The lower your credit score, the harder you'll find it to get loans, financial deals, and approval for accounts. It's a vicious circle; the worse your score, the harder it is to manage money, and the less flexibility you have, with fewer options available to you.

Financial institutions of various kinds have implemented a variety of different methods to help improve your credit score. Among those options is a secured credit card.

Financial institutions of various kinds have implemented a variety of different methods to help improve your credit score. Among those options is a secured credit card.You likely have some questions about these credit cards, so let's go through and answer them!

With a normal credit card, you apply and are approved by a bank based on your credit score and history. They are, essentially, the bank letting you borrow money (up to a certain limit), with terms allowing you to repay it over time. It's simple in concept, but the terms of a credit card make things more complicated. Different credit cards have different limits, there are usually rewards programs (like cash back, points of some kind, or frequent flyer miles) attached, and they may have different grace periods, interest rates, and repayment terms.

Secured credit cards are, by contrast, much simpler. They still work roughly the same way; you apply for a card, and a bank approves you.

There are numerous differences, though.

The biggest difference, though, is the security deposit. It's what makes the credit card "secured" in the first place.

The security deposit is a lump sum of money you give to the bank to put on hold. It's a prerequisite for a secured credit card. Most secured credit cards start around $200, though some are closer to $99 on the low end or as much as $500 on the high end. Typically, the higher the deposit, the better the terms and the lower the interest rate.

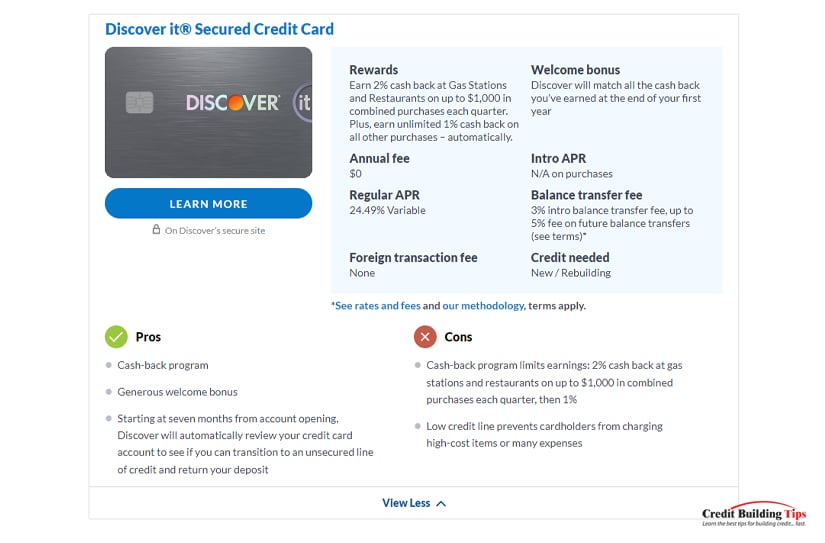

The security deposit is a lump sum of money you give to the bank to put on hold. It's a prerequisite for a secured credit card. Most secured credit cards start around $200, though some are closer to $99 on the low end or as much as $500 on the high end. Typically, the higher the deposit, the better the terms and the lower the interest rate.You can see some examples of secured credit cards and their terms here.

Some people view a secured credit card as a form of debit card or prepaid card because you have to put money into it to get it. That's not quite accurate, though. You don't use that money to pay for your purchases. Instead, it's a form of security for the bank so they're not stuck with a negative balance.

Usually, the deposit is 1:1 to your credit limit, at least initially. You put $200 into a security deposit and get a secured credit card with a $200 limit. Then, you can buy things up to $200 on the card and pay them off over time. If you end up defaulting on the credit card, the bank has your money to cover it, so they don't assume much risk. "Secured" in the name of the card refers to security for the bank, not for you.

Your money isn't lost, though. Most secured credit cards have some mechanism for retrieving the money. Sometimes, it's simply refunded to you if you close the account. Other times, as you use the card and pay it off appropriately, the security deposit is slowly applied to purchases to reduce your costs or even slowly refunded to you over the course of months.

Obviously, all of this varies depending on the issuing financial institution and the terms of the specific secured credit card you're looking into.

How do you pay for the things you buy?

If you pay in cash or use a cash-equivalent debit card, your transactions aren't reported to the credit bureaus. As such, they don't earn you any benefit to your credit score. A credit card, as we all know, is a line of credit and is thus reported. Maintaining an account in good standing and carrying as low a balance as possible (preferably zero) helps build your credit score.

A secured credit card is still a credit card. Therefore, purchases made using a secured credit card – and the payments made to pay them off – are reported to the credit bureaus. Making payments on a secured credit card will gradually raise your credit score. Additionally, having lines of credit and a good debt-to-income ratio will benefit you as well.

Why not just use a regular credit card instead of a secured card? Well, as many of you likely know firsthand, you probably can't get one if your credit score is low enough.

The biggest benefit of a secured credit card is that, because of the security deposit, banks and financial institutions are much more likely to offer them to people with lower credit scores. The security deposit helps mitigate some of the risk the bank would otherwise assume.

Moreover, after using a secured credit card appropriately for a while, you may be able to "graduate" to an unsecured card without having to close your card and open a new line of credit. This maintains continuity in accounts, which is beneficial since "age of credit accounts" is a credit calculation factor. Banks like this because you've already proven you can stay financially solvent with the secured card, and you stick with them to give them your business.

There's one all-important question left to answer, and that's "how much will a secured credit card help?" If you're talking about five points here, that's barely anything and might not be worth the effort. On the other hand, if it can rocket your credit score up 200 points, you'd be jumping at the chance.

The truth is, it's highly variable.

Keep in mind that the more blemishes there are on your credit report, the harder it will be to raise your credit score until you deal with them. That's why we always recommend pulling your credit report, checking for errors to get them removed, negotiating to have accounts in collections removed, and employing other strategies to mitigate the damage.

If you're interested in using a secured credit card to improve your credit score, here's how.

The first thing you need to do is some research. While most secured credit cards are fairly similar, they are not all created equal. There are many different cards with different terms. Figure out what you can afford as a security deposit; a higher deposit will get you a higher credit limit, and a higher credit limit improves your debt-to-income ratio (as long as you don't carry a balance), so it's generally more beneficial. However, make sure you don't try to take on more than you can afford; jeopardizing your ability to pay off your credit will only make your credit score worse.

Once you've picked a card, apply. Since secured credit cards are usually aimed at people with low credit scores, many banks will either have very broad terms or won't check your credit score at all. If they don't check, they likely check something else, like the ChexSystems Report. Some of the stricter or better cards will be hard to gain approval for, but most secured cards will be open to you as long as your expectations are reasonable.

The key to building your credit with a secured credit card is to avoid carrying a balance. Treat it as you would cash; only make purchases you can afford, and pay them off immediately. Carrying a balance does not improve your credit score, and the interest charges will make it harder to keep paying it off.

While you're working to improve your credit score using a secured credit card, you can also try out additional strategies. For example, you can get credit builder loans without a credit check, and paying those off (if you can afford them in the first place) is another good avenue for improving your score.

After you've been using your secured credit card for several months, keeping it paid off effectively, you can contact the issuer and request a higher credit limit. A higher credit limit makes your debt-to-income and credit utilization ratios look better, especially if you continue with reasonable spending. Note, though, that this only works if you don't start using it as an excuse to spend more money and carry a balance.

After about a year of using a secured credit card effectively, your credit score will have gone up, and, more importantly, you will have proven to the issuer that you have financial responsibility. You can often request a graduation from your secured card to an unsecured card. This maintains your existing account but allows you to transition to a card with added benefits, such as a rewards program, a higher limit, and a lower interest rate. Once you've done this, congratulations! You've made it and can leave secured credit cards behind.

After reading today's article, do you have any questions about secured credit cards, how they work, or how they may be able to boost your credit score? If so, please feel free to reach out and ask your questions at any time! We'd be honored to assist you on your credit-building journey however we possibly can!

Sometimes, building your credit seems like an impossible task. Does this sound familiar?

How do you get a loan to pay off to build your credit if you need good credit to get a loan in the first place?

Luckily, many credit builder loans are structured in such a way that they're attainable if you have bad credit or even no credit at all.

Luckily, many credit builder loans are structured in such a way that they're attainable if you have bad credit or even no credit at all.To understand why, you have to know how they work.

So, let's dig in and discuss how they work and how to get them.

Credit builder loans are akin to normal loans but with a twist.

When you take out a normal loan, you are given money and expected to pay it back over time. The most common uses of loans like this are to pay for purchases much larger than you can normally afford, like a car or a house.

Banks take on a lot of risk for these loans. If you end up not paying back the loan, the bank is the one losing the money. That's why they often have liens or other collateral on record, so if you stop paying your mortgage, you lose the house. Your credit score exists as a way to measure how effectively you control and pay off your debt.

Credit builder loans operate differently. When you take out a credit builder loan, you don't get the money. Instead, the money is put into a bank-controlled account, often a savings account or a Certificate of Deposit (CD) with some small interest rate attached.

Credit builder loans operate differently. When you take out a credit builder loan, you don't get the money. Instead, the money is put into a bank-controlled account, often a savings account or a Certificate of Deposit (CD) with some small interest rate attached.To use a very simple example, say you take out a $1,200, one-year credit builder loan at zero percent interest. That $1,200 is put into a savings account, and you are asked to pay $100 per month to pay off the loan. Each month, you make a $100 payment; by the end of the year, you're down $1,200. When you finish paying off the loan, the savings account is cashed out and given to you; you get your $1,200 back.

Make sense?

There are a handful of different factors that adjust how this situation works, but that's the core idea. Build on it with:

A credit building loan is, essentially, a secured loan. Since the money isn't given to you until you've paid it back, you're the one who takes on the risk, not the bank. If you stop paying, well, the money is still there in a bank-owned account, and they can liquidate it for themselves.

Different credit building loans have different terms and restrictions that may adjust how much they can keep versus how much they give back, if anything, and what they do with interest, fees, and other details. Always make sure to read the fine print on any loan you consider taking out.

One thing to note is that you can still be denied for a credit builder loan, even when bad credit isn't a problem. Most of these loan providers will still check the ChexSystems report, and if you've had a lot of bounced checks in the past, it can lead to a denial of loan.

One thing to note is that you can still be denied for a credit builder loan, even when bad credit isn't a problem. Most of these loan providers will still check the ChexSystems report, and if you've had a lot of bounced checks in the past, it can lead to a denial of loan.Credit building loans are not standard loans and are not generally offered by most major banks. Instead, you usually have to turn to other organizations to get them.

There are generally three types of institutions offering credit builder loans.

There are dozens of organizations that offer credit builder loans with no credit check. They can do this because, as mentioned above, the credit builder loan is not a risk to the bank. Since you assume the risk of the loan, it doesn't matter what your credit is; the bank can "lend" to you anyway.

Examples of credit building loan servicers include the following. Note, however, that we make no judgment as to the quality of these banks, credit unions, and online lenders; we simply mention that they exist.

This is just a representative sample of financial institutions offering credit builder loans. Their terms, qualifications, and requirements may vary.

Credit builder loans put the risk on you, so you need to make sure any loan you take out is one you can afford to pay back. Luckily, most credit builder loans have relatively low balances and good terms because it defeats the purpose if people can't handle paying them off.

Still, you need to take a close look at your financial situation and determine how much you can afford to reliably pay every month. Taking on a loan that asks you to pay more than that amount is a significant risk because a credit builder loan only helps you if you maintain successful payments. If you fall behind, default, or otherwise cannot pay off the loan, it backfires and leaves you worse off than you started.

Most credit builder loan programs are 1-2 years, though some will go up to ten years. We highly recommend avoiding those; short-term loans are much easier to handle, and it's much harder to predict your financial position a decade ahead of time.

Ideally, you will find a credit builder loan with 0% interest. This isn't always possible, though. APRs generally range from 4-5% on the low end to 25% on the high end.

Many credit builder loan servicers will also require a loan that has a particular minimum payment. This is usually somewhere in the $15 to $25 range, though some can be as much as $50. (Yes, our $100 per month example is higher than most actual credit builder loans.)

You will also want to take a look at any fees associated with the loan. Many credit builder loans will have one-time administrative fees, usually between $5 and $25, though some have additional monthly fees. It's usually best to avoid the latter if you can qualify for the former.

All in all, this will give you an idea of the capacity of the loan you can handle paying regularly. Then, you can look for credit builder loan programs that offer terms that match what you can pay.

Remember: Bigger isn't necessarily better! A larger loan takes up more of your credit utilization and may hurt you somewhat in the short term while it builds credit in the long run. Take a loan you can comfortably pay off, not the biggest loan you may be able to pay off.

Remember: Bigger isn't necessarily better! A larger loan takes up more of your credit utilization and may hurt you somewhat in the short term while it builds credit in the long run. Take a loan you can comfortably pay off, not the biggest loan you may be able to pay off.Once you've chosen a loan, apply! Some lenders may have certain requirements to qualify, like minimum annual income, but most will not perform a credit check specifically because they cater to people with poor credit, so it doesn't matter.

Once you apply and are approved, all that's really left to do is make your regular monthly payments. If you have enough leeway to set money aside specifically for paying for the loan, do so. Otherwise, just make sure you have enough to pay it off each month. Since your loans should only last 12-24 months and usually have low numbers attached, this shouldn't be too hard of a burden.

As you successfully pay for your loan, your payments will be reported to the credit bureaus. This will have a slow impact on growing your credit score, often by 10-30 points, which will continue to grow as you pay off your loan. By the time the loan is done and paid off, many people with low credit see a jump of 60 points or so. Obviously, the exact amount that your credit score can increase will depend on your specific financial situation.

When you finish paying off your loan and close out the account, the balance of the loan will be returned to you. This is usually something less than the total value of the loan due to fees, interest, and so on. For example, a $1,200 loan will likely return something like $1,050 to you when all is said and done.

While this may feel like a windfall, especially if you're used to operating on thin, paycheck-to-paycheck margins, it's important to remember that this money should be handled responsibly. Whether it goes towards bills, paying off other debts, or is rolled into another credit builder loan, ideally, handling your money responsibly is part of growing your credit.

Additionally, it can be a good idea to check your credit score a few days or weeks after you finished paying off your loan. You are always able to check your credit score and can check your credit report for free once per year; doing so can show you that your payments were correctly processed, no errors have occurred, and that your credit score has risen accordingly.

As always, if you see any errors on your credit report, dispute them. It's hard enough maintaining a proper credit score without having misreporting or errors dragging you down.

Depending on your current financial situation, yes, it most certainly can be.

Credit builder loans are not without risk. If you take on more of a loan than you can reliably pay off, missed payments can hurt your credit score, eliminating the benefit you would be getting from the loan.

Additionally, if you have existing debt on credit cards or other loans, it's better to put your money towards paying them off rather than taking on another form of debt. Adding more debt won't improve your score as much as paying off existing high-interest debt.

All of that said, credit builder loans are often beneficial for those who have no credit or low credit and won't qualify for other forms of loan with favorable terms. They serve to help you reach a point where you can get to more favorable financial positions.

All of that said, credit builder loans are often beneficial for those who have no credit or low credit and won't qualify for other forms of loan with favorable terms. They serve to help you reach a point where you can get to more favorable financial positions.Do you have any questions or concerns about credit builder loans, or whether you should apply for one? If so, please feel free to reach out and contact us at any time! We'd be more than happy to answer any of your questions, and assist you on your credit building journey however we possibly can!

When your credit score is low, and you need to gain approval for a loan – like a car loan or a mortgage – you are probably looking for any way you can to build your credit quickly.

There are all manner of credit builder programs available, some better than others, but many of them share one common issue: they're an added financial burden. A credit builder loan is taking out money for the sole purpose of repaying it, for example. You're just adding an extra bill to pay for a credit bump, but you don't get anything tangible to improve your life immediately.

It makes sense, then, that you might start looking for ways to build your credit that also get you something. Financing a new phone is one such idea.

The question is, does it work?

These days, smartphones are nearly indispensable. The little pocket computers are powerful for all manner of benefits, including task scheduling, calendar management, banking, payments, and much more. They can even make phone calls! Statistically, half of you reading this post are probably doing so on a mobile device of some kind.

At the same time, many smartphones are quite expensive. The latest Google Pixel is $600, and the Pro is $900. The latest iPhone is $700 with a Pro starting at $1,000 with the higher end models landing around $1600. The latest Samsung is similarly expensive. Many people, especially those living paycheck to paycheck, can't afford to pay full price up-front for a new phone.

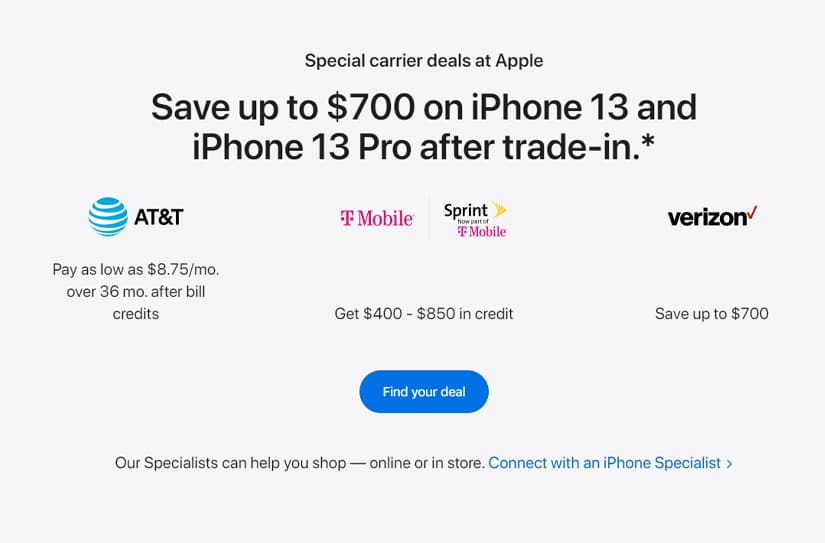

Of course, phone manufacturers and cell carriers know this, so they all offer a variety of different ways to spread out the costs. You can trade in an older device for a discount, you can add the cost of the phone as monthly payments on top of your cell phone plan, or you can even finance the phone.

Financing the phone usually happens in one of three different ways.

Retail financing usually works by asking you to open a credit card, often with the store itself. Apple offers the Apple Card, retail outlets like Best Buy and Amazon have their own credit cards, and so on.

Credit cards are credit cards, and they are almost always reported to the credit bureaus. Of course, many of these credit cards are limited. They may, for example, offer 0% interest on a cell phone purchase, but an incredibly high interest rate if you use the card for other purchases. They're meant to be opened to buy the phone or some other piece of flagship technology from the manufacturer, and then either closed or let to lie when the purchase is done.

Cell carriers – the people you're paying to have access to cell service, like T-Mobile or Verizon – often offer their own forms of financing for phones. The phones they offer may be slightly cheaper than buying an "unlocked" phone, or they may have their own added software or even a slightly-customized operating system to customize the phone experience for that carrier.

Carrier financing usually involves signing a contract and paying in installments, usually for 24 or 36 months. The cost of the phone is divided across your monthly bill, so your bill contains charges for both the device and your usage of the service. Since this isn't a line of credit, it is usually not reported to the credit bureaus.

On the other hand, these options are usually a bit cheaper than other financing choices, especially if you're working with one telecom for your household. Bundling multiple phones together, or even your cell service along with your TV and internet service may allow you access to cheaper pricing than everything individually would cost.

Services like Affirm and AfterPay are third-party services that vendors may offer. They're technically known as "point of sale installment loans" and function similarly to loans. You "buy" the phone at the time of purchase, taking out a loan with this third-party service to pay for it. The vendor has their money and is no longer involved; the loan is with the BNPL service provider.

Though these services operate as loans, they generally do not report to the credit bureaus, so they don't affect your credit. It depends a lot on the provider. For example:

Of course, this all depends on the vendor to offer one of these services; many do not.

If you've read up on how credit scores work, you know that taking out lines of credit, paying regularly, and keeping your debt-to-income ratio low can all help boost your credit score. However, it's all dependent on one thing: whether or not the loan/credit and activity is reported to the credit bureaus.

Most options for financing a cell phone are not reported to the credit bureaus. Of the three options, only the first – opening a vendor credit card – is likely to be reported. Only a few of the buy now, pay later services report activity, so you would have to shop around to find a vendor that uses the service, and that you trust to make a large purchase, which can be a tall order.

This means that financing a cell phone can boost your credit score, but only if you're able to open a credit card with the store. This isn't always possible.

This means that financing a cell phone can boost your credit score, but only if you're able to open a credit card with the store. This isn't always possible.When you apply for financing for a store line of credit, the credit provider will analyze your financial situation and will decide whether or not to approve you. If your current credit situation is poor, they are just as likely to deny you a line of credit as they are to accept you, and if they do accept you, they may offer extremely risky terms.

Conversely to the above, financing a cell phone has the potential to hurt your credit score. This can happen in several ways.

1. Failure to make payments.

As with any line of credit, loan, or financing plan, if you fail to make payments on time, that failure is likely to have negative repercussions. At the very least, you'll rack up interest and fees. In some cases, you may violate the terms of the loan and lose benefits like 0% interest. You may be able to try to get these removed with a Goodwill Letter, though it's never guaranteed to work.

And, of course, if you fail to pay your loan, you will go into default, and your debt will likely be sold to a collection agency. That agency will be more than happy to report to the credit bureaus to leverage additional pressure to force you to pay what you can. In fact, with some of the buy now, pay later financing plans, they only report if you fail to pay. This means the potential benefit to your credit is nil, while the potential downside is significant.

2. The hard credit check for approval.

You may have heard that a hard pull of your credit report can hurt your credit score. Here's a quick lowdown:

Realistically, a hard credit pull for a phone is unlikely to really harm your credit score, and the brief dip will go away relatively quickly if it even happens. However, if you're financing multiple pieces of technology in a short time, multiple hard pulls can hurt more.

3. A worse credit utilization ratio.

Depending on how the loan or line of credit is formed, it can make your credit utilization look worse.

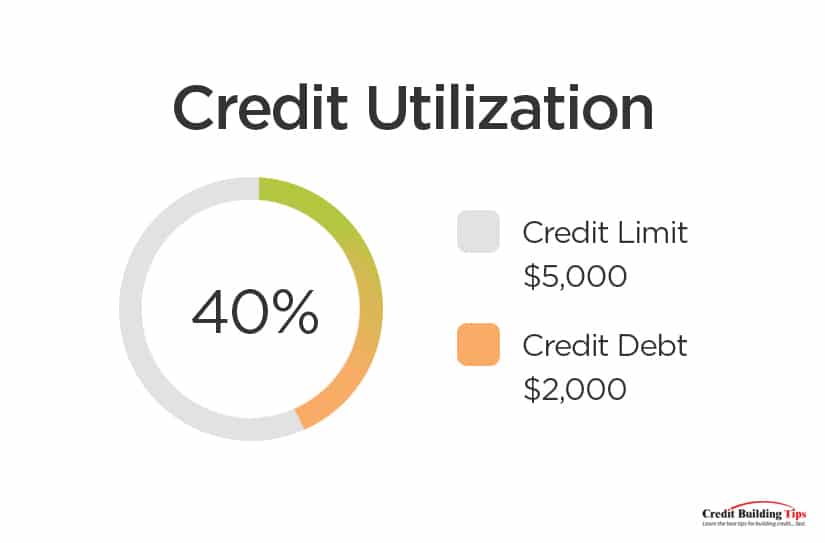

For example, say you have one credit card with a $4,000 limit and $1,000 in debt on it. That's a 25% credit utilization, which isn't bad. If you then finance a cell phone for $1,000, you're opening a line of credit with a $1,000 limit and using $1,000 of it; that puts your totals at $5,000 of limit and $2,000 of utilization, which is 40% utilization; much worse.

Debt to income ratio is also relevant here. The more debt you have relative to your income, the worse your financial situation looks. Taking out financing on a cell phone increases debt, so unless your income went up as well, your ratio looks worse.

If you need a cell phone and you don't want to finance one, you have a few options.

For one thing, you can look for a cheaper phone. Often, manufacturers have smaller, less fully-featured phones available for lower prices, or they may sell the previous generation of phones at a discount. You can get a slightly older model, or a non-flagship model, often for half the price or less.

You can also buy a used phone. This carries the risk of the phone already wearing out some of its lifespan, so you'll need to replace it sooner than you otherwise would, but it can carry you through a tight time or still work out to be cheaper in the long run.

Some brands of cell phones are also cheaper across the board. However, an off-brand cell phone may have compatibility or usage issues, which need to be considered depending on what you need your phone to do for you.

If you're just looking for ways to boost your credit and are now convinced that financing a cell phone is not a good way to do it, you have plenty of options.

It's entirely possible to raise your credit score quickly, especially if your current score is relatively poor. Taking the right actions and being smart with the money you have available can have a dramatic impact.

Financing a cell phone is usually not a great option, simply because most of the available methods to do so don't report to the credit bureaus unless something goes wrong. It can be beneficial if you need a cell phone and can't afford to buy one in cash, but it's not likely to help your credit score outside of certain specific situations.

If you have any additional questions about financing anything, whether it's technology, furniture, or anything else, simply drop us a line. Our goal with this blog is to answer your questions, so we highly encourage you to ask them. Drop us a comment, send us a message, and make sure to subscribe to our newsletter for more great credit building tips! We would love to assist you on your credit building journey by answering any of your potential questions or clearing up any concerns you may have to the best of our ability!

There's no single thing called a "credit builder program"; instead, there are a handful of different financial and non-financial programs you can enroll in to boost your credit. Some of them work, some are minimal in their impact, and some are scams.

How do you know which is which? What should you pursue?

Let's dig in!

Credit builder programs generally fall into a few categories.

While they each work a bit differently, they are all designed to help individuals boost their credit score by establishing a pattern of on-time payments to creditors.

To see how these all work, let's talk about them in greater detail.

Let's start with credit-building loans.

You take out a loan for X amount of money at Y% interest with a typical loan. You make payments over time, showing your reliability and improving your credit score. You also pay interest, which can be steep over time. However, it's also a risk; you use the money from the loan to buy something, and you have to come up with the funds to repay it.

When you take out a loan with a credit builder loan, you aren't given the money. Instead, the money is put into a short-term savings or investment account, like a Certificate of Deposit (CD), where it can earn some interest.

Then, for the duration of the loan's terms, you make payments towards the loan. Making regular payments towards a loan builds your credit, and since the loan values are usually small (often under $1,000), the payments are easy to make, and the hit to your credit utilization is low.

So, wait. If you're paying a company to hold money in a savings account in your name, how do you benefit, other than your credit score? Well, when you finish paying off the loan, the loan's value is returned to you. The savings account/CD is cashed out and given to you.

You end up building your credit, and the only costs are:

Because the company controls the money the entire time you're making payments, it's no risk to them, so they're much more willing to issue these loans to people with bad or no credit, unlike a typical financial institution. And, because you aren't given the money until you fully pay off the loan, there's no temptation to splurge and waste the money, then fall off the wagon in paying.

A credit builder loan is often a short-term loan, though some servicers offer them up to 10-year terms. Making regular payments on a credit builder loan can potentially increase your credit score between 25 to 75 points.

A credit builder loan is often a short-term loan, though some servicers offer them up to 10-year terms. Making regular payments on a credit builder loan can potentially increase your credit score between 25 to 75 points.Typically, a debit card is tied directly to your bank account and pulls money immediately in an ACH transaction when you pay for a product or service. Money is transferred immediately, with no need for a line of credit, interest calculations, monthly payments, or any other trappings of a credit card.

Since debit cards require you to have the funds on hand, it's essentially just like cash. The transaction isn't reported to the credit bureaus because it doesn't say anything about your ability to handle credit, just cash on hand.

Unlike credit cards, you can't go into debt with a debit card (unless you overdraft your account, which the financial institution typically disallows). It doesn't count as part of your credit utilization.

A reported debit card is a twist on this concept. It works like a debit card, linking to your bank account and only allowing you to buy things if you have the money on hand. However, it also works like a credit card by putting the transaction on a line of credit to be repaid.

The difference is the repayment terms. With a credit card, your debts are tallied up, and you're issued a monthly bill for part of the overall balance, while any remaining balance accrues interest. With a reported debit card, your transactions are due for repayment within 24 hours, and the money is debited from your account automatically.

This strategy is no different from monitoring your credit card and paying off any outstanding balance every day or week. However, doing so with a credit card requires you to have the discipline to do so and the funds on hand if you make a purchase beyond what you have available in your bank account. With a reported debit card, you can't buy anything you don't have the money on hand to pay for.

In exchange for the tighter limitations on buying with the card, your reported debit card is reported to the credit bureaus. And, since the card requires you to have the money to pay it off before you use it, it's low-risk to the issuer, so they're willing to issue it to individuals with poor credit.

These debit cards can boost your score anywhere from 5 points to a whopping 100 points, depending on your initial credit score and how frequently you use the card.

These debit cards can boost your score anywhere from 5 points to a whopping 100 points, depending on your initial credit score and how frequently you use the card.Consider all of the bills you have to pay regularly to survive.

Sure, some of these aren't essential – nobody needs a Netflix subscription to survive – but they're usually bills that you regularly pay, on time, every month. Why shouldn't that be reported to the credit bureaus? It's proof that you can pay a regular monthly bill, on time, with no delinquency issues.

Any of these can be reported to the credit bureaus, but it's usually the responsibility of the company issuing you the bills. It's also expensive for those companies, and a company like Netflix or your property manager/landlord doesn't want that added expense for no benefit to them. Thus, those bills are never reported.

Unfortunately, you cannot self-report your own bills. Only officially-designated "data furnishers" can report bills. That's where bill reporting services come in.

Unfortunately, you cannot self-report your own bills. Only officially-designated "data furnishers" can report bills. That's where bill reporting services come in.Bill reporting services come in two forms.

1. The first is usually for rent. You give the rent reporting company read-only access to your bank account, so they can scan your bank statements for rent payments and report those payments to the credit bureaus. They can generally report up to the last two years of rent payments immediately, which can be a massive boon of up to 40 points of credit score growth near-immediately.

There may be some restrictions, however. You need to have a valid rental agreement for these services to verify your payments, and they may not be able to confirm if you pay in cash, even if you withdraw the cash regularly. They're verifying a specific transaction, after all.

You can also enroll in ongoing reporting, usually for a minor (under $5) monthly fee.

2. The second form of bill reporting works for other bills, like your utilities or your entertainment.

They work by, essentially, issuing you a heavily-limited credit card. You switch your payment method on those services to the credit card, and the credit card charges you for the bills every month just like if you were paying the bills as you typically would. The only difference is where your money is going and where the money is coming from that Netflix or your utility company sees.

Because it's technically a credit card, it builds your credit by showcasing credit utilization and regular payments reported to the credit bureaus. They also generally don't charge interest because you're guaranteed to pay off your balance every month, or they stop paying your bill for you.

Unlike rent reporters, bill reporting doesn't reach back and report historical payments, so you need to enroll and use the service on an ongoing basis. Thus, your credit growth will build over time but starts small.

If you have low credit or no credit, it can be tough to get started. Many credit issuers will either not give you the time of day or will only offer you programs with extremely steep interest rates or very unfavorable terms.

Credit building programs take advantage of loopholes or structures in payments that:

As such, they can help you if you're in a position to use them.

There are always downsides, though.

You "take out a loan" with a credit-building loan, but you don't get the money until you're done paying it off. So, you're essentially just paying money for nothing except a boost to your credit score. It's an added bill that may not be feasible to support if you're already tight on cash.

Reported debit cards require you to use them properly, though if you already use a debit card, there are no real drawbacks.

Bill reporting also tends to be limited in that it can only report certain kinds of bills, so you have to have those bills first. Rent reporting won't work if you've spent time homeless, pay your rent informally, or don't have an official rental agreement.

These are all more favorable to you than many other forms of building credit. Unlike secured credit cards, you don't have to worry about the risk of going into debt, and you don't need the sizable up-front payment. Unlike becoming an authorized user on someone else's card, you don't have to have a friend willing to risk their credit for you.

The truth is, these programs work. How well they work depends on the program you use, your existing credit, and other factors that might be suppressing your credit. Many people will see a jump of anywhere from 20 to 100 points, depending on those various factors.

The truth is, these programs work. How well they work depends on the program you use, your existing credit, and other factors that might be suppressing your credit. Many people will see a jump of anywhere from 20 to 100 points, depending on those various factors.These are some of the best options for improving your credit quickly and effectively. You need to make sure you're financially able to keep up with the payments and pay the small fees associated with using the services. Rent reporting, for example, might charge you $2-5 per month. It's minuscule, but it's still essential.

Please give them a look. There are dozens of companies providing these services today, so you have plenty of choices. Find the ones that work best for you. Whether you're having trouble securing a mortgage or trying to get your first credit card, these credit builder programs can be a huge help to prove to the credit bureaus that you're capable of making on-time payments.

Do you have any questions about any specific credit building program? Are you thinking of trying one of these credit-building programs, or have you used any of them in the past? Please let me know! I'd love to get a conversation started on this subject for the benefit of everybody reading and working to boost their credit score.

In our modern world, having access to a car is near-essential. Urban sprawl, poor public transportation, inaccessible city design, and other factors all come into play to make cars a requirement for participation in society. Regardless of your feelings on the matter, this is the reality of our modern way of life.

Whether to buy or lease a car is one of the most important decisions you'll make, and it has repercussions beyond just your monthly payments. It can even impact your credit score. The question is, is it good or bad, or both? Can it help you build a score, or can it hurt to lease?

Let's dig in.

Your credit score is a numeric indicator of your financial reliability. It is used in many different situations where large amounts of money or assets are on the line. Much like when you want to find an apartment to rent, your credit score can impact your ability to obtain a vehicle.

Having bad credit can impact your ability to qualify for a car lease, affecting your ability to be eligible for a car loan. Despite the outward similarity – approval for money for a vehicle – credit can impact your ability to qualify differently.

Having bad credit can impact your ability to qualify for a car lease, affecting your ability to be eligible for a car loan. Despite the outward similarity – approval for money for a vehicle – credit can impact your ability to qualify differently.There are two significant differences between leasing and buying that mean your credit score has a different impact.

The first is the source. You're making a deal with a car dealership when leasing a car. If you default, the company leasing you the car is at risk, who has to repossess the vehicle to recoup their losses, and who has to collect payments regularly. When buying a car, you're typically working with a bank to get a loan to pay for the car, at which point the dealership has no further hand in it, and the deal is between you and your bank.

Banks are more flexible with credit than dealers because they tend to have better arrays of safety nets in place and more options for handling financial issues. Dealerships are much smaller entities.

The second difference is the collateral. When you apply for a car loan and use that loan to buy the car, the car becomes collateral. You're paying towards the loan, which the bank technically owns until you pay it off and they send you the paperwork. With a lease, the dealership owns the vehicle, and you're just granted temporary use of it.

All of this means that leases tend to have higher standards for credit scores than loans. Most auto dealerships will only lease a vehicle to someone with a credit score of 620 or above, and many prefer a score of over 700.

An exception is the agencies that allow for lease transfers. People who want to get out of a lease can "sell" the lease to you; you take on the lease for the remainder of its duration, picking up responsibility. This option can be a good choice when credit is exceptionally poor or non-existent.

Both leases and loans have variable terms, and the lower your credit score, the worse the conditions will be for you, primarily in the form of an interest rate for loans and monthly payments for leases. A bad credit score means you're less reliable financially, so a dealership will want to get the most out of you that they can if you default.

You may be able to qualify for a loan to buy, but the terms may not be in your favor. In practice, what this means is that if you have bad credit, you likely won't even be offered the option to lease. Even still, it's better than nothing.

However, all of this is about your credit score before you buy or lease. The question is, though, what happens to your credit score after you sign the paperwork?

Your credit score is a single number calculated based on several factors. The five elements, and their weight in the total calculation, are:

The single most significant factor influencing your credit score is establishing a history of paying off your debts.

The single most significant factor influencing your credit score is establishing a history of paying off your debts.It doesn't matter if it's a credit card you pay off fully every month, a loan you pay the minimum towards each month, or a lease you pay regularly; the act of making regular payments, on time, with no late payments or defaults, is the critical part.

When you sign a lease for a car, you're signing up to make regular payments. Making those regular payments can benefit your credit score – if the dealership reports leases to the credit reporting bureaus. Most dealerships will make those reports, but occasionally one may not. Your credit score is only based on what is reported, so if your payments aren't being reported, they won't do you any good.

The general exception is rent-to-own businesses, similar to but distinct from leases. Rent-to-own agencies often don't report to credit bureaus because they're self-interested and specifically target people with poor credit. Those credit scores don't improve by not reporting, so those customers are forced to use their limited options. Cynical, predatory, but legal.

If you can get one, a lease for a vehicle can help build your credit score by establishing a reported history of regular payments. It can also add to your credit mix and be part of new credit, so it has more impact than you might expect.

Buying a car is similar to any other loan. Qualifying for a loan has a relatively low bar in terms of credit score, but the better your credit score, the better the loan terms.

The dealership doesn't necessarily care about your credit score unless they work with their financing process. If you come with a cheque in hand, money is money, and you'll get your car. You have to deal with a financial institution to get the loan, but once you have it, the vehicle is yours.

A car loan is a loan and, as such, impacts your credit. Opening a new loan, making regular payments on the vehicle, and maintaining a reasonable debt-to-income ratio benefit your credit score.

A car loan is a loan and, as such, impacts your credit. Opening a new loan, making regular payments on the vehicle, and maintaining a reasonable debt-to-income ratio benefit your credit score.The only way buying a car will hurt your credit is:

Opening a new loan account can temporarily hurt your credit, but your credit will grow as long as you maintain making payments on time.

When a lease ends, you give the car back to the dealership, and the relationship ends. At least, that's the way it works on paper.

In reality, most dealerships will offer you three options.

When a lease ends, and a new one begins, it may not even be reported as a new lease and will no further impact your credit score. If you choose to buy the car or walk away, the cancellation of the lease may hurt your credit score a small amount, temporarily.

Your credit score can take a minor hit because you're closing a line of credit – even if it was a financial relationship you were successfully paying off – removes one line from your credit mix and number of accounts.

Your credit score can take a minor hit because you're closing a line of credit – even if it was a financial relationship you were successfully paying off – removes one line from your credit mix and number of accounts.However, this credit drop is temporary; in most cases, the credit bureaus are smart enough to recognize that closing the account is beneficial, and your score will return to where it was or higher. This phenomenon is, after all, why your credit mix and number of accounts are such small percentages of your overall score.

The one possible way a lease ending could hurt your credit is if you had additional closing fees, like wear and tear charges, and you don't pay those right away. In that case, it becomes like any other debt you default on and hurts your score.

Like ending a lease, ending a loan closes a credit account and can temporarily cause your credit score to go down. And, much like a lease, when the bureaus recognize that it's a beneficial action, your score will return to its previous heights.

Closing a loan can be more impactful if you have few or no other lines of credit and aren't making any other regular payments that the dealerships would report to the credit bureaus. However, even still, your credit score is likely to be higher than before opening the loan, mainly if you had bad credit and made your payments on time the whole way through.

Whether or not a lease or a loan is better depends on a few factors.

The first is if you have bad credit. With bad credit, anything that improves it can have a significant impact. More importantly, you want short-term solutions rather than long-term solutions because a completed contract is valuable to your credit score.

A car loan usually starts at two years and may stretch as far as seven. That means it can be as much as seven years before you get a completed contract on your record. Of course, regular payments during that time are beneficial, too.

On the other hand, leases are often 1-4 years. If you opt for shorter contracts, you can have more closed contracts and thus a better credit score.

In both cases, however, the history of making regular monthly payments is much more impactful and roughly equivalent between methods.

The other factor is the value of the debt you take on.

You're taking on debt for the car's total value with a car loan. Taking a $30,000 loan for a vehicle means taking on $30,000 in debt - a significant hit to your debt-to-income ratio.

With a lease, the total amount of the debt is only reported when the lease ends and is only the amount you paid. A $30,000 car, after a three-year lease, might only be worth $20,000; your lease burden will be reported to be the $10,000 paid towards it in that time. Your debt-to-income ratio looks better, so leasing has a better impact.

From a pure credit standpoint, leasing may be the better option. However, there are numerous caveats to this.

Then there are the other considerations. With a lease, you are often restricted on the number of miles you can drive in a month. You may not have steep maintenance bills, as the dealership may cover maintenance, unlike with a vehicle you've purchased.

However, terms can vary, so make sure you know what you're getting into.

In the end, the choice may not be yours to make.

Are you thinking of leasing or purchasing a vehicle, or do you already lease a vehicle? Do you have any questions for us about your options? Please share with us in the comments below! It will help other users out, and we would be happy to give you advice on your current situation.

Credit scores are a fact of life we all have to confront sooner or later. They've attached to us our whole lives, and they rise and fall according to our decisions, often before we even understand what credit is and what affects it.

Moreover, credit scores are inscrutable. The credit tracking agencies keep the specifics of their algorithms a secret. Many people don't even know that Equifax, Experian, and TransUnion are not the exclusive authorities on credit. There are dozens of credit reporting agencies. All of them track and weight aspects of credit differently, so your score across them all will be different.

Yet, despite all of this mystery, credit scores are a critical deciding factor for everything from your ability to buy a car to your chances of getting a mortgage. Having a lower score can tangibly harm your life and lifestyle, and you may never quite know why or even realize it's happening.

As if this wasn't enough, the internet – and casual advice from friends and family – is full of misinformation. For example, maybe you've heard this one:

"Carry a balance on your credit cards, and never pay them off completely; making regular payments helps your score!"

Did you know that this is entirely false?

We're not sure where the myth got started. Maybe it's a misinterpretation of the advice not to close a line of credit, or perhaps it's a myth put forth by banks who pull in the interest on your balance. Either way, it's not true, and it's financially better for you to pay off any outstanding loans or balances as quickly as possible (in general).

Our goal with this site is to provide accessible, easy to internalize knowledge to help you build a higher credit score and improve your quality of life. So, let's start with five tangible actions you can take to improve your credit score quickly.

Your credit score is, in part, a measurement of how reliable you are at paying off the money you borrow. This score applies whether you're getting a massive 30-year mortgage or buying $50 worth of groceries on your credit card. You borrow money, you pay that money back, regularly and on time.

One aspect of credit that hugely factors into your score is utilization. Credit utilization is the amount of your total credit that you use. Utilization also accounts for as much as a third of your credit score, so keeping your utilization low can be a considerable boost.

Your target number is around 30% or lower. So, let's talk about how you get there.

The first thing you need to do is tally up all of your lines of credit and their credit limits. Let's say you have three credit cards:

For now, don't worry about your balances. Just add up the total of all three credit limits. In our example, this is $12,000.

Next, figure out what 30% of your total limit is. 30% of $12,000 is $3,600.

Your goal should be to keep your total running balance across all of your cards at under $3,600. If your total balance across your three credit cards is higher than that, pay off enough to get it under. Keep it low by avoiding borrowing too much whenever possible.

Your goal should be to keep your total running balance across all of your cards at under $3,600. If your total balance across your three credit cards is higher than that, pay off enough to get it under. Keep it low by avoiding borrowing too much whenever possible.Getting and keeping your utilization under 30% is a sure-fire way to boost your score.

Now, we understand that "pay off your debts" isn't exactly helpful advice for many people. Millions of Americans live paycheck to paycheck and don't have the luxury of quickly paying down debt.

Luckily, you can approach the problem from the other side as well. Consider asking your financial institutions for a higher credit limit. If your account is in good standing – that is, no late payments – they may be more than happy to raise your limits. Increasing limits will lower your percentage utilized and can be helpful to your score – as long as you don't rack up even more debt.

Most of the time, asking for a higher credit limit is as simple as calling your credit card or bank and talking to customer service. As long as your account is in good standing – even if you're already carrying a balance – many institutions will be more than happy to increase your limit for you.

This credit increase isn't always purely out of magnanimous interest in your well-being, of course. Banks want you to have a higher limit when you've proven you can pay it off because then you'll be more likely to carry a higher balance and thus rack up even more interest for them to earn off of your spending.

That's why the key here is to ask for a higher limit, but treat your spending as if you didn't have that higher limit. That way, you keep your utilization low and carry as small a balance as possible. This strategy is great because it can boost your score, but it also helps you by keeping your monthly payments small and your interest low.

Note: Some lines of credit will pull a hard check on your credit score when requesting an increase, and others may only request a soft check or won't check your credit at all. It's advised that you ask them for this information before they pull a report.

Note: Some lines of credit will pull a hard check on your credit score when requesting an increase, and others may only request a soft check or won't check your credit at all. It's advised that you ask them for this information before they pull a report.The closer you can get to paying off your debts, the better off you'll be.

Another factor that goes into your credit score is the overall age of your credit history. The older your credit history, the more experience you have with managing your money appropriately, so the better off you'll be.

The trick here is that you have to keep old accounts active. You can't open a credit card and never use it.

Generally, our advice is to set up auto-pay on a bill or two and then forget about it. Even something as simple as a Netflix subscription can be enough to keep your line of credit active with relatively little risk of ever boosting utilization too high or otherwise breaking the pattern.

Now, you don't need to carry a balance to keep a line of credit active. You need to use it. Maintaining a balance only gives banks or financial institutions more money through interest payments and doesn't help you. Use the line of credit, but pay it off as much as possible.

Banks are not infallible. They can make errors. Payments – especially payments by check or mail – can slip through the cracks. Reports can get mixed up. Someone swapping digits on a social security number when they file for a loan can throw an issue on your information when it has nothing to do with you. Identity theft can wreak havoc.

Federal law requires that each of the three main credit reporting bureaus – Equifax, Experian, and TransUnion – provide a full credit report to everyone upon request, for free, once a year. During Covid-19, the credit reporting agencies are offering weekly reports for free. Take advantage of them if you want to keep an active eye on your credit report! You can request your information from Annual Credit Report.

Important: You do not need to pay for your credit report if it's the first one you've requested in the year.

Important: You do not need to pay for your credit report if it's the first one you've requested in the year.Once a year, at minimum, you want to request your credit report and look for errors.

What kind of errors might you find?

Essentially, you can dispute anything inaccurate, fraudulent, or false. How do you do it?

Start by creating a list of all of the errors you find, so you can keep track of what you challenge, when, and when it's removed. You want to maintain proof in case any of it reappears.

Next, gather any supporting evidence you can to challenge the errors—for example, payment and transaction history may show zero late fees to contest a late payment report.

At this point, you want to write a Credit Challenge Letter. This letter is a formal statement to the credit bureau that you are challenging a line on your credit report as inaccurate and why. This page provides templates and examples. You can also contact the agency responsible for the error – like a bank that misreported a late payment – and see if you can fix it from their end.

Note: if you determine that the line item isn't an error but is a case of identity theft, you can take additional steps to handle it. Here's an excellent place to start.

Note: if you determine that the line item isn't an error but is a case of identity theft, you can take additional steps to handle it. Here's an excellent place to start.In general, your credit score only keeps track of things like loans, credit cards, and other significant financial transactions.

You might be surprised. A lot of your basic, everyday transactions aren't counted. What falls into this category?

All of these are regular monthly payments that you pay on time (obviously, or else your service is canceled) and should count towards your credit score.

You might even notice that mortgage payments are counted, but rent payments aren't. This phenomenon is another example of the many systemic ways the credit system is fundamentally flawed, but that's a topic to go into another time.

The problem here is that the lender has to pay to submit the information to the credit bureaus to get those sorts of transactions reported. Your landlord or your utility company don't want to spend this extra fee, in part because it doesn't help them in any way, so you're left with all of these regular payments that don't go on your report and don't help you.

Luckily, there are a few ways you can get these reported.

Additionally, newer versions of FICO (your credit score) take these other channels into account and are slowly gaining popularity.

Considering the above tips, how much can you raise your score?

The truth is, it varies.

Some of these steps can have a near-instant effect, and you'll see a bump in your score within a month or less. Others might be more long-term since credit scores are slow to change even in the best of times.

The lower your score is, the more benefit you'll get from any given credit-boosting step you take. The dream goal is a 100-point boost, and if your credit score is low (say, 300-400), you can achieve it. On the other hand, if your credit score is already in the 700s, you're probably not going to get more than 10 points or so from them. The higher your score, the harder it is to improve. Virtually no one has perfect credit, anyway.

Luckily, you don't need a perfect score. Getting your score above 750 can get you slightly lower interest rates or better loan terms, but the most significant benefit is bringing your score from under 500 to over 600. In practical terms, anything above 650 is good enough for most people.

Sound financial habits over time, along with a few tips and tricks, can help you boost your score by a surprisingly significant amount. Be sure to check back here regularly; we'll have plenty of advice for you in the coming months, and we're more than happy to answer your questions.