When you open a credit card account, the creditor assesses the likelihood that you will be able to pay back the debt. What happens if something unexpected happens and your circumstances change, though? What happens if you’re struggling to make your payments or you’re behind on the debt?

If you’re dealing with an event or a circumstance that has impacted your ability to pay, you might consider writing your creditor a hardship letter.

You can send a hardship letter to a credit card company when you’ve dealt with a hardship that makes you unable to make a payment on time, such as a serious illness, job loss, or natural disaster. This letter explains the hardship you went through, the plan of action you are asking the credit card company to take, and has substantiating documents attached.

You can send a hardship letter to a credit card company when you’ve dealt with a hardship that makes you unable to make a payment on time, such as a serious illness, job loss, or natural disaster. This letter explains the hardship you went through, the plan of action you are asking the credit card company to take, and has substantiating documents attached.A hardship letter is a letter you can write to a lender that explains the circumstances that made you unable to make your payments on time. Included in this type of letter are the specific details about when your hardship started, what the cause of the hardship was, and when you expect to begin making regular payments again.

This is also an opportunity for you to express how you want your lender to help and how the solution you are proposing would benefit them.

There are a number of types of relief you might ask for in a hardship letter, including:

For instance, you might communicate to your lender that you will be able to avoid going into default if they are willing to reduce your interest rate for a certain number of months. In this scenario, you could explain to them that you believe you will be able to start making regular payments at the current interest rate after that period of time.

While the dictionary might define “hardship” as severe suffering, lenders are only going to consider certain events to be hardships. In their view, hardships are negative events that harm your finances that are outside of your control.

Some examples of occurrences that a creditor might deem financial hardships include:

Hardship events don’t necessarily have to happy directly to you for a creditor to consider altering their agreement with you. These occurrences can also happen to individuals that you either take care of or rely on.

For instance, if your child were to fall seriously ill in a way that you took on increased medical debt and had to work less hours, a creditor could understand this situation as a valid hardship.

On the other hand, lenders likely won’t consider the following to be financial hardships:

For more in-depth information about credit cards and your credit, check out our recent guides on closing a credit card with a remaining balance, opening a new card before buying a house, and properly reporting income on credit card applications.

Before you start drafting your hardship letter, you’ll want to determine whether or not this is the right way to try and communicate to the credit card company. You might find that your creditor actually provides all of the info that you need online to request hardship assistance.

For instance, American Express has a page on their website that gives clear instructions regarding how you can request financial relief in the form of temporarily lower interest rates and monthly payments.

You’ll want to login to your credit card account online to find out if the credit card company that you want to negotiate with has an easy and already-existing process you can go through in order to request assistance.

Some individuals also might prefer to talk to a customer service representative through online chat or by making a phone call. Even if you aren’t going to be emailing a hardship letter or sending one through the mail, it can be useful to write a simple script for yourself to make sure you hit all of the most important points. This doesn’t necessarily need to be a word-for-word script, but rather a list of essential bullet points.

If you have dealt with a hardship and need to seek financial help for your family, you can learn more about government benefit assistance programs at the U.S. Department of Health and Human Services site.

How should you go about drafting a hardship letter? What will you want to keep in mind as you're writing? These tips will help you create a letter that gives you the best chance of receiving a favorable response.

When you are overwhelmed by your credit card debt due to a hardship, it can feel like a desperate situation. You might be tempted to try and stretch the truth or even tell the creditor things that simply aren’t true in order to ensure that they’ll provide you with some relief.

You’ll want to resist this temptation. Instead, be honest about your situation and provide documentation that helps substantiate the claims you are making.

Depending on your situation, the types of documents you will want to submit are going to vary quite a bit. Here are some examples of documents you might consider including:

Are you trying to get on top of your credit cards and credit score? Check out these posts about hiding your credit utilization, getting an Amex card, department store cards for bad credit, and how getting a new credit card impacts your credit.

When you’ve gone through a difficult time, it can be difficult to separate essential from nonessential information in a hardship letter. It’s best to be concise and straightforward when writing while not getting too lost in the details of your situation.

If you are having a hard time determining which information should be included in your hardship letter, consider having someone you trust look over your draft before submitting it. Frequently, people that are outside of a situation are better able to identify the most important objective facts that you would want to share with your creditor in order to help them understand the hardship you have endured.

Templates and examples can be incredibly useful when you are learning how to write a hardship letter. However, if you simply insert your information into an online template, it won’t be specific to your circumstances and won’t come off nearly as genuine.

When writing this type of letter, you might be tempted to try and show the credit card company that you are worthy of assistance through your use of language. It can also feel awkward to write a letter to a creditor, and you might find yourself using bigger words than you normally would or relying on jargon to get your point across.

After you have written your draft, take a look and make sure that it reads smoothly and clearly. Typically, it’s best to stick with simple language. This can also help ensure that your letter is short and to the point.

When you’ve experienced hardship, it’s hard to not think about the factors, organizations, or people that contributed to your current situation. That being said, it’s best to not use your letter as an opportunity to cast blame on others. Instead, you’ll want to focus on explaining your situation in a clear and simple way.

Are you trying to boost your credit with a secured credit card? Take a look at this guide to learn how much of an increase you can expect when you take out a secured line of credit.

Your letter should emphasize the reason that you’re writing– to request hardship assistance. You will need to make a strong case that you are going through a difficult situation that makes it difficult if not impossible for you to remedy the situation without brokering a deal with them.

It’s important to go beyond simply explaining the trouble you’ve gone through. An essential section of your letter is where you express what it is that you want from the creditor.

What can the creditor do for you to help make it possible for you to pay off your debt without defaulting? You will have a much better chance of receiving the help that you need if you propose a clear action plan to your creditor.

Additionally, you’ll want to make it abundantly clear that the plan you are proposing is absolutely necessary in order for you to be able to continue paying off your debt.

As stated previously, it’s best to use examples and templates as inspiration for your own letter rather than simply inserting your information into an existing sample. That being said, it can be very useful to see examples in order to understand what a hardship letter should look like.

Your Name

Your Address

Your Phone Number

Name of Credit Card Issuer

Mailing Address of Credit Card Issuer

Credit Card Company Phone Number

RE: Hardship Letter

Date

To Whom It May Concern,

I am writing because I am experiencing financial hardship and would like to ask for a settlement of my credit card balance. My offer is to pay twenty-five percent of the outstanding balance on my account.

Over the last (X months), I have experienced a considerable decrease in my income. With the high-interest rate that is currently being charged on my account, I am unable to make the monthly payments in the amount of (X dollars.)

I have attached proof of my hardship in the form of the last three months of bank statements, my pay stubs, and copies of late payment statements. Please let me know if there is more information I can provide to help you understand my current financial hardship.

I am currently doing what I can to avoid filing for bankruptcy. In order to do so, I need to make debt settlement arrangements with creditors.

I ask that you please consider my settlement offer and accept it. At the point at which I receive your written agreement, I will send the payment within five business days.

Please don’t hesitate to contact me if you have any concerns or questions. You can contact me at (phone number) to discuss the settlement offer.

Thank you for your time.

Sincerely,

(Your name)

Your Name

Your Address

Your Phone Number

Name of Credit Card Issuer

Mailing Address of Credit Card Issuer

Credit Card Company Phone Number

RE: Hardship Letter

Date

Dear (name),

In this letter I will be explaining the unfortunate set of circumstances that have led me to fall behind on my credit card payments. I have done everything I possibly could to try and stay current with my bills, but the hardship I have experienced has made it impossible for me to do so. I am asking that you will work with me in my effort to pay off the debt that I owe by lowering my monthly payments to (X amount) temporarily for (X months).

Due to my husband’s chronic illness and the resulting medical bills, our financial situation has significantly changed in ways that we could not have anticipated. I have included documents to illustrate our current financial situation, including medical bills, bank statements, and income records. Please let me know if there is more information I can send to help you understand the dire nature of our financial circumstances.

If you agree to reduce my monthly payment temporarily as discussed above, I will be able to resume paying the current monthly payment after (X months). Within this time, I expect that reducing my monthly payment for this period of time will make it possible for me to continue paying my debt to you while also managing medical bills and other expenses associated with my husband’s chronic illness.

If you have any questions or concerns, please feel free to contact me at (phone number) to discuss this further.

Thank you for your time and consideration.

Sincerely,

(Your name)

Before you sit down to write your first draft, there are a few common mistakes that you'll want to steer clear of when writing a hardship letter to a credit card company.

Writing a hardship letter can feel quite strange– you’re ultimately telling a person that you’ve never met at a credit card company about deeply personal issues you have been going through. This can make it difficult to know where to draw the line, and it can be tempting to start telling your whole life story in order to ensure that they understand how truly difficult your financial situation is.

The reality is, though, that you want to avoid expressing any personal problems that aren’t relevant to the situation at hand. For example, if you have had problems with alcohol or drugs in the past, this is not something that you want to mention unless it is directly related to your current concern.

We made the point earlier, but it bears repeating– keep it short. You’ll want to include all of the information that is relevant to your situation without any additional fluff.

It might feel strange to thank your creditor, but it’s important to be professional and polite in your hardship letter. Don’t forget to thank them for their time and consideration before signing off.

If you mention that there are additional funds elsewhere that you haven’t provided proof of, there’s a good chance that the credit card company won’t be willing to work with you to adjust your agreement. It’s never a good idea to suggest that you could borrow money from a family member or sell an asset, even if it feels like you’re just trying to be reasonable in the negotiation process.

Sometimes the simplest mistakes are the ones we’re most likely to make. Make sure that your letter is clearly signed and dated. Otherwise, they might just pass over it without giving it a second look.

If you're trying to make sense of your credit card debt, you might be wondering whether there's any difference between a due date and a closing date. These are actually both very important yet different dates and it's worth understanding how they differ. Take a look at our recent post about the difference between credit card closing date and due date.

Feeling angry when you are dealing with a financial hardship is perfectly natural, particularly if you feel that your troubles were caused maliciously by another party. Even if this is the case, the place to express your anger isn’t your hardship letter. Keep things objective and simple– don’t start talking about how much of a jerk your boss was or how your business partner screwed you over.

You also don’t want to imply or clearly state that your situation is the fault of the credit card company. Even if you legitimately feel this way, saying as much won’t get you very far.

If you’ve gone through an event or are dealing with a circumstance that makes it impossible for you to pay your debt to a credit card company, it can feel totally hopeless. Luckily, some credit card companies allow you to submit information online regarding hardship. Even if your creditor doesn’t have this type of option on their site, you can send them a hardship letter.

Credit card companies aren’t under any obligation to agree to the proposal that you make in a hardship letter. However, they are motivated to collect payment and a hardship letter can convince them to work with you on resolving the debt you owe.

Remember, it’s important to keep your hardship letter short and concise, never blaming the creditor or other parties for your circumstance. Though it’s incredibly stressful to be in a troubled financial situation, you’ll have the best luck getting the results you want by being polite and cordial.

If you're ready to get a handle on your credit, make sure you check out our credit building blog.

When you look at your credit report, the last thing you want to see is a name you don’t recognize next to a loan or a credit pull.

If you recently checked your credit report and you see the acronym COAF listed, you might be wondering what organization this is and whether it’s indicative of fraud.

COAF stands for Capital One Auto Finance, the auto loan arm of the major credit card issuer Capital One. If you see this acronym on your credit report, it likely means that they ran a credit check after you applied for a loan (or applied to see if you prequalify,) that you have a loan or have had a loan with them, or that you’re a co-signer on a loan.

COAF stands for Capital One Auto Finance, the auto loan arm of the major credit card issuer Capital One. If you see this acronym on your credit report, it likely means that they ran a credit check after you applied for a loan (or applied to see if you prequalify,) that you have a loan or have had a loan with them, or that you’re a co-signer on a loan.The term ‘COAF’ stands for Capital One Auto Finance. It can also show up on your credit report in a number of different variations, such as ‘capital one auto fin’ or ‘cap one auto.’

Though you might be worried at first when you see this acronym on your credit report, it refers to a legitimate company. In fact, Capital One is the third largest credit issuer after JPMorgan Chase and Citigroup and the fourth largest auto loan provider after Ally Bank, Wells Fargo, and JP Morgan Chase.

Capital One Auto Finance offers financing for vehicles (both new and used) through its network of participating dealerships. Additionally, it provides refinancing for existing auto loans.

You can learn more on their official website.

If you see ‘COAF’ on your credit report, there are a number or reasons it might be occurring. Here are three legitimate reasons that COAF might be appearing on your credit report:

Let’s take a deeper look at these options and what they mean for your credit report and score.

Did you recently apply for an auto loan through Capital One Auto Financing? If so, they will usually run a credit check in order to determine whether you are eligible for the loan.

When you complete an auto loan application, it results in a hard credit pull.

A hard credit pull typically occurs when a financial institution checks your credit during the process of making a lending decision. A soft credit pull usually occurs when your credit has been checked as a part of a background check.

You usually have to authorize a hard credit pull before a lender can run this type of inquiry. It can have a negligible effect on your credit scores or it can lower your score by a few points. If it does do slight damage to your credit, the impact usually decreases or completely disappears before the inquiry falls off your credit reports, which usually takes about two years.

Even if you didn’t end up taking out a loan with Capital One Auto Finance, the hard inquiry will appear on your credit report if you completed an application and authorized the credit pull.

Are you wondering what your current credit scores are? This guide goes over how you can get your credit scores from all three of the credit bureaus for free.

You will also likely see COAF on your credit report if you applied for prequalification through the auto loan company. When you apply to see if you prequalify for a loan, lenders will run a soft credit pull rather than a hard credit pull.

Soft credit inquiries show up on your credit reports but don’t have any impact on your credit scores.

Whether or not a soft pull shows up on your credit report depends on the credit bureau. These inquiries are only visible to you when you take a look at your credit reports since they aren’t connected to a specific new credit application.

If you’re currently making monthly loan payments to Capital One Auto Finance for an auto loan, you will likely see it appear on your credit report. Lenders almost always record monthly loan payments with at least one of the primary credit reporting agencies.

A previous auto loan that has been paid off in full can also show up on your credit report, which will be recorded as a closed account.

Is your credit a mess? Take a look at our guides to removing derogatory marks from your credit report, deleting a collection account, removing an eviction from your records, and deleting a 30-day late payment.

Car loan applicants are allowed to apply with a co-signer through Capital One Auto Finance. Having a co-signer is a useful tool for people that don’t have great credit as a co-signer with a credit history can help them get approved or receive better terms for their loan.

If you have co-signed on an auto loan application with someone else, there will likely be a credit inquiry on your credit report. It’s worth noting that your credit can be impacted by being a co-signer and you are responsible for making loan payments if the other borrower stops making payments.

How long COAF will stay on your credit report depends on the underlying reason that it is there in the first place.

For example, if you applied to see if you prequalify for a loan but didn’t end up filling out an application, lenders will only run a soft pull of your credit. Though soft inquiries will be visible to you when you look at your credit report, they are not visible to lenders.

Beyond that, soft pulls don’t have any impact on your credit scores. This is true no matter how many soft inquiries have been run on your credit.

According to Capital One, soft pulls only stay on your credit report for 12-24 months.

If you completed an auto loan application through Capital One Auto Finance, a hard inquiry will more than likely show up on your credit report.

Unlike soft inquiries, hard inquiries can be seen by lenders and can impact your credit scores.

Even if you didn’t end up taking out a loan with COAF, the hard pull will still appear on your credit report. Usually, hard inquiries will stay on your credit report for about two years.

If you have an auto loan with COAF, it will show up on your credit reports along with other types of installment loans, like mortgages and student loans.

Even once you have paid the loan off in full, it will remain on your credit report as a closed account. A closed positive account that doesn’t have any associated negative information can stay on your credit report for up to ten years from the closing date.

Car loans are one of the more popular types of installment loans. This means that you make a down payment or apply the trade-in value of a car you already own and then finance the balance with an auto loan that is paid in monthly payments.

How long a closed COAF account stays on your credit depends on what the status of the loan was when the account was closed.

If the account was delinquent at the time that it was closed, the entire account will remain on your credit report for seven years starting from the date that the account was initially recorded as delinquent. The date that the account first became late without being made current is known as the original delinquency date.

If there were past due payments on the account but they were paid in full before the account was closed, the late payment marks will disappear from your credit after seven years. After this point, it will appear as a positive account on your credit report.

If there wasn’t any negative information in the account's history, it will be recorded as a closed positive account and can stay on your credit report for up to ten years after the closing date.

If you applied for an auto-loan as a co-signer, a hard pull will be run on your credit. Hard pulls typically stay on your credit report for about two years.

If the person you co-signed with actually borrows money after being approved for the loan, the loan will show up on your credit report as if the loan is your own. The loan will stay on your credit report following the same timeline outlined in the previous section– “Closed Accounts.”

If you see COAF on your credit report and you didn’t recently apply for a car loan or otherwise have any interaction with Capital One Auto Finance, it’s perfectly reasonable to feel confused and stressed.

There are a number of reasons why an inquiry might show up on your credit report that you didn’t authorize, including either a reporting error or identity theft.

If you see a hard inquiry on your credit report from COAF that you didn’t authorize, it’s a good idea to call the creditor (in this case, COAF,) and ask why your credit was run. If you see a hard inquiry on your report and you’re not sure who the creditor is, you can find it listed under the hard inquiry section of your credit report.

If it appears that the hard pull was simply an error, the creditor will most likely be able to help you and remove the hard pull from your report. If you are struggling to get the inquiry removed over the phone with COAF, you will want to file a dispute by mailing a letter to the credit bureau or calling the credit bureau.

When you call COAF to find out why a hard pull was run on your credit that you didn’t authorize, the best case scenario is that it was an error on their end.

In some instances, though, they might claim that you supposedly did authorize the inquiry.

If this occurs, there’s a possibility that you are the victim of identity theft.

Here are the steps you’ll want to take:

You can find out more about what to do about identity theft using the Federal Trade Commission’s IdentityTheft.gov.

After you’ve dealt with the initial fraudulent activity, there are a few more steps you can take:

If you're on a mission to improve your credit, check out our posts about why your credit dropped 100 points, building credit when you have no credit history, and whether prepaid cards help improve your credit.

It’s always a good idea to check your credit report regularly so that you can spot anything strange as soon as possible. If the COAF on your credit report is inaccurate, you should contact Capital One Auto Finance to verify that it was an error and have it removed. If they believe it was accurate, it’s possible that you were the victim of identity theft and there are a number of steps you’ll want to take.

Is it time to make your credit something that works for you rather than against you? Check out our credit-building blog for more articles and guides about boosting your scores and cleaning up your credit report.

Having a debt in collections can wreak havoc on your credit scores.

In some cases, it is possible to delete a collection from your credit report in exchange for payment.

If you're trying to delete a collection account from your credit report, you can contact the collection agency and see if they will be willing to delete the account in exchange for full or partial payment of the debt.

If you're trying to delete a collection account from your credit report, you can contact the collection agency and see if they will be willing to delete the account in exchange for full or partial payment of the debt.Though this type of action is discouraged by credit bureaus, it is possible in some cases to have this type of derogatory mark removed from your report in some cases.

If you are interested in a pay-for-delete arrangement with a debt collector, the first thing you will want to do is contact them via the phone or through a pay for delete letter.

Opinions regarding whether it's a good idea to attempt to pay to delete a collection vary widely, which we'll get into later. The steps you will want to take if you want to take this course, though, are as follows:

In exchange for full or partial payment, debt collectors will sometimes promise to change the classification of your account on your credit reports.

If a debt collector does agree to remove the marks from your credit report, you will want to request a letter for them stating that they will adjust your credit report. Collections agencies are primarily focused on collecting the debt they are owed, and have been known to say whatever they need to in order to receive payment.

For more information about improving your credit score, take a look at these four simple ways you can remove derogatory marks from your credit report.

If you have a debt in collections and you want it taken off of your credit report, you can propose a deal with the debt collector: you’ll pay off the account if they will update your credit report to remove the account.

This is known as ‘pay for delete.’

Before you get excited about having this negative mark taken off your credit report, it’s worth understanding that these agreements are quite rare. Credit reporting bureaus go out of their way to discourage attempts to take information off of reports that is accurate.

The reason for this is that creditors and lenders are legally obligated to report information that is both accurate and complete to the credit agencies.

That being said, creditors do have some leeway to choose to not report information. Beyond that, the Fair Credit Reporting Act doesn’t explicitly prohibit pay for delete. This means that there’s a chance a debt collector will be willing to strike a pay for delete deal.

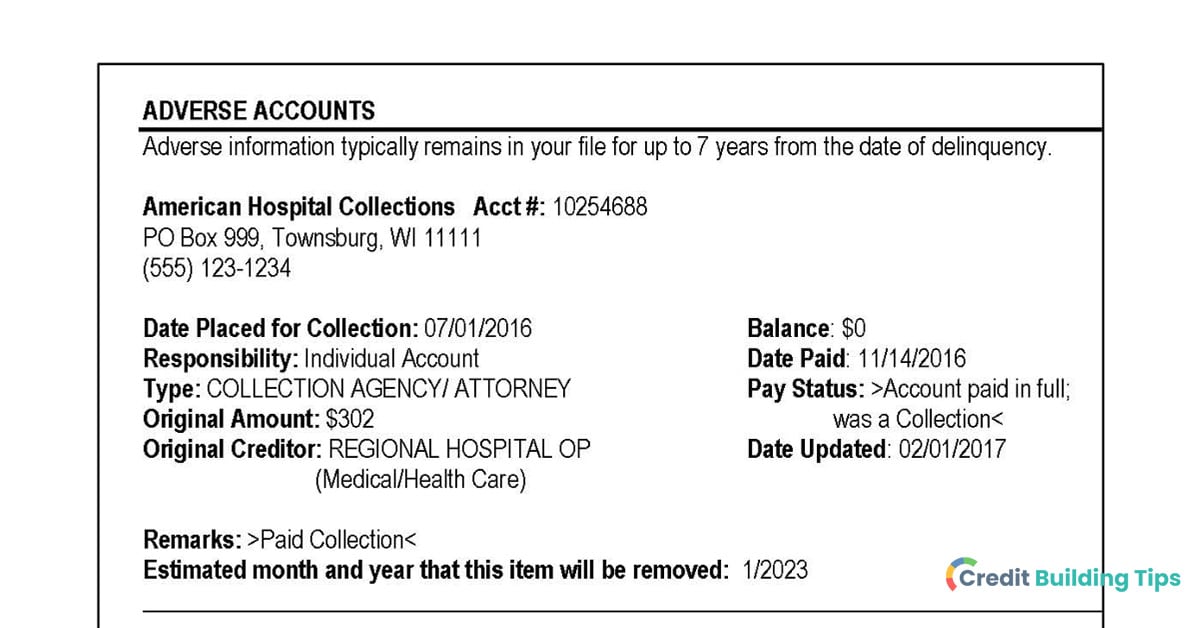

When an account is sent to collections, it usually stays on your credit report for seven years. Accounts get less harmful to your credit the older they get, but they will still be present on your report for seven years until they “drop off.”

If you want to propose a pay for delete arrangement with a debt collector, the first thing you’ll want to do is either give the collection agency a call or submit a pay for delete letter, which is a formal request letter.

If you write a letter rather than calling, you’ll want to clearly state your offer– that you want to pay off either all or part of the debt in question and, in return, you’d like the debt collector to delete the account from your report.

At this point, you’ll have to wait to see whether the collection agency is willing to take the deal. If they do agree, it’s a good idea to ask for written confirmation of the agreement before making the payment. Since the pay for delete letter doesn’t really hold any weight legally, you could otherwise end up in a situation where you make the payment but still have the account on your credit report.

Though pay for delete is a tempting solution to a frustrating problem, there are some reasons you might not want to go this route. Here are some things to consider before calling the collections agency and trying to broker a deal:

Even if you aren't able to get the mark removed from your credit report, there are still steps you can take to increase your credit score. Check out these articles about opening a new credit card, using second chance credit unions, credit repair software programs, and getting a secured credit card to boost your credit score. Before hiring a credit repair agency, make sure you read the pros and cons of credit repair services.

If you have a debt in collections that showed up on your credit report and you pay it off, it will stay on your credit report but be recorded as a paid collection.

Many people mistakenly believe that if they pay their debt in full, the mark will be removed from their credit report automatically.

Unless the collections agency agrees to fully delete the account rather than update the status to 'paid,' it will remain on your credit report for seven years.

Even if they do agree to these terms, it can be difficult to actually enforce a pay for delete agreement, as a pay for delete letter isn't legally binding.

If you're on a mission to achieve the highest credit score you can, check out this post about the maximum possible score.

If you are late making payments to creditors, it can have a negative impact on your credit score. If an account is so delinquent that it was sent to a debt collector, though, it can have much larger repercussions for your credit score.

By some accounts, having a debt sent to collections can mean your credit score dropping around 110 points. How many points you’ll lose depends on a number of different factors, but you’ll lose more points the higher your score was to begin with.

Your overall credit profile will have an impact on how much a pay for delete will help your score. If you only have one debt in collections and they are willing to delete it from your credit report in exchange for payment, you might see your score increase once it is removed. However, if you get one derogatory mark removed but you have several other debts in collection, it probably won’t make much of a difference for your score.

Some experts have been sounding the alarm recently, spreading the word that pay for delete is becoming outdated as a method of dealing with a collection account on your credit report.

One of the reasons for this is that some of the latest credit scoring models-- particularly FICO 9 and VantageScore 3.0-- don't factor in collections accounts that have been paid in full.

What this means is that, while the account still appears on your credit report, it doesn't have nearly as much of a negative impact as it would using older models or if you hadn't paid off the debt.

However, not all creditors use these new scoring models. For example, most mortgage lenders use a model that considers all collections accounts.

At both the federal and state level, credit bureaus, debt collectors, and lenders are all highly regulated. What this means is that you are granted certain rights as a consumer.

If you and the collections agency are negotiating a payment plan for your outstanding debt, make sure you take a look at this guide to installment plans and payment plans.

Understandably, consumers that are interested in a pay for delete arrangement typically have a lot of unanswered questions. Let's look at some of the most commonly asked questions about this method of credit repair to help you make the right decision.

In some cases, it can be difficult to determine who exactly owns your debt. You’ll want to try the following tactics if you need to track down the right collections agency:

If the original creditor hasn’t yet sold the debt to a collections agency, you’ll want to contact the creditor to try and arrange a ‘pay for delete’ deal. If they have already sold it, you might find that the original creditor is willing to reclaim the debts. They aren’t obligated to do this, though, so there’s no certainty that they will agree.

It is not illegal to send a pay for delete letter. That being said, the concept of pay for delete does exist in a legal gray area, as debt collectors often have contracts with the credit bureaus that explicitly prohibit them from deleting information from a credit report that is accurate.

Collection agencies do not have any legal obligation to remove information from your credit report. They also cannot remove information that was entered by the original creditor.

There are mixed perspectives about whether it is a good idea to try and and broker a deal with a collections agency to have your derogatory mark deleted in exchange for payment.

On the one hand, it's possible that the debt collector will agree to this and follow through on their end of the deal.

On the other, though, they might not actually remove the debt once they receive payment, and there is little recourse consumers have in this situation because pay-for-delete letters aren't enforceable.

Additional considerations include the fact that newer credit scoring models don't even take paid collections account into consideration when calculating your score and that a debt collector might not have the power to fully remove an account from your credit report if it was submitted by the original creditor.

Let's break down the possible outcomes in a slightly simpler way:

If you can't get the collections account deleted from your credit report even once its paid off, all hope is not lost. Instead, you'll want to focus your energy toward rebuilding your credit. For more information about how to improve your credit score, check out our credit building blog.

If you've been evicted in the past or you are currently dealing with an eviction, learning how to get an eviction removed from your credit report is likely on your mind.

You'll be glad to know that the actual eviction itself won't show up on your credit report. In the past, the public record of a judgment against you in a civil suit (like an eviction) would show up on your credit report, but this is no longer the case. If your landlord sends an outstanding debt you owe to collections, though, this will show up on your report and impact your credit.

Even though the actual eviction itself won't show up on your credit report, it will show up on your tenant screening report and background checks.

Even though the actual eviction itself won't show up on your credit report, it will show up on your tenant screening report and background checks.Let's look at what you need to know to clean up your records.

A common misconception is that getting evicted will show up on your credit report. The actual eviction itself will not appear on your credit report or impact your credit score.

In the past, the following related actions could be reported to the credit agencies:

That's right-- the actual act of eviction will not show up on your credit report. Until recently, legal judgments against you would appear on your credit report as well as any debts you have in collections. Nowadays, you don't have to worry about judgments showing up on your credit report, but any unpaid rent that goes to collections will appear on your report.

If you were evicted for non-payment and you still have an outstanding debt with your landlord, they might choose to sell your debt to a collection agency.

If your debt goes to collections, it will appear on your credit report. This negative mark on your credit report can decrease your credit scores and stay on your credit report for seven years.

Having a less than ideal credit score can have a major impact on your ability to rent an apartment, borrow money, and your ability to grow wealth over time. Make sure you check out these five ways you can raise your credit score instantly.

Though the eviction itself won't be recorded on your credit report, that doesn't mean it can't have negative consequences for you. This is because your eviction will show up on tenant screening reports and background checks, which are not the same as credit reports.

Your credit report is a statement containing information regarding your current credit situation and credit activity.

On your credit report, the following types of information can be found:

Though there is a ton of information about you in your credit report, some personal and financial details won't show up. These include your income, education, marital status, and bank account details.

A tenant screening report can be used by landlords to make decisions about potential tenants. Multiple sources are used to create these reports, including credit reports, rental history, and more.

Any of the following information can be found in a tenant screening report:

While the actual eviction won't show up on your credit report, it will show up on your tenant screening report.

If your landlord took you to court and won a civil suit against you, it would be recorded in the public record and, in the past, would show up on your credit report.

Historically, the following events can lead to a "public record" showing up on your credit report:

As of July 2017, though, the new reporting standards for public records actually resulted in the removal of nearly half of tax liens and all civil judgments from consumer credit reports.

In many cases, public records with negative information will stay on your credit report for somewhere between seven and ten years. These days, the only public record that will show up on your credit report is filing for bankruptcy.

Did you file for bankruptcy in the past and you're wondering whether your credit will improve after it falls off? This guide tells you everything you need to know.

If you've noticed an error regarding public records on your credit report, you can dispute these errors through the appropriate credit bureau. If an old judgment is still on your credit report, contact the credit bureau to dispute it.

If you're working to improve your credit, you might me interested to learn about some of the credit repair software programs that can help to streamline the credit repair process.

If your unpaid rent was sent to a collections agency and it's damaging your credit, there are a few things you can do.

You'll want to take a look at both your credit reports and your own records to figure out how an outstanding debt is impacting your credit.

Gather all of the information you have about payments you've made to your landlord or to the debt collector. You'll want to request your credit report from all of the major agencies-- Experian, Equifax, and TransUnion-- to see if the debt appears on all three.

You can use AnnualCreditReport.com to request your credit reports from all three of these credit bureaus.

If you believe that a collections account is on your report in error, you'll want to dispute it. You can file a dispute through the mail, on the phone, or online with the credit agencies.

Before you hire a credit repair agency to help improve your credit, read the pros and cons of credit repair services.

If the debt is correct but has been paid in full, you can ask the creditor for a goodwill deletion. While they have no obligation to do this, it doesn't hurt to ask. If you have a good track record of making payments on time, this can help your case.

It is also possible to try and broker a deal with the debt collector, stating that you will pay off the debt in exchange for the mark being removed from your credit report. If they agree to this, make sure you get them to send you the arrangement in writing.

If you are trying to improve your credit through every possible avenue, use this guide to goodwill letters to help you understand what your chances of success are.

If the collections agency has agreed to the goodwill deletion, make sure you follow up after the fact. You'll want to wait about thirty days and then pull your credit reports again to make sure that the account has been removed.

For more information about cleaning up your credit report, check out our recent post about four simple ways to remove derogatory marks on your credit.

Are you shooting for the moon when it comes to repairing your credit? Learn about the maximum possible credit score here.

If you believe that your eviction is going to show up on your tenant screening records, you're likely wondering if there's anything you can do to remove it from your record.

Let's take a look at the different steps you can take depending on your circumstance.

The first thing you'll want to do is determine whether your eviction is showing up on your tenant screening record.

If your property manager or landlord actually started the legal process of eviction against you, it will create a public record. Since judgments against you are no longer supposed to show up on your credit report, you will want to look for this information on your tenant screening report.

You can access a tenant screening report for yourself by requesting one from a tenant screening agency. If you are currently looking for an apartment, you can ask the property manager at rental you're interested in what agency they use.

Are you wondering how your credit score is going to impact your ability to rent a new place? This article looks at the credit score you'll need to rent a house or an apartment.

There are different laws surrounding eviction in every state. If you think that you were wrongfully evicted, you'll want to check in with the landlord tenant laws of your state and, in some cases, your municipality.

If you can prove that you didn't violate the lease and shouldn't have been evicted or that the property manager didn't follow the proper procedures outlined in the law, you might be able to have the eviction removed from your public record by petitioning the court.

You will want to pay any outstanding balances you have that are related to your eviction-- if they are legitimate, of course. If you don't have the funds to pay the debt in full, the collection agency or property manager might be willing to negotiate with you.

It's possible that they will agree to setting up a payment plan or settling the debt for less than the original amount.

If your unpaid rent has been sent to collections, it will stay on your credit report even after you've paid it in full or negotiated a settlement.

Before you make your payment, you can ask your property manager or the collection agency to request that the account be removed from your credit report if you pay in full. It's important to get this agreement in writing rather than relying on a verbal agreement.

If your property manager still owes the debt or is able to reclaim it, you can ask them to remove the eviction from your tenant screening report in return for a settlement or paying the debt in full. You will also want to make sure you receive this agreement in writing.

If your property manager or the collections agency agrees to remove derogatory marks from your credit report or tenant screening report, you'll want to follow up after the fact and make sure they actually do so.

If you found any inaccuracies or errors on your tenant screening record, you can contact the company you used to generate the report to dispute them. You'll want to have proof on hand that substantiates your claim that the report is not accurate, such as the documents exchanged between you and the debt collector when you agreed on a settlement or paid your rental debt.

There are few things as stressful as dealing with an eviction, and this is only magnified when it impacts your ability to borrow money, rent an apartment, or otherwise try and move forward with your life.

The good news is that evictions and civil judgments against you will not show up on your credit report.

The bad news is that any outstanding debts that have been sent to collections will show up on your credit report. Beyond this, your eviction and any judgments against you will show up on your tenant screening report.

If an eviction or a debt is showing up on either your credit report or your tenant screening report and you believe it is an error, you can dispute the error and have your reports adjusted. That is, so long as you can prove that the information was inaccurate.

While there are no guarantees, it's possible that you will be able to have the eviction removed from your tenant screening report and your debt removed from your credit report in exchange for payment. If you strike an agreement with an agency in this way, you'll want to make sure you get it in writing.

If you're motivated to improve your credit, make sure you check out the rest of our credit building blog.

Figuring out how to remove a 30-day late payment from your credit report isn’t anyone’s idea of a good time– once a creditor has reported a late payment to one or more of the credit agencies, it can be difficult to get removed if you did, in fact, miss making the payment by more than thirty days.

The first question to ask is whether the late payment on your credit report is an error or if it’s accurate.

Removing a 30-day late payment from your credit report is simple if it was an error-- you'll need to contact the credit bureau, your creditor, or both to have it removed. Unfortunately, it isn't always possible to remove a late payment if it is accurate.

Removing a 30-day late payment from your credit report is simple if it was an error-- you'll need to contact the credit bureau, your creditor, or both to have it removed. Unfortunately, it isn't always possible to remove a late payment if it is accurate.In this article we'll explore what to do if the late payment was an error, strategies you can try if it is an accurate mark on your credit, and more.

When a lender reports that you paid a bill late to the credit bureaus, a late payment is reported on your credit report. There are two different ways that this can occur:

If the late payment is the result of an error on the part of the lender or the credit bureau, it isn’t too difficult to have it removed from your credit report. You will need to file a dispute that explains the mistake and demands that the late payment on your report be removed.

However, it can be much more difficult to get a late payment removed from your credit report if you did actually make a late payment. Not only can it be a frustrating process, but it can be quite time-consuming. Even so, there is no guarantee that you will succeed in your attempts.

For help cleaning up your credit report, check out these four simple ways you can remove derogatory marks from your credit.

If the lender was correct in reporting your late payment, there are a number of steps you can take to try and get it removed from your report. The reality is, though, that your chances of having a late payment removed from your credit report aren’t great if you don’t have a compelling argument (with evidence) for why it should be removed.

If you realize that your payment was late before it ends up showing up on your credit report, you’ll want to get on the phone with the lender as soon as humanly possible. They might be willing to help you resolve the issue before they report it to the credit bureau. This is particularly true if this is the first time you’ve ever missed a payment with the lender.

When you missed a payment and the creditor has already reported it to the credit bureaus, you can try sending them a letter that explains why the payment wasn’t made on time. Commonly referred to as a “goodwill letter,” this is your opportunity to formally explain why you believe the payment should be removed from your case.

It’s worth understanding that lenders aren’t required to remove late payments from your report if they were accurate. Considering the impact it can have on your credit, though, it’s still worth trying.

You might find that your creditor is willing to help you out, particularly if you can provide proof that supports circumstances such as one or more of the following scenarios:

It’s really easy to get stressed out and frustrated when you’re trying to get a 30-day late payment removed from your credit report. The truth is, though, you have a much better chance of receiving the outcome you’re looking for if you are nice and cordial.

When writing your goodwill letter, here are some things to keep in mind:

You’ll want to include the following information in a goodwill letter:

It’s possible that your creditor will update your credit report after they receive your letter. However, a common response from lenders is that they aren’t legally allowed to remove accurate information from a consumer’s credit report.

Mistakes aren’t uncommon on credit reports, which is why it’s a good idea to regularly review your credit reports. If you find an inaccurate 30-day late payment on your report, you can ask the credit bureau to prove that the late payment is correct. If it’s found to be a mistake, you can request that it is removed.

When it’s clear that the late payment was a mistake, removing the mark from your credit shouldn’t be too difficult. Under the Fair Credit Reporting Act (FCRA), you are entitled to request substantiation and that the late payment be taken off your report if it is found to be an error.

There are two ways that you can request that an inaccurate 30-day late payment is removed from your credit report.

The Consumer Financial Protection Bureau advises that you contact both the company that provided the information to the credit reporting agency as well as the credit reporting company.

You’ll want to start by disputing the error with the credit reporting company that generated the error on your report– either Equifax, Experian, or Transunion.

You should explain why the late payment is an error including copies of documents that help to substantiate your dispute.

You can use this template provided by the Consumer Financial Protection Bureau to draft your letter.

The following information should be included in your dispute letter:

It can be prudent to send your letter by certified mail and ask for a return receipt. This way, you will know with certainty that the appropriate credit reporting agency received your letter.

Lenders and creditors use your credit scores to help predict how likely it is that you’ll make your payments on time before they lend you money. When you think of it this way, it makes sense that missing a payment would end up having a negative impact on your score.

Even so, it’s pretty frustrating to realize that your credit score dropped because of one bad mark on your credit report.

Even just one 30-day late payment can have a negative impact on your credit scores. The most influential factor in calculating your score is payment history.

Once a late payment is reported to the credit bureaus, it will drop your credit score and it will stay on your report for seven years. At that point, it will drop off from your credit report automatically.

There are a number of different factors that influence how a late payment will impact your credit score. These include how late your payment was, how often you’ve made late payments, and how recently the late payment was reported to the credit bureau.

While there are many factors that determine your credit score, one single late payment can reportedly drop your credit score by anywhere between 90 and 180 points.

If you are able to make a payment before 30 days have passed, you most likely won’t see it show up on your credit report. However, once 30 days have gone by, lenders will most likely report it.

These late payments get categorized as 30-day late payments, 60-day late payments, 90-day payments, and so on. This sequence will continue until the creditor deems the debt uncollectable (aka resorting to a “charge-off.”)

The later you make your payment, the more severe the impact will be on your credit scores.

Did you recently notice a significant drop in your credit score? This guide look at the multitude of factors that can contribute to reduction in your score.

Though it’s frustrating to have your credit scores go down due to a 30-day late payment, it shouldn’t be life-shattering if it only happens one or two times. If you have late payments on a number of different loans, though, or you regularly pay your bills more than 30 days late, you’ll find that the impact it has on your credit score is much greater.

The impact of late payments will decrease over time, and how recent information is a meaningful factor for the scoring models. However, that doesn’t mean it isn’t worth fighting to remove late payments that are a few years old, as they still have a negative influence on your scores.

If you realize that you missed a payment, the best possible course of action is to make the payment before thirty days have passed from the original due date. If you do this, there’s a good chance the late payment won’t have been reported to the credit agency yet.

If there’s already a mark on your credit report, though, it, unfortunately, won’t be automatically removed once you pay it off.

Are you negotiating with a creditor or a debt collector to pay off your debt? Make sure you read this guide to payment and installment plans first.

In most cases, a late payment won’t show up on your credit report for at least thirty days after the due date has been missed. However, it’s worth understanding that, in the case of credit card companies, there is a lot of flexibility when it comes to reporting payments that are late.

Credit card companies can choose when they report late payments and how often they report them. If you make a payment a few days late, it might never get reported to a credit bureau.

It can be frustratingly difficult to get a late payment removed from your credit report if you did actually make your payment more than 30 days late after the due date. Any late payments that you can’t successfully remove from your report will stay there for seven years until they fall off your credit report.

Though this can be discouraging, this doesn’t mean your credit scores are doomed to be terrible or that you can’t borrow money for the next seven years.

Are you trying to improve your credit and you're wondering if opening a new credit card will help? This post goes over everything you need to know about how opening a new credit card impacts your score.

If you’ve run out of options when it comes to removing the late payment from your credit report, it doesn’t mean that you’re doomed to a bad credit score forever. The late payment will have a gradually less severe impact as time goes on and it gets older. Additionally, you can focus on deliberately building your credit score back up.

What could your credit score look like if you were very good at managing your credit over the course of years? Take a look at the highest possible credit score and whether it's possible to achieve this maximum score.

First things first, you’ll want to make sure that you don’t miss another due date. You might choose to sign up for auto-payments to help make this easier, or build the habit or sending your payments a few days early to make sure you don’t miss one.

Another thing you can do is make sure you keep your credit utilization rate on the lower end. It’s ideal to stay under 30%. This is the ratio between how much credit has been extended to you and how much you are using.

When you're desperate to build your credit back up, it's easy to get tempted by credit repair company offers that promise to work miracles for your credit. Make sure you read this post about the pros and cons of hiring a credit repair agency before making any decisions.

If your credit score has been problematically damaged by late payments and other negative marks on your credit report, you might worry that you won’t be able to borrow money when you need to. There are still ways you can borrow money with poor credit, but you’ll always want to be skeptical as there are many predatory lenders out there that will lend money to people with bad credit in exchange for outrageous interest rates and fees.

Depending on the type of loan you’re applying for, a co-signer could help. A co-signer is a person that joins in on a loan application and promises to pay back the loan if you aren’t able to make the payments on time. Of course, this is a risky proposition for the co-signer, as their credit could end up being damaged if make payments late.

Late payments can stay on your credit report for seven years, so it's important to have a system in place to avoid making payments after the due date. If you already have a mark on your credit report for a 30-day late payment, these are the steps you can take to try and remedy the situation:

If you're motivated to improve your credit score, make sure you check out the rest of our credit building blog.

Deciding whether to open a new credit card before buying a house can be tricky. On the one hand, a new credit card can give you access to additional funds and rewards; on the other hand, opening a new card can also negatively impact your credit score.

In this blog post, we will look at both sides of the argument to help you decide if opening a new credit card before buying a house is the right decision for you.

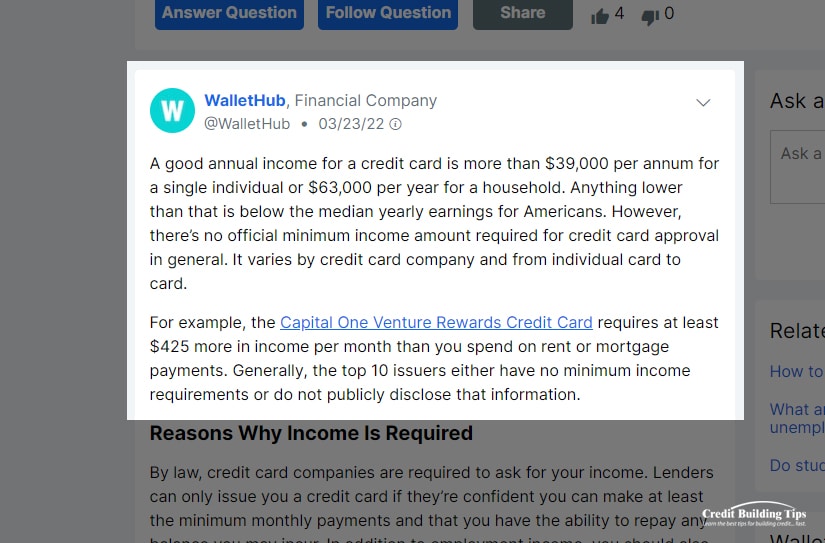

In this blog post, we will look at both sides of the argument to help you decide if opening a new credit card before buying a house is the right decision for you.When you apply for a mortgage loan, the lender will closely scrutinize your credit report. They assess your income, including any additional income, such as from investments or rental properties. The lender will also analyze your debt-to-income ratio to ensure you can afford to make the payments on the loan. The lender may also verify your income and employment information.

In addition to the credit report, lenders usually want to see bank statements and list assets such as cash, stocks, bonds, and investments. It's important to have enough assets to cover closing costs and reserves for mortgage payments.

A 20% down payment is typically recommended, but some conventional loans have lower down payment requirements. And if you're applying for a government-backed loan, you may not need a down payment at all.

Financial institutions dig deep into your credit report and consider the following:

It's important to be aware of all the factors lenders look at when evaluating a loan application. Make sure that you have a good understanding of your finances so that you can increase your chances of being approved for a mortgage loan.

While managing a new credit card well is one of the best ways to build good credit, applying for and opening a new account causes your credit score to take a dip. That's due to the "hard inquiry" that comes when a credit card company reviews your credit report and score to see if you're a good risk for them to extend you credit.

Hard inquiries (or pulls) only temporarily affect your credit score. Within a few months, your score should return to what it was before the hard inquiry.

FICO, a credit scoring company, looks carefully at how many recent pulls show up on your credit report. Not only how recently but also how many credit cards you may have applied for in a short amount of time. Applying and opening a few cards at the same time can be seen as risky behavior and may cause a mortgage lender to view you with caution.

The length and average age of your credit history are other factors that contribute to your credit score. New accounts lower the average age of all your accounts. This factor makes up 15% of your credit score.

Your credit utilization is an important factor in your credit score — 30%. The total amount of your credit card balances are referred to as "revolving credit." Your credit utilization ratio is determined by adding up all the revolving credit you currently have and dividing that number by the total credit available to you.

It's best to try to keep this number under 30% at all times. Doing so will cause mortgage lenders to look more favorably on your application. For instance, if your total available credit is $9,000, but you have only used $2,700 before paying off your credit card statement, your credit utilization is 30%.

It's best to try to keep this number under 30% at all times. Doing so will cause mortgage lenders to look more favorably on your application. For instance, if your total available credit is $9,000, but you have only used $2,700 before paying off your credit card statement, your credit utilization is 30%.Opening a new credit card with an additional $4,000 credit limit but keeping the total of your revolving credit to $2,700 will cause your credit utilization ratio to drop to 21% — even better as far as mortgage lenders are concerned.

New types of loan accounts can add diversity to your "credit portfolio" and cause your credit score to improve. Although it only accounts for about 10% of your credit score, having a mix of revolving credit cards and installment loans can help increase your score.

The biggest factor in your credit score is always how consistently and fully you pay your bills — your credit history. This accounts for 35% of your score and can make the biggest difference in whether your credit score is excellent, good, or fair.

Unfortunately, it takes a few billing cycles for a new credit account to increase your score before it recovers from the dip a hard inquiry causes.

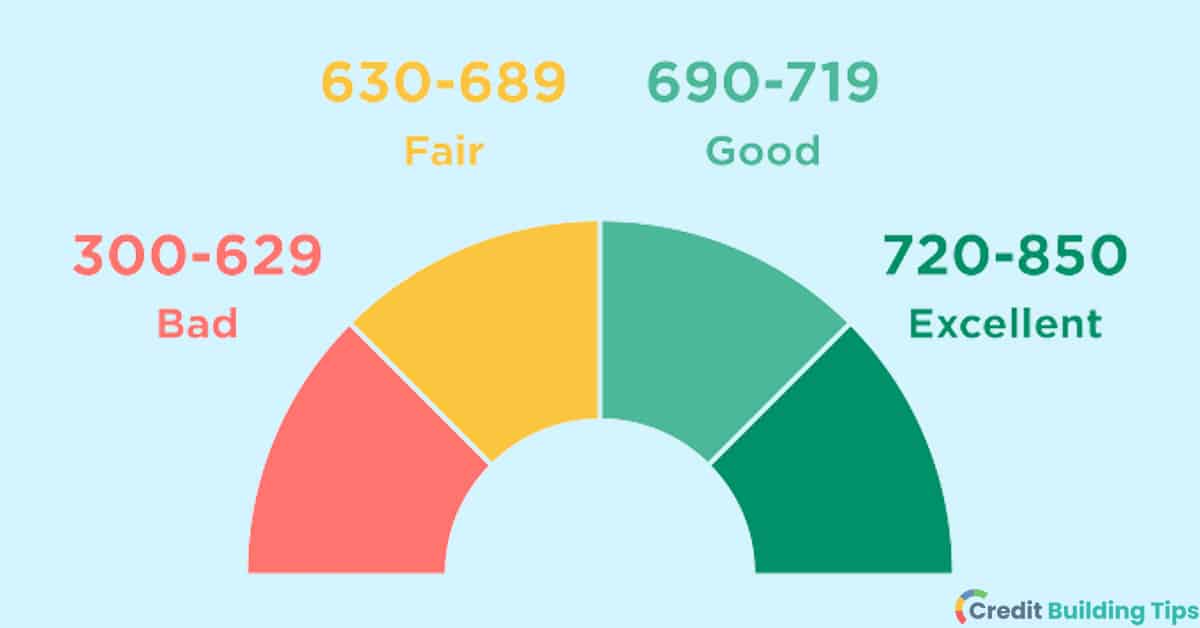

When applying for a mortgage in the United States, having a good credit score is essential. A credit score is a three-digit number that indicates how reliable a borrower is and affects the interest rate you can get. Generally, the higher your credit score, the better the interest rate and loan options available to you.

The minimum credit score requirements vary depending on the type of loan you are applying for:

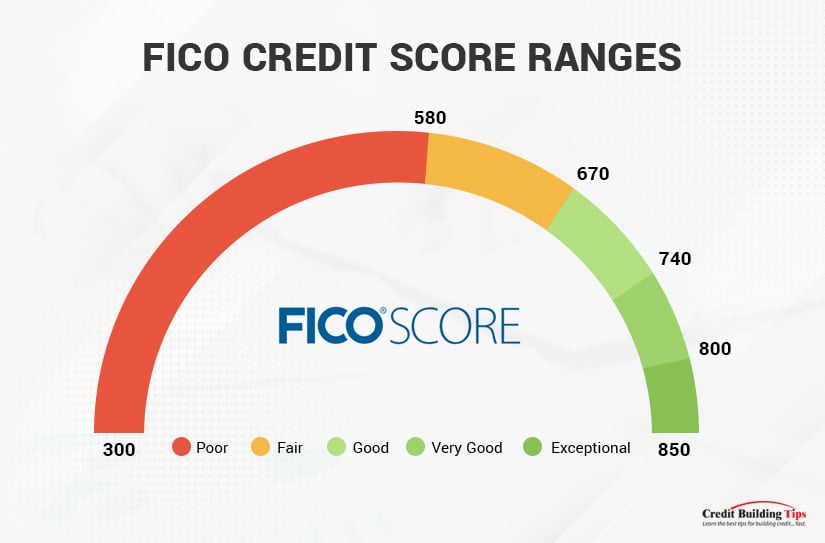

It is important to note that there is a difference between a FICO® Score and a Credit Score. A FICO® Score is an algorithm used by most mortgage lenders to determine your creditworthiness. It ranges from 300 to 850 and is based on information such as payment history, amount of debt owed, length of credit history, types of credit used, and recent inquiries into your credit.

A Credit Score is a numerical representation of your creditworthiness and is used by lenders to assess your ability to repay debts. In order to increase your chances of getting approved for a mortgage, it is important to raise your credit score before you apply. This can be done by paying off any outstanding debt, making sure bills are paid on time, and not applying for too much credit at once.

Other considerations when buying a house include factors such as your debt-to-income ratio (DTI), loan-to-value ratio (LTV), income, and assets. It is also important to understand the costs associated with getting a mortgage, such as closing costs and origination fees.

Having a good credit score when buying a house is essential. It is important to understand the different loan types, the difference between a FICO® Score and a Credit Score, and other factors that can affect your ability to qualify for a mortgage. Raising your credit score before applying can help you get the best terms possible on your loan.

Generally, there are five credit score ranges that lenders use to decide:

Credit ranges don't start at zero, the lowest credit number possible is 300, and the highest number is 850:

When you apply for a new credit card, it can take a few points off your credit score. This isn't a huge amount of damage by itself, but if you are frequently applying for new cards, it can add up quickly and do a lot of damage to your credit score.

This is particularly concerning for credit card "churners," or people who frequently open and close accounts to take advantage of promotional offers.

According to Dan Green, publisher of TheMortgageReports.com, "Churning cards could affect your scores by 100 points or more." Even a difference of just a few points can bump up the rate you get by as much as a percentage point, and that can cost you thousands over the life of the loan.

Green advises, "Opening a store credit card may save you 10% today, but, long term, it could cost you thousands." Applying for multiple credit cards at once also counts against your credit score, so this is something to avoid doing when preparing to buy a house.

If you've just applied for a new credit card, it's best to wait a few months before applying for a mortgage. The reason is that opening up a new line of credit can negatively impact your credit score, which lenders take into account when reviewing your mortgage application.

If you've just applied for a new credit card, it's best to wait a few months before applying for a mortgage. The reason is that opening up a new line of credit can negatively impact your credit score, which lenders take into account when reviewing your mortgage application.

Lenders also need to see that you have a steady and reliable repayment history with the new credit card account. If you have opened a new credit card account and are planning to apply for a mortgage soon, it's important to make sure you're making your payments on time each month. Even one missed payment can have a negative effect on your credit score.

When it comes to getting a mortgage, lenders will look at both your credit score and repayment history. It's important to show lenders that you are responsible for your credit and that you can handle the payments associated with a mortgage.

So if you've recently applied for a new credit card account, it's best to wait until you have at least three to four months of payment history before you apply for a mortgage. This will give you a chance to build up your credit score and show lenders that you are reliable with your payments. It will also give you time to adjust your budget and ensure that you are financially prepared for the additional costs of owning a home.

Although applying for a new credit card before buying a house may make some people nervous, it doesn't necessarily mean your mortgage application will be denied. As Craig Coffey, former head of marketing and eBusiness for Wells Fargo Home Mortgage, states: "Every loan, borrower, and situation is different, and creditworthiness isn't determined based on a single factor."

In some cases, borrowers may be able to explain a recent change to their credit profile to their lender. However, it is still important to exercise caution when using a new credit card. Adding charges to the new credit card could drive up the debt-to-income ratio, making it harder to qualify for a loan.

Ultimately, the fewer changes made to personal finances until the mortgage is secured, the better. However, if you have recently opened a new credit card account, you should not be worried as long as you can explain your circumstances to the lender. The lender can review your entire financial profile to determine whether you are qualified for the mortgage.

Using your new credit card responsibly while waiting for approval on your home purchase is also important. Keeping your balance low, always making payments on time, and only charging what you can afford are all essential steps to ensure that you don't overburden yourself financially before taking out a large loan like a home mortgage.

While having an additional source of credit may result in slightly higher interest rates in certain scenarios, it does not necessarily mean that your mortgage application will be denied. As long as you demonstrate financial responsibility by maintaining low balances and paying off any debts you do incur, there shouldn't be any issues with obtaining a home loan.

If you recently applied for a new credit card, it's likely that you'll start receiving offers in the mail from lenders eager to finance your mortgage. It's important to remember that these offers are contingent upon you passing the lender's credit score and other criteria. Although it may be tempting to accept one of these offers, it's important to remember that it could end up costing you more in interest if you don't shop around for the best deal.

It's important to take a step back and consider all of your options when shopping for a mortgage. Lenders want you to take out the loan with them and will often offer incentives and special terms to make sure you do.

However, the best way to ensure you get the best deal is to shop around and compare different lenders. The goal is to get a loan with a low-interest rate, favorable repayment terms, and minimal fees.

It's also worth considering whether you're getting the best deal possible with the lender who issued your credit card. Many lenders offer preferred rates or special discounts if you open a new credit card account before applying for a mortgage. If this is the case, it may be beneficial to take advantage of those offers before looking elsewhere.

Finally, remember that while opening a new credit card account can help you secure better rates on your mortgage, it can also hurt your credit score if you fail to make payments on time or end up carrying large balances. Make sure you understand the implications of taking out new credit cards before you commit to any loan agreement.

For more information on how to achieve excellent credit over time in order to qualify for a mortgage or any other type of loan, contact us, and we'll be happy to help!

As Americans, we love our credit opportunities. According to recent stats, 83% of adults (8 in 10) say they have at least one credit card, and the average American has a total of five credit cards.

The projection for the total number of credit cards in use in 2023 is more than 1.25 billion. Nearly 193 million — a growth of nearly 6% is expected this year.

But sometimes, you'll find yourself needing to close one of your credit cards, and in today's post, we'll discuss good reasons you may want to close a credit card, what happens when you close your card with a remaining balance, and how to close your card safely.

But sometimes, you'll find yourself needing to close one of your credit cards, and in today's post, we'll discuss good reasons you may want to close a credit card, what happens when you close your card with a remaining balance, and how to close your card safely.But first, are there any good reasons to close a credit card?

Your financial situation will determine whether you should close a credit card, but before you do, you need to think through whether it's a good idea.

There are a few reasons it may be better to close a credit card than to keep it open. Here are five:

1. Someone has used your card fraudulently. While almost every credit card issuer is quick to help if your card has been lost or stolen, there are occasions when you might want to close your account if you find you need to fight to get the fraudulent charges reversed.

Making an on-time online purchase can happen only to find the supplier continues to send you the product and charge your credit card. Or you gave someone your credit card number, and they charged you more than you agreed to every month.

2. The annual fees are higher than the savings you get from the card. Most credit cards with higher (or higher) annual fees offer lots of perks, but at some point, you need to consider if the rewards give you more than the cost of the annual fee.

A simple way to calculate this is to add up the value of all the combined rewards you've earned in 12 months and then deduct the annual fee cost. This will inform you whether you end up ahead or behind. If the cost of the card is more than the value you get, close the card.

3. You've found better rewards with another card. Reward cards continually work to compete to offer the best possible rewards in order to entice new cardholders.

While you don't want to easily transfer from one card to another, if your current card causes you to miss out on savings other cards offer and they aren't willing to match a better card rewards plan, you may want to close your account.

4. You're going through a separation or divorce. If you share a joint account with a soon-to-be partner or spouse, you'll want to close the shared credit card. As long as the account remains open, you are both fully responsible for all the bills, whether you approve of the purchase or not.

Even if you have a divorce decree that says the other person is the one responsible for the bill, the credit card issuer won't see it that way as long as there is any outstanding amount owing. Open a credit card in your own name and transfer any balance to your new card.

5. The card simply no longer makes sense. A credit card may no longer make sense if, for example, you have a card that gives you great travel rewards and you no longer travel.

If your business (or pleasure) requires you to travel extensively, having a travel reward makes perfect sense. But if that's no longer the case, you may do better with a different type of rewards card that offers rewards you can use.

Closing a credit card, even without any money owing, can have an impact. We'll unpack this in the next section, but first, let's address what happens when you close your account, which still carries a balance owed.

The bottom line is that you will be responsible for the money owing, no matter how long the account has been closed. And the longer you don't pay the balance, the worse the impact will be.

Credit card issuers will continue to charge you interest on the amount owing. If you close an account with money owing, that amount can grow to far more than the product or service was worth over time.

Let's say you've purchased a pair of Nike basketball shoes for $150 and decided to close your account without paying off the purchase. The average APR on a credit card in 2022 is 15.13%.

"To calculate how much interest you'll pay each day you carry a balance, you can convert your annual percentage rate to a daily percentage rate by dividing it by 365 [days in a year]. At the end of each day, the credit card company multiplies the current balance on your account by the daily rate. That daily interest charge is added to your balance the next day."

Using this formula, your $150 unpaid balance with a 15.13% APR will be calculated at 0.06%. One day's interest would only be $0.06. But that six-cent interest will be added to the total $80, so now you owe $80.06.

Every day you don't clear up the payment, the interest will be added to the total owing. On day 2, the interest will be charged on $150.06 — still just another $0.06. You can probably afford that, right?

Let's fast forward and see what the compound interest will do to the amount you owe after 10 years. If you simply ignored the charge over that length of time, you would owe $613.73 and continue to increase until you paid the bill in full.

Now, while that may not be completely devastating, and you may be in a better place to pay off the full amount, the greater the balance owing, the more you will owe in the future. If you closed your credit card account with a $1,500 balance owing, after 10 years, you would owe a whopping $6,137.29.

And an important thing to know about credit card companies — they never forget and they never forgive. The only way to get out of this debt is to pay it in full or declare bankruptcy.

The bottom line is that, yes, it can. Not forever, but certainly in the short term. Closing an account can change your credit history and your credit utilization rate (CUR), two major factors when it comes to calculating your credit score.

The longer you've had the account, the more closing it will affect your credit score. If you have $25,000 worth of credit between three credit cards and you close one, your available amount of credit will drop, affecting your utilization rate.

Let's imagine a case scenario:

Your current utilization rate is the total owing divided by your total credit limit. With $25,000 available credit and a total of $10,244 owing, your CUR is 41%.