What's a credit card nickname, and why would you want one?

We're not talking about the synonyms for the actual credit card itself. People refer to credit cards as "plastic money," "charge plate," "bank cards," or simply "plastic." These terms can also refer to a debit card, but in the main, when someone uses one of these terms, they're referring to their credit card.

The nicknames we're talking about in this article are the ones you give your cards to distinguish one from the other as you use them. With credit card nicknames, you can easily identify which card is which and make sure you're using the right one for the right purpose.

The nicknames we're talking about in this article are the ones you give your cards to distinguish one from the other as you use them. With credit card nicknames, you can easily identify which card is which and make sure you're using the right one for the right purpose.Credit cards are identified by the 16-digit account number (15 digits for American Express), and for most of us, this number isn't one we find easy to memorize, along with the expiry date and CVV.

Most people assume the number on their credit card is the same as their account number. While the two are linked, they're not identical, which you will notice when you receive your credit card statement or view it online.

Forbes Advisor warns that "the sad truth is that credit card numbers get stolen all the time." They recommend using caution at all times. Giving your credit card a nickname is a great way to disguise the card numbers from anyone peeking over your shoulder as you input the number into a field while you're shopping online.

Credit card nicknames are names that you assign to your credit (or debit) cards for easy reference. By creating nicknames for your cards, you can easily remember which cards have what features and benefits. This can be especially helpful if you have multiple credit cards from different banks or if you're trying to keep track of your spending.

These nicknames are also a great way to differentiate between personal and business cards. For instance, you may have a "Personal Chase" and a "Business Chase," or a "Grocery Visa" and an "Eating Out Visa." With nicknames like these, it's easy to recall which card is for which purpose.

A credit card nickname is a user-defined identifier useful in distinguishing among multiple credit cards kept on file for use when you're shopping online, giving someone your number over the phone, or filling out online forms. Think of assigning a nickname to your credit card as a way to avoid mixing up which card you want to use for a particular purchase.

A "preferred name" for your credit card refers to banks allowing their users to assign a name that's not their legal name to their credit, debit, or banking accounts. One example is using your preferred name Bill when your legal name is William.

A timely example of this concerns the transgender community. Seventy percent of transgender people don't have banking documents or IDs showing the names they choose to be known by in their everyday lives. Almost 33% told the National Center for Transgender Equality they were denied services when trying to use "outdated" documents.

While the process of getting your name changed on a credit card takes work, it's not especially difficult. Once you have all your documents in order, the change can happen easily — as long as you're patient and prepared.

A credit card nickname doesn't change the name of the account holder; it simply changes how the card is described as you use it.

As the card's user, you can assign a description or name to any and all of your credit cards and use it as the card's unique ID. For most people, remembering a nickname is much simpler than remembering the string of numbers that make up your credit card account.

Digital wallets and applications will often ask you for a nickname you want to create or have already assigned to your credit card. You're not required to have a nickname, and if you choose not to, the app will just default to the last four digits of your account as an identifier.

While we can't give you a one-size-fits-all list of instructions on how to add a nickname to your credit card, we can give you a general idea of how to do this. The exact instructions will vary from website (or app) to website, but this should help give you a good idea of the process.

The first step you'll need to do is save your cards to your device. You'll be asked for the following:

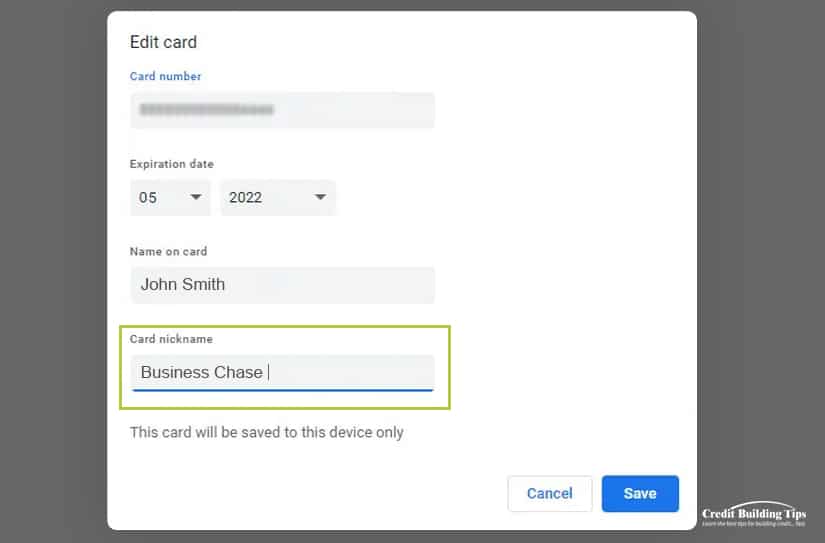

Once you've filled in the information (correctly to make sure your card works), some sites will automatically prompt you to give your card a nickname. If you get this prompt, you'll want to click on it. If you don't automatically get this prompt, you will need to input your payment settings.

Choose the card to which you want to assign a nickname. It's worth double and triple-checking at this point as it will create problems for your book balancing if you mix up which card gets what nickname!

A dialogue box will pop up, and you'll get to type in the nickname you want to use. Once that step is completed, click the "Save" button.

Rinse and repeat for every card you want to give a nickname.

Next time you want to buy something, you can simply click on the nickname of the card you want to use. Easy and convenient!

If you want to edit a nickname, you can search your payment settings, click on them and locate the "Edit" button's dialogue box to change the name. If you don't want to use the card, you can also search your payment settings, click on them and locate the "Delete" button's dialogue box to take the card off your account.

No, not all vendors let you assign a nickname to your credit cards when you use them to make a purchase.

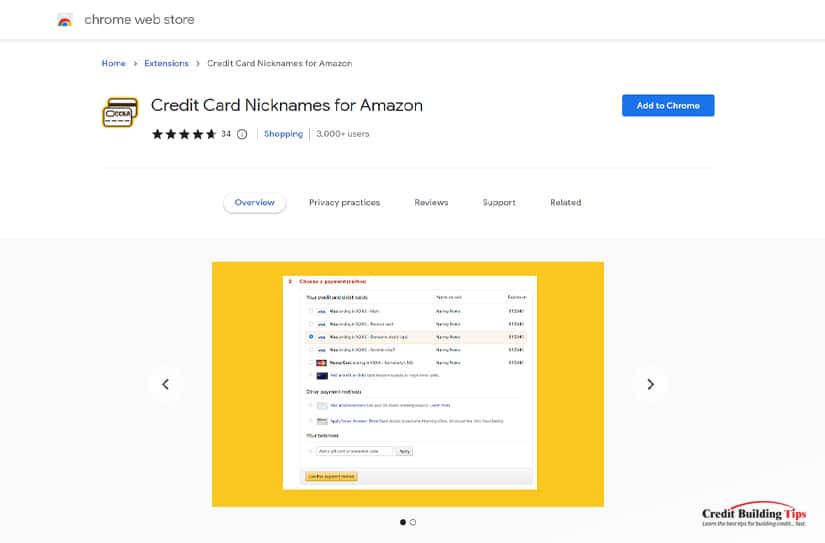

No, not all vendors let you assign a nickname to your credit cards when you use them to make a purchase.Amazon, for instance, doesn't (yet) have a way to let you assign nicknames to your credit cards if you have more than one stored on your account. However, according to The Big Tech Question, there is a browser extension that lets you create a workaround for this.

The first step is downloading and installing "the Credit Card nicknames for Amazon browser extension." You can find it on the Chrome Web Store, and it works with Google Chrome, Microsoft Edge, Vivaldi, and other web browsers based on the "Chromium engine."

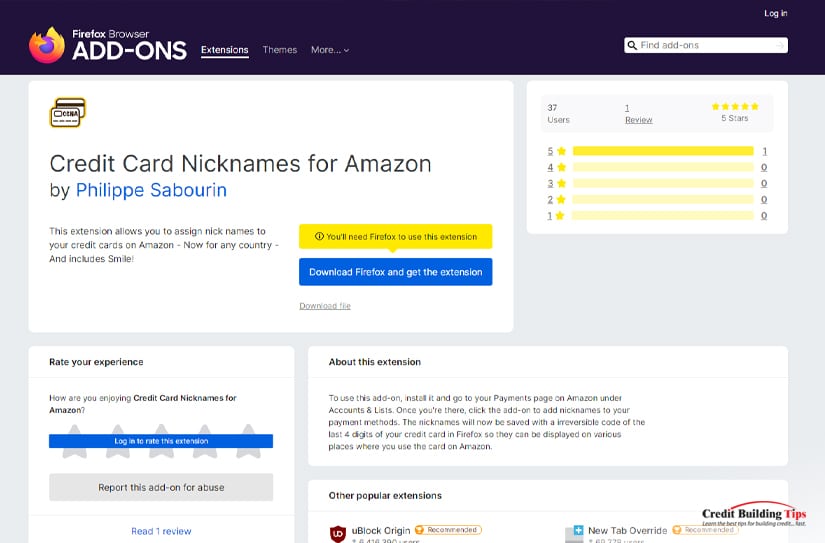

Using Firefox? Here's their browser extension. Unfortunately, there doesn't appear to be a version for Macs using Safari.

After you install the extension in your browser, go to your Amazon checkout card and click on the small credit card icon at the top of the browser window. You may need to expand the window in order to see the icon.

Now when you're asked to select a payment card, you'll have an opportunity to create a nickname for every payment card you have on file. Before you assign a nickname to the card, you should see just the last four numbers of the card.

Now when you visit your checkout, your available cards will be displayed along with a text label showing your nickname. Note that while this workaround works for the Amazon website, it doesn't carry over to the Amazon apps.

Choose a nickname that's easy to remember. While few people can remember (correctly, at least) their 16+ credit card numbers, the point of assigning a nickname is to make it easy to remember. But if your credit card nickname is too obscure, you may not recognize which card it is connected to when you go to pay.

There are a couple of ways to distinguish one credit card from another. You can identify your card by its network:

If you own more than one of the same cards issued by the same network, you could add more details, such as the types of rewards or benefits the card gives you:

Alternatively, you can give your credit card a nickname that identifies how you use it:

Another way to make sure that you can quickly and easily identify your cards is by utilizing visual cues. If there's a picture on the card, use that as a basis for your nickname. For example, if you have a card with a beach scene on it, you might call it "Beach Getaway."

Some databases won't let you input spaces or special characters or may have a limit to how many characters you can use in the field set up for nicknames. If you've developed a system to help you remember multiple nicknames, you may encounter an issuer who won't create one with a special character or number.

When setting up a password, it's generally considered more secure to include upper and lower case letters, numbers, and symbols, as this greatly increases the possible combinations of your password.

Good advice for creating a strong password includes the following:

Using nicknames can also help you track your spending more effectively. Since each nickname will be associated with a specific card, you'll be able to easily identify where your purchases came from and how much you've spent on each card.

This can be especially helpful if you have one credit card for your personal expenses and one for your business. At the end of each month's credit cycle, you'll be able to quickly see how many business expenses you have as opposed to the total of personal expenses you've incurred during the time frame.

Assigning a nickname to your credit cards is one way to help protect yourself from someone stealing your card information and using it for themselves. But today's savvy thieves and hackers continue to come up with creative ways to work around the best security measures created, like chip and pin technology.

Along with assigning your card a nickname, here are some other ways to protect yourself from identity theft and from someone using your card for their purchases:

Spyware can be installed on your computer without you even knowing about it. Opening or downloading a file from an unfamiliar email or website is one way hackers can compromise your credit card without it leaving your wallet.

Phishing emails are sent out for just this purpose. A link that's clicked on one of these emails can automatically let the hacker view your keystrokes and "read" your account number as you shop online.

That's all they need to access your credit card number and use it. Always verify the legitimacy of anything you download and consider buying and installing antivirus software.

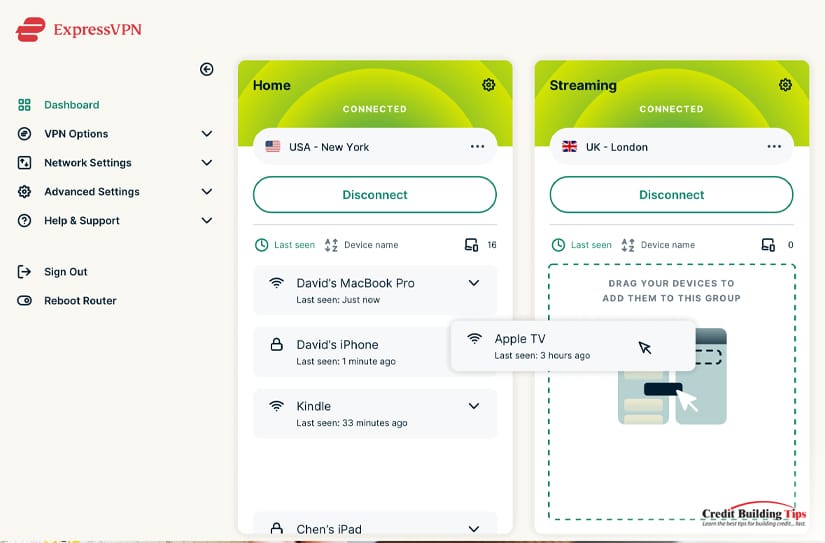

Using public Wi-Fi networks can also put your online security at risk. These types of networks often allow someone to monitor your screen and see your account information or sensitive documents. You'll have no idea this has happened until purchases are made by someone that's not you.

The best protection against this is to install a Virtual private network. A VPN is a subscription service that "encrypts your activity on the internet and keeps your identity hidden while browsing."

Installing new updates to your operating systems will keep your OS, apps, and browser up-to-date. Almost all updates include security fixes in an effort to help keep hackers from accessing your system. As well, continue to review your security settings and make sure to prevent websites from tracking your movements.

Shutting down your computer overnight is a simple way to lower your visibility to hackers. They tend to look for targets that are available, and turning off your computer breaks any connections a hacker may have set up with your computer. This makes it less worthwhile for someone to try to break in and steal your information.

In the same vein, backing up your computer, while it doesn't protect your computer, can be critical if your information is compromised and destroyed. This lets you re-establish and rebuild your data more quickly.

Looking for more ways to protect your credit rating? Subscribe to our blog, and you'll get helpful information and tips on how to stay out of debt and become financially healthy.

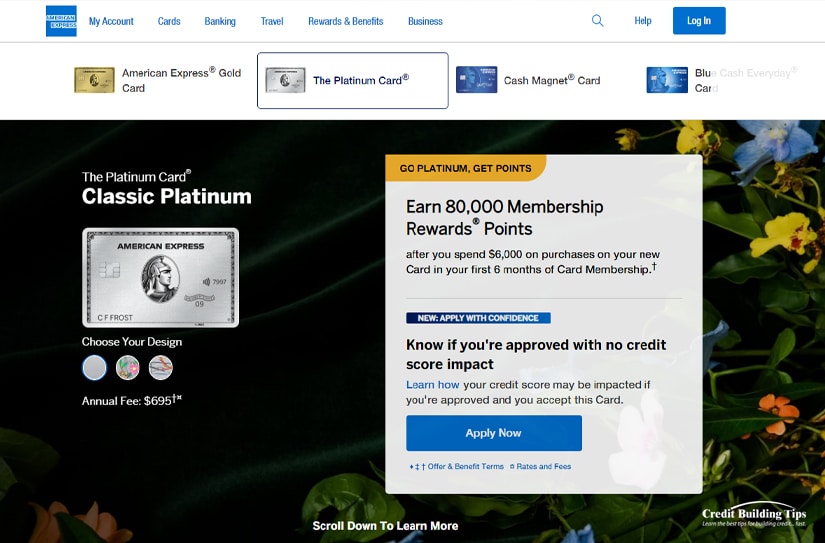

Many consider the Amex Platinum Card a luxury card only used by wealthy people who can afford to throw away almost $700 yearly on its annual fee.

It certainly is pretty. And heavy. At 18.5 grams, the card is made of solid stainless steel and outweighs almost any other metal credit card other than the Luxury Card Mastercard® Gold Card (22 grams), the Luxury Card Mastercard® Black Card (22 grams), and the Luxury Card Mastercard® Titanium Card (22 grams).

The only heavier card than all of these is the JP Morgan Reserve card. It weighs 27 grams, but it's an invite-only card, and if you don't have $10 million in investable assets at the JP Morgan Private Bank, you won't get an invitation to apply for their card in the mail.

Compared to the typical 5 grams weight of a plastic credit card, the Amex Platinum Card certainly makes its presence felt when you hand it to a cashier or toss it onto the dining table after eating out.

If you do apply and qualify for the Amex Platinum Card, it will be delivered to your front door in a carded die-cut box. Inside the box is a substantial wooden slab with a carved inset that holds your new card. You may feel even richer just holding it in your hand.

But is it worth it? And do you need to be rich to qualify for one?

First of all, you'll need a credit score above 700 with an average approval score of 715. Lower credit scores in the high 600s have also been approved, depending on credit quality.

First of all, you'll need a credit score above 700 with an average approval score of 715. Lower credit scores in the high 600s have also been approved, depending on credit quality.American Express looks at your credit score but also considers:

The Amex Platinum Card is a "no pre-set spending limit" card. This isn't the same as unlimited spending — purchases are approved based on your "credit record, account history, and personal resources."

Interestingly, the card has a Flexible Payment Option (FPO). This lets you carry a portion of your balance with interest on qualified purchases.

Reviewers across the board agree that the Amex Platinum Card is the "king of luxury rewards travel cards." It's ideal for folks who travel a lot and want to do so comfortably and in style.

If you're a new Platinum Cardmember, you'll receive a healthy welcome bonus that totals 80,000 points. You can first earn your 60,000 welcome bonus points after you charge $6,000 to your card during your first three months of owning the card.

To qualify for the additional 20,000 points, you'll have to make one purchase of "any amount" and charge it to your card within 14 to 17 months of owning the card.

Amex Membership Rewards points are each worth two cents, which makes the 80,000 welcome bonus worth $1,600. This alone will cover the annual fee for three years.

It's worth checking to see if you are eligible for an additional 125,000 to 150,000 points Amex is offering through their CardMatch tool, via mailings, or, in some cases, when logging into other online card accounts. These extra points offers can be worth $2,500 to $3,000, covering the card's annual fee for up to four years.

The Amex Platinum Card is loaded with perks and lets you earn Membership Rewards Points® on every purchase you make. However, there's a difference between the value of the points depending on where you "spend" them.

To get the most out of the rewards points offered, you'll want to spend them on just two things:

When you spend your bonus points in either of those ways, you'll get five times the value of the points. For every dollar you spend, you'll get five points up to $500,000 each year. If you spend more than $500,000, the points value drops to one point for every dollar spent.

You'll get the most value from your points when you transfer them to a travel partner. Your Amex Platinum Card offers 17 airline and three hotel transfer partners. All but three of the partners use a 1:1 point-to-mile transfer ratio.

You'll want to keep your eye on the amount of time it takes to effect a transfer from your points to the transfer partner you choose. Lengths of time vary by partner, so be sure to leave yourself enough time before purchasing.

The Points Guy offers a handy guide to each program's Membership Rewards transfer times.

The same blog post goes into even more detail on what to know before you transfer your Membership Rewards Points and tips to make sure you don't get stuck transferring points to a program you won't be using.

If you're not using your Membership Rewards Points® on travel directly with an airline or through Amex Travel, your points will be calculated at a one-to-one ratio. One point for every dollar spent.

Single-value Membership Rewards® Points can be used in several ways:

American Express provides a handy online calculator to show the value of their points.

You'll also get $200 statement credits each year if you book with:

You can receive up to $20 in statement credits each month if you shop at:

This card is loaded with benefits, and the better you understand them, the more value you'll get from the card to offset the annual fee.

As it's considered the best luxury travel rewards card, it's no surprise that the providers of Amex Platinum are generous with offering travel perks.

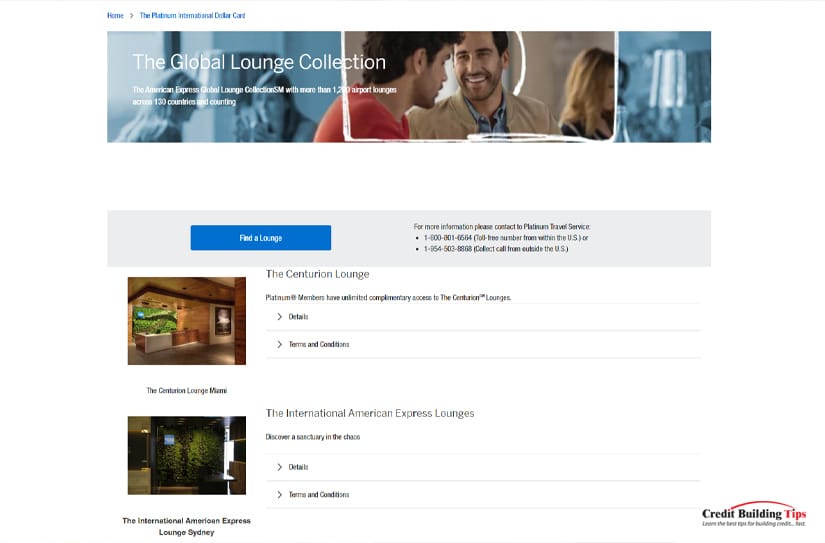

Included in The Global Lounge Collection are more than 1,400 airport lounges across 140 countries "and counting." Card members have complimentary access to Delta Sky Club®, where they can find Wi-Fi access, satellite TV, free (and hot) food and beverages (alcoholic and non-alcoholic), personalized flight assistance, private restrooms with clean showers, and more.

It costs $545 each year to purchase an individual membership to the Sky Club, so you'll save this fee with an Amex Platinum card.

The card also offers several travel-related features that include:

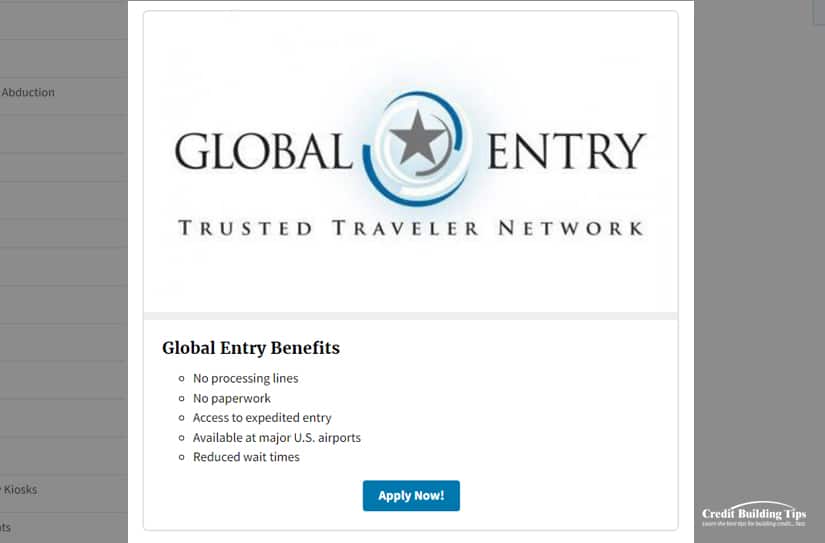

The Global Entry, or TSA PreCheck service, is a wonderful perk for those who travel a lot. This ensures they'll experience quicker screening at airport security. Platinum cardholders receive this service for free by using a statement credit.

The card also offers its members complimentary car rental status with

If you've been waiting to go on a cruise, Amex Platinum extends Cruise Privileges Program (CPP) for new CPP bookings made with "participating cruise lines through American Express Travel." Onboard credit and amenities apply "per stateroom, with a three-stateroom limit per eligible card member, per cruise.

Cruise lines in the program include:

Cardholders that frequently stay either at the Marriott or the Hilton are eligible to enroll in Marriot Bonvoy Gold Status. Gold Status will allow you to

Amex is proud of their "Do Anything" Platinum Card Concierge, that offers 24/7 service to help make arrangements for dinner, help source hard-to-come-by event tickets, or even find the right gift for someone special. The service also offers access to concerts and sporting events.

Other shopping perks of owning their card include:

Card members can enroll their Platinum Card into InCircle and receive one InCircle point for each dollar spent at:

For every 10,000 points you accumulate, you'll get a $100 InCircle point card. InCircle doesn't offer double or bonus-points opportunities, and points can't be received on sales tax, shipping, alterations, gift wrapping, fur services, shoe repair and cleaning, handbags, optical, precious jewelry, monogramming, salon products and services, and valet parking.

Go here for an exhaustive list of "Important Information Regarding Rates, Fees, and Other Cost Information." Amex provides this document with the fine print on their full card member agreement, terms and conditions, interest rates and charges, benefit terms, and Amex Assurance Company disclosures.

With all that's been said so far, is Amex Platinum worth the $695 annual premium?

It depends.

When you get your first card, you can collect rewards points that would cover the first three years of annual fees. As long as you spend $6,000 in the first six months and then make sure to make another purchase within the next 14 to 17 months.

If you take advantage of all the annual statement credits, you'll benefit to the tune of $1,500 every year. After the $695 annual fee, you'll still have pocketed just over $800 in statement credits. That's pretty good.

If you travel extensively, you can save serious amounts on insurance and other travel perks. And if you place a value on how you travel, your savings can be even more. Free food, drinks, and comfort when you travel mean you don't have to shell out on airport food or other small luxuries.

At the end of the day, if you spend money on frequent travel, luxury hotels, car rentals, and shopping, you'll be well rewarded with the Amex Platinum Card.

If your lifestyle is more modest with infrequent travel, spending nights away from home in higher-end hotels, and, in general, you simply don't use your credit card for non-essential purchases, it may not be worth the cost of keeping the card.

However, if you can see yourself spending $6,000+ within the first 18 months of receiving the card, you will have pocketed in the neighborhood of $800 after paying the first year's annual fee.

That won't be enough to travel around the world and see the Great Wall of China, but it will be enough to splash out on a nice weekend away with dinner to boot.

As always, make sure you aren't overspending to justify the cost of any credit card. Keep your spending within your monthly budget and work towards getting and maintaining a good credit score.

Staying out of credit card debt and on track to be financially healthy can sometimes make even a hamburger taste more like steak.

After reading today's article, do you have any questions about the Amex platinum card? Was there anything we mentioned that you'd like additional clarification on? If so, we'd be more than happy to help you out! Additionally, if you're searching for any further information on credit and credit building, we highly urge you to check out our collection of articles! We've written dozens of articles about credit and credit-related topics, so you're bound to find something beneficial to your particular situation!

When it comes to credit card utilization, you may wonder if it's possible to hide your usage from creditors and lenders. It's important to understand the impact of credit utilization on your credit score and whether it's possible to hide your utilization from your creditors.

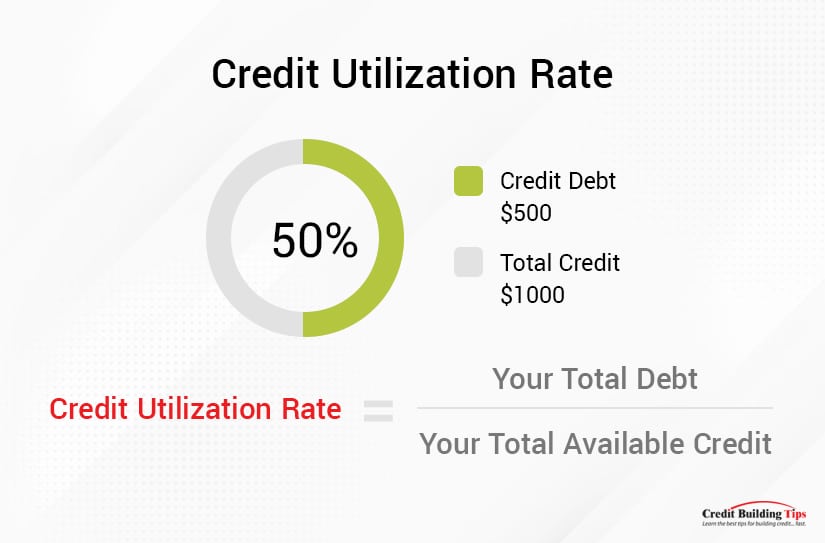

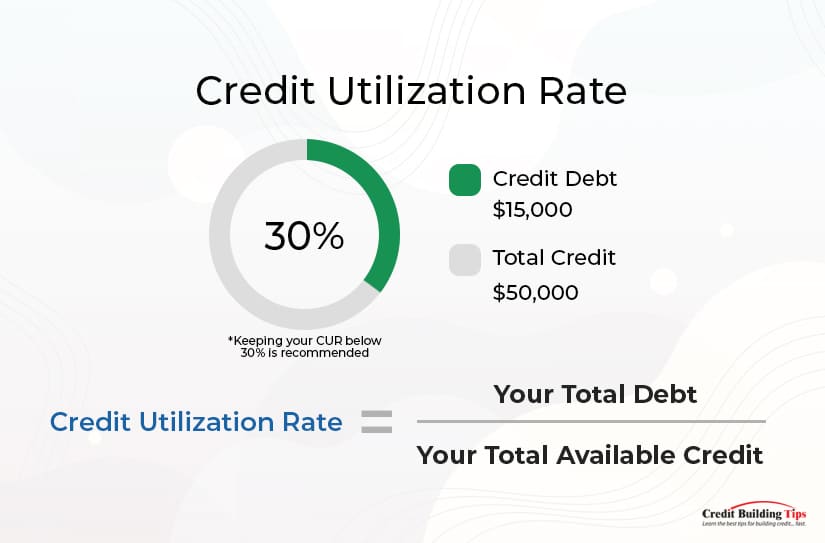

Credit utilization is a metric that measures the amount of available credit you have used up relative to your total credit limit. It is an important factor in determining your overall creditworthiness and plays a major role in determining your credit score.

Your credit utilization ratio is calculated by dividing your total amount of revolving credit (such as credit cards) by your total available credit limit. To calculate it, you'll need to add up all your current credit card balances and divide it by the sum of all your credit limits.

Your credit utilization ratio is calculated by dividing your total amount of revolving credit (such as credit cards) by your total available credit limit. To calculate it, you'll need to add up all your current credit card balances and divide it by the sum of all your credit limits.For example, if you have a credit card with a limit of $1,000 and you currently owe $500, your credit utilization would be 50%.

The higher your credit utilization ratio, the worse your credit score will be. Generally, it's recommended that you keep your credit utilization ratio at or below 30%. Keeping your credit utilization ratio low can help you improve your credit score. It's important to keep an eye on your credit utilization ratio and take steps to reduce it if it gets too high.

It is important to monitor your credit utilization because it can significantly impact your credit score. If you're utilizing too much of your available credit, lenders may be less likely to approve you for new lines of credit or loans due to their concerns about your debt burden. On the other hand, having a low credit utilization ratio indicates to lenders that you are a responsible borrower who can manage your finances well.

Your credit score takes both your total credit limit and the amount you've used into account when determining your credit score. The amount of credit you use is known as your credit utilization ratio. Your credit utilization ratio is the amount of debt you have relative to your total credit limit. A higher credit utilization ratio suggests that you are using more of your available credit, which can have a negative impact on your credit score.

It's important to keep in mind that your creditors report your total available credit limit and the amount of debt you're carrying. This means that if you have a large credit limit and only a small amount of debt, your credit utilization ratio will be lower, and your credit score will be better. However, if you have a smaller credit limit and a larger debt, your credit utilization ratio will be higher and can negatively impact your score.

The best way to ensure that your credit utilization ratio does not have a negative impact on your score is to keep it below 30% of your total available credit limit. Doing this will help ensure that you get the best possible score, regardless of whether your creditors take into account your total credit limit or only the amount you've used.

Before you start to put to use the tips we'll share with you below, you will want to be aware of your current credit card utilization ratio.

You can do this in one of four ways:

On the face of it, it may seem dangerous and even illegal to try to hide your credit card utilization from your creditors. You could end up being flagged for fraud or deception, and it could also severely damage your credit score.

But try Googling "Tips to Hide Your Credit Card Utilization," and your search page will be flooded with "tips, hacks, tricks, and secrets" on how to do just that.

We're not in any way recommending you attempt to lie or deceive the tax department (or any department) with information that is untrue, but there are legitimate ways to manage your credit card utilization that will reduce your utilization ratio, which will then help to improve your credit scores.

We're not in any way recommending you attempt to lie or deceive the tax department (or any department) with information that is untrue, but there are legitimate ways to manage your credit card utilization that will reduce your utilization ratio, which will then help to improve your credit scores.We've found 11 simple and effective ways you can manage your spending in order to lower your credit utilization.

Spending less can be a challenge, but it's a necessary step if you want to lower your credit utilization ratio. Here are some tips to help you on your way:

By using your debit card for purchases, you are only using the amount of money you have in the bank. This helps keep your debt-to-income ratio low and keeps your credit utilization low. You can use your debit card to pay off smaller debts that you may have with other creditors. This can help to lower your overall debt-to-income ratio, which can help to improve your credit score.

Paying your credit card in full every month is one of the best ways to lower your credit utilization ratio and improve your credit score. When you pay off your balance in full each month, you're not utilizing any of your available credit. That means your utilization ratio is zero, which is ideal for a strong credit score.

But if you do end up using some of your available credit each month, paying your balance in full can still help. Every time you make a payment, it reduces the amount of credit you have left to use. For example, if you use $500 of your $1,000 credit limit, then make a payment of $500, you now have a utilization ratio of $0/$1,000 (or 0%). This helps to keep your utilization ratio low, which is good for your credit score.

Paying down your credit card balance more than once a month can also help to lower your credit utilization ratio. This is because when you pay down your balance, the amount of money you've used to pay off your balance is taken into account.

By paying down your balance more than once a month, you can pay off more debt at once. For example, if you have a balance of $1,000, and you make two payments of $500 each during the month instead of one payment of $1,000 at the end of the month, then your credit utilization ratio will be lower because you will have a lower balance outstanding on your card.

Strategically paying your credit card debts can be a great way to lower your credit utilization ratio and improve your credit score. To do this, you'll want to pay off your highest balance cards first or prioritize paying off cards with the highest interest rate.

This will directly impact your credit utilization ratio because you'll be reducing the amount of credit that is being used compared to the total amount of credit you have access to.

One of the quickest and easiest ways to lower your credit utilization ratio is to apply for a new credit card. A higher credit limit can positively impact your credit utilization ratio, as it increases the amount of available credit you have. This will lower the ratio and can result in a higher credit score.

When you apply for a new card, be sure to look for one with an attractive rewards program, other benefits, and a reasonable annual fee. Make sure the interest rate is low and that you understand the terms and conditions of the card before signing up.

A variation on applying for a new credit card to lower your utilization ratio is to ask your current credit card company to raise your credit card limit. It's important to remember that it's not always easy to get your credit limit increased, especially if you have a low credit score. However, if you can increase your credit limit, it can be a great way to reduce your credit utilization ratio and, in turn, boost your credit score.

When it comes to your credit utilization ratio, one of the most important things you can do is to keep your unused credit cards open. This is because closing an unused card can harm your ratio. Your total credit limit will be reduced, which means that even if you don't use the card, you are still being penalized for having a high credit utilization ratio.

When you don't use a card, the amount you owe on it will remain at zero, which won't be considered when calculating your credit utilization ratio. As a result, your credit utilization ratio will stay lower. The longer you keep the card open, the better your score could become, as you'll show lenders that you are able to manage credit responsibly over an extended period of time.

Getting a temporary personal loan to pay off your credit card balances can effectively lower your credit utilization ratio. This is because the loan will reduce the amount of total debt you have outstanding, meaning that your ratio of credit card debt to total available credit will decrease.

It's important to note that taking out a loan to pay off your credit card balances should only be done as a last resort. Before doing so, consider other options, such as consolidating your credit card debt or transferring your balances to a card with a lower interest rate. Additionally, ensure that you are able to meet the repayment terms of the loan and avoid any late payments, as this could negatively impact your credit score.

Another way to potentially lower your credit utilization ratio is by asking for a statement balance rather than a current balance. Your credit utilization is calculated based on the amount of credit you've used compared to your total credit limit.

By requesting a statement balance, you're asking the creditor to report the amount due at the end of the billing cycle, not the amount that's currently due. This means that if you've already paid off most of the amount you owe or if the statement balance is significantly lower than the current balance, this will help reduce your credit utilization.

Transferring your balance to a low-interest credit card is our last tip for ways to lower your credit utilization ratio and help improve your credit score. By transferring your balance, you're essentially increasing your total credit limit while keeping your amount of debt the same. This, in turn, lowers your utilization ratio and can increase your credit score.

It's important to note that transferring a balance is not without risks. Balance transfers typically come with fees, and you will need to make sure that the new interest rate on the new card is lower than the old one before making a move. Some creditors may also report the balance transfer as a new account, which could negatively affect your score. It's best to weigh the pros and cons of transferring your balance carefully before making any decisions.

As always, if you're looking for ways to improve your credit scores as fast as possible, I'm here to help!

Are you looking for an easier and more flexible way to pay for the things you need? If so, you're not alone. According to recent estimates, over 63 million Americans use some kind of "buy now, pay later" (BNPL) plan.

In recent years, the use of BNPL-type installment plans has been on the rise among Americans.

According to a survey conducted in 2019, as many as 60 percent of Americans had used this type of installment plan in the past year.

According to a survey conducted in 2019, as many as 60 percent of Americans had used this type of installment plan in the past year.Although inflation rates are expected to ease towards the end of 2023, these numbers are likely to increase as more people turn to these plans as a way to manage their money. In this blog post, we will provide an ultimate guide to payment and installment plans, explaining what installment plans are and how they work, as well as the application process and tips for choosing the right plan for you.

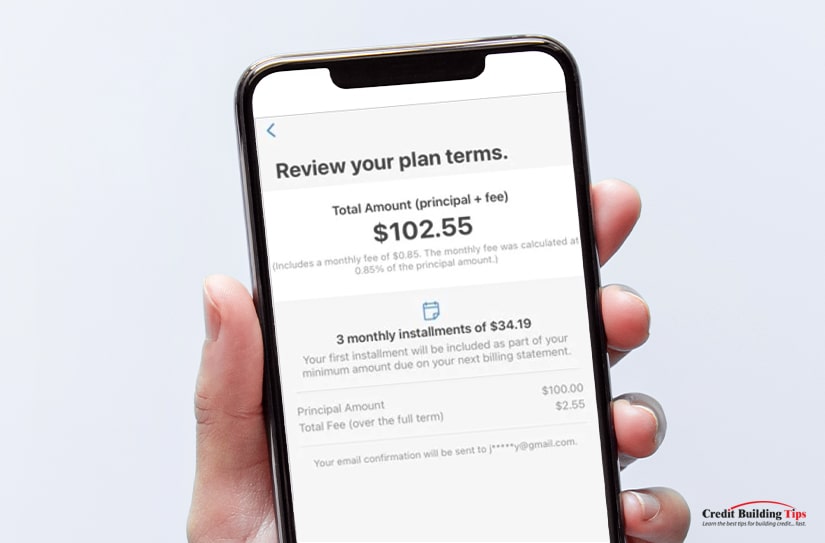

First of all, installment plans are payment plans that allow you to purchase an item now and pay it off over time with fixed payments.

These plans are generally offered by businesses that specialize in consumer loans or by stores that offer credit cards with the option to pay for an item in installments.

Installment plans allow people to spread out the cost of a purchase over several payments. If payments are made on time, no interest is charged; however, late payments may incur additional fees. There is usually a minimum spending requirement, and some plans offer promotional discounts for early payment.

Applying for a payment and installment plan is relatively easy. Generally, businesses that offer these types of plans will have an online application process available. The application process will require you to provide some personal information such as your name, address, date of birth, and Social Security Number.

Depending on the type of plan you are applying for, you may also need to provide bank account information, proof of income, or savings to support your ability to make regular payments. Many services also require applicants to provide at least two valid forms of identification, such as a driver's license or passport.

Most services will check the applicant's credit score, but this is not always required. Depending on the service, there may also be eligibility requirements such as age or residence in a particular state.

Once you have submitted the required information, the lender will review it and require additional verification before approving your application, such as making a decision about whether or not to approve your loan. Some lenders may need a valid form of identification.

Once accepted, the customer has to agree to make regular payments, often monthly or quarterly. The customer must also have sufficient funds in their bank account or credit card account in order to make their payments.

It is important to remember that buy now, pay later plans are not a form of credit and can be risky to finance purchases.

Before signing up for any installment plan, it is important to make sure you understand the terms and conditions of the agreement. Be sure to read the fine print and make sure you know what fees you may incur if you make late payments or if you decide to cancel the agreement.

Before signing up for any installment plan, it is important to make sure you understand the terms and conditions of the agreement. Be sure to read the fine print and make sure you know what fees you may incur if you make late payments or if you decide to cancel the agreement.Make sure you also know what interest rate, if any, will be charged if you are late on payments. Finally, be sure to keep track of your payments and make sure you are always on top of the due dates so that you can avoid late fees or other penalties. Failure to make timely payments could result in penalties or even cancellation of the agreement.

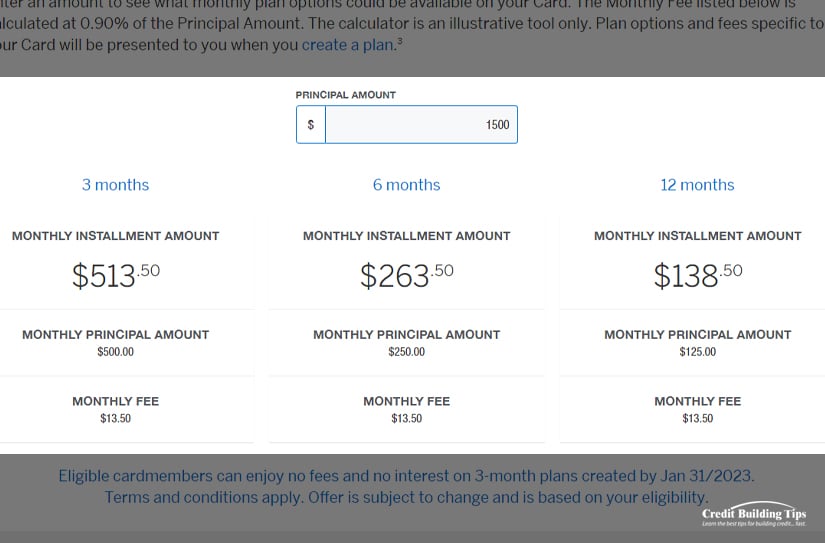

Installment plans allow you to spread out the cost of an item over a longer period than a traditional loan or credit card payment. With installment plans, you can typically choose the length of time you'd like to pay off the purchase and the number of your fixed payments.

Buy now, pay later plans are not good for everyone, and it is important to know your personal financial situation before signing up for one. Not everyone is approved for an installment plan, depending on the cost of the product and the user's history with the service. It is important to read the terms and conditions of each payment and installment plan carefully before applying.

The main advantage of installment plans is that they allow you to purchase something without needing to pay the full price upfront. This can be beneficial if you're on a tight budget but still want to purchase a specific item. Additionally, installment plans often come with lower interest rates than traditional loan or credit card rates.

Payment and installment plans offer a great way to budget and manage your finances.

One of the biggest advantages of using an installment plan is its low interest rate. This makes it easier to pay off your debt in the long run. Additionally, installment plans give you more control over your spending since you can choose when and how much to pay.

One of the biggest advantages of using an installment plan is its low interest rate. This makes it easier to pay off your debt in the long run. Additionally, installment plans give you more control over your spending since you can choose when and how much to pay.Installment plans also allow for flexible payments that can be tailored to your budget. You can choose to make payments every week, month, or any other frequency that suits your lifestyle.

With an installment plan, you don't have to worry about purchasing additional products or services. You can simply sign up for the plan and make monthly payments.

Another advantage of using an installment plan is that it often comes with rewards. Many companies offer incentives like cashback, discounts, or bonus points when you use their installment plans. This can help you save even more money while managing your debt.

The pricing and terms of an installment plan are usually simple and transparent, so you always know what you're paying for. Finally, you have the flexibility to cancel your installment plan at any time if your financial circumstances change.

Using payment and installment plans can be a great way to purchase items without feeling the financial strain of the full cost upfront. However, there are some drawbacks to using these plans that should be considered before signing up.

First, it is important to remember that payment and installment plans could cause financial stress later on. As interest builds up over time, a person may find themselves in more debt than they expected when they signed up for the plan. In addition, some payment and installment plans come with late fees that can add up quickly if payments are missed.

First, it is important to remember that payment and installment plans could cause financial stress later on. As interest builds up over time, a person may find themselves in more debt than they expected when they signed up for the plan. In addition, some payment and installment plans come with late fees that can add up quickly if payments are missed.Another potential issue with payment and installment plans is that they can encourage spending beyond one's means. People might feel tempted to purchase more expensive items than they would normally be able to afford if not for the plan.

As a result, people may find themselves in a situation where they cannot afford their payments or have difficulty paying off their debt.

For these reasons, it is important to consider all of the drawbacks before signing up for any payment and installment plans. It is important to consider if the item is truly necessary, as well as if the cost fits into your budget. Make sure to read all terms and conditions carefully, and remember that you may not be able to pay off the debt right away.

Howard Dvorkin is a vocal advocate of installment and payment plans. He believes that they offer a much-needed lifeline to consumers struggling to pay off large purchases or cannot pay up-front costs. He feels that these types of plans can be beneficial to people in a variety of circumstances.

Dvorkin states that installment and payment plans can help individuals with their budgeting, allowing them to spread out the cost of expensive items over a period of time. This type of plan also helps consumers avoid costly late fees and interest charges, which can add up quickly when making large purchases.

But he also acknowledges that it is important for consumers to be responsible and mindful when using installment and payment plans, as these plans can quickly become overwhelming if used without caution.

Dvorkin emphasizes the importance of reading all the terms and conditions associated with any plan before agreeing to it, as well as considering one's personal financial situation. He advises that individuals shop around for the best rates when considering an installment plan.

Depending on which site you reference, there are a number of opinions on what apps make the shortlist for the best payment and installment plans. Here's our take on which ones we'd recommend and why.

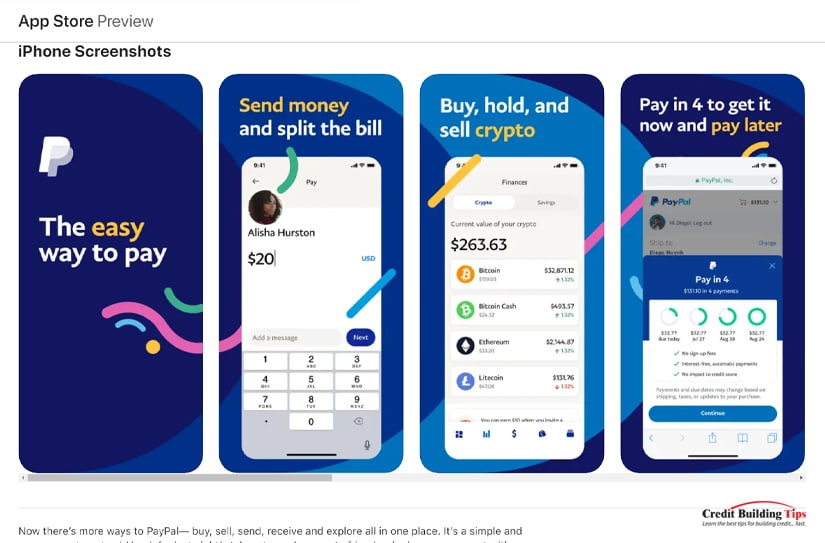

PayPal Pay in 4 is an easy and convenient way to pay for purchases on PayPal. You can set up the app to break down your payments into four smaller, more manageable chunks over a period of time.

Their pay structure requires the first 25% payment to be paid at the time of the transaction, with three additional 25% payments every two weeks after. There are no fees when you use the Pay in 4 plan, and it can be used everywhere PayPal is accepted.

Afterpay keeps things simple with their buy now, pay later plan. All you need to sign up is your email, phone number, address, date of birth, and current debit or credit card information.

They spread the cost of your shopping into four payments over the course of six weeks and even allow a grace period for late payments. Only then will they start charging a late fee, which will never be more than 25% of your initial order.

Klarna not only gives you a pay-in-four option, but they also let you earn one point for every dollar you spend using their app. These rewards can get you "exclusive access to deals, content, and other perks."

If approved, you may also choose a pay-in-30 option or a financing plan from six months to three years. No interest will be charged on the pay-in-four or pay-in-30 option.

Affirm offers affordable monthly payments where you choose the length of your repayment plan, typically three, six, or 12 months. They also offer 4 interest-free payments (every two weeks) depending on eligibility.

We love the fact that they don't charge late fees, prepayment fees, annual fees, fees to open or close your account, or any hidden fees.

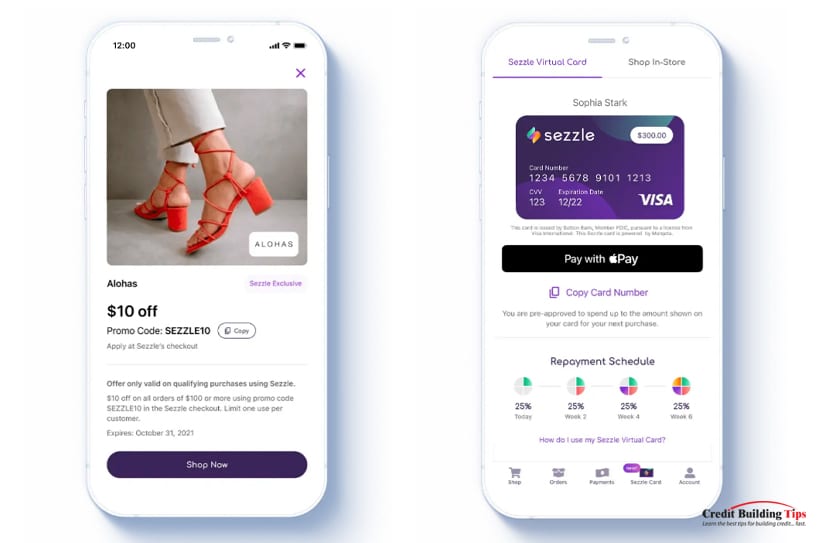

Sezzle's app (as of August 2022) has had 6+ million downloads and boasts a 4.84 rating with 140K reviews. If you pay on time, there are no fees; they offer free payment reschedules and guarantee "zero impact on your credit score."

This app offers discounts, deals, and promotions when you shop using Sezzle.

Viabill lets you "pay for your purchases over time, [and] interest-free." Simply choose the app at checkout and make four installment payments over the course of three months.

The first payment is made at the time of order and then on the last business day of every month. Sign-up requirements are easy as long as you have "sufficient funds to cover your first installment at the time of purchase."

Perpay offers "a new way to build credit" while you "automatically pay over time for your order with a small amount from each paycheck." Every on-time payment will help to build your credit score, and you can see this reflected in an increased score in as soon as four months.

The app is targeted toward people with bad credit. It takes each payment directly from your paycheck and is helpful for those who struggle to make payments on time and in full.

Zip (formerly Quadpay) is set up similarly to PayPal's Pay in 4; splitting your payment into four equal payments allows you to pay over the course of six weeks. Unlike PayPal, Zip charges a 34.7% interest rate for the privilege.

For a $400 purchase, you would need to make four $102 payments every two weeks, for a total of $408.00. Orders can also be "subject to platform fees and/or late fees."

These buy now, pay later services work for online shopping, but some let you use them when you purchase from a brick-and-mortar store. Big box stores like Target use Affirm, Zip, and Sezzle, while Walmart uses Affirm for their BNPL apps.

While there's no guaranteed way to predict the future of these payment and installment plans, some heavy-hitter personal finance experts are speculating on what the next several years will look like.

Howard Dvorkin has kept his eye on BNPL trends since they began. He predicts four significant strictures with buy now, pay later plans:

The winners in the game of BNPL will be the ones who use the plans only when necessary and are then diligent in making timely payments. They'll benefit from extra breathing room in regard to making important purchases and will see a positive impact on their credit scores.

Looking for more ways to build your credit? Subscribe to our blog, and you'll get helpful information and tips on how to stay out of debt and become financially healthy.

Are you tired of worrying about overdraft fees? If so, you're not alone. Banks can be difficult to navigate, and it's hard to know which one offers the best deals.

We've put together a guide of the ten best U.S. banks that offer checking accounts with no overdraft fees. These banks provide great benefits, including online and mobile banking services, competitive interest rates, and no overdraft fees.

An overdraft occurs when a person's account balance drops below zero, and they spend more than they have in their account. The bank then charges an overdraft fee — which can be very expensive if it keeps happening.

An overdraft fee is typically charged for every transaction that puts your account into the negative. That's why overdraft protection is important if you use your checking accounts for day-to-day transactions.

Not having one can mean wasting money and possibly damaging your credit score, or at best, wasting money on costly overdraft fees!

Not having one can mean wasting money and possibly damaging your credit score, or at best, wasting money on costly overdraft fees!An overdraft protection plan is a financial service offered by banks and other financial institutions to help prevent account holders from making transactions that exceed their available funds. It works by allowing customers to overdraw their checking accounts up to a certain limit without incurring an overdraft fee.

The main benefit of an overdraft protection plan is that it can help you avoid the costly fees associated with overdrafts. For example, many banks charge $35 or more for each overdraft transaction. Having a plan in place can save you from these high fees.

An overdraft protection plan can also provide peace of mind knowing that you won't accidentally be charged for a purchase you didn't have the money to cover. It can be especially helpful if you are on a tight budget, as it gives you the freedom to make purchases without worrying about insufficient funds.

Many banks will waive some fees associated with their overdraft protection plans. This can be an added bonus for those trying to save money. Some banks may offer discounted annual fees or lower interest rates when you sign up for an overdraft protection plan. This can make the plan even more affordable.

Having an overdraft protection plan in place is also important because it helps reduce the risk of incurring multiple overdraft fees at once. If you do not have overdraft protection and you make multiple purchases that total more than your account balance, you could incur multiple overdraft fees from each purchase. This can quickly add up and become very expensive.

Overall, an overdraft protection plan helps ensure that you won't have to worry about unexpected fees or charges due to an accidental overdraft. It can help you avoid potential financial damage and keep your accounts secure.

Overdraft fees in the United States have been a touchy topic since the Consumer Financial Protection Bureau (CFPB) first implemented the "Know Before You Owe" rule in 2010. This rule requires banks to disclose all the details of overdraft fees clearly and concisely, making it easier for consumers to make informed decisions.

The CFPB also implemented a regulation in 2010 that stops banks from charging overdraft fees on transactions of $10 or less. Another rule in 2012 required banks to give customers the option of opting out of overdraft protection altogether.

However, despite these regulations, it is estimated that banks still generate around $15 billion yearly from overdraft fees.

However, despite these regulations, it is estimated that banks still generate around $15 billion yearly from overdraft fees.

In 2020, the Consumer Financial Protection Bureau (CFPB) proposed a rule prohibiting certain banks from charging certain overdraft fees unless consumers opt into them. In 2021, the CFPB finalized the new rule that is set to go into effect on July 1st, 2023. This rule will require banks to give consumers more control over their accounts and make it easier for them to avoid overdraft fees.

It is important to note that individual states may have laws in place that are more restrictive than federal regulations. For example, California has a law that bans any overdraft fee if it brings a customer's balance below zero.

Overall, 2023 looks like a good year for those looking to protect themselves from costly overdraft fees. The CFPB's proposed changes could help make sure that banks don't take advantage of customers who don't know how to manage their accounts properly.

It's good news that the days of racking up overdraft fees are quickly becoming a thing of the past. Many U.S. banks have eliminated or reduced overdraft fees, making them more consumer-friendly.

This is a great development, as overdraft fees can be quite costly and add up quickly. In addition to eliminating fees, some banks have also introduced new technology, such as real-time notifications, to help customers avoid going into overdraft in the first place.

Many major U.S. banks have already implemented policies to eliminate overdraft fees. Bank of America, Wells Fargo, Citibank, and U.S. Bank have all eliminated overdraft fees for most checking accounts and credit cards. Other large banks, such as Chase and Capital One, are introducing new products with no overdraft fees, such as savings accounts and prepaid cards. In addition, many online-only banks have no overdraft fees at all.

Bank of America is one of the biggest banks in the U.S., and it recently announced that it would eliminate its overdraft fees as of 2023. The no overdraft fees checking accounts at Bank of America are free, meaning you won't have to pay any additional fees when you use the account.

The bank has a feature called "Safe Balance," which will limit your debit card transactions to only the amount that is in your checking account. If you go over the balance, you won't be charged an overdraft fee, but your transaction will simply be declined.

Wells Fargo is a leading bank in the United States and offers a no-overdraft fee checking account that comes with no minimum balance requirements or monthly fees. You won't incur any charges or fees if you overdraw your account. You'll also enjoy free ATM access across the U.S., online and mobile banking, and bill pay services.

In addition to the no overdraft fee checking account, Wells Fargo offers other checking accounts such as Everyday Checking and Preferred Checking. Both accounts have advantages and disadvantages, depending on your needs and preferences.

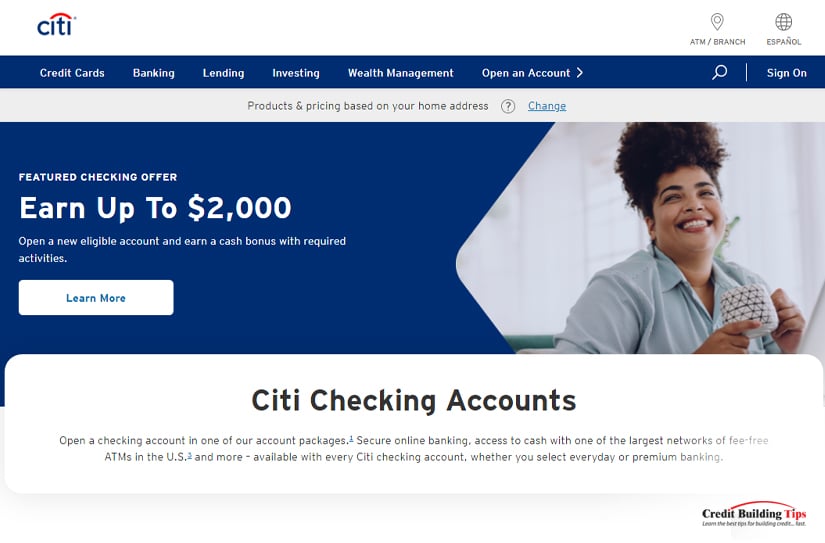

Citibank offers a great "No Overdraft Fees" checking account and comes with various features, such as free online banking, free direct deposit, and up to $500 in overdraft protection.

The account also offers unlimited check writing and free ATM access, so you won't need to pay extra fees just to use the ATM. Plus, you get 24/7 access to customer service, so you can get help if you ever need it.

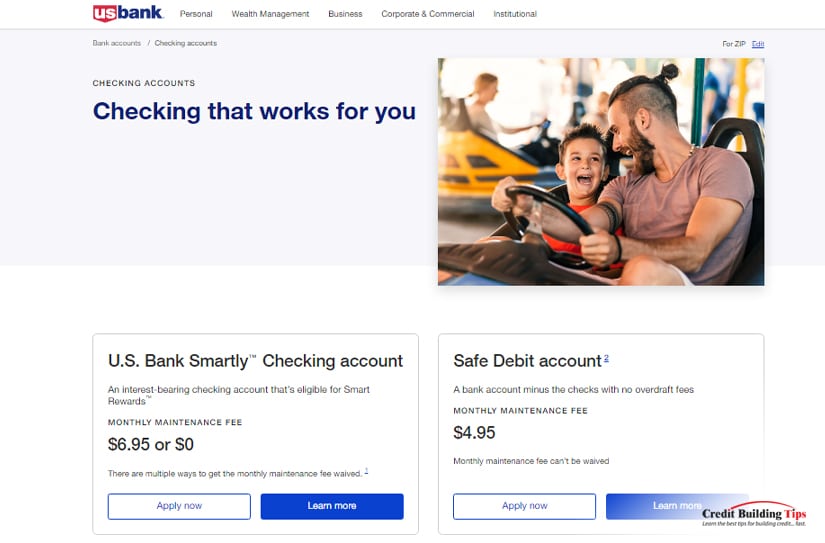

U.S. Bank offers a range of no overdraft fees checking accounts that can help you manage your finances and avoid hefty bank charges. In addition to the no overdraft fees feature, U.S. Bank also offers several other ways to help customers avoid overdrafts.

The bank provides free access to budgeting tools that allow customers to create budgets, track spending and analyze their financial activity. It also has low minimum balances and overdraft protection plans that can be tailored to meet individual needs.

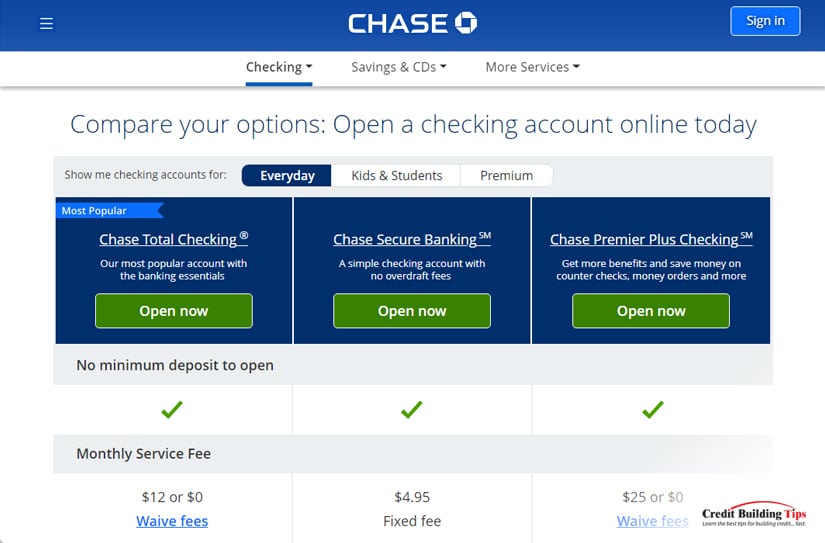

Chase Bank offers one of the market's most comprehensive no-overdraft checking accounts. They offer zero overdraft fees and a monthly service fee of just $12, making it one of the most affordable options for those looking to avoid high overdraft fees.

With a Chase checking account, you also get access to Chase's mobile banking app, a debit card with free ATM withdrawals at over 16,000 Chase and Allpoint ATMs, and free online transfers to other banks.

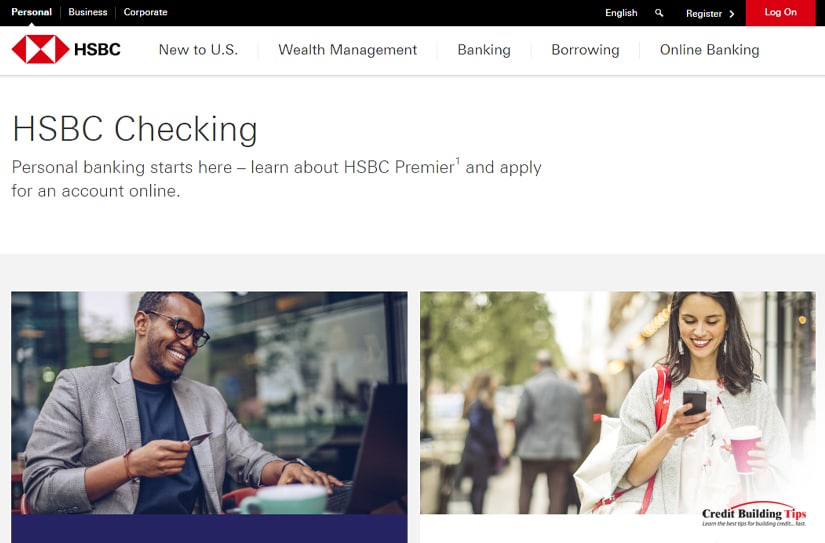

HSBC's banking institution offers an online checking account without any overdraft fees. Their checking accounts have no minimum balance, minimum deposits, or service fees.

HSBC's overdraft fee waiver provides extra protection when you accidentally overdraw your account. You won't be charged the typical overdraft fee, but instead, they will provide a limited line of credit at zero interest to cover the transaction. This is an excellent option for those who need a little extra financial security.

USAA, the United Services Automobile Association, is one of the best options for no overdraft fees checking accounts. It offers competitive interest rates, no monthly fees, and a network of more than 5,000 fee-free ATMs.

USAA is a great option for members of the military and their families, as they are eligible for even better rates and special discounts.

Ally Bank is a top choice for those seeking a no-overdraft fees checking account. Their checking account has unlimited ATM transactions, which means you don't have to worry about paying extra fees every time you use an ATM.

The bank also provides a debit card and mobile app to manage your account, allowing you to easily track your transactions and spending.

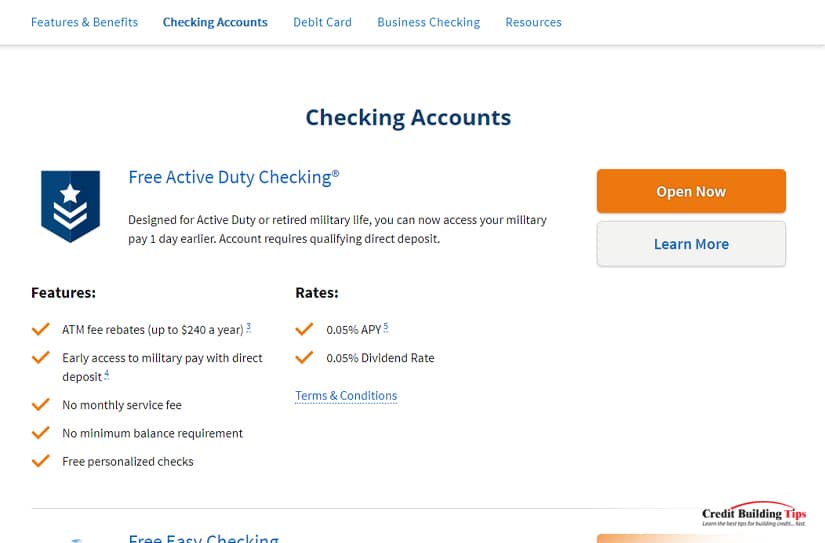

Navy Federal Credit Union is one of the best banks offering no overdraft fees checking accounts.

To apply for a no overdraft fees checking account at Navy Federal Credit Union, you will need to be a member of the organization.

SunTrust Bank (Truist) is a well-known and reputable bank in the U.S., offering no overdraft fees on their checking accounts. With SunTrust, you can open a checking account without any minimum balance or monthly maintenance fee and get access to online banking and mobile banking.

Fortune Magazine notes that "cutting overdraft fees could save Americans $17 billion a year" but feels that many U.S. banks are making the changes quickly enough.

On an individual level, if you normally spend around $200 a month on transactions that cause an overdraft, you could save yourself $240 a year by not paying those overdraft fees.

Staying out of your overdraft is simple when you have the right tools. It takes diligence, a good budget, and an understanding of your account balance to stay out of your overdraft.

Here are some of the best ways to make sure you don't end up in your overdraft.

In some cases, it's possible to negotiate with your bank to waive or reduce the fees associated with overdraft protection plans.

There are a few things to consider before you start negotiating with your bank.

Negotiating with your bank to eliminate overdraft fees is possible, but it will take some effort and research on your part. Make sure to keep the tips above in mind, and be bold and speak up regarding your finances.

If you want to save money and eliminate potential fees, getting a checking account with no overdraft fees may be right for you. Avoiding these fees ensures that your hard-earned money is going towards what matters most instead of unnecessarily high bank fees.

Our mission is to provide helpful tips for those who are just beginning to build credit or those who need help improving their credit score. Let us know if you have any questions about taking advantage of our system to improve your credit score as fast as possible.

Are you trying to improve your credit score but have been held back by an eviction notice on your credit report? If so, you are not alone.

An eviction can be a major obstacle to building a strong credit history and can stay on your credit report for up to seven years.

An eviction can be a major obstacle to building a strong credit history and can stay on your credit report for up to seven years.However, there are ways to remove the eviction from your credit report and get your credit back on track. In this blog post, we'll discuss the step-by-step process of how to remove evictions from your credit report.

You may not even know that there's an eviction notice on your credit report until you need to find a new place to rent. Even then, it may not occur to you that your credit report is telling your prospective landlord about your difficulties with a past landlord.

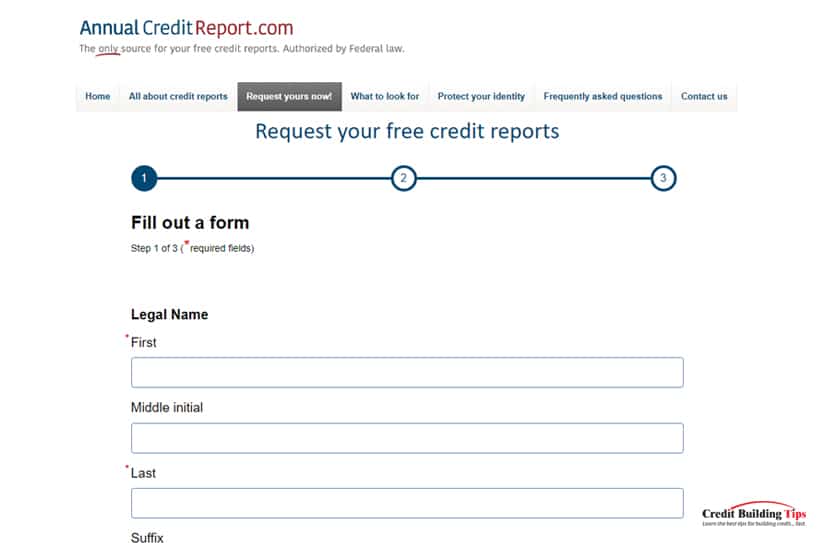

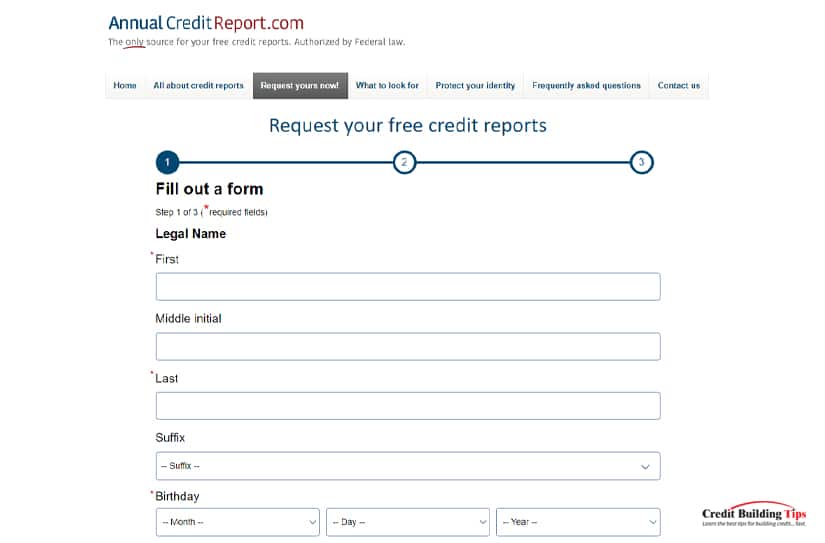

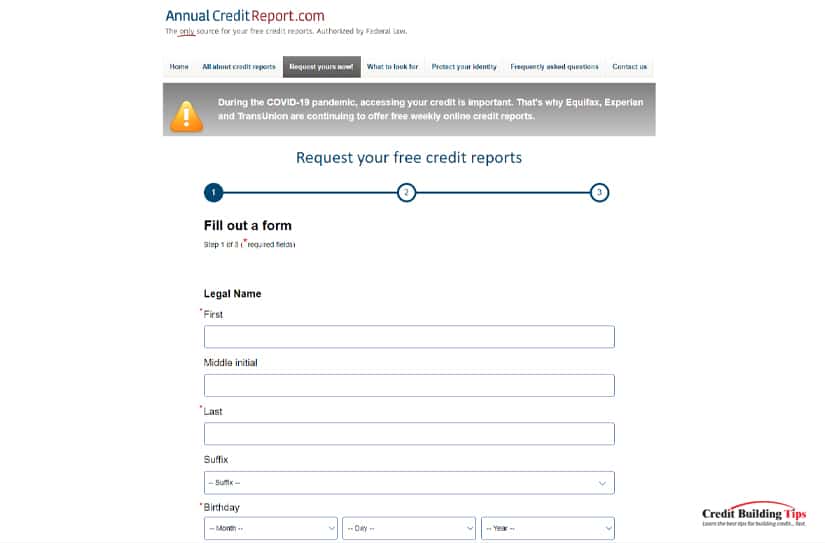

If you do think you may have an eviction notice on your credit report, the first step is to check your credit score and review your report.

If you do think you may have an eviction notice on your credit report, the first step is to check your credit score and review your report.It's a good idea to get a copy of your credit report from each of the three major credit bureaus — Equifax, Experian, and TransUnion — as they often contain different information.

An eviction notice can appear in several places on your credit report. To find out if you have an eviction notice, you'll want to look for the notice under the section that lists "Public Records." Here, you'll be able to see whether you have any unpaid evictions or judgments listed on your report.

If you have an eviction notice on your credit report, it can significantly lower your credit score. It can also prevent you from renting a home or apartment. Fortunately, you can take steps to remove an eviction notice from your credit report.

It's important to know that even if you paid off the eviction in full, it might still appear on your report for up to seven years. Once you've determined whether or not you have an eviction notice on your credit report, you can take the necessary steps to get it removed.

Landlords may evict tenants for many reasons. The most common reason is failure to pay rent. Tenants are legally obligated to pay rent on time, and if they do not, they may be subject to eviction.

Other reasons include violations of the rental agreement, engaging in illegal activities in the unit, damaging the property, or nuisance behaviors like loud music or partying late into the night. Eviction may also occur if the tenant does not comply with local or state laws related to health and safety. Finally, a landlord may choose to evict a tenant due to personal differences.

Landlords must also follow strict procedures when attempting to evict tenants. It's important to understand that each state has different regulations regarding evictions, so it's essential to familiarize yourself with your local laws if you are concerned about being evicted.

A few resources are available for renters who want to better understand the laws surrounding evictions in their state. Every state has its own laws and rules when it comes to evictions, and these can be found online at various state government websites.

To find out more information, renters should visit their state's website to read through the different eviction statutes. The National Conference of State Legislatures provides an overview of state-by-state eviction laws on its website.

It is important to note that some states have limited rights for tenants when it comes to evictions. For example, some states don't allow for tenant counterclaims or defenses, while others may require landlords to offer a settlement agreement before evicting a tenant.

Additionally, renters should familiarize themselves with the Fair Housing Act, which is the federal law that protects tenants from discrimination based on race, color, national origin, religion, sex, familial status, or disability. It's important to know your rights under this law as well as any state-specific laws regarding evictions.

Many legal aid organizations across the country provide assistance and legal advice to tenants who are facing eviction. Legal aid organizations are typically staffed by volunteer lawyers and paralegals who are experienced in tenant-landlord law and can help tenants better understand their rights in relation to evictions.

The amount that an eviction report on your credit report lowers your credit score will depend on several factors. Generally, an eviction report can cause a drop in your credit score of up to 100 points or more.

This can be especially damaging for people with low credit scores. Additionally, the more recent the eviction report is, the more it can affect your score. It is important to keep in mind that credit scores are not static and can change over time as you make positive financial decisions, such as paying bills on time and reducing debt.

If you find out that you have an eviction report on your credit report, it is essential to contact the landlord who reported the eviction and ask them to remove the report from your credit file. If the landlord agrees, then the eviction report will be removed from your credit report, and your credit score should begin to improve.

It's possible that a landlord or management company may have reported an eviction to the credit bureaus without obtaining a court judgment. If this happens, it can still appear on your credit report and negatively impact your score.

If they fail to do this, then the tenant may have the right to challenge the eviction in court. If an eviction order is issued against the tenant, it will show up on their credit report as a negative item, thus lowering their credit score.

Even if the landlord refuses to remove the eviction report, there are still steps you can take to improve your credit score, such as making sure that all of your other debts are current and up-to-date.

The steps you'll need to follow in order to remove an eviction notice from your credit report differ depending on whether the report is accurate or inaccurate. Making sure the eviction notice is accurate is as easy as checking your credit report, as we mentioned above.

Go here to get a free copy of your credit report from the three credit bureaus and find out whether or not there are any eviction notices on your report.

If you find an eviction notice on your credit report, but you know it shouldn't be there, there are a few things you can do to fix the situation.

1. If the eviction is incorrect, you should contact the landlord or property management company and ask them to provide written documentation that the eviction never happened. You should also obtain a copy of your rental agreement if possible. This can be used as proof that you were never legally evicted.

2. Once you have gathered all of this information, you should contact the three major credit bureaus and file a dispute letter.

3. The credit bureau will then investigate the claim and contact the landlord or property management company for further evidence. If the eviction is found to be inaccurate, it should be removed from your credit report.

Make sure all the information on your report is accurate, including the dates and amounts involved. Include supporting documentation, such as a copy of your lease agreement and any court documents. If the information is inaccurate, contact the creditor involved and ask them to correct any mistakes.

You'll need to attach copies of the documentation of payment, such as a copy of the check you sent, bank statements, or a receipt from the landlord. The credit bureau will investigate and determine if the eviction was due to an honest mistake or a valid one.

4. If the dispute is successful, the creditor must update the records with the correct information and notify all three credit bureaus (Equifax, Experian, and TransUnion) of the change. Once updated, any late payments associated with the eviction should no longer appear on your credit report, and your score should improve accordingly.

5. If the credit bureau denies your dispute or fails to investigate, you can contact a consumer law attorney and ask for assistance. A lawyer can help you understand how to navigate the legal system and determine whether or not you may be able to get the eviction removed through legal action.

An attorney may be able to help you dispute the eviction notice more successfully or even sue the landlord if necessary if you feel like the eviction was done unfairly or illegally. They can guide you through the process of suing the landlord for damages related to unfair treatment.

6. Contacting a credit repair agency may also be worthwhile if you need help disputing the eviction. These companies often deal with credit errors and can help you correct them quickly.

Unfortunately, sometimes eviction notices are accurate and do appear on your credit report. Even if this is the case, you can do a few things to make things better.

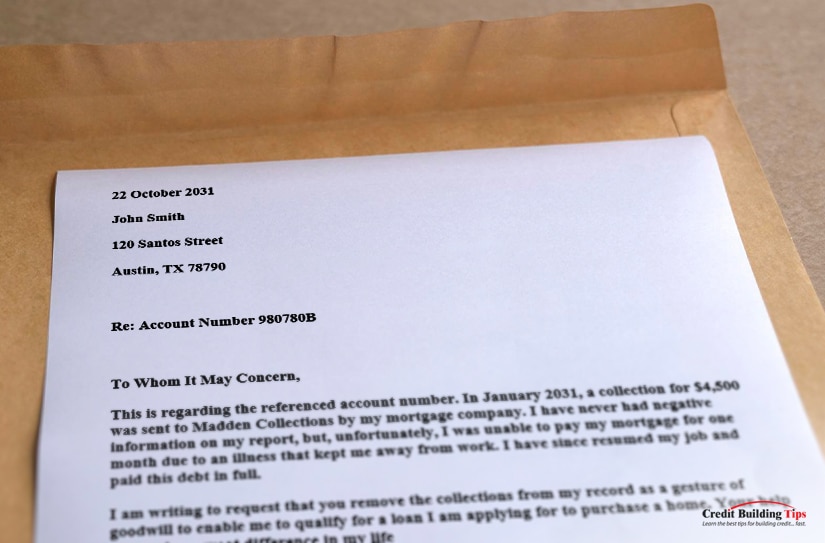

One way to remove an eviction from your credit report is through a goodwill letter. This involves writing to the landlord or management company and asking them to remove the eviction notice on your credit report. They may or may not be willing to accept this request, but if they do, then they must update the records accordingly and alert the credit bureaus.

However, even if the creditor agrees to delete the negative items from your report, the account itself will still appear on the report. Therefore, it is best to use this method only if you feel confident that you can prove the account was handled incorrectly.

You may be able to work out a repayment plan with the landlord who evicted you in order to have the eviction notice removed from your credit report.

You may also be able to get the eviction notice removed from your credit report by making on-time rental payments for at least 12 months after the eviction.

While sending a dispute letter helps when the information on your credit report is inaccurate, you can also send a letter to each credit bureau that provides evidence that you had a good reason for being evicted and/or that the eviction was not your fault.

For example, if you were evicted due to an inability to pay rent due to a sudden job loss or another unexpected financial difficulty, you can provide documentation of the event to the credit bureau.

One of the best places ways to get help with your credit report is to contact a credit counseling agency or a credit repair company.

These organizations can provide valuable insight into what you need to do in order to remove the eviction notice from your credit report. They may even be able to negotiate with the landlord or collection agency that reported the eviction.

Finally, if you're unable to get a valid eviction notice removed from your credit report, make sure to focus on other aspects of your credit report that show responsible financial behavior.

A good payment history, a low debt-to-income ratio, and a steady income can help offset an eviction notice and improve your credit score over time.

You may need to work a little harder to find a landlord or property management company willing to overlook an eviction notice on your credit report. In the U.S., the Fair Credit Reporting Act states that landlords cannot deny a tenancy based solely on a tenant's credit report. However, if there is an eviction on your record, landlords are allowed to take that into consideration.

It is important to note that some states have laws protecting tenants from being denied a rental because of an eviction, so research your state's ruling on this issue.

One option is to provide additional documentation, such as pay stubs or bank statements showing that you are financially stable and responsible. You should also be prepared to explain the circumstances of the eviction, such as extenuating financial hardships or other mitigating factors.

It helps to provide references from past landlords and employers that can vouch for you as a tenant. You may also consider finding a cosigner for the rental agreement with strong credit who can agree to pay the rent if you cannot do so. Also, try searching for a "second chance" apartment complex that is more lenient about credit checks and allows renters with evictions.

Finally, if you're having trouble understanding how credit works and how to repair your credit score, subscribe to our free credit-building tips newsletter. You'll get information, guides, and tutorials on how to fix your bad credit, increase your credit faster than you realized possible, and even achieve a high credit score.

American Express credit cards aren't easy to get as they all require at least a "good" credit score. With FICO®, that's a credit score of at least 670; with VantageScore®, that's a credit score of at least 661.

What's the big deal about getting an American Express (also known as Amex) credit card? What does it offer that other credit card companies don't?

Amex credit cards are attractive because they offer high-end credit cards with "great rewards and luxury perks." They're not easy to get, which creates a sense of exclusivity and prestige for the cardholder.

Amex credit cards are attractive because they offer high-end credit cards with "great rewards and luxury perks." They're not easy to get, which creates a sense of exclusivity and prestige for the cardholder.Nearly all Amex cards offer generous rewards on travel, groceries, dining, and streaming services. And as long as you pay your monthly statement in full and don't incur interest charges, the savings you'll get by using the card will offset its fees.

Most Amex cards offer rental car insurance and extended warranty. Top-tier Amex cards also offer several types of travel insurance, return protection, and purchase protection. Another attractive feature of an Amex card is they offer a low-interest introductory period.

When it comes to credit cards, there are two sides to the same coin — networks and issuers. In total, there are four major credit card networks across the U.S. — Visa, Mastercard, Discover, and American Express.

A credit card network processes transactions and determines where their cards can be used. They also provide benefits like travel insurance or purchase protection, monitor transactions and work on fraud prevention, and create rules for how the cards are used.

On the other hand, credit card issuers are typically banks or credit unions — Bank of America, Wells Fargo, Capital One, Chase, and many others. These banking institutions "provide cards to consumers and handle application as well as determining what it takes to qualify for one of their cards and set the card's terms (APR, credit limit, fees, etc.)."

American Express is fairly unique because it's both a card network and a card issuer. Visa and Mastercard are only card networks, while Discover, like Amex, also issues their cards. It's also good to know that not every American Express card is issued by the company itself — some are issued through a third party.

What's the difference? It doesn't matter much to the consumer, but behind the scenes, it means that Amex controls how transactions and fees are handled. By acting as the "bank" behind their cards, Amex gets to set their fee structure, keep a bigger cut of the fee revenue and offer better rewards as a result.

American Express boasts that they are uniquely positioned to:

"Provide safe, reliable, and convenient ways to make payments and process transactions, connecting millions of customers and businesses around the world."

The company was founded in 1850 by consolidating three companies that were "active in the express transport of goods, valuables, and specie between New York City and Buffalo, New York and points in the Midwest."

After the Civil War, it had grown to 900 offices in 10 states and by 1873 was renamed by American Express Company. The Second Industrial Revolution had just started, 12 million people had immigrated to the States, and slavery had been made illegal just eight years previously.

American Express offers generous rewards and benefits, and they set the bar high on getting one of their cards.

As of this year, American Express offers three main credit card categories:

Only some U.S. merchants accept American Express cards, and internationally, more merchants accept Visa, Mastercard, and Discover cards than American Express cards.

Now that you're clear that American Express cards are intended for those with at least "good" credit scores, which of their credit cards are easiest to get approval for?

These cards require at least a credit score of 650, and while they're not considered the "best" American Express cards, they still offer great benefits and rewards.

The American Express® Gold Delta Card is best for travel rewards with a free annual fee the first year, which then goes up to $95 each subsequent year. This card's APR (interest rate) is a variate rate at 17.24% to 26.24%.

It lets you:

U.S. News rated the Gold Delta Card card from Amex as its "Best in Rewards Credit Cards 2023,' for rewards credit cards.

They gave this award to the Gold Delta card because, with it, you can:

The American Express® Green Card is best for reward points with a free annual fee the first year, which then goes up to $95 each subsequent year. The Green Card has no interest rate but rather requires the cardholder to pay back dues each month.

It offers:

The Amex Green Card works best for first-time credit card holders and those who don't plan to make big purchases with the card, as the monthly statement must be paid in full.

U.S. News rated the Gold card from Amex as its "Best in Rewards Credit Cards 2023,' for small-to-medium-sized businesses credit cards. They gave this award to the Green card because, with it, you can:

Ideal for small business owners, the Amex Green card keeps "business owners in full control of card spending." Employers can preset spending limits, freeze or unfreeze individual cards and see scanned receipts on the American Express Business App.

The American Express® Blue Cash Preferred is best for general shopping with a $95 annual fee each year. The APR on this card is 0% for the first year but then jumps between a variable of 14.49% to 25.49%.

You can:

With guaranteed fraud protection, the Amex Blue Card gives you added security. It also has the lowest APR variable, which is a great way to offset the $95 annual fee and enjoy more rewards.

U.S. News also rated the Blue Cash Preferred® card from Amex as its "Best in Rewards Credit Cards 2023,' for rewards credit cards. They gave this award to the Blue Cash Preferred® card because, with it, you can:

The Credit One Bank American Express® Credit Card is a third-party crossover credit card issued by the Credit One Bank for those with a fair or average credit score. There's a $39 annual fee and a regular 26.99% variable APR.

It lets you:

Before approving you for a new credit card, lenders will check your current credit with a "hard inquiry" (also known as a hard pull). They want to learn what kind of loans and credit cards you currently use, how long you've had these accounts, and if you pay your debts and bills on time.

Digging through this information before you are given a new credit card will cause your credit score to drop. The effect may be negligible if you apply for a single credit card. Still, if you apply for a few American Express cards in the hope of qualifying for one, your score may be negatively affected, and this drop in score will stay on your report for about two years.

American Express allows you to request a prequalification through their website. Prequalification can be used interchangeably with preapproval, but they are actually different processes.

Prequalifications let you give Amex information to see if you might qualify for a card. This is information you provide without the credit issuer checking your credit report to verify the information. This involves a "soft credit check," which won't cause your credit score to drop.

Think of prequalifications as a marketing opportunity. American Express looks at the demographics of your profile and will send you a "special offer" they think might be a good match for you.

You can't find a tool for prequalified offers on the American Express website. You'll find these offers in your mailbox, which you can follow up on or put straight into your recycle bin.