If you need to rebuild your credit, you're not alone. In 2022, 15.5% (39.28 million) of Americans have bad credit, and 21.7% (54.99 million) have fair credit.

While that may seem like a lot — 94.27 million people combined, the good news is that the percentage of Americans with good credit increased by 5% year-over-year this year.

That's the highest year-over-year increase in 16 years!

One of the ways to rebuild your credit is by working with a second-chance credit union. They're a great way to get a fresh start at rebuilding your banking history.

One of the ways to rebuild your credit is by working with a second-chance credit union. They're a great way to get a fresh start at rebuilding your banking history.Second chance bank accounts are "individual accounts offered at some…credit unions to help people with a troubled banking history." Troubled banking history may mean your bank account has been closed due to excessive overdrafts, unpaid fees, or other issues.

If a bank closes your account for one of these reasons, you may be put on a list at ChexSystems, which is a "bank account screening consumer reporting agency (C.R.A.) that keeps your name on file for up to five years as a high-risk bank customer."

Shockingly, millions of Americans do not have a bank account. The Federal Deposit Insurance Corporation (FDIC) reports that 22% (63 million) of American adults were "unbanked" or "underbanked" in 2019.

Shockingly, millions of Americans do not have a bank account. The Federal Deposit Insurance Corporation (FDIC) reports that 22% (63 million) of American adults were "unbanked" or "underbanked" in 2019.Unbanked Americans (6%) have no bank account whatsoever. Without a bank account, you have to rely on payday loans, check cashing services, money orders, foreign remittances, and pawnshop loans to manage your finances. Even the "underbanked" need to rely on alternative financial services.

The most recent survey from the FDIC asked households that didn't have full access to bank services why this was the case.

Just over 52% said they didn't have enough money to keep in an account, while 30% claimed they didn't trust banks.

Being unbanked (or underbanked) isn't just an inconvenience. NerdWallet calculated the annual cost of being unbanked at 1% of the average annual income. While 1% doesn't sound like much, over a lifetime, it can add up to $70,000.

Those who are unbanked and need to rely on "alternative services" like payday loans are vulnerable to "predatory lenders, exorbitant interest rates, and costly fees." Not only that, it's impossible to get approved for loans and mortgages, which every American needs in order to improve their financial situation.

The direct costs for the unbanked are significant. Without a bank account, they can't pay bills electronically and need to rely on cash payments. Imagine the inconvenience, at the very least, of not having access to a bank account!

Direct costs of being unbanked are:

Some of the challenges that come without access to credit include:

Second-chance bank accounts are typically checking accounts, although some credit unions may also offer second-chance savings accounts.

Another way to think of a second chance bank account is as a probationary account. They're intended to help people rebuild their banking history and reputation as low-risk customers. Similar to how secured credit cards can help people build their credit history.

Another way to think of a second chance bank account is as a probationary account. They're intended to help people rebuild their banking history and reputation as low-risk customers. Similar to how secured credit cards can help people build their credit history.Second-chance checking accounts are relatively easy to get, and some credit unions work with their clients to help them move to "more robust banking options." They operate like other checking accounts but usually have more restrictions, higher fees, and limited features.

And they're not available everywhere. They may be called "Opportunity Checking" or "Fresh Start Checking." If no credit unions in your town or city offer this service, you may want to check with a local community bank.

Forbes Advisor collated a list of second-chance checking credit unions by state:

| State | Bank 1 | Bank 2 | Bank 3 | Bank 4 |

|---|---|---|---|---|

| Alabama | Azalea City Credit Union Opportunity Draft | Family Security Credit Union Give Me a Break Checking | Gulf Winds Credit Union MyOpportunity Checking | |

| Alaska | True North Federal Credit Union True Options Checking | |||

| Arizona | Banner Federal Credit Union Opportunity Checking | Copper State Credit Union Try Again Checking | MariSol Federal Credit Union Start Again Checking | Tucson Old Pueblo Credit Union Mission Checking |

| Arkansas | Red River Credit Union Fresh Start Checking | River Valley Community Federal Credit Union Fresh Start Checking | Unify Federal Credit Union Right Start Checking | |

| California | North County Credit Union Fresh Start Checking | Premier America Credit Union Fresh Start Checking | Priority One Credit Union New Leaf Checking | Strata Credit Union Fresh Start Checking |

| Colorado | NuVista Federal Credit Union The Last Chance Checking | Unify Federal Credit Union Right Start Checking | ||

| Connecticut | Finex Credit Union Re-Start Checking | Hartford Federal Credit Union 2nd Chance Checking | Tobacco Valley Teachers Federal Credit Union myChance Checking | |

| Florida | Compass Financial Federal Credit Union Restart Checking | First Florida Credit Union Smart Track Checking | Gold Coast Federal Credit Union Fresh Start Checking | South Florida Federal Credit Union Aspire Checking |

| Georgia | Georgia's Own Credit Union Resolution Checking | Health Center Credit Union Fresh Start Checking | Peach State Federal Credit Union Fresh Start Checking | |

| Idaho | Latah Credit Union Second Chance Checking | |||

| Illinois | Catholic & Community Credit Union Rebound Checking | |||

| Indiana | Centra Credit Union Opportunity Checking | Heritage Federal Credit Union 2nd Chance Checking | Liberty Federal Credit Union Opportunity Checking | |

| Iowa | Collins Community Credit Union Take2 Checking | Greater Iowa Credit Union Fresh Start Checking | North Iowa Community Credit Union Fresh Start Debit | |

| Kansas | United Consumers Credit Union Second Chance Checking | |||

| Kentucky | Liberty Federal Credit Union Opportunity Checking | |||

| Louisiana | Neighbors Federal Credit Union Basic Checking | Pelican State Credit Union Horizon Checking | Southwest Louisiana Credit Union Fresh Start Checking | |

| Maine | Five County Credit Union Second Chance Checking | |||

| Maryland | Central Credit Union of Maryland Renew Checking | Market U.S.A. Federal Credit Union Fresh Start Checking | Security Plus Federal Credit Union Revive Checking | |

| Massachusetts | Alden Credit Union No Boundaries Checking | Athol Credit Union Fresh Start Checking | ||

| Michigan | Marshall Community Credit Union Fresh Start Checking | Michigan State University Federal Credit Union Rebuild Checking | ||

| Minnesota | Minnesota Valley Federal Credit Union Second Chance Checking | |||

| Mississippi | Gulf Coast Community Federal Credit Union New Chance Checking | Liberty Federal Credit Union Opportunity Checking | MUNA Federal Credit Union Fresh Start Checking | |

| Missouri | St. Louis Community Credit Union Second Chance Checking | United Consumers Credit Union Second Chance Checking | ||

| Montana | Clearwater Credit Union SmartSpend Checking | Valley Credit Union Opportunity Checking | ||

| Nevada | Clark County Credit Union CheckAgain Checking | WestStar Credit Union Fresh Start Checking | ||

| New Jersey | Credit Union of New Jersey Right Turn Checking | Jersey Shore Federal Credit Union Fresh Start Checking | United Teletech Financial Federal Credit Union Fresh Start Checking | |

| New York | Adirondack Regional Federal Credit Union Free New Beginnings Checking | Alternatives Federal Credit Union Fresh Start Checking | Centra Credit Union Opportunity Checking | Financial Trust Federal Credit Union 2nd Chance Checking |

| North Carolina | Centra Credit Union Opportunity Checking | Excite Credit Union Fresh Start Checking | Skyla Credit Union Fresh Start Checking | |

| Ohio | Buckeye State Credit Union Second Chance Checking | Eaton Family Credit Union, Inc. Second Chance Checking | Hopewell Federal Credit Union Rebound Checking | Kemba Federal Credit Union Fresh Start Checking |

| Oklahoma | Allegiance Credit Union Second Chance Checking | Oklahoma Educators Credit Union Fresh Start Checking | Weokie Federal Credit Union Fresh Start Checking | Western Sun Federal Credit Union Fresh Start Checking |

| Oregon | Heritage Grove Federal Credit Union Fresh Start Checking | Point West Credit Union Fresh Start Checking | ||

| Pennsylvania | Centra Credit Union Opportunity Checking | Utilities Employees Credit Union Green Light Checking | West Branch Valley Federal Credit Union Back on Track Checking | |

| South Carolina | Carolina Trust Federal Credit Union Encore Checking | Market U.S.A. Federal Credit Union Fresh Start Checking | Skyla Credit Union Fresh Start Checking | |

| Tennessee | Liberty Federal Credit Union Opportunity Checking | Hearthside Bank Square One Checking | Select Seven Credit Union Second Chance Checking | |

| Texas | Associated Credit Union of Texas 180 Checking | Baptist Credit Union Draft Builder Checking | Kelly Community Federal Credit Union Smart Choice Checking | Prestige Community Credit Union Fresh Start Checking |

| Utah | American United Federal Credit Union Fresh Start Checking | Cyprus Credit Union Fresh Start Checking | ||

| Virginia | Central Virginia Federal Credit Union Fresh Start Checking | Healthcare Systems Federal Credit Union Renew Checking | Member One Federal Credit Union Smart Choice Checking | |

| Washington | MountainCrest Credit Union Fresh Start Checking | |||

| West Virginia | West Virginia Federal Credit Union Fresh Start Checking | |||

| Wisconsin | Brewery Credit Union Fresh Start Checking | Crossbridge Community Bank Fresh Start Checking | WESTconsin Credit Union Foundations Checking | |

| Wyoming | WyHy Federal Credit Union Second Chance Checking | Wyo Central Federal Credit Union 2nd Chance Checking | Valley Credit Union Opportunity Checking |

You'll want to understand the limited features that come with most second-chance bank accounts when you're trying to open one. As we said before, most credit unions will happily work to build your credit reputation with you over the course of time.

The goal is to help you graduate to a checking and saving account with full privileges and features. That will also help you to qualify for a credit card and improve your credit score.

Second chance checking account features include:

Your second chance account "dream list" come with the following:

Low or no monthly fees. No minimum balance requirements. Free services like: Debit card access, Online bill payments, Unlimited check-writing privileges.

You'll find that some second chance credit unions don't have some of these services or benefits, so you may have to shop around to find a credit union that fits your needs.

The good news is that, yes, they do.

The N.E.W. Credit Union tracks stories of their clients who have been helped by working with them:

"I came down with COVID-19 after starting a new job. I was sick for three weeks and had no health insurance, and also developed another medical issue that I am still battling one year later. During this time, we emptied our savings accounts and got behind on our loans. We didn't know where to turn, but the V.P. of Lending at N.E.W. Credit Union reached out and offered help. We were about to lose our vehicles when she helped us put a claim in for debt protection which brought the loans current. She went above and beyond making the calls for us, which made it possible for me to focus on getting well again. They have given us hope that we can rebuild everything with N.E.W. Credit Union in our corner!"

Second-chance checking accounts really do offer you a fresh start. It takes up to five years for negative remarks to fall off your report but don't worry about that.

Once you have a second chance bank account, you have a clean slate to start building a positive history with ChexSystem. And that will open doors of opportunity for you and your family to create a bright future.

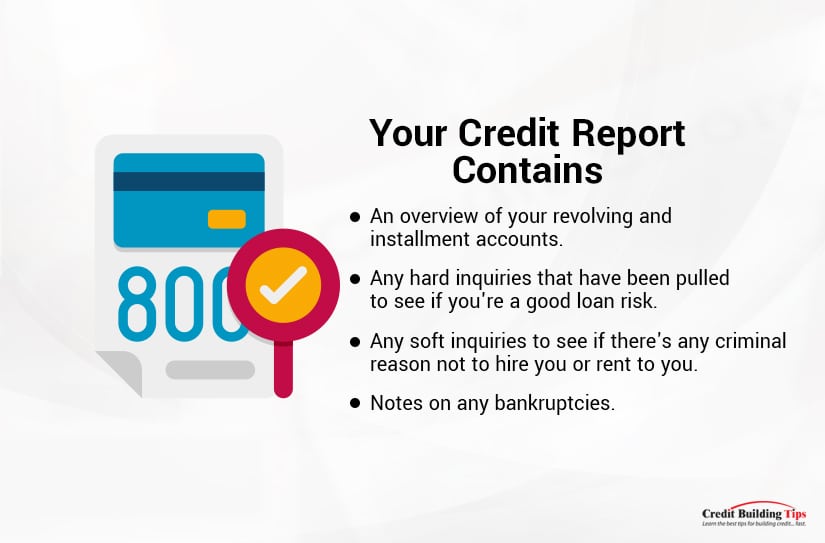

Did you know there are nearly 40 credit reporting agencies in the U.S.? But you've probably only heard of three of them as they're the ones regularly, and almost exclusively, referred to when talking about credit bureaus.

The three main credit reporting agencies are TransUnion, Experian, and Equifax.

They collect information on how Americans manage their financial obligations and then sell that information to lenders and credit-scoring companies. Lenders and credit-scoring companies then use that information to determine whether someone is a good loan or credit card candidate, how much they can safely loan them, and what interest rate they should offer.

While there's no need to keep these three agencies on your contact's "favorites" list, it is good to know how to get in touch with them if the need arises.

As you'll read below, each credit reporting agency has an extensive database. Forbes Advisor puts the number at approximately 220 million U.S. consumers. Whenever you apply for a loan or a credit card, it's "almost a given" that the lender will look at the credit reports compiled by at least one of these agencies.

They gather the lion's share of information about individuals and businesses from "data furnishers." These include lenders, banks, credit card issuers, collection agencies, and others. They can also gather information from public records and from data aggregation companies like Public Access to Court Electronic Records (PACER) and LexisNexis.

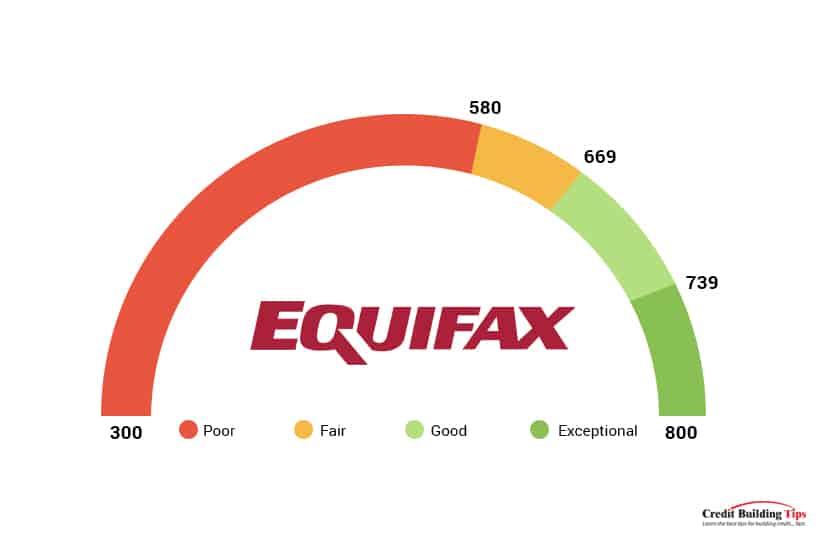

Equifax was founded in 1899 and is the oldest of the big three credit bureaus. It's currently headquartered in Atlanta, GA, and has approximately 11,000 employees. Their strongest presence in the U.S. is in the south and midwest, and they operate or have investments in 24 countries.

They collect and "aggregate" information on over 800 million consumers and more than 88 million businesses around the world. In addition to collecting credit and demographic data, they also sell credit monitoring and fraud prevention services to customers.

Equifax is a publicly owned company (stock ticker symbol EFX), and Better Business Bureau currently gives them an A rating. In spite of this rating, they've come under scrutiny for violating the FCRA.

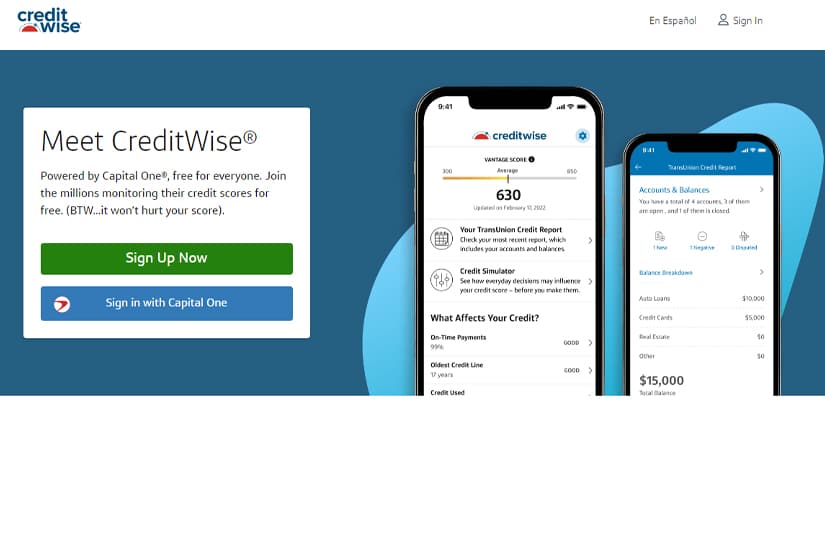

TransUnion was founded 54 years ago, and its headquarters are located in Chicago, IL. Like Equifax, they are a publicly owned company, and as of 2021, reported having 10,100 employees. It's reported to be the smallest of the big three credit agencies.

The latest numbers from TransUnion say they have a consumer credit database of 1 billion consumers in 30+ countries. Their global customer base extends to over 65,000 businesses, and they offer more than 3 billion updates per month from data providers.

The largest shareholders of TransUnion stock (stock ticker symbol TRU) are Goldman Sachs and Advent International. They have an A- on their Better Business Bureau rating but have also dealt with lawsuits and government penalties relating to credit-reporting practices over the years.

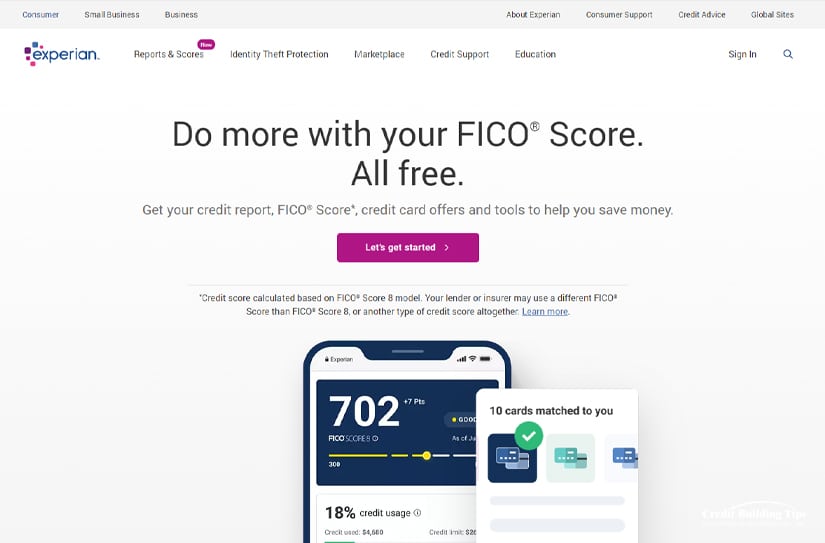

Experian is the youngest of the big three credit agencies, founded in 1996 in Dublin, Ireland. They're an American-Irish multinational data analytics and consumer credit reporting company. Their U.S. headquarters are located in Allen, TX, and they have over 20,000 employees in 43 countries.

Experian was created when the "now-defunct British retailer GUS acquired TRW Information Services — the largest U.S. credit bureau at the time." Since then, Experian has expanded around the globe, with operational hubs in England, Brazil, and California.

Its business focuses on credit, marketing, consumer services, and analytics. Experian tracks information on consumers, businesses, insurance, motor vehicles, and "select lifestyle characteristics."

Publicly owned (stock ticker symbol is EXPN.L), they have the lowest Better Business Bureau rating at B+. Experian has also experienced its fair share of legal woes, with consumers reporting outrage over a hard-to-cancel monthly subscription service that was offered as a "free credit report."

Even worse, 60 Minutes aired a segment about the number of errors on American credit reports. The news show interviewed three former Experian employees who described their experiences of company policies restricting them from fully investigating consumer disputes.

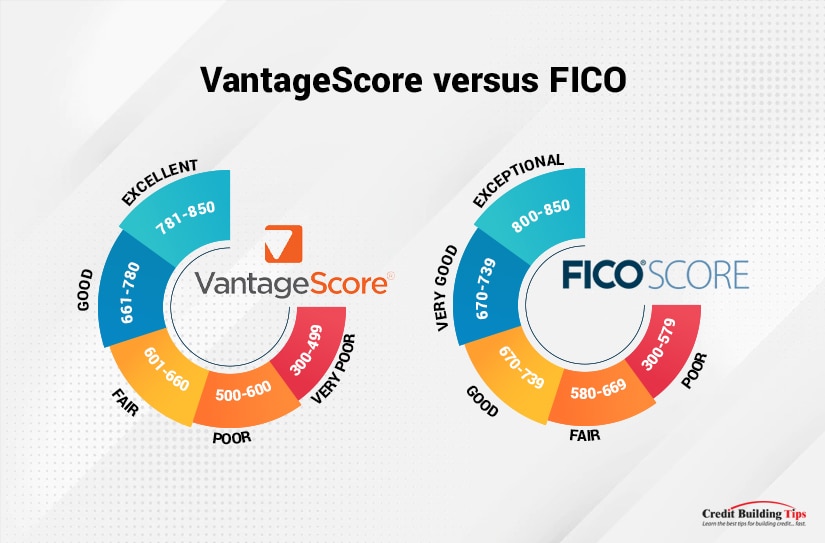

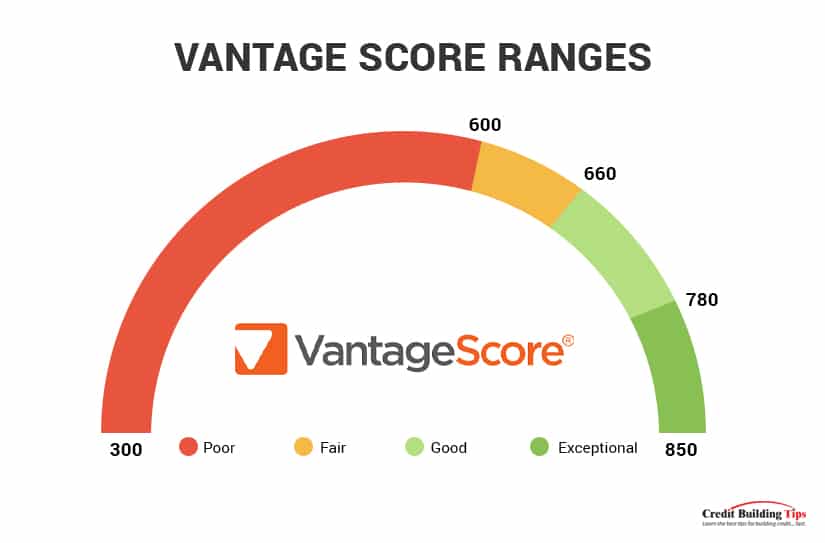

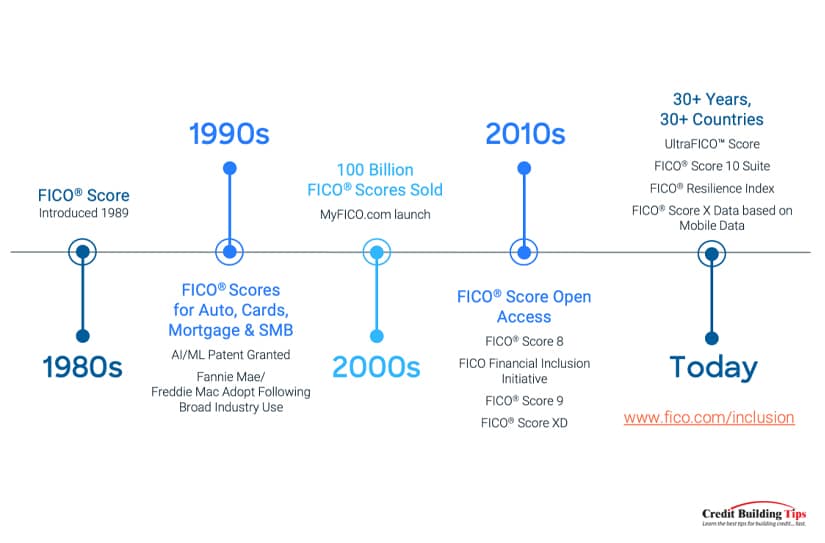

Before 2006, credit scores were generated by the Fair Isaac Corporation (FICO). In order to compete with FICO, TransUnion, Equifax, and Experian joined forces to create VantageScore. The first VantageScore model — 1.0 — could score 15 million more people than FICO had previously done.

In 2022, the latest tri-bureau credit scoring model is VantageScore 4.0. This version added features that let the model score 37 million more U.S. adults than was possible previously.

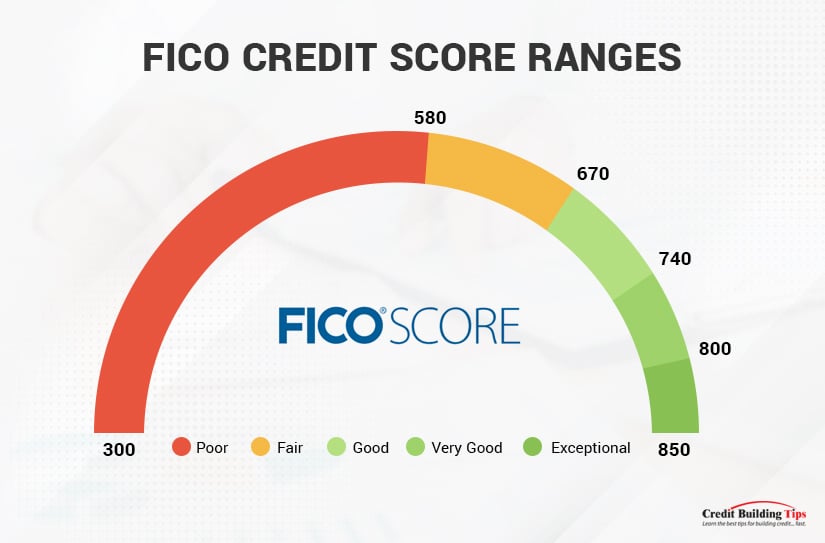

FICO and VantageScore use the same range for credit scores — 300 to 850- but they use different calculations to determine your credit score. FICO uses five categories of information and designates lending risk as poor, fair, good, very good, and exceptional. VantageScore uses six categories of information and designates lending risk as very poor, poor, fair, good, and excellent.

Many people view checking their credit report like they would view going to their doctor. They only think about making a doctor's appointment when something is wrong. Most of us don't consider regular medical checkups necessary unless we have an ongoing health concern.

We'd like to suggest you think about reading your credit reports more as you think about going to your dentist. Most people make regular dental appointments to have their teeth cleaned to ensure their mouth stays healthy, and so we're aware of any issues before they become major ones.

Regularly checking your credit report is one good way to be aware of the health of your finances. The government seems to agree, as they offer you a free copy of your credit report every year. Due to the COVID-19 pandemic, they're offering free weekly online credit reports through December 2023.

Three important reasons to check your credit report regularly are:

According to Alvenetta Wilson, Business Office Technology professor at San Jacinto College, one of the biggest misconceptions people have about credit bureaus is that:

"There's no reason to check their credit often if they have decent credit because the credit bureau produces accurate information."

Unfortunately, if you further research the history of the three main credit bureaus, you will find several instances of data breaches, lawsuits, fines, and even, in some cases, charges by the U.S. Department of Justice for sales to identity thieves.

Most recently, a Tennesse woman brought a lawsuit against all three credit bureaus, alleging the companies violated the U.S. Fair Credit Reporting Act. TransUnion, Equifax, and Experian all marked the woman as "deceased" on credit reports they created and then sold to third parties.

The complaint charges that these credit bureaus:

"Violated the FCRA by failing to follow reasonable procedures to assure the maximum possible accuracy of the information they reported about our client, which led to the companies falsely claiming our client was deceased."

The woman has disputed the inaccurate information since September 2021. Frustratingly, "all three companies allegedly lack the procedures to confirm a consumer is deceased even when the consumer communicates directly with them."

Hopefully, this will help you see how checking your credit reports might be worthwhile. An important part of becoming and staying financially healthy is knowing what's on your credit report and how to deal with any errors and possible fraud.

While it's impossible to walk through the front door of any of these offices, we've found as many ways as possible for you to contact and communicate with Equifax, TransUnion, and Experian.

Website: Equifax

Mailing address:

Equifax Information Services LLC

P.O. Box 740241

Atlanta, GA 30374-0241

Note: If you are mailing any type of dispute letter to Equifax, make sure to send it by certified mail and get a return receipt. If you are asked to include supporting documents, make copies, and don't send the originals. Unless you're specifically asked to. Then make a copy for yourself and send the original.

Note: If you are mailing any type of dispute letter to Equifax, make sure to send it by certified mail and get a return receipt. If you are asked to include supporting documents, make copies, and don't send the originals. Unless you're specifically asked to. Then make a copy for yourself and send the original.Phone number: 1-866-640-2273

Calls to this number are answered by a real person, and a call-back is available. The best time to call is 9:05 am, with an average wait time of 20 minutes.

Call center hours are:

9:00 am to 9:00 pm (E.T.) Monday through Friday

9:00 am to 6:00 pm (E.T.) Saturday and Sunday

Email: My Equifax

Website: TransUnion

Mailing address:

TransUnion

P.O. Box 1000

Chester, PA 19022

Note: If you are mailing any type of dispute letter to TransUnion, make sure to send it by certified mail and get a return receipt. If you are asked to include supporting documents, make copies, and don't send the originals. Unless you're specifically asked to. Then make a copy for yourself and send the original.

Note: If you are mailing any type of dispute letter to TransUnion, make sure to send it by certified mail and get a return receipt. If you are asked to include supporting documents, make copies, and don't send the originals. Unless you're specifically asked to. Then make a copy for yourself and send the original.Phone number: 1-800-916-8800 (Customer service)

Calls to this number are answered by a real person, and a call-back is available. The best time to call is 8:15 am, with an average wait time of 22 minutes.

Call center hours are:

8:00 am to 11:00 pm (E.T.) Monday through Friday

8:00 am to 5:00 pm (E.T.) Saturday and Sunday

1-833-806-1626 (Tech support)

Call center hours are:

8:00 am to 9:00 pm (E.T.) Monday through Friday

8:00 am to 5:00 pm (E.T.) Saturday and Sunday

Social: @AskTU (Facebook)

@Ask T.U. (Twitter)

Private messages or D.M. center hours are:

5:00 am to 12:00 pm (E.T.) Monday through Sunday

Website: Experian

Mailing address:

Experian

P.O. Box 2104

Allen, TX 75013-0949

Note: If you are mailing any type of dispute letter to Experian, make sure to send it by certified mail and get a return receipt. If you are asked to include supporting documents, make copies, and don't send the originals. Unless you're specifically asked to. Then make a copy for yourself and send the original.

Note: If you are mailing any type of dispute letter to Experian, make sure to send it by certified mail and get a return receipt. If you are asked to include supporting documents, make copies, and don't send the originals. Unless you're specifically asked to. Then make a copy for yourself and send the original.Phone number: 1-714-830-7000 (Best toll-free number)

Calls to this number are answered by a real person, and a call-back is available. The best time to call is 8:15 am, with an average wait time of 21 minutes.

1-800-493-1058 (Customer service department)

1-866-617-1894 (Membership questions)

Call center hours are:

7:00 am to 8:00 pm (E.T.) Monday through Friday

7:00 am to 7:00 pm (E.T.) Saturday and Sunday

Online: Dispute online

Order an Experian Credit Report

This service will cost up to $12 (plus tax) for a one-time Experian credit report, plus you can dispute online for free.

Order an Experian CreditWorks Basic report

This service is free from Experian and will give you an Experian credit report every 30 days on sign-in and basic Experian credit monitoring, and you can also dispute online for free.

Email: support@experiandirect.com

Other:

Experian Corporate Headquarters

475 Anton Blvd

Costa Mesa, CA 92626

1-714-830-7000Experian Corporate Headquarters

955 American Lane

Schaumburg, IL 60173

1-224-698-5600

Social: Experian Facebook

@Experian (Twitter)

Experian, Equifax, and TransUnion aren't the only credit reporting agencies out there. There are many other companies that provide credit reports of various sorts. Most have picked a niche for themselves, from rent and utility tracking to monitoring checking accounts and insurance behaviors.

Here's a quick glimpse of the alternative credit bureaus and what information they track.

Background checks:

Banking:

Histories:

Identity protection analytics:

Medical records:

Motor vehicle records:

Public information:

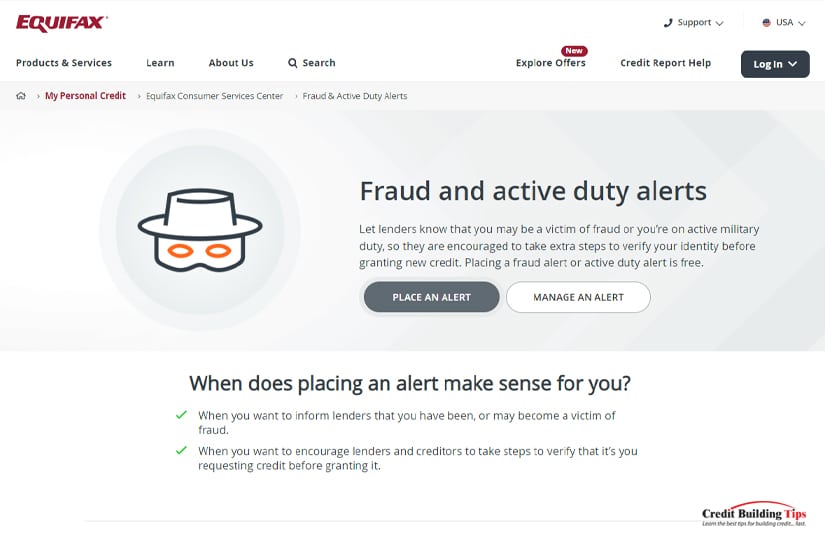

If you think you might be the victim of identity theft, you should contact your local law enforcement, your state attorney general, and/or the Federal Trade Commission (FTC). The FTC also has helpful information on how to protect yourself against identity theft.

Website: www.ftc.gov/idtheft

Mailing address:

Consumer Response Center

600 Pennsylvania Avenue NW

Washington, DC 20580

Phone number: 1-887-IDTHEFT (1-877-438-4338)

Website: www.naag.org/naag/attorneys-general/whos-my-ag.php

You can visit this website to see a list of all 50 U.S. states, plus the District of Columbia, American Samoa, Guam, the Northern Mariana Islands, Puerto Rico, and the U.S. Virgin Islands attorney generals' contact information.

Are there such things as "guaranteed approval" credit cards for people with bad credit? Doesn't it sound a little like a pink unicorn?

Well, believe it or not, guaranteed approval credit cards not only exist, but they're designed for people with bad credit!

Well, believe it or not, guaranteed approval credit cards not only exist, but they're designed for people with bad credit!But before you think you've found the answer to all your credit dilemmas, you should know that even a guaranteed approval credit card has a few qualification requirements. They may be minimal, but they're still there.

There are two basic requirements issuers want to see even for a guaranteed approval credit card:

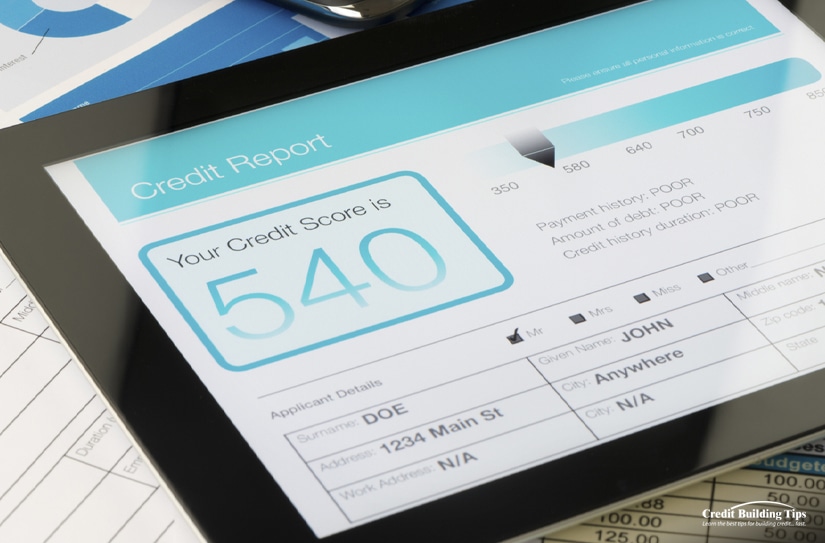

And while these types of cards are intended to help people with bad credit, just how bad can someone's credit be before they don't qualify for one of these cards? FICO considers a score between 300 and 600 as a bad credit score, while VantageScore uses the language of "poor" to indicate a bad credit score. Any number between 500 and 600 is considered a poor credit score, and a number between 300 and 499 is considered "very poor."

Knowing which companies will help "subprime borrowers" is extremely important, as applying for a credit card and getting rejected causes your credit score to drop again.

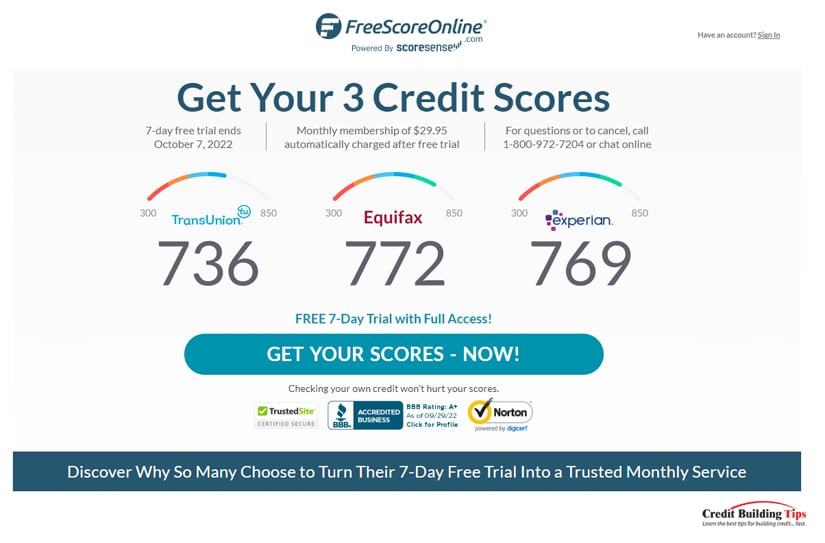

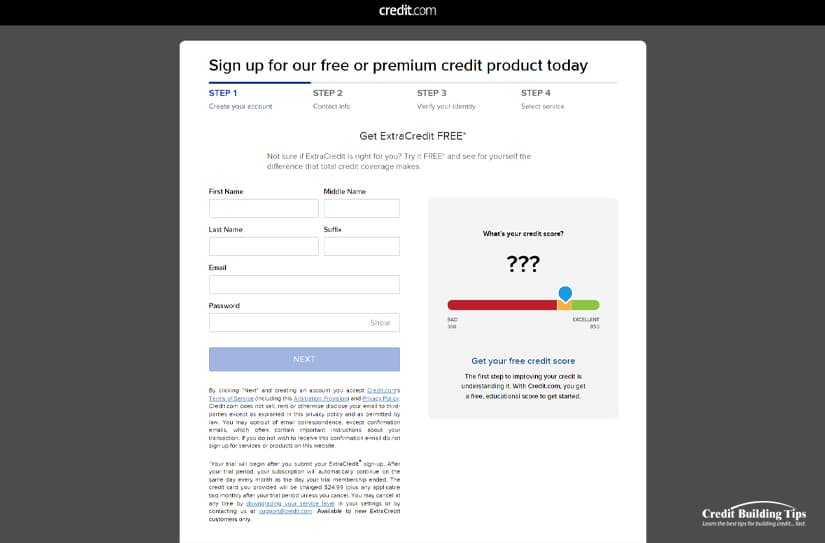

Along with knowing which companies can provide you with a credit card, even if you have "bad" credit, you need to know your credit score. Now is not the time to stick your head in the sand and hope for the best.

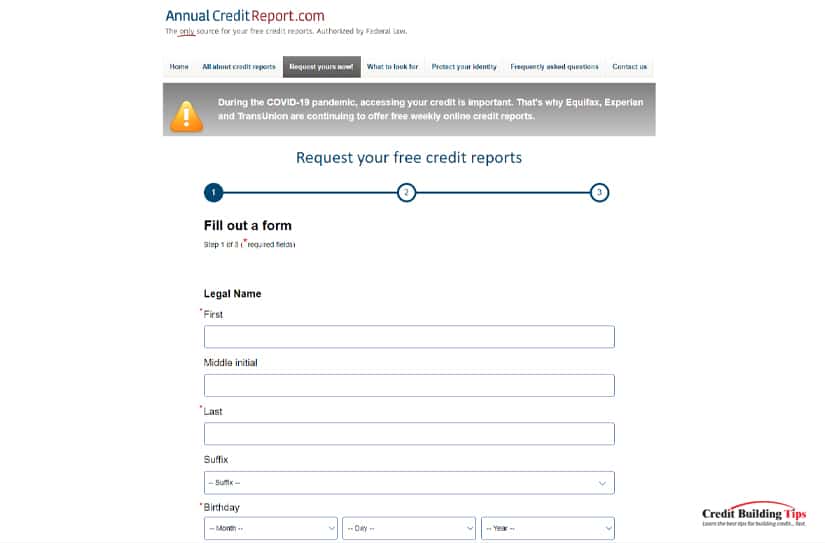

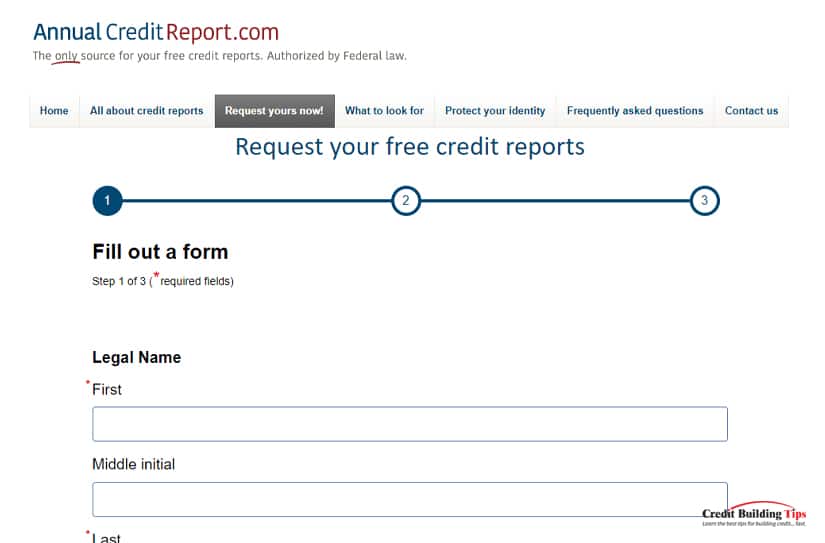

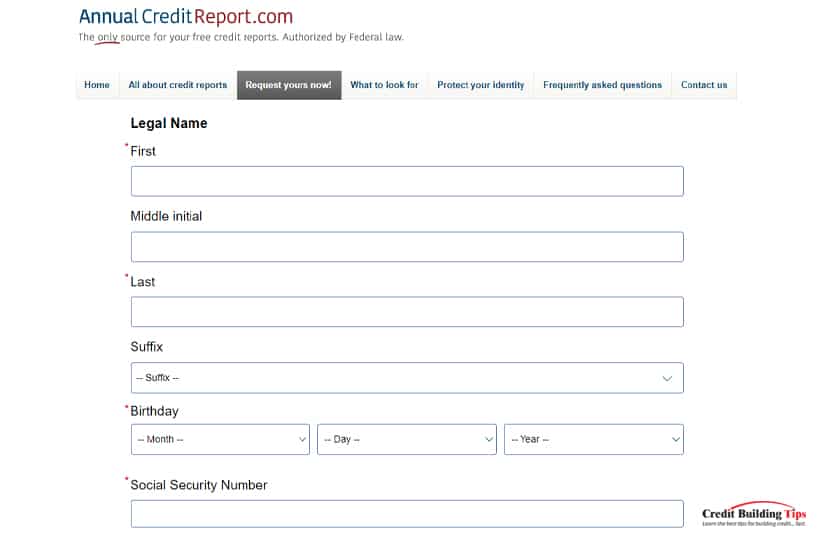

Through 2023, you can request a free copy of your credit report at www.annualcreditreport.com. It takes three easy steps to request credit reports from Equifax, Experian or TransUnion (or all three simultaneously).

You'll be asked a few questions to which only you should know the answer. They're meant to be challenging to help protect you from identity theft. Once you answer the questions, you can download and print your credit report.

On Annual Credit Report's site, they disclaimed,

"Your free annual credit report does not include credit scores."

The primary reason it's important to check your credit report is to make sure all the information on the report that determines your score is accurate.

That's on you. No one will check your report to verify that your identifying information is correct and up-to-date or if a company inputs the wrong information or claims that you owe them money when you really don't.

You can use dispute processes to correct any errors and should do so as soon as you are aware of the mistakes:

It's normal for the two credit scoring models to produce different numbers. Lenders understand this and look beyond the number to what it represents — good, bad, fair, excellent.

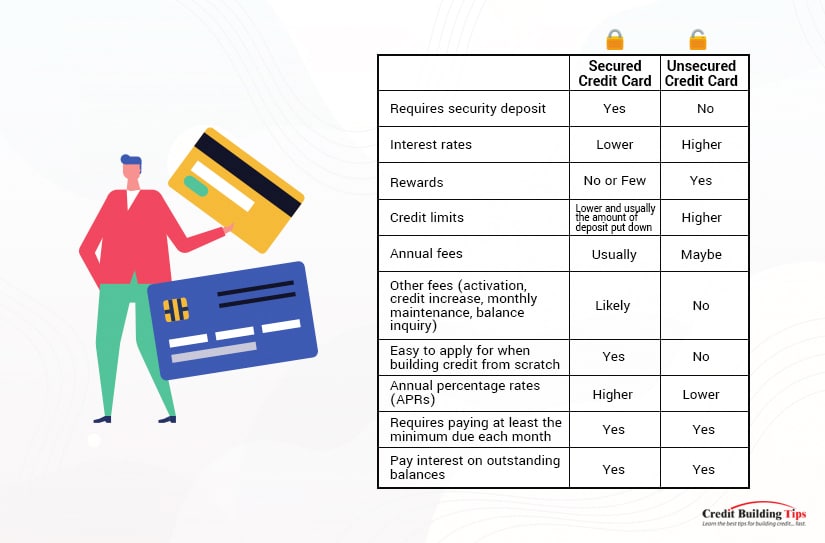

There's a major difference between secured and unsecured credit cards.

Investopedia defines a secured credit card as a "type of credit card that is backed by a cash deposit from the cardholder." With a secured credit card, you pay a cash deposit upfront to guarantee your credit line if you default on any payments.

An unsecured credit card doesn't require collateral as a security deposit to secure it. They're a common type of credit card, but not one that someone with poor credit will likely qualify for.

Once the deposit is in place, a secured credit card acts like any other credit card, although they usually have lower credit limits and more fees than unsecured credit cards do.

In a sense, secured credit cards act like debit or ATM cards, so why are they better than using a debit card or getting cash from an ATM? Technically speaking, a secured credit card still uses credit from the issuer — they just have access to a cash reserve if the user doesn't pay their credit card bill.

A secured card is worth getting because it is a way to build your credit score, whether you have bad credit or no credit due to your age or life circumstances. As long as you continue to pay at least the minimum owing on your card, you'll improve your credit score and may look forward to qualifying for an unsecured credit card without needing to tie up collateral or a cash deposit.

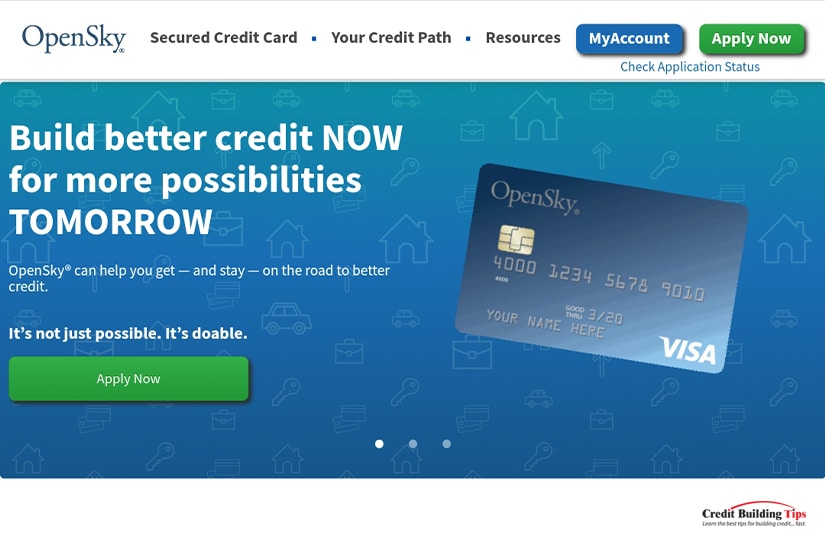

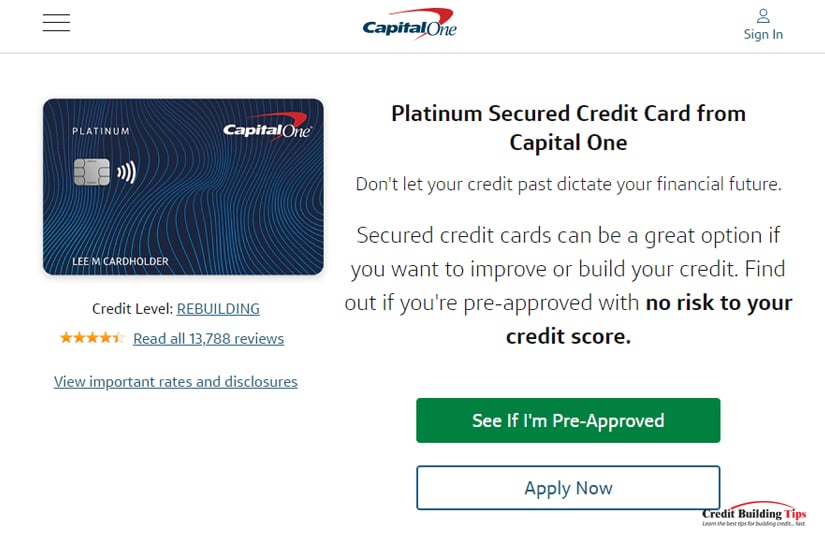

While nothing is truly guaranteed, these are the easiest credit cards to get approved for. Bad credit or no credit is not, on its own, a barrier to getting one of these 12 credit cards.

Secured rating: 4.5

Average approval rate: 85% for the past five years

Credit needed: Poor

Requires: U.S. mailing address, proof of identity, some income

Doesn't require: Credit history, credit check

Annual fee: $35

Regular APR: 20.39% variable

Secured rating: 4.6

Average approval rate: N/A

Credit needed: All scores welcome to apply

Requires: $300 initial refundable deposit (sets your credit limit)

Annual fee: $69

Regular APR: 19.99% variable

Secured rating: 4.7

Average approval rate: N/A

Credit needed: Limited or bad

Requires: A deposit amount that's less than the credit limit you'll be given, credit check with all three credit bureaus

Doesn't require: Credit score

Annual fee: None

Regular APR: 28.49% variable

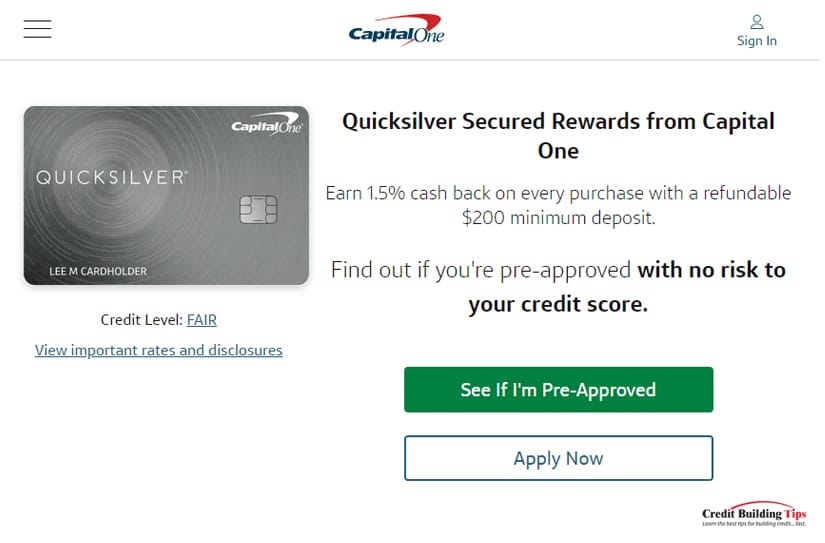

Secured rating: 4.8

Credit needed: Limited, bad

Requires: U.S. mailing address, have a valid SSN, disclosure of total annual income, access to authorized bank account, refundable $200 security deposit to get a $200 initial credit line

Annual fee: None

Regular APR: 28.49% variable

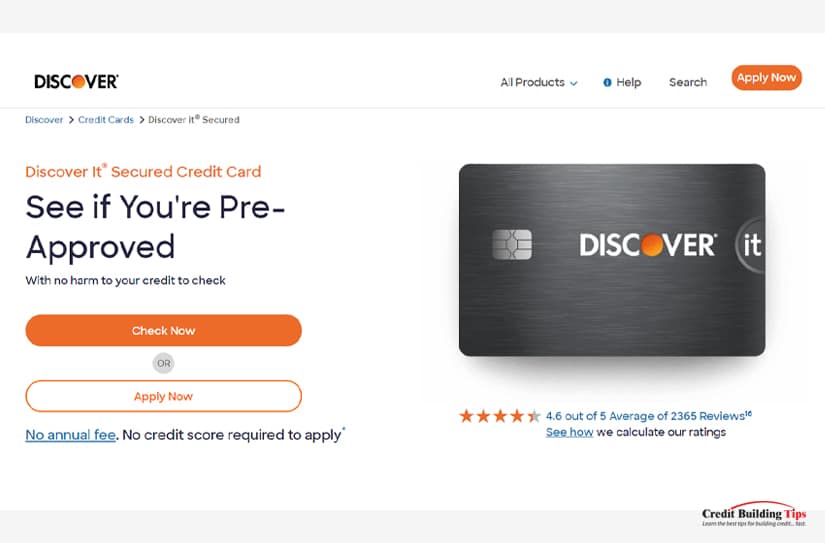

Secured rating: 4.7

Average approval rate: N/A

Credit needed: New or rebuilding

Requires: 10.99% intro APR for six months, minimum refundable $200 security deposit to get a $200 initial credit line

Doesn't require: Credit score

Annual fee: None

Regular APR: 25.99% variable

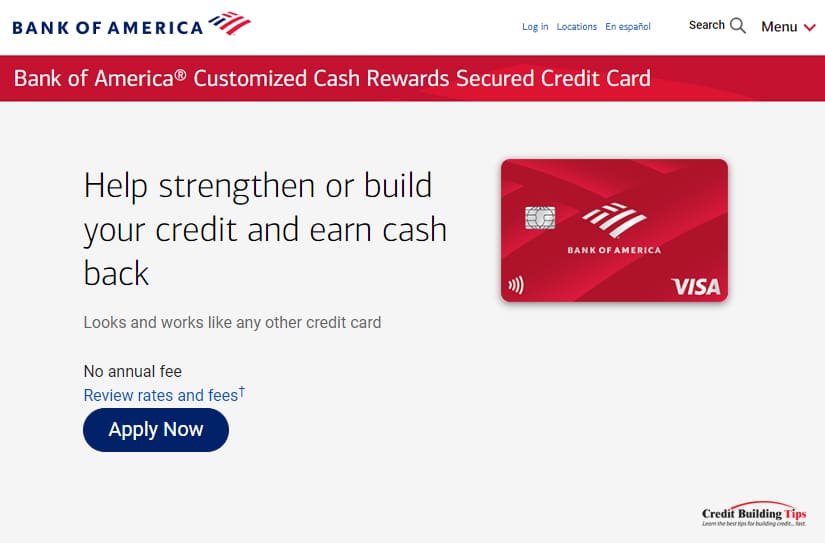

Secured rating: 4.6

Average approval rate: N/A

Credit needed: Bad or limited

Requires: A minimum refundable security deposit of $200 (maximum of $5,000)

Doesn't require: Credit check

Annual fee: None

Regular APR: 25.49% variable

Secured rating: 4.5

Average approval rate: N/A

Credit needed: Limited history, no credit, new to credit

Requires: Minimum refundable $200 security deposit

Doesn't require: Credit check

Annual fee: None

Regular APR: 25.49%

Secured rating: 4.5

Average approval rate: N/A

Credit needed: N/A

Requires: Minimum refundable $250 security deposit

Doesn't require: Credit check

Annual fee: None

Regular APR: 14.99%

Secured rating: 4.5

Average approval rate: None, poor

Credit needed: N/A

Requires: Must be a member of Navy Federal Credit Union, minimum refundable $200 security deposit

Doesn't require: Credit check

Annual fee: None

Regular APR: 18%

Secured rating: 4.5

Average approval rate: N/A

Credit needed: Bad, limited, no credit

Requires: Minimum refundable $200 security deposit

Doesn't require: Credit check

Annual fee: None

Regular APR: 18%

Bad credit rating: 4.3

Average approval rate: N/A

Credit needed: Fair, good or previous bankruptcy

Requires: Minimum refundable $200 security deposit

Doesn't require: Credit check

Annual fee: $0 - $99

Regular APR: 24.9%

Bad credit rating: 4.4

Average approval rate: N/A

Credit needed: Bad, fair, or no credit

Requires: See terms

Doesn't require: Credit check

Annual fee: See terms

Regular APR: 24.99 - 29.99% variable

Bad credit rating: 4.3

Average approval rate: N/A

Credit needed: Bad, poor, fair

Requires: See terms

Doesn't require: Credit check

Annual fee: See terms

Regular APR: 29.99%

In general, no credit is better than having bad credit. But when it comes to qualifying for loans or a credit card, these issues put you in a difficult position. If you find a loan or credit card company that will lend you money, you'll likely have a higher interest rate with less attractive borrowing terms.

Even with these similarities, bad credit and no credit are two different problems, requiring different strategies to overcome them.

Bad credit is usually defined by one or more of these behaviors: late payments, collection accounts, bankruptcies, charge-offs, or other damaging items. Bad credit behavior is reflected in bad credit scores of less than 600 for FICO and VantageScore.

According to FICO Score, the average credit score is currently 716, and 15.5% of Americans have a score below 600.

According to FICO Score, the average credit score is currently 716, and 15.5% of Americans have a score below 600.

No credit is when someone has never applied for a loan, credit card, or financing before and has zero credit history. It's hard to develop a credit score when one is "credit invisible" and doesn't meet the minimum requirements for a FICO or VantageScore credit score.

In the eyes of lenders, bad credit is seen as worse than no credit. No credit means you're an unknown quantity, while bad credit means you're a known quantity with a history of credit management mistakes.

We've alluded to some ways to fix bad credit above, but let's be clear about four ways you can fix bad credit and turn a low credit score into a higher one that will give you more opportunity to borrow money with fewer penalties.

Here are the four ways you can fix bad credit:

So, while you can get a credit card even with bad credit, we'll keep encouraging you to move forward by repeating the last bit of advice: develop good credit habits. Do the work to pay your bills on time, every time.

You'll not only improve your credit score, but you'll also sleep better. And the world will offer you more opportunities to expand your horizons.

You'll not only improve your credit score, but you'll also sleep better. And the world will offer you more opportunities to expand your horizons.Do you have any questions about any of these listed credit cards or anything else credit-related? If so, be sure to drop us a comment down below, and we'll get to answering any of your potential questions as soon as possible!

It's easy enough to make a payment late during the best of times, but with the effects of COVID-19 still lingering, many people still struggle to pay all their bills on time.

The recent shock to the world economy disrupted supply chains which caused major delays in shipping. Labor shortages and rising demand only made things worse for many Americans, and inflation remained near a 40-year-high as of last month.

Two-and-a-half years into the pandemic, 75% of Americans have non-mortgage debt, and many of them report that they are struggling hard to pay them down. Last year Americans thought they would be able to pay their COVID-related debt off within a year, but now only 22% do.

"Seventy percent of Americans have lived paycheck to paycheck at some point during the pandemic, and nearly half (48%) are living paycheck to paycheck right now."

Forbes posted an article reporting that:

"75% of Americans have missed credit card payments due to COVID-19."

Obviously, some of these missed payments could be due to forgetfulness, but a "whopping 43% of respondents missed or paid late due to needing that money for essentials, while another 27% couldn't pay due to unexpected expenses."

Households who qualified as middle-income put their expenses on their credit cards, hoping to pay the debt off in the future. They also used bank loans and lines of credit and, in some cases, took on payday loans.

Experian reports,

"There's a good chance your lenders are prepared to work with you to provide payment relief without causing late payments to appear on your credit reports."

With the best will in the world, it hasn't been possible for everyone to pay bills on time and avoid late payment fees. We've researched ways for you to deal with and remove the late payments you may have incurred since 2020.

Thankfully, if you have late payments that resulted during COVID-19, there are ways to remove them from your credit report.

Thankfully, if you have late payments that resulted during COVID-19, there are ways to remove them from your credit report.The CARES Act is the Coronavirus Aid, Relief, and Economic Security Act that came into effect on March 27, 2020, and was created to help Americans impacted by COVID-19.

One of the biggest ways this act protects you is that creditors must make accommodations for people who are having trouble making their payments on time. You'll still have to make your payments, but if you contact your creditor or lender, they must offer you an alternative payment arrangement.

One of the biggest ways this act protects you is that creditors must make accommodations for people who are having trouble making their payments on time. You'll still have to make your payments, but if you contact your creditor or lender, they must offer you an alternative payment arrangement.

There are four main types of agreements creditors and lenders are currently making:

Once you have contacted your creditor and made arrangements with them, they cannot report your payments as "past due" as long as your account was in good standing prior to the pandemic.

The timeline applies to agreements that were made between January 31, 2020, and 120 days after the COVID-19 national emergency ends.

Before you start negotiating with your creditor in order to get a late payment removed, you'll want to understand why you were reported late and identify the circumstances that caused the late payment.

Check if the payment was missed or if it bounced. A payment may be marked late because you didn't make a big enough payment to cover the minimum amount due.

It's always worth checking to see if the creditor made a mistake, not you.

If you do find they made a mistake, call them as soon as possible.

If you do find they made a mistake, call them as soon as possible.Ten of these common mistakes were listed by Ali Zane on his iMax Credit site, and we've included them as he listed them:

If you find your late payment is due to one of these reasons, he recommends you ask the creditors to remove the "late payment" designation as a courtesy. It's also wise to ask them for a letter stating their willingness to remove the "incorrect late payment from the credit report."

Some banks and credit card companies may positively respond to requests made by phone, while others would need a lot of convincing, and some would take hard work to get them to change their position.

Some extenuating circumstances may work in your favor if they apply to your situation. We haven't found a better list of these types of circumstances than those listed by Ali Zane in the same article, so we'll give them to you in their entirety:

You won't be able to communicate these extenuating circumstances via a phone call. You'll need to fax the information to the appropriate credit bureau and ask them to review it, which usually happens within two to four weeks.

If you can now make your payments, were able to pay your bills on time, and only fell behind when the pandemic started, there are ways to remove the late payments from your account.

Many creditors can understand and sympathize with people struggling to keep up with paying their bills during this time. Calling your lender directly may give you a more human experience than you anticipated.

First, let them know that you have made or are making the past due payment immediately. They'll want to know your circumstances since the pandemic began so they can fully understand your situation. They might also ask you to scan and email them (or fax) supporting documents that show you lost your job or were ill due to COVID-19.

You can request three things while on the phone with the representative:

Most creditors have higher-level customer resolution departments. If your initial phone call doesn't get you the results you need, ask to speak to a manager or someone in a more senior position.

Alternatively, you can Google the company's website to find their phone number, address, or department's email address. Send a letter to the CEO and include all your contact information so they can reply to your request.

Make sure to include as much information as possible as to the circumstances that caused your payments to be late, and include any documents that will support your claim. A respectful and honest letter can go a long way to getting your late payments removed.

If you do any amount of research or try to accomplish this on your own, you'll see that it's a lot of work. That's why it's sometimes best to hire a credit repair company to help you.

Don't assume all credit repair companies are created equal. Make sure to check reviews to see what other people have to say about their experience with the company. Check to see if it complies with your state's licensing and registration requirements.

Finally, read the fine print about when they will charge you for their services. You don't want to pay them anything until they successfully repair your credit. Nor do you want to pay them a monthly fee or any extra hidden fees.

Although the circumstances of COVID-19 don't meet the criteria of "ordinary" circumstances that will qualify you for forbearance, many lenders are approving forbearance for those who are financially struggling due to the pandemic.

According to Experian:

"…any of your accounts placed in forbearance under the CARES Act will be "paused" in the payment status they are at when forbearance begins. If the account is current and in good standing, it will stay that way even if payments are reduced or suspended during forbearance. If an account is, say, 30 days past due when forbearance starts, it will remain at that status (and not rack up further delinquency) during the forbearance period."

They've also compiled an exhaustive list of financial and non-financial institutions' websites to help you find more relief measures.

The U.S. is also invested in helping you get through this season and back on track financially. They've instituted a wide range of government programs to help with everything from phone bills to medical bills to prescription drug costs.

These programs include:

SNAP — also known as food stamps — just got a boost to $36 a month for the average recipient. Check their eligibility requirements to determine whether you or someone you know who's in need qualifies.

Once the pandemic is behind us and we've had a chance to catch up, we'll all be in a better position to take charge of our financial life again.

The most important reason to prioritize making payments on time is that this alone is the best thing you can do to improve your credit score. Your payment history makes up 35% of your score. Pay on time, every time, and you'll be on your way to a great credit score.

Paying your bills on time will also save you money as you won't be charged late fees. Some companies set your "payment due" on a timer and will start to charge late fees the second the clock ticks over.

You'll benefit from lower interest rates as well as getting access to better products. Landlords consider your credit score as part of your application, and a higher credit score can give you the edge over other applicants.

One last shout-out to iMax Credit. Their team of expert credit repair specialists can help you with every credit situation you may face. The last list we'll share with you from them rates an extensive list of creditors based on how easy or difficult it is to get them to remove late payments:

The creditors we consider to be easy to work with include:

The creditors that may take a little more effort to work with include:

The creditors that are considered difficult to work with include:

Some good news is that the Federal Reserve Bank (and many experts) don't think this inflation is long-term. They believe that once the supply chain issues are worked out, "in a lot of cases…prices will actually drop."

We can only hope they're right. In the meantime, if you're looking for ways to improve your credit scores as fast as possible, I'm here to help!

You may be surprised to learn that many Americans currently have issues with their credit scores — and it's not their fault.

In August of this year, CBS News reported that Equifax:

"Admitted last week that it misreported some consumers' credit scores."

Over three weeks this spring, the credit bureau sent out incorrect scores for consumers who were applying for mortgages, car loans, and credit cards.

The Wall Street Journal pushed back against Equifax's CEO, Mark Begor, when he said,

"The impact is going to be quite small, not something that's meaningful to Equifax."

He described the issue as a "flub," while the WSJ found that according to bank executives and others "familiar with the errors," the company provided inaccurate credit scores on millions of U.S. consumers.

A Florida woman who experienced the "flub" and found her car loan to be "substantially pricier" is now part of a lawsuit that's seeking class-action status against Equifax. Nydia Jenkins was pre-approved for a car loan in January, but it was denied in April because her credit score was off by 130 points.

Ms. Jenkins then had to buy a car from a different dealership that charged her a much higher interest rate. Her pre-approved rate would have had her paying $350 each month for the car loan, but the new rate has her paying $544 each month. That adds up to about $2,352 more each year she has the loan.

LendingTree surveyed more than 1,000 U.S. consumers to see whether they thought their credit scores "accurately reflect their financial responsibility." On the report, 42% of Americans said their credit scores stopped them from getting some type of loan.

Shockingly, 44% of Gen Zers don't know their credit scores, and 25% don't know how to find out what it is. The survey also found that, overall, 19% of all Americans don't know their credit score, and 12% admit they don't know how to check it.

Shockingly, 44% of Gen Zers don't know their credit scores, and 25% don't know how to find out what it is. The survey also found that, overall, 19% of all Americans don't know their credit score, and 12% admit they don't know how to check it.While you may or may not be one of those millions affected by the spring's problems, it certainly makes a good case for checking your credit report for errors and dealing quickly with any you find.

Not all errors are widescale as the ones I talked about above. Sometimes they're a result of simple human error. Credit files can get mixed up, data entries can be mistyped, names misspelled, or a furnisher falls behind in updating their system.

Sometimes, errors on your credit report are a sign of identity theft. If there's an account on your credit card or a loan application you don't recognize, don't wait to contact the credit bureau to investigate.

Fortunly recently posted two concerning statistics that should wake all Americans up:

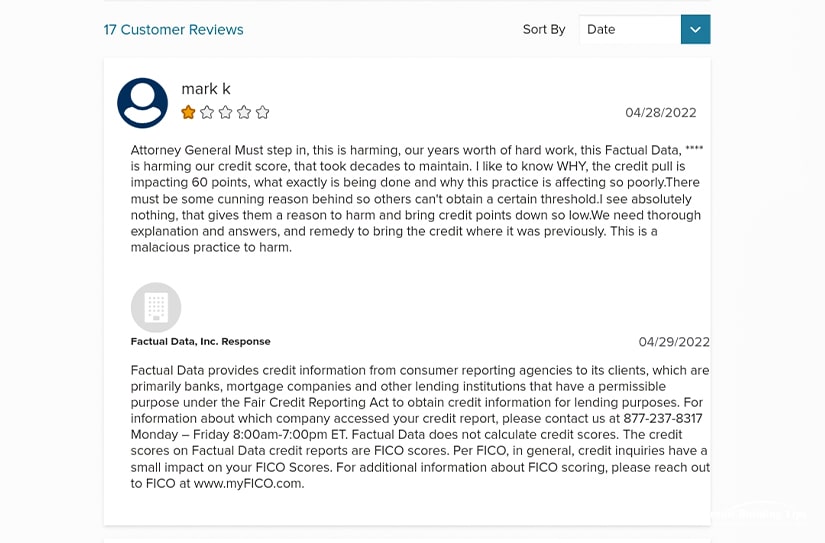

If the first basic step is to check your credit score number, the next step is to check your report for any errors. And if you do find an error or two? That's where 611 dispute letters come to the rescue.

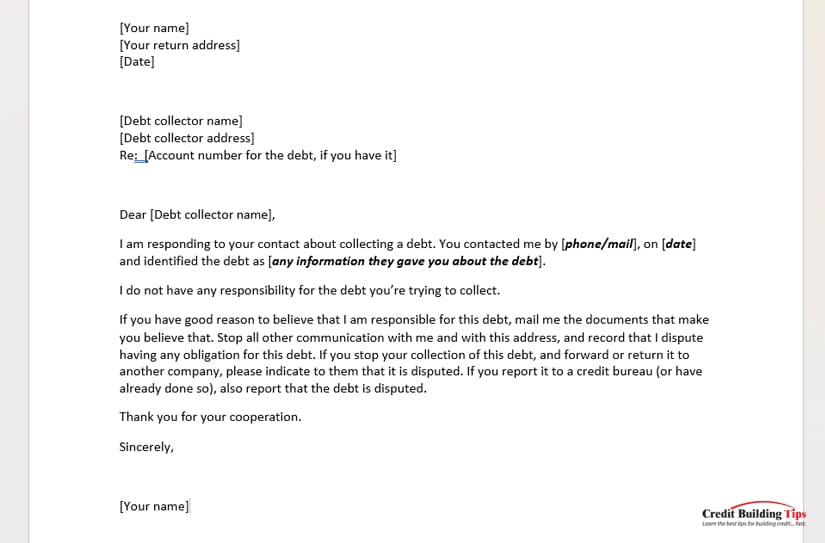

A credit report dispute letter is well-named. It's just what it sounds like — a letter you send that tells the credit bureau you don't agree with one of the items on your report.

A credit report dispute letter is well-named. It's just what it sounds like — a letter you send that tells the credit bureau you don't agree with one of the items on your report.You can send the letter directly to the credit bureau (they're also called credit reporting agencies) or to the data furnishers that gave the information to the bureau in the first place.

You can choose to send a credit report dispute letter through an online form, but experts recommend that you print a physical copy and send it through the U.S. postal system. For the price of a stamp, you get these two advantages:

The Federal Trade Commission (FTC) recommends you send your letter by certified mail and ask for a return receipt. That way, you have indisputable proof the credit bureau or data furnishers received your letter.

There are three types of credit report dispute letters. You can send a general dispute letter — simple and easy. This type of letter shows the mistake made, provides proof, and asks the bureau to fix the mistake.

Then there are the numbered credit dispute letters — 609, 611, and 623. Each of these letters references a different section of the Fair Credit Reporting Act (FCRA). The act was created in 1914 to make sure Americans had the following rights:

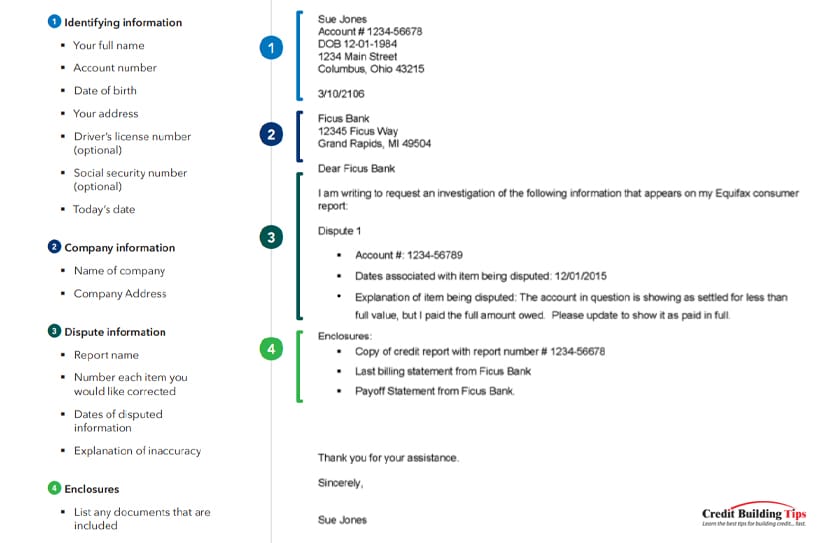

Not surprisingly, a 611 credit report dispute letter references Section 611 of the FCRA. Just like a 609 credit report dispute letter references Section 609 and a 623 credit report dispute letter references Section 623 of the FCRA. They're all variations on a theme.

You can think of a 611 credit report dispute letter as a second state letter. You learned about a 609 credit report dispute letter in this earlier post. If you don't get the answer you wanted from the 609 letter, a 611 letter is your second kick at the can.

You can think of a 611 credit report dispute letter as a second state letter. You learned about a 609 credit report dispute letter in this earlier post. If you don't get the answer you wanted from the 609 letter, a 611 letter is your second kick at the can.

After you write the initial 609 letter asking the credit bureau to verify an item on your credit report, they'll get back to you with one of two responses. The hoped-for response is, "Oops, our mistake. We will correct it, and the error will no longer affect your credit score." End of the correspondence.

If they respond by letting you know they checked the information and believe no error was made, you can write them a second letter. A 611 letter of dispute.

A 611 credit report dispute letter needs to include four specific parts:

1. Your identifying information:

2. The company information you're making a dispute against:

3. Dispute information:

4. Enclosures:

It's also good to know that along with sending a 611 letter to your credit bureau, you can also send a copy with the same information to the company that gave the wrong information to the bureau. For instance, if your credit report lists wrong information from your bank, landlord, or cell phone company, you could (and probably should) send them a duplicate of what you've put together to send to the credit bureau.

Make sure to keep all original paperwork. Mail one copy to the credit bureau and one copy to the furnisher. Don't forget to pay extra money to send both packages by certified mail and ask for a return receipt.

I've given you the snail mail addresses of the three main credit bureaus before, but here they are again:

Equifax Information Services LLC

P.O. Box 740256

Atlanta, GA 30374Experian

P.O. Box 4500

Allen, TX 75013TransUnion LLC

Consumer Dispute Center

P.O. Box 2000

Chester, PA 19016

Each of these credit bureaus provides an online link to download a dispute form but remember that the FTC recommends you go the extra mile and print out and mail your dispute letter with all the supporting documentation.

Another helpful tip is to dispute one error at a time. If you find a large number of errors, you may want to group them into bundles and space out the disputes.

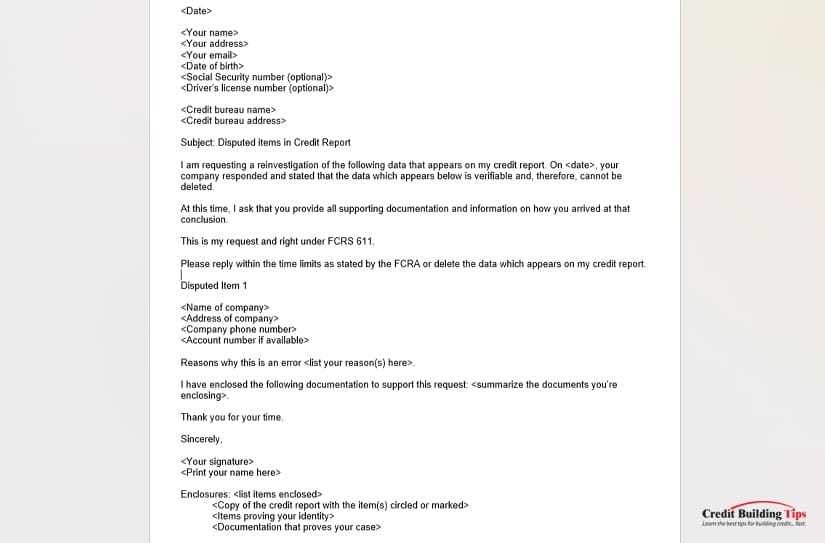

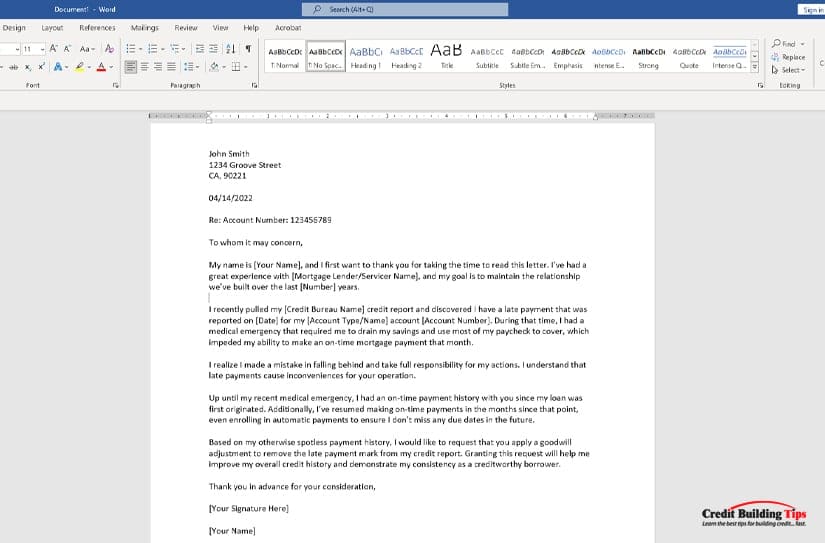

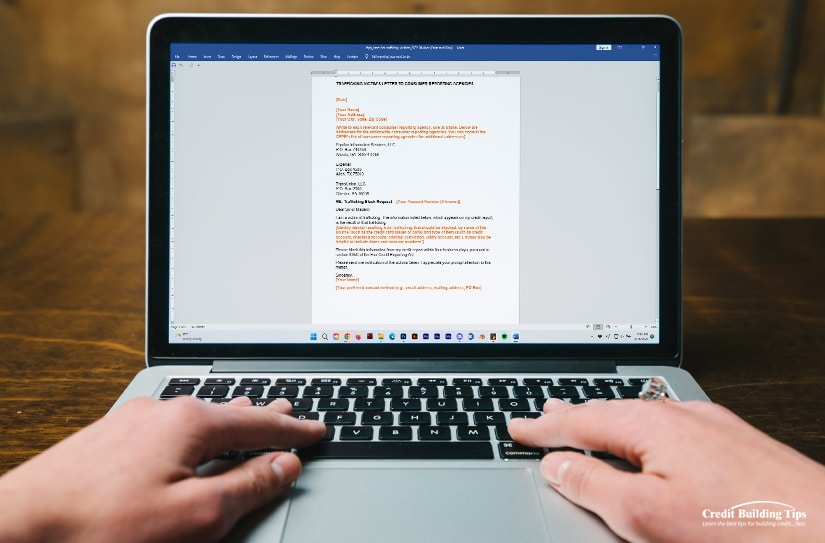

Here's a template we found on Debt.com that anyone can use for a simple 611 dispute letter:

<Date>

<Your name>

<Your address>

<Your email>

<Date of birth>

<Social Security number (optional)>

<Driver's license number (optional)><Credit bureau name>

<Credit bureau address>Subject: Disputed items in Credit Report

I am requesting a reinvestigation of the following data that appears on my credit report. On <date>, your company responded and stated that the data which appears below is verifiable and, therefore, cannot be deleted.

At this time, I ask that you provide all supporting documentation and information on how you arrived at that conclusion.

This is my request and right under FCRS 611.

Please reply within the time limits as stated by the FCRA or delete the data which appears on my credit report.

Disputed Item 1

<Name of company>

<Address of company>

<Company phone number>

<Account number if available>Reasons why this is an error <list your reason(s) here>.

I have enclosed the following documentation to support this request: <summarize the documents you're enclosing>.

Thank you for your time.

Sincerely,

<Your signature>

<Print your name here>Enclosures: <list items enclosed>

<Copy of the credit report with the item(s) circled or marked>

<Items proving your identity>

<Documentation that proves your case>

Once the credit bureau receives a 611 letter, they are required by law to

"Conduct a reasonable reinvestigation to determine whether the disputed information is inaccurate and record the current status of the disputed statement, or delete the item from the file…"

In other words, if you ask them to check again, they must do so. And they need to do it free of charge within 30 days of receiving your letter. They're entitled to a 15-day extension if they get new information that's relative to their investigation.

If, after the reinvestigation, the disputed claim is found to be:

The credit bureau has no choice but to promptly:

Go online, and you'll see vendors selling these types of letters and bragging they're a loophole that will let you play the system. Nothing can be further from the truth.

The FCRA protects its consumers' right to question whether there's an error on their credit report. If an error is found or the information provided to credit bureaus and furnishers cannot be verified, they must remove it.

If the credit bureau can provide the information to show an item on your credit report is legitimate, they are under no obligation to remove it. Any legitimate item will stay on your credit report until enough time has passed and it falls off.

You are far better served to work hard on repairing your credit report by paying your bills on time, paying your credit card balances strategically, and asking for higher credit limits, than trying to play the system over fake negative items.

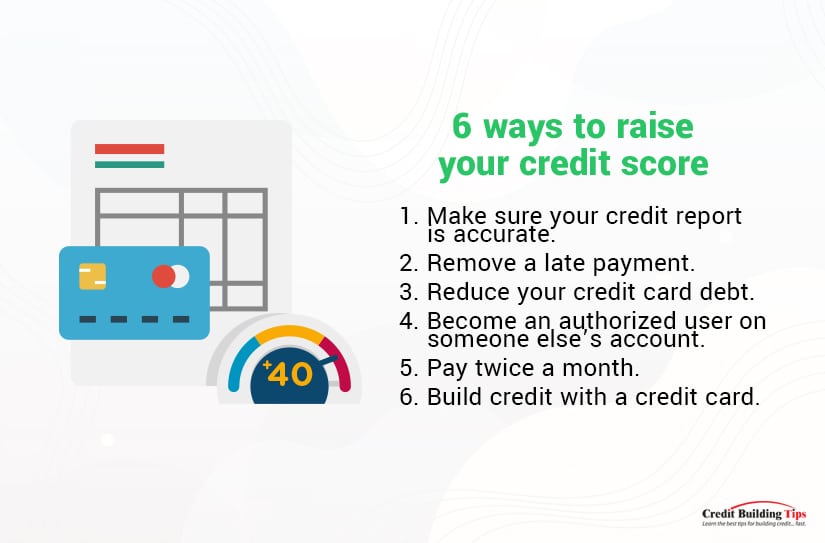

These three strategies are considered "highly influential" in raising your credit score by Nerd Wallet. While they include six other ways to improve your credit fast, these three help you the most.

Paying your bills on time is the "largest scoring factor in FICO and VantageScore credit scoring systems." If you find you can't make a payment and the time drags on over 30 days, call your creditor and let them know. Make arrangements with them for how soon you can pay and ask them if they would not report the missed payment to the credit bureaus.

Strategically paying your credit card balances is linked to your credit utilization. Develop the discipline to use less than 30% of your credit card's limit — lower is even better. You can manage this by keeping an eagle eye on your credit card and paying off the balance once you see you're getting close to the 30% utilization cut-off line.

Ask for higher credit limits to repair your credit score. Your credit utilization ratio will drop if you receive a higher credit limit and don't add to your credit balance. Your credit utilization ratio will drop if you receive a higher credit limit. Don't spend the extra credit limit!

Please let me know if you have questions in the comments about how to fix your credit, build your credit, or do anything credit-related! I'm here to help you eliminate your debt and improve your credit.

One of the most recent surveys reports that 77% of Americans are anxious about their financial situation regarding money, credit, and debt. So stressed, in fact, that 43% feel tired, 42% find it hard to concentrate at work, and 41% don't sleep as well. All because of money.

Unfortunately, when you're stressed, the study also shows that you are less likely to:

Falling behind on your bills or debts makes matters even worse. And if you find you have debts in "collections," the knots in the pit of your stomach can lead to ulcers. Not good.

Let's discuss how collections work, what happens when you have a collection on your credit score, and how to fix it.

Having a debt in collections is, unfortunately, one of the "most serious negative items that can appear on your credit report," according to Credit Karma.

If you have a debt and still haven't been able to pay it for 120 to 180 days after the due date, your original creditor may send the debt to a collection agency. Some of the most common types of debt are credit card debts, mortgages, car loans, and student loans.

If you have a debt and still haven't been able to pay it for 120 to 180 days after the due date, your original creditor may send the debt to a collection agency. Some of the most common types of debt are credit card debts, mortgages, car loans, and student loans.Once a debt is handed over to a collections agency, you can expect to hear from them sooner rather than later. They operate on the premise that the earlier they track you down, the better their chance of collecting the overdue money.

Collection agencies get paid by getting the debt paid. In other words, they get paid for results. That's why the industry has such a bad rap. They don't get paid to help you, so there is no incentive to work with you or even to work with the law if they can get away with it.

Payments on your credit report that are 120 days overdue will lower your credit score more than a payment that is 30 days overdue. And having more than one debt transferred to collections also impacts your credit score.

According to Rob Rader, President at Top Choice Consultants LLC, it's helpful to know what matters when it comes to any collection debt.

He says:

"The biggest hit to your credit score will occur when that first collection account reports. Each additional collection will have more of a marginal impact. As long as the collection agencies are not continuing to update the account every month, the score impact will lessen over time."

The date a collection debt is listed on the credit report matters significantly. The more recent, the more negative the impact is on your score. Bizarrely, this is true even if you pay off the collection agency debt.

Rader lists an example where a debt was defaulted on five years ago but only now was it sold to a collection agency. The credit bureau then lists the "open date" as the current year.

Again, this matters because the more recent, the more damaging. And in 99 times out of 100, paying the debt off will not make a difference to your score. It will stay the same until seven years from the date of your first missed payment with the original creditor.

FICO Scores consider a good credit score somewhere between 670 and 739, a fair credit score from 580 to 669, and a poor credit score from 300 to 579.

VantageScore has a slightly different scoring system. They consider a good credit score between 700 to 749, a fair credit score from 650 to 699, a poor credit score from 550 to 649, and a very poor credit score from 300 to 549.

To have a very good credit score with FICO, your number will have to be between 740 and 799. An exceptional credit score for FICO is between 800 and 850. Vantage Score considers an excellent credit score to be between 750 to 850.

It's important to understand the factors that make up the respective scores, as this impacts how many points a collection causes your score to drop.

With FICO, they determine the scores by assigning values to percentages:

VantageScore uses "influential" language to calculate what weighs more and less in their credit scoring:

There's not always a clear-cut answer to the question, "how many points does a collection drop my credit score." There are other factors to consider apart from how much your debt figure is and how long your debt has been in collections.

It does matter if this is the first time you have had an unpaid debt go to a collections agency. If you have a high score of 700, the first time you have an unpaid debt that gets sent to a collection agency, you can expect your credit score to drop over 100 points. Sometimes.

If your score is less than 700, it can drop even more.

The amount of the collection debt doesn't seem to change how many points your credit score can drop. Whether your debt is $200 or $100,000, your credit score drops by the same number of points.

You may think there's no good news when it comes to your credit score plus collections debt, but it is possible to have a 700 credit score even with a collections remark on your report. It's not common, but still possible.

Remember, a credit score of 700 is considered to be in the middle of the good range for FICO and at the lower end of the good range for VantageScore.

Lisa Goh, the CFO of Sensible Dollar, reports that there are over 50 scoring models that are used for FICO scores. No wonder it seems so elusive to understand how credit bureaus come up with their credit score numbers and what yours might be.

Credit bureaus use algorithms to determine your score. Each algorithm starts with a perfect 850, which is the highest possible credit score and only 1.6% of all credit-holding Americans have this score.

Not that you need to have a perfect score to "hit the pinnacle of what [lenders] care about." A score above 760 or 780 will get you the same treatment as if you had a score of 850. The national average FICO score hit a record high of 703 in 2019.

Your perfect starting score of 850 then gets points taken off for "every circumstance that, according to the algorithm, is less than ideal." Circumstances such as payment history, the length of credit history, and other information.

So, if it's possible to still attain a 700 credit score with a debt in collections, what factors come into play?

According to Goh, the contributing factors are:

Collections that are less than $100 won't significantly impact your credit score, and some score models will disregard them altogether. Having said that, if your debt in collection is over $100, your credit score will be impacted, possibly severely.

Collections that are less than $100 won't significantly impact your credit score, and some score models will disregard them altogether. Having said that, if your debt in collection is over $100, your credit score will be impacted, possibly severely.In a nutshell, if the most lenient scoring model is used that weighs more heavily on your credit history, the collections are almost at the seven-year mark where they will disappear from your credit report, and you only have one which has been settled; you may still see a credit score of 700 on your report.

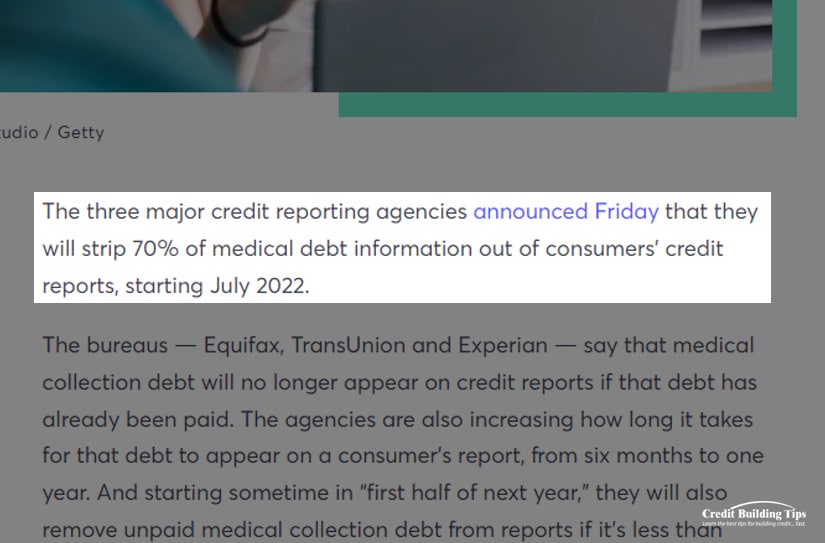

CNBC reported that two-thirds of medical debt in the U.S., effective July 1, 2022, will no longer be included on consumer credit reports. Equifax, TransUnion, and Experian went back to "strip" the debt information out of the reports.

There's also an increase in how long it takes for medical debt to show up on someone's credit report. Before, it was six months; now, it's one year.

And sometime in the first six months of 2023, they'll also eliminate unpaid medical collection debts from reports if the debt is under $500. This will be a significant help to the 1 in 10 Americans who carry medical debt over $250

The Consumer Financial Protection Bureau reported that as of spring 2021, 58% of bills that had been sent to collection agencies were medical bills. They also found that medical collections were "less predictive of future payment problems than other debt collections," like mortgages or car loans.

Once a medical debt goes to collections, it will affect your credit score. Up until now, these debts would stay on your credit report for up to seven years, even if you paid them off. The new rule will now remove them if they are paid off.

"Some of the newer FICO and VantageScore algorithms report that they disregard paid medical collections and place a lower emphasis on unpaid medical debt compared to other types of debt." This statement was given by Ted Rossman, a senior industry analyst at Bankrate.

He went on to say there "seems to be an acknowledgment that medical care is essential and should not be penalized by the credit bureaus."

Remember the study we talked about at the beginning of this article? The one that said 77% of us are anxious about our financial situations? The Mind Over Money study didn't end there.

Once they discovered how stressful the topic of finances is to most people, they asked them to do a short mindset-shifting exercise. The exercise asked people to think about long-term goals. They didn't have to think for a long time, as little as a few seconds.

You might be as surprised as I was to learn that thinking more about the big picture caused this same 77% of stressed Americans to be:

The study's outcomes are so powerful you may want to practice these smart Money Mindset tips to lower your stress, make better financial choices and see your credit score rise!

Giving makes you feel good. It's been linked to the release of oxytocin, a hormone that "induces feelings of warmth, euphoria, and connection to others." Giving elicits feelings of gratitude which is integral to happiness, health, and social bonds. A wide range of research, including the book Why Good Things Happen to Good People, finds that giving to others results in better health.

Giving comes back to you. Whatever you can afford to give — a little money, a little time, a little service, you'll find yourself in a better place and in better spirits. And maybe your credit score will start to reflect that.

Even the most financially savvy of us may find ourselves in a position where we get behind on paying our bills. Sometimes the cost can simply result in paying extra interest we hadn't counted on, but sometimes the cost is higher.

Urban Institute reports that roughly 77 million American adults have a credit file with some level of debt in collections. On average, they owe $5,178.

Urban Institute reports that roughly 77 million American adults have a credit file with some level of debt in collections. On average, they owe $5,178.If you haven't made at least the minimum payment to a particular creditor or lender, the first step will often be to have an in-house collections representative contact you. Not just once or twice but multiple times.

If you don't respond to this in-house representative and don't make a payment within three to six months, the issuer may pass your debt on to a third-party collections agency.

According to CNBC Select, there are currently 7,060 collection agencies in the U.S.

"A collection agency is a company hired by lenders, creditors, medical providers, and federal and local governments to get you to pay or make arrangements to pay what you owe them," Shelley-Ann Eweka, a wealth management director at TIAA, told CNBC Select.

Typically, the original creditor either sold the debt to a "debt buyer" or turned it over to a collection agency. The goal of a collections agency is to get the money.

The strategies they may use to get you to pay your debt can be one or all of the following:

Debt.org says there are three phases to a typical debt collection process:

So, how do you avoid being sent to collections?

If you do find yourself in debt and in need of help, most major credit card companies now offer customer assistance and recognize the toll the Coronavirus pandemic has taken on Americans, and are willing to extend grace.

Here are a few potential solutions to avoid debt collectors:

If you're not able to pursue any of these options, dealing with a debt collection agency may be inevitable. Here's what you can expect.

If you simply can't satisfy your debt before it's turned over to a collection agency, you should know your rights when it comes to dealing with an agency.

Debt collection agencies have a bad reputation because they cannot only contact you through every communication system available but also take debt settlements to civil court. A 2020 study from Pew Charitable Trust reports the number of debt collection lawsuits jumped from 1.7 million cases in 1993 to 4 million cases in 2013.

The study also reveals that "less than 10 percent of defendants in debt collection lawsuits from 2010 to 2019 had counsel, while nearly all plaintiffs did." Moreover, in the last decade, courts favored more than 70% of lawsuits by awarding default payments to the plaintiff.

In essence, most people who deal with a collections agency are taken to court, and most of these court cases favor the collection agency.

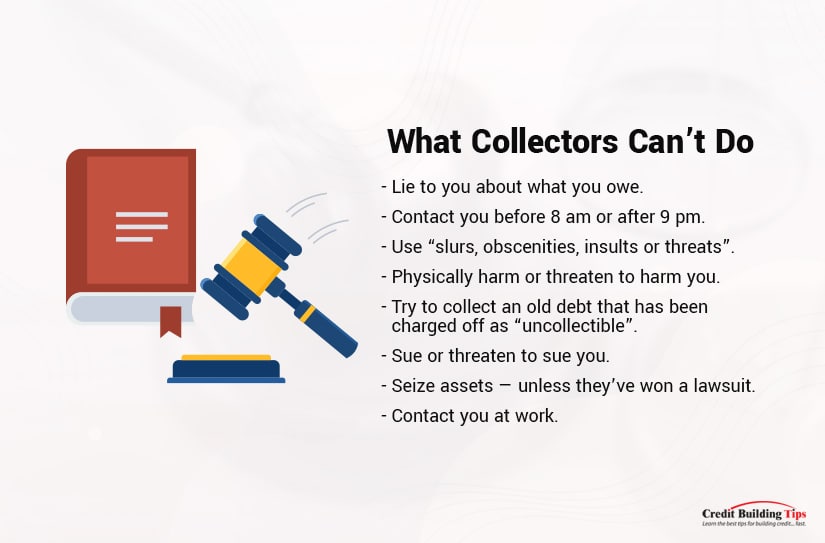

In essence, most people who deal with a collections agency are taken to court, and most of these court cases favor the collection agency.Thanks to the Fair Debt Collection Practices Acts, there are restrictions on what a collector can do to get you to pay your debts.

They may not:

The Association of Credit and Collection Professionals (ACA International) represents the majority of U.S. collection agencies (approximately 3,200), requiring them to obey all laws and regulations. The organization also has its own codes of ethics and operations.

The ACA requires its members to "treat consumers with consideration and respect" and "communicate with consumers with honesty and integrity." It also restricts collectors from engaging in "dishonorable, unethical or unprofessional conduct … likely to deceive, defraud, or harm a consumer."

If a collection agency is harassing you, you can report them to the Attorney General's office in your state or the Federal Trade Commission. You can also sue them in state court.

If a collection agency is harassing you, you can report them to the Attorney General's office in your state or the Federal Trade Commission. You can also sue them in state court.Suing a collections agency in court isn't easy, and you should hire an attorney to represent you. You'll have one calendar year from the date of any violation on the collection agency's part to file a lawsuit.

Andrew Katzman took his debt collectors to court and won $1,700 to compensate him for the harassment he endured. Even though the debt was because of a communication breakdown between the hospital and his insurance carrier and had been resolved, the collections agency continued to harass him.

In Andrew's case, he kept getting phone calls for four months after the issue was settled. The collections agency had him on auto-dial and called him after he let them know the issue was resolved. He requested they stop calling, but they didn't, and he estimated the phone rang twice a day.

Unfortunately, even paying off an account that's gone to collections doesn't immediately improve your credit score. What it does accomplish is "end the harassing phone calls and collection letters, and it will prevent the debt collector from suing you."

Stilt is an organization focused on providing credit to immigrants and the underserved. They say having a collection on your credit report can lower your credit score by approximately 110 points. If your score had been in the "fair" category, it might drop down to the "bad" category.

Even after paying your debt, you'll need to wait until your debt score reaches its limitations period before it recovers. This period can last up to seven years before it disappears fully from your credit score.

Even after paying your debt, you'll need to wait until your debt score reaches its limitations period before it recovers. This period can last up to seven years before it disappears fully from your credit score.The good news is that the more time passes after you pay your debt, the less influence it will have on your credit score.

Although your credit score may not jump up immediately, other significant ways resolving this debt will benefit you include:

The FICO 9 scoring methodology is only being phased in gradually, but most lenders are poised to start using them. In this latest version of the FICO score, medical bills will be given less weight, and debts in collections will be entirely ignored.

Knowing that even paying off your collection debt in full doesn't automatically boost your credit score isn't the last word on the subject. There are other ways you can eliminate collections accounts from your credit score.

1. Order credit reports from Experian, TransUnion, and Equifax.

The first step to take is a look at your current credit report. These three credit bureaus extended the time they're allowing Americans to check their credit report for free. You now have until December 31, 2023, to get a weekly update through the Annual Credit Report website.

2. Write a statement of explanation to explain your circumstances. Adding a statement of explanation to your credit report can be viewed by potential lenders when they are checking your account and may be helpful in opening up a dialogue between you.

Don't waste this opportunity by writing something that excuses why your account has been sent to a collections agency. Lenders aren't impressed by the "my dog ate my homework" type of excuse. Rather, an explanation about how you lost your job due to a COVID-related or other natural or declared disaster may change the lender's perspective on your trustworthiness.

It's important to remember to ask the credit bureau to remove this statement after the delinquent account in question isn't on your credit report. Leaving the statement after the account has been removed may raise unnecessary questions in a potential lender's mind.

3. Dispute any errors. This is an important step to take if you want more information about the collections agency's claim or if you don't think you owe the money. The Consumer Financial Protection Bureau has a list of sample letters you can use to deal with debt collectors.

They note that if you use any of their sample letters, it's crucial to do so right away after the initial contact is made by a collections agency. As well, it's important to keep copies of any letters you send and receive.

4. Send a pay-for-delete letter. This is a way to "heal" your credit score by bartering with the collection agency. If you are prepared to pay your debt to them, you can offer payment in full in exchange for a "pay-for-delete" letter.

Credit Repair suggests you include the following information in this type of letter:

5. Ask for a goodwill letter. A goodwill letter is a written request to one of your creditors asking them to remove a negative mark on your credit report out of the goodness of their hearts.

While they suggest you not get your hopes up that this tactic will work, they also say it doesn't hurt to ask. A goodwill letter is your attempt to connect emotionally with creditors.

6. Get professional help. Sometimes you're in too deep and just need a helping hand. Contact the National Foundation for Credit Counseling (NFCC) and ask to work with a nonprofit credit counselor.

It's in your best interest to settle any outstanding debts as quickly as possible. Paying or settling collections will end the harassing phone calls and collection letters and keep the debt collector from suing you.

Now that the COVID-19 pandemic seems to be in the rearview mirror as far as the government is concerned, they have stopped letting us check our credit reports every week and reverted to one free credit report check each year.

These reports list your bill payment history, loans, current debt load, and other financial information. They include information on your work and whether you've ever been sued or filed for bankruptcy. Or whether you've been arrested and have a criminal record.