debt? Make sure you read this guide to payment and installment plans first.

In most cases, a late payment won’t show up on your credit report for at least thirty days after the due date has been missed. However, it’s worth understanding that, in the case of credit card companies, there is a lot of flexibility when it comes to reporting payments that are late.

Credit card companies can choose when they report late payments and how often they report them. If you make a payment a few days late, it might never get reported to a credit bureau.

It can be frustratingly difficult to get a late payment removed from your credit report if you did actually make your payment more than 30 days late after the due date. Any late payments that you can’t successfully remove from your report will stay there for seven years until they fall off your credit report.

Though this can be discouraging, this doesn’t mean your credit scores are doomed to be terrible or that you can’t borrow money for the next seven years.

Are you trying to improve your credit and you're wondering if opening a new credit card will help? This post goes over everything you need to know about how opening a new credit card impacts your score.

If you’ve run out of options when it comes to removing the late payment from your credit report, it doesn’t mean that you’re doomed to a bad credit score forever. The late payment will have a gradually less severe impact as time goes on and it gets older. Additionally, you can focus on deliberately building your credit score back up.

What could your credit score look like if you were very good at managing your credit over the course of years? Take a look at the highest possible credit score and whether it's possible to achieve this maximum score.

First things first, you’ll want to make sure that you don’t miss another due date. You might choose to sign up for auto-payments to help make this easier, or build the habit or sending your payments a few days early to make sure you don’t miss one.

Another thing you can do is make sure you keep your credit utilization rate on the lower end. It’s ideal to stay under 30%. This is the ratio between how much credit has been extended to you and how much you are using.

When you're desperate to build your credit back up, it's easy to get tempted by credit repair company offers that promise to work miracles for your credit. Make sure you read this post about the pros and cons of hiring a credit repair agency before making any decisions.

If your credit score has been problematically damaged by late payments and other negative marks on your credit report, you might worry that you won’t be able to borrow money when you need to. There are still ways you can borrow money with poor credit, but you’ll always want to be skeptical as there are many predatory lenders out there that will lend money to people with bad credit in exchange for outrageous interest rates and fees.

Depending on the type of loan you’re applying for, a co-signer could help. A co-signer is a person that joins in on a loan application and promises to pay back the loan if you aren’t able to make the payments on time. Of course, this is a risky proposition for the co-signer, as their credit could end up being damaged if make payments late.

Late payments can stay on your credit report for seven years, so it's important to have a system in place to avoid making payments after the due date. If you already have a mark on your credit report for a 30-day late payment, these are the steps you can take to try and remedy the situation:

If you're motivated to improve your credit score, make sure you check out the rest of our credit building blog.

If you want to increase your credit score, you need to find away to remove the derogatory marks that are on your credit report.

There are several ways to remove derogatory marks on your credit. You can:

You must follow different steps depending on how you want to remove negative information from your credit. Keep reading to find out which method is best for you.

Waiting for negative information to fall off your credit report can take years. Derogatory information stays on your report for seven years from the last date of activity on the account.

While the damaging information is on your report, it will impact your credit score. However, it will have the most significant impact on your credit profile for the 24 months following the negative information.

When you have chargeoffs or accounts in collections, you have the option of paying off those accounts. After you settle the debt, the creditor will report the information to the bureaus, removing the derogatory information from your credit report.

After you pay off an account, your credit report should reflect the change within a month or two in most cases as long as the account servicer reports the information promptly.

A letter of goodwill is a formal notice in which you ask a lender to remove a late payment. Companies are generally willing to work with you if you usually pay your bills on time and have a positive account history.

However, you can not make a habit of sending goodwill letters because they usually only work as an occasional courtesy. Your letter does not need to be long, but it does need to include information like:

Then, you need to explain why you fell behind on the account and ask the lender if they would be willing to remove the negative information. It can also help you to tell the creditor how long you have been a customer, and if there is a reason you need the mark removed, you can include that, as well.

For example, if you are trying to qualify to refinance your mortgage loan, but the late payment is preventing you from doing that, you may want to include that in the letter.

If you have inaccurate information on your credit report, you can file a dispute directly with the credit reporting agencies. Credit bureaus have thirty days to complete an investigation after you submit a dispute. If the creditor does not verify the information during that timeframe, they remove the information from your account.

When you dispute information on your credit report, you must file a notification with each credit bureau. You can do so on each credit agency website, or you can send a 609 Letter of Dispute to each. The three agencies do not share data or remove information just because one of the other credit bureaus did.

Due to each agency conducting a separate investigation, one credit agency may remove a debt while the other two may not. It is not a great idea to dispute valid information, though.

If the creditor verifies the account, it can reset the clock on that debt. It could take another seven years from the date the creditor verifies the account for the negative information to come off your credit report.

Disputing information on your credit report does not adversely affect your credit. However, the outcome of the dispute may impact your score. So, it is essential to proceed with caution when filing credit disputes.

Savvy consumers know that it is necessary to remove derogatory marks on your credit from time to time. It is also a good idea to check your credit report regularly to ensure that it does not contain any incorrect data.

If you find information about fraudulent credit accounts, you should immediately file a dispute with all three credit bureaus. If an account that belongs to you has inaccurate reports, you can contact the lender directly to request that they correct data like incorrect late payments and account balances.

Your best option for chargeoff accounts and collections may be to settle with the creditor. While late payments will still appear on your credit report in some cases, paying a chargeoff is always better than leaving it on your report unless the debt is scheduled to come off your report soon.

Are you trying to improve your credit score but have been held back by an eviction notice on your credit report? If so, you are not alone.

An eviction can be a major obstacle to building a strong credit history and can stay on your credit report for up to seven years.

An eviction can be a major obstacle to building a strong credit history and can stay on your credit report for up to seven years.However, there are ways to remove the eviction from your credit report and get your credit back on track. In this blog post, we'll discuss the step-by-step process of how to remove evictions from your credit report.

You may not even know that there's an eviction notice on your credit report until you need to find a new place to rent. Even then, it may not occur to you that your credit report is telling your prospective landlord about your difficulties with a past landlord.

If you do think you may have an eviction notice on your credit report, the first step is to check your credit score and review your report.

If you do think you may have an eviction notice on your credit report, the first step is to check your credit score and review your report.It's a good idea to get a copy of your credit report from each of the three major credit bureaus — Equifax, Experian, and TransUnion — as they often contain different information.

An eviction notice can appear in several places on your credit report. To find out if you have an eviction notice, you'll want to look for the notice under the section that lists "Public Records." Here, you'll be able to see whether you have any unpaid evictions or judgments listed on your report.

If you have an eviction notice on your credit report, it can significantly lower your credit score. It can also prevent you from renting a home or apartment. Fortunately, you can take steps to remove an eviction notice from your credit report.

It's important to know that even if you paid off the eviction in full, it might still appear on your report for up to seven years. Once you've determined whether or not you have an eviction notice on your credit report, you can take the necessary steps to get it removed.

Landlords may evict tenants for many reasons. The most common reason is failure to pay rent. Tenants are legally obligated to pay rent on time, and if they do not, they may be subject to eviction.

Other reasons include violations of the rental agreement, engaging in illegal activities in the unit, damaging the property, or nuisance behaviors like loud music or partying late into the night. Eviction may also occur if the tenant does not comply with local or state laws related to health and safety. Finally, a landlord may choose to evict a tenant due to personal differences.

Landlords must also follow strict procedures when attempting to evict tenants. It's important to understand that each state has different regulations regarding evictions, so it's essential to familiarize yourself with your local laws if you are concerned about being evicted.

A few resources are available for renters who want to better understand the laws surrounding evictions in their state. Every state has its own laws and rules when it comes to evictions, and these can be found online at various state government websites.

To find out more information, renters should visit their state's website to read through the different eviction statutes. The National Conference of State Legislatures provides an overview of state-by-state eviction laws on its website.

It is important to note that some states have limited rights for tenants when it comes to evictions. For example, some states don't allow for tenant counterclaims or defenses, while others may require landlords to offer a settlement agreement before evicting a tenant.

Additionally, renters should familiarize themselves with the Fair Housing Act, which is the federal law that protects tenants from discrimination based on race, color, national origin, religion, sex, familial status, or disability. It's important to know your rights under this law as well as any state-specific laws regarding evictions.

Many legal aid organizations across the country provide assistance and legal advice to tenants who are facing eviction. Legal aid organizations are typically staffed by volunteer lawyers and paralegals who are experienced in tenant-landlord law and can help tenants better understand their rights in relation to evictions.

The amount that an eviction report on your credit report lowers your credit score will depend on several factors. Generally, an eviction report can cause a drop in your credit score of up to 100 points or more.

This can be especially damaging for people with low credit scores. Additionally, the more recent the eviction report is, the more it can affect your score. It is important to keep in mind that credit scores are not static and can change over time as you make positive financial decisions, such as paying bills on time and reducing debt.

If you find out that you have an eviction report on your credit report, it is essential to contact the landlord who reported the eviction and ask them to remove the report from your credit file. If the landlord agrees, then the eviction report will be removed from your credit report, and your credit score should begin to improve.

It's possible that a landlord or management company may have reported an eviction to the credit bureaus without obtaining a court judgment. If this happens, it can still appear on your credit report and negatively impact your score.

If they fail to do this, then the tenant may have the right to challenge the eviction in court. If an eviction order is issued against the tenant, it will show up on their credit report as a negative item, thus lowering their credit score.

Even if the landlord refuses to remove the eviction report, there are still steps you can take to improve your credit score, such as making sure that all of your other debts are current and up-to-date.

The steps you'll need to follow in order to remove an eviction notice from your credit report differ depending on whether the report is accurate or inaccurate. Making sure the eviction notice is accurate is as easy as checking your credit report, as we mentioned above.

Go here to get a free copy of your credit report from the three credit bureaus and find out whether or not there are any eviction notices on your report.

If you find an eviction notice on your credit report, but you know it shouldn't be there, there are a few things you can do to fix the situation.

1. If the eviction is incorrect, you should contact the landlord or property management company and ask them to provide written documentation that the eviction never happened. You should also obtain a copy of your rental agreement if possible. This can be used as proof that you were never legally evicted.

2. Once you have gathered all of this information, you should contact the three major credit bureaus and file a dispute letter.

3. The credit bureau will then investigate the claim and contact the landlord or property management company for further evidence. If the eviction is found to be inaccurate, it should be removed from your credit report.

Make sure all the information on your report is accurate, including the dates and amounts involved. Include supporting documentation, such as a copy of your lease agreement and any court documents. If the information is inaccurate, contact the creditor involved and ask them to correct any mistakes.

You'll need to attach copies of the documentation of payment, such as a copy of the check you sent, bank statements, or a receipt from the landlord. The credit bureau will investigate and determine if the eviction was due to an honest mistake or a valid one.

4. If the dispute is successful, the creditor must update the records with the correct information and notify all three credit bureaus (Equifax, Experian, and TransUnion) of the change. Once updated, any late payments associated with the eviction should no longer appear on your credit report, and your score should improve accordingly.

5. If the credit bureau denies your dispute or fails to investigate, you can contact a consumer law attorney and ask for assistance. A lawyer can help you understand how to navigate the legal system and determine whether or not you may be able to get the eviction removed through legal action.

An attorney may be able to help you dispute the eviction notice more successfully or even sue the landlord if necessary if you feel like the eviction was done unfairly or illegally. They can guide you through the process of suing the landlord for damages related to unfair treatment.

6. Contacting a credit repair agency may also be worthwhile if you need help disputing the eviction. These companies often deal with credit errors and can help you correct them quickly.

Unfortunately, sometimes eviction notices are accurate and do appear on your credit report. Even if this is the case, you can do a few things to make things better.

One way to remove an eviction from your credit report is through a goodwill letter. This involves writing to the landlord or management company and asking them to remove the eviction notice on your credit report. They may or may not be willing to accept this request, but if they do, then they must update the records accordingly and alert the credit bureaus.

However, even if the creditor agrees to delete the negative items from your report, the account itself will still appear on the report. Therefore, it is best to use this method only if you feel confident that you can prove the account was handled incorrectly.

You may be able to work out a repayment plan with the landlord who evicted you in order to have the eviction notice removed from your credit report.

You may also be able to get the eviction notice removed from your credit report by making on-time rental payments for at least 12 months after the eviction.

While sending a dispute letter helps when the information on your credit report is inaccurate, you can also send a letter to each credit bureau that provides evidence that you had a good reason for being evicted and/or that the eviction was not your fault.

For example, if you were evicted due to an inability to pay rent due to a sudden job loss or another unexpected financial difficulty, you can provide documentation of the event to the credit bureau.

One of the best places ways to get help with your credit report is to contact a credit counseling agency or a credit repair company.

These organizations can provide valuable insight into what you need to do in order to remove the eviction notice from your credit report. They may even be able to negotiate with the landlord or collection agency that reported the eviction.

Finally, if you're unable to get a valid eviction notice removed from your credit report, make sure to focus on other aspects of your credit report that show responsible financial behavior.

A good payment history, a low debt-to-income ratio, and a steady income can help offset an eviction notice and improve your credit score over time.

You may need to work a little harder to find a landlord or property management company willing to overlook an eviction notice on your credit report. In the U.S., the Fair Credit Reporting Act states that landlords cannot deny a tenancy based solely on a tenant's credit report. However, if there is an eviction on your record, landlords are allowed to take that into consideration.

It is important to note that some states have laws protecting tenants from being denied a rental because of an eviction, so research your state's ruling on this issue.

One option is to provide additional documentation, such as pay stubs or bank statements showing that you are financially stable and responsible. You should also be prepared to explain the circumstances of the eviction, such as extenuating financial hardships or other mitigating factors.

It helps to provide references from past landlords and employers that can vouch for you as a tenant. You may also consider finding a cosigner for the rental agreement with strong credit who can agree to pay the rent if you cannot do so. Also, try searching for a "second chance" apartment complex that is more lenient about credit checks and allows renters with evictions.

Finally, if you're having trouble understanding how credit works and how to repair your credit score, subscribe to our free credit-building tips newsletter. You'll get information, guides, and tutorials on how to fix your bad credit, increase your credit faster than you realized possible, and even achieve a high credit score.

As of this month, there are 212 companies offering credit cards. But if your credit score is fair or poor, it may take a lot of work to get approved for one.

With low fees, store credit cards can be a great way to build credit if you are trying to establish credit or rebuild credit if your score has taken a hit for whatever reason. That's just one perk of getting a store credit card. Most store cards offer retailer discounts and membership perks.

When it comes to department stores, even though their numbers may be dropping across the country, they are still the anchor stores in many malls. And along with offering a wide range of products from fashion and fragrance to bedding and bath sets, almost all department stores also offer store credit cards.

The two most common store cards are "open- and closed-loop" cards.

Although store cards have a reputation for inflicting high-interest rates and hidden rates on their customers, they can offer special financing on big purchases and let you earn rewards and discounts at your favorite store.

To help you make decisions before you reach the checkout aisle, we've compiled a list of the best store credit cards to get, even if your credit score is under 600!

To help you make decisions before you reach the checkout aisle, we've compiled a list of the best store credit cards to get, even if your credit score is under 600!Card details: The TJX Rewards® Platinum Mastercard® can be used at T.J. Maxx, Marshalls, HomeGoods, Sierra Trading Post, and Homesense. It's ideal if you often shop at this family of stores, but it can be used anywhere Mastercard is accepted.

Pros:

Cons:

Card details: This card is worth considering if you plan to spend up to $1,667 at the store in the first two days of having the card, as you can earn 15% off all purchases. The discounted savings is capped at $250.

Pros:

Cons:

Card details: You can qualify for the Kohl's Credit Card with a lower-than-fair credit card score if your income, debt load, opening of accounts, employment, and housing status are higher.

Pros:

Cons:

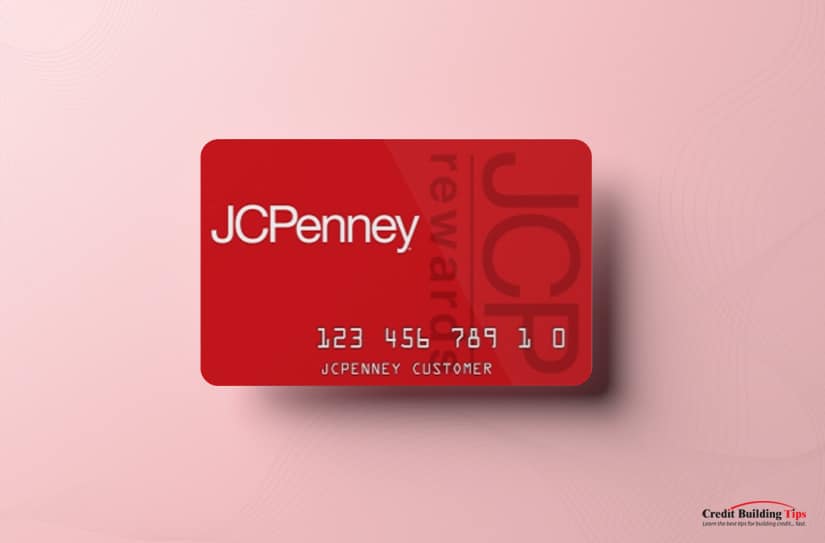

Card details: The JC Penney credit card is a department store credit card that can only be used at JC Penney. It doubles the rewards rate of a standard JCPenney rewards member.

Pros:

Cons:

Card details: Citibank, N.A. issues the Macy's credit card that can be used at Macy's, Macy's Backstage, and macys.com. It's available in four levels — Bronze, Silver, Gold, and Platinum, each with increasing benefits.

Pros:

Cons:

Card details: The Montgomery Ward retail card is an unsecured store credit card that even people with bad credit can get. They report to the credit bureaus monthly, so if you make on-time payments and have a reasonable credit utilization rate, you'll be able to build a positive credit history.

Pros:

Cons:

Card details: The BJ's Perks® Mastercard® lets you add authorized buyers to share your credit card and membership number. One authorized buyer can be added when you apply for the card, and three additional authorized buyers can be added once your account is opened.

Pros:

Cons:

Although not technically department stores, these four stores (big box, home improvement, catalog/online retailer, and clothing store) will also extend credit to those with lower or bad credit scores.

Card details: If a significant amount of your shopping for groceries, garden supplies, new clothes, or other everyday items is done online at Walmart, the Capital One® Walmart credit card provides great rewards.

Pros:

Cons:

Card details: This in-house store credit card can only be used at Lowe's, a home improvement retailer that sells building supplies, hard finishes, and appliances.

Pros:

Cons:

Card details: This is the store credit card that's easiest to qualify for with bad credit. Not technically a department store; it's an online retailer/mail catalog store.

Pros:

Cons:

Card details: The Old Navy credit card can be used at Old Navy, Gap, Banana Republic, and Athleta. When you shop at two or more of these stores, you can earn up to 2,000 bonus points.

Pros:

Cons:

When your credit score is lower than you'd like it to be and you can't find a department credit card that suits your style, two other types of credit cards may extend your credit and help you build up a higher credit score.

In the main, secured credit cards work like conventional credit cards. The main difference is that secured credit cards require you to give an upfront cash deposit that acts as collateral against the card's future use.

Student credit cards are a great first step to building credit as they don't rely on someone's previous credit history or income before approving the card. Most student credit cards don't offer rewards, but the SCENE® Visa* card for students and the L'earn® Visa* card do.

The SCENE card lets you earn five Scene+ Points for every $1 spent in Cineplex cinemas and one Scene+ Point for every dollar spent elsewhere. Using the L'earn card lets you earn 1% money back on all "eligible" purchases.

Credit bureaus update information sent by lenders every 30-45 days. If any changes are made to your financial behavior, like how many credit accounts you have and your payment history, your report will reflect the updated information.

Due to COVID-19, AnnualCreditReport allows you to get your credit report for free until the end of 2023. After that, you'll be able to check your report for free once a year.

It's important to check your credit report for errors, as these can negatively impact your score. It also benefits you by helping you understand what future lenders see and what specific activities (how you pay your bills, what types of credit you use, your credit utilization ratio, etc.) you need to do to improve your score.

How you pay your bills — your payment history — makes up 35% of how your credit score is calculated. This is why it's important to pay all your bills on time. The more on-time payments you make, the higher your credit score will be.

Payment history considers if you pay your bills on time, if and how often you miss a payment due date, how far past the due date your payment was made, and how long it's been since you missed one or more of your payments.

Of course, paying your credit card bills fully helps your credit health. To create a healthy credit report, you need to make at least the minimum payment on each credit card.

But if that's all you pay, you will incur hefty interest charges on top of any unpaid balance you owe. The cost of one $30 sweatshirt, if you make only minimum payments over a year, can end up costing you $300+ by the time you've paid it off in full.

Repaying your balance in full and on time every time is one of the best ways you can move a low credit score to a higher one. This will make you a more attractive loan recipient from lenders offering you better borrowing terms.

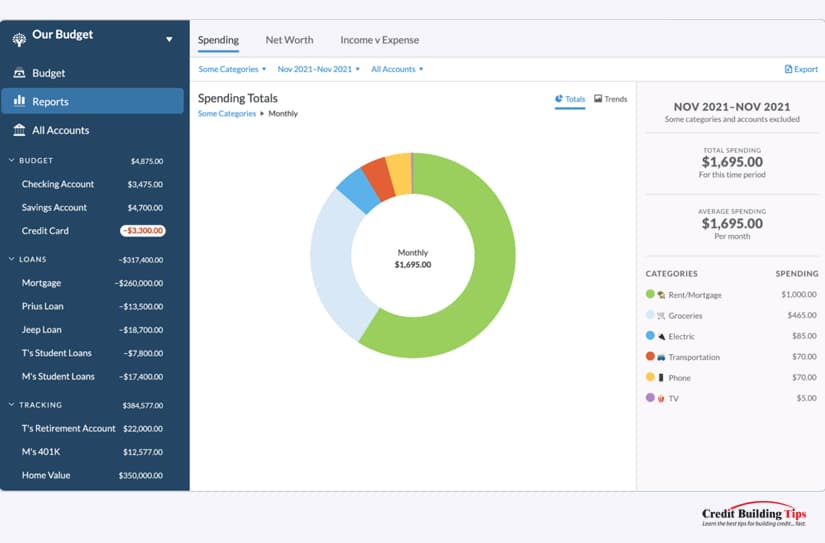

When working hard to improve your credit score, you may want to consolidate your credit card debts if you have multiple cards with high balances you find difficult to pay off.

For example, if you have four credit cards with varying balances between $800 and $1,400, you may need help remembering to make the four separate payments on time. A consolidation loan to cover the entire credit card debt amount would let you have one single amount owing at a lower APR, which will lower the interest you'll have to pay.

This may not seem obvious, but calling your credit card company can change how your credit mistakes are reported to the three main credit bureaus — Experian, TransUnion, and Equifax.

Yes, you'll need to go through the painful phone tree or wait endlessly on hold while you listen to elevator music, but remembering that a single late payment can cause your credit score to drop by 90-110 points should help ease the irritation.

Once you get through to a human being, an honest and reasonable explanation for why you were late (your payment was made by mistake) can set the stage for them to extend a little bit of helpful mercy. Tell them you're doing everything you can to build a good credit report, and ask if they would consider removing the late payment from your record.

A polite and sincere request can help your case and, along with a commitment to developing good credit habits in the future, should move your credit score in the right direction.

If you need to rebuild your credit, you're not alone. In 2022, 15.5% (39.28 million) of Americans have bad credit, and 21.7% (54.99 million) have fair credit.

While that may seem like a lot — 94.27 million people combined, the good news is that the percentage of Americans with good credit increased by 5% year-over-year this year.

That's the highest year-over-year increase in 16 years!

One of the ways to rebuild your credit is by working with a second-chance credit union. They're a great way to get a fresh start at rebuilding your banking history.

One of the ways to rebuild your credit is by working with a second-chance credit union. They're a great way to get a fresh start at rebuilding your banking history.Second chance bank accounts are "individual accounts offered at some…credit unions to help people with a troubled banking history." Troubled banking history may mean your bank account has been closed due to excessive overdrafts, unpaid fees, or other issues.

If a bank closes your account for one of these reasons, you may be put on a list at ChexSystems, which is a "bank account screening consumer reporting agency (C.R.A.) that keeps your name on file for up to five years as a high-risk bank customer."

Shockingly, millions of Americans do not have a bank account. The Federal Deposit Insurance Corporation (FDIC) reports that 22% (63 million) of American adults were "unbanked" or "underbanked" in 2019.

Shockingly, millions of Americans do not have a bank account. The Federal Deposit Insurance Corporation (FDIC) reports that 22% (63 million) of American adults were "unbanked" or "underbanked" in 2019.Unbanked Americans (6%) have no bank account whatsoever. Without a bank account, you have to rely on payday loans, check cashing services, money orders, foreign remittances, and pawnshop loans to manage your finances. Even the "underbanked" need to rely on alternative financial services.

The most recent survey from the FDIC asked households that didn't have full access to bank services why this was the case.

Just over 52% said they didn't have enough money to keep in an account, while 30% claimed they didn't trust banks.

Being unbanked (or underbanked) isn't just an inconvenience. NerdWallet calculated the annual cost of being unbanked at 1% of the average annual income. While 1% doesn't sound like much, over a lifetime, it can add up to $70,000.

Those who are unbanked and need to rely on "alternative services" like payday loans are vulnerable to "predatory lenders, exorbitant interest rates, and costly fees." Not only that, it's impossible to get approved for loans and mortgages, which every American needs in order to improve their financial situation.

The direct costs for the unbanked are significant. Without a bank account, they can't pay bills electronically and need to rely on cash payments. Imagine the inconvenience, at the very least, of not having access to a bank account!

Direct costs of being unbanked are:

Some of the challenges that come without access to credit include:

Second-chance bank accounts are typically checking accounts, although some credit unions may also offer second-chance savings accounts.

Another way to think of a second chance bank account is as a probationary account. They're intended to help people rebuild their banking history and reputation as low-risk customers. Similar to how secured credit cards can help people build their credit history.

Another way to think of a second chance bank account is as a probationary account. They're intended to help people rebuild their banking history and reputation as low-risk customers. Similar to how secured credit cards can help people build their credit history.Second-chance checking accounts are relatively easy to get, and some credit unions work with their clients to help them move to "more robust banking options." They operate like other checking accounts but usually have more restrictions, higher fees, and limited features.

And they're not available everywhere. They may be called "Opportunity Checking" or "Fresh Start Checking." If no credit unions in your town or city offer this service, you may want to check with a local community bank.

Forbes Advisor collated a list of second-chance checking credit unions by state:

| State | Bank 1 | Bank 2 | Bank 3 | Bank 4 |

|---|---|---|---|---|

| Alabama | Azalea City Credit Union Opportunity Draft | Family Security Credit Union Give Me a Break Checking | Gulf Winds Credit Union MyOpportunity Checking | |

| Alaska | True North Federal Credit Union True Options Checking | |||

| Arizona | Banner Federal Credit Union Opportunity Checking | Copper State Credit Union Try Again Checking | MariSol Federal Credit Union Start Again Checking | Tucson Old Pueblo Credit Union Mission Checking |

| Arkansas | Red River Credit Union Fresh Start Checking | River Valley Community Federal Credit Union Fresh Start Checking | Unify Federal Credit Union Right Start Checking | |

| California | North County Credit Union Fresh Start Checking | Premier America Credit Union Fresh Start Checking | Priority One Credit Union New Leaf Checking | Strata Credit Union Fresh Start Checking |

| Colorado | NuVista Federal Credit Union The Last Chance Checking | Unify Federal Credit Union Right Start Checking | ||

| Connecticut | Finex Credit Union Re-Start Checking | Hartford Federal Credit Union 2nd Chance Checking | Tobacco Valley Teachers Federal Credit Union myChance Checking | |

| Florida | Compass Financial Federal Credit Union Restart Checking | First Florida Credit Union Smart Track Checking | Gold Coast Federal Credit Union Fresh Start Checking | South Florida Federal Credit Union Aspire Checking |

| Georgia | Georgia's Own Credit Union Resolution Checking | Health Center Credit Union Fresh Start Checking | Peach State Federal Credit Union Fresh Start Checking | |

| Idaho | Latah Credit Union Second Chance Checking | |||

| Illinois | Catholic & Community Credit Union Rebound Checking | |||

| Indiana | Centra Credit Union Opportunity Checking | Heritage Federal Credit Union 2nd Chance Checking | Liberty Federal Credit Union Opportunity Checking | |

| Iowa | Collins Community Credit Union Take2 Checking | Greater Iowa Credit Union Fresh Start Checking | North Iowa Community Credit Union Fresh Start Debit | |

| Kansas | United Consumers Credit Union Second Chance Checking | |||

| Kentucky | Liberty Federal Credit Union Opportunity Checking | |||

| Louisiana | Neighbors Federal Credit Union Basic Checking | Pelican State Credit Union Horizon Checking | Southwest Louisiana Credit Union Fresh Start Checking | |

| Maine | Five County Credit Union Second Chance Checking | |||

| Maryland | Central Credit Union of Maryland Renew Checking | Market U.S.A. Federal Credit Union Fresh Start Checking | Security Plus Federal Credit Union Revive Checking | |

| Massachusetts | Alden Credit Union No Boundaries Checking | Athol Credit Union Fresh Start Checking | ||

| Michigan | Marshall Community Credit Union Fresh Start Checking | Michigan State University Federal Credit Union Rebuild Checking | ||

| Minnesota | Minnesota Valley Federal Credit Union Second Chance Checking | |||

| Mississippi | Gulf Coast Community Federal Credit Union New Chance Checking | Liberty Federal Credit Union Opportunity Checking | MUNA Federal Credit Union Fresh Start Checking | |

| Missouri | St. Louis Community Credit Union Second Chance Checking | United Consumers Credit Union Second Chance Checking | ||

| Montana | Clearwater Credit Union SmartSpend Checking | Valley Credit Union Opportunity Checking | ||

| Nevada | Clark County Credit Union CheckAgain Checking | WestStar Credit Union Fresh Start Checking | ||

| New Jersey | Credit Union of New Jersey Right Turn Checking | Jersey Shore Federal Credit Union Fresh Start Checking | United Teletech Financial Federal Credit Union Fresh Start Checking | |

| New York | Adirondack Regional Federal Credit Union Free New Beginnings Checking | Alternatives Federal Credit Union Fresh Start Checking | Centra Credit Union Opportunity Checking | Financial Trust Federal Credit Union 2nd Chance Checking |

| North Carolina | Centra Credit Union Opportunity Checking | Excite Credit Union Fresh Start Checking | Skyla Credit Union Fresh Start Checking | |

| Ohio | Buckeye State Credit Union Second Chance Checking | Eaton Family Credit Union, Inc. Second Chance Checking | Hopewell Federal Credit Union Rebound Checking | Kemba Federal Credit Union Fresh Start Checking |

| Oklahoma | Allegiance Credit Union Second Chance Checking | Oklahoma Educators Credit Union Fresh Start Checking | Weokie Federal Credit Union Fresh Start Checking | Western Sun Federal Credit Union Fresh Start Checking |

| Oregon | Heritage Grove Federal Credit Union Fresh Start Checking | Point West Credit Union Fresh Start Checking | ||

| Pennsylvania | Centra Credit Union Opportunity Checking | Utilities Employees Credit Union Green Light Checking | West Branch Valley Federal Credit Union Back on Track Checking | |

| South Carolina | Carolina Trust Federal Credit Union Encore Checking | Market U.S.A. Federal Credit Union Fresh Start Checking | Skyla Credit Union Fresh Start Checking | |

| Tennessee | Liberty Federal Credit Union Opportunity Checking | Hearthside Bank Square One Checking | Select Seven Credit Union Second Chance Checking | |

| Texas | Associated Credit Union of Texas 180 Checking | Baptist Credit Union Draft Builder Checking | Kelly Community Federal Credit Union Smart Choice Checking | Prestige Community Credit Union Fresh Start Checking |

| Utah | American United Federal Credit Union Fresh Start Checking | Cyprus Credit Union Fresh Start Checking | ||

| Virginia | Central Virginia Federal Credit Union Fresh Start Checking | Healthcare Systems Federal Credit Union Renew Checking | Member One Federal Credit Union Smart Choice Checking | |

| Washington | MountainCrest Credit Union Fresh Start Checking | |||

| West Virginia | West Virginia Federal Credit Union Fresh Start Checking | |||

| Wisconsin | Brewery Credit Union Fresh Start Checking | Crossbridge Community Bank Fresh Start Checking | WESTconsin Credit Union Foundations Checking | |

| Wyoming | WyHy Federal Credit Union Second Chance Checking | Wyo Central Federal Credit Union 2nd Chance Checking | Valley Credit Union Opportunity Checking |

You'll want to understand the limited features that come with most second-chance bank accounts when you're trying to open one. As we said before, most credit unions will happily work to build your credit reputation with you over the course of time.

The goal is to help you graduate to a checking and saving account with full privileges and features. That will also help you to qualify for a credit card and improve your credit score.

Second chance checking account features include:

Your second chance account "dream list" come with the following:

Low or no monthly fees. No minimum balance requirements. Free services like: Debit card access, Online bill payments, Unlimited check-writing privileges.

You'll find that some second chance credit unions don't have some of these services or benefits, so you may have to shop around to find a credit union that fits your needs.

The good news is that, yes, they do.

The N.E.W. Credit Union tracks stories of their clients who have been helped by working with them:

"I came down with COVID-19 after starting a new job. I was sick for three weeks and had no health insurance, and also developed another medical issue that I am still battling one year later. During this time, we emptied our savings accounts and got behind on our loans. We didn't know where to turn, but the V.P. of Lending at N.E.W. Credit Union reached out and offered help. We were about to lose our vehicles when she helped us put a claim in for debt protection which brought the loans current. She went above and beyond making the calls for us, which made it possible for me to focus on getting well again. They have given us hope that we can rebuild everything with N.E.W. Credit Union in our corner!"

Second-chance checking accounts really do offer you a fresh start. It takes up to five years for negative remarks to fall off your report but don't worry about that.

Once you have a second chance bank account, you have a clean slate to start building a positive history with ChexSystem. And that will open doors of opportunity for you and your family to create a bright future.

Are there such things as "guaranteed approval" credit cards for people with bad credit? Doesn't it sound a little like a pink unicorn?

Well, believe it or not, guaranteed approval credit cards not only exist, but they're designed for people with bad credit!

Well, believe it or not, guaranteed approval credit cards not only exist, but they're designed for people with bad credit!But before you think you've found the answer to all your credit dilemmas, you should know that even a guaranteed approval credit card has a few qualification requirements. They may be minimal, but they're still there.

There are two basic requirements issuers want to see even for a guaranteed approval credit card:

And while these types of cards are intended to help people with bad credit, just how bad can someone's credit be before they don't qualify for one of these cards? FICO considers a score between 300 and 600 as a bad credit score, while VantageScore uses the language of "poor" to indicate a bad credit score. Any number between 500 and 600 is considered a poor credit score, and a number between 300 and 499 is considered "very poor."

Knowing which companies will help "subprime borrowers" is extremely important, as applying for a credit card and getting rejected causes your credit score to drop again.

Along with knowing which companies can provide you with a credit card, even if you have "bad" credit, you need to know your credit score. Now is not the time to stick your head in the sand and hope for the best.

Through 2023, you can request a free copy of your credit report at www.annualcreditreport.com. It takes three easy steps to request credit reports from Equifax, Experian or TransUnion (or all three simultaneously).

You'll be asked a few questions to which only you should know the answer. They're meant to be challenging to help protect you from identity theft. Once you answer the questions, you can download and print your credit report.

On Annual Credit Report's site, they disclaimed,

"Your free annual credit report does not include credit scores."

The primary reason it's important to check your credit report is to make sure all the information on the report that determines your score is accurate.

That's on you. No one will check your report to verify that your identifying information is correct and up-to-date or if a company inputs the wrong information or claims that you owe them money when you really don't.

You can use dispute processes to correct any errors and should do so as soon as you are aware of the mistakes:

It's normal for the two credit scoring models to produce different numbers. Lenders understand this and look beyond the number to what it represents — good, bad, fair, excellent.

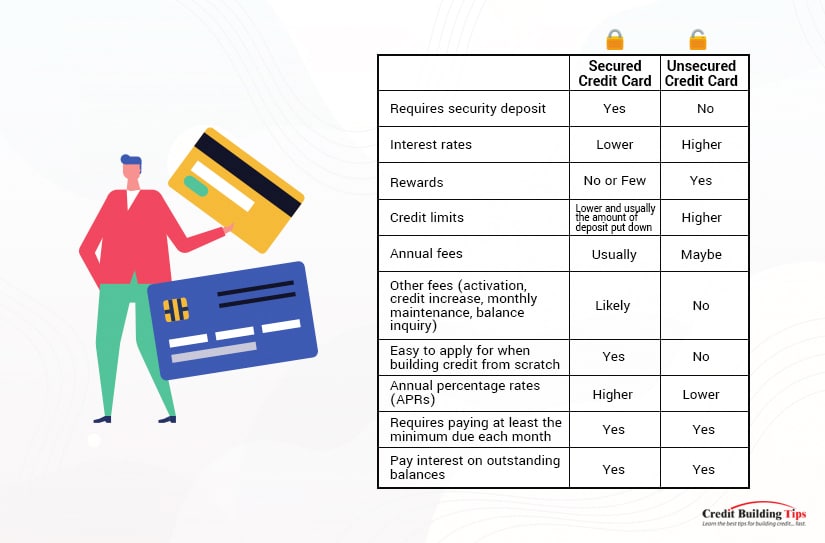

There's a major difference between secured and unsecured credit cards.

Investopedia defines a secured credit card as a "type of credit card that is backed by a cash deposit from the cardholder." With a secured credit card, you pay a cash deposit upfront to guarantee your credit line if you default on any payments.

An unsecured credit card doesn't require collateral as a security deposit to secure it. They're a common type of credit card, but not one that someone with poor credit will likely qualify for.

Once the deposit is in place, a secured credit card acts like any other credit card, although they usually have lower credit limits and more fees than unsecured credit cards do.

In a sense, secured credit cards act like debit or ATM cards, so why are they better than using a debit card or getting cash from an ATM? Technically speaking, a secured credit card still uses credit from the issuer — they just have access to a cash reserve if the user doesn't pay their credit card bill.

A secured card is worth getting because it is a way to build your credit score, whether you have bad credit or no credit due to your age or life circumstances. As long as you continue to pay at least the minimum owing on your card, you'll improve your credit score and may look forward to qualifying for an unsecured credit card without needing to tie up collateral or a cash deposit.

While nothing is truly guaranteed, these are the easiest credit cards to get approved for. Bad credit or no credit is not, on its own, a barrier to getting one of these 12 credit cards.

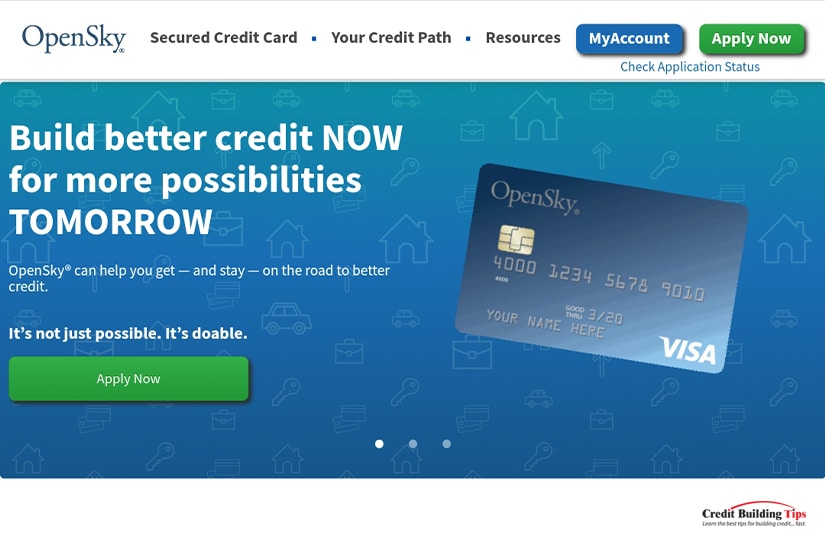

Secured rating: 4.5

Average approval rate: 85% for the past five years

Credit needed: Poor

Requires: U.S. mailing address, proof of identity, some income

Doesn't require: Credit history, credit check

Annual fee: $35

Regular APR: 20.39% variable

Secured rating: 4.6

Average approval rate: N/A

Credit needed: All scores welcome to apply

Requires: $300 initial refundable deposit (sets your credit limit)

Annual fee: $69

Regular APR: 19.99% variable

Secured rating: 4.7

Average approval rate: N/A

Credit needed: Limited or bad

Requires: A deposit amount that's less than the credit limit you'll be given, credit check with all three credit bureaus

Doesn't require: Credit score

Annual fee: None

Regular APR: 28.49% variable

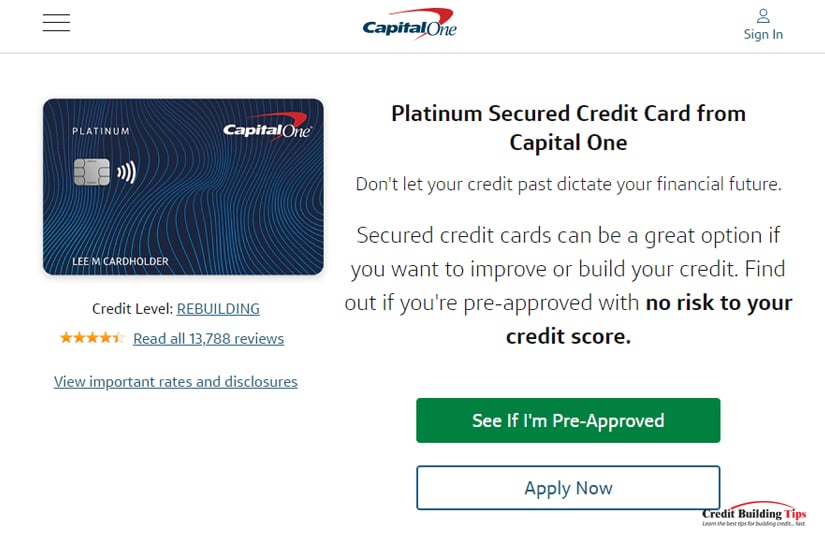

Secured rating: 4.8

Credit needed: Limited, bad

Requires: U.S. mailing address, have a valid SSN, disclosure of total annual income, access to authorized bank account, refundable $200 security deposit to get a $200 initial credit line

Annual fee: None

Regular APR: 28.49% variable

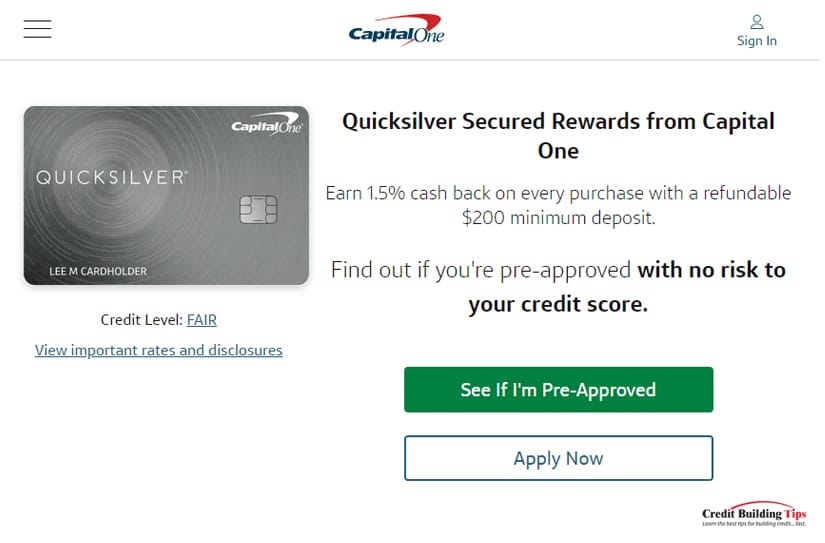

Secured rating: 4.7

Average approval rate: N/A

Credit needed: New or rebuilding

Requires: 10.99% intro APR for six months, minimum refundable $200 security deposit to get a $200 initial credit line

Doesn't require: Credit score

Annual fee: None

Regular APR: 25.99% variable

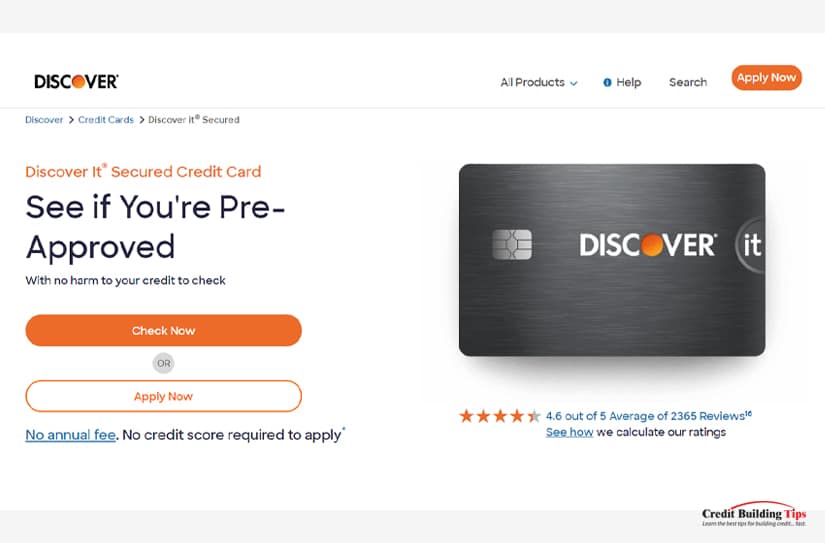

Secured rating: 4.6

Average approval rate: N/A

Credit needed: Bad or limited

Requires: A minimum refundable security deposit of $200 (maximum of $5,000)

Doesn't require: Credit check

Annual fee: None

Regular APR: 25.49% variable

Secured rating: 4.5

Average approval rate: N/A

Credit needed: Limited history, no credit, new to credit

Requires: Minimum refundable $200 security deposit

Doesn't require: Credit check

Annual fee: None

Regular APR: 25.49%

Secured rating: 4.5

Average approval rate: N/A

Credit needed: N/A

Requires: Minimum refundable $250 security deposit

Doesn't require: Credit check

Annual fee: None

Regular APR: 14.99%

Secured rating: 4.5

Average approval rate: None, poor

Credit needed: N/A

Requires: Must be a member of Navy Federal Credit Union, minimum refundable $200 security deposit

Doesn't require: Credit check

Annual fee: None

Regular APR: 18%

Secured rating: 4.5

Average approval rate: N/A

Credit needed: Bad, limited, no credit

Requires: Minimum refundable $200 security deposit

Doesn't require: Credit check

Annual fee: None

Regular APR: 18%

Bad credit rating: 4.3

Average approval rate: N/A

Credit needed: Fair, good or previous bankruptcy

Requires: Minimum refundable $200 security deposit

Doesn't require: Credit check

Annual fee: $0 - $99

Regular APR: 24.9%

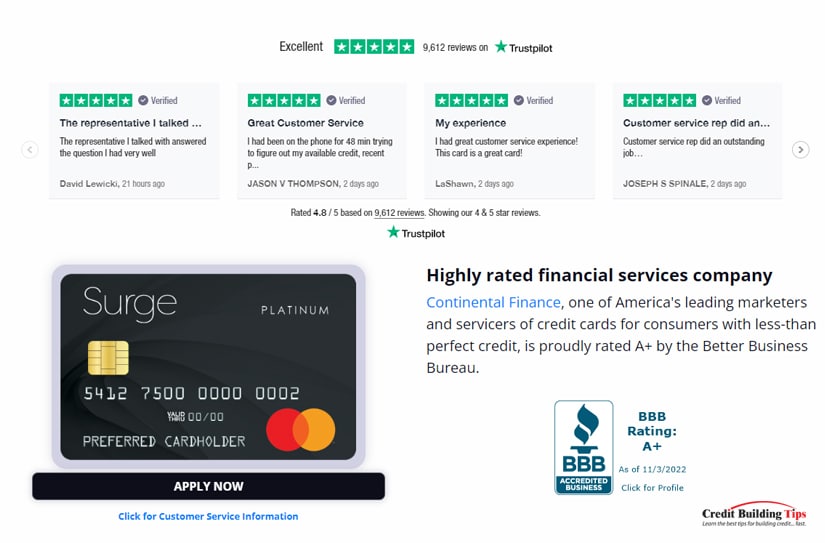

Bad credit rating: 4.4

Average approval rate: N/A

Credit needed: Bad, fair, or no credit

Requires: See terms

Doesn't require: Credit check

Annual fee: See terms