Have you ever wondered how merchants can ensure that a credit card being used during a transaction isn't being used fraudulently? When someone enters a credit card number online or reads it over the phone, after all, the merchant has no way of knowing whether the consumer actually physically has the card in their posession.

This is where a CID number comes in-- also known as a CVV2 or CVC2.

CID on a credit card stands for "card identification number." It is a three or four-digit number that can be found on the card that serves to add additional security for online or over-the-phone transactions.

CID on a credit card stands for "card identification number." It is a three or four-digit number that can be found on the card that serves to add additional security for online or over-the-phone transactions.Let's take a look at everything you need to know about CID numbers.

CID stands for "card identification number." A CID number is a security feature that is used when you are making a transaction when your card isn't physically present. This is a three or four-digit number that can be found on your credit card.

You also might hear the terms:

All of these terms of usually used interchangeably.

This three or four-digit number essentially offers a payment system a method to determine whether your card is authentic.

There are two things that a CID number helps to verify:

These verification numbers aren't contained in the magnetic stripe information of the card. Instead, they are only on the card itself.

Additionally, these numbers can't be found on credit card statements or on receipts. Using a CID helps payment processors ensure that they aren't accepting counterfeit cards.

You can find the CID number on a Visa, MasterCard, or Discover card on the back of the card. It will be located to the right of the credit card number near the signature area. CID numbers on these types of cards consist of three digits.

On American Express cards, the CID number is actually located on the front of the card. It will appear above the account number on the card's face. It usually is on the right side, but it will sometimes appear on the left side of the card.

Many people don't realize exactly what function the security code on their card offers. They sometimes give it out when they don't need to because they think it is necessary information, even in in-person transactions. Stick with us as we answer some of the most common questions about CID to help ensure your credit card info stays safe and secure.

You should never need to give your CID to another person when you are making a sales transaction in person.

In fact, most online retailers will require that you enter your CID when you are making purchases in an effort to prevent fraudulent transactions. That being said, you always want to make sure that you only give your credit card information to reputable companies.

For this reason, it's important to always be careful when entering your card information online.

Here are some steps you can take to protect your financial information online:

Did you overdraw your bank account and you're worried it's going to ding your credit? Check out this article to learn more about whether a bank overdraft affects your credit score.

You will end up with a new CID code when you get a new credit card. This is the case whether you apply for an entirely new card or if an old card expires and you need to replace your existing card.

When you use a credit or debit card in person, you can supply a signature, pin, ID, or another type of verification when making a purchase. However, if you're making an online purchase or buying something over the phone, the merchant and the card processor have no way of knowing for sure that you are actually in possession of the card. You could, instead, be someone who has the name and card number of someone else.

People can steal credit card numbers through a number of venues, including:

Though a CID number isn't a completely foolproof security measure-- after all, not all merchants ask for it-- it does serve as an extra layer of security against fraudulent activity.

Was your identity stolen and it took a serious toll on your credit file? This guide goes over how to repair your credit after ID theft and fraud.

Yes, a CVV, CVC, CVV2, and CVC2 are all acronyms used to describe the same security code on your credit card.

If someone has your CID without any of your other credit card information, they probably won't be able to do any damage. However, if they have your credit card number, your name, your CID, and other important info, you could become a victim of credit card fraud.

If you find yourself in this situation, follow these steps:

Are you trying to improve your credit health? Check out these posts about removing charge-offs, collections accounts, hard inquiries, evictions, and 30-day late payments from your credit report.

Credit cards allow us a tremendous amount of freedom by letting us buy things now and pay for them later. This freedom also comes with responsibility-- the responsibility to both use credit responsibly and keep our credit card information secure so it doesn't fall into the hands of identity thieves.

In order to make sure that your credit card accounts are safe, you'll want to practice the following:

Building a healthy credit score and maintaining it can seem like a big chore sometimes. After all, there are many different moving parts that go into keeping a credit score and credit report in good shape.

Your CID is one of the things that protect you from credit card fraud and therefore protects your credit report. After all, if an identity thief uses your credit card information to make purchases online or over the phone, it can end up resulting in marks on your credit report when payments aren't made on time.

Even though maintaining good credit health can feel like a lot of work, it's well worth the trouble. Having great credit can make it much easier to borrow money when you need to, as well as ensure that you get the best rates and terms when you do. Over your lifetime, having a healthy credit score versus a poor credit score can save you thousands and thousands of dollars.

Are you on a mission to improve your credit? If so, head over to our credit building blog to learn more tips and tricks for boosting your credit score and fixing your credit report.

If your credit score has seen better days, you might be struggling to get a loan, rent an apartment, or qualify for a credit card.

To help improve your chances as an applicant, credit repair services will often promise to help boost your credit score. These are companies that will review your credit reports and act on your behalf to address any negative items with the credit bureau.

Credit repair services will help you dispute incorrect information on your credit report in exchange for a fee-- usually a monthly fee ranging from $20 to $150. There can be additional charges for these services, including start-up fees and cancellation fees.

Credit repair services will help you dispute incorrect information on your credit report in exchange for a fee-- usually a monthly fee ranging from $20 to $150. There can be additional charges for these services, including start-up fees and cancellation fees.It's important to understand that there are scammers out there masquerading as credit repair services, so you'll want to learn about the red flags to watch out for. Additionally, it's worth noting that credit repair services don't have magical abilities to clean up your credit report-- everything they do is something you can do for yourself for free.

Credit repair services help you come up with a plan you can use to repair your credit and will act on your behalf in order to dispute inaccurate information.

Essentially, these companies can help you remove errors or other incorrect marks on your credit report that are damaging your score. What they can't do, however, is remove accurate information.

Some of the types of items that a credit repair service can remove include:

You'll often find that credit repair companies will offer extra features for additional fees, such as:

In many cases, these extra services aren't worth the steep fees that are charged.

If your credit is less than ideal and you want to improve your score, the concept of credit repair services might sound too good to be true.

The truth is, though, that a credit repair company isn't going to be able to help you remove accurate information from your credit report.

For instance, if you have a high credit utilization ratio, several late payments, or other derogatory marks, credit repair services won't be able to help if the information is correct.

Did you overdraw your bank account and you're worried it's going to ding your credit? Check out this article to learn more about whether a bank overdraft affects your credit score.

When shopping around for credit repair companies, you'll find that they all tend to have their own pricing structure. Typically, though, they sell packages of services and charge fees monthly.

In addition to the monthly fee, some companies charge enrollment or set-up fees as well as fees when you cancel the service. You can find some companies that will offer a money-back guarantee, but this isn't always the case.

It's common for companies to have policies that essentially require you to stay signed up for several months.

For example:

Only you can decide whether or not it's worth the cost to hire a credit repair company, but it's important to note that pretty much anything a credit repair service can do for you, you can do for yourself.

To do so, you'll want to follow these steps:

Was your identity stolen and it took a serious toll on your credit file? This guide goes over how to repair your credit after ID theft and fraud.

The idea of paying someone to repair your credit report can seem a bit too good to be true at first, and there are certainly companies out there that make promises they simply won't be able to keep. Here are some of the most commonly asked questions about credit repair companies to help you determine whether paying for one of these services is the right choice for you.

It can take several months to start seeing results after you've signed up for a credit repair service. The length of time it takes for your credit to be fully repaired can be six months or even longer.

It's also possible that the inaccuracies you had fixed will end up showing up on your credit report again down the road, so you'll still want to keep an eye on your report.

You can find credit repair companies that operate nationally, while others only offer their services in certain states.

Depending on the package of services you purchase from a credit repair company, you also might receive credit monitoring services. This means that they will keep an eye on your credit report for any changes that could potentially stem from fraudulent activity.

Are you trying to improve your credit health? Check out these posts about removing charge-offs, collections accounts, hard inquiries, evictions, and 30-day late payments from your credit report.

Unfortunately, scammers can be attracted to the field of credit repair. There are plenty of legitimate companies out there, but you'll want to be on your toes when choosing one to make sure you aren't sending money to a party that has no interest in helping you.

There are a number of things you'll want to watch out for when seeking credit repair services.

According to the Consumer Financial Protection Bureau, some of the signs of a credit repair scam include:

It's important to understand that pretty much anything a credit repair company can do for you is going to be something you can do for yourself. They don't have magical abilities to fix your credit report, but they do have experience going through the dispute process and otherwise engaging with the credit bureaus.

Additionally, there is still some work you will have to do on your own, even if you hire credit repair services.

All that being said, some consumers find that it is worth the money to have credit repair companies take on some of the work of disputing inaccurate information on their credit reports.

While credit repair and credit counseling services might sound kind of similar, they are actually two very different services.

Credit counseling is tailored to your specific situation and consists of receiving financial advice from a credit counselor. They will also be able to offer you resources that give you the information you need to improve your financial situation. Consumers will typically seek credit counseling when they need advice on how to get themselves out of debt.

Your credit profile will not be wiped clean by a credit repair company. Legitimate negative information on your reports, such as bankruptcy, default, or late payments, will age off your reports after a certain number of years, depending on the nature of the mark.

Here is how long it takes for specific information to fall off of your report:

Credit repair services are only able to dispute incorrect information on your credit report. Some services might offer to send a goodwill letter to your creditor or debt collector on your behalf in order to ask them to remove the derogatory marks. However, creditors and debt collectors are not obligated to honor these requests.

Unfortunately, we can't just wipe the slate clean and start over with our credit reports. What we can do, though, is take actions that help to improve our credit scores.

Some of the things you can do to rebuild your credit include:

Believe it or not, it can actually hurt your score to open a new credit score-- at least immediately. It will, eventually, start to help your credit score.

This is because the credit card company will run a hard pull of your credit when you apply, which can ding your credit.

However, you'll soon start to appreciate the benefits of having a new card because your credit utilization ratio will drop, which is a metric where lower is always better. Making up roughly 30% of your FICO score, giving yourself a more advantageous credit utilization ratio can be a fairly quick way to boost your credit score.

Whether or not it's worth the cost to hire a credit repair service is something that only you can decide. It's important to be diligent when choosing a credit repair service, though, as there are definitely scammers out there that make lofty promises and don't return any results.

Beyond that, remember that credit repair companies cannot delete correct information from your credit report. They can only dispute incorrect information with the credit bureaus on your behalf. In some cases, they might also send goodwill letters to debt collectors on your behalf to attempt to have accurate negative accounts removed, but there is no guarantee that this effort will be successful.

If you don't want to take the time or deal with the headache of interacting with the credit bureaus when there's an error on your report, you might find that it's worth it to pay a credit repair company. That being said, you might find that the money is better spent going toward your debt and that you can actually handle the disputes on your own without paying start-up fees, monthly fees, and cancellation fees.

Are you ready to improve your credit score and make yourself a more appealing borrower to lenders? Make sure you check out our credit building tips blog for more resources to help you boost your credit and clean up your report.

Having a less-than-ideal credit score can have some very impactful real-life consequences. It can mean it's more difficult to be approved for a mortgage or car loan, you'll pay higher interest rates when you do borrow money, and it can ultimately affect your ability to begin building wealth.

Beyond that, a bad credit score and a credit file filled with derogatory marks can even make it difficult to rent an apartment, it can increase your insurance premiums, and it might affect your career opportunities.

If your credit score has seen better days, there are a number of credit repair hacks you can use to help increase your score and improve your credit profile. The important thing is to understand which elements are hurting your credit score the most so that you can start addressing the factors that are most adversely impacting your score right away.

If your credit score has seen better days, there are a number of credit repair hacks you can use to help increase your score and improve your credit profile. The important thing is to understand which elements are hurting your credit score the most so that you can start addressing the factors that are most adversely impacting your score right away.Without further ado, let's jump in to help you determine the best actions you can take to improve your credit.

One of the most important things you can do to ensure that your credit score is where you want it to be is to check your credit report regularly.

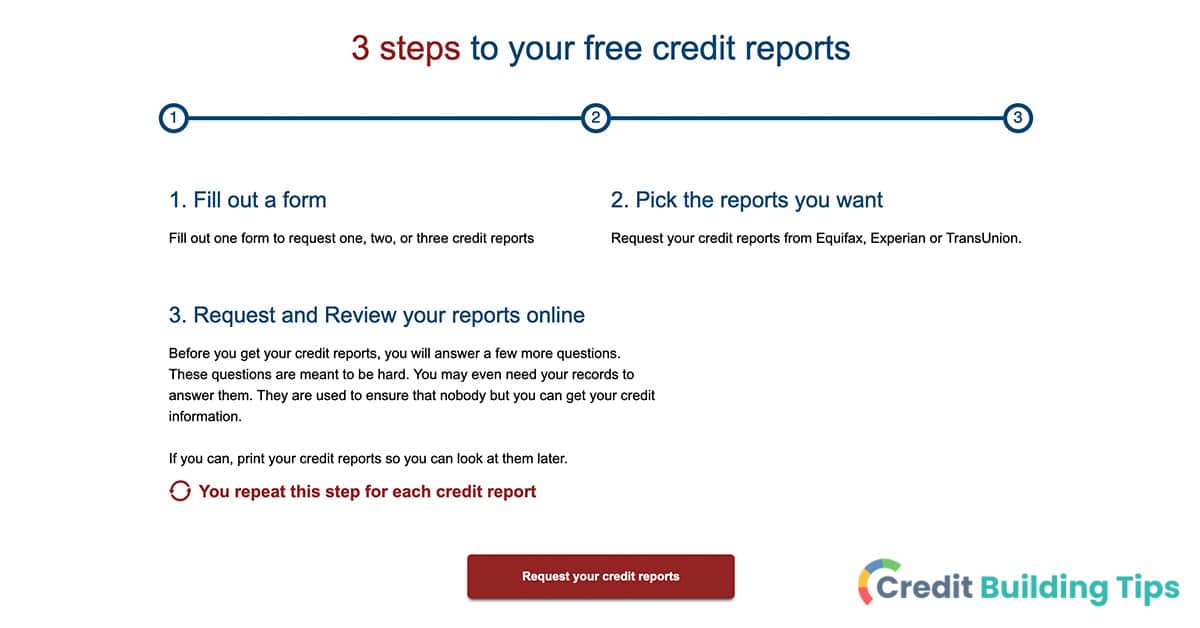

There are three major credit reporting agencies-- Experian, Equifax, and TransUnion. At each bureau, you have a credit report.

It's worth checking all three credit reports because not all creditors report to all three credit bureaus.

You can receive a free credit report from all three agencies through the Federally authorized site AnnualCreditReport.com.

Your credit score is calculated using your credit report. You can find out what your credit score is through a soft inquiry using one of the major credit scoring websites. Some credit card issuers also provide credit score tools.

The Federal Trade Commission reports that 25% of people have had errors on their credit reports. You, therefore, shouldn't assume that errors and inaccurate information are in any way rare, and you should always keep an eye out for accounts or other info that isn't correct.

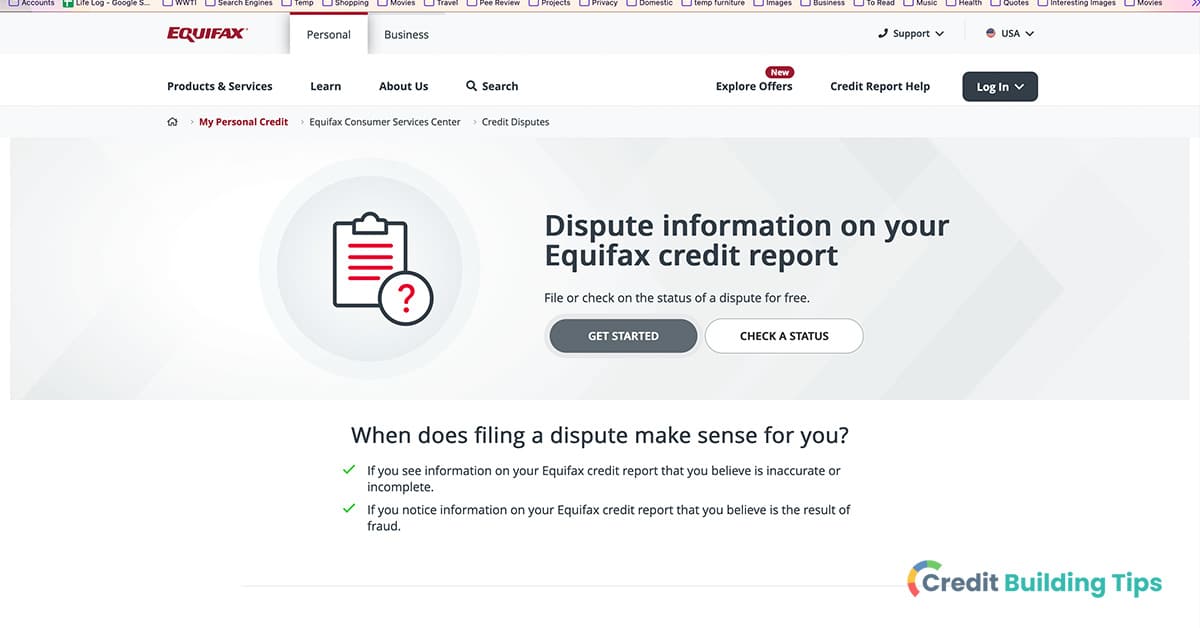

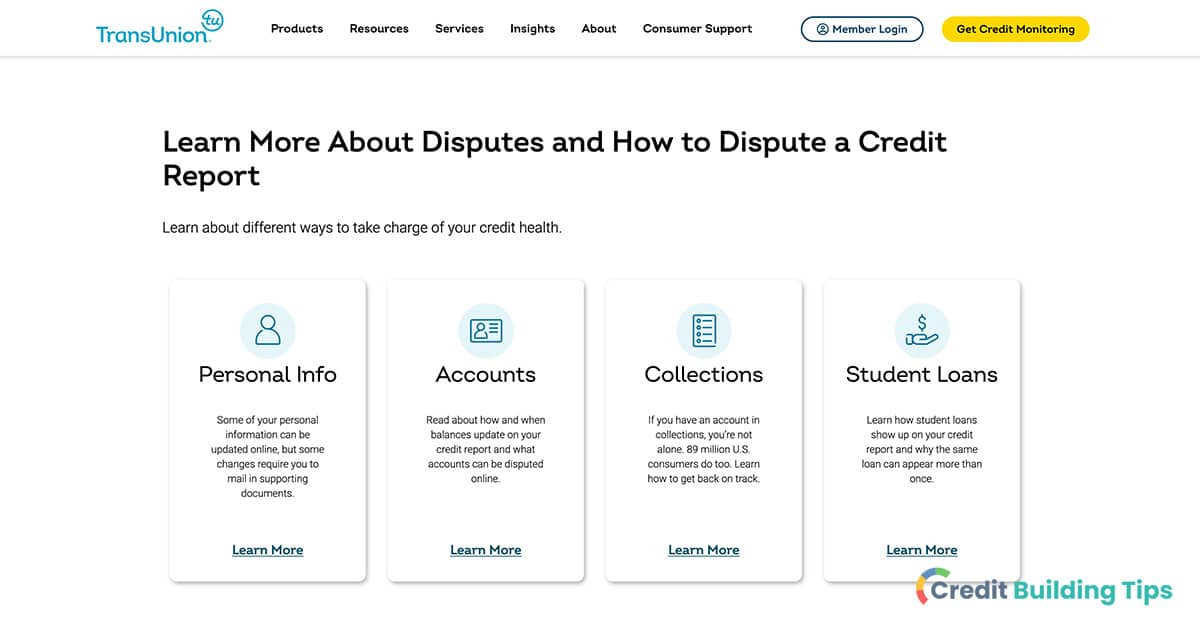

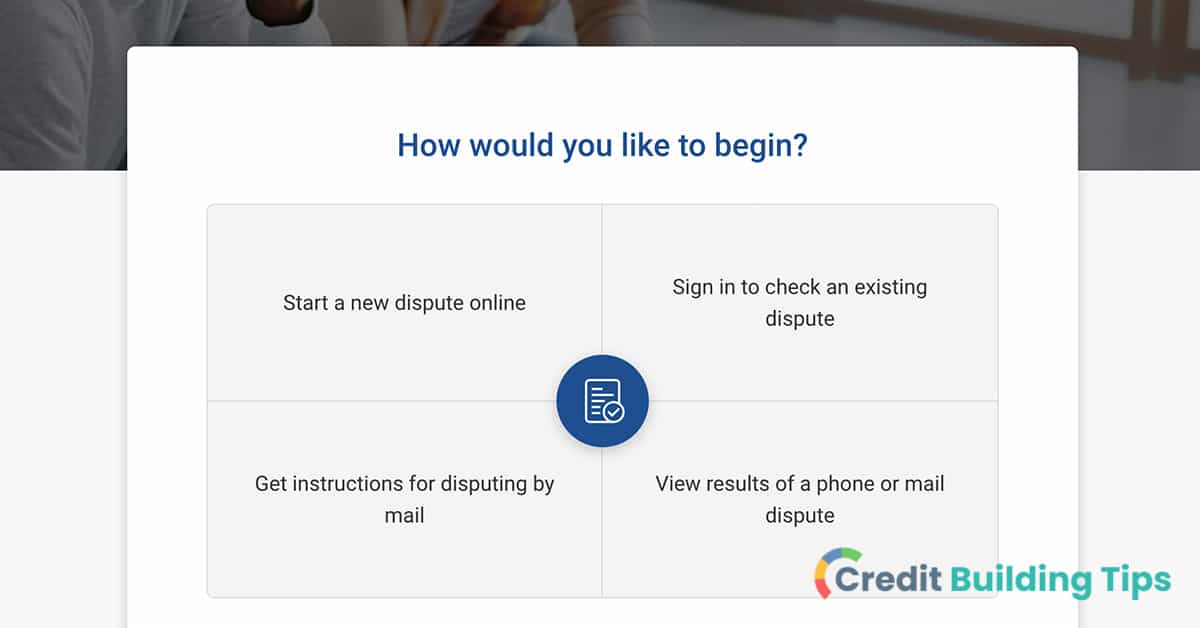

If you do find any errors on your credit report, you'll want to remove them right away. You can dispute errors on your credit report at all three bureaus. The easiest way to do so is by using their online platforms for disputing credit report errors.

Sometimes, there's negative information on your credit report that is accurate. Whether it's a collections account, missed payment marks, or another derogatory mark, it isn't always possible to remove negative information from your credit report. However, since this type of info can be detrimental to your credit, it's always worth giving it a shot.

Has a creditor written off your debt? Learn how to remove charge offs from your credit report in this guide.

If you have a missed payment on your credit report, you can ask your creditor for a goodwill adjustment. They aren't obligated to remove correct information from your report and will sometimes argue that they are bound to report accurate info to the credit bureaus.

Is your credit damaged because your identity was stolen? Check out our post on how to repair your credit after identity theft and fraud.

Having a collections account on your credit report can have a negative impact on your credit score. If a past debt of yours has been sent to collections, you can try and negotiate with the collections agency through what is known as a pay-for-delete agreement.

Make sure you receive their end of the bargain in writing before making a payment if you do strike a deal with them.

Your payment history is the most important component of your credit score when calculated using either of the two most popular credit scoring models-- FICO and VantageScore. In a FICO credit score, your payment history accounts for 35% of your score, and it makes up about 40% of your score in a VantageScore credit score.

Of course, never missing a payment is easier said than done. However, there are a few steps you can take to ensure that you get a derogatory mark for missed payments and to help keep your credit score as high as possible.

There are few things as frustrating as missing a bill payment simply because it slipped your mind. One of the best things you can do for your credit is to set up automatic payments. This way, you can remove human error as a factor when it comes to making payments on time.

If you do realize that you had a bill due recently and you didn't have automatic payments set up, don't panic.

If possible, make any missed payments before thirty days have gone by to ensure that it doesn't decrease your credit score.

If you missed a payment and have been charged a fee, consider calling your creditor and asking them to waive the fee.

While this fee doesn't impact your credit score, you want to make sure that you aren't paying any money unnecessarily that could otherwise be going toward paying down your debt.

Your credit utilization ratio accounts for 30% of your FICO Score calculation and 20% of your Vantage Score calculation.

When it comes to credit utilization ratios, lower is always better. Experts advise that you work to keep your credit utilization ratio below 30%.

There are a number of things you can do to make sure your credit utilization ratio is as low as possible, including paying down your debt, increasing your credit limit, timing your payments, reducing spending, and more.

Paying down your debts will mean that you are using less of the credit that has been extended to you, reducing your credit utilization ratio.

Your credit utilization is a ratio that represents the percentage of your credit limit that you're using.

If you want to increase your credit score quickly, paying down debt (and not taking on new debt) can help your score improve dramatically.

Paying off high-balance cards is one of the fastest ways to lower your credit utilization ratio.

Beyond your overall credit utilization ratio, there is also something known as a line-item utilization ratio.

For this reason, it can make sense to pay down high-balance cards first.

Another important factor when it comes to your credit utilization is the number of accounts you own that have balances. Your score will benefit from having fewer accounts with balances.

If you want to boost your credit score, consider paying down your low-balance accounts to reduce the total number of accounts that are carrying a balance.

Another way to ensure that you aren't carrying a balance on too many accounts is to consolidate your debt.

Beyond that, debt consolidation can help you pay off your debt more quickly when you snag a lower interest rate. It can also be much simpler to manage debt when you are only making one payment instead of many.

Important note: While debt consolidation can be a powerful tool to reduce debt and increase your credit score, you have to use it carefully. If you end up running up debt on your original cards again in addition to the balance transfer card debt, you can find yourself in a deeper hole than you initially started in.

Lowering your interest rates on your existing credit cards won't directly impact your credit score. However, the less interest you pay on each card every month, the faster you will be able to pay down your debt.

The worst that could happen is they say no. If they do say yes, it could save you hundreds or thousands of dollars in interest.

One of the fastest and easiest ways to boost your credit score is to increase your credit card limits. That being said, there are a few things you'll want to consider before you ask your issuers to increase your limit.

Since your credit utilization ratio is a number that relates how much credit you have available to the debt you owe, increasing your credit limit can lower your credit utilization ratio quickly and easily in a way that improves your credit score.

Once you've paid off old cards, it's best not to close the accounts in most cases.

In some cases, though, it might make sense to close old cards.

For example:

Additionally, if you have really struggled with overspending, you might find it is worth closing old accounts so that you aren't tempted to rack up more debt.

It's reasonable to assume that by simply paying off your cards each month, your credit utilization ratio should stay low. However, it's also important to consider when creditors are reporting to credit bureaus.

Creditors and lenders will run a hard inquiry every time you apply for credit or a loan.

Additionally, new card accounts can lower the average age of your accounts, which can also negatively impact your score.

Another way you can build credit is through a method called credit piggybacking. The most common way to improve your credit by associating yourself with someone else's credit is to become an authorized user, but you can also open a joint account or find a co-signer for a loan.

One of the fastest ways to build credit is to become an authorized user on a seasoned tradeline.

When you become an authorized user on someone else's account, it can quickly add years of credit history to your report.

Though there aren't many issuers that offer joint credit cards anymore, it's possible that you can benefit from your partners' good credit by opening a joint account.

If you need to take out a loan but you have less than ideal credit (or very little credit history,) finding a co-signer can be a very useful tool. Though it can be difficult to find someone to take on this role, a co-signer can help a primary borrower build credit over time so long as they make on-time payments.

If you have no credit or a very limited credit history, it can be difficult to know how to start building credit. In these instances, a credit builder loan can help individuals build credit and boost their scores when they make regular, on-time payments.

If you are what is known as "credit invisible"-- i.e., you don't have a credit score-- this is a method you can use to gain additional access to financial services and products.

Another loan you can use to help rebuild credit after it's been damaged is an installment loan. I've personally used this type of loan to improve my credit.

If you are going to shop around for a loan or a new credit card soon, you'll want to be thoughtful about adding additional hard inquiries to your credit report.

While each hard inquiry usually only takes a few points off your credit score, too many of these on your report can be a red flag to lenders.

For mortgages, auto loans, and student loans, inquiries that occur during a fourteen day window are considered one single inquiry. This is because it is understood that savvy consumers will shop around for the best rates and terms when borrowing money.

It's worth noting that FICO scores don't group together inquiries for credit cards-- each one shows up as its own separate hard pull. With the VantageScore model, however, inquiries made during a fourteen-day period are grouped together for any type of account.

If you've used some of these tips and tricks to improve your credit, it still can take some time to see the fruits of your labor show up in your credit score.

Only mortgage lenders can provide rapid rescores. If you aren't planning on applying for a home loan, this means that updating your credit report quickly will require that you manually contact each of your creditors after you've corrected errors, paid down your balances, and otherwise improved your credit profile.

When you contact your creditors, you can ask them to send a verification letter that reflects the new information on your account. This letter can then be forwarded to the credit bureau so your information will be updated.

The word "triage" is:

When you want to increase your credit score quickly, you'll want to use a similar approach. You should take a look at your credit report and find out which elements are most adversely affecting your score. You can then work to deal with these issues first before moving on to less urgent, less impactful aspects of your credit profile.

Finally, one of the most important things you can do for your credit score and your overall financial health in the long term is to ensure that you always use credit responsibly.

However, irresponsibly using credit cards can mean that you rack up more debt than you can afford, significantly damage your credit score, leave you with high-interest payments, have accounts go into collections, and so on.

No one likes spending their free time trying to improve their credit score, but it's a project well worth dedicating some time to. This is particularly true if you are expecting to apply for a loan or credit card in the near future.

There are a lot of things you can do to improve your credit, but not all actions you take in this regard are created equal. It's, therefore, a good idea to make sure you understand which elements of your credit report are most damaging so that you can focus on pursuing the most impactful factors first.

If you're motivated to improve your credit score and clean up your credit report, make sure you check out our credit-building tips blog for more useful resources!

Your checking account is a central part of your financial life. For this reason, you might assume that overdrawing your account could have an impact on your credit score.

The truth is, though, that normal day-to-day use of your checking account won't show up on your credit report as you aren't spending money that you borrowed from someone else. Instead, when you use a debit card, write a check, use an ATM, or otherwise use your checking account, you're simply drawing upon your own stash of cash.

Bank overdrafts and other checking account activity won't appear on your credit report. However, if you do not pay your overdraft fees or return your account to a positive balance after an overdraft, the debt can be sent to collections. Collection accounts appear on your credit report and can have a serious impact on your credit score.

Bank overdrafts and other checking account activity won't appear on your credit report. However, if you do not pay your overdraft fees or return your account to a positive balance after an overdraft, the debt can be sent to collections. Collection accounts appear on your credit report and can have a serious impact on your credit score.Let's take a look at what you need to know about overdraft fees and your credit score to ensure that your score stays as healthy as possible.

Your credit report displays information about your current credit situation and your credit activity. This means that information about your credit card accounts will show up on your credit report, including 30 day late payments.

However, a debit card isn't using money that you're borrowing-- it's taking money out of the checking account you have with a bank.

This means that checking accounts aren't one of the accounts that are listed on your credit report. The same is true when you use a debit card to withdraw money from an ATM, write a check, withdraw money in person, or have automatic payments withdrawn from your checking account.

When you use a debit card, you aren't borrowing money from anyone but instead using the money you have in your checking account. This means that checking accounts don't show up on credit reports.

Information about your checking accounts won't appear on your credit report unless a financial institution sends your account to collections for unpaid overdraft fees or negative balances.

When you make a payment using your checking account, but there isn't enough money in your bank account to cover the cost, banks will sometimes still pay the transaction.

There are a number of ways you can overdraw your checking account, such as through debit card, ATM transactions, checks, electronic or in-person withdrawals, or automatic bill payments.

There are lots of banks and credit unions that offer programs known as overdraft protection programs.

If you spend more money than there is in your checking account and your bank covers it, you might incur an overdraft fee.

It's worth knowing that there is an organization called ChexSystems-- a bank reporting bureau-- that does keep an eye on your checking and savings accounts with credit unions and banks.

Items like overdrafts, unpaid negative balances, bounce checks, fraud related to your account, or involuntary account closures will be tracked by ChexSystems.

If your ChexSystems report shows that you have used bank and credit union accounts irresponsibly in the past, you could be denied when you apply to open a new bank account.

If you're denied opening a new bank account because of your ChexSystems report, this can obviously cause a number of problems for you financially. That being said, it won't impact your ability to get a new credit card or take out a loan, and it won't affect your credit score.

There is one circumstance where your credit score could be hurt by an overdraft-- if it is sent to a collection agency.

Are you worried you won't qualify for a loan because you have too many recent hard inquiries on your credit report? Check out this guide to removing hard inquiries from your report.

If your bank or credit union covers the cost of a transaction for you via overdraft protection, you will have fees and a negative balance to pay. If you pay these, it won't have any impact on your credit score.

However, if you don't pay the fees or your negative balance, the financial institution might send your debt to a collection agency. Once an account has been created for you with a debt collector, it can end up appearing on your credit report.

It's, therefore, essential that you cover any negative balances you have as well as any overdraft fees right away. This is the only way to avoid the account being sent to collections.

If your credit dropped dramatically over a short period of time, check out our post about why you might experience a large drop in your credit score.

It will negatively impact your credit score if your account is sent to collections for unpaid overdraft fees or negative balances.

The longer you have unpaid debt in collections, the more derogatory marks you will accrue on your report. This is because late payments appear in a number of categories, such as 30-day, 60-day, and 120-day late payments.

Having a debt in collections is one of the most severe derogatory marks you can have on your credit report. This is because the original creditor has written off recouping the debt and has passed it off to a collection agency.

The best way to avoid this situation is to make sure your accounts are current before they get to the point of reaching collections. Ideally, any money you owe will be paid before thirty days have passed, as financial institutions usually report to credit bureaus once payment is thirty days late.

If you already have debts in collections, make sure you check out our post about how to delete collections from your credit report.

Overdraft protection can be a useful safety net, but you might choose to opt out of the program if you are consistently overdrawing your bank account. This is because it can mean paying a lot of money in overdraft fees in aggregate.

Though this can be uncomfortable or embarrassing when you go to make a purchase, it does mean that you aren't racking up overdraft fees.

Another thing you can do to provide overdraft protection for yourself is to link your checking account with a savings account. If you don't have enough money in your checking account to cover a purchase, the money will be moved from the account that you linked to your checking account.

It's worth noting that your bank might still charge you a fee for moving money from a savings account to a checking account to cover the cost of the transaction. In most cases, though, the fee is much lower for linked accounts than when the bank or credit union is covering the cost for you.

Avoiding overdrafts is the best way to avoid negative marks on your ChexSystems report as well as the potential for your account to be sent to collections for unpaid negative balances or overdraft fees.

Many banks and credit unions offer a number of different options for overdraft protection.

For example, some offer:

If you are frequently incurring overdraft fees, the best choice might be to opt out of overdraft protection completely. Though this means that your transaction will be declined, it does ensure that you aren't spending money you can't afford to pay back.

One useful tool you can use to avoid overdrafts is to sign up for an alert system if your bank offers one.

Low balance alerts can help you stay aware of when you might not have enough money in your account to cover a transaction. This can either indicate to you that it's time to transfer money into your account or to slow down on your spending.

Are you suffering from imperfect credit because someone stole your identity? Make sure you check out our recent post about how to repair your credit after identity theft and fraud.

A number of major banks in the United States have begun implementing policies to eliminate overdraft fees.

These include:

Other banks have started introducing new financial products without overdraft fees.

You might find that opening a checking account with one of these institutions is a useful strategy. Make sure you take a look at our list of the best "no overdraft fee" checking accounts.

Though overdrawing your checking account might not have a direct impact on your credit score, there are still a lot of reasons why you want to avoid spending more money than you have in your checking account.

Beyond that, if you don't settle a debt you owe to a bank for accrued overdraft fees or negative balances, the debt can end up being sent to collections. This will almost certainly have a negative impact on your credit score and make you seem like a riskier borrower to lenders.

For these reasons, it's generally a good idea to come up with a plan to avoid overdrawing your checking account. If you do end up spending more than you have in your account and your bank covers the cost, make sure you bring your account back to a positive balance and pay any overdraft fees right away. This way, you can avoid them being sent to collections.

Is it time for you to improve your credit score and clean up your credit report? Make sure you check out our credit-building tips blog for more resources that will help you boost your credit.

According to the 2022 Identity Fraud Study conducted by Javelin Strategy & Reserve, 15 million consumers in the U.S. were victims of identity theft.

Identity theft isn't just scary and potentially expensive, but it can also wreak havoc on your credit for years to come if you aren't careful.

Repairing your credit after identity theft can be a time-consuming process, but it's worth it to ensure that you don't suffer the consequences of bad credit down the road. You'll need to communicate with any creditors and companies where fraud occurred, dispute incorrect information on your credit reports, freeze your credit, and more to make sure that your credit isn't damaged by the experience.

Repairing your credit after identity theft can be a time-consuming process, but it's worth it to ensure that you don't suffer the consequences of bad credit down the road. You'll need to communicate with any creditors and companies where fraud occurred, dispute incorrect information on your credit reports, freeze your credit, and more to make sure that your credit isn't damaged by the experience.As with most things, prevention is the best cure to identity theft when it comes to your finances and your credit. However, the next best thing is to regularly monitor your credit reports, credit card statements, and bank statements so you can catch strange or unusual activity right away.

When someone uses your personal information without your permission, it's known as identity theft.

An individual can use your personal information to commit identity theft in a number of different ways, including:

Obviously, any of these occurrences is a huge problem in their own right. When you add in the fact that it can have an impact on your credit reports and credit scores, it only adds insult to injury.

Before we get into how to repair your credit after someone has stolen your identity, there are a few steps you're going to want to take to ensure that the fraudster isn't able to do any further damage.

There are essentially three different categories of actions you will want to take when someone has stolen your identity. These are:

This doesn't necessarily mean that you will want to go through these three stages in order, though. When you realize that your identity is stolen, you will essentially need to perform a number of important actions as quickly as possible to ensure that no further damage is done and that your personal and financial information is protected.

Here is a breakdown of the steps you'll want to take after you realize that your identity has been used for fraudulent purposes:

In the next section, we will take a closer look at the steps that involve repairing your credit after identity theft and fraud.

Now that you have seen a full list of the steps you will want to take after you realize that your identity was stolen let's take a closer look at the actions you'll need to take in order to repair your credit.

Different credit scoring models vary slightly in how they weigh factors, but in general, they place a similar amount of importance on each type of information. The primary factors credit scores take into account(presented in order of importance) are:

If hard inquiries are impacting your credit score, this guide looks at how to remove hard inquiries from your credit report.

If an identity thief steals your credit card information or opens fraudulent loans or cards, missed payments might be accruing. This could be happening on cards you opened yourself or accounts you don't even know about.

The good news is that your liability is limited for paying back fraudulent purchases so long as you catch it quickly and report it right away, thanks to Federal law. The bad news is that your credit reports will show missed payments that have a negative impact on your score and how you appear to potential lenders as a borrower.

Even if you file these disputes immediately after the fraud occurs, it can still take some time for the changes to reflect on your credit report and in your scores.

If an identity thief racks up debt in your name, it will have a negative impact on your credit utilization rate. Experts typically recommend that you keep your credit utilization rate at 30% or under. Lower is always better.

Once the problem has been remedied, your credit utilization rate will return to its normal level.

Though identity thieves likely won't have a direct impact on the length of your credit history, they can open new cards and get new loans that will wreak havoc on your credit score.

You will need to report the fraudulent activity to any lenders or creditors that allowed the thief to borrow money in your name and close the accounts. It can take time for the fraudulent accounts to be removed.

Identity theft shouldn't have an impact on your credit mix, as it is unlikely that a fraudster will close your legitimate accounts. This is one of the few factors that you don't have to worry about, but, unfortunately, it is also one of the least impactful factors on your scores.

If an identity thief has taken out a loan or opened a credit card in your name, it means that hard inquiries were made into your credit report.

Hard inquiries will remain on your credit reports even once you have closed fraudulent accounts and removed them from your credit report. You will need to dispute hard inquiries with the credit bureaus to ensure they don't impact your credit or your ability to borrow money in the future.

You will want to take action quickly when you realize that your identity might have been stolen.

Here are the steps you'll need to take:

On a mission to fix your credit? Take a look at our guides to removing a 30-day late payment, deleting a collection in exchange for payment, and removing derogatory marks on your credit report.

If you suspect identity theft, take a look at both your credit card and bank statements.

On credit card statements, look for any unfamiliar charges. You don't want to ignore charges just because the amount is small-- many scammers will start with small charges to see if it works before making more expensive purchases.

Even if you don't suspect fraudulent activity, it's important to review your credit card statements regularly.

On your bank statements, keep an eye out for strange activity and contact your bank if there are any unusual charges you don't recognize.

AnnualCreditReport.com is the site authorized by Federal law where you can request a free credit report from all three of the major credit bureaus.

Did your credit score drop unexpectedly? Take a look at this post about why your credit score might have dropped by 100 points or more.

Now that you have your credit report in hand, here is what you will want to look for:

It's best to follow up on any strange activity or marks on your credit report, even if it doesn't seem like a big deal or isn't currently impacting your credit score. If someone has your personal information, there's a good chance they will continue to do further damage.

You'll also want to check public records for civil court judgments or liens in your name. An identity thief that stole your ID could be masquerading as you in a way that impacts your public record. Since civil court judgments and liens no longer appear on your credit report, you'll want to contact the recorder's office in your county to look at your public records.

There are a number of steps you'll need to take if there has been fraudulent activity in your name. Some of these were briefly touched upon in the section "What to Do If You've Been a Victim of Identity Theft."

First, you'll want to call any companies where the fraud has occurred. To stop further damage, ask credit card companies and lenders to close or freeze any and all fraudulent accounts.

You'll also want to ask for a letter confirming that:

Beyond placing a fraud alert with all three credit bureaus, you'll also want to dispute any incorrect info that can be found on your credit report. All three credit bureaus-- TransUnion, Equifax, and Experian-- have online pages where you can begin the dispute process.

You'll also want to tell them to stop reporting the debt to credit bureaus and ask them for more details about the debt.

Now that you've been through the process of dealing with identity theft, you're likely motivated to avoid this experience in the future. Once you have worked everything out with the credit card companies, lenders, credit bureaus, debt collectors, and any other involved parties, you'll want to make sure that you take any and all necessary steps to ensure your identity and credit are protected in the future.

For more info about how to protect yourself from ID theft, scroll down to the section entitled "How Can I Protect Myself From Identity Theft?"

There are a number of things you will want to always keep an eye out for when it comes to identity theft and fraud.

Some of the signs of identity theft can include:

Before we sign off, let's touch upon some other frequently asked questions about identity theft and credit.

There are a number of different ways that identity thieves can steal personal information from individuals.

These include:

Do you need to repair your credit report so you are better able to qualify for a mortgage or another loan? Make sure you check out our articles about removing collections from your credit report, removing hard inquiries from your credit report, and removing evictions from your credit report.

The thought of someone coming into possession of your personal information is truly terrifying. Luckily, there are a number of things you can do to prevent identity theft from occurring.

Here are some habits you can practice in order to avoid your private information ending up in the wrong hands:

Having your identity stolen can be an overwhelming and terrifying experience. With your personal or financial information, thieves have the ability to rack up debt, take out loans, or even masquerade as you in police interactions.

Are you on a mission to rebuild your credit and make sure that you always have the ability to borrow money and take out loans with the best terms? If so, make sure you check out our credit building blog.

If a borrower misses several months of payments, the creditor might give up on trying to collect the debt and write it off as a loss. When this happens, the account is designated as a charged-off account or simply a "charge-off."

Just because the creditor has charged off the account doesn't mean that you aren't still expected to pay back the debt, though. They might sell your debt to a third-party collections agency, which can also appear as an account in collections on your credit report.

A charge-off on your credit report will typically remain there for seven years starting from the date that you first missed a payment. You can remove inaccurate charge-off accounts by disputing them with the credit bureaus. You can attempt to have accurate charge-offs removed by negotiating with the creditor or debt collector.

A charge-off on your credit report will typically remain there for seven years starting from the date that you first missed a payment. You can remove inaccurate charge-off accounts by disputing them with the credit bureaus. You can attempt to have accurate charge-offs removed by negotiating with the creditor or debt collector.Let's take a closer look at everything you need to know about charge-offs and what you can do to remove them from your credit report.

When you take out a loan or a line of credit, the creditor or lender is expecting that you will pay back the money that you owe based on the agreement you’ve made. However, if you are unable to keep up with your payments or completely stop paying toward your loan, it can mean your account becomes delinquent.

After a certain number of days, the creditor might choose to charge off your account. In many cases, the length of time after an account is delinquent before a creditor charges it off ranges between 120 and 180 days.

Charge-off is the term used when a creditor has closed your account to future changes and written it off as a loss.

When your account is charged-off, it means that the creditor has given up on collecting the debt from you and written it off as a loss. This doesn’t mean that you’re off the hook, though.

With your debt now in the debt collection agency's hands, the debt collector will try and get you to pay off the debt. They can send you letters, call you, email you, or text you in an attempt to collect the debt. They can even file a civil lawsuit against you in order to recoup the money that is owed.

When an account is charged off, it doesn't mean that you are no longer obligated to repay the debt.

Yes, charge-offs will appear on your account history along with other negative information, such as missed or late payments. Negative information typically stays on your credit report for seven years.

Not only will charge-offs show up on your credit report, but they can also be very damaging to your credit score.

Did you miss a payment and it showed up on your credit report? This article looks at what you can do to remove a 30-day late payment from your credit report.

You might assume that paying the debt you owe to a collector will automatically remove the mark from your credit report.

Unfortunately, this is not the case.

Negative marks such as collection accounts usually stay on your credit report for up to seven years. This is true even when you have paid them off. Paid charged-off accounts and collections accounts will still show up on your credit report rather than disappearing and will simply appear as 'paid' in their status.

What can you do when there is negative information on your credit report? This guide looks at four simple ways to remove derogatory marks on your credit.

There is a bit of good news on the collections account front, though-- the latest credit scoring models (VantageScore 3.0 and FICO 9) ignore paid collections accounts. If a creditor or lender uses one of these newer models to calculate your score and you pay off the collections account, it won't do nearly as much damage to your score as if you didn't pay the debt.

At this point, though, most creditors are still using the older FICO versions. Collections under $100 are ignored by FICO 8, but all collection accounts are considered in the version most commonly used by mortgage lenders.

If your charged-off account has been sent to collections, take a look at our guide to removing collections from your credit report.

If you’re planning on applying for a mortgage, car loan, or otherwise borrowing money in the near future, you might be motivated to clean up your credit report. Even if the negative account first went delinquent several years ago, this can still mean that it will stay on your report for a few more years.

Before we look at how to remove charge-offs from your credit report, you'll need to determine whether the information on your credit report is accurate or an error.

We'll take a look at the details of how to do this in the next section.

On the other hand, accurate negative information can be very difficult to remove from your credit report. Technically, creditors have an obligation to report accurate information to the credit bureaus, and they will sometimes be unwilling to cooperate when you ask to have negative information removed. That being said, there are some steps you can take that could help improve your credit files, which we'll discuss in the section entitled "Negotiating With the Creditor When a Charge-Off Is Accurate."

The first thing you'll want to do if you know that the charge-off on your credit report is an error is to gather all of the information you have about the debt.

This includes:

Suppose you find that there is an inaccuracy in the information showing up on your report. In that case, you'll want to file a dispute with the credit bureau that is reporting the incorrect information.

You can file disputes online with all three major credit bureaus. In many cases, this is the fastest way to have the error in your credit report addressed and resolved.

You are allowed to initiate disputes with credit reporting agencies under Federal law when you believe the information is inaccurate. The credit bureaus will then have to look into your claim and either fix or remove any errors from your report.

After you've gathered all of the information about your debt, you might find that the information showing up on your report is, in fact, accurate.

If you find yourself in this situation, you can try and negotiate with the debt collector or the creditor. Basically, you can offer to pay off the debt in full or in part in exchange for having the charge-off account updated or removed from your report.

You do not necessarily have to pay the full balance in order for a debt collector or creditor to accept this deal. This is particularly true if the account has been delinquent for a substantial amount of time or it has been passed on to another entity, who likely bought it at a discount.

Striking this type of deal with a creditor or debt collector is known as pay-for-delete.

Basically, this means:

Important: Though pay for delete arrangements are technically legal, creditors are not obligated to agree to a pay for delete deal or remove charge-offs from your credit. If a creditor or debt collector agrees to a pay for delete agreement, make sure you receive written confirmation that they will remove the charge-off before making your payment.

Another way you can deal with negative information like charge-offs on your credit report is by hiring a legitimate credit repair company. It's important to understand that there are a lot of scammers out there in the credit repair industry.

Watch out for credit repair companies that are thinly veiled scams: You should be particularly skeptical of any debt relief or credit repair companies that promise results that appear too good to be true or ask for money upfront.

Hiring a legitimate and reputable credit repair company can help save you the time of dealing with credit bureaus, debt collectors, and creditors. However, in most cases, these companies aren't able to make any changes to your credit report that you don't have the power to make on your own. Additionally, there is almost always an additional fee when you use these services.

Are you worried that a past or upcoming eviction is going to have a negative impact on your credit file? Check out this post about how to get an eviction removed from your credit report.

In some cases, you might do everything you can to get a charge-off account removed from your credit report to no avail. This can be incredibly frustrating, particularly if you are relying on an impeccable credit file to help you secure a loan with the best rates and terms.

The good news is that the account will fall off your credit report eventually-- negative information typically stays on your credit report for seven years from the date of first delinquency. Once this happens, it won't have any impact on your credit score.

Is your credit score suffering because of too many hard inquiries? This guide goes over how to remove hard inquiries from your credit report.

That being said, you will still be legally obligated to pay the debt even once it falls off your credit report. It is possible, though, that the statute of limitations on the debt could eventually expire. The statute of limitations for each kind of debt is different from state to state, so you'll want to take a look at the laws in your state.

In the meantime, you can work on rebuilding your credit. As the charge-off accounts get older, they won't always have as much of an impact on your score. The fact that the overall impact of negative information lessens as it ages and a dedicated effort to rebuild a positive credit history can help you bring your score back up and make you appear a better borrower to lenders and creditors.

If you fell behind on your payments due to a hardship, you can send your creditor what is known as a "hardship letter." This is a letter that explains your circumstances and the action that you're asking the creditor to take to help you repay what you owe. If you incurred late payments during COVID, take a look at this post to learn how to remove them.

If you have a charge-off account on your credit report that you simply can't remove, don't despair.

You can work to rebuild a positive credit history by taking actions such as:

It can feel like a huge weight off your shoulders to pay off old debts and get on top of your personal financial and credit situation. At the same time, be very careful in how you deal with old debts. A number of things can reset the statute of limitations timeline on your debt-- such as promising over the phone to pay the money you owe.

Are you struggling to build credit because you don't have any credit history? You can learn more about how to establish credit from the ground up in this article.

Another way you can rebuild your credit is by using installment loans. You can learn more about installment loans and how they can improve your credit in my recent post on the topic. I've personally used this type of loan to improve my own credit score in the past.

Before I sign off, let's answer some of the most commonly asked questions about charge-offs.

If you're researching what to do about your charged-off account, you might also be bumping into the term "write-off." A write-off and a charge-off are the same things, and the two terms are used interchangeably.

When this happens, it can have a negative impact on your credit. However, it can also be moved or sold to a different creditor. Depending on the circumstances, the transferred account can be listed as a charge-off or in good standing.

In order for a creditor to decide that it's not worth trying to collect on your debt, you typically have to miss quite a few payments.

If the account is finally listed as a charge-off, though, your scores will likely further decrease.

Your credit can continue to take a beating if you don't pay the debt collector, as they can report missed payments to the credit reporting agencies.

On the bright side, even though derogatory marks typically don't fall off your reports for seven years, their negative effects usually diminish after two years, so long as you are able to show that you are using credit responsibly from now on.

Whether or not you should pay a charged-off account depends on a few different factors. You will want to verify the information before you make a decision, as it's possible that the charged-off account is an error that should be disputed with the credit bureau.

If you determine that the charge-off is accurate, you will typically want to pay it off. However, it's worth trying to negotiate a pay-for-delete agreement in the hopes that the mark will also be removed from your report. Making payments toward old debts can also re-start the clock on the statute of limitations for the debt as well, so you'll want to think about what makes the most sense in your situation.

You can pay charged-off accounts in three different ways:

If you realize that the charge-off is an error, don't pay it. Instead, file a dispute with the credit bureau that is reporting the erroneous charge-off.

Looking at your credit report and finding that there is a charge-off is a very unpleasant experience. Not only can it reduce your credit score, but potential lenders might offer you worse terms or deny your applications as a borrower when there is a charge-off on your credit report.

Resist the urge to ignore this problem when it happens to you-- there are steps you can take to try and remedy the situation.

Even if you are unable to remove the mark from your credit report, dealing with the debt can help ensure that it doesn't do further damage to your credit score. In the meantime, you can work to rebuild a positive credit history by making payments on time, keeping your credit utilization ratio low, limiting how often you apply for new credit, and using other credit building tactics.

When a collections account appears on your credit report, it generally stays there for seven years starting from the date the account first went delinquent. This is true even if you end up paying off the account in full.

Having collections accounts on your credit report can make you seem like a risky borrower to lenders and creditors, so you might be wondering how you can remove collections from your report before the seven year period is over.

If the collections account is on your credit report in error, you'll want to dispute the account with either the credit bureaus or the debt collector. If the account is accurate, you can ask for a goodwill deletion from the debt collector or original creditor.

If the collections account is on your credit report in error, you'll want to dispute the account with either the credit bureaus or the debt collector. If the account is accurate, you can ask for a goodwill deletion from the debt collector or original creditor.Having a collections account on your credit report can reflect negatively on you when lenders or creditors pull your credit report. The newest versions of VantageScore and FICO credit scoring models now ignore paid collections, but a lot of lenders still use the older models that do incorporate paid collections when calculating your score.

For this reason, many people want to remove collections accounts from their credit reports before the seven year period is over. Here are the steps you’ll want to take in the effort to clean up your credit file.

The first thing you’ll want to do is gather information about the debt in question. There are two places you’ll want to look for this information:

Collect all of the documents you have on the account that is in collections, including your payment history as well as the age of the debt. If possible, it can be useful to also find a personal banking statement that displays the date that you made your last payment toward the debt.

Now that you’ve pulled your own records together, print out your credit reports from each of the major credit reporting agencies– Experian, Equifax, and TransUnion.

Look at each individual credit report and highly any difference you find between them. These reports aren’t always precisely identical, as a lot of lendors and creditors only report to one or two bureaus rather than all three.

Are you wondering how to get your credit reports? You can have free access to your credit reports under Federal Law. The quickest way to get your report is to use AnnualCreditReport.com, which is offering free weekly online credit reports for the rest of 2023. This site is authorized by Federal law.

Once you have your credit reports in hand, verify the following details:

Once you have looked at your own records and your credit reports, you might find that the collections account shouldn’t be on your reports. Maybe it is completely incorrect, or perhaps it has been seven years since it went delinquent and it therefore should no longer be on your report.

There are two primary parties that could have made an error: the credit bureaus or the debt collector.

If there is a collections account on your report that is older than seven years since the delinquency date, you’ll want to file a dispute with any credit bureau that is still listing the account on your report.

Other mistakes that credit bureaus can make include showing a paid account as unpaid or listing an account that you don’t recognize.

You’ll then need to gather documentation that supports your case and file a dispute with the credit bureaus that have made the error. You can do this by phone, by mail, or online, and the bureau must respond to you within thirty days.

Disputing credit report errors won’t harm your score and filing a dispute is free. You can file a dispute through the mail, by phone, or online.

If you believe that the debt collector has made the error rather than the credit bureau, the first thing you’ll want to do is to ask the debt collector to validate the debt. They should then send you a debt validation letter, which includes information about the original creditor, the amount you owe, and more.

If the debt collector is unable to validate the debt, it should be removed from your credit reports.

If the account listed on your credit report is legitimate and it is accurately reported as a paid account, there are still some steps you can take to have it removed.

You can contact the original creditor or the collections agency that is handling debt collection to ask them for a “goodwill deletion.”

You can send creditors and/or debt collectors a “goodwill letter” that explains why you were unable to repay the debt on time and requests that the negative mark is removed from your credit reports.

In your goodwill letter, you can explain why you would like the debt removed and the circumstances that led to your debt being paid late. For example, you might tell them that you are going to apply for a mortgage and that you would like the mark removed from your credit report.

It’s worth understanding that neither creditors nor debt collectors are obligated to remove an account from your credit report. That being said, it doesn’t hurt to ask. You will be in a much better position to make your case if you have had a strong payment history since you paid off the debt.

If you remove the account from your credit report through a goodwill letter, any late payments on your reports that preceded the debt going to collections will still appear.

Did you experience an event or circumstance that had an impact on your ability to repay a debt you owed? This article goes over what you need to know about sending a hardship letter to creditors.

If all of your efforts still haven’t resulted in the account being removed from your credit reports, the only thing you can do is wait for it to fall off. Most negative information is removed after seven years have passed starting from the first date of delinquency.

The first date of delinquency refers to the first date that your delinquent accounts are reported to the bureaus. This means that the information will be removed from the first reporting date, not the date the debt went into collections.

It’s worth noting that an account falling off your credit report doesn’t necessarily mean that you don’t need to pay the debt. A creditor can still pursue payment if the statute of limitations hasn’t passed and can even take you to court in an effort to receive the payment.

Laws governing the statute of limitations on debt are found at the state level, meaning that how long a creditor has to pursue an unpaid debt varies between states. It’s important that you learn what your responsibility is under the law of your state.

Pay-for-delete is an agreement that you can sometimes strike with creditors or debt collectors where you agree to pay a portion of the debt or the debt in full in exchange for the account being removed from your credit report.

There is no guarantee that sending a pay-for-delete letter will result in the outcome you’re looking for, but it can be worth a shot. It’s important to proceed with caution– make sure you receive something in writing from the debt collector and make sure that they agree to remove both the account and late payment information.

Creditors are technically not supposed to remove accurate information from credit reports, but it isn’t exactly illegal for them to do so either. Pay-for-delete agreements exist in a legal gray area.

Your claim must be addressed within thirty days when you dispute an error with a credit bureau or request that a debt collector remove a paid account from your report. If the credit bureau, debt collector, or creditor agreed to remove the mark from your reports, it’s generally a good practice to look at your credit reports after thirty days have gone by to verify that the changes you requested were made.

Are you looking for more information about improving your credit? Check out our guides to hiding credit card utilization, removing evictions from your credit report, opening a new credit card, and removing late payments incurred during the pandemic.

When you don’t pay a debt that is due for a period of time, it can be sent to collections.

Thirty days after a debt is due and unpaid, it can be reported as delinquent to the credit bureaus. You will receive notices about the unpaid debt and potentially even phone calls from the creditor in an effort to collect payment.

The creditor will give up on trying to collect the debt after a period of time without payment– usually 120 or 180 days. This doesn’t mean you’re off the hook, though.

At this point, they might choose to sell your debt to a debt collection agency. This is when you start receiving notices from collection agencies– through the mail, over the phone, via text, or through email. Essentially, a third party has purchased the right to collect your debt and you are still responsible for paying it.

Collections accounts will usually stay on your credit reports for seven years after the date that the account first went delinquent. This is true even if you have already paid the account in full. At this point, the account will show us with a “paid” status.

Since there are a number of different factors that influence your credit scores, there isn’t a simple answer to this question. Unfortunately, your score won’t change much even if you pay off the debt in order for the status to move from “unpaid” to “paid.”

Somewhat counterintuitively, paying off an old collections account can actually further impact your score by activating the accounts again. It’s a good idea to check with your lender to figure out what the best course of action is for you if you’re considering paying off the debt in order to take out a loan.

How your score is impacted is also influenced by the type of debt in collections. For example, medical collections aren’t given as much weight in the most recent iteration of the FICO scoring model.

It’s worth understanding that the newest FICO and VantageScore models don’t take paid collection accounts into consideration when calculating your score. At the same time, many lenders still use old models that do factor in paid collections accounts.

When there is a collections account on your credit report, it can be quite distressing. This can be the case whether the information reported is accurate or if you believe that it is an error.

If you know that the collection account on your credit report is legitimate, it's understandable to want to have it removed. After all, it can have a negative impact on your credit score and make you seem like a risky borrower to potential lenders. The truly frustrating thing is that this can be the case even if you've paid the debt off in full.

For collections accounts that you've already paid, you can try sending a goodwill letter to the debt collector and see if they will be willing to remove it from your account. If the account hasn't been paid yet, you can try and negotiate for a pay-for-delete agreement. They aren't obligated to work with you in these ways, but it doesn't hurt to ask.

If the collections account is inaccurate, you will want to dispute the claims with the credit bureaus that reported them. You can do this online, over the phone, or through the mail.

Fixing bad credit and rebuilding your credit can feel overwhelming, but it doesn't have to be. For more information about improving your credit files, check out our credit building blog.

A lender will check one or more of your credit reports when you apply for a new line of credit or loan, which is known as a hard inquiry or a hard pull.

If a creditor sees too many hard inquiries on your file, they can view it as a red flag. The more hard pulls on your credit report, the more they are likely to assume that you are trying to borrow money you can't afford to pay back.

You can only remove hard inquiries if they are inaccurate. Otherwise, you will have to wait for them to fall off naturally, which typically happens in about two years.

You can only remove hard inquiries if they are inaccurate. Otherwise, you will have to wait for them to fall off naturally, which typically happens in about two years.When you apply for a new line of credit, such as a credit card or a loan, a hard inquiry occurs. Also referred to as a “hard pull” or a “hard credit check,” this means that the lender has requested to look at one or more of your credit reports.

Creditors and lenders want to look at your credit file before extending credit or lending money to you because it allows them to assess how much risk you pose as a borrower.

When a hard inquiry occurs, it shows up on your credit report and can have an impact on your score.

Hard inquiries usually stay on your credit report before they naturally fall off.

What happens when an account is closed when you still owe money? Take a look at this post about what happens if a credit card is closed with a balance.

Lenders and creditors can also do something known as a “soft pull” or a soft inquiry. Here are the major differences between hard and soft pulls:

Are you motivated to improve your credit score and reports? Check out our guides to removing evictions from your credit report, opening a new credit card, removing late payments incurred during the pandemic, and hiding credit card utilization.

Hard inquiries usually only impact your credit for a few months, but during this time they will have a negative impact on your score. Though they stop having an influence on your actual score after a few months in most cases, they will remain listed on your credit report for two years until they fall off.

If your credit report shows that you applied for a number of loans and credit cards during a short period of time, this can have a negative impact on your credit and signal to potential lenders and creditors that you might be seeking loans and lines of credit that you might not have the ability to repay.

You can’t always avoid hard inquiries– they are a necessary part of the process of applying for an auto or home loan.

In these scenarios, credit bureaus are aware that consumers will frequently apply to a number of lenders in order to compare rates. This means that several inquiries made within a 14-45 day period for one type of loan won’t penalize your score and are often treated as one inquiry.

On the other hand, if you apply for a number of personal loans and credit cards during the same short period of time, they won’t be treated as one inquiry and is often viewed as a red flag that you’re applying for credit you can’t actually afford.

In most cases, you can only remove hard inquiries on your credit report if they are a result of fraud. For example, if a person opens a new account in your name using personally identifiable information like your Social Security number, you can dispute the hard pull and have it removed.

There are two reasons you can request to have hard pulls removed from your credit reports:

Hard inquiries that you approved or that resulted from an application you submitted, you can’t remove them.

Improving your credit has many benefits, including making it easier to borrow money and give you access to better interest rates on loans. For this reason, it can be quite tempting to try and remove hard inquiries from your credit report to try and boost your score a bit.