We've all been there — you want to apply for a credit card. Whether it's your first application or your 21st, it's easy to wonder what the criteria are for properly reporting your income.

While it may be easy to pull out your Form 1040 (if you have one), that figure rarely describes the entirety of the allowable income you may have received throughout the year. The more income you can list on your credit card application, the higher the credit line you'll likely qualify to be approved for.

But in order to properly report income — declaring everything you can legitimately include without adding in non-allowable "income" can be confusing. In this post, we're going to look at what precisely you can and cannot include.

But in order to properly report income — declaring everything you can legitimately include without adding in non-allowable "income" can be confusing. In this post, we're going to look at what precisely you can and cannot include.Summary:

Let's get started!

When it comes to properly listing your income when applying for a credit card, the U.S. government has some opinions. Also known as Acts or Law.

A detailed explanation of what banks may consider income to determine credit card eligibility can be found in the Consumer Financial Protection Bureau's (CFPB) official interpretation of 12 CFR Part 1026, specifically in its Comment for 1026.51 Ability To Pay.

In a nutshell, banks (credit issuers) must follow the government's guidelines when considering income and assets in order to give or increase credit. Part of the comment reads, "a card issuer [must] consider a consumer's ability to make the required minimum periodic payments under the terms of an account based on the consumer's income or assets and current obligations."

The bank is charged to look for "current or reasonably expected income" when calculating if and how much credit they may advance to a potential card user. The card issuer needs to have confidence that if they extend you credit and you use that credit to purchase an item or service, you'll be able to pay it back.

The bank is charged to look for "current or reasonably expected income" when calculating if and how much credit they may advance to a potential card user. The card issuer needs to have confidence that if they extend you credit and you use that credit to purchase an item or service, you'll be able to pay it back.

The government also makes a distinction between applicants who are between 18 and 21 and those who are 21 and older. For the short window of time before your 21st birthday, you may only include income that you "personally and independently make."

However, you can also report "the residual amount from scholarships and other financial aid (not student loans) after paying tuition and other college expenses." You can also include the monies from any "regular allowances" you receive.

The CARD Act of 2009 tightened up any loopholes that may get young adults into trouble by mandating that "borrowers under 21 must have an independent ability to make the minimum required payments or have a cosigner who is 21 years or older and who agrees to become liable for the debt on the account."

Obviously, the first and most meaningful "income" you can report on your credit card application is the amount of your paycheck. But there's still a lot of room for interpretation when it comes to understanding how and what kind of income you can report.

Regular employment income — full-time, part-time or casual, salaried, freelance, or a side hustle. If your hard work earned money, it can be reported as income. This also includes any:

If you have a joint account with your spouse or partner, you can use their income on your credit card application. If a state or local statute "grants you an ownership interest in another person's income, you can usually use that person's income…" on your application.

Any rental income from properties you own can be reported on your credit card application, even if it's for intermittent holiday rentals. If you get periodic or regular payments for expenses such as subletting a room in your home, you can also consider the money you collect income on your application.

There seems to be some disagreement on whether unemployment funds count as income. The best rule of thumb we found is "if the IRS counts it as income, so will the credit card issuers." Unemployment payments are "taxed as income by the IRS," so you should be able to report these payments as income.

Other assets that can be reported as income include:

It's important to report your income correctly when applying for a credit card because this can help determine your creditworthiness and the type of card you are eligible for. The information you provide on the application is used by lenders to assess your ability to make payments on the card.

If you report an income amount that is too low, lenders may not approve your application or may offer you a card with a lower limit and higher interest rate. On the other hand, if you report an income amount that is too high, lenders may be suspicious of your application or offer you a higher limit than you can actually afford.

Reporting an accurate income also helps protect you from potential identity theft. If someone were to steal your identity and apply for a credit card using false information, their creditworthiness might be based on your reported income. This could result in them obtaining a credit card with a much higher limit than they could manage, putting you at risk of being liable for any unpaid debt.

In addition to knowing what income you should include in your application, you also need to know what income you shouldn't include. In this sense, you should avoid reporting:

The bottom line for staying on the right side of the law comes down to three simple guidelines:

Credit card issuers don't expect you to know down to the penny the exact amount of your next year's stated income will be. They're simply looking for your honest and best estimate of your current income. Or what your expected income will be.

It's never a good idea to overreport your income. If the credit card company suspects your stated income is inflated, they might ask for a financial review of your application.

You'll then be required to submit documentation to prove that your income figures are accurate. Types of proof of income documents include:

If you don't provide the information or they find you've exaggerated your income claims, they can reject your application, reduce any current credit lines, close your accounts, or, if you report "false or nonexistent income," you could be fined. Or worse.

Read the application carefully and report in good faith.

The regulations that address which types of income and assets are allowable in determining creditworthiness are directed towards the banks, not the individuals applying for credit.

That's why you'll find the questions banks ask about your income on a credit card application can vary from one bank to another or even one card to another. You'll need to carefully read the application to ensure you're giving the bank the information they're asking for!

For instance, some applications want to know your gross income, while others are interested in your net income. The difference between these different calculated incomes is significant.

Gross income is the amount of money you make before deductions. Deductions can be income tax withholding, retirement plan contributions, employee benefit costs, etc. If you make $60,000/year, your gross monthly income would be $5,000 (60,000 divided by 12).

Your net income is the amount of money you make once all deductions have been made. You'll be able to see on your Form 1040 your gross monthly income of $5,000 and then an itemized list of each deduction, followed by a smaller total. That's your net income.

Some credit card companies may request that you provide your most recent W2 form to prove your income. Others may require that you provide copies of your pay stubs or a letter from your employer verifying your income. Still, other credit card companies might ask for bank statements or tax returns in order to verify your income.

No matter which method of reporting your income is requested by the credit card company, it is important to ensure that you provide accurate and up-to-date information. Some credit card companies may ask you to provide proof of income that is older than one year, so make sure to have the appropriate documentation on hand in case it is required.

Be aware that some credit card companies might use an automated system to review your income information that will use algorithms to verify the accuracy of your reported income and the consistency of your financial records. That's why it is important to make sure that all the information you provide is accurate and up-to-date.

Q: What if I've just been laid off?

A: If you've just been laid off but expect that you'll be employed again shortly, you may use your previous income to apply for a credit card. The key is that you have a "reasonable expectation of employment."

Q: What is irregular income?

A: Having an irregular income simply means you don't get the same amount of money each time you get paid. Self-employed, project-based, or commission-based jobs are all examples of irregular income.

This should not impact your reported income on a credit card application, as most issuers are looking for your annual income, not month-to-month.

Q: What's considered a "good income" for a credit card application?

A: The more income you can report, the higher your potential credit limit will be, but there's no set or minimum of income that guarantees you qualify for any particular credit card.

Having said that, WalletHub recommends a good annual income is "more than $39,000 per annum for a single individual or $63,000 per year for a household." They also note that this figure varies depending on the credit card company.

Credit card issuers are looking at whether you can afford the minimum payments on a credit card. If your disposable income can assure the issuer you will be able to make these minimum payments, you should qualify for a credit card, even if it has a low credit limit.

Q: What if I don't have any income — can I still apply for a credit card?

A: As long as you have some income (not tied to a job) coming in, credit card issuers will consider your application. They'll also look carefully at your credit history, credit score, and any existing debt.

Q: My income is low. What can I do to improve my chances of qualifying for a credit card?

A: If your income is too low, you may find it difficult to qualify for a credit card. To give yourself every chance of successfully applying for a card, check these things off your to-do list to make sure you give yourself every chance:

Q: What other factors besides my income will affect my credit card application?

A: Besides your income, your credit score is an important consideration when banks look at your credit card application. The top five factors that determine your credit score are:

Do you have any other questions about reporting income on your credit card application? Let us know in the comments below if we missed anything on this topic, and we'll be sure to add it!

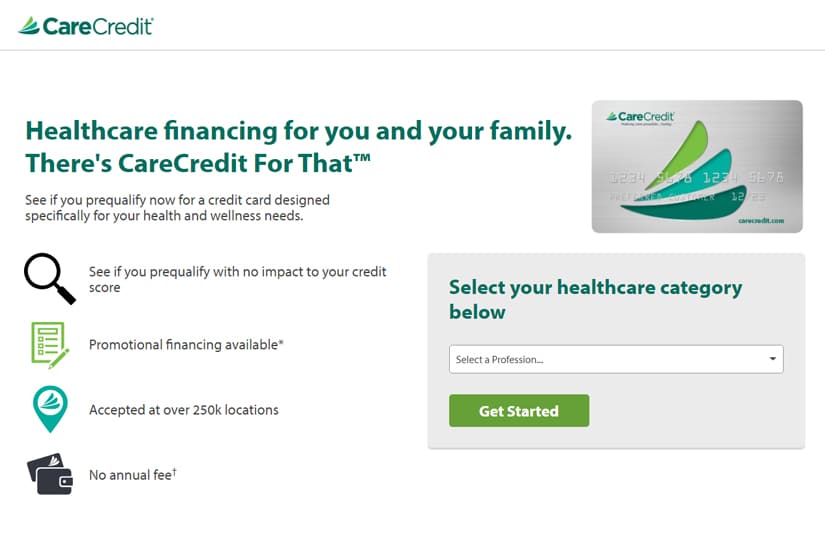

CareCredit has this to say about itself,

"We do something very simple at CareCredit:

We help people get the care they want for themselves and their families."

The card is intended to be used to pay for healthcare expenses that aren't covered by insurance and works similarly to a standard credit card. The CareCredit card is issued by Synchrony Bank, one of the 10 largest credit card issuers in the States, and will show up on your credit report as "SynchronyBank/CareCredit."

Synchrony Financial is a consumer financial services company. Its company headquarters are in Stamford, CT, and it got its start in 1932, during the Great Depression. The company is the largest provider of private-label credit cards in the country.

Some of the brands and cards that have partnered with Synchrony include:

Synchrony Bank uses all three major credit bureaus — Equifax, Experian, and TransUnion — to assess your creditworthiness. Their CareCredit credit card is "designed for your health and wellness needs" and lets you buy from 250,000+ healthcare providers in the U.S, including:

Let's talk about the CareCredit card, how to apply, and what kind of credit score is required for eligibility.

Let's talk about the CareCredit card, how to apply, and what kind of credit score is required for eligibility.There's an easy and fast way to see if you prequalify for CareCredit:

The average credit card score you'll need to have in order to qualify for and register for a CareCredit card is at least 620. This credit score is considered "fair," and some people have even qualified for the card with a score of 600.

The average credit card score you'll need to have in order to qualify for and register for a CareCredit card is at least 620. This credit score is considered "fair," and some people have even qualified for the card with a score of 600.Considering that the two lowest possible credit score ranges are 300-570 (poor) and 580-669 (fair), the CareCredit is one that almost everyone has a shot at getting approved.

Other criteria that impact your chances of qualifying for the card include the following:

When applying for the CareCredit card, you'll need to supply your:

There's no annual fee if your application is accepted. The card's interest rate is 26.99%, and the minimum interest charge is $2.

Although the CareCredit card is a convenient way to pay medical bills and healthcare expenses, there are some downsides you need to be aware of. Remember how earlier in this post, we said, "The card is intended to be used to pay for healthcare expenses that aren't covered by insurance and works similarly to a standard credit card?"

Similarly, this card is not the same as a credit card.

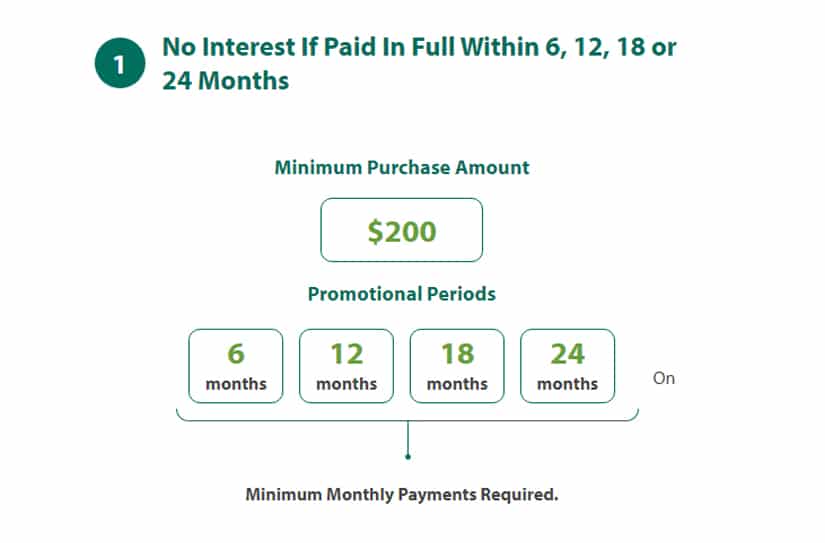

Similarly, this card is not the same as a credit card.CareCredit doesn't calculate your payments in the same way as other credit cards do. According to their site, there are two common scenarios for "making payments using each of the promotional financing options available."

The first scenario is "No interest if paid in full within 6, 12, 18, or 24 months." That's for a promotional period on "qualifying" purchases over $200. You'll need to make minimum monthly payments, and if you don't pay the charge off in full within the promotional period time, you will be charged 26.99% interest on the remaining balance.

If, for example, you make a purchase of $874.00 on a 12-month interest-free promotional period, in order to avoid paying interest, you will need to make sure that you pay at least $72.83 each month. That way, your account balance at the end of the 12-month period will be $0.

If you simply make the minimum monthly payment of $14.00, you'll be left with $706.00 owing and will now be charged 24.99% interest on this remaining balance until it is paid in full.

And that's just for this single purchase.

Purchases of $1,000 or more may be eligible for a 24-month period with a lower interest rate of 14.90%, a 36-month period at 15.90%, or a 48-month period at 16.9%. Purchases of $2,500 or more could be eligible for a 60-month period with a 17.9% APR.

The "deferred interest/no interest if paid in full" promotional offers only apply if you pay the entire balance in full by the end of the promotional period. Many people get caught in a trap of mistakenly thinking they won't need to pay any interest as long as they continue to make the minimum monthly payments.

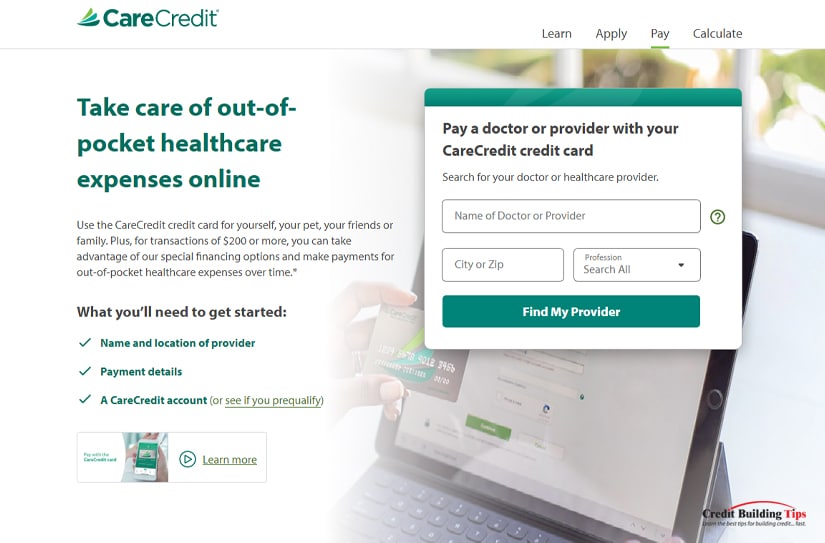

You can pay online for a medical visit by searching for your doctor or healthcare provider by name. This can be the provider's office or a billing address on their invoice.

Enter the city or zip where you received treatment as well the type of service from the drop-down menu of provided professions:

The site will search for your provider and ask you for your payment details and CareCredit account. You'll also need to provide the outstanding balance due, an invoice number or patient id, and the date of service. Prompts will move you through the process.

Once you review the information you've submitted, you'll get a confirmation email, as will your provider. Within two business days, the transaction should appear on your CareCredit account.

The company has set up limits on how much you can pay and how often you can pay a specific provider within a specific timeframe. If you pay more than the accepted limit, you'll see an error message on your screen.

Not every medical clinic or doctor will accept the CareCredit card. Only providers who have registered with the company will accept your card. If you can't find your provider, you can refer them to join CareCredit.

If you're using your CareCredit card to pay for goods at one of their partner retail stores, you can simply use it the same way you'd use a credit or debit card.

The CareCredit card is accepted at major retail stores like:

CareCredit lets you pay your card statement in several ways. You can:

If you worry your payment may be late, call the office at 1-866-893-7867 before the payment due date, as Synchrony may be able to offer you choices that fit your needs.

The best way to make a CareCredit card work for you is the same as the best way to make any credit card work. Pay your statement balance in full — every single time, and you'll not only maintain your credit rating, but you'll also improve it!

Think about paying at least half if you can't pay the full balance. If that's simply not possible, pay as much as you can. Make sure you pay at least the required minimum monthly payment on time. If you miss the payment date, you'll be charged late fees of up to $41 plus interest on the unpaid balance.

If you can only make a minimum payment every month, it will take a long time to pay off your debt, and you will inevitably waste a lot of money on interest fees. This will also negatively affect your credit score.

Check your monthly statement as soon as it arrives in the mailbox or your inbox. It's good to make sure the statement aligns with the receipts you've collected over the month.

If you don't recognize some of the charges, you'll want to contact the company that issued the charge. If that doesn't clear up the mystery, contact the credit card company immediately.

You may be the victim of identity fraud. Or you may find out that you're still paying for a subscription you no longer use that still's taking automatic payment from your account.

Credit can be tremendously helpful in today's financial world, but only if you use it wisely and well. Having good credit is the best way to take advantage of lower interest rates and work towards qualifying for a future home mortgage or other major expense.

The most current information on loans for veterans from the Department of Veterans Affairs (VA) says that VA direct and VA-backed Veterans home loans can "help Veterans, service members, and their survivors to buy, build, improve, or refinance a home."

As of 2023, loan limits are at an all-time high, which makes it possible for "service members to buy a home with no down payment." Veterans need to meet several requirements, but the loan program has several "perks" along with not needing a down payment.

According to benefits.va.gov, the main pillars of the VA home loan benefit include:

Two other benefits include:

They aim to provide:

"A home loan guarantee benefit and other house-related programs to help you buy, build, repair, retain, or adapt a home for your own personal occupancy."

While the VA Home Loans are given by private lenders, such as traditional banks and mortgage companies, VA stands behind a portion of the loan. This lets the lender offer you more favorable terms.

Let's discuss the VA loan process, as well as some special credit requirements that you must meet before you apply for them.

Let's discuss the VA loan process, as well as some special credit requirements that you must meet before you apply for them.The research team at Consumer Affairs "vetted 11 VA lenders rated by over 27,613 borrowers." Their top picks have at least a 3.5-star overall satisfaction rating as well as a 2:1 ratio of 5-star to 1-star reviews over the period of April 29, 2020, through April 29, 2021.

Here are their top findings:

Not surprisingly, Veterans United Home Loans was their top pick overall.

The company only offers VA loans and is intimately familiar with its programs. Reviewers had this to say about their experience with Veterans United Home Loans:

Currently, the US Department of Veteran Affairs doesn't set a minimum credit score. This good news may be somewhat misleading, however, as the private lenders who offer VA loans do set minimum credit scores to qualify for a loan.

While a conventional loan requires, as a minimum, a 620-credit score, loans backed by the VA typically require, as a minimum, a credit score of 580 to 620.

While a conventional loan requires, as a minimum, a 620-credit score, loans backed by the VA typically require, as a minimum, a credit score of 580 to 620.Not everyone is eligible for a VA loan. Consumer Affairs again distilled down Veterans United's critical requirements, as well as the requirements of which you may need to meet one or more.

Critical loan requirements:

Service loan requirements (one or more):

If you don't feel you meet these minimum service requirements, don't despair. The VA's criteria are nuanced, and talking with one of the company's loan specialists can help you determine whether or not you still qualify.

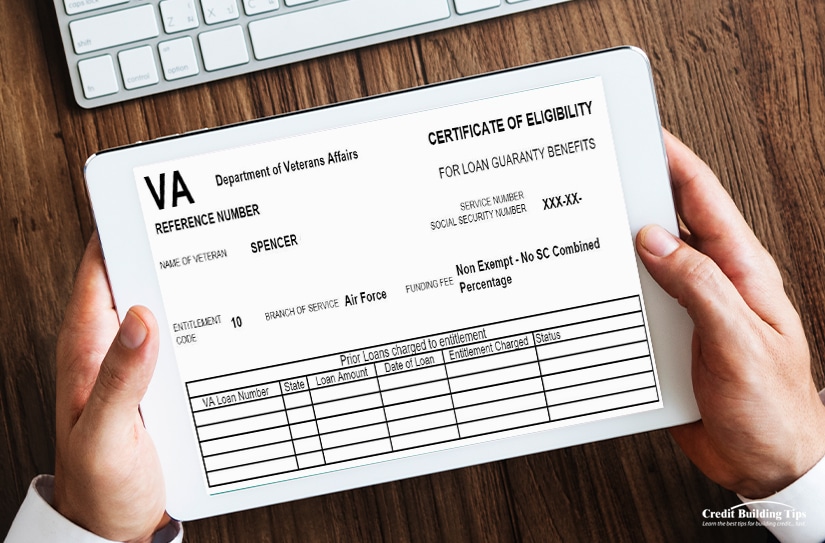

Before you can qualify for a VA loan, you'll need to apply for and receive a VA loan certificate. The certificate is issued by the US Department of Affairs and gives legal credence to:

You can request a COE online by logging in at the eBenefits with your Premium DS Login account. Once there, you'll need the following:

Any discharged members of the National Guard or Reserves who were never active need to meet a few other requirements. Check out the list.

Even if you were discharged with less than the minimum service requirements, you might still qualify for a COE if one of the following reasons apply:

You may not be eligible for VA benefits if you've received an "other than honorable, bad conduct, or dishonorable discharge, but there are still two ways you can try in order to qualify:

Besides an approved credit score and your COE, potential lenders will also look at how much credit you currently have, your debt-to-income ratio (DTI), your history of making timely payments, and your current income to determine whether you qualify and what interest rate you'll be offered.

The VA lists 41% as the maximum DTI ratio at which they'll approve loans. Exceptions may be made for applicants who have enough "residual" income even if their ratio is above the 41% preferred.

As mentioned before, most VA loans don't require a minimum down payment when it comes to making a down payment on a house purchase. But if the price of your new home is more than its appraised value, you may be required to pay some amount to make up a chunk of the difference.

Even if that's not the case, any amount you can put down as a down payment will help to minimize the VA funding fee. This is a one-time fee the VA requires veterans to pay on a VA-backed or VA direct home loan. The fee helps "lower the loan cost for US taxpayers.

The amount of the fee depends on how much you are borrowing as well as other factors. You can pay the fee by either including the fee in your loan and paying it off over time or paying the fee in its entirety at closing.

Even though the VA will approve those with lower credit scores, your credit score is still one of the most important factors lenders consider when evaluating your loan application. Your credit score reflects your past payment history and other information about you and your credit accounts, such as how much debt you have and how many accounts you've opened recently.

A good credit score indicates that you're a reliable borrower and can be trusted to repay loans on time.

The following factors can affect your credit score:

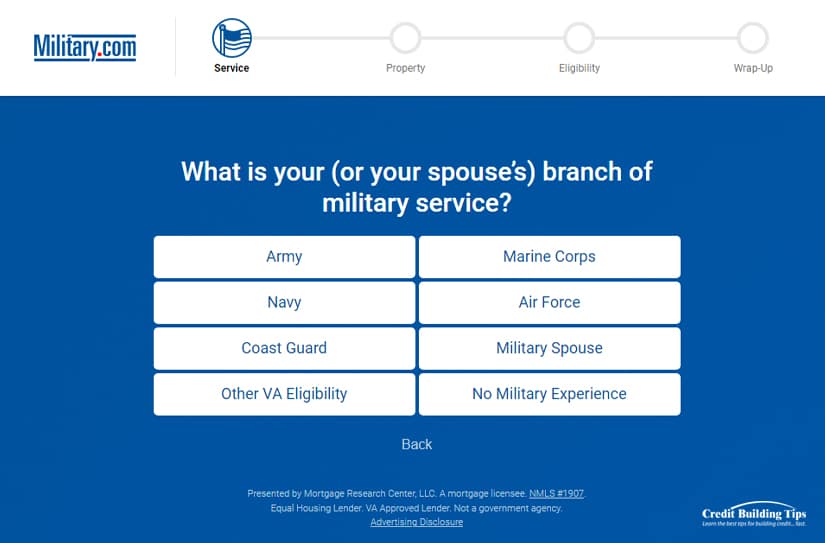

Military.com outlines the "six easy steps to a VA Loan" and offers "more information on the process," along with the chance to get several no-obligation quotes.

These six outlined steps are:

Although VA loans offer some of the best deals in the mortgage industry, there are still a few disadvantages to consider. For one, many lenders require a funding fee that can range from 1.4% to 3.6% of the loan amount. This can add up to a significant amount over time and reduce the overall savings from the loan.

Additionally, borrowers are limited to the types of properties they can buy with a VA loan; they are not allowed to purchase second homes, vacation homes, or investment properties. As well, VA loans may require an appraisal that can cost more than appraisals for conventional loans.

For over 20 years now, we, as Americans, have celebrated National Appreciation Month and publicly show our appreciation for the US Armed Forces. The president makes a proclamation and reminds us of the important role every soldier has played in the history and development of our country.

The VA has a network of eight Regional Loan Centers ready to offer consultations for those veterans who are struggling financially.

Currently, regional loan centers are closed to the public. However, you can reach a VA Home Loan Representative by calling toll-free, 1-877-827-3702, anytime Monday to Friday from 8:00 am to 6:00 pm EST.

Alternatively, if you'd like to reach out via mail, in person, or by email, you can find the contact information on each of their regional loan centers:

Operation Gratitude "proudly delivers Care Packages to deployed troops, first responders, military families, recruit graduates, veterans, wounded heroes, and caregivers." Its vision is for "all who serve [to] believe the American people care, and their mission is to "honor the service of our Military and first responders by creating opportunities to express gratitude."

One of the ways they do this is through their letter-writing program. We'd like to encourage you all to take a few minutes to recognize the services, sacrifices, and courage these men and women show every day.

If you ever have any questions or concerns about anything credit-related, we'd be more than happy to assist you. Drop us a comment down below, and we'll be sure to get back to you as soon as possible! Additionally, why not check out our other articles while you're here? We've written dozens of articles all about credit and credit-related topics, so it's very likely you'll find information useful to your particular situation.

What's a credit card nickname, and why would you want one?

We're not talking about the synonyms for the actual credit card itself. People refer to credit cards as "plastic money," "charge plate," "bank cards," or simply "plastic." These terms can also refer to a debit card, but in the main, when someone uses one of these terms, they're referring to their credit card.

The nicknames we're talking about in this article are the ones you give your cards to distinguish one from the other as you use them. With credit card nicknames, you can easily identify which card is which and make sure you're using the right one for the right purpose.

The nicknames we're talking about in this article are the ones you give your cards to distinguish one from the other as you use them. With credit card nicknames, you can easily identify which card is which and make sure you're using the right one for the right purpose.Credit cards are identified by the 16-digit account number (15 digits for American Express), and for most of us, this number isn't one we find easy to memorize, along with the expiry date and CVV.

Most people assume the number on their credit card is the same as their account number. While the two are linked, they're not identical, which you will notice when you receive your credit card statement or view it online.

Forbes Advisor warns that "the sad truth is that credit card numbers get stolen all the time." They recommend using caution at all times. Giving your credit card a nickname is a great way to disguise the card numbers from anyone peeking over your shoulder as you input the number into a field while you're shopping online.

Credit card nicknames are names that you assign to your credit (or debit) cards for easy reference. By creating nicknames for your cards, you can easily remember which cards have what features and benefits. This can be especially helpful if you have multiple credit cards from different banks or if you're trying to keep track of your spending.

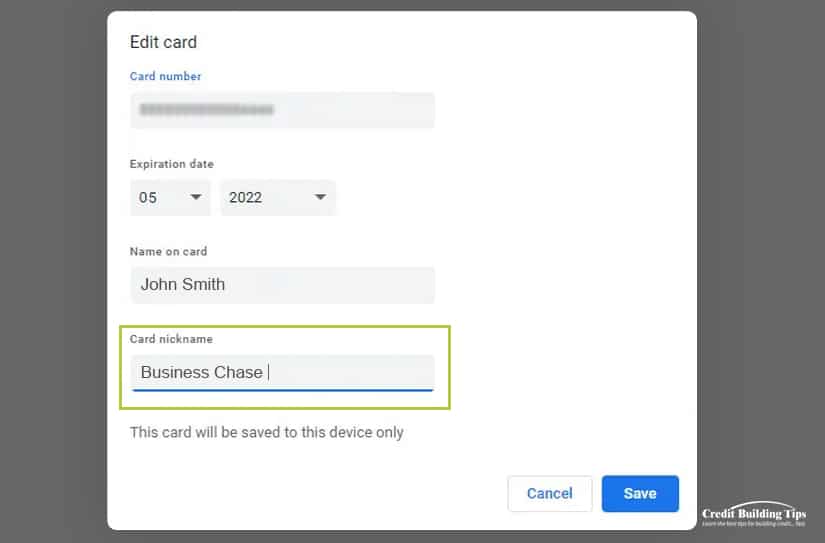

These nicknames are also a great way to differentiate between personal and business cards. For instance, you may have a "Personal Chase" and a "Business Chase," or a "Grocery Visa" and an "Eating Out Visa." With nicknames like these, it's easy to recall which card is for which purpose.

A credit card nickname is a user-defined identifier useful in distinguishing among multiple credit cards kept on file for use when you're shopping online, giving someone your number over the phone, or filling out online forms. Think of assigning a nickname to your credit card as a way to avoid mixing up which card you want to use for a particular purchase.

A "preferred name" for your credit card refers to banks allowing their users to assign a name that's not their legal name to their credit, debit, or banking accounts. One example is using your preferred name Bill when your legal name is William.

A timely example of this concerns the transgender community. Seventy percent of transgender people don't have banking documents or IDs showing the names they choose to be known by in their everyday lives. Almost 33% told the National Center for Transgender Equality they were denied services when trying to use "outdated" documents.

While the process of getting your name changed on a credit card takes work, it's not especially difficult. Once you have all your documents in order, the change can happen easily — as long as you're patient and prepared.

A credit card nickname doesn't change the name of the account holder; it simply changes how the card is described as you use it.

As the card's user, you can assign a description or name to any and all of your credit cards and use it as the card's unique ID. For most people, remembering a nickname is much simpler than remembering the string of numbers that make up your credit card account.

Digital wallets and applications will often ask you for a nickname you want to create or have already assigned to your credit card. You're not required to have a nickname, and if you choose not to, the app will just default to the last four digits of your account as an identifier.

While we can't give you a one-size-fits-all list of instructions on how to add a nickname to your credit card, we can give you a general idea of how to do this. The exact instructions will vary from website (or app) to website, but this should help give you a good idea of the process.

The first step you'll need to do is save your cards to your device. You'll be asked for the following:

Once you've filled in the information (correctly to make sure your card works), some sites will automatically prompt you to give your card a nickname. If you get this prompt, you'll want to click on it. If you don't automatically get this prompt, you will need to input your payment settings.

Choose the card to which you want to assign a nickname. It's worth double and triple-checking at this point as it will create problems for your book balancing if you mix up which card gets what nickname!

A dialogue box will pop up, and you'll get to type in the nickname you want to use. Once that step is completed, click the "Save" button.

Rinse and repeat for every card you want to give a nickname.

Next time you want to buy something, you can simply click on the nickname of the card you want to use. Easy and convenient!

If you want to edit a nickname, you can search your payment settings, click on them and locate the "Edit" button's dialogue box to change the name. If you don't want to use the card, you can also search your payment settings, click on them and locate the "Delete" button's dialogue box to take the card off your account.

No, not all vendors let you assign a nickname to your credit cards when you use them to make a purchase.

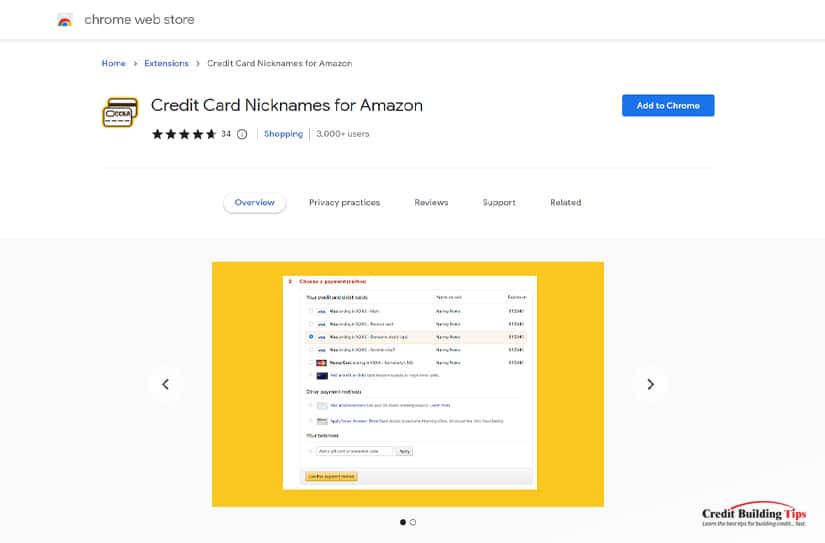

No, not all vendors let you assign a nickname to your credit cards when you use them to make a purchase.Amazon, for instance, doesn't (yet) have a way to let you assign nicknames to your credit cards if you have more than one stored on your account. However, according to The Big Tech Question, there is a browser extension that lets you create a workaround for this.

The first step is downloading and installing "the Credit Card nicknames for Amazon browser extension." You can find it on the Chrome Web Store, and it works with Google Chrome, Microsoft Edge, Vivaldi, and other web browsers based on the "Chromium engine."

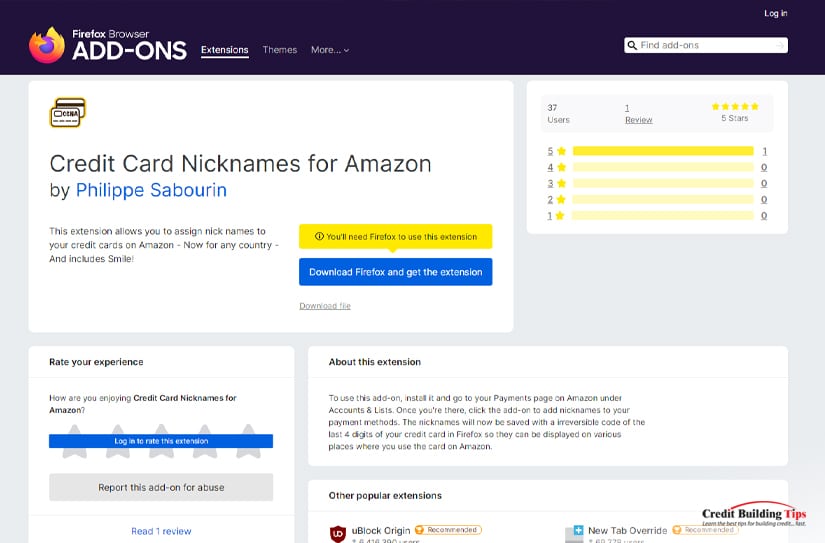

Using Firefox? Here's their browser extension. Unfortunately, there doesn't appear to be a version for Macs using Safari.

After you install the extension in your browser, go to your Amazon checkout card and click on the small credit card icon at the top of the browser window. You may need to expand the window in order to see the icon.

Now when you're asked to select a payment card, you'll have an opportunity to create a nickname for every payment card you have on file. Before you assign a nickname to the card, you should see just the last four numbers of the card.

Now when you visit your checkout, your available cards will be displayed along with a text label showing your nickname. Note that while this workaround works for the Amazon website, it doesn't carry over to the Amazon apps.

Choose a nickname that's easy to remember. While few people can remember (correctly, at least) their 16+ credit card numbers, the point of assigning a nickname is to make it easy to remember. But if your credit card nickname is too obscure, you may not recognize which card it is connected to when you go to pay.

There are a couple of ways to distinguish one credit card from another. You can identify your card by its network:

If you own more than one of the same cards issued by the same network, you could add more details, such as the types of rewards or benefits the card gives you:

Alternatively, you can give your credit card a nickname that identifies how you use it:

Another way to make sure that you can quickly and easily identify your cards is by utilizing visual cues. If there's a picture on the card, use that as a basis for your nickname. For example, if you have a card with a beach scene on it, you might call it "Beach Getaway."

Some databases won't let you input spaces or special characters or may have a limit to how many characters you can use in the field set up for nicknames. If you've developed a system to help you remember multiple nicknames, you may encounter an issuer who won't create one with a special character or number.

When setting up a password, it's generally considered more secure to include upper and lower case letters, numbers, and symbols, as this greatly increases the possible combinations of your password.

Good advice for creating a strong password includes the following:

Using nicknames can also help you track your spending more effectively. Since each nickname will be associated with a specific card, you'll be able to easily identify where your purchases came from and how much you've spent on each card.

This can be especially helpful if you have one credit card for your personal expenses and one for your business. At the end of each month's credit cycle, you'll be able to quickly see how many business expenses you have as opposed to the total of personal expenses you've incurred during the time frame.

Assigning a nickname to your credit cards is one way to help protect yourself from someone stealing your card information and using it for themselves. But today's savvy thieves and hackers continue to come up with creative ways to work around the best security measures created, like chip and pin technology.

Along with assigning your card a nickname, here are some other ways to protect yourself from identity theft and from someone using your card for their purchases:

Spyware can be installed on your computer without you even knowing about it. Opening or downloading a file from an unfamiliar email or website is one way hackers can compromise your credit card without it leaving your wallet.

Phishing emails are sent out for just this purpose. A link that's clicked on one of these emails can automatically let the hacker view your keystrokes and "read" your account number as you shop online.

That's all they need to access your credit card number and use it. Always verify the legitimacy of anything you download and consider buying and installing antivirus software.

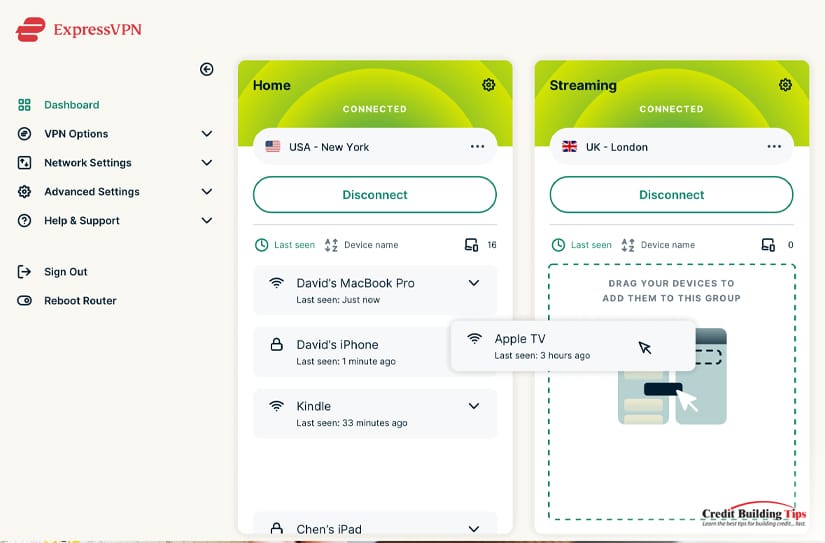

Using public Wi-Fi networks can also put your online security at risk. These types of networks often allow someone to monitor your screen and see your account information or sensitive documents. You'll have no idea this has happened until purchases are made by someone that's not you.

The best protection against this is to install a Virtual private network. A VPN is a subscription service that "encrypts your activity on the internet and keeps your identity hidden while browsing."

Installing new updates to your operating systems will keep your OS, apps, and browser up-to-date. Almost all updates include security fixes in an effort to help keep hackers from accessing your system. As well, continue to review your security settings and make sure to prevent websites from tracking your movements.

Shutting down your computer overnight is a simple way to lower your visibility to hackers. They tend to look for targets that are available, and turning off your computer breaks any connections a hacker may have set up with your computer. This makes it less worthwhile for someone to try to break in and steal your information.

In the same vein, backing up your computer, while it doesn't protect your computer, can be critical if your information is compromised and destroyed. This lets you re-establish and rebuild your data more quickly.

Looking for more ways to protect your credit rating? Subscribe to our blog, and you'll get helpful information and tips on how to stay out of debt and become financially healthy.

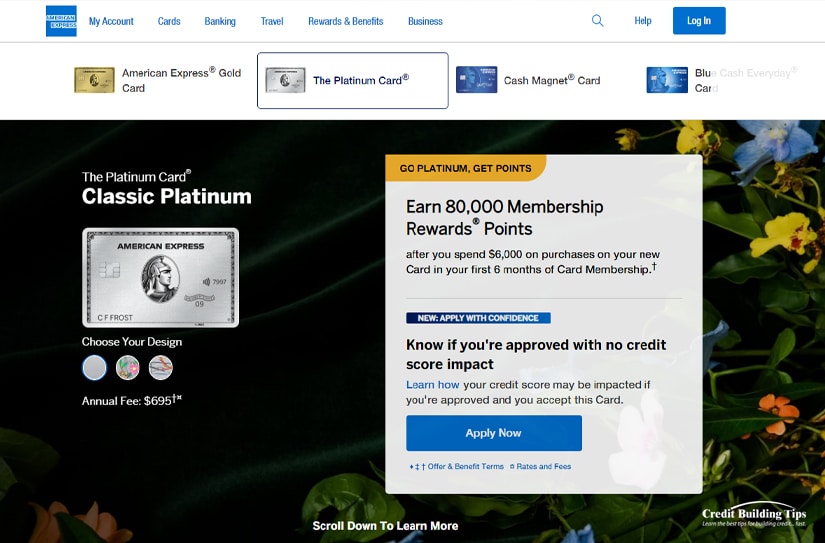

Many consider the Amex Platinum Card a luxury card only used by wealthy people who can afford to throw away almost $700 yearly on its annual fee.

It certainly is pretty. And heavy. At 18.5 grams, the card is made of solid stainless steel and outweighs almost any other metal credit card other than the Luxury Card Mastercard® Gold Card (22 grams), the Luxury Card Mastercard® Black Card (22 grams), and the Luxury Card Mastercard® Titanium Card (22 grams).

The only heavier card than all of these is the JP Morgan Reserve card. It weighs 27 grams, but it's an invite-only card, and if you don't have $10 million in investable assets at the JP Morgan Private Bank, you won't get an invitation to apply for their card in the mail.

Compared to the typical 5 grams weight of a plastic credit card, the Amex Platinum Card certainly makes its presence felt when you hand it to a cashier or toss it onto the dining table after eating out.

If you do apply and qualify for the Amex Platinum Card, it will be delivered to your front door in a carded die-cut box. Inside the box is a substantial wooden slab with a carved inset that holds your new card. You may feel even richer just holding it in your hand.

But is it worth it? And do you need to be rich to qualify for one?

First of all, you'll need a credit score above 700 with an average approval score of 715. Lower credit scores in the high 600s have also been approved, depending on credit quality.

First of all, you'll need a credit score above 700 with an average approval score of 715. Lower credit scores in the high 600s have also been approved, depending on credit quality.American Express looks at your credit score but also considers:

The Amex Platinum Card is a "no pre-set spending limit" card. This isn't the same as unlimited spending — purchases are approved based on your "credit record, account history, and personal resources."

Interestingly, the card has a Flexible Payment Option (FPO). This lets you carry a portion of your balance with interest on qualified purchases.

Reviewers across the board agree that the Amex Platinum Card is the "king of luxury rewards travel cards." It's ideal for folks who travel a lot and want to do so comfortably and in style.

If you're a new Platinum Cardmember, you'll receive a healthy welcome bonus that totals 80,000 points. You can first earn your 60,000 welcome bonus points after you charge $6,000 to your card during your first three months of owning the card.

To qualify for the additional 20,000 points, you'll have to make one purchase of "any amount" and charge it to your card within 14 to 17 months of owning the card.

Amex Membership Rewards points are each worth two cents, which makes the 80,000 welcome bonus worth $1,600. This alone will cover the annual fee for three years.

It's worth checking to see if you are eligible for an additional 125,000 to 150,000 points Amex is offering through their CardMatch tool, via mailings, or, in some cases, when logging into other online card accounts. These extra points offers can be worth $2,500 to $3,000, covering the card's annual fee for up to four years.

The Amex Platinum Card is loaded with perks and lets you earn Membership Rewards Points® on every purchase you make. However, there's a difference between the value of the points depending on where you "spend" them.

To get the most out of the rewards points offered, you'll want to spend them on just two things:

When you spend your bonus points in either of those ways, you'll get five times the value of the points. For every dollar you spend, you'll get five points up to $500,000 each year. If you spend more than $500,000, the points value drops to one point for every dollar spent.

You'll get the most value from your points when you transfer them to a travel partner. Your Amex Platinum Card offers 17 airline and three hotel transfer partners. All but three of the partners use a 1:1 point-to-mile transfer ratio.

You'll want to keep your eye on the amount of time it takes to effect a transfer from your points to the transfer partner you choose. Lengths of time vary by partner, so be sure to leave yourself enough time before purchasing.

The Points Guy offers a handy guide to each program's Membership Rewards transfer times.

The same blog post goes into even more detail on what to know before you transfer your Membership Rewards Points and tips to make sure you don't get stuck transferring points to a program you won't be using.

If you're not using your Membership Rewards Points® on travel directly with an airline or through Amex Travel, your points will be calculated at a one-to-one ratio. One point for every dollar spent.

Single-value Membership Rewards® Points can be used in several ways:

American Express provides a handy online calculator to show the value of their points.

You'll also get $200 statement credits each year if you book with:

You can receive up to $20 in statement credits each month if you shop at:

This card is loaded with benefits, and the better you understand them, the more value you'll get from the card to offset the annual fee.

As it's considered the best luxury travel rewards card, it's no surprise that the providers of Amex Platinum are generous with offering travel perks.

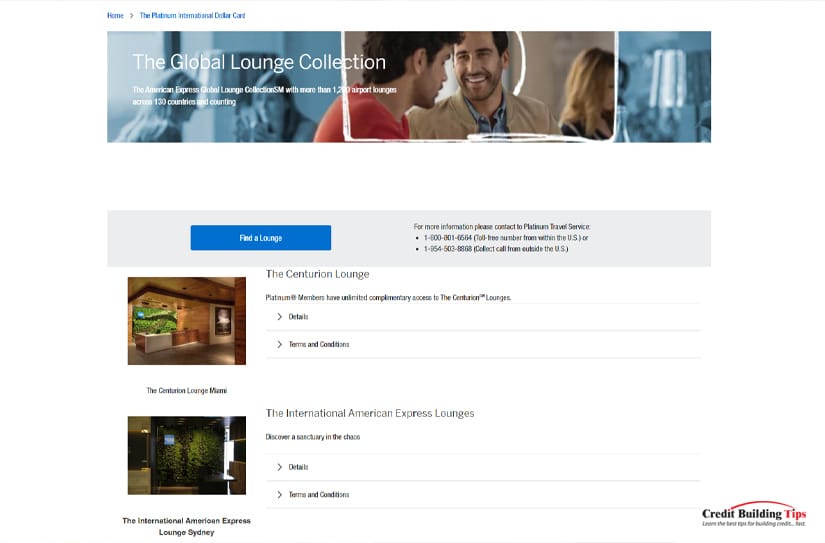

Included in The Global Lounge Collection are more than 1,400 airport lounges across 140 countries "and counting." Card members have complimentary access to Delta Sky Club®, where they can find Wi-Fi access, satellite TV, free (and hot) food and beverages (alcoholic and non-alcoholic), personalized flight assistance, private restrooms with clean showers, and more.

It costs $545 each year to purchase an individual membership to the Sky Club, so you'll save this fee with an Amex Platinum card.

The card also offers several travel-related features that include:

The Global Entry, or TSA PreCheck service, is a wonderful perk for those who travel a lot. This ensures they'll experience quicker screening at airport security. Platinum cardholders receive this service for free by using a statement credit.

The card also offers its members complimentary car rental status with

If you've been waiting to go on a cruise, Amex Platinum extends Cruise Privileges Program (CPP) for new CPP bookings made with "participating cruise lines through American Express Travel." Onboard credit and amenities apply "per stateroom, with a three-stateroom limit per eligible card member, per cruise.

Cruise lines in the program include:

Cardholders that frequently stay either at the Marriott or the Hilton are eligible to enroll in Marriot Bonvoy Gold Status. Gold Status will allow you to

Amex is proud of their "Do Anything" Platinum Card Concierge, that offers 24/7 service to help make arrangements for dinner, help source hard-to-come-by event tickets, or even find the right gift for someone special. The service also offers access to concerts and sporting events.

Other shopping perks of owning their card include:

Card members can enroll their Platinum Card into InCircle and receive one InCircle point for each dollar spent at:

For every 10,000 points you accumulate, you'll get a $100 InCircle point card. InCircle doesn't offer double or bonus-points opportunities, and points can't be received on sales tax, shipping, alterations, gift wrapping, fur services, shoe repair and cleaning, handbags, optical, precious jewelry, monogramming, salon products and services, and valet parking.

Go here for an exhaustive list of "Important Information Regarding Rates, Fees, and Other Cost Information." Amex provides this document with the fine print on their full card member agreement, terms and conditions, interest rates and charges, benefit terms, and Amex Assurance Company disclosures.

With all that's been said so far, is Amex Platinum worth the $695 annual premium?

It depends.

When you get your first card, you can collect rewards points that would cover the first three years of annual fees. As long as you spend $6,000 in the first six months and then make sure to make another purchase within the next 14 to 17 months.

If you take advantage of all the annual statement credits, you'll benefit to the tune of $1,500 every year. After the $695 annual fee, you'll still have pocketed just over $800 in statement credits. That's pretty good.

If you travel extensively, you can save serious amounts on insurance and other travel perks. And if you place a value on how you travel, your savings can be even more. Free food, drinks, and comfort when you travel mean you don't have to shell out on airport food or other small luxuries.

At the end of the day, if you spend money on frequent travel, luxury hotels, car rentals, and shopping, you'll be well rewarded with the Amex Platinum Card.

If your lifestyle is more modest with infrequent travel, spending nights away from home in higher-end hotels, and, in general, you simply don't use your credit card for non-essential purchases, it may not be worth the cost of keeping the card.

However, if you can see yourself spending $6,000+ within the first 18 months of receiving the card, you will have pocketed in the neighborhood of $800 after paying the first year's annual fee.

That won't be enough to travel around the world and see the Great Wall of China, but it will be enough to splash out on a nice weekend away with dinner to boot.

As always, make sure you aren't overspending to justify the cost of any credit card. Keep your spending within your monthly budget and work towards getting and maintaining a good credit score.

Staying out of credit card debt and on track to be financially healthy can sometimes make even a hamburger taste more like steak.

After reading today's article, do you have any questions about the Amex platinum card? Was there anything we mentioned that you'd like additional clarification on? If so, we'd be more than happy to help you out! Additionally, if you're searching for any further information on credit and credit building, we highly urge you to check out our collection of articles! We've written dozens of articles about credit and credit-related topics, so you're bound to find something beneficial to your particular situation!

When it comes to credit card utilization, you may wonder if it's possible to hide your usage from creditors and lenders. It's important to understand the impact of credit utilization on your credit score and whether it's possible to hide your utilization from your creditors.

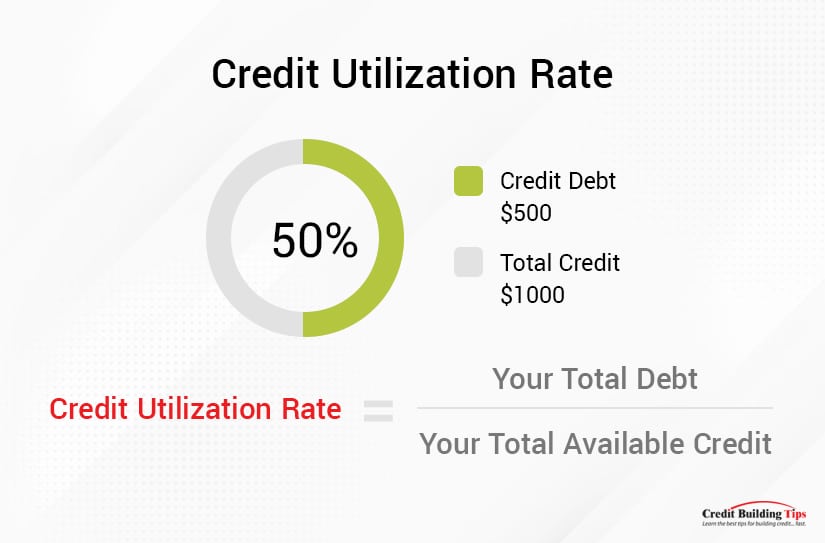

Credit utilization is a metric that measures the amount of available credit you have used up relative to your total credit limit. It is an important factor in determining your overall creditworthiness and plays a major role in determining your credit score.

Your credit utilization ratio is calculated by dividing your total amount of revolving credit (such as credit cards) by your total available credit limit. To calculate it, you'll need to add up all your current credit card balances and divide it by the sum of all your credit limits.

Your credit utilization ratio is calculated by dividing your total amount of revolving credit (such as credit cards) by your total available credit limit. To calculate it, you'll need to add up all your current credit card balances and divide it by the sum of all your credit limits.For example, if you have a credit card with a limit of $1,000 and you currently owe $500, your credit utilization would be 50%.

The higher your credit utilization ratio, the worse your credit score will be. Generally, it's recommended that you keep your credit utilization ratio at or below 30%. Keeping your credit utilization ratio low can help you improve your credit score. It's important to keep an eye on your credit utilization ratio and take steps to reduce it if it gets too high.

It is important to monitor your credit utilization because it can significantly impact your credit score. If you're utilizing too much of your available credit, lenders may be less likely to approve you for new lines of credit or loans due to their concerns about your debt burden. On the other hand, having a low credit utilization ratio indicates to lenders that you are a responsible borrower who can manage your finances well.

Your credit score takes both your total credit limit and the amount you've used into account when determining your credit score. The amount of credit you use is known as your credit utilization ratio. Your credit utilization ratio is the amount of debt you have relative to your total credit limit. A higher credit utilization ratio suggests that you are using more of your available credit, which can have a negative impact on your credit score.

It's important to keep in mind that your creditors report your total available credit limit and the amount of debt you're carrying. This means that if you have a large credit limit and only a small amount of debt, your credit utilization ratio will be lower, and your credit score will be better. However, if you have a smaller credit limit and a larger debt, your credit utilization ratio will be higher and can negatively impact your score.

The best way to ensure that your credit utilization ratio does not have a negative impact on your score is to keep it below 30% of your total available credit limit. Doing this will help ensure that you get the best possible score, regardless of whether your creditors take into account your total credit limit or only the amount you've used.

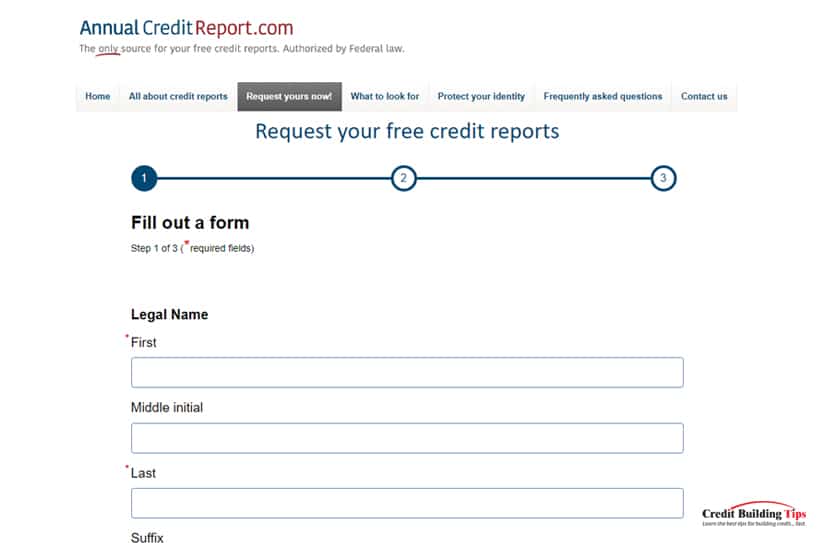

Before you start to put to use the tips we'll share with you below, you will want to be aware of your current credit card utilization ratio.

You can do this in one of four ways:

On the face of it, it may seem dangerous and even illegal to try to hide your credit card utilization from your creditors. You could end up being flagged for fraud or deception, and it could also severely damage your credit score.

But try Googling "Tips to Hide Your Credit Card Utilization," and your search page will be flooded with "tips, hacks, tricks, and secrets" on how to do just that.

We're not in any way recommending you attempt to lie or deceive the tax department (or any department) with information that is untrue, but there are legitimate ways to manage your credit card utilization that will reduce your utilization ratio, which will then help to improve your credit scores.

We're not in any way recommending you attempt to lie or deceive the tax department (or any department) with information that is untrue, but there are legitimate ways to manage your credit card utilization that will reduce your utilization ratio, which will then help to improve your credit scores.We've found 11 simple and effective ways you can manage your spending in order to lower your credit utilization.

Spending less can be a challenge, but it's a necessary step if you want to lower your credit utilization ratio. Here are some tips to help you on your way:

By using your debit card for purchases, you are only using the amount of money you have in the bank. This helps keep your debt-to-income ratio low and keeps your credit utilization low. You can use your debit card to pay off smaller debts that you may have with other creditors. This can help to lower your overall debt-to-income ratio, which can help to improve your credit score.

Paying your credit card in full every month is one of the best ways to lower your credit utilization ratio and improve your credit score. When you pay off your balance in full each month, you're not utilizing any of your available credit. That means your utilization ratio is zero, which is ideal for a strong credit score.

But if you do end up using some of your available credit each month, paying your balance in full can still help. Every time you make a payment, it reduces the amount of credit you have left to use. For example, if you use $500 of your $1,000 credit limit, then make a payment of $500, you now have a utilization ratio of $0/$1,000 (or 0%). This helps to keep your utilization ratio low, which is good for your credit score.

Paying down your credit card balance more than once a month can also help to lower your credit utilization ratio. This is because when you pay down your balance, the amount of money you've used to pay off your balance is taken into account.

By paying down your balance more than once a month, you can pay off more debt at once. For example, if you have a balance of $1,000, and you make two payments of $500 each during the month instead of one payment of $1,000 at the end of the month, then your credit utilization ratio will be lower because you will have a lower balance outstanding on your card.

Strategically paying your credit card debts can be a great way to lower your credit utilization ratio and improve your credit score. To do this, you'll want to pay off your highest balance cards first or prioritize paying off cards with the highest interest rate.

This will directly impact your credit utilization ratio because you'll be reducing the amount of credit that is being used compared to the total amount of credit you have access to.

One of the quickest and easiest ways to lower your credit utilization ratio is to apply for a new credit card. A higher credit limit can positively impact your credit utilization ratio, as it increases the amount of available credit you have. This will lower the ratio and can result in a higher credit score.

When you apply for a new card, be sure to look for one with an attractive rewards program, other benefits, and a reasonable annual fee. Make sure the interest rate is low and that you understand the terms and conditions of the card before signing up.

A variation on applying for a new credit card to lower your utilization ratio is to ask your current credit card company to raise your credit card limit. It's important to remember that it's not always easy to get your credit limit increased, especially if you have a low credit score. However, if you can increase your credit limit, it can be a great way to reduce your credit utilization ratio and, in turn, boost your credit score.

When it comes to your credit utilization ratio, one of the most important things you can do is to keep your unused credit cards open. This is because closing an unused card can harm your ratio. Your total credit limit will be reduced, which means that even if you don't use the card, you are still being penalized for having a high credit utilization ratio.

When you don't use a card, the amount you owe on it will remain at zero, which won't be considered when calculating your credit utilization ratio. As a result, your credit utilization ratio will stay lower. The longer you keep the card open, the better your score could become, as you'll show lenders that you are able to manage credit responsibly over an extended period of time.

Getting a temporary personal loan to pay off your credit card balances can effectively lower your credit utilization ratio. This is because the loan will reduce the amount of total debt you have outstanding, meaning that your ratio of credit card debt to total available credit will decrease.

It's important to note that taking out a loan to pay off your credit card balances should only be done as a last resort. Before doing so, consider other options, such as consolidating your credit card debt or transferring your balances to a card with a lower interest rate. Additionally, ensure that you are able to meet the repayment terms of the loan and avoid any late payments, as this could negatively impact your credit score.

Another way to potentially lower your credit utilization ratio is by asking for a statement balance rather than a current balance. Your credit utilization is calculated based on the amount of credit you've used compared to your total credit limit.

By requesting a statement balance, you're asking the creditor to report the amount due at the end of the billing cycle, not the amount that's currently due. This means that if you've already paid off most of the amount you owe or if the statement balance is significantly lower than the current balance, this will help reduce your credit utilization.

Transferring your balance to a low-interest credit card is our last tip for ways to lower your credit utilization ratio and help improve your credit score. By transferring your balance, you're essentially increasing your total credit limit while keeping your amount of debt the same. This, in turn, lowers your utilization ratio and can increase your credit score.

It's important to note that transferring a balance is not without risks. Balance transfers typically come with fees, and you will need to make sure that the new interest rate on the new card is lower than the old one before making a move. Some creditors may also report the balance transfer as a new account, which could negatively affect your score. It's best to weigh the pros and cons of transferring your balance carefully before making any decisions.

As always, if you're looking for ways to improve your credit scores as fast as possible, I'm here to help!

Are you looking for an easier and more flexible way to pay for the things you need? If so, you're not alone. According to recent estimates, over 63 million Americans use some kind of "buy now, pay later" (BNPL) plan.

In recent years, the use of BNPL-type installment plans has been on the rise among Americans.

According to a survey conducted in 2019, as many as 60 percent of Americans had used this type of installment plan in the past year.

According to a survey conducted in 2019, as many as 60 percent of Americans had used this type of installment plan in the past year.Although inflation rates are expected to ease towards the end of 2023, these numbers are likely to increase as more people turn to these plans as a way to manage their money. In this blog post, we will provide an ultimate guide to payment and installment plans, explaining what installment plans are and how they work, as well as the application process and tips for choosing the right plan for you.

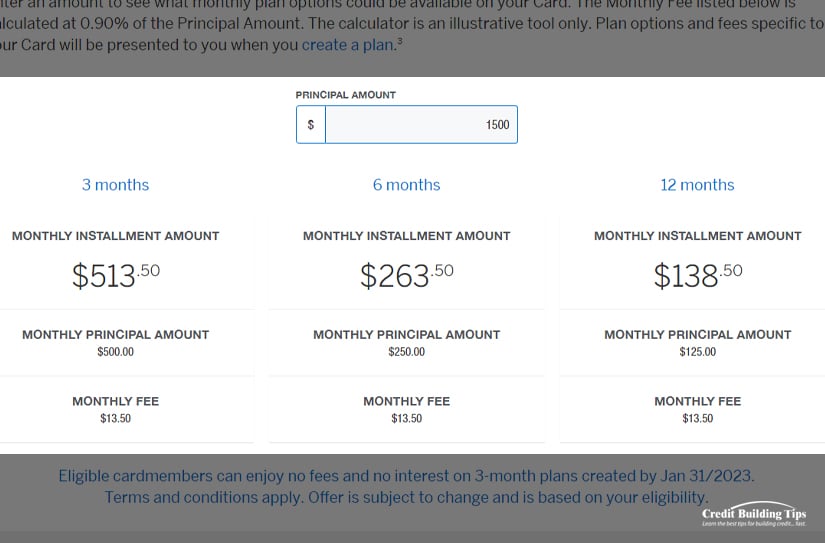

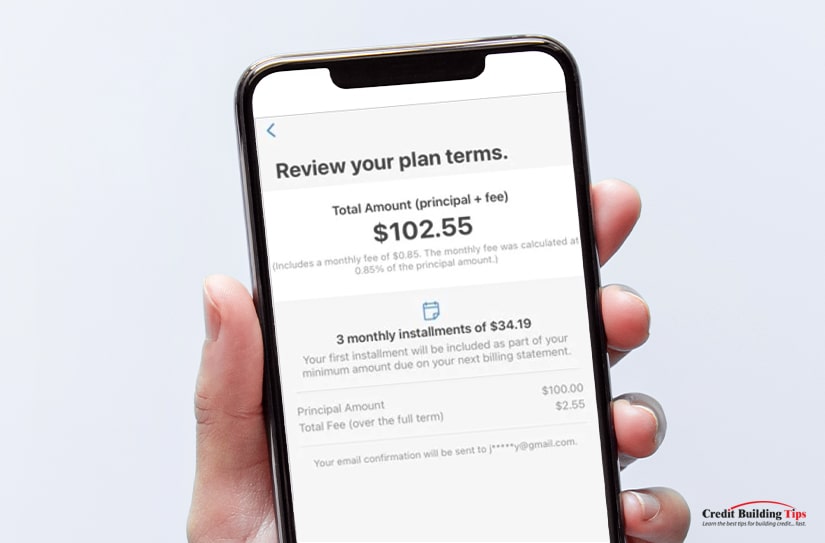

First of all, installment plans are payment plans that allow you to purchase an item now and pay it off over time with fixed payments.

These plans are generally offered by businesses that specialize in consumer loans or by stores that offer credit cards with the option to pay for an item in installments.

Installment plans allow people to spread out the cost of a purchase over several payments. If payments are made on time, no interest is charged; however, late payments may incur additional fees. There is usually a minimum spending requirement, and some plans offer promotional discounts for early payment.

Applying for a payment and installment plan is relatively easy. Generally, businesses that offer these types of plans will have an online application process available. The application process will require you to provide some personal information such as your name, address, date of birth, and Social Security Number.

Depending on the type of plan you are applying for, you may also need to provide bank account information, proof of income, or savings to support your ability to make regular payments. Many services also require applicants to provide at least two valid forms of identification, such as a driver's license or passport.

Most services will check the applicant's credit score, but this is not always required. Depending on the service, there may also be eligibility requirements such as age or residence in a particular state.

Once you have submitted the required information, the lender will review it and require additional verification before approving your application, such as making a decision about whether or not to approve your loan. Some lenders may need a valid form of identification.

Once accepted, the customer has to agree to make regular payments, often monthly or quarterly. The customer must also have sufficient funds in their bank account or credit card account in order to make their payments.

It is important to remember that buy now, pay later plans are not a form of credit and can be risky to finance purchases.

Before signing up for any installment plan, it is important to make sure you understand the terms and conditions of the agreement. Be sure to read the fine print and make sure you know what fees you may incur if you make late payments or if you decide to cancel the agreement.

Before signing up for any installment plan, it is important to make sure you understand the terms and conditions of the agreement. Be sure to read the fine print and make sure you know what fees you may incur if you make late payments or if you decide to cancel the agreement.Make sure you also know what interest rate, if any, will be charged if you are late on payments. Finally, be sure to keep track of your payments and make sure you are always on top of the due dates so that you can avoid late fees or other penalties. Failure to make timely payments could result in penalties or even cancellation of the agreement.

Installment plans allow you to spread out the cost of an item over a longer period than a traditional loan or credit card payment. With installment plans, you can typically choose the length of time you'd like to pay off the purchase and the number of your fixed payments.

Buy now, pay later plans are not good for everyone, and it is important to know your personal financial situation before signing up for one. Not everyone is approved for an installment plan, depending on the cost of the product and the user's history with the service. It is important to read the terms and conditions of each payment and installment plan carefully before applying.

The main advantage of installment plans is that they allow you to purchase something without needing to pay the full price upfront. This can be beneficial if you're on a tight budget but still want to purchase a specific item. Additionally, installment plans often come with lower interest rates than traditional loan or credit card rates.

Payment and installment plans offer a great way to budget and manage your finances.

One of the biggest advantages of using an installment plan is its low interest rate. This makes it easier to pay off your debt in the long run. Additionally, installment plans give you more control over your spending since you can choose when and how much to pay.

One of the biggest advantages of using an installment plan is its low interest rate. This makes it easier to pay off your debt in the long run. Additionally, installment plans give you more control over your spending since you can choose when and how much to pay.Installment plans also allow for flexible payments that can be tailored to your budget. You can choose to make payments every week, month, or any other frequency that suits your lifestyle.

With an installment plan, you don't have to worry about purchasing additional products or services. You can simply sign up for the plan and make monthly payments.

Another advantage of using an installment plan is that it often comes with rewards. Many companies offer incentives like cashback, discounts, or bonus points when you use their installment plans. This can help you save even more money while managing your debt.

The pricing and terms of an installment plan are usually simple and transparent, so you always know what you're paying for. Finally, you have the flexibility to cancel your installment plan at any time if your financial circumstances change.

Using payment and installment plans can be a great way to purchase items without feeling the financial strain of the full cost upfront. However, there are some drawbacks to using these plans that should be considered before signing up.

First, it is important to remember that payment and installment plans could cause financial stress later on. As interest builds up over time, a person may find themselves in more debt than they expected when they signed up for the plan. In addition, some payment and installment plans come with late fees that can add up quickly if payments are missed.

First, it is important to remember that payment and installment plans could cause financial stress later on. As interest builds up over time, a person may find themselves in more debt than they expected when they signed up for the plan. In addition, some payment and installment plans come with late fees that can add up quickly if payments are missed.Another potential issue with payment and installment plans is that they can encourage spending beyond one's means. People might feel tempted to purchase more expensive items than they would normally be able to afford if not for the plan.

As a result, people may find themselves in a situation where they cannot afford their payments or have difficulty paying off their debt.

For these reasons, it is important to consider all of the drawbacks before signing up for any payment and installment plans. It is important to consider if the item is truly necessary, as well as if the cost fits into your budget. Make sure to read all terms and conditions carefully, and remember that you may not be able to pay off the debt right away.

Howard Dvorkin is a vocal advocate of installment and payment plans. He believes that they offer a much-needed lifeline to consumers struggling to pay off large purchases or cannot pay up-front costs. He feels that these types of plans can be beneficial to people in a variety of circumstances.

Dvorkin states that installment and payment plans can help individuals with their budgeting, allowing them to spread out the cost of expensive items over a period of time. This type of plan also helps consumers avoid costly late fees and interest charges, which can add up quickly when making large purchases.

But he also acknowledges that it is important for consumers to be responsible and mindful when using installment and payment plans, as these plans can quickly become overwhelming if used without caution.

Dvorkin emphasizes the importance of reading all the terms and conditions associated with any plan before agreeing to it, as well as considering one's personal financial situation. He advises that individuals shop around for the best rates when considering an installment plan.

Depending on which site you reference, there are a number of opinions on what apps make the shortlist for the best payment and installment plans. Here's our take on which ones we'd recommend and why.

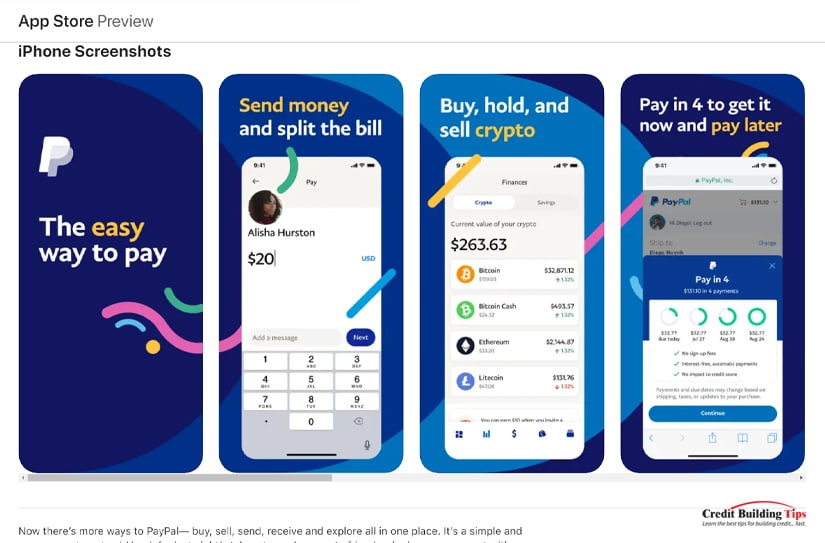

PayPal Pay in 4 is an easy and convenient way to pay for purchases on PayPal. You can set up the app to break down your payments into four smaller, more manageable chunks over a period of time.

Their pay structure requires the first 25% payment to be paid at the time of the transaction, with three additional 25% payments every two weeks after. There are no fees when you use the Pay in 4 plan, and it can be used everywhere PayPal is accepted.

Afterpay keeps things simple with their buy now, pay later plan. All you need to sign up is your email, phone number, address, date of birth, and current debit or credit card information.

They spread the cost of your shopping into four payments over the course of six weeks and even allow a grace period for late payments. Only then will they start charging a late fee, which will never be more than 25% of your initial order.

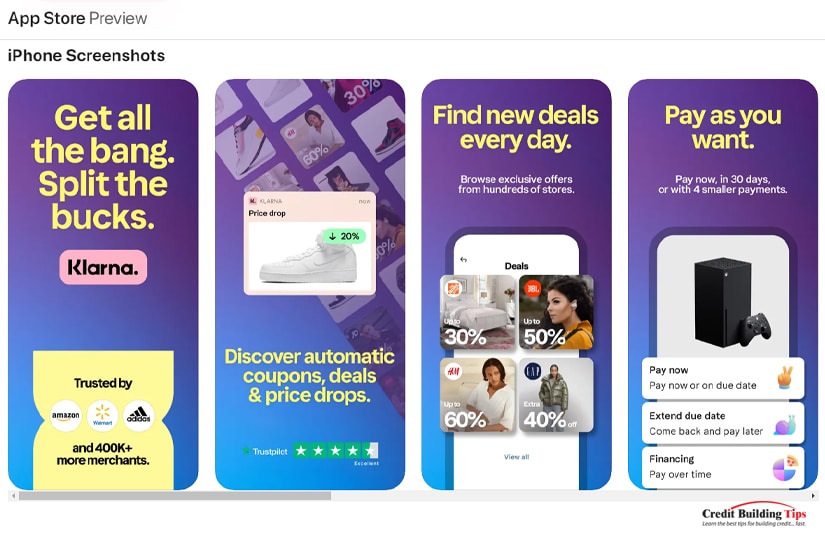

Klarna not only gives you a pay-in-four option, but they also let you earn one point for every dollar you spend using their app. These rewards can get you "exclusive access to deals, content, and other perks."

If approved, you may also choose a pay-in-30 option or a financing plan from six months to three years. No interest will be charged on the pay-in-four or pay-in-30 option.

Affirm offers affordable monthly payments where you choose the length of your repayment plan, typically three, six, or 12 months. They also offer 4 interest-free payments (every two weeks) depending on eligibility.

We love the fact that they don't charge late fees, prepayment fees, annual fees, fees to open or close your account, or any hidden fees.

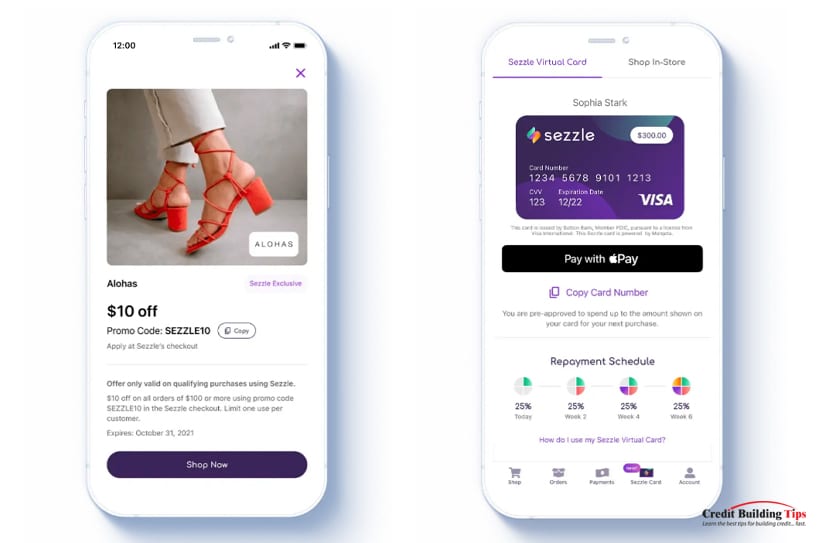

Sezzle's app (as of August 2022) has had 6+ million downloads and boasts a 4.84 rating with 140K reviews. If you pay on time, there are no fees; they offer free payment reschedules and guarantee "zero impact on your credit score."

This app offers discounts, deals, and promotions when you shop using Sezzle.

Viabill lets you "pay for your purchases over time, [and] interest-free." Simply choose the app at checkout and make four installment payments over the course of three months.

The first payment is made at the time of order and then on the last business day of every month. Sign-up requirements are easy as long as you have "sufficient funds to cover your first installment at the time of purchase."

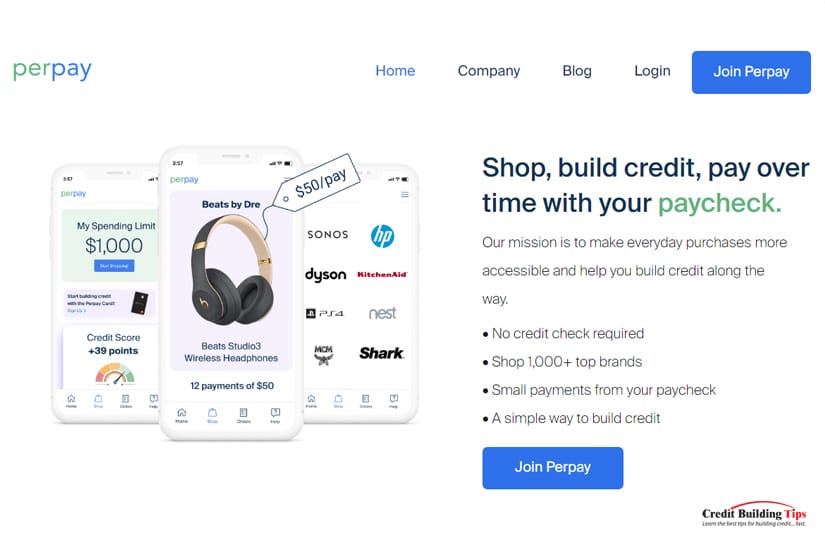

Perpay offers "a new way to build credit" while you "automatically pay over time for your order with a small amount from each paycheck." Every on-time payment will help to build your credit score, and you can see this reflected in an increased score in as soon as four months.

The app is targeted toward people with bad credit. It takes each payment directly from your paycheck and is helpful for those who struggle to make payments on time and in full.

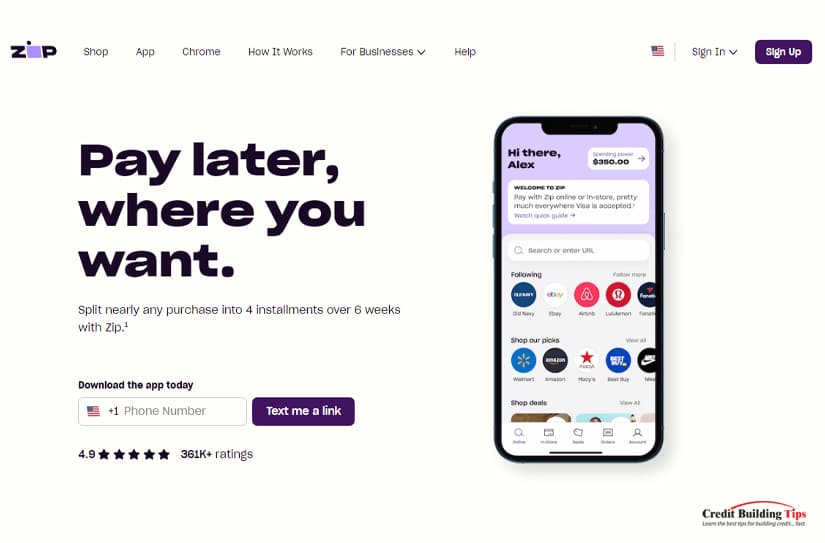

Zip (formerly Quadpay) is set up similarly to PayPal's Pay in 4; splitting your payment into four equal payments allows you to pay over the course of six weeks. Unlike PayPal, Zip charges a 34.7% interest rate for the privilege.

For a $400 purchase, you would need to make four $102 payments every two weeks, for a total of $408.00. Orders can also be "subject to platform fees and/or late fees."

These buy now, pay later services work for online shopping, but some let you use them when you purchase from a brick-and-mortar store. Big box stores like Target use Affirm, Zip, and Sezzle, while Walmart uses Affirm for their BNPL apps.

While there's no guaranteed way to predict the future of these payment and installment plans, some heavy-hitter personal finance experts are speculating on what the next several years will look like.

Howard Dvorkin has kept his eye on BNPL trends since they began. He predicts four significant strictures with buy now, pay later plans:

The winners in the game of BNPL will be the ones who use the plans only when necessary and are then diligent in making timely payments. They'll benefit from extra breathing room in regard to making important purchases and will see a positive impact on their credit scores.

Looking for more ways to build your credit? Subscribe to our blog, and you'll get helpful information and tips on how to stay out of debt and become financially healthy.

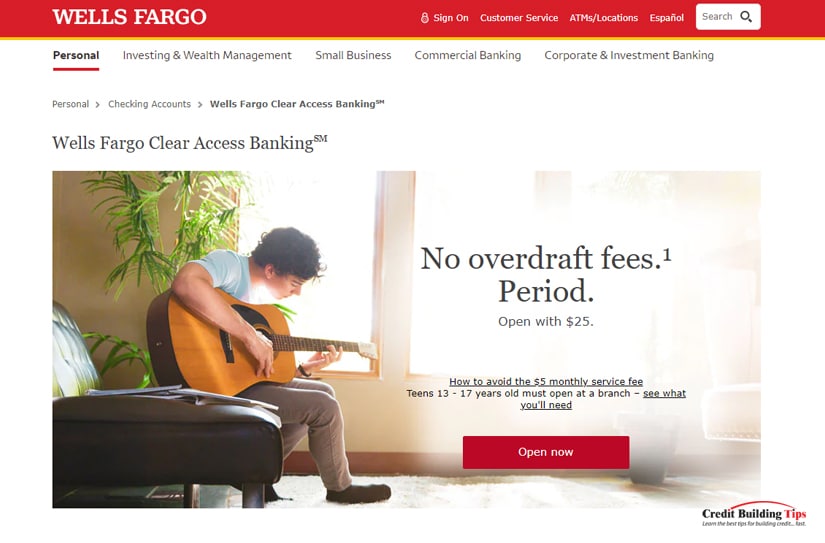

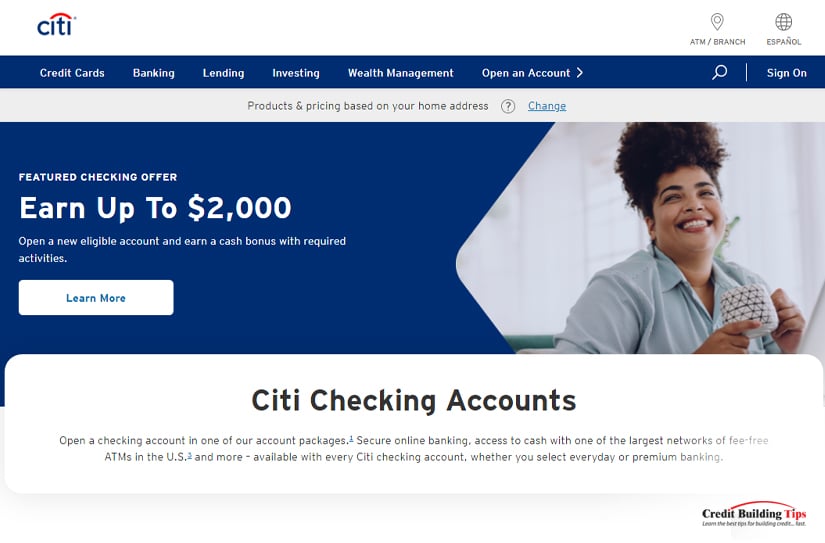

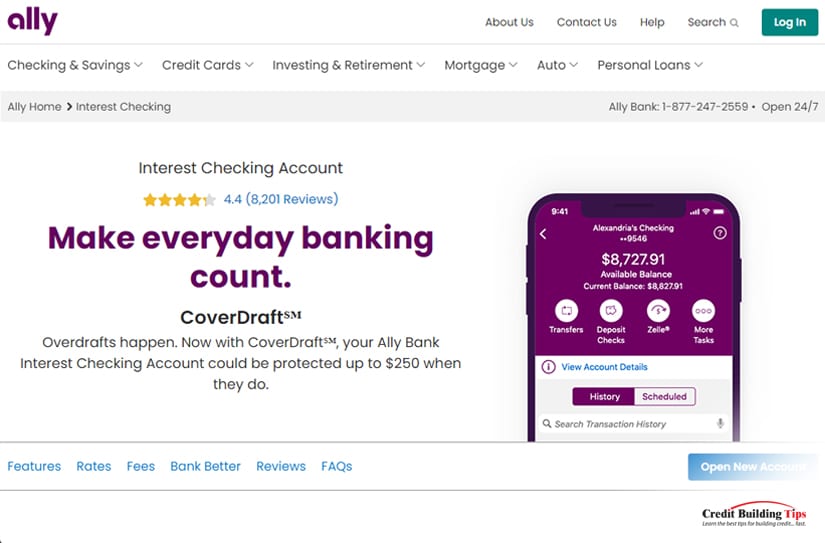

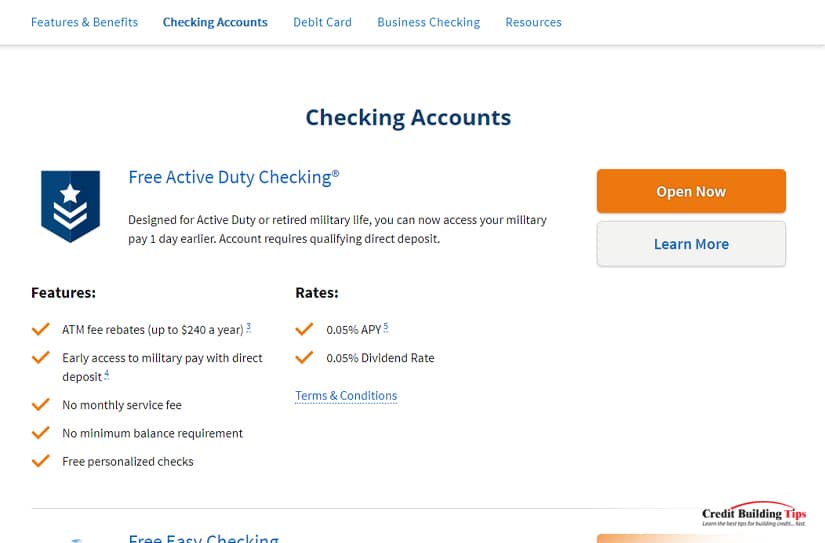

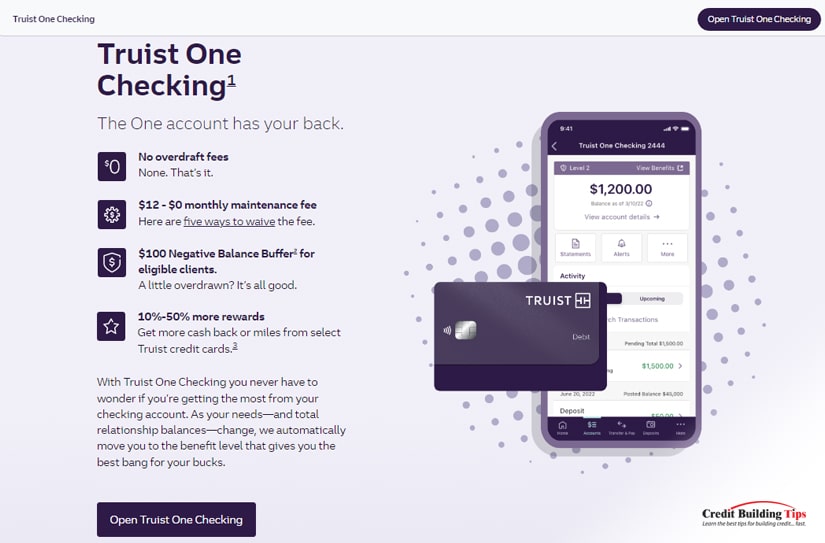

Are you tired of worrying about overdraft fees? If so, you're not alone. Banks can be difficult to navigate, and it's hard to know which one offers the best deals.

We've put together a guide of the ten best U.S. banks that offer checking accounts with no overdraft fees. These banks provide great benefits, including online and mobile banking services, competitive interest rates, and no overdraft fees.

An overdraft occurs when a person's account balance drops below zero, and they spend more than they have in their account. The bank then charges an overdraft fee — which can be very expensive if it keeps happening.

An overdraft fee is typically charged for every transaction that puts your account into the negative. That's why overdraft protection is important if you use your checking accounts for day-to-day transactions.

Not having one can mean wasting money and possibly damaging your credit score, or at best, wasting money on costly overdraft fees!

Not having one can mean wasting money and possibly damaging your credit score, or at best, wasting money on costly overdraft fees!An overdraft protection plan is a financial service offered by banks and other financial institutions to help prevent account holders from making transactions that exceed their available funds. It works by allowing customers to overdraw their checking accounts up to a certain limit without incurring an overdraft fee.

The main benefit of an overdraft protection plan is that it can help you avoid the costly fees associated with overdrafts. For example, many banks charge $35 or more for each overdraft transaction. Having a plan in place can save you from these high fees.

An overdraft protection plan can also provide peace of mind knowing that you won't accidentally be charged for a purchase you didn't have the money to cover. It can be especially helpful if you are on a tight budget, as it gives you the freedom to make purchases without worrying about insufficient funds.

Many banks will waive some fees associated with their overdraft protection plans. This can be an added bonus for those trying to save money. Some banks may offer discounted annual fees or lower interest rates when you sign up for an overdraft protection plan. This can make the plan even more affordable.

Having an overdraft protection plan in place is also important because it helps reduce the risk of incurring multiple overdraft fees at once. If you do not have overdraft protection and you make multiple purchases that total more than your account balance, you could incur multiple overdraft fees from each purchase. This can quickly add up and become very expensive.

Overall, an overdraft protection plan helps ensure that you won't have to worry about unexpected fees or charges due to an accidental overdraft. It can help you avoid potential financial damage and keep your accounts secure.

Overdraft fees in the United States have been a touchy topic since the Consumer Financial Protection Bureau (CFPB) first implemented the "Know Before You Owe" rule in 2010. This rule requires banks to disclose all the details of overdraft fees clearly and concisely, making it easier for consumers to make informed decisions.

The CFPB also implemented a regulation in 2010 that stops banks from charging overdraft fees on transactions of $10 or less. Another rule in 2012 required banks to give customers the option of opting out of overdraft protection altogether.

However, despite these regulations, it is estimated that banks still generate around $15 billion yearly from overdraft fees.

However, despite these regulations, it is estimated that banks still generate around $15 billion yearly from overdraft fees.

In 2020, the Consumer Financial Protection Bureau (CFPB) proposed a rule prohibiting certain banks from charging certain overdraft fees unless consumers opt into them. In 2021, the CFPB finalized the new rule that is set to go into effect on July 1st, 2023. This rule will require banks to give consumers more control over their accounts and make it easier for them to avoid overdraft fees.

It is important to note that individual states may have laws in place that are more restrictive than federal regulations. For example, California has a law that bans any overdraft fee if it brings a customer's balance below zero.

Overall, 2023 looks like a good year for those looking to protect themselves from costly overdraft fees. The CFPB's proposed changes could help make sure that banks don't take advantage of customers who don't know how to manage their accounts properly.

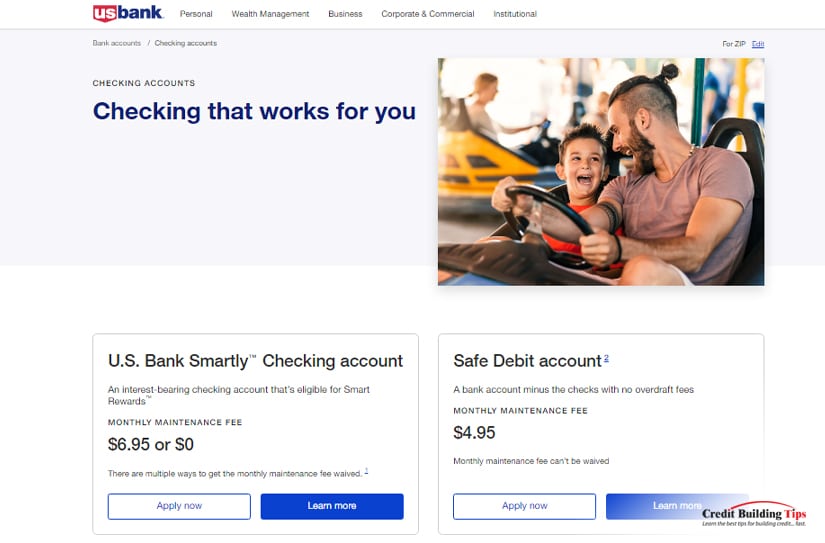

It's good news that the days of racking up overdraft fees are quickly becoming a thing of the past. Many U.S. banks have eliminated or reduced overdraft fees, making them more consumer-friendly.