Your credit score is made up of five primary factors. You've probably seen this breakdown before:

Most of these can be controlled, but one stands out: the length of credit history.

Building credit happens over time, and the longer your credit history, the better. Except, that's not purely true, or young people would never have good credit, and older people would have better credit as a baseline.

The length of your credit history accounts for roughly 15% of your score calculation, but that's not a very helpful description. You know that credit history is important but not what makes a good credit history.

The length of your credit history accounts for roughly 15% of your score calculation, but that's not a very helpful description. You know that credit history is important but not what makes a good credit history.So, how long is long enough? What is a "good" length for your credit history? Is there a cap? Let's dig in.

Did you know that there's a minimum age to have a credit score?

Technically, the minimum age is 18 throughout the U.S. in order to start gaining credit. That's because you have to be 18 to open up lines of credit, qualify for loans, and have your own major assets in your own name.

Technically, the minimum age is 18 throughout the U.S. in order to start gaining credit. That's because you have to be 18 to open up lines of credit, qualify for loans, and have your own major assets in your own name.There are exceptions, though. If you're younger than 18, you can still be added as an authorized user on someone else's credit card (usually your parents') and start building a credit history earlier. There's technically no minimum age here, but most credit card companies will limit it to 16 or so.

Sometimes you can have a longer credit history if a credit reporting bureau started tracking you erroneously. This can happen both out of mistakes and due to identity theft. Unfortunately, the added benefit of a slightly longer history here isn't going to outweigh the issues caused by identity theft, at least until you get them figured out.

There's also a minimum length for how long of a credit history you have before you even get assigned a credit score.

Contrary to what some people believe, you don't get a credit score immediately.

The minimum age for a credit history is six months. That is, if you open a credit card on your 18th birthday, it will be six months after your birthday before you are assigned a score based on credit factors.

The minimum age for a credit history is six months. That is, if you open a credit card on your 18th birthday, it will be six months after your birthday before you are assigned a score based on credit factors.It won't be a great score since you don't have a mixture of credit scours or a long history of on-time payments, but it will be a starting score.

Credit scores are highly variable and easily influenced when they're relatively new. That's because there's so little data to them, so even small changes can have an outsized effect on the whole.

Just like how if you have $1, giving you a quarter will be a significant increase in money, but if you have $100, a quarter is barely anything.

The "training wheels" period for credit scores is around 2-4 years. That is, you have to have been building credit for 2-4 years before your score starts to reach a point where it settles down and becomes somewhat harder to influence.

The "training wheels" period for credit scores is around 2-4 years. That is, you have to have been building credit for 2-4 years before your score starts to reach a point where it settles down and becomes somewhat harder to influence.We say "somewhat" harder here because your credit score is always relatively easy to influence if you know what you're doing and take the right actions. This entire website is predicated on teaching you how to do exactly that, after all.

Before two years of credit history, you don't have a lot established. Creditors looking at your credit history can't see a long line of on-time payments because you haven't had a score long enough to even be making payments.

Each factor in a credit score has an "ideal" or "best" range to hit. For example, the number of late payments should be zero, and the percentage of utilized credit should be under 30%.

So, is there a "best" point for the age of your credit history? Yes and no.

Most people consider a credit history to be fully matured at around ten years. That means you can't get a "perfect" score on your credit history until you're at least 28 years old, assuming you started from scratch at age 18. Obviously, this can be lowered slightly if you took advantage of loopholes like being an authorized user at 16.

Some creditors will say seven years is good enough, as well. That means the youngest feasible age to have a "mature" credit score is 23, assuming you started early. On average, though, this is relatively uncommon.

Another age-related factor you might have heard before is that negative marks and blemishes on your credit report will drop off after seven years.

This is a little tricky to conceptualize, and it won't affect everyone. It's specifically for delinquent accounts and the report on your credit history that payments were missed.

This is a little tricky to conceptualize, and it won't affect everyone. It's specifically for delinquent accounts and the report on your credit history that payments were missed.For example, say that you miss a single payment on a car loan, and it's late by over 30 days. You then pay it, but the blemish remains; you were reported to have missed a payment. That blemish hurts your credit, but if your overall credit report is positive, it won't be devastating.

Unfortunately, it will take seven full years from the date of that account becoming delinquent for that blemish to fall off of your credit report. For a single missed payment, that's pretty obnoxious. That's why many people recommend trying out a goodwill letter, asking your loan servicer to remove that blemish from your credit report in light of the rest of your credit history.

This gets a little more complex if your account falls delinquent for a longer period. Say you miss three payments in a row, putting your account 90 days delinquent. If you then bring the account up to current, paying off that debt, those blemishes will stay on your report.

When, though, do they fall off? "Luckily," it's the date when the account first fell delinquent. So, the date at which the first payment was labeled late, plus seven years, all of those late payments will fall off. That can be a (very) slight boon to your credit score, letting slightly more recent blemishes fall off along with older blemishes.

This only works if it's a single instance, however. If you miss three payments, bring your account up to current, then six months later, miss another payment, the seven-year erasure will only remove the original string of blemishes and not the more recent one.

What if you completely abandon the account and it goes to collections? When the seven-year mark of the original delinquency is reached, the entire account, along with any accounts it was sold to as collections, will be removed. This is beneficial in that a delinquent account is removed, but it's also detrimental in that an old credit account is removed from your history, collectively making the age of your credit history lower.

This is why, if an account falls to collections, many people will consider trying a "pay for delete." A pay for delete is a negotiation with a debt collector. In it, you offer to pay some portion of your debt in exchange for the debt collector removing the blemish from your credit report. The debt collector makes money because they likely bought your debt for pennies on the dollar, and it's no benefit to them to punish you after you pay them, so many will accept these terms rather than have to hound you for years until they can no longer pursue a debt.

"If your account has been current ever since, the status will change to show "never late" when the last series of late payments falls off, and the account will appear as positive. However, if the account was never brought current, then the entire account will be removed seven years from the original delinquency date." – Jennifer White, via Experian.

One thing to note is that this isn't all-or-nothing. A delinquency will fade in impact the older it is until it finally falls off your credit history. Thus, you generally don't see a massive improvement when a late payment falls off your report because the negative impact of it has gradually faded over the years up to that point.

Another important age-related factor for your credit history is how old the accounts you maintain are. Generally, the older an account is, the better, especially with lines of credit like credit cards. A credit card that is one year old won't be necessarily as representative of your credit performance as a credit card that is six years old, with a similarly positive history of on-time payments and low utilization.

Credit bureaus will generally consider the average age of your accounts rather than just the age of the oldest. This is why opening several lines of credit in a short time can be indicative of something negative and can impact your score.

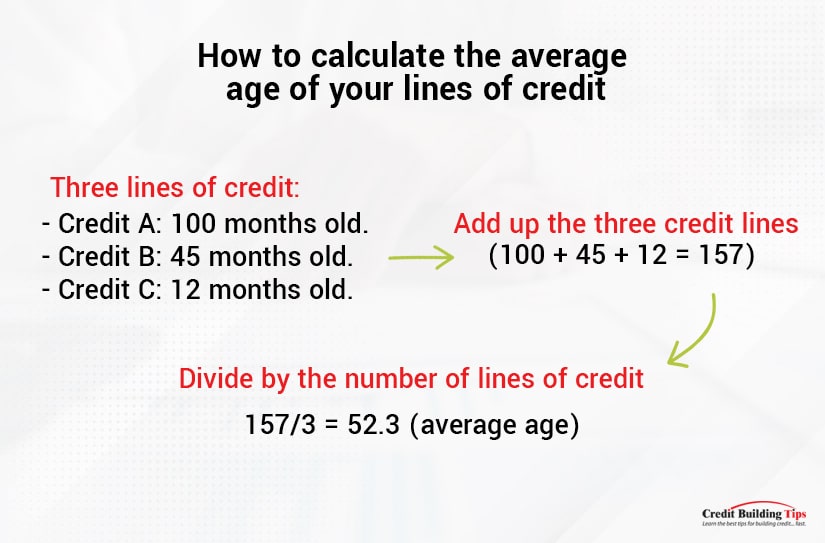

To calculate the average age of your lines of credit, simply take the average of each line's age. For example, if you have three lines of credit:

You add up the three (100 + 45 + 12 = 157) and divide by the number of lines of credit (three in this case, so 157/3 = 52.3, for an average of a little over 4 years old) to get your average age.

This is why it's generally recommended to keep an older line of credit around, even if you don't frequently use it. Setting it to auto-pay a few small bills and forgetting about it helps build credit passively, simply out of age and a history of on-time payments and low utilization.

This is why it's generally recommended to keep an older line of credit around, even if you don't frequently use it. Setting it to auto-pay a few small bills and forgetting about it helps build credit passively, simply out of age and a history of on-time payments and low utilization.It's also important to keep your older lines of credit active. There are two reasons for this.

The first is that inactive accounts can, sometimes, be charged fees for being unused. This is relatively rare today, but some credit cards and other lines of credit, when left idle, might charge service fees or other charges just to be kept open. Luckily, this has been banned in the USA since 2009, so it shouldn't be a problem unless you're dealing with international creditors.

The second is that dormant accounts are often simply closed out by creditors. After a period of inactivity – usually at least a year, though it varies by creditor – they may simply close your account. In addition to losing any accrued rewards or benefits, you also lose that account's history on your credit report; rather than an old, active account, you have a closed account, which is worth significantly less.

Truthfully, this is one of the least important factors to concern yourself with when you're trying to improve your score.

Why?

Well, it's simple: you can't speed up time. No matter what you do (short of traveling near the speed of light), you can't alter the flow of time. Your credit history's length will grow at a rate of one day per day, one year per year, and you can't really change that.

Well, it's simple: you can't speed up time. No matter what you do (short of traveling near the speed of light), you can't alter the flow of time. Your credit history's length will grow at a rate of one day per day, one year per year, and you can't really change that.The only thing you need to concern yourself with is keeping older accounts in good status and keeping lines of credit around as long as they benefit you. You may want to think twice about closing out an old credit card if it's acting as an anchor for the average age of your credit accounts, but that's not the credit history length metric at all. Remember, there are two different age-related metrics in your credit report.

Start building credit as early as you can, but otherwise, don't worry that much about it. If you're still young, just remember that you'll be building credit over time. If you're already older, chances are you've built up your history already, and the age factor is already as good as it can be.

If you ever have questions or concerns about anything credit related, please feel free to drop me a line at any time! I'd be more than happy to answer any of your potential questions and assist you on your credit building journey however I possibly can!

Your credit score is a rating of your financial reliability, and it's used by all sorts of different institutions to make decisions that affect your future and your lifestyle.

If you're trying to improve your credit score, you may have asked yourself, "Is there a limit to how good my credit score can be?" According to Experian, the short answer to this question is that while there are reports of individual credit scores as high as 990, the official highest possible credit score in the US is 850. But before we get into what exactly determines your FICO score and why it matters, let's take a step back and look at the big picture on credit scores in general.

It's a numerical score in a certain range, so the question is, is it possible to cap it? Can you hit the maximum possible credit score if you're very good at managing credit for years?

Let's dig in!

The FICO score is the credit score you're likely most familiar with. It's the one everyone thinks of when they think of credit score, even if they don't really know much about credit in the first place. FICO is the score tracked by the major credit bureaus, Experian, Equifax, and TransUnion.

There are, however, other credit scores and scoring systems, and a whole host of other credit bureaus, but we'll get to that in a bit.

The FICO score is the Fair Isaac Corporation's scoring system. Fair Isaac was formerly known as Fair, Isaac, and Company, founded by Bill Fair and Earl Isaac back in 1956.

Want a glimpse into Big Brother? The Fair Isaac Corporation is a data analytics company, and the FICO score was their hidden, secret way of rating and ranking people based on their financial history. The FICO score itself wasn't actually developed and made public until 1989, just 33 years ago.

Note: That's not to say that credit tracking is truly that new. The first credit reporting organizations sprang up in the late 1830s in response to the Panic of 1837, which started the Great Depression. It's just FICO in its current form that's only a few decades old.

Note: That's not to say that credit tracking is truly that new. The first credit reporting organizations sprang up in the late 1830s in response to the Panic of 1837, which started the Great Depression. It's just FICO in its current form that's only a few decades old.It shocks a lot of younger people to realize that the credit score system didn't exist before the 90s and that it's not really a thing outside of North America. Some other countries have credit scoring systems, but nothing quite the same as the U.S. model. Anyway, that's beside the point.

While FICO the company created and developed the analytics algorithms behind the FICO score, it's the job of the credit bureaus to aggregate the data and report on it accurately.

Another fun fact: while we think of credit as being managed by the big three credit bureaus – Experian, Equifax, and TransUnion – there are many more. It's just that those three are the national credit bureaus, while others are smaller companies with less range.

Another fun fact: while we think of credit as being managed by the big three credit bureaus – Experian, Equifax, and TransUnion – there are many more. It's just that those three are the national credit bureaus, while others are smaller companies with less range.Additionally, none of this is tracked by the government. Credit scores and credit reports are entirely managed by private companies, though the government has put regulations in place to ensure fair and accurate reporting, like the Fair Credit Reporting Act.

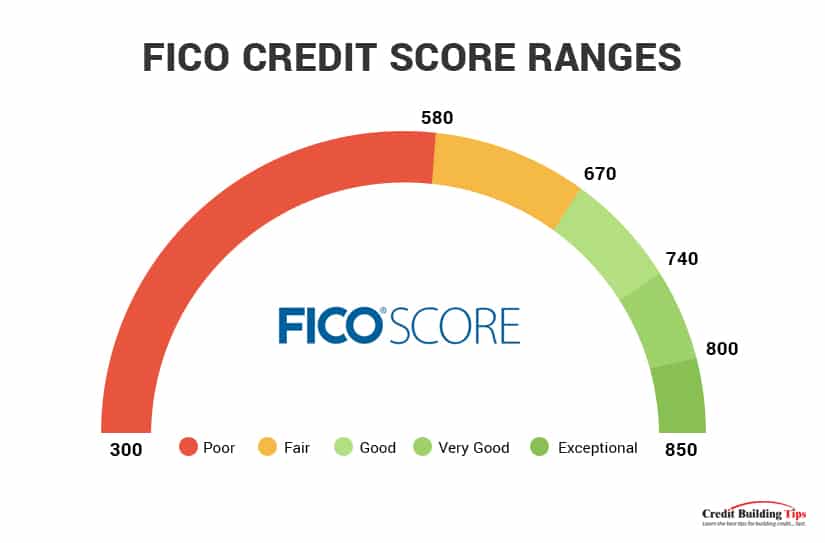

Back to FICO. The FICO score is the most widely-used score, and it is a numerical rating between 300 at the lowest and 850 at the highest. Therefore, for a FICO score, the highest possible score is 850.

Is it possible to get a perfect 850?

The answer is yes. In fact, the FICO company itself says that around 1% of people have a perfect 850 score.

The answer is yes. In fact, the FICO company itself says that around 1% of people have a perfect 850 score.There's no one sure-fire way to have a perfect credit score. It takes time, continued effort, smart decisions with your money, and a little luck. FICO itself says that the people with a perfect score share certain traits, such as:

So, if you're aiming for a perfect score, it's going to take quite a long time. Any late payments need to fall off your report, so it's at least seven years to wait. A long credit history is required, so virtually no one under the age of 38 (since 13 is the youngest you can be made an authorized user on a credit card and start your credit history.)

Luckily, a perfect score isn't necessary for anything but bragging rights. Anything over 720 or 750 is considered Excellent and will get you anything you need that checks credit.

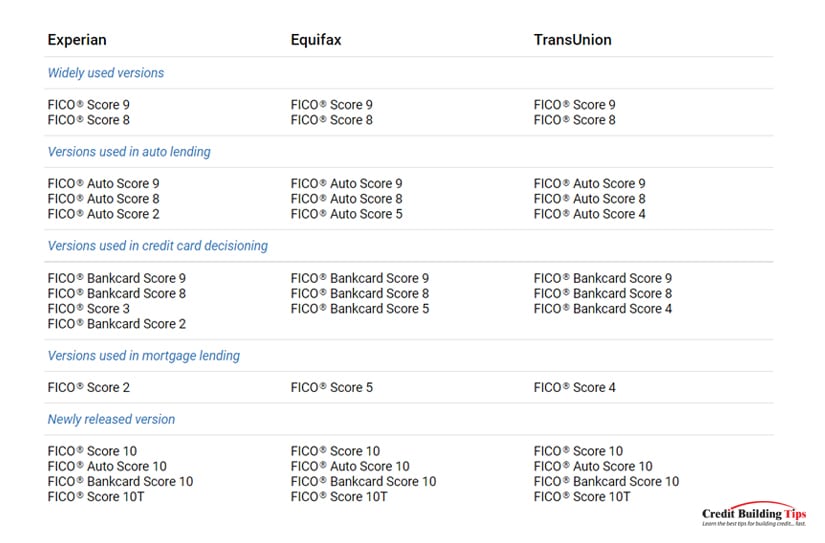

Did you know that each credit bureau has its own way of calculating your score? Every breakdown of the FICO score out there is a generalization; each credit bureau uses its own proprietary algorithm. While similar, these are slightly different, so your score can vary between different bureaus.

The perfect score for these is still 850, but you might not be able to reach it on all the different credit bureaus at once. Equifax reporting 850 doesn't mean TransUnion also reports it. Again, though, anything over 720 is good enough.

FICO also provides a range of other scores, mostly centered around specific industries. These scores are tailored to different banks and different purposes. There are 49 different scores provided by FICO and potentially hundreds more from other sources.

These are generally narrower, more tailored scores that focus on a specific kind of financial deal.

For example, there are:

So, a mortgage lender might not be looking at your full FICO score; they'll be looking at a tailored score that focuses on key metrics that indicate suitability for a mortgage. You could have a perfect general FICO score, but your FICO Mortgage score could be lower.

We cannot reiterate enough, though, that the variance between them won't be so major as to be worth worrying over. Any score above 720 or so is good enough, regardless of your narrower goal.

FICO was created by the Fair Isaac Company and is reported by the credit bureaus. However, the credit bureaus also teamed up to create a competing score. After all, why should they do all the legwork for someone else's algorithm when they can use the same data to generate their own score instead?

Of course, FICO is so engrained in modern financial dealings that they can't just do away with it. So, now the bureaus offer both FICO and VantageScore.

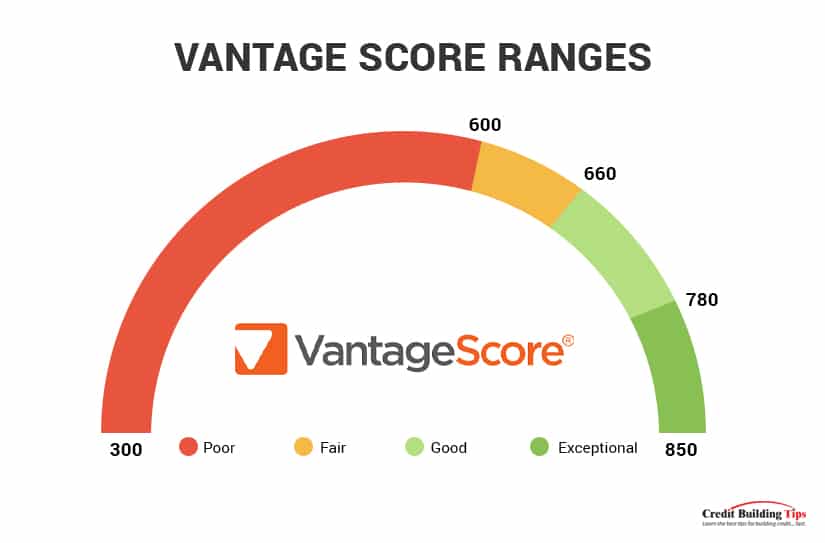

VantageScore is an alternative credit scoring system. When it was invented, it used a different numeric scale, ranging from 501 to 990. Since this disparity was confusing and unnecessary, however, the modern version of VantageScore (released in 2006) uses the same 300 to 850 system as FICO, so they're more directly comparable.

While both FICO and VantageScore monitor the same metrics, they weigh them differently. Thus, your two scores can be different, despite your financial situation remaining the same. The two scores are similar enough now that having anything over 750 on both of them is good enough.

Above, we mentioned that the big three reporting agencies – Equifax, Experian, and TransUnion – are not the only three. In fact, there are at least four more, with other players operating in regional geographic areas or in certain industries.

Other credit reporting bureaus include:

Many of these use what is known as Alternative Data, which includes things like utility bills and telecom bills.

One common way to build credit via a Credit Builder Program is to open a new line of credit and use it for bills that aren't normally reported. If you pay for electricity, gas, water, internet, or TV (or even things like Netflix) regularly, great! However, FICO and VantageScore don't care. For whatever reason, these transactions aren't classified as "important enough" to be counted the same way loans, mortgages, and other payments are.

But, if you pay those same bills via a credit card and pay off the credit card immediately, it counts because paying off a debt on a credit card is tracked. Why the disparity? That's just how the reporting has worked.

Many of these alternative credit reporting bureaus will harvest and use information about utilities and other payments, removing this loophole. After all, there's no reason why regularly paying your power bill shouldn't benefit you.

Of course, there are some forms of "alternative data" that aren't relevant but may be used by certain agencies. These include things like social media activity, psychometric data, and smartphone meta data. An example of how these may be used (and how it goes wrong) is China's Social Credit system.

It's impossible to run down every single alternative credit score. They all vary and use different scales.

It's impossible to run down every single alternative credit score. They all vary and use different scales.One example is the Connect (PRBC) score. Their score operates on a point scale from 100 to 850, but it's stretched and squished in a weird way. To FICO, anything under 600 is considered poor, but only scores under 500 are "very poor" and likely to get you denied credit. Meanwhile, anything over 720 is excellent.

With Connect, anything under 600 is poor enough to get you denied credit, while anything over 750 is excellent. This essentially makes the score less nuanced while encouraging a more gamified experience of building it (when you have a very low score, it's much easier to raise it because each point is a smaller gap). Of course, relatively few lenders actually use this score for anything, so unless you're applying for loans to buy furniture or something similar, it's not going to matter.

Alternative credit scores take two forms.

One form is generally just meant to be FICO or VantageScore, but with more attention paid to other bills that matter, like rent and utilities. They add a little nuance and give many people a way to build credit when they can't otherwise afford something like a mortgage or a car loan.

The purpose of these alternative credit scores is to put pressure on the primary credit bureaus to start recording and caring about this information. It's more of a social and political movement than it is a viable alternative score to rely on for financing.

The other way these alternative credit scores are used is as a way for small-time lenders to filter and justify lending to individuals with sub-prime credit on the FICO or VantageScore ratings. If you have sub-prime credit, most traditional lenders will either have extortionate terms or won't lend to you at all. However, small-time lenders like credit unions or stores and retailers might use an alternative score to take a closer look.

For example, Connect's score shows more nuance between someone with a score of 200 and a score of 500, even though on FICO, both people might have a score in the 400-range. These small-scale lenders can then choose between these two individuals with more reliability.

So, alternative credit scores can be useful as a narrative device and useful for people with sub-prime credit, but most others don't have to care about them.

When we're talking about the perfect 850 on FICO or VantageScore, we have to wonder, is it worth pursuing at all?

The answer is not really. If you want to push yourself to the point where you have immaculate financial habits and your score is as good as you can get it, then, by all means, pursue it. However, if you're only looking for the best interest rates and loan terms, anything over 750 or 800 is going to be fine.

The answer is not really. If you want to push yourself to the point where you have immaculate financial habits and your score is as good as you can get it, then, by all means, pursue it. However, if you're only looking for the best interest rates and loan terms, anything over 750 or 800 is going to be fine.Realistically, there's no difference between the loan offer you'll get with a credit score of 800 versus the one you'll get at 850.

If your credit score is under 700, work on improving it. If your credit score is above 720, there's not much need to push for higher, and if it's above 800, you pretty much don't need to worry about it. A perfect score is worth bragging rights, but the tangible effect on your life is going to be minimal at best compared to what it was at 800-849.

What do you think? Is it worth caring about a perfect score, and if so, how would you go about earning it? Be sure to leave all your thoughts down in the comments section below! I'd love to hear what you think! Additionally, if you have any questions or concerns about anything involving credit scores, be sure to leave those as well! I'd be more than happy to answer any of your questions, clear up any concerns you may be having, and assist you however I possibly can!

Having a place to live is an essential part of modern life. Unfortunately, it can be distressingly difficult to lock down a home. The cost of housing is rising every year, and banks are hesitant to repeat the subprime mortgage crisis that led to the 2007 recession, so they're pickier than ever about the mortgages they offer.

That means your credit score is more important than ever when it comes to securing a home loan.

That means your credit score is more important than ever when it comes to securing a home loan.The question is, what credit score do you need? Is 650 good enough?

First, let's look at the lowest options. Credit scores range from 300 to 850.

Typically a rating scale might look like this:

Of course, this scale is just a general impression of what your credit score means. There are many factors that go into your credit score, and anyone considering lending you a lot of money – like a home loan – will take a closer look to see why your credit score is low, not just that it's low.

Is there a minimum credit score necessary to get a home loan?

In actuality, there is, but it's a little lower than you might expect. It also depends on the kind of loan you're after.

In actuality, there is, but it's a little lower than you might expect. It also depends on the kind of loan you're after.A conventional mortgage from a bank typically requires a credit score of about 620 or 630. Requirements vary depending on the financial institution; some are more flexible than others.

Mortgages from credit unions may have a higher requirement, but since credit unions are often more local institutions, they may be more willing to work with you as a member of the community. On the other hand, since they carry more risk to themselves proportionally, they might not.

VA loans usually have a lower credit score requirement, around 580. Of course, to qualify for a VA loan, you must have the relevant military service requirements.

FHA loans are the most available of the lot, and they may be able to offer a home loan for those with credit scores as low as 500. These loans have strict limits on their size and terms, though, so they aren't ideal for most people.

So, as a simple answer: can you get a home loan with a credit score of 650? Almost certainly. Nearly every lender will offer you a home loan, though the terms might not be the best possible they could offer.

So, how does your credit score affect your home loan? Several ways, actually.

The first is your classification. Above, we mentioned the subprime lending crisis, but what is subprime? It's another scale for credit scores.

It looks like this:

Subprime essentially means that your credit score falls under the range where mortgage lenders feel comfortable in your ability to repay the loan they offer you. Subprime loans often require higher down payments and have less favorable terms than prime and super-prime loans.

During the mortgage crisis, banks felt invincible and readily offered mortgages to borrowers with subprime credit, fully aware that if many of those borrowers defaulted, the banks would be bailed out. Banks also leveraged these loans as a form of securities investment, further muddying the waters. Eventually, the bubble burst, and it all collapsed in a subprime meltdown, with dramatic repercussions.

As the saying goes, "once bitten; twice shy," so now banks are more hesitant to offer loans to people with subprime or lower credit scores. It's not impossible, but it's more difficult.

Luckily, at a credit score of 650, you are above the range of subprime and in the acceptable range. You won't be getting the best rates, but neither will you be denied a loan in most cases.

Your credit score primarily affects three things about your home loan.

The first is whether or not you're eligible at all. People with a credit score in the subprime range can still get home loans, but they will have unfavorable terms. People with credit scores under 580 will be very limited in what they can access, if they can access anything at all. With a credit score of 650, you should be eligible to get a home loan from most financial institutions that offer them, though some credit unions may not offer you a loan.

The second is what kind of down payment you need to offer up. Generally, most conventional loans will ask for about 3% of the total value of the loan as a down payment. FHA loans ask for 3.5% on average. "Jumbo" loans, and loans offered to subprime and lower credit scores, usually ask for higher down payments, up to 10% of the value of the home.

The higher the down payment, the lower the total principal of the loan, so even if the interest rate is higher, it's not quite as much money as it could be.

Some VA loans don't ask for any down payment, but again, they have more restrictions.

The third factor influenced by your credit score is the interest rate you'll be asked to pay, at least initially. Mortgages can be fixed-rate or variable rate, and variable rate loans change from time to time. Your initial rate will be lower the better your credit is.

Banks use interest rates to ensure that they get as much money repaid as possible, as quickly as possible, in case you end up defaulting on your loan. It helps them minimize the loss and make more money off of you as you continue to pay. Charging people with poor credit more money to exist may not be a sensible strategy from a community-focused point of view, but to banks, with their bottom lines as the driving factor, it makes sense.

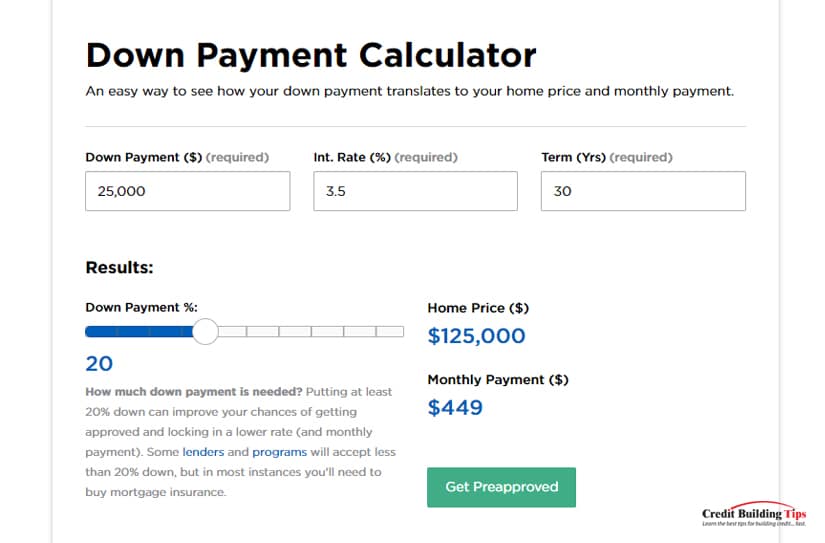

Many sites, such as NerdWallet here, offer housing payment calculators. These calculators allow you to specify numbers for principal, interest rates, and down payments, to get an idea of what your home loan might look like. They don't factor credit score into the mix because credit score doesn't directly impact your loan, just the terms the bank will offer.

With a credit score of 650, you'll be well above the threshold necessary for a 10% down payment and can typically get away with a lower down payment. Your interest rates will be higher than the best possible terms, but they won't be exceptionally bad. For example, you might have an interest rate of around 3.5%, rather than something closer to 5% if your credit score was closer to 620.

Your credit score is an important part of your eligibility for a home loan, but it doesn't tell the whole story.

Your credit score is made up of several factors:

You may notice that some aspects of your financial situation are not represented in your credit score. For example, nowhere in your credit score does it report on whether or not you have a job or how good or stable your job is. Likewise, it doesn't track or report on how much you have saved in a savings account, in investments, or otherwise.

Lenders will often look at things like your debt-to-income ratio, your bank statements and assorted assets, and other signs of financial stability beyond your credit score and credit report to calculate and offer you a loan.

As you might expect, having more assets and having a better, more stable job are going to make you look less risky to the lender than not having those things.

If you have a credit score of about 650, should you work to improve your score before applying for a home loan, or is it good enough?

The truth is, while 650 is "fine" for a home loan, it's still not the best. Improving it is always going to be a good thing.

The truth is, while 650 is "fine" for a home loan, it's still not the best. Improving it is always going to be a good thing.If you can take your credit score from 650 to 670, you'll likely reach a better bracket of offers and will see better terms on your home loans. If you can push all the way up to over 700, or even up to 740+, you'll be able to reach Super Prime status and will get the best possible offers (contingent on other factors, of course.)

Buying a home is a major decision, and it stands to reason that you should take the time to lay the groundwork and prepare as best you can. However, we also recognize that the housing market is on a historic, meteoric rise, and it's possible that you'll be priced out if you wait too long. Thus, you have three options.

Obviously, the third option is impossible to predict and may not ever actually happen. And regardless of which of the three options you want to pursue, you should be working to improve your credit score.

If you want to boost your credit score quickly, you have a handful of good actions you can take.

Before any major purchase or loan application, you should pull your complete credit report and review it. Make sure you don't have any signs of identity theft and that there are no issues on your report. If there are, dispute them, and wait to apply for a mortgage until the dispute is settled.

Reducing your debt-to-income ratio by paying off debts will put you in a better position to get a higher score and a better loan. Start with the debts with the highest interest rates because they're the ones that are most expensive over time. You may also consider consolidating credit balances and refinancing lines of credit for better interest rates.

A goodwill letter is a letter you send to a lender asking them to, out of the goodness of their heart, forgive a late payment and remove it from your credit report. You can read all about what they are and how they work – as well as how to send them – in our post on the subject here.

Credit builder programs are generally short-term loans and other kinds of credit meant specifically to help you build up a payment history and a better debt-to-income ratio to boost your credit score. They can be quite effective when done right.

With a few months or up to a year of effort, you may be able to get your credit score up into the Prime or even Super Prime area, especially if you're already starting at 650. It's well worth the effort before applying for a home loan, but a score of 650 will not disqualify you from getting a mortgage, so make the choice that makes sense for your needs and financial situation.

Do you have any questions about getting a home loan with an acceptable credit score of around 650, or lower? Or do you, perhaps, have any questions about getting a home loan, in general? If yes to either of these questions, please let me know! I'd love to provide you with any needed knowledge and assist you however I can!

Maybe you've just moved into a new apartment or a home, and you're looking to build your rooms with some new furniture. Perhaps you have a new addition to the family coming soon, and you need a crib and a child-size bed. Maybe you're looking at replacing an old hand-me-down couch and want a new one.

You look around, do some shopping, and what you see is shocking. Individual pieces of furniture can cost as much as a used car. Couches can cost upwards of $5,000, and bedroom sets can surpass $3,000 - on sale.

Most Americans are living paycheck to paycheck. How can you hope to swing that much cash for a piece of furniture?

As you might expect, there are options. You could try to take out a loan, but going to the bank and asking for a loan to buy a couch is disheartening. You can put the furniture on credit, but if you need your credit card for emergencies – or your credit limit is lower than the furniture cost – you might not want to do that.

Luckily, many furniture stores today understand this. They use systems like Afterpay, Klarna, or Affirm, to offer financing options. They may also offer in-store financing. You can buy your furniture, get it delivered and set up, and make lower monthly payments until you've paid it off.

Financing anything – whether it's a home, a car, or a couch – involves opening up a line of credit, and that all gets reported on your credit report. That brings us to the crux of the issue; will financing a piece of furniture hurt your credit score, and if so, is it a temporary or long-lasting hit?

If we distill everything down to a simple answer, then the answer is yes. Yes, financing a piece of furniture can hurt your credit score. The damage may be temporary or permanent, depending on various factors, and that's what the rest of this post will discuss.

Any time you open up a new line of credit, you run the risk of hurting your credit score. Most of the time, the drop in points between opening a new line of credit and the credit checks associated with it will be temporary.

Your score will recover, especially as you make regular payments on time, and when you close out the account successfully, your score will potentially even rise.

Your score will recover, especially as you make regular payments on time, and when you close out the account successfully, your score will potentially even rise.What factors should be considered? Do you have alternatives?

Let's dig in.

Financing furniture can be risky in more ways than just your credit score. Your credit score is essential to significant financial decisions and major purchases, but it's not usually impactful for most of your everyday purchases. Meanwhile, your ongoing monthly expenses, debt, income, and ability to pay for living costs are much more impactful. Here are several of the risks inherent in financing furniture.

One of the most significant risks of financing furniture is over-spending. This risk can present itself in two ways.

The first is only looking at monthly payments and not the overall cost of a piece of furniture. You don't notice because all you see is a $99 monthly payment. A good furniture piece might run you $1-2,000, but the price jumps up to nearly double when financed.

The second risk is spending more than you need to pay. What's the difference between a $2,000 couch and a $5,000 couch? Often, the answer is "a brand name" as much as anything else. The cheaper couch might not have a designer name or come from as fancy a store, but it's still a durable piece of furniture. But, when you're looking at monthly fees instead of overall pricing, it's easy to convince yourself you can justify a more significant expense.

Another risk is the dreaded "introductory offer" that stores will use to get you to sign a contract without fully understanding what you're doing. They'll tell you that you'll have 0% interest for many months or years, but the actual duration of the financing goes on much longer. After a certain point, your total loan value starts to increase. If you don't increase monthly payments to match, you could pay $5,000 for a $3,000 couch just because of how the interest compounds.

Generally, financing furniture is an excellent way for a store to hide the real numbers from their customers and make significantly more from you than they should. Always make sure to read and understand the terms of any financing you consider.

Generally, when you finance a piece of furniture, it will be reported on your credit score in one of two ways.

The first is a "consumer finance loan," a subprime loan commonly responsible for low credit scores. Even if your credit is otherwise acceptable, a consumer finance loan – or more than one, if you're financing multiple pieces of furniture – can look very bad to the credit bureaus.

The other is even worse: the revolving account. Revolving accounts count towards your credit utilization while not giving you the benefits of different kinds of utilized credit - this is because of how a revolving account is reported.

A revolving account is reported as a line of credit with, essentially, 100% utilization. If you finance a piece of furniture for $3,000, your credit report sees a new line of credit with a $3,000 limit and $3,000 utilization for 100%. This increase adds to your other lines of credit. If you have one credit card with a $4,000 limit and a $500 balance, your credit score utilization is 12.5%. If you add on the furniture account, you now have a total credit limit of $7,000 and total utilization of $3,500, or 50%.

Utilization is 30% of your total FICO score, and a higher utilization is generally worse. Going from 12.5% to 50% overnight is devastating.

Another factor related to your credit utilization but slightly different is your debt-to-income ratio or DTI. Your DTI is the percentage of your income that goes towards your debts every month. You total up all debts (like mortgage, car loans, personal loans, and, yes, financed furniture) and divide them by your monthly income.

If you make $2,000 per month and have $1,000 per month in ongoing debts, your DTI is 50%.

When you finance furniture, you're adding to your debt burden - this isn't always a bad thing (debt is natural and expected), but a high DTI can be detrimental to your credit score.

When you finance furniture, you're adding to your debt burden - this isn't always a bad thing (debt is natural and expected), but a high DTI can be detrimental to your credit score.The trick is that DTI isn't directly relevant to your FICO score. It's indirectly relevant. Lenders will look at your reported DTI to decide what kinds of loan terms to give you. A high DTI can make it harder to get a car loan or mortgage or will only offer you hire rates when you get one. That further hurts your overall financial situation.

One of the most significant risks of financing furniture is missing payments, paying late, or generally failing to pay on time.

Late payments can be detrimental to your credit score simply because your payment history and reliability are part of your score calculation. If you fall behind on payments, it can be reported to the credit bureaus and negatively impact your credit score.

Late payments can be detrimental to your credit score simply because your payment history and reliability are part of your score calculation. If you fall behind on payments, it can be reported to the credit bureaus and negatively impact your credit score.Moreover, it's easier to slip on paying for something like a piece of furniture than it is something more essential, like medical bills, rent, car payments, or credit card debt. Furniture purchases aren't viewed with the same seriousness as a car loan, even if, legally speaking, the loans are near-identical.

On top of this, even if you financed furniture for 0% interest, there are guaranteed to be fees for late or missed payments. Those penalties can add up on top of the loan's initial principle, making it harder to keep paying off.

Many furniture stores will happily work with you to lower or even temporarily defer your payments if you face financial hardship. However, many people don't think of that option and might not consider it. The vendor would much rather continue to get regular payments than have to deal with collecting on an account or selling the debt to a debt collection agency.

If you miss enough payments on any loan, you go into default. You can also default on a loan for furniture. If anything, that second example is even more common. Paying a credit card or a bank loan is more prominent and usually has higher value and higher importance; if any debt will slip through the cracks, it's financed furniture or other household items.

Defaulting on any loan is devastating to your credit score. Moreover, you may still end up with financial penalties. Often, if a collection agency can't get you to pay, they will get a court order to repossess the item in question, like your couch. Since furniture depreciates significantly, it will be valued lower when they sell it than the remaining value of the loan, and you'll still be responsible for the difference. Further financial strain puts additional stress on your ability to handle payments and can spiral your credit score downwards.

Now, if you read through the above and think, "none of this is relevant to me; I'm not going to default on my loan," that's fine. Financing is acceptable when done correctly, with no late or missed payments.

That's all it is: fine. It's not inherently good for your credit, but neither is it bad.

You will take an initial hit to your credit for opening a new line of credit for the loan, and that hit might be significant due to the nature of furniture financing, as mentioned above. However, as you continue to pay down the loan and show financial responsibility, your credit score will rise - potentially higher than before.

You will take an initial hit to your credit for opening a new line of credit for the loan, and that hit might be significant due to the nature of furniture financing, as mentioned above. However, as you continue to pay down the loan and show financial responsibility, your credit score will rise - potentially higher than before.Your credit score may even have improved when you finish paying off the loan. By paying for financing, you demonstrate that you can be reliable with your payments and that payment history can be beneficial.

Is financing furniture better than putting the cost of the furniture on a credit card, assuming you have a limit high enough to support it? No, not really. A revolving account can be worse than a higher credit card balance, but neither is great, and we're likely talking about a difference of less than 5-10 points. Either way, you're bumping up your credit utilization.

If reading all of the above has scared you away from the idea of financing, don't fret; you have two alternatives.

The first, if you need furniture immediately, is to buy used. Used furniture may not be as glamorous – and it can still be expensive to purchase directly – but it's an excellent way to get furniture for less cost than buying and financing new. Even if it's only a year or so old and relatively undamaged, used furniture is going to be much less expensive than the same piece of furniture brand new. It's like a new car losing value the moment you drive it off the lot.

If you buy used from another individual, it won't even be reported on your credit score. If you buy from a used furniture store, you would only notify the credit bureaus if you purchased it with a credit card or financed it, and even then, the number is much lower, so the hit to your credit is lower.

If you don't need furniture immediately, the other option is to save for it. Calculate your monthly payment for the furniture if you financed it, and then put that amount of money into a savings account each month. Then, when you've racked up enough to purchase the furniture outright, you can afford the purchase and save significant amounts of money on financing fees and interest.

You avoid any fees or penalties associated with financing by saving up for a purchase. You prevent any hit to your credit report. You also have liquid cash available in the case of a catastrophe and the need to spend in an emergency. On top of that, you can even gain some value to your credit score by purchasing with a credit card and immediately paying it off.

Financing, when done correctly, isn't going to demolish your credit score. However, it's still not often a good idea unless you have no other options.

Are you considering financing furniture, and have you considered some of these other options? Will you finance through your bank, a credit union, or directly with the furniture seller? Do you have any questions for me on this topic? Please let me know in the comments section, and I'll do my best to point you in the right direction!

Housing is a basic human need, but there are many roadblocks in our society that get in the way of having a place to call home. One such roadblock for many is a credit score.

When you apply to rent an apartment, a house, a condo, or any other form of shelter, the landlord will do their due diligence to control the property. This process includes several aspects of a background check to minimize the chances of renting to someone who cannot pay, has a history of property destruction, or is an otherwise high risk to the property itself.

One small part of this due diligence is a credit check and credit report analysis. Landlords are (one of several) entities that routinely pull credit reports to analyze their potential renters for suitability.

A landlord is likely to look for your credit score and an overall impression of your credit report.

A landlord is likely to look for your credit score and an overall impression of your credit report.If you're having trouble applying for an apartment or renting a house, read on.

Your credit score is a semi-objective measurement of your financial presence and history. A long and successful history of making payments on time, utilizing credit appropriately, and maintaining diverse assets will help build a credit score. Conversely, a short credit history, a credit history fraught with late payments, or a credit report with adverse events like bankruptcy can drop a credit score.

Credit scores are always a three-digit number ranging from 300 to 850. You can raise this score in various ways, some faster than others.

While there is no objective number that landlords look for, specific credit ranges have certain associations.

A generally-accepted scale typically looks like this:

The question is, what is the minimum necessary to rent an apartment? Can you rent an apartment with a poor score, a fair score, or a good score?

In general, many landlords look for a minimum score of 650 to rent their properties.

In general, many landlords look for a minimum score of 650 to rent their properties.650 falls into the higher end of Fair and is relatively easy to achieve. However, it's not a hard-and-fast rule. Landlords look at more than just the credit score number. Additionally, the competition in the housing market can raise or lower the score necessary to rent in any given area.

Typically, rural areas, areas with lower general income levels, lower property values, and less competitive markets will have an even lower credit score requirement. Some landlords in these areas may not even check credit scores, though this is typically rare.

Conversely, higher value, upscale, and highly competitive markets will have higher credit score requirements. For example, many landlords in New York City – a highly competitive and expensive environment – will look for 680 or 700 as a minimum.

"According to a 2017 survey report from RentCafe, the average credit score of approved applicants was 650, while the average credit score of rejected applicants was 538. The numbers are a little higher for high-end buildings: 683 for accepted applicants and 553 for rejected applicants. The location has an even bigger impact on the average credit score needed for approval. The cities with the highest credit scores were Boston (737), San Francisco (724), Seattle (711), Minneapolis (711), Oakland (707), Philadelphia (702), and Los Angeles (691)." - Bungalow.

Again, this all varies from landlord to landlord and depends on the property's location. Individual landlords may be more flexible than property management companies, as well.

While the credit score is a simple, bite-sized way to analyze an individual's level of financial solvency, it's not the whole story. This shortcoming is why landlords and property managers will typically pull a full credit report rather than rely solely on your credit score.

The full credit report will offer more detail than a credit score alone and can show a landlord more helpful information - this allows them to make a better judgment of their rental candidates.

What might a landlord look for in a credit report? Like the score level required to rent, this can vary from landlord to landlord. In general, they may look for:

A landlord's #1 concern with their tenants is consistency in rental payments. If the landlord isn't getting paid, they're losing money on the maintenance, upkeep, property taxes, and other expenses of keeping up on a property.

Thus, the landlord's most significant factor is the presence and frequency of any late payments reported to a credit agency.

Thus, the landlord's most significant factor is the presence and frequency of any late payments reported to a credit agency.Be aware, however, that late payments are not guaranteed to affect your credit score or even show up on your credit history. Typically, an overdue payment will only show up on your credit report if it has been more than 30 days since the due date of the payment.

If you're living paycheck to paycheck and are late on a payment by 1-2 days, or even by a week, the late payment is still unlikely to show up on your credit report.

In some cases, you may have even more leeway. Some banks, lenders, and financial agencies will not report a late payment until it has reached 60 days unpaid.

The idea is not to punish people who forget a bill or whose mail gets lost, or who lose a job and are temporarily out of income. Minor mistakes should not, and are not, held against you in that way.

This example is also why it can be a good idea to pursue something like an economic hardship deferment or another kind of deferment or payment plan on a past-due loan; because you undertake such a deferment or payment plan with the permission of the financial institution, they generally will not report it as an adverse event on your credit report.

When a debt is past due for long enough, a financial institution no longer wants to pursue collecting the money. Some may forgive the debt, but many sell the debt to a collections agency. The collections agency pays the institution typically pennies on the dollar and then attempts to collect the total amount (or a lesser amount) from you.

This transfer of debt to a collections agency is typically reported on a credit report. A landlord looking up your credit report when you try to rent an apartment will see any accounts in collections, likely along with what collection agency is pursuing it, the value of the debt, and other details.

Debt collectors have an extensive list of laws and regulations governing their behavior. Regardless of your feelings on the ethics of debt collection, the fact remains that collection agencies exist and will be visible on a credit report.

When you or another entity requests your credit information, the request can be classified as a "hard inquiry" or a "soft inquiry." A soft inquiry is not reported on the credit report and is not factored into your credit score - a hard inquiry is.

Hard inquiries typically include credit card companies and lenders pulling your complete credit report. Soft inquiries include checking your report using your legally-mandated free annual report, when a lender pre-qualifies you for a loan offer, and many other credit pulls.

When a landlord checks your credit report, their check may be classified as a hard inquiry or a soft inquiry, depending on the method they use to pull the information.

Having too many recent hard inquiries can lower your credit score. The presence of hard inquiries can account for up to 10% of your credit score.

Having too many recent hard inquiries can lower your credit score. The presence of hard inquiries can account for up to 10% of your credit score.Why would a landlord check if you have other hard inquiries? It gives them an indication of whether you've been applying for other lines of credit, other apartments, or other loans that could affect your ability to pay rent. This factor can be significant if you have many hard inquiries and no new open lines of credit; this indicates you may have been repeatedly denied. The landlord might look for more information as to why this has happened.

There are provisions here.

"According to FICO, its scoring model allows for "rate-shopping" for consumers applying for a loan or, in this case, apartment-hunting for people seeking a place to live. FICO ignores inquiries made within 30 days of your apartment application. So, as long as your apartment hunt doesn't drag on for too long, your score won't be hurt by multiple credit inquiries." - Bankrate.

Essentially, multiple hard inquiries of the same type will be lumped together. If you apply to multiple landlords or mortgage lenders to find the best terms, you may have numerous hard inquiries, but they will only count as one event for your report and score calculation.

Declaring bankruptcy is a complex process with many factors. Bankruptcy can wipe out debts you cannot pay, though some debts cannot be removed through the bankruptcy process. However, it can be devastating to your credit report. It is, essentially, a huge sign that says you were unable to meet your debt obligations.

Of course, there are many reasons why your debt burden could rise up above and beyond your means, including a sudden loss of a job, medical issues, and related strains. Context can be necessary, and while bankruptcy can be devastating, it may not necessarily be a deal-breaker for all landlords.

Another potential red flag for landlords is a high debt-to-income ratio.

Even if you can sustain your debt payments with your income and lifestyle, a high debt-to-income ratio puts you at greater risk of financial disaster if you lose a job or another tragedy occurs.

This can be the worst red flag on a credit report in many ways.

This can be the worst red flag on a credit report in many ways.However, it all comes down to an individual landlord's judgment as to what is an essential factor in their consideration.

Even if you have a poor credit score, you still need somewhere to live. Typically, you have options. While some landlords will deny you the ability to rent from them, others may be more forgiving.

Another option you could consider is apartments that offer no credit checks. These are fine as a last resort, but you risk worse terms and a worse living situation. Be cautious when pursuing this option if you have any viable alternatives.

While landlords generally tend to look for at least 650 in the credit score of their tenant applicants, the score alone does not tell the whole story. If you have a lower score, you may still be able to argue your case and prove your financial solvency. Good luck!

Is your credit score affecting your opportunity to apply for an apartment or purchase a house? Which credit score factors caused you to be denied by your application? Do you have any questions for me? Please share with us in the comments below, and I'll get back to you with an answer!