It's always a little heart-stopping when you check your credit report and see your score has dropped by 100 points. Why does this happen, what does it mean, and what can you do about it?

There are many factors that can contribute to a drop in your credit score. While it's not uncommon for your credit score to drop some, if you experience a large plummet, it's good to understand this could be due to one big reason or a combination of several smaller ones.

While a 10 or 20 point drop may not necessarily negatively affect whether you would qualify to borrow money or get a new credit card, a drop of 100 points almost certainly would.

While a 10 or 20 point drop may not necessarily negatively affect whether you would qualify to borrow money or get a new credit card, a drop of 100 points almost certainly would.And if this credit score drop happens at the same time you are in the process of buying a house and need to get a conventional mortgage, a 100-point drop could disqualify you. You need a minimum credit score of 620 to qualify for a conventional mortgage.

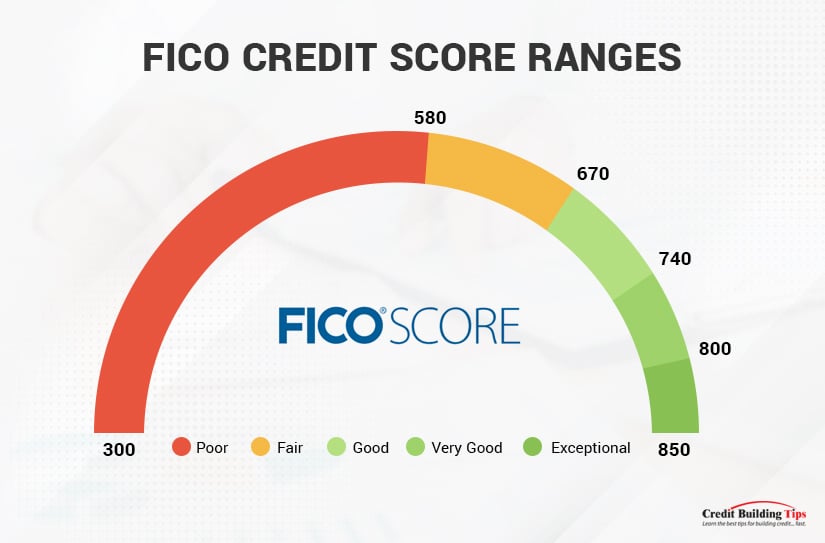

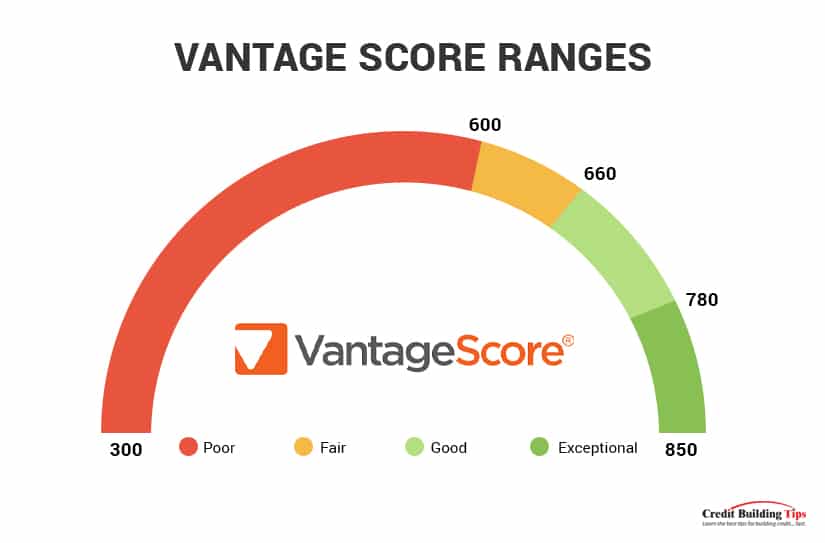

If your credit score had been 700 (a "good" score according to FICO and "prime" according to VantageScore) and your score dropped by 100 points, you wouldn't qualify for any conventional mortgage, and your interest rates would be significantly higher.

There's also a difference between a gradual decline in your credit score and a quick (and significant) drop in the number. If your score drops by 100 points quickly, it's usually because you were more than 90 days late paying one of your bills.

Your payment history accounts for 35% of your overall credit score. The factors that make up this payment history include:

Missing a credit card payment has an immediate effect on your credit score. If you are more than 30 days late paying a bill, lenders will report you to one or all three of the credit bureaus. FICO will drop a "very good" or "excellent" credit score by 63 to 83 points and a "fair" credit score by 17 to 37 points.

The penalty is even higher if you are 90 days late in making a credit card bill payment. Your "excellent" credit score will drop by 113 to 133 points, and your "fair" credit score will drop by 27 to 47 points. The higher your credit score before the missed payment, the greater the penalty will be.

Missing or making a late payment can drop your credit score by 17 to 133 points.

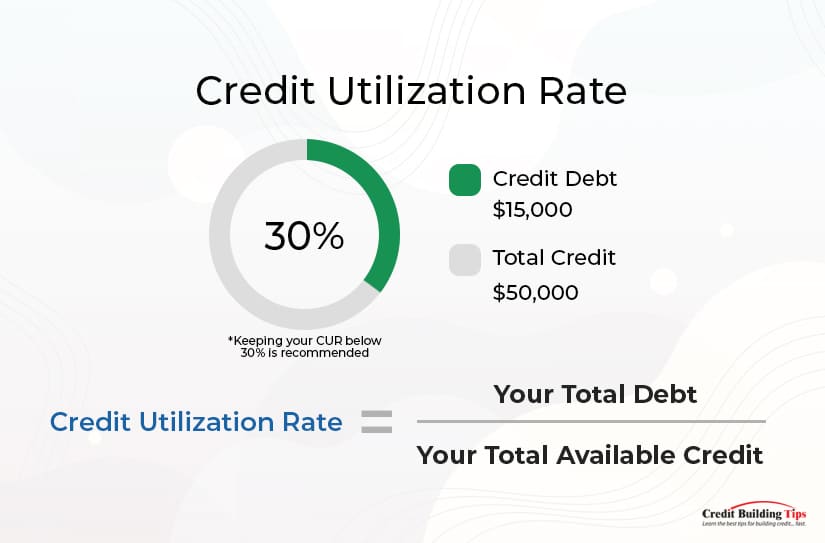

Your credit utilization rate (CUR) measures how much credit you use compared to how much is available to you. Keeping your CUR below 30% is recommended, and some experts even urge a lower 10% to protect your credit score.

For example, let's say you have a total of $50,000 in credit available between three or four credit cards. You owe $17,000 on one card, $8,000 on another, and $3,400 and $1,200 on the others; your total credit utilization ratio is calculated at 59%.

That's much higher than the recommended 30%. Your per-card credit utilization rate changes the percentages and informs you which credit card you should aggressively work towards paying down without adding more charges.

Although you owe more on the first card than the second one, your per-card credit utilization rate suggests that paying down the $8,000 owing on your card will help lower your credit score faster than paying down the $17,000 owing on the first card.

A change in your credit utilization rate can impact your credit score by up to 30%.

Late payments or bankruptcies can leave a negative "mark" on your credit report. These marks can indicate that you failed to keep your agreement to pay back a loan, your account was sent to collections, you declared bankruptcy, or you had a civil judgment or a tax lien made against you.

These derogatory marks can stay on your credit report for seven years (longer if the mark is due to bankruptcy). They'll damage your credit score, but you can work to mitigate the damage by making minimum payments on time on each account, only applying for new credit if you absolutely need to, and keeping your balances low.

While seven years is a long time for your credit score to be negatively impacted, if you take the steps listed above, your credit score should start to improve.

Having a negative mark on your credit report will definitely drop your credit score, but due to the secret and proprietary way credit bureaus make this calculation, it's impossible to know by how much.

You might think paying off debt will increase your credit score, but that's not always true. It is true when it comes to credit card debt, but paying off your student loan, auto loan, or mortgage will actually cause your credit score to fall.

The reason is that student or auto loans and mortgages are considered "installment" debts, where you pay an agreed-upon amount every month until the debt is paid out. Once the debt is paid back or retired, you'll have one less credit account in your name.

The types of credit accounts you have makes up 10% of your credit score. Ideally, you'll have a mix of accounts with some retail and credit cards, home loans, and installment loans. Making the last payment on your car or student loan is a reason to celebrate, but it will also cause a temporary dip in your credit score.

The length of your credit history is also considered when credit bureaus calculate your credit score. This accounts for 15% of your score; the longer you've made payments on time and in full, the better your score will be.

For this reason, you don't want to unnecessarily close an older credit card account, even if you no longer use it regularly. Closing accounts can actually hurt your credit score. You want as high a credit limit as possible, and long-standing closing accounts lower the credit limit that's available to you.

You might consider closing the account if you no longer use a credit card that charges you an annual fee. But before you do, check with the credit card company to see if they'll issue you a "no annual fee" card or upgrade you to an unsecured card. That way, you'll still benefit from the card's credit limit but not shell out money each year for the privilege.

When you apply for a new credit card, the card issuer will want to check your credit risk with a hard inquiry or "hard pull."

Applying for credit cards is an important step in establishing and building credit and worth the dip in your credit score a hard inquiry will cause if you pay off your credit statement in full by the due date.

By checking if you qualify for a new card by using issuers' preapproval or prequalification offers, you can reduce the number of hard pulls on your credit report. Another tip to protect your credit score is not to apply for several credit cards at the same time. By waiting a few months between applications (or even more if you already have a lower score), your overall score won't drop significantly.

Applying for a new loan or credit card will generally drop your credit score by five to 10 points.

It's bad enough when you fall behind on your bill payments, and this negatively impacts your credit score. What's worse is if the credit score drops due to errors on the part of the credit bureau. Credit files can get mixed up, and information is input incorrectly or not input in a timely manner.

Last month I wrote about incorrect scores that Equifax sent out in the spring. Equifax described the issue as a "flub" even though millions of U.S. consumers were provided with inaccurate credit scores, and one Florida woman found her credit score to be off by 130 points.

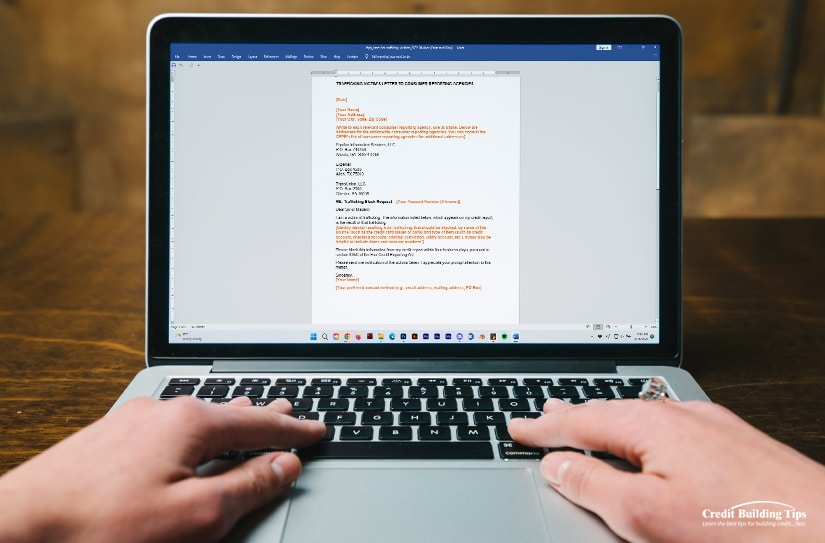

If you see an error on your credit report, you should deal with it as soon as possible. You can send four types of "dispute" letters to address the issue: a general dispute letter or a 609, 611, or 623 dispute letter.

The first step to disputing information on your credit report can be handled by a general dispute letter; if that doesn't fix the issue, you can then send a 609, then a 611, then a 623 dispute letter until you get the issue dealt with. Ultimately, the Fair Credit Reporting Act (FCRA) is on the consumer's side and will help you if needed.

Inaccuracies on your credit report can drop your credit score — sometimes dramatically.

In 2021 the Federal Trade Commission reported the total number of identity theft reports at a whopping 1,434,676. More women than men were victims, and the age group with the highest number of victims were those aged 30-39.

Loans and credit card fraud were the top types of identity theft. Only government documents and benefits showed a higher number of identity theft. According to TransUnion, 19 people are victimized by identity theft every minute.

Identity theft works like this: A fraudster would apply for new credit, max out the credit card and fail to make payments. Every credit inquiry could take 10 - 20 points off your score. The increase in credit card debt will hurt your score. Missed payments will have the biggest impact.

Fraud from identity theft can ruin your credit score.

The bad news is that nothing is permanent in credit. Your credit score can be fair to good one day, and then the next time you check, it may have dropped significantly due to your spending and bill-paying behavior or forces outside your control.

The good news is also that nothing is permanent in credit. Your credit score can be lower than you like, but by applying good money-managing habits, you can overcome and build up your credit over time.

Before you start to lose sleep about a "sliding credit score," keep these points in mind:

Fluctuations are normal. Credit scores are calculated by a series of criteria on a variety of factors and are never truly constant. Paying bills a little late, applying for a new credit card, or changing your credit utilization rate all contribute to your higher or lower score.

That's not to say that a 40-point drop shouldn't grab your attention or a 100-point drop should prompt you to take immediate action, but there's a normal rhythm to your score going up or down. What's more important than stressing about these ups and downs is recognizing the difference between a "natural rhythm" and a red flag.

Don't stress until you need to. Timing is everything, and until you apply for a loan, mortgage, or credit card, the number doesn't really affect your life and finances.

While you always want to work towards maintaining at least a good credit score, especially pay attention in the six months before you may need to apply for some type of loan or credit card. If your credit score is too low, you run the risk of not qualifying for a loan or getting charged higher interest rates than necessary.

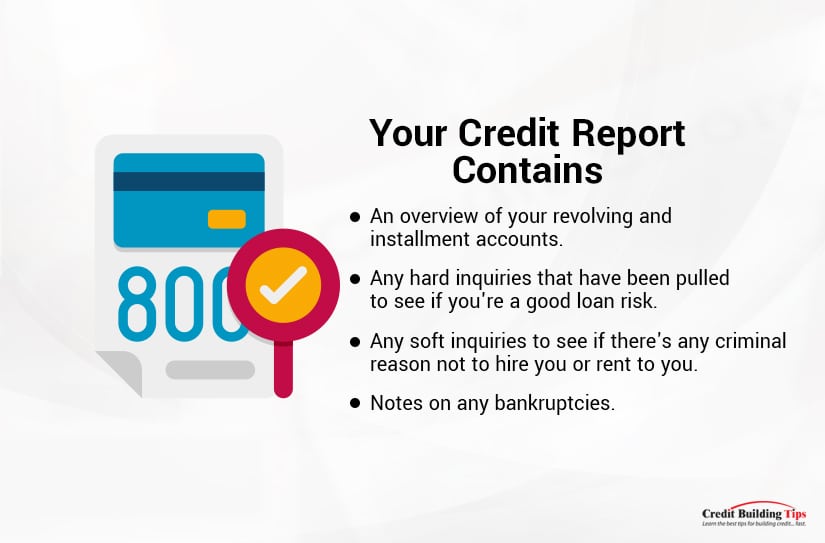

Your credit report means more than your credit score. Credit reports detail your bill payment history, current loans, debt load, and other financial information. They list where you live and where you work, plus whether you've been sued, arrested, or have filed for bankruptcy.

You want to keep an eye on your credit report and make sure the information shown is accurate. Credit card bureaus are not infallible, and it's important to regularly check your credit report for any mistakes or inaccuracies that will negatively impact how lenders see you.

If you're experiencing a downward drop in your credit score, make sure to check your credit report and see if any of the eight issues are relevant to you.

Facing up to what's happening is the first step towards fixing the problem. And fortunately, with diligence and discipline, even a poor credit score can be turned into a good or excellent one.

Did you know there are nearly 40 credit reporting agencies in the U.S.? But you've probably only heard of three of them as they're the ones regularly, and almost exclusively, referred to when talking about credit bureaus.

The three main credit reporting agencies are TransUnion, Experian, and Equifax.

They collect information on how Americans manage their financial obligations and then sell that information to lenders and credit-scoring companies. Lenders and credit-scoring companies then use that information to determine whether someone is a good loan or credit card candidate, how much they can safely loan them, and what interest rate they should offer.

While there's no need to keep these three agencies on your contact's "favorites" list, it is good to know how to get in touch with them if the need arises.

As you'll read below, each credit reporting agency has an extensive database. Forbes Advisor puts the number at approximately 220 million U.S. consumers. Whenever you apply for a loan or a credit card, it's "almost a given" that the lender will look at the credit reports compiled by at least one of these agencies.

They gather the lion's share of information about individuals and businesses from "data furnishers." These include lenders, banks, credit card issuers, collection agencies, and others. They can also gather information from public records and from data aggregation companies like Public Access to Court Electronic Records (PACER) and LexisNexis.

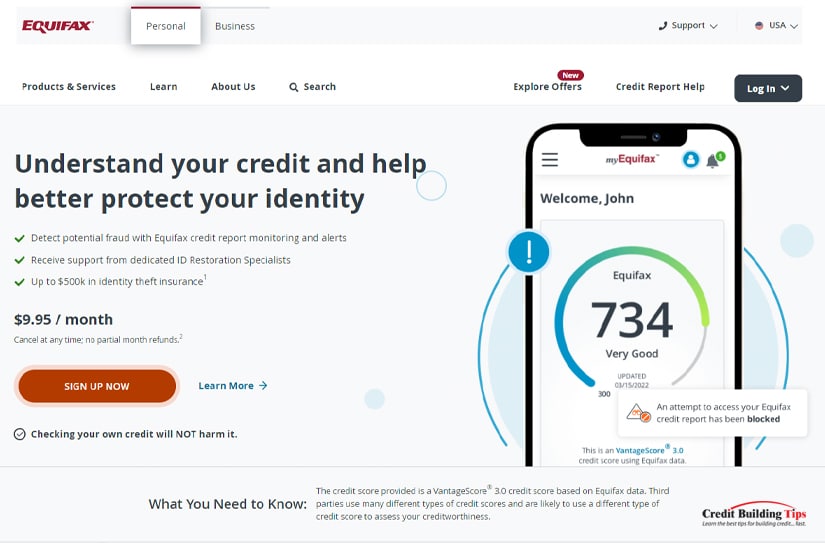

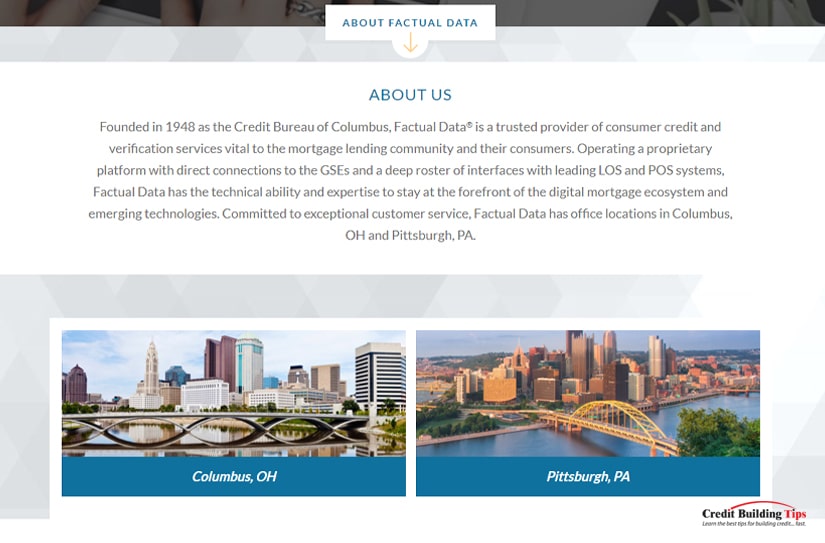

Equifax was founded in 1899 and is the oldest of the big three credit bureaus. It's currently headquartered in Atlanta, GA, and has approximately 11,000 employees. Their strongest presence in the U.S. is in the south and midwest, and they operate or have investments in 24 countries.

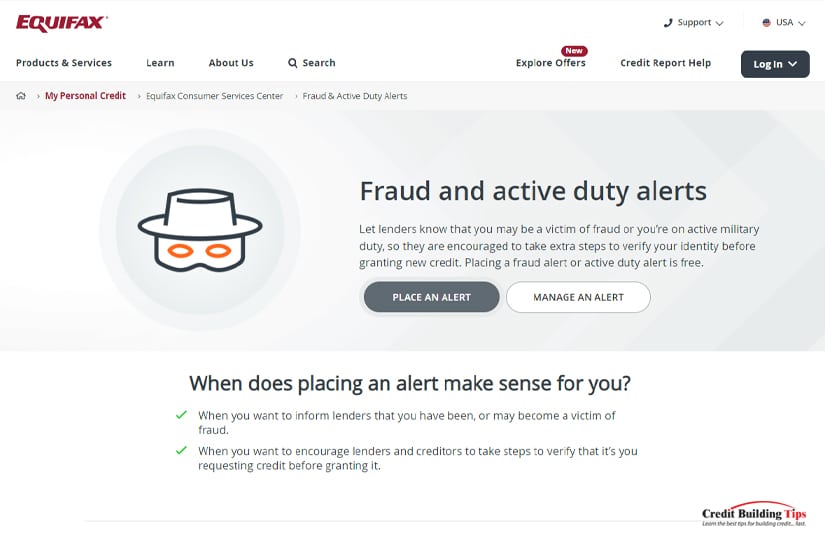

They collect and "aggregate" information on over 800 million consumers and more than 88 million businesses around the world. In addition to collecting credit and demographic data, they also sell credit monitoring and fraud prevention services to customers.

Equifax is a publicly owned company (stock ticker symbol EFX), and Better Business Bureau currently gives them an A rating. In spite of this rating, they've come under scrutiny for violating the FCRA.

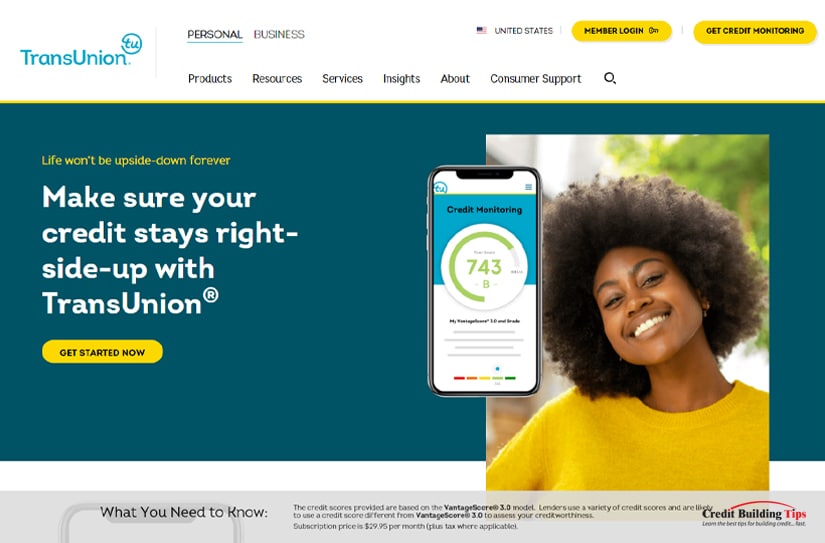

TransUnion was founded 54 years ago, and its headquarters are located in Chicago, IL. Like Equifax, they are a publicly owned company, and as of 2021, reported having 10,100 employees. It's reported to be the smallest of the big three credit agencies.

The latest numbers from TransUnion say they have a consumer credit database of 1 billion consumers in 30+ countries. Their global customer base extends to over 65,000 businesses, and they offer more than 3 billion updates per month from data providers.

The largest shareholders of TransUnion stock (stock ticker symbol TRU) are Goldman Sachs and Advent International. They have an A- on their Better Business Bureau rating but have also dealt with lawsuits and government penalties relating to credit-reporting practices over the years.

Experian is the youngest of the big three credit agencies, founded in 1996 in Dublin, Ireland. They're an American-Irish multinational data analytics and consumer credit reporting company. Their U.S. headquarters are located in Allen, TX, and they have over 20,000 employees in 43 countries.

Experian was created when the "now-defunct British retailer GUS acquired TRW Information Services — the largest U.S. credit bureau at the time." Since then, Experian has expanded around the globe, with operational hubs in England, Brazil, and California.

Its business focuses on credit, marketing, consumer services, and analytics. Experian tracks information on consumers, businesses, insurance, motor vehicles, and "select lifestyle characteristics."

Publicly owned (stock ticker symbol is EXPN.L), they have the lowest Better Business Bureau rating at B+. Experian has also experienced its fair share of legal woes, with consumers reporting outrage over a hard-to-cancel monthly subscription service that was offered as a "free credit report."

Even worse, 60 Minutes aired a segment about the number of errors on American credit reports. The news show interviewed three former Experian employees who described their experiences of company policies restricting them from fully investigating consumer disputes.

Before 2006, credit scores were generated by the Fair Isaac Corporation (FICO). In order to compete with FICO, TransUnion, Equifax, and Experian joined forces to create VantageScore. The first VantageScore model — 1.0 — could score 15 million more people than FICO had previously done.

In 2022, the latest tri-bureau credit scoring model is VantageScore 4.0. This version added features that let the model score 37 million more U.S. adults than was possible previously.

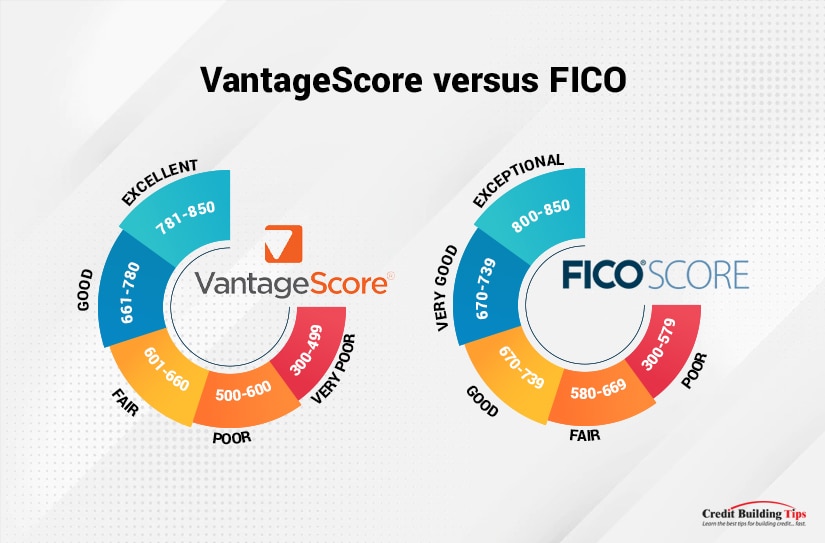

FICO and VantageScore use the same range for credit scores — 300 to 850- but they use different calculations to determine your credit score. FICO uses five categories of information and designates lending risk as poor, fair, good, very good, and exceptional. VantageScore uses six categories of information and designates lending risk as very poor, poor, fair, good, and excellent.

Many people view checking their credit report like they would view going to their doctor. They only think about making a doctor's appointment when something is wrong. Most of us don't consider regular medical checkups necessary unless we have an ongoing health concern.

We'd like to suggest you think about reading your credit reports more as you think about going to your dentist. Most people make regular dental appointments to have their teeth cleaned to ensure their mouth stays healthy, and so we're aware of any issues before they become major ones.

Regularly checking your credit report is one good way to be aware of the health of your finances. The government seems to agree, as they offer you a free copy of your credit report every year. Due to the COVID-19 pandemic, they're offering free weekly online credit reports through December 2023.

Three important reasons to check your credit report regularly are:

According to Alvenetta Wilson, Business Office Technology professor at San Jacinto College, one of the biggest misconceptions people have about credit bureaus is that:

"There's no reason to check their credit often if they have decent credit because the credit bureau produces accurate information."

Unfortunately, if you further research the history of the three main credit bureaus, you will find several instances of data breaches, lawsuits, fines, and even, in some cases, charges by the U.S. Department of Justice for sales to identity thieves.

Most recently, a Tennesse woman brought a lawsuit against all three credit bureaus, alleging the companies violated the U.S. Fair Credit Reporting Act. TransUnion, Equifax, and Experian all marked the woman as "deceased" on credit reports they created and then sold to third parties.

The complaint charges that these credit bureaus:

"Violated the FCRA by failing to follow reasonable procedures to assure the maximum possible accuracy of the information they reported about our client, which led to the companies falsely claiming our client was deceased."

The woman has disputed the inaccurate information since September 2021. Frustratingly, "all three companies allegedly lack the procedures to confirm a consumer is deceased even when the consumer communicates directly with them."

Hopefully, this will help you see how checking your credit reports might be worthwhile. An important part of becoming and staying financially healthy is knowing what's on your credit report and how to deal with any errors and possible fraud.

While it's impossible to walk through the front door of any of these offices, we've found as many ways as possible for you to contact and communicate with Equifax, TransUnion, and Experian.

Website: Equifax

Mailing address:

Equifax Information Services LLC

P.O. Box 740241

Atlanta, GA 30374-0241

Note: If you are mailing any type of dispute letter to Equifax, make sure to send it by certified mail and get a return receipt. If you are asked to include supporting documents, make copies, and don't send the originals. Unless you're specifically asked to. Then make a copy for yourself and send the original.

Note: If you are mailing any type of dispute letter to Equifax, make sure to send it by certified mail and get a return receipt. If you are asked to include supporting documents, make copies, and don't send the originals. Unless you're specifically asked to. Then make a copy for yourself and send the original.Phone number: 1-866-640-2273

Calls to this number are answered by a real person, and a call-back is available. The best time to call is 9:05 am, with an average wait time of 20 minutes.

Call center hours are:

9:00 am to 9:00 pm (E.T.) Monday through Friday

9:00 am to 6:00 pm (E.T.) Saturday and Sunday

Email: My Equifax

Website: TransUnion

Mailing address:

TransUnion

P.O. Box 1000

Chester, PA 19022

Note: If you are mailing any type of dispute letter to TransUnion, make sure to send it by certified mail and get a return receipt. If you are asked to include supporting documents, make copies, and don't send the originals. Unless you're specifically asked to. Then make a copy for yourself and send the original.

Note: If you are mailing any type of dispute letter to TransUnion, make sure to send it by certified mail and get a return receipt. If you are asked to include supporting documents, make copies, and don't send the originals. Unless you're specifically asked to. Then make a copy for yourself and send the original.Phone number: 1-800-916-8800 (Customer service)

Calls to this number are answered by a real person, and a call-back is available. The best time to call is 8:15 am, with an average wait time of 22 minutes.

Call center hours are:

8:00 am to 11:00 pm (E.T.) Monday through Friday

8:00 am to 5:00 pm (E.T.) Saturday and Sunday

1-833-806-1626 (Tech support)

Call center hours are:

8:00 am to 9:00 pm (E.T.) Monday through Friday

8:00 am to 5:00 pm (E.T.) Saturday and Sunday

Social: @AskTU (Facebook)

@Ask T.U. (Twitter)

Private messages or D.M. center hours are:

5:00 am to 12:00 pm (E.T.) Monday through Sunday

Website: Experian

Mailing address:

Experian

P.O. Box 2104

Allen, TX 75013-0949

Note: If you are mailing any type of dispute letter to Experian, make sure to send it by certified mail and get a return receipt. If you are asked to include supporting documents, make copies, and don't send the originals. Unless you're specifically asked to. Then make a copy for yourself and send the original.

Note: If you are mailing any type of dispute letter to Experian, make sure to send it by certified mail and get a return receipt. If you are asked to include supporting documents, make copies, and don't send the originals. Unless you're specifically asked to. Then make a copy for yourself and send the original.Phone number: 1-714-830-7000 (Best toll-free number)

Calls to this number are answered by a real person, and a call-back is available. The best time to call is 8:15 am, with an average wait time of 21 minutes.

1-800-493-1058 (Customer service department)

1-866-617-1894 (Membership questions)

Call center hours are:

7:00 am to 8:00 pm (E.T.) Monday through Friday

7:00 am to 7:00 pm (E.T.) Saturday and Sunday

Online: Dispute online

Order an Experian Credit Report

This service will cost up to $12 (plus tax) for a one-time Experian credit report, plus you can dispute online for free.

Order an Experian CreditWorks Basic report

This service is free from Experian and will give you an Experian credit report every 30 days on sign-in and basic Experian credit monitoring, and you can also dispute online for free.

Email: support@experiandirect.com

Other:

Experian Corporate Headquarters

475 Anton Blvd

Costa Mesa, CA 92626

1-714-830-7000Experian Corporate Headquarters

955 American Lane

Schaumburg, IL 60173

1-224-698-5600

Social: Experian Facebook

@Experian (Twitter)

Experian, Equifax, and TransUnion aren't the only credit reporting agencies out there. There are many other companies that provide credit reports of various sorts. Most have picked a niche for themselves, from rent and utility tracking to monitoring checking accounts and insurance behaviors.

Here's a quick glimpse of the alternative credit bureaus and what information they track.

Background checks:

Banking:

Histories:

Identity protection analytics:

Medical records:

Motor vehicle records:

Public information:

If you think you might be the victim of identity theft, you should contact your local law enforcement, your state attorney general, and/or the Federal Trade Commission (FTC). The FTC also has helpful information on how to protect yourself against identity theft.

Website: www.ftc.gov/idtheft

Mailing address:

Consumer Response Center

600 Pennsylvania Avenue NW

Washington, DC 20580

Phone number: 1-887-IDTHEFT (1-877-438-4338)

Website: www.naag.org/naag/attorneys-general/whos-my-ag.php

You can visit this website to see a list of all 50 U.S. states, plus the District of Columbia, American Samoa, Guam, the Northern Mariana Islands, Puerto Rico, and the U.S. Virgin Islands attorney generals' contact information.

You may be surprised to learn that many Americans currently have issues with their credit scores — and it's not their fault.

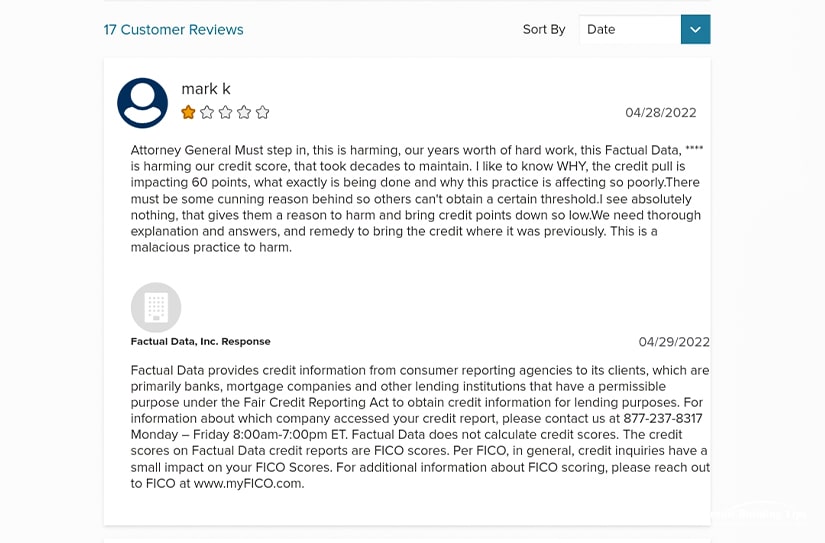

In August of this year, CBS News reported that Equifax:

"Admitted last week that it misreported some consumers' credit scores."

Over three weeks this spring, the credit bureau sent out incorrect scores for consumers who were applying for mortgages, car loans, and credit cards.

The Wall Street Journal pushed back against Equifax's CEO, Mark Begor, when he said,

"The impact is going to be quite small, not something that's meaningful to Equifax."

He described the issue as a "flub," while the WSJ found that according to bank executives and others "familiar with the errors," the company provided inaccurate credit scores on millions of U.S. consumers.

A Florida woman who experienced the "flub" and found her car loan to be "substantially pricier" is now part of a lawsuit that's seeking class-action status against Equifax. Nydia Jenkins was pre-approved for a car loan in January, but it was denied in April because her credit score was off by 130 points.

Ms. Jenkins then had to buy a car from a different dealership that charged her a much higher interest rate. Her pre-approved rate would have had her paying $350 each month for the car loan, but the new rate has her paying $544 each month. That adds up to about $2,352 more each year she has the loan.

LendingTree surveyed more than 1,000 U.S. consumers to see whether they thought their credit scores "accurately reflect their financial responsibility." On the report, 42% of Americans said their credit scores stopped them from getting some type of loan.

Shockingly, 44% of Gen Zers don't know their credit scores, and 25% don't know how to find out what it is. The survey also found that, overall, 19% of all Americans don't know their credit score, and 12% admit they don't know how to check it.

Shockingly, 44% of Gen Zers don't know their credit scores, and 25% don't know how to find out what it is. The survey also found that, overall, 19% of all Americans don't know their credit score, and 12% admit they don't know how to check it.While you may or may not be one of those millions affected by the spring's problems, it certainly makes a good case for checking your credit report for errors and dealing quickly with any you find.

Not all errors are widescale as the ones I talked about above. Sometimes they're a result of simple human error. Credit files can get mixed up, data entries can be mistyped, names misspelled, or a furnisher falls behind in updating their system.

Sometimes, errors on your credit report are a sign of identity theft. If there's an account on your credit card or a loan application you don't recognize, don't wait to contact the credit bureau to investigate.

Fortunly recently posted two concerning statistics that should wake all Americans up:

If the first basic step is to check your credit score number, the next step is to check your report for any errors. And if you do find an error or two? That's where 611 dispute letters come to the rescue.

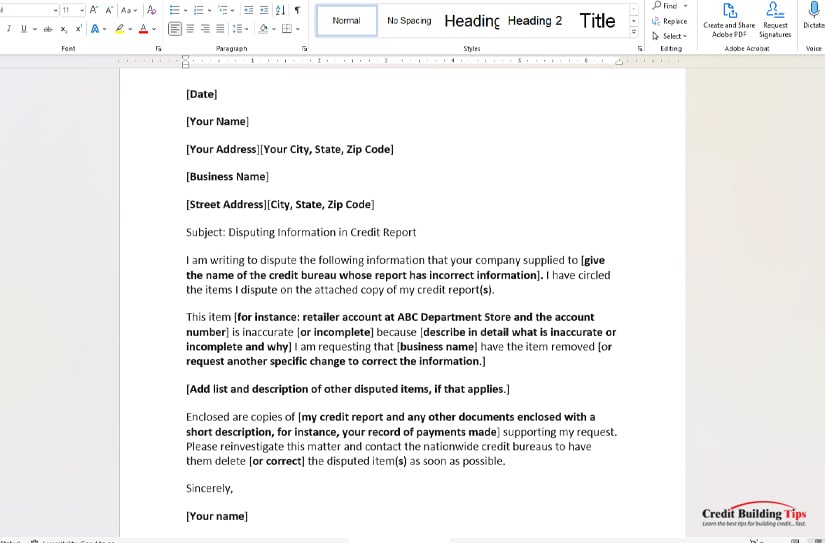

A credit report dispute letter is well-named. It's just what it sounds like — a letter you send that tells the credit bureau you don't agree with one of the items on your report.

A credit report dispute letter is well-named. It's just what it sounds like — a letter you send that tells the credit bureau you don't agree with one of the items on your report.You can send the letter directly to the credit bureau (they're also called credit reporting agencies) or to the data furnishers that gave the information to the bureau in the first place.

You can choose to send a credit report dispute letter through an online form, but experts recommend that you print a physical copy and send it through the U.S. postal system. For the price of a stamp, you get these two advantages:

The Federal Trade Commission (FTC) recommends you send your letter by certified mail and ask for a return receipt. That way, you have indisputable proof the credit bureau or data furnishers received your letter.

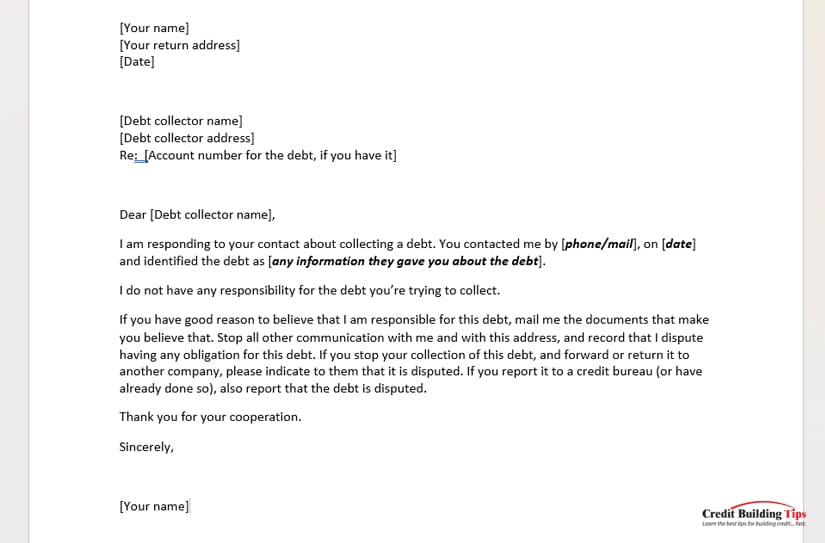

There are three types of credit report dispute letters. You can send a general dispute letter — simple and easy. This type of letter shows the mistake made, provides proof, and asks the bureau to fix the mistake.

Then there are the numbered credit dispute letters — 609, 611, and 623. Each of these letters references a different section of the Fair Credit Reporting Act (FCRA). The act was created in 1914 to make sure Americans had the following rights:

Not surprisingly, a 611 credit report dispute letter references Section 611 of the FCRA. Just like a 609 credit report dispute letter references Section 609 and a 623 credit report dispute letter references Section 623 of the FCRA. They're all variations on a theme.

You can think of a 611 credit report dispute letter as a second state letter. You learned about a 609 credit report dispute letter in this earlier post. If you don't get the answer you wanted from the 609 letter, a 611 letter is your second kick at the can.

You can think of a 611 credit report dispute letter as a second state letter. You learned about a 609 credit report dispute letter in this earlier post. If you don't get the answer you wanted from the 609 letter, a 611 letter is your second kick at the can.

After you write the initial 609 letter asking the credit bureau to verify an item on your credit report, they'll get back to you with one of two responses. The hoped-for response is, "Oops, our mistake. We will correct it, and the error will no longer affect your credit score." End of the correspondence.

If they respond by letting you know they checked the information and believe no error was made, you can write them a second letter. A 611 letter of dispute.

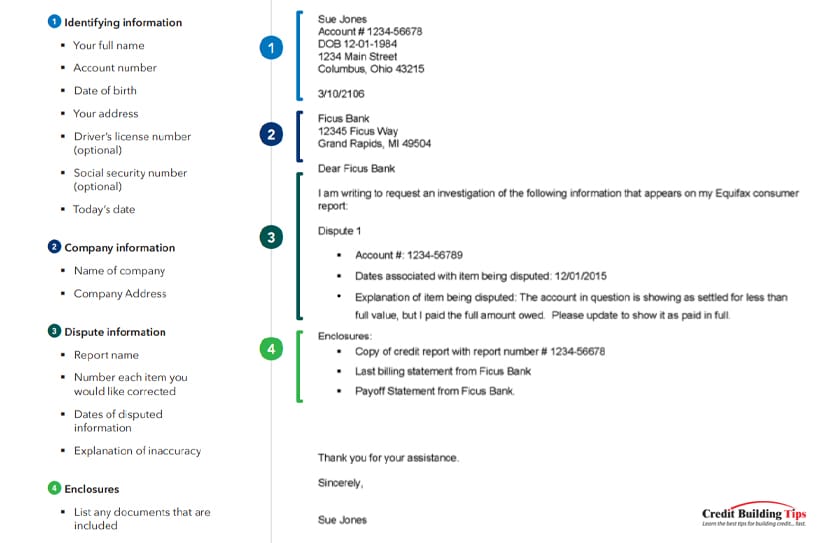

A 611 credit report dispute letter needs to include four specific parts:

1. Your identifying information:

2. The company information you're making a dispute against:

3. Dispute information:

4. Enclosures:

It's also good to know that along with sending a 611 letter to your credit bureau, you can also send a copy with the same information to the company that gave the wrong information to the bureau. For instance, if your credit report lists wrong information from your bank, landlord, or cell phone company, you could (and probably should) send them a duplicate of what you've put together to send to the credit bureau.

Make sure to keep all original paperwork. Mail one copy to the credit bureau and one copy to the furnisher. Don't forget to pay extra money to send both packages by certified mail and ask for a return receipt.

I've given you the snail mail addresses of the three main credit bureaus before, but here they are again:

Equifax Information Services LLC

P.O. Box 740256

Atlanta, GA 30374Experian

P.O. Box 4500

Allen, TX 75013TransUnion LLC

Consumer Dispute Center

P.O. Box 2000

Chester, PA 19016

Each of these credit bureaus provides an online link to download a dispute form but remember that the FTC recommends you go the extra mile and print out and mail your dispute letter with all the supporting documentation.

Another helpful tip is to dispute one error at a time. If you find a large number of errors, you may want to group them into bundles and space out the disputes.

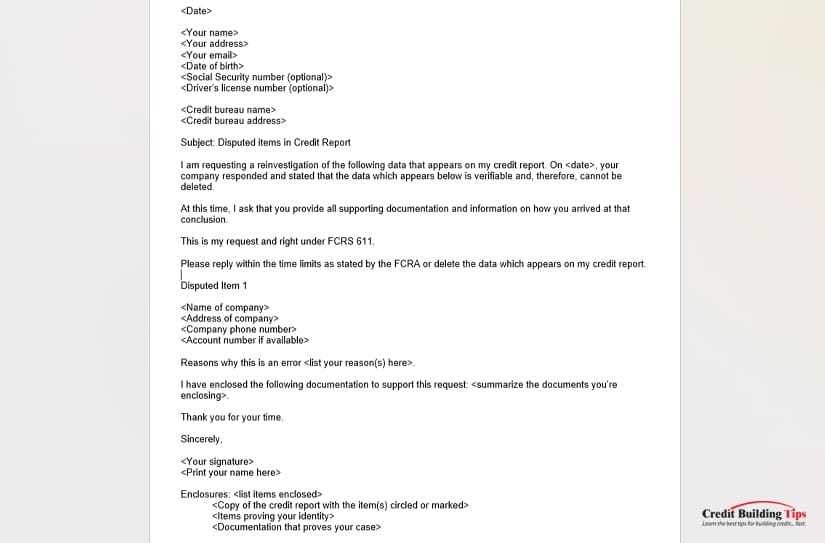

Here's a template we found on Debt.com that anyone can use for a simple 611 dispute letter:

<Date>

<Your name>

<Your address>

<Your email>

<Date of birth>

<Social Security number (optional)>

<Driver's license number (optional)><Credit bureau name>

<Credit bureau address>Subject: Disputed items in Credit Report

I am requesting a reinvestigation of the following data that appears on my credit report. On <date>, your company responded and stated that the data which appears below is verifiable and, therefore, cannot be deleted.

At this time, I ask that you provide all supporting documentation and information on how you arrived at that conclusion.

This is my request and right under FCRS 611.

Please reply within the time limits as stated by the FCRA or delete the data which appears on my credit report.

Disputed Item 1

<Name of company>

<Address of company>

<Company phone number>

<Account number if available>Reasons why this is an error <list your reason(s) here>.

I have enclosed the following documentation to support this request: <summarize the documents you're enclosing>.

Thank you for your time.

Sincerely,

<Your signature>

<Print your name here>Enclosures: <list items enclosed>

<Copy of the credit report with the item(s) circled or marked>

<Items proving your identity>

<Documentation that proves your case>

Once the credit bureau receives a 611 letter, they are required by law to

"Conduct a reasonable reinvestigation to determine whether the disputed information is inaccurate and record the current status of the disputed statement, or delete the item from the file…"

In other words, if you ask them to check again, they must do so. And they need to do it free of charge within 30 days of receiving your letter. They're entitled to a 15-day extension if they get new information that's relative to their investigation.

If, after the reinvestigation, the disputed claim is found to be:

The credit bureau has no choice but to promptly:

Go online, and you'll see vendors selling these types of letters and bragging they're a loophole that will let you play the system. Nothing can be further from the truth.

The FCRA protects its consumers' right to question whether there's an error on their credit report. If an error is found or the information provided to credit bureaus and furnishers cannot be verified, they must remove it.

If the credit bureau can provide the information to show an item on your credit report is legitimate, they are under no obligation to remove it. Any legitimate item will stay on your credit report until enough time has passed and it falls off.

You are far better served to work hard on repairing your credit report by paying your bills on time, paying your credit card balances strategically, and asking for higher credit limits, than trying to play the system over fake negative items.

These three strategies are considered "highly influential" in raising your credit score by Nerd Wallet. While they include six other ways to improve your credit fast, these three help you the most.

Paying your bills on time is the "largest scoring factor in FICO and VantageScore credit scoring systems." If you find you can't make a payment and the time drags on over 30 days, call your creditor and let them know. Make arrangements with them for how soon you can pay and ask them if they would not report the missed payment to the credit bureaus.

Strategically paying your credit card balances is linked to your credit utilization. Develop the discipline to use less than 30% of your credit card's limit — lower is even better. You can manage this by keeping an eagle eye on your credit card and paying off the balance once you see you're getting close to the 30% utilization cut-off line.

Ask for higher credit limits to repair your credit score. Your credit utilization ratio will drop if you receive a higher credit limit and don't add to your credit balance. Your credit utilization ratio will drop if you receive a higher credit limit. Don't spend the extra credit limit!

Please let me know if you have questions in the comments about how to fix your credit, build your credit, or do anything credit-related! I'm here to help you eliminate your debt and improve your credit.

One of the most recent surveys reports that 77% of Americans are anxious about their financial situation regarding money, credit, and debt. So stressed, in fact, that 43% feel tired, 42% find it hard to concentrate at work, and 41% don't sleep as well. All because of money.

Unfortunately, when you're stressed, the study also shows that you are less likely to:

Falling behind on your bills or debts makes matters even worse. And if you find you have debts in "collections," the knots in the pit of your stomach can lead to ulcers. Not good.

Let's discuss how collections work, what happens when you have a collection on your credit score, and how to fix it.

Having a debt in collections is, unfortunately, one of the "most serious negative items that can appear on your credit report," according to Credit Karma.

If you have a debt and still haven't been able to pay it for 120 to 180 days after the due date, your original creditor may send the debt to a collection agency. Some of the most common types of debt are credit card debts, mortgages, car loans, and student loans.

If you have a debt and still haven't been able to pay it for 120 to 180 days after the due date, your original creditor may send the debt to a collection agency. Some of the most common types of debt are credit card debts, mortgages, car loans, and student loans.Once a debt is handed over to a collections agency, you can expect to hear from them sooner rather than later. They operate on the premise that the earlier they track you down, the better their chance of collecting the overdue money.

Collection agencies get paid by getting the debt paid. In other words, they get paid for results. That's why the industry has such a bad rap. They don't get paid to help you, so there is no incentive to work with you or even to work with the law if they can get away with it.

Payments on your credit report that are 120 days overdue will lower your credit score more than a payment that is 30 days overdue. And having more than one debt transferred to collections also impacts your credit score.

According to Rob Rader, President at Top Choice Consultants LLC, it's helpful to know what matters when it comes to any collection debt.

He says:

"The biggest hit to your credit score will occur when that first collection account reports. Each additional collection will have more of a marginal impact. As long as the collection agencies are not continuing to update the account every month, the score impact will lessen over time."

The date a collection debt is listed on the credit report matters significantly. The more recent, the more negative the impact is on your score. Bizarrely, this is true even if you pay off the collection agency debt.

Rader lists an example where a debt was defaulted on five years ago but only now was it sold to a collection agency. The credit bureau then lists the "open date" as the current year.

Again, this matters because the more recent, the more damaging. And in 99 times out of 100, paying the debt off will not make a difference to your score. It will stay the same until seven years from the date of your first missed payment with the original creditor.

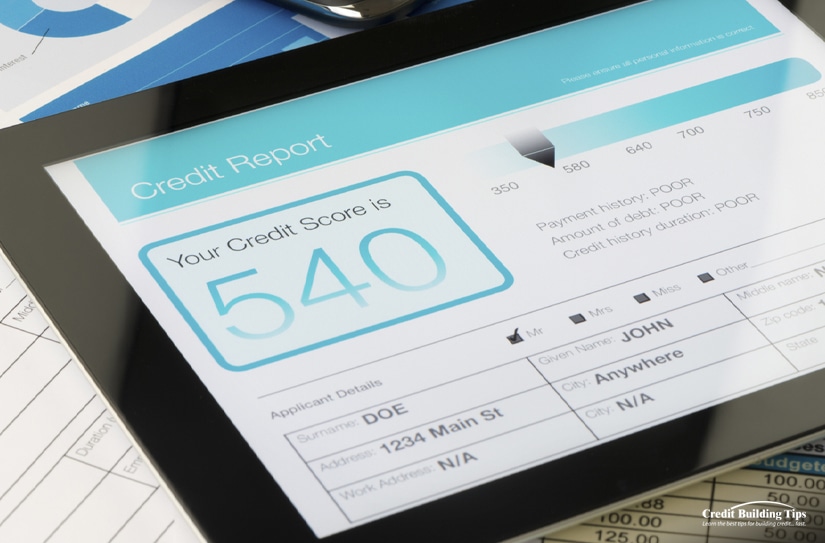

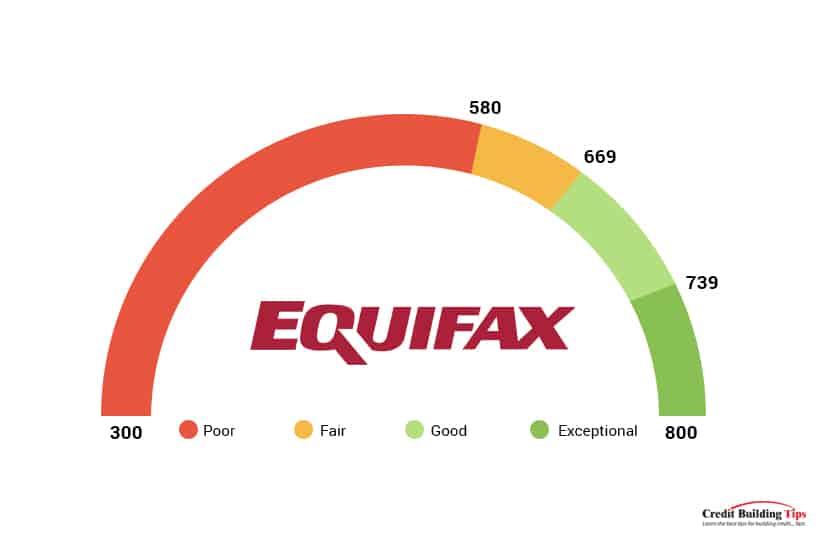

FICO Scores consider a good credit score somewhere between 670 and 739, a fair credit score from 580 to 669, and a poor credit score from 300 to 579.

VantageScore has a slightly different scoring system. They consider a good credit score between 700 to 749, a fair credit score from 650 to 699, a poor credit score from 550 to 649, and a very poor credit score from 300 to 549.

To have a very good credit score with FICO, your number will have to be between 740 and 799. An exceptional credit score for FICO is between 800 and 850. Vantage Score considers an excellent credit score to be between 750 to 850.

It's important to understand the factors that make up the respective scores, as this impacts how many points a collection causes your score to drop.

With FICO, they determine the scores by assigning values to percentages:

VantageScore uses "influential" language to calculate what weighs more and less in their credit scoring:

There's not always a clear-cut answer to the question, "how many points does a collection drop my credit score." There are other factors to consider apart from how much your debt figure is and how long your debt has been in collections.

It does matter if this is the first time you have had an unpaid debt go to a collections agency. If you have a high score of 700, the first time you have an unpaid debt that gets sent to a collection agency, you can expect your credit score to drop over 100 points. Sometimes.

If your score is less than 700, it can drop even more.

The amount of the collection debt doesn't seem to change how many points your credit score can drop. Whether your debt is $200 or $100,000, your credit score drops by the same number of points.

You may think there's no good news when it comes to your credit score plus collections debt, but it is possible to have a 700 credit score even with a collections remark on your report. It's not common, but still possible.

Remember, a credit score of 700 is considered to be in the middle of the good range for FICO and at the lower end of the good range for VantageScore.

Lisa Goh, the CFO of Sensible Dollar, reports that there are over 50 scoring models that are used for FICO scores. No wonder it seems so elusive to understand how credit bureaus come up with their credit score numbers and what yours might be.

Credit bureaus use algorithms to determine your score. Each algorithm starts with a perfect 850, which is the highest possible credit score and only 1.6% of all credit-holding Americans have this score.

Not that you need to have a perfect score to "hit the pinnacle of what [lenders] care about." A score above 760 or 780 will get you the same treatment as if you had a score of 850. The national average FICO score hit a record high of 703 in 2019.

Your perfect starting score of 850 then gets points taken off for "every circumstance that, according to the algorithm, is less than ideal." Circumstances such as payment history, the length of credit history, and other information.

So, if it's possible to still attain a 700 credit score with a debt in collections, what factors come into play?

According to Goh, the contributing factors are:

Collections that are less than $100 won't significantly impact your credit score, and some score models will disregard them altogether. Having said that, if your debt in collection is over $100, your credit score will be impacted, possibly severely.

Collections that are less than $100 won't significantly impact your credit score, and some score models will disregard them altogether. Having said that, if your debt in collection is over $100, your credit score will be impacted, possibly severely.In a nutshell, if the most lenient scoring model is used that weighs more heavily on your credit history, the collections are almost at the seven-year mark where they will disappear from your credit report, and you only have one which has been settled; you may still see a credit score of 700 on your report.

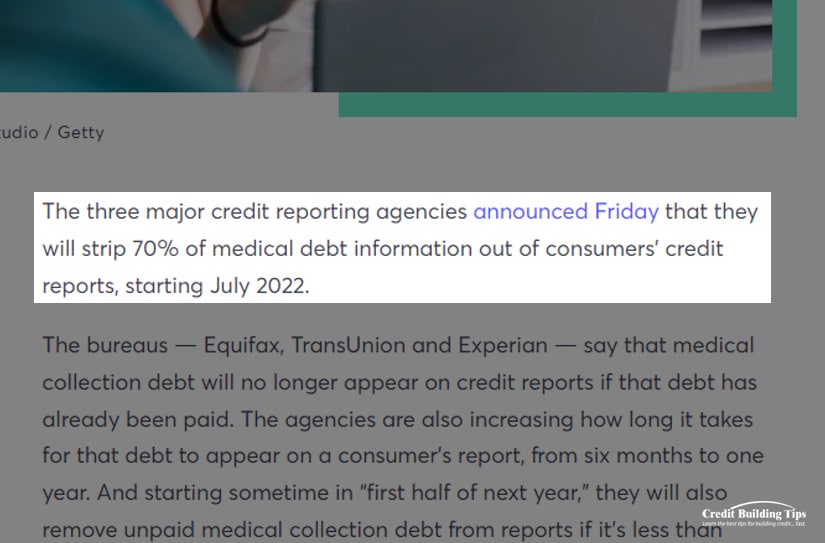

CNBC reported that two-thirds of medical debt in the U.S., effective July 1, 2022, will no longer be included on consumer credit reports. Equifax, TransUnion, and Experian went back to "strip" the debt information out of the reports.

There's also an increase in how long it takes for medical debt to show up on someone's credit report. Before, it was six months; now, it's one year.

And sometime in the first six months of 2023, they'll also eliminate unpaid medical collection debts from reports if the debt is under $500. This will be a significant help to the 1 in 10 Americans who carry medical debt over $250

The Consumer Financial Protection Bureau reported that as of spring 2021, 58% of bills that had been sent to collection agencies were medical bills. They also found that medical collections were "less predictive of future payment problems than other debt collections," like mortgages or car loans.

Once a medical debt goes to collections, it will affect your credit score. Up until now, these debts would stay on your credit report for up to seven years, even if you paid them off. The new rule will now remove them if they are paid off.

"Some of the newer FICO and VantageScore algorithms report that they disregard paid medical collections and place a lower emphasis on unpaid medical debt compared to other types of debt." This statement was given by Ted Rossman, a senior industry analyst at Bankrate.

He went on to say there "seems to be an acknowledgment that medical care is essential and should not be penalized by the credit bureaus."

Remember the study we talked about at the beginning of this article? The one that said 77% of us are anxious about our financial situations? The Mind Over Money study didn't end there.

Once they discovered how stressful the topic of finances is to most people, they asked them to do a short mindset-shifting exercise. The exercise asked people to think about long-term goals. They didn't have to think for a long time, as little as a few seconds.

You might be as surprised as I was to learn that thinking more about the big picture caused this same 77% of stressed Americans to be:

The study's outcomes are so powerful you may want to practice these smart Money Mindset tips to lower your stress, make better financial choices and see your credit score rise!

Giving makes you feel good. It's been linked to the release of oxytocin, a hormone that "induces feelings of warmth, euphoria, and connection to others." Giving elicits feelings of gratitude which is integral to happiness, health, and social bonds. A wide range of research, including the book Why Good Things Happen to Good People, finds that giving to others results in better health.

Giving comes back to you. Whatever you can afford to give — a little money, a little time, a little service, you'll find yourself in a better place and in better spirits. And maybe your credit score will start to reflect that.

Even the most financially savvy of us may find ourselves in a position where we get behind on paying our bills. Sometimes the cost can simply result in paying extra interest we hadn't counted on, but sometimes the cost is higher.

Urban Institute reports that roughly 77 million American adults have a credit file with some level of debt in collections. On average, they owe $5,178.

Urban Institute reports that roughly 77 million American adults have a credit file with some level of debt in collections. On average, they owe $5,178.If you haven't made at least the minimum payment to a particular creditor or lender, the first step will often be to have an in-house collections representative contact you. Not just once or twice but multiple times.

If you don't respond to this in-house representative and don't make a payment within three to six months, the issuer may pass your debt on to a third-party collections agency.

According to CNBC Select, there are currently 7,060 collection agencies in the U.S.

"A collection agency is a company hired by lenders, creditors, medical providers, and federal and local governments to get you to pay or make arrangements to pay what you owe them," Shelley-Ann Eweka, a wealth management director at TIAA, told CNBC Select.

Typically, the original creditor either sold the debt to a "debt buyer" or turned it over to a collection agency. The goal of a collections agency is to get the money.

The strategies they may use to get you to pay your debt can be one or all of the following:

Debt.org says there are three phases to a typical debt collection process:

So, how do you avoid being sent to collections?

If you do find yourself in debt and in need of help, most major credit card companies now offer customer assistance and recognize the toll the Coronavirus pandemic has taken on Americans, and are willing to extend grace.

Here are a few potential solutions to avoid debt collectors:

If you're not able to pursue any of these options, dealing with a debt collection agency may be inevitable. Here's what you can expect.

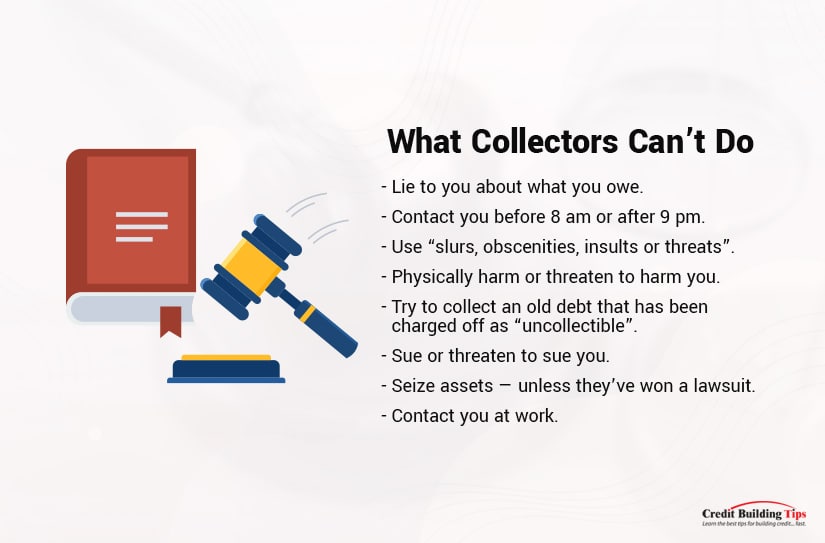

If you simply can't satisfy your debt before it's turned over to a collection agency, you should know your rights when it comes to dealing with an agency.

Debt collection agencies have a bad reputation because they cannot only contact you through every communication system available but also take debt settlements to civil court. A 2020 study from Pew Charitable Trust reports the number of debt collection lawsuits jumped from 1.7 million cases in 1993 to 4 million cases in 2013.

The study also reveals that "less than 10 percent of defendants in debt collection lawsuits from 2010 to 2019 had counsel, while nearly all plaintiffs did." Moreover, in the last decade, courts favored more than 70% of lawsuits by awarding default payments to the plaintiff.

In essence, most people who deal with a collections agency are taken to court, and most of these court cases favor the collection agency.

In essence, most people who deal with a collections agency are taken to court, and most of these court cases favor the collection agency.Thanks to the Fair Debt Collection Practices Acts, there are restrictions on what a collector can do to get you to pay your debts.

They may not:

The Association of Credit and Collection Professionals (ACA International) represents the majority of U.S. collection agencies (approximately 3,200), requiring them to obey all laws and regulations. The organization also has its own codes of ethics and operations.

The ACA requires its members to "treat consumers with consideration and respect" and "communicate with consumers with honesty and integrity." It also restricts collectors from engaging in "dishonorable, unethical or unprofessional conduct … likely to deceive, defraud, or harm a consumer."

If a collection agency is harassing you, you can report them to the Attorney General's office in your state or the Federal Trade Commission. You can also sue them in state court.

If a collection agency is harassing you, you can report them to the Attorney General's office in your state or the Federal Trade Commission. You can also sue them in state court.Suing a collections agency in court isn't easy, and you should hire an attorney to represent you. You'll have one calendar year from the date of any violation on the collection agency's part to file a lawsuit.

Andrew Katzman took his debt collectors to court and won $1,700 to compensate him for the harassment he endured. Even though the debt was because of a communication breakdown between the hospital and his insurance carrier and had been resolved, the collections agency continued to harass him.

In Andrew's case, he kept getting phone calls for four months after the issue was settled. The collections agency had him on auto-dial and called him after he let them know the issue was resolved. He requested they stop calling, but they didn't, and he estimated the phone rang twice a day.

Unfortunately, even paying off an account that's gone to collections doesn't immediately improve your credit score. What it does accomplish is "end the harassing phone calls and collection letters, and it will prevent the debt collector from suing you."

Stilt is an organization focused on providing credit to immigrants and the underserved. They say having a collection on your credit report can lower your credit score by approximately 110 points. If your score had been in the "fair" category, it might drop down to the "bad" category.

Even after paying your debt, you'll need to wait until your debt score reaches its limitations period before it recovers. This period can last up to seven years before it disappears fully from your credit score.

Even after paying your debt, you'll need to wait until your debt score reaches its limitations period before it recovers. This period can last up to seven years before it disappears fully from your credit score.The good news is that the more time passes after you pay your debt, the less influence it will have on your credit score.

Although your credit score may not jump up immediately, other significant ways resolving this debt will benefit you include:

The FICO 9 scoring methodology is only being phased in gradually, but most lenders are poised to start using them. In this latest version of the FICO score, medical bills will be given less weight, and debts in collections will be entirely ignored.

Knowing that even paying off your collection debt in full doesn't automatically boost your credit score isn't the last word on the subject. There are other ways you can eliminate collections accounts from your credit score.

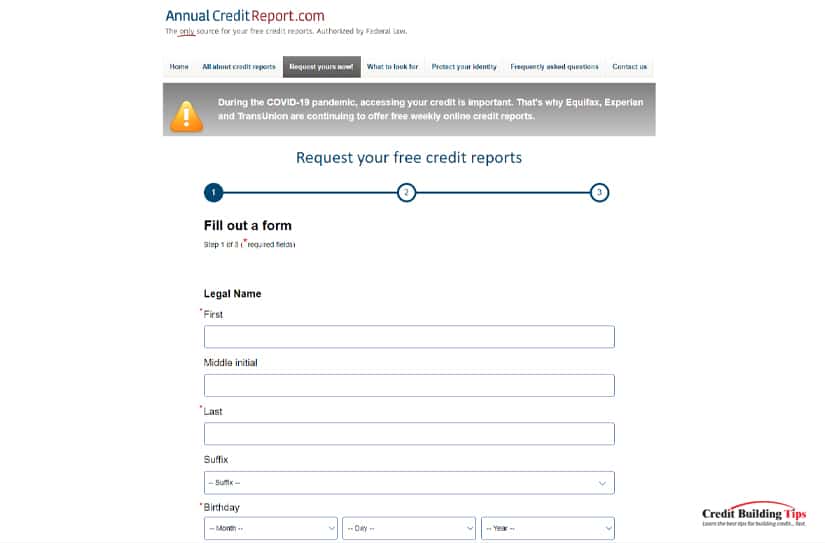

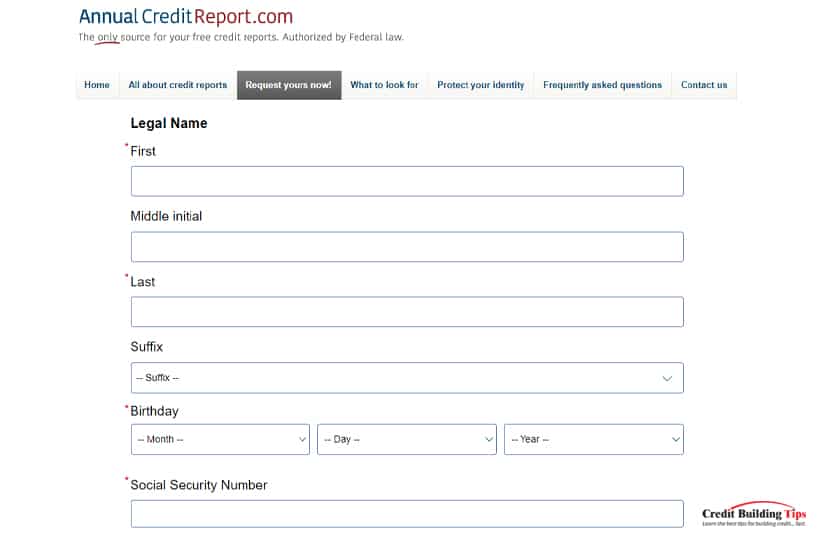

1. Order credit reports from Experian, TransUnion, and Equifax.

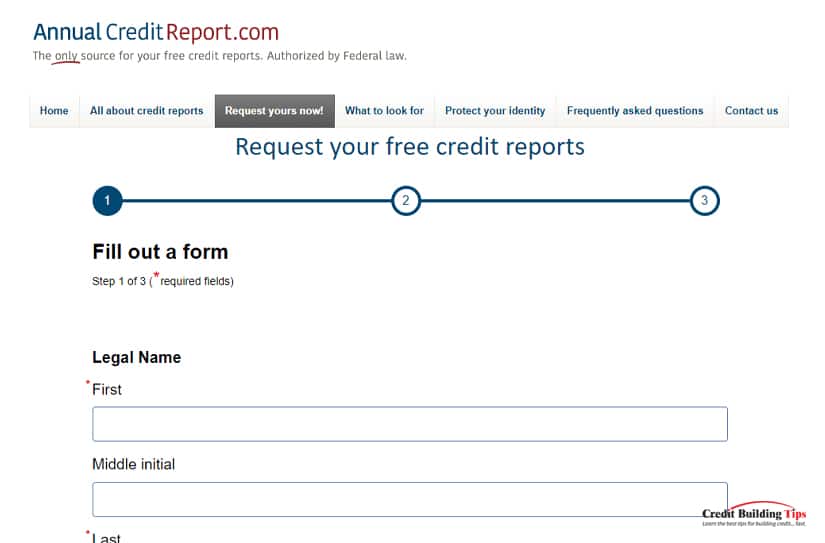

The first step to take is a look at your current credit report. These three credit bureaus extended the time they're allowing Americans to check their credit report for free. You now have until December 31, 2023, to get a weekly update through the Annual Credit Report website.

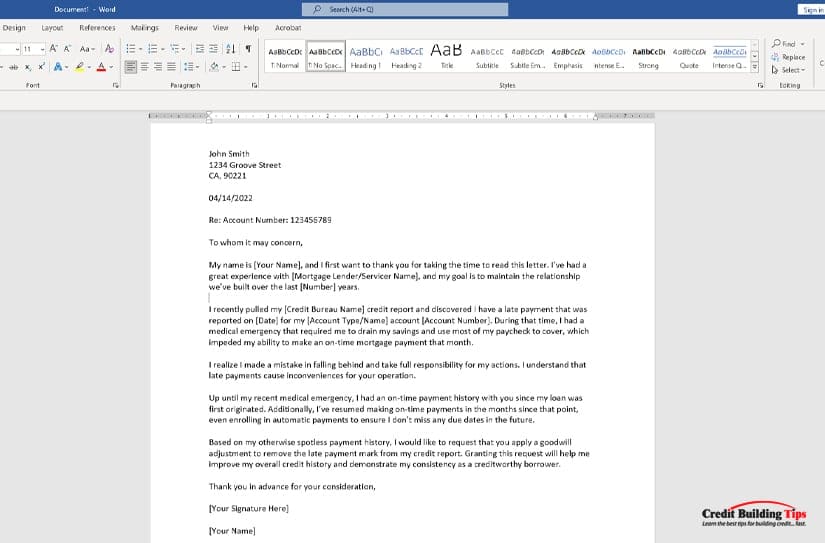

2. Write a statement of explanation to explain your circumstances. Adding a statement of explanation to your credit report can be viewed by potential lenders when they are checking your account and may be helpful in opening up a dialogue between you.

Don't waste this opportunity by writing something that excuses why your account has been sent to a collections agency. Lenders aren't impressed by the "my dog ate my homework" type of excuse. Rather, an explanation about how you lost your job due to a COVID-related or other natural or declared disaster may change the lender's perspective on your trustworthiness.

It's important to remember to ask the credit bureau to remove this statement after the delinquent account in question isn't on your credit report. Leaving the statement after the account has been removed may raise unnecessary questions in a potential lender's mind.

3. Dispute any errors. This is an important step to take if you want more information about the collections agency's claim or if you don't think you owe the money. The Consumer Financial Protection Bureau has a list of sample letters you can use to deal with debt collectors.

They note that if you use any of their sample letters, it's crucial to do so right away after the initial contact is made by a collections agency. As well, it's important to keep copies of any letters you send and receive.

4. Send a pay-for-delete letter. This is a way to "heal" your credit score by bartering with the collection agency. If you are prepared to pay your debt to them, you can offer payment in full in exchange for a "pay-for-delete" letter.

Credit Repair suggests you include the following information in this type of letter:

5. Ask for a goodwill letter. A goodwill letter is a written request to one of your creditors asking them to remove a negative mark on your credit report out of the goodness of their hearts.

While they suggest you not get your hopes up that this tactic will work, they also say it doesn't hurt to ask. A goodwill letter is your attempt to connect emotionally with creditors.

6. Get professional help. Sometimes you're in too deep and just need a helping hand. Contact the National Foundation for Credit Counseling (NFCC) and ask to work with a nonprofit credit counselor.

It's in your best interest to settle any outstanding debts as quickly as possible. Paying or settling collections will end the harassing phone calls and collection letters and keep the debt collector from suing you.

Now that the COVID-19 pandemic seems to be in the rearview mirror as far as the government is concerned, they have stopped letting us check our credit reports every week and reverted to one free credit report check each year.

These reports list your bill payment history, loans, current debt load, and other financial information. They include information on your work and whether you've ever been sued or filed for bankruptcy. Or whether you've been arrested and have a criminal record.

Lenders, insurers, employers, and rental property owners can all check your credit score before they lend you money, hire you or allow you to become their tenant. Lenders use the information to determine whether you're a good risk to lend money, and your lending history will help them decide what interest rate to charge you.

They'll go to a credit reporting agency and check the information this agency has on you. The credit report agency manages its records and may or may not have every bit of information about all your accounts. The information they do have has to be accurate but not comprehensive.

The trouble is there are three main credit reporting agencies — Experian, Equifax, and TransUnion.

The trouble is there are three main credit reporting agencies — Experian, Equifax, and TransUnion.There are several other credit reporting agencies that aren't as mainstream, and you don't often know which agency will be used to report on you. It could just be one, or they could go the distance and check all three main credit bureaus.

The way to ensure any future lender, insurance agency, employer, or landlord has the most accurate, comprehensive, and up-to-date information on your account is to regularly check your credit report and look for any errors. If there are errors in your credit history, like a lender claiming you haven't paid a loan when you have, you need to address these errors as soon as possible.

That's why the federal government lets you check your credit report for free once a year. That is, one free report from every credit reporting agency. They encourage people to check their reports for the reasons listed above and to help you catch signs of identity theft.

Central Source, LLC is the authorized government body that accepts your request for your annual credit report in three easy steps.

The first step asks for your legal name, current address, previous address if you've lived at your current address for less than two years, and your Social Security Number.

Next, you'll be able to choose which credit bureaus' report you want: Equifax, Experian, TransUnion, or all three. And finally, you'll need to answer a set of security questions to verify your identity.

The security questions you'll be asked to answer may require your tax information or other information that you'll have in your files, but no one else will know or be able to guess.

Wait a minute. Did you notice that this request will give you an annual free credit report? It doesn't mention getting your credit score along with the report. To put it bluntly, you won't get your credit score.

Wait a minute. Did you notice that this request will give you an annual free credit report? It doesn't mention getting your credit score along with the report. To put it bluntly, you won't get your credit score.You may be deep in the land of Google, skimming how to get your credit score for free, and read several sources that indicate that your free annual credit report from Annual Credit Report also gives you your credit score. It doesn't.

If you're not going to get your credit score which may be what you're vitally interested in determining, why should you ask for your annual credit report?

You'll be able to see:

Your credit report contains a breakdown of your financial history within the last seven to ten years.

Most of us have probably heard about FICO. We may not know exactly who he is and what he's about, but bring up the topic of credit reports and scores, and fairly soon, his name gets thrown around.

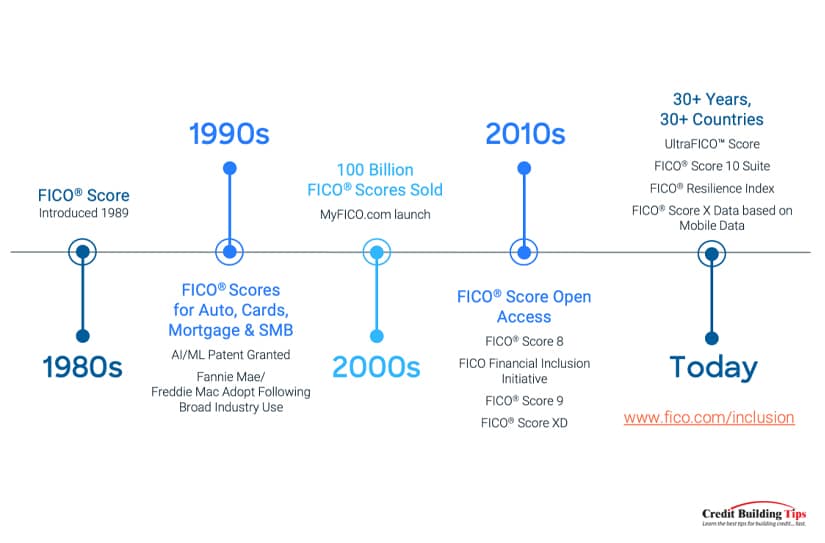

The Fair Isaac Corporation (FICO®) developed a credit scoring system in 1956 and named it after themselves. Initially, the system failed, and credit bureaus didn't take another look at it until 1989 when they created the FICO score using a "closely guarded mathematical formula that considers a variety of information contained in consumers' credit bureau reports.

The Fair Isaac Corporation (FICO®) developed a credit scoring system in 1956 and named it after themselves. Initially, the system failed, and credit bureaus didn't take another look at it until 1989 when they created the FICO score using a "closely guarded mathematical formula that considers a variety of information contained in consumers' credit bureau reports.FICO determined that five types of behavior would be considered when coming up with a credit score: payment history, the current level of debt, types of credit used, length of credit history, and new credit accounts.

In 2022, FICO isn't the only credit scoring system used, but it certainly is the biggest. Whether it's the best may be up for debate. Gartner Peer Insights ranked eight FICO alternatives and awarded them between 4.2 and 4.8 stars.

Not on Gartner Peer Insight's list is VantageScore. The three major credit bureaus created this credit scoring model. These companies wanted to create a credit scoring model that competed with FICO while expanding their credit scoring reach.

They stated that their goal was to give more consumers, like college students and new immigrants, the ability to have a credit score. Not everyone is eligible to get a credit score.

You can only get a FICO score if you have at least one account open with at least six months of credit history. Not only open, but you'll need to have at least one account that has generated a report within the last six months.

VantageScore can generate a score with only one month of credit history, and they only need one account's report within the past two years. This makes it much easier for those who don't often use credit or have just started using credit.

So, if the Annual Credit Report doesn't give you your credit score for free, who does?

Many services and websites advertise a "free credit score." Some of these are legitimate, but many are not quite as free as they may seem at first glance.

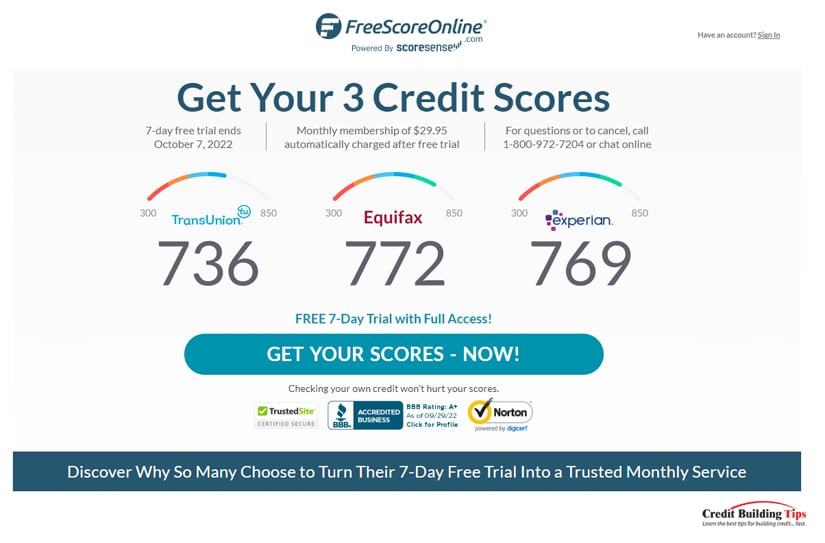

Free Score Online offers a 7-day free trial with credit scores and reports from the three main credit bureaus. To get your free 7-day trial, you will need to give your credit card number and information. That way, once the seven days have passed, your card will automatically be charged the $29.95/month membership fee.

Membership with Free Score Online gives you monthly updates on your credit scores and reports from the three main credit bureaus. You'll get daily credit monitoring and alerts and $1 million in identity theft insurance. Their Credit Insights pinpoint what's most affecting your scores, and their credit specialists are available to help you make sense of your credit.

National Credit Report invites you to "view your free scores now" by signing up for a free 7-day trial. Like Free Score Online, they'll require your credit card information and automatically begin billing your card $29.95 each month after the initial free trial period is over.

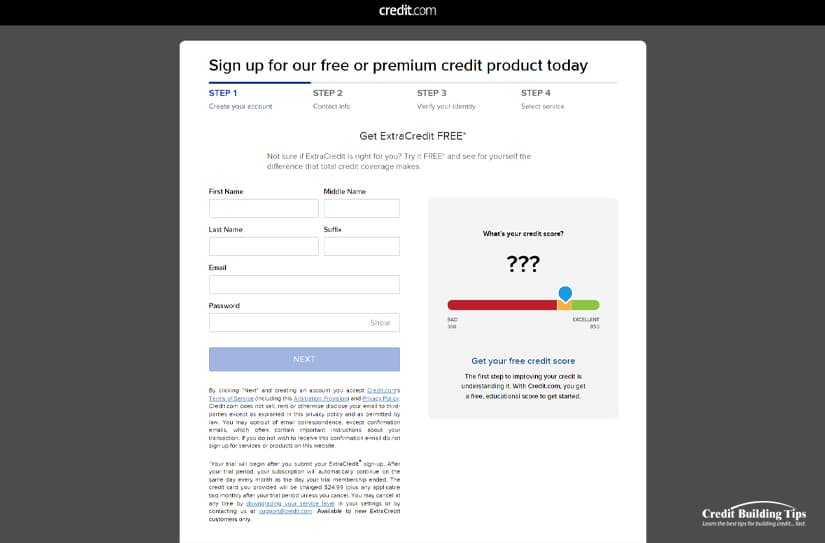

Credit.com promises to give you both your credit score and a credit report card (a summary of your full credit report) completely free of charge. They stress there's no catch and will let you have your credit score without a credit card or a hard inquiry.

If you're looking for a truly free experience, don't accidentally sign up for ExtraCredit. After a free trial period, your credit card will automatically be charged $24.99 (plus any applicable tax) monthly unless you cancel.

Experian goes one better. They let you view your Experian credit score for free. No credit card is required. Simply visit their website, select "Reports and Scores" from the header menu, then select "Free Credit Score." Input your information as directed and select "Create Your Account." Simple as that. You'll immediately see your Experian credit score.

You can also view your credit score from the two other credit bureaus, just not for free. To view these additional two credit bureaus will cost you a one-time fee of $39.99

Creditwise is powered by Capital One and is "free for everyone." It checks your score on TransUnion and Equifax and offers a dark web scan.

Credit Karma uses VantageScore 3.0 to calculate your credit scores from TransUnion and Equifax for free. Year-round. There's no limit on how many times you can check your score, and it's considered a soft inquiry that won't negatively impact your credit scores.

Major credit card companies have begun to provide credit scores for their customers every month. However, not every credit card company does, so check if yours offers the info. The score is usually listed on your monthly statement or can be found by logging in to your online account.

Auto loan companies are also getting on board with sharing your credit score. They'll see your credit score when they need to pull a hard inquiry on your credit report to assess whether you are a good risk. It's not really in their interest to withhold this from you, but it's also not in their interest to pull your score if you're not actually buying a vehicle from them.

Non-profit credit counselors are willing and available to talk to you (for free) if you are having trouble with your credit. HUD-approved housing counselors can often give you a free credit report and score and help you review them.

There is a way to work around companies that offer a free trial and then go on to start charging your credit card for their services. It takes some extra work and a good memory, but it can be done.

There is a way to work around companies that offer a free trial and then go on to start charging your credit card for their services. It takes some extra work and a good memory, but it can be done.First and most importantly, read the fine print before you take someone up on their free offer to see what might be hidden in the small print.

Next, sign up for a free Experian account. After signing in, you'll have to log out of your account for this next step to work.

At some point in the near future (potentially on your next sign-in), you'll see an upsell offer to try their paid offering for free for 7 days. After the 7 day free trial, you'll be charged $24.99 per month.

For this to be free, you will need to sign up for the free trial, check your scores, and then cancel the account before the automatic payments begin. Put the end date in your calendar, set an alert on your phone, place a sticky note on your bathroom mirror or do whatever it takes to remind yourself to cancel the account.

After you've retrieved your credit scores on all three bureaus, log in to your account and find "Your Account" on the home page. Look for "Membership Details" or some language like this, and you will find a place to "Cancel Your Membership."

The trick is that you can do this over and over again. You've probably heard of people signing up for a free, limited-time streaming service on Amazon or another platform. Cancel once the free period is over, wait a while, and sign up for another free trial.

Same idea, different product. No entertainment, but a great step towards financial health.

Q: Is it ever worth paying a fee to check my credit score?

The Consumer Financial Protection Bureau recommends you check your credit report and score at least once a year and more often before you make a major purchase that involves getting a loan, applying for a new job, or if you think you may be the victim of identity theft.

Q: Do I have more than one credit score?

You do have more than one credit score. Credit scores are calculated based on the information in your credit reports. If the information about you in the credit reports of the three large consumer reporting companies is different, your credit score from each company will be different. Lenders also use slightly different credit scores for different types of loans.

Q: What's an educational credit score?

Some credit score sources provide an "educational" credit score instead of a score that a lender would use. The Consumer Financial Protection Bureau (CFPB) published a report on the differences between educational scores and lenders' use.

The differences have to do with how the scores are generated, and the report looked at whether those differences disadvantaged the consumer. The report found that only for a "substantial minority" did the different scoring models give "meaningfully different results. Ones that would impact a lender's decision.

Q: Do credit bureaus score differently?

The scoring models do indicate that each credit bureau has its own typically generated credit score ranges:

FICO: 300 - 850

VantageScore: 501 - 990

Equifax: 280 - 850

Experian: 330 - 830

TransUnion: 300 - 850

Q: Do variations between credit scores ever lead to "consumer harm?"

Harm could happen if, after buying (or getting a free) credit score, a consumer understands their score to be quite different from what a lender would understand it to be. A credit score that's higher than it should be might prompt a consumer to apply for a loan that wouldn't be approved, and their credit score would drop as a result of the hard inquiry.

So, to recap, while getting a free credit report once a year is easy, it takes a little more work to find ways to get a free credit score. You don't just have one credit score, and they're not all the same, but for most people, the difference is minor and doesn't negatively impact their ability to borrow money.

Many people Google online to find out why their credit score isn't changing.

CRedit (Reddit's credit subreddit) is a forum where people can post their questions and get answers from the general public, which may or may not be the ideal way to get solid financial advice.

I found a question from last year where someone posted:

"I have been paying off a decent portion of my credit card since the start of 2021 (at least a few hundred/month and a few thousand here and there), but my credit score does not budge at all and stays at 712 on Credit Karma/TransUnion. I recently also got a new credit card and am waiting for its statement to potentially change my credit score as well, but I don't understand what is happening and if my credit score is stuck or something."

Seven helpful readers weighed in with comments and questions of their own that ran the gamut:

"Check your FICO scores."

"Utilization has no month-to-month memory in current FICO score models, so your score will improve as you lower your credit card balances, dropping your revolving utilization %."

"Man, I feel like we need a sticky at the top of the sub explaining the differences between FICO and Vantage score for those who don't know the difference."

"Paying down balances usually helps, but the totality of the report also matters, which is why it's also important to know what is on your report in order to determine how the scores may increase."

Umm. If they weren't clear before they asked their question, I'm not sure they're any clearer now. Let me see if I can help here.

If you're asking why your credit score hasn't changed or moved in months, there are probably a couple of pieces to your question. Let's start with:

A: Knowing how your credit reports get updated could be helpful here. Lenders (credit card companies, car loan companies, mortgage lenders, and any other company lending you money) usually update your account information about once a month or at least every 45 days.

A: Knowing how your credit reports get updated could be helpful here. Lenders (credit card companies, car loan companies, mortgage lenders, and any other company lending you money) usually update your account information about once a month or at least every 45 days.They send the new information to the nationwide credit reporting agencies: Equifax, TransUnion, Experian, and Innovis.

Although lenders typically submit information every month to 45 days to credit reporting agencies, updates aren't necessarily done in real-time. If the lender is behind with their updates, there can be a significant time delay. But probably not months.

A: If you don't ask a loan company to lend you money and you have the same credit cards and pay them off each month without fail, your score will stay the same because nothing has changed.

A: If you don't ask a loan company to lend you money and you have the same credit cards and pay them off each month without fail, your score will stay the same because nothing has changed.If you miss a payment but overall have a good credit history, it's not likely to change or lower your score. But the same is true if you have several negative factors on your credit report, then a single positive action, like making a full payment, may not change or boost your score.

Suppose enough time has passed for the credit reporting agency to have reasonably updated your report, and your activity has been relatively constant. In that case, your score may stay the same because of your lenders.

Building your credit score takes time because lenders look for a long-term pattern of dependable payments. They look at your whole report, not just whether the credit score number is high or low.

That's good news because if you continue to make payments consistently, lenders can see what type of a borrower you are every month.

Some lenders look for diversity in credit reports. If you've just had one credit card for years and paid it faithfully, your score will stay the same. While that's good, what's even better is for your score to increase so you can be considered a good risk when it comes time to borrow more money, for example, when you want to purchase a house.

When it comes to credit scores, what you really want is a stable high score.

Equifax considers credit scores between 580-669 as fair, 670-739 good, 740-799 very good, and 800 and up as excellent.

Equifax considers credit scores between 580-669 as fair, 670-739 good, 740-799 very good, and 800 and up as excellent.So, if your credit score is 740 or higher and it hasn't changed or moved in months, you've got nothing to worry about. A credit score above 740 lets you "make a lower down payment, get a more attractive interest rate and save on private mortgage insurance."

A credit score above 800 gets you the best credit cards, mortgages, and competitive loan rates. The best credit cards let you earn generous rewards on groceries and dining out. CNBC chose the American Express® Gold Card as the best rewards card.

To finance new purchases or get out of debt with a balance transfer card, you'll also have to have excellent or at least very good credit.

If your credit score is lower than 739 and it hasn't changed or moved in months, you can do things to get it going in the right direction.

Making or missing payments is the number one factor when it comes to calculating your credit score. Payment history accounts for 35% of your FICO score — more than any of the other four factors.

How you've managed your credit accounts is the factor used by 90% of top lenders. Research has shown that payment history tends to be the "strongest predictor of the likelihood that you'll pay all debts as agreed to."

While a few late payments aren't going to automatically lower your credit rate, get into the habit of paying on time all the time. Set up payment alerts on your calendar and when possible, set up automatic withdrawals from your bank account to the account holder.

This works best when the payment is a consistent amount each month, like with a car payment. If the account can vary significantly over the course of a payment schedule, this may be harder to manage on a monthly budget.

This may be a little trickier to wrap your head around, but you'll appreciate how important it can be when you consider that this factor accounts for 30% of your credit score. Together, this and your payment history have the biggest impact on your score.

Popular wisdom suggests that you use only 30% of the credit you qualify for. If you were to Google "how much of my credit limit should I use," you'll get about 1,230,000,000 results. I didn't check all of them, but most sources agreed that using 30% or less of your credit limit is the best way to maintain a good or excellent credit score.

Some experts suggest that you should aim for less than 10%. Financial expert John Ulzheimer, formerly of FICO and Equifax, told CNBC:

"Less than 10% is much more doable [than the 1% of healthy utitlization], and it will serve your scores well. [It] is great for both FICO and VantageScore's scoring systems."

Keep your credit utilization ratio as low as possible, or at least under 30%. If your total credit limit for all credit accounts is $20,000, your total credit balance debt shouldn't exceed $6,000. Or, if you want to follow a financial guru's advice, keep your total credit balance debt under $600.

It may sound, on the face of it, impossible to increase your credit history. That's like saying, "Be older than you are." But when it comes to moving your credit card forward faster, there are ways to increase your credit history.

I previously outlined what a tradeline is and how to make them work for you. Getting two or three "seasoned" tradelines can help you quickly jump to a higher credit score if your current score is less than ideal.