When you pull your credit report, seeing something you don't understand or recognize is always a bit disconcerting. After all, this is supposed to be a report of all of your credit activity, so you would expect everything on your report to be intelligible.

If you're looking at your credit report and you see a term or account that doesn't make sense, you might be worried that something has gone wrong. One common question we receive is what 'updated tradeline' means on your credit report and whether this is a good or a bad thing.

"Tradeline" is simply the term used in the credit industry to describe an account on a credit report. When your report says 'updated tradeline,' it simply indicates that some sort of change has occurred that led to one or more of the credit bureaus to correct or update information on your report.

"Tradeline" is simply the term used in the credit industry to describe an account on a credit report. When your report says 'updated tradeline,' it simply indicates that some sort of change has occurred that led to one or more of the credit bureaus to correct or update information on your report.In many cases, an updated tradeline shouldn't be cause for concern. However, it's always worth taking a closer look to make sure that the activity being reported didn't result from identity theft or fraud.

When your credit report says 'updated tradeline,' it simply means that some sort of change has occurred with one of your accounts, and one or more of the credit bureaus is therefore updating the information.

A tradeline is the term used in the credit industry to refer to the accounts that appear on your credit report. Examples of tradelines include personal loans, credit card accounts, and mortgages.

There are several different possible reasons that you could see a message indicating an updated tradeline on your report, including:

There are a number of ways that an updated tradeline can influence your credit score. The nature of the update is going to be important when considering how it might change your score.

Before we look at some potential ways that updated tradelines can change your credit scores, it's important to remember that several factors go into calculating your scores. Depending on your particular credit history and profile, in addition to the nature of the updated information, an update to one of your tradelines could have a very noticeable effect on your credit, or it could have little to no effect.

Here are some examples of how an updated tradeline could impact your score depending on the nature of the updated information:

Tradeline alerts are notifications that communicate updates or changes to your credit report's tradelines. You can use this tool to proactively monitor your credit report and accounts.

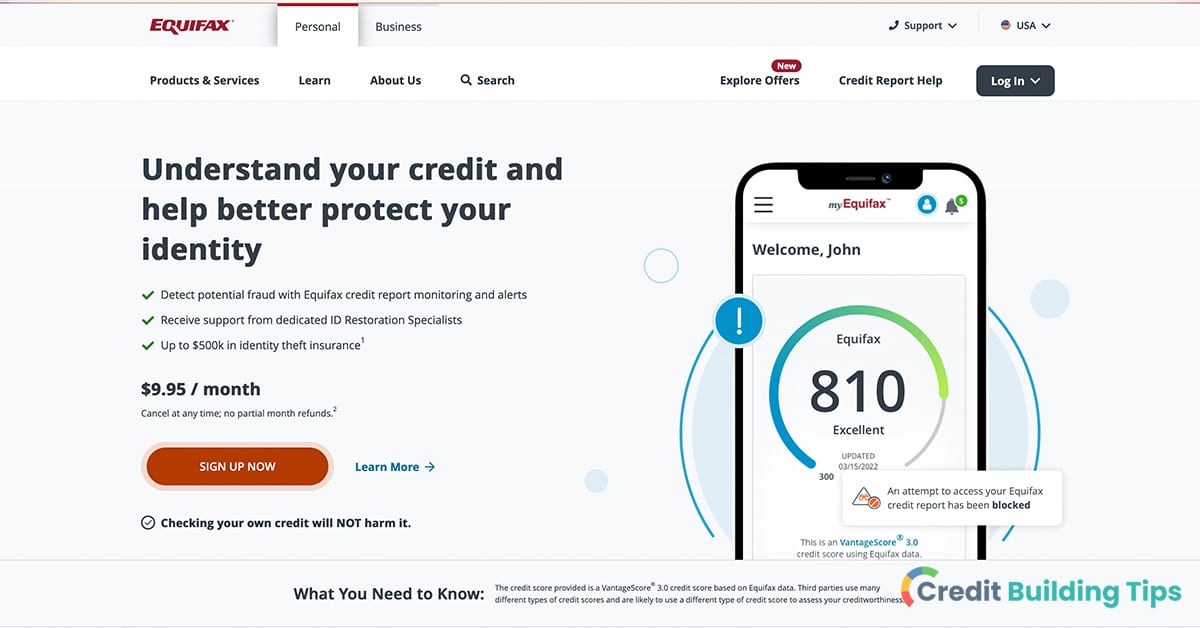

You can set up tradeline alerts through the credit bureaus or through credit monitoring services. Anytime there is a change on one of your tradelines, such as a payment update, a new account opening, delinquency, or a change in your credit limit, you can receive an alert through one of the following:

Staying vigilant and aware of any major changes in your credit file is important, and signing up for tradeline alerts can help you do just that. When you know that something significant has changed on your credit card, you can detect potentially fraudulent activities, promptly address any inaccuracies, and take any necessary steps to manage your credit responsibly.

Each credit bureau has its own process and format for updating credit report tradelines. Therefore, you can expect there to be some variation in the information provided by each credit bureau. In general, though, updated tradelines will include the following details:

Depending on the reporting practices of the creditor or lender, the frequency of tradeline updates can vary quite a bit.

Here are some general points regarding tradeline update timing to help you get a sense of when you should expect a tradeline will be updated:

There are a number of reasons a new tradeline might appear on your credit report. The most common explanations for a new tradeline showing up are:

Considering the potential for identity theft and credit fraud, it's vital that you pay attention to new tradeline alerts or at least regularly check your credit report.

Understanding the details of your credit report can be tricky, so let's take a minute to go over some basic information about tradelines and updated tradelines that appear on your credit report.

Every account that you own appears on your credit report as a single credit tradeline. This is true regardless of whether the account is open or closed, your payment is current or past due, or you are the sole owner or a joint owner of an account.

That being said, there are three different categories that tradelines can fall into.

Examples of revolving accounts include lines of credit or credit cards.

Revolving accounts involve being alloted a credit line that can be accessed in an ongoing manner, which payments minus interest and feed charged opening up credit to the account holder. Examples of revolving accounts credit cards, home equity lines of credit (HELOCs), and lines of credit.

Since the available credit, balance, and payment due are all regularly changing as you make payments and purchases, these are known as revolving accounts.

Examples of installment loans include auto loans, mortgages, student loans, and personal loans.

Rather than having a credit limit that you can continue to borrow from and pay back as with revolving credit accounts, installment loans involve borrowing a fixed amount of money and repaying the debt on fixed terms.

Installment loans are loans where a fixed amount of money is borrowed that is paid back according to a fixed schedule and terms. Examples include personal loans, student loans, auto loans, and mortgages.

While many experts lump mortgages in with other installment loans, some prefer to classify home loans as their own separate, fourth category of tradeline.

Open accounts are not common for individuals and are instead more often used by businesses.

Also known as an account payable by the bearer, open accounts are mostly used in the business world and aren't normally going to show up on an individual's credit report.

These involve an account that is payable in full when the buyer receives merchandise or a specific item of value.

To some extent, how much weight a credit tradeline carries depends on the type of tradeline.

For example:

It's also worth noting that your credit limit and utilization will be included in a credit card tradeline, while this information won't be present for an auto loan tradeline.

When you see a note or receive a notification that says a tradeline has been updated, it simply means that the info on your credit report in relation to a specific account has been altered to reflect the most recent accurate details.

At the same time, there is always the possibility that the credit bureau or your creditor has made a mistake and is reporting inaccurate information. Beyond that, there's also the possibility that someone else has gotten a hold of your personal information, and activity on your accounts is indicative of identity theft or fraudulent behavior.

For this reason, it's very important to regularly check your credit report and keep an eye out for errors or anything that seems off. You can take a look at our guides to removing 30-day late payments, evictions, hard inquiries, and collections from your credit report to help you in your quest to clean up your credit report.

Building credit is something that is best tackled slowly over time, but there are some ways to quickly boost your credit and improve your chances of being approved for a loan, credit card, or another new tradeline. For more resources about cleaning up your credit report and increasing your credit score, check out our Credit Building Tips blog.

Honda is well known for producing reliable car that will keep you safe on the road. There are lots of people that swear by Honda vehicles as offering the best bang for your buck, as they put out a wide range of affordable, long-lasting models.

That being said, even the cheapest new Honda (the LX trim of the Honda Odyssey starts at a little over $33k) likely costs more than you're going to want to pay out of pocket.

If you're planning on financing a Honda through Honda Financial Services, you'll likely need a credit score of at least 610. However, criteria for financing can vary by the Honda dealership, and there are also other financing options available for purchasing a new Honda.

If you're planning on financing a Honda through Honda Financial Services, you'll likely need a credit score of at least 610. However, criteria for financing can vary by the Honda dealership, and there are also other financing options available for purchasing a new Honda.Let's take a look at what you need to know about purchasing a Honda with financing, and how your credit score can impact your ability to qualify for good rates and terms.

There is no set minimum credit score for purchasing a Honda using financing. Even if you are seeking financing through a Honda dealership, the minimum required credit score can vary from one dealership to the next.

That being said, to buy a Honda through dealer financing, you will likely need a credit score of at least 610.

The general rule of thumb is that you will need a credit score of at least 600 in order to qualify for a traditional car loan. To receive financing through a Honda dealership, you will most likely need a score of at least 610.

Every lender has its own criteria through which it determines whether or not to extend an auto loan to a potential borrower. That being said, a credit score of 600 is usually considered the cut-off point for getting a traditional car loan.

If your credit is less than ideal, it doesn't mean that you're completely out of luck. What it does mean, though, is that you will probably need to look for a car loan specifically for people with bad credit, which will mean that your rates and terms aren't nearly as favorable.

Are you wondering what credit score you need to purchase a brand new Mercedes-Benz with financing? Check out our guide to getting a Mercedes car loan to learn more.

Before we go further into how to finance a Honda, let's talk a little bit about the difference between buying a Honda with financing and leasing one. Depending on your particular circumstances and preferences, you might find one of these options more appealing than the other.

If you want to purchase a Honda using their financing program, you can go online to get pre-approved before heading to the dealership. It's usually not a bad idea to shop around a bit when it comes to car loans, though-- it's possible that your local credit union or another lender will be able to offer you a better deal. Even if you don't intend to go through with either of these loans, you can have them in hand when you go to the dealership and use them as leverage to get a better deal.

Honda dealerships will sometimes offer 0% APR promotional financing offers, so you might want to search around for local dealerships and see if any of them have particularly good offers. Their loans typically range in length from 2 to 6 years.

Are you wondering how auto financing shows up on your credit report? You can learn more in our guide to Capital One Auto Financing.

You can often lease a Honda with a small down payment or even no down payment at all. Just like with purchase financing, each dealership is going to have its own offerings.

Some typical lease terms you might find at a Honda dealership include the following:

What happens when your lease is up, you ask?

Honda Financial Services makes it fairly easy to apply for financing. You can use their online platform to apply for pre-approval as well as to check your approval status.

Getting pre-approved before you head to the dealership can help you save time and also give you a better sense of the price range of the vehicle you should be looking for.

When you apply for preapproval, you'll want to have the following information close at hand:

You will usually receive your pre-approval decision within one business day via email.

Once you have this in hand, you can head to the dealership, which will help you with the next steps in acquiring financing. Of course, you don't have to use Honda Financial Services to finance a vehicle from a Honda dealership, and it can be worth shopping around for a better deal. More favorable preapproval offers might mean that Honda will offer you better rates and terms, or it might mean that it's worth taking some extra steps to use financing from elsewhere to purchase your new car.

Some sources state that Honda Financial Services only uses the Equifax credit bureau. In contrast, others claim they will pull your credit from all three credit reporting agencies when you apply for financing.

If you are planning to apply for a car loan from Honda Financial Services, it's best to take a look at all three of your credit reports to make sure that there aren't any inaccuracies or errors. Doing so in advance can give you ample time to dispute any mistakes before the lender pulls your report.

Are you trying to clean up your credit report before applying for a car loan? Take a look at our guides to removing 30 day late payments, evictions, hard inquiries, and collections from your credit report.

Again, every Honda dealership is going to be a bit different when it comes to their criteria for offering financing. In general, though, here are some things you'll want to keep in mind when it comes to the pros and cons of using Honda Financial Services.

Some of the advantages of using Honda Financial Services include:

Some of the disadvantages of using Honda Financial Services include:

Unfortunately, Honda doesn't disclose a great deal of information about the specific eligibility criteria for receiving an auto loan. That being said, the dealership might be able to help arrange financing for you through a different lender if your score is on the lower side. Of course, the lower your credit score is, the less likely you'll be to receive great rates and terms.

There are a number of other things you'll want to keep in mind when you're shopping around for a new Honda, including:

If you want to buy a Honda, but your credit is less than perfect, you can either deal with the fact that the loan is going to cost more, or you can work to build your credit first before applying.

Are you ready to start improving your credit? As your credit score climbs and your credit report gets cleaned up, you'll find that the financial opportunities available to you significantly expand.

Wondering what you can do to make sure you come off as a responsible borrower to any potential lenders or creditors? Make sure you check out our Credit Building Tips blog more resources. If you're wondering where you should get started, take a look at our guides to removing derogatory marks from your credit report, building credit with no credit history, and simple credit repair hacks.

According to the Pew Research Center, the vast majority of Americans own a cellphone of one kind or another. A whopping 97% of people in the U.S. have a cellphone, and 85% of the population use a smartphone.

Having a cell phone (and, specifically, a smartphone) is pretty much a necessity these days as the world moves increasingly into the digital space. It’s certainly possible to get by without one, but this is a decision that requires accepting inconveniences and difficulties as employers, retailers, airlines, hospitals, etc. increasingly expect that everyone has a smartphone in their pocket.

If you have bad credit, you might be worried that you won’t be able to qualify for smartphone financing or a plan through a carrier. Even if you do qualify, you might be worried about paying a hefty deposit upfront. Luckily, there are a number of strategies you can apply for both purchasing a device and signing up for service when your credit is less than ideal.

If you have bad credit, you might be worried that you won’t be able to qualify for smartphone financing or a plan through a carrier. Even if you do qualify, you might be worried about paying a hefty deposit upfront. Luckily, there are a number of strategies you can apply for both purchasing a device and signing up for service when your credit is less than ideal.Getting a cell phone with bad credit without paying a deposit might require a bit of creativity, but it’s certainly possible.

When it’s time to get a new cell phone, your credit score might not be the first thing on your mind. After all, you’re not buying a house or a car, so why should anyone pull your credit report?

The reality is, though, that there are a number of different reasons why your credit score can have an impact on your ability to purchase a cell phone and a traditional postpaid plan:

If you are motivated to avoid a credit check when getting a new cell phone, you do have some options. Additionally, there are some routes you can take in order to get a cell phone, even if your credit is less than ideal. Some of these options even involve a little-to-no deposit, which can be incredibly helpful when you need a phone but are strapped for cash.

It might seem frustrating that your credit is relevant for something that is so essential in the modern world– a cell phone– but it’s important to recognize that cell phone providers are businesses that are motivated to minimize their own financial risk. They can use your credit score to help determine how likely you are to fulfill the contractual obligations and pay back the money you owe on time.

Getting a cellphone with bad credit and little-to-no deposit is not impossible at all. All it means is that you might have to stray from the traditional contract-based postpaid plans and settle for a device that isn’t one of the brand-new models or has been previously used.

As we’ll discuss a little later on, you can receive the benefits of a traditional postpaid plan (if that’s desirable to you) with bad credit if you are able to join a family plan or find a cosigner.

If your credit isn’t awesome, but you need to get a new phone plan, one of the easiest ways to do so is to simply get a prepaid plan. As opposed to postpaid plans, where you pay a bill the month after using the service, prepaid plans involve paying a specific fee in advance every month or refilling your minutes, texts, and data as needed.

Prepaid cell phone plans don't require a credit check or a contract.

Since you are paying ahead of time for services that you have yet to use rather than agreeing to repay services you have already used, prepaid plans don’t require a credit check. This means that your credit won’t have any effect on your ability to get a prepaid plan. That being said, if you’re buying a new phone at the same time and you can only afford to buy it through financing options, you will face a credit check for the phone purchase.

If possible, you might choose to use an old phone or purchase a used phone with cash that you can then use with the prepaid plan. This way, you can completely avoid the credit check or a required deposit for having bad credit. Of course, you will need to pay your monthly bills in advance rather than after the fact, but you won’t face a hefty deposit upfront.

AT&T offers a number of prepaid plans, one of which includes unlimited high-speed data with 5G access for $50 a month (after an autopay discount of $15 per month.) One of their cheapest plans is only $25 a month when you pay for 12 months upfront, offering you 16 GB of data and excluding taxes and fees.

As of May 2023, AT&T is advertising that you can get a free SIM card when you bring your own phone and have the $15 activation fee waived when you sign up for one of their prepaid plans with a compatible phone.

Verizon also offers a number of Prepaid options, ranging from $30 to $60 a month when you enroll in autopay. Without autopay, these plans range from $35 to $70 per month.

The cheapest plan gives you unlimited talk and text but only light data use. The cheapest plan that allows a bit more wiggle room for data usage gives you unlimited talk and text, 5G access for capable devices, and 15 GB of data. Their priciest plan is the “Unlimited Plus,” which costs $60 per month after the $10 a month auto pay discount and includes a lot more bells and whistles for people that heavily rely on their smartphones.

Here are some other carriers that offer prepaid plans. Depending on your needs and expected usage, there’s likely a plan out there that will fit what you’re looking for:

No contract plans are similar to prepaid phone plans– in fact, prepaid plans fall under the umbrella of no contract plans. Rather than having to sign on for a contract of two or so years, you can sign on for a monthly plan that lets you opt out whenever you want without a cancellation fee.

A no-contract phone doesn't require that you commit to a specific carrier for several years as is common with traditional post-paid plans.

A number of the big-name carriers offer no-contract options, and there are also a number of smaller providers that advertise similar or less expensive plans. The strictest definition of prepaid plans requires that you pay for every minute you talk and every text you send, refilling your minutes, texts, and data when necessary. No-contract plans, on the other hand, only involve one set bill each month. It’s worth noting that the line between prepaid plans and no-contract plans is quite blurry.

For example:

Another option when it’s time to get a cell phone with bad credit is to join a family plan. Major cell service providers offer multi-line cell phone plans where you can share data with other people or even have access to unlimited data.

A family plan allows a number of mobile contracts to be linked under one account with only one monthly bill payment. They often offer a discount and only require a credit check for the primary account holder.

When you’re on a family plan, the main account holder’s credit report will be pulled in order to initially establish service. However, the people that are added to the plan won’t have to pass a credit check. In this situation, the primary account holder is the only one that is responsible when payments are missed, so it’s important to make sure that you are holding up your end of the bargain so you don’t cause trouble for them.

Joining a family plan allows you to bypass the credit check and maybe even save some cash.

For example:

Are you ready to get a cell phone but don’t have any credit history, a very thin credit profile, or straight-up bad credit? One option is to put down a deposit. Though this can be a bit frustrating, it’s a method worth considering if you have the cash on hand.

If you are not opposed to paying a deposit up-front but just want to get a regular cell plan, this is another option when you have no credit or bad credit. Deposits are usually eligible for refund once you have paid your bill in full and on time for a specific number of months. That being said, you'll want to read the fine print for each carrier as they can vary.

How much the deposit will be is going to depend on both your credit score and the carrier you are working with. The specifics of how deposits are handled vary between carriers, so it’s important that you take a close look at the fine print before moving forward.

Another option on the table is finding a cosigner to help you get a cell phone. Of course, this is only useful if the cosigner (either a family member or close friend, usually) has good credit. It’s also important to understand that the account would be opened solely in their name, meaning that they are the one that is responsible if you don’t hold up your end of the bargain and pay your bill.

If you can find someone with good credit that is willing to act as a co-signer, it can allow you to get a new phone with a traditional plan even if you have bad credit. The co-signer will be responsible if you fail to make payments.

One of the good things about this option is that the account can eventually be moved into your name by the co-signer. Though the carrier will usually run a credit check before this process is complete, you don’t necessarily have to pay a deposit.

Each carrier handles the process of having a co-signer and transferring account names differently, so it’s always a good idea to look at the fine print offered by the specific carrier you are considering working with. As an example, T-Mobile will allow account ownership to be transferred after 90 days.

If you’re trying to avoid the credit check that comes along with financing a new smartphone, consider trying to buy a pre-owned phone instead. These will often be quite a bit cheaper than the newest, snazziest versions of popular Apple and Android devices. You can also find refurbished options sometimes offered by wireless carriers, smartphone companies, or private sales.

Buying a pre-owned or refurbished phone could give you the ability to purchase the device outright rather than needing to obtain financing.

You will need to put a new SIM card in your phone and will also need to make sure that the phone is compatible with the carrier you use.

“Bad credit” can sound like kind of a vague term, but each cell phone company has its own specific definition of what number you need to be below in order to end up in this category.

Different companies have their own cut-off points for what they consider bad credit, but in general a score below 550-600 will be considered a subprime score.

For example:

For another example, let’s look at AT&T:

You are not completely out of luck when it comes to getting a phone if your credit is less than ideal. Additionally, it is possible not to pay a hefty deposit when you have bad credit. However, depending on how pressing your need for a new phone is, you might consider building your credit first before applying in order to make the process simpler and more straightforward.

If your primary concern is avoiding putting a deposit down when getting a cell phone and you want to sign up for a standard postpaid plan, here are your best options.

Enrolling in a family member with your relatives or friends will help you avoid paying a deposit even if you have bad credit. The credit check will only be for the primary account holder, and they will also be the one held accountable if bills go unpaid. For this reason, it’s important to make sure you are taking care of your end of the deal to ensure that they are not punished for your unpaid bills.

The other best option for avoiding paying a deposit when you have bad credit is to find a cosigner. The cosigner will be the person listed as the account holder, meaning that it will be their credit report that is pulled and their responsibility if you stop paying your bills.

Before we sign off, let’s take a look at some of the most common questions about the relationship between cell phones and credit scores.

There are a number of different ways that you can finance a cell phone:

Major phone manufacturers like Apple or Samsung typically offer financing options. This type of financing typically works in a similar way as credit cards, meaning that a line of credit will be opened in your name.

This means that activity on your account will be reported to the credit bureaus. If you make your payments on time and keep your account in good standing, it can help you build credit over time.

There are probably going to be a number of different financing options when you buy a phone from the wireless carrier you plan on using. One way is to lease a phone with the option to upgrade in the future. Another is to pay off the phone monthly without interest (for a set period of time) through an installment plan.

Activity regarding your financing or leasing agreement usually isn’t reported to the major credit bureaus. This means that this method of getting a phone typically won’t help you build credit.

You might find that other third-party retailers offer financing for phones, such as electronics stores. It’s common for these types of stores to offer credit cards that come with 0% interest for a specific period of time.

Financing a cell phone can, in some cases, affect your credit. Here are the three ways it can have an impact on your scores:

Fortunately or unfortunately, depending on your perspective, cell phone providers usually won’t report your payments to the three major credit bureaus. This is the case even though they will typically check your credit score when making a decision about whether to approve you for an installment plan or a phone contract. Since these carriers don’t normally report to credit bureaus, it means that your on-time payments won’t help your credit score.

Though it might seem unfair, missing payments can hurt your credit score, even though on-time payments don’t help. For the record, one or two late payments usually won’t impact your credit as long as you catch up on the money you owe before the carrier chooses to terminate the contract and turn the account over to collections.

If the account does end up in collections, though, it will hurt your credit. Collections accounts show up as a tradeline on your credit report. This won’t just harm your score, but it won’t be something that lenders look favorably on when determining your creditworthiness for a loan or line of credit.

It’s also possible to hurt your credit score if you disconnect your phone services without paying the remaining balance or the early termination fee. Additionally, terminating your contract prematurely can result in a lowered credit score if you don’t pay the money that you owe.

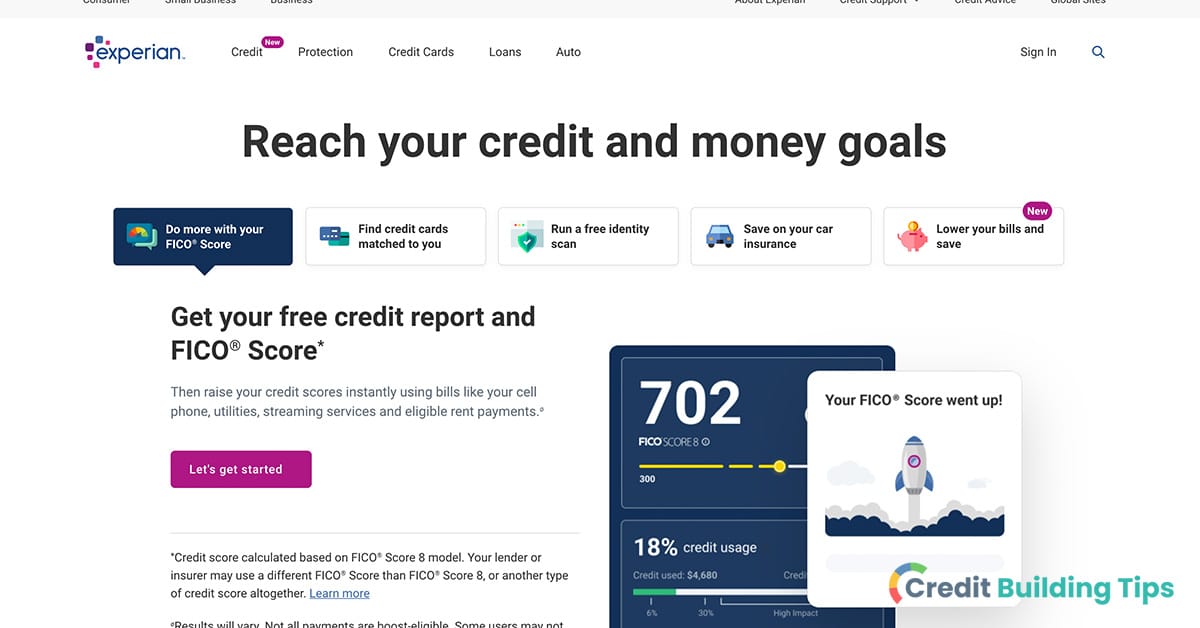

If you want all of your on-time payments to help your credit, there are services you can use, like Experian Boost. These monitor your checking account for on-time payments to service providers like cell phone companies and utility companies. Though this can potentially boost your credit score by adding up to two years of payment history, it’s worth noting that you will need to give up your bank account and other information in order to set up the service.

If you need a cell phone right now and your credit is bad, using one of the many options listed above will help you achieve your goal. When getting a new device, you could choose to purchase a cheaper pre-used or refurbished option or even ask your friends and family if they have an old phone they’re no longer using. Older models tend to be cheaper than newer models as well.

On the other hand, if you are simply trying to plan ahead for getting a new phone and plan down the road, you might choose to use this time to work on improving your credit.

Are you ready to build your credit so you don’t have to spend time researching things like how to get a cell phone with bad credit? Are you ready to increase the number of financial opportunities available to you by cleaning up your credit report?

If so, make sure you check out our Credit Building Tips blog for tons of useful resources that will help you improve your credit scores.

The accounts that are listed on your credit report are referred to as "tradelines." The two most common types of tradelines that you will see on your report are revolving credit accounts (such as credit cards or other lines of credit) and installment credit accounts (such as mortgages or auto loans.)

If you don't have enough tradelines on your credit report, it can put you in the "thin credit profile" category or even make you "unscorable," meaning that you don't have a credit score. Even if you don't fall into one of these two categories, there are numerous benefits to adding new positive tradelines to your report.

There are three primary ways to add a tradeline to your credit report: opening a new account, adding an existing account, or utilizing a service that lets you add utility or rent payments.

There are three primary ways to add a tradeline to your credit report: opening a new account, adding an existing account, or utilizing a service that lets you add utility or rent payments.Let's take a look at all of the most important details you will want to know about adding tradelines to your credit report.

Tradelines, in short, are the accounts that appear on your credit report. The two most common types of tradelines for individuals are:

If you have any debts that have been sold to collection agencies, you will probably also see these appear as separate tradelines on your credit reports.

The tradelines on your report are important because they directly impact your credit scores. They are an essential part of your credit history. The information found in your tradelines-- including the length of your credit history and your payment history-- will be used to calculate your credit scores.

To learn more about tradelines, check out our article about how long tradelines stay on your credit report.

There are a number of reasons you might want to add a tradeline to your credit report, including:

There are three primary ways you can add tradelines to your credit report:

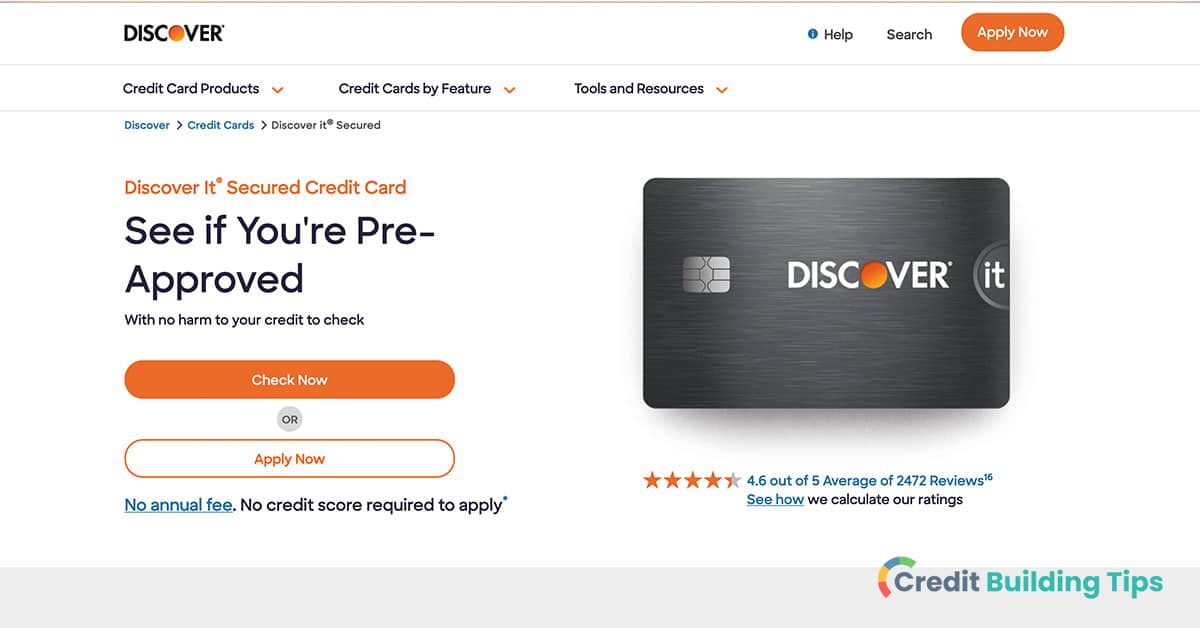

The first way you can add a tradeline to your report is by opening a new account. This might mean applying for an unsecured credit card, a secured credit card, or a loan. I've personally used installment loans in the past, for example, to help my own credit score and credit file.

If you have reasonable credit, the most obvious option is to apply for a traditional credit product, such as a credit card from a lender, a credit account through department stores and merchants, or a personal loan.

However, if you find yourself in a situation where you will struggle to qualify for a traditional product, you could also apply for a secured credit card.

Secured credit cards require a security deposit that will equal the credit limit you are offered. Since you are borrowing against your own deposit, it is much easier to be approved for a secured credit card than an unsecured credit card.

Of course, you'll want to be thoughtful when applying to borrow money-- the whole plan could backfire if you end up digging yourself into debt. Adding tradelines to your credit report will ultimately only be favorable to your credit score and creditworthiness if you are able to make on-time payments and otherwise prove that you are a responsible borrower.

You don't necessarily have to apply for a new credit card or loan in order to add a tradeline to your credit report.

You might also:

Perhaps one of the easiest ways to add another tradeline to your credit report is to ask someone you are close with if they would be willing to add you as an authorized user to one of their accounts.

If a parent, relative, or close friend is willing to add you as an authorized user, it will add the tradeline to your credit report. This will allow you to benefit from the positive payment history, credit history length of your account, and additional available credit of this account.

Before asking to be added as an authorized user on someone else's account, you'll want to make sure that their credit history is excellent and their income is stable. Otherwise, it could end up backfiring and harming your credit rather than helping.

For what it's worth, it is possible to be added as an authorized user but not be given access to actually using the available credit. This can help put the other party's mind at ease, as they will know there is no risk of the arrangement damaging their credit.

One way you can add your utility accounts to your credit report is through a program like Experian Boost, which we will discuss a little later on in the article.

However, you can also contact your utility companies directly and ask them if they would be willing to report your information to the credit bureaus. Of course, you will only want to do this if you have a positive payment history, and adding the tradeline will benefit your credit file.

There is no guarantee that your utility companies will comply, but it also isn't uncommon. There is no harm in asking, and if they say yes, it could help improve your credit report and credit score.

Creditors almost always report your account information to the three major credit bureaus (Experian, Equifax, and TransUnion.) However, it is possible that some of your creditors do not report to all three of the bureaus, and some in-store accounts might not report to any of the bureaus.

For example, let's say that you purchased an expensive appliance using an installment loan through a retailer. If you are making payments for it regularly and on time, you might be able to ask the retailer to report your information to the credit bureaus. When you communicate with them, make sure you ask them to report your information to all of the credit bureaus.

Before we start telling you why Experian Boost can help you add tradelines to your credit report, it's worth understanding that you will be required to share your accounts and banking information in order to use this service. It's entirely up to you whether you feel comfortable with this, and Experian states that they don't store consumer credentials and use world-class encryption in order to ensure that your data remains secure.

What is Experian Boost, exactly, and how can it add tradelines to your credit file?

Basically, Experian Boost is a credit-building tool that will allow you to raise your FICO score instantaneously. The way it works is that you can add accounts that have positive payment histories, such as phone bills, utility bills, and even streaming service payments.

You will need to link your bank account and any other accounts that you use to pay your bills. From there, Experian Boost can use the information regarding your on-time payments to add tradelines to your report and increase your score.

There are a few alternatives to Experian Boost that are worth knowing about, including eCredable Lift and Perch.

One of the benefits of eCredable Lift is that there is a wider selection of utility providers to choose from, while Perch lets you add your on-time rent payments to your credit report.

When your credit history has too few tradelines, it can mean that you have a "thin credit file" or that you're "unscorable." Both of these can be obstacles to having a healthy credit score.

If you have less than three tradelines, it means that you have a "thin credit file."

Even if you have at least three tradelines, there can still be additional benefits to adding more tradelines to your credit report.

You can benefit from adding tradelines to your credit report in a number of ways, including:

Positive tradelines (like well-managed loans or credit cards) can help to increase your credit score. When your credit report clearly shows that you have been making payments on time and demonstrating responsible credit usage, it can have a positive impact on your score.

If you are able to add a tradeline to your credit report that has a high credit limit and a good payment history, it can increase your creditworthiness.

Creditworthiness is the extent to which an individual or company is determined to be suitable to receive financial credit. It is typically based on their history of reliably repaying debts in the past.

The more creditworthy you seem to lenders and credit card companies, the easier it will be to receive approval when you apply for loans or new cards.

If you are able to add an existing tradeline to your credit report that is older than your oldest account, it can help to expand your credit history. The length of your credit history is one of the factors taken into account when calculating your credit score.

Lenders like to know that you have experience with several types of tradelines when applying for a loan. You can help increase your creditworthiness and maybe even your credit score by adding a tradeline from a different type of account.

For example, if you only have credit card tradelines on your credit report, you might consider getting an installment loan to diversify your credit profile.

To learn more about using installment loans to improve your credit, check out our ultimate guide to payment and installment plans.

If you have a strong credit profile with positive tradelines, it can help you receive lower interest rates and more favorable terms on both credit cards and loans.

Over your lifetime, you could save tens of thousands of dollars if you were able to receive the most favorable rates and terms when you borrow money. According to Experian, taking out a 30-year fixed-rate mortgage with an interest rate of 4.3% with a 700 credit score would cost you $16,319 more over the life of the loan than if you had a credit score of 760.

If you are able to add a tradeline with a high credit limit, it means that your overall available credit can increase significantly. This results in a lower credit utilization rate, which is one of the factors taken into consideration when calculating your credit score.

Your credit utilization ratio represents the amount of revolving credit that you are currently using divided by the amount of total credit that you have access to. Credit utilization ratios are typically expressed as a percentage and should ideally be below 30%. When it comes to credit utilization ratios, lower is always better.

When you add a new tradeline to your credit report and make on-time payments consistently, it allows you to build a positive payment history. Lenders will look closely at your payment history when determining whether or not to extend a loan or line of credit to you, as they want to know how likely you are to pay them back on time.

Payment history is a crucial factor in determining your credit score. In FICO scoring models, your payment history accounts for 35% of your score. Even one 30-day late payment can result in a decreased credit score.

Are you thinking about taking out a loan to buy a home or a car? Were you considering applying for a personal loan to consolidate your credit card debt?

No matter what type of loan you're applying for, adding a positive tradeline can help your chances of being approved. The same goes for applying for credit cards, as creditors want to see that you have experience managing credit responsibly.

If you have a less-than-ideal credit score, you aren't alone. According to LendingTree, 42% of Americans were denied a financial product (such as a personal loan or a credit card) due to their credit score between June 2021 and June 2022.

There are a number of things you can do to help build your credit when there are negative items on your credit report, including adding positive tradelines. When you are able to add tradelines in good standing to your report, it can offset the negative impact of less desirable items and help you in your quest to demonstrate creditworthiness to lenders.

Having good credit can open up new financial opportunities to you, and one of the ways you can improve your credit is by adding positive tradelines. Beyond getting the best rates and terms for credit cards and loans, an excellent credit score can help you qualify for rental applications, obtain favorable insurance rates, and secure lower security deposits.

When you research adding tradelines to your credit report, you will come across numerous articles claiming that you can simply buy tradelines that will then be added to your credit report.

It isn't difficult to find companies that sell tradelines for a fee, which can be expensive indeed (some prices stretch up into the thousands of dollars.) If you utilize one of these services, a tradeline will usually be added to your report for a brief period before it is removed as an open account.

Whether you have a thin credit profile or your credit report isn't the shining example of responsible borrowing that you hope it would be, adding positive tradelines can benefit your credit file and your credit score.

There are, luckily, a number of different ways that you can add new tradelines to your report, including opening a new account, adding an existing account, or using a service like Experian Boost.

Considering that there are a number of avenues you can take to add tradelines to your report, it really isn't worth going the route of buying tradelines from a potentially predatory company. Not only can this be expensive, but lenders and credit bureaus can see it as deceptive, and it can even put you at risk of committing bank fraud.

Building your credit the right way can take time, but it's worth going about it through the proper methods. Otherwise, you could end up harming your credit more than you help it.

If you're interested in discovering more tips for improving your credit, make sure you check out our Credit Building Tips blog.

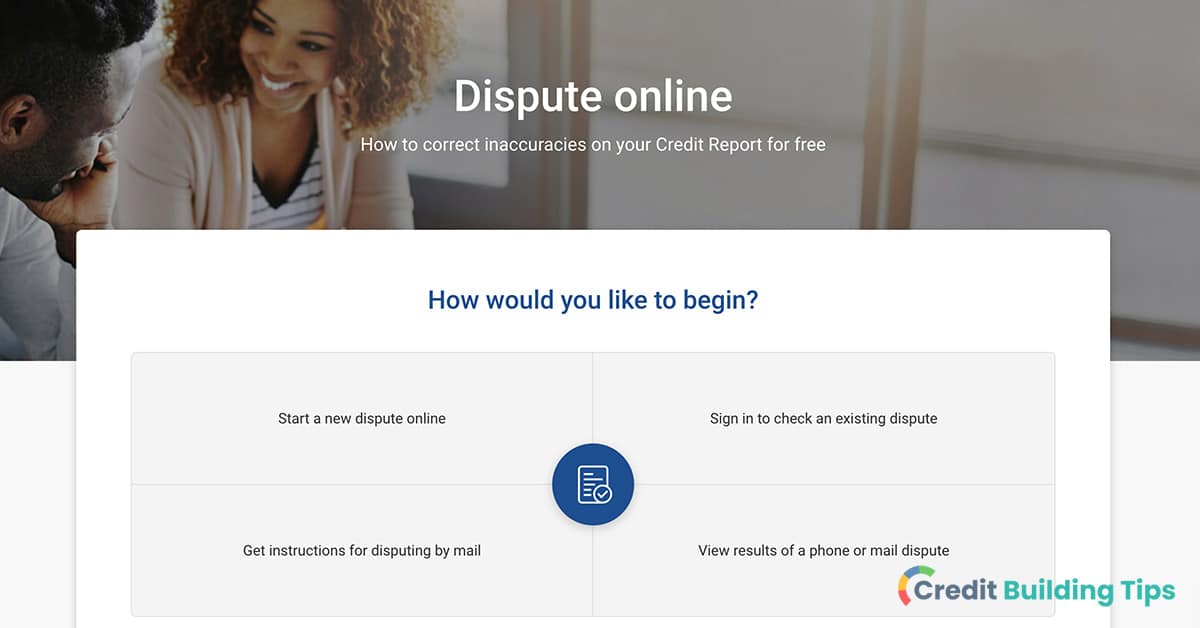

When incorrect information shows up on your credit report, the next step is to open a dispute with the credit bureau that is displaying the error. This opens an investigation, which normally takes about thirty days.

During this time, the account in question will likely show a "dispute comment." This is an indication that there is currently a dispute under investigation.

Dispute comments usually shouldn't be a problem, but sometimes mortgage lenders will want them removed because they will temporarily mask the account from being calculated as a part of your credit score. Additionally, you might want a dispute comment removed because it is making your credit score artificially low.

Dispute comments usually shouldn't be a problem, but sometimes mortgage lenders will want them removed because they will temporarily mask the account from being calculated as a part of your credit score. Additionally, you might want a dispute comment removed because it is making your credit score artificially low.Removing dispute comments isn't always a good idea, so it's important to determine whether or not it will be advantageous to you. You can ask credit bureaus to remove dispute comments by calling them and talking to a representative or sending a letter via mail or fax.

Anytime you file a dispute regarding one of the accounts that appear on your credit report, an investigation into the claim will begin. This is the case whether you question the validity of an account or information about an account with the credit bureaus or with a debt collector.

These investigations usually take about thirty days to be completed. During this time, the account will be marked on your credit report as “disputed.”

Your right to dispute information on your credit report is outlined in the Fair Credit Reporting Act (FCRA). In this Act, companies that provide information to credit bureaus have:

“...specific legal obligations, including the duty to investigate disputed information.”

Since there will be a period of time after you file a dispute and before the investigation is over, this comment serves to indicate that there is a dispute or disagreement regarding specific information that is found on your credit report. In most cases, dispute comments are added when a consumer believes that certain information is incomplete, inaccurate, or misrepresented.

If you are looking at your credit report and you see a dispute comment, there are two primary forms it can take:

This first type of dispute comment means that there is an active investigation underway after a dispute has been filed. When applying for a home loan, lenders will usually want to see these notes removed before determining whether to approve you for a mortgage and, if so, what rates and terms to offer. This is because the account won’t be factored into your credit score via FICO credit scoring models.

If the second type of dispute comment appears, it means that a resolution has been reached after the completion of the investigation. This particular type of dispute comment won’t be something that bothers lenders, as the account will once again be incorporated into your credit score calculation.

Are you ready to improve your credit score and clean up your credit report? Check out our guides to credit repair hacks, credit repair services, and repairing your credit after you're the victim identity theft.

Removing a dispute comment isn’t always necessary and isn’t always favorable. In the next section, we’ll discuss when you should and should not ask for dispute comments to be removed from your credit report. In this section, however, we’ll look at the steps you need to take to have a dispute comment removed, assuming that you have already decided that this is the right course of action.

The fastest way to have dispute comments removed from your credit report is going to be calling the credit bureaus. Though this can be frustrating as it often means sitting on hold for a while, you’ll find that it’s a much quicker way of going about it than sending a letter through the mail.

Here are the numbers and subsequent menu items to select that you’ll want to try in an effort to speak with an actual human:

If these numbers don’t work, your next best bet will be pulling your free credit report from AnnualCreditReport.com, which is a site authorized by Federal Law and put together by the three main credit bureaus. On each of your credit reports, you should be able to find a phone number that you can call in addition to a personal credit report ID number.

Once you have someone on the phone, you’ll want to tell them that you want to have a dispute comment removed from some of your accounts. If you are doing so because you are pending mortgage approval, mention that the lender has asked you to do so in order to move forward with your home loan.

If you’d prefer to write the credit bureaus rather than call them, you will want to enclose a copy of each of the following with a letter sent via certified mail or fax:

Here are the addresses you can use to mail your request to have a dispute comment removed:

The fax numbers for each credit bureau are not listed on their website, which means you might need to call and confirm the current and correct fax number to use. Given this, you might find that simply dealing with deleting the dispute comment over the phone is the quickest way to resolve the issue.

You might think that it’s always a good idea to remove dispute comments from your credit report, but this isn’t necessarily the case.

There are really only two reasons that you should go through the trouble of asking the credit bureaus to remove dispute wording from your credit report:

If you have derogatory marks on your credit report, it can really make it difficult to get approved for a loan with good rates and terms. If it's time to clean up your credit report, take a look at our guides to removing charge offs, removing collections, removing hard inquiries, removing evictions, and removing 30-day late payments from your credit report.

It isn’t always easy to know whether or not removing dispute comments will increase your credit scores. However, if you know that the account is in excellent standing, you might want to remove the dispute comment if you are currently applying for a loan or line of credit.

That being said, it’s possible that the account is increasing your score in one way and decreasing your score in another, leaving you with a net neutral result when removing the dispute comment. It can be pretty tricky to figure out whether an account is going to help or hurt your score, so you’ll want to proceed with caution.

If you’re applying for a home loan, there’s a chance that your mortgage program might require that dispute comments are removed before the process can be completed.

The four most common mortgage programs out there are:

Each of these programs is going to have its own unique underwriting rules. The underwriting rules for each respective program are going to govern things like:

In many cases, mortgage loan programs will allow some types of dispute comments to remain on a credit report. For example, FHA loans don’t require that dispute comments are removed from medical accounts and accounts with zero balances. Additionally, dispute comments don’t have to be removed for an FHA loan if the total balance of these accounts in dispute is less than $1000.

When the digital version of your credit report is run through the automated underwriting service run by your loan program, it’s possible that dispute comments won’t trigger an alert regarding a disputed account.

In some cases, you might find that it is a better option to switch loan programs rather than to remove dispute wording on your credit report. Once the account is unmasked, it's possible that it will drop your credit score enough that you will no longer qualify for the loan program you were initially approved for.

Before we sign off, let's take a closer look at the answers to some commonly asked questions about credit report dispute comments.

Credit report disputes can indirectly impact your credit score. FICO credit scoring systems will not take accounts that are actively in dispute into consideration when calculating your score. Even though the dispute comment will show up on your report, the entire account will not be used to help determine your score.

Depending on the status of the account, this could mean that your credit score is artificially lower or higher than it would be if the account was factored in. Until the comment is removed, FICO credit scoring models will not incorporate the account into their calculations.

If you are applying for a home loan, a lender will often be able to see that there is a dispute comment on your report and will know that this is impacting your true credit score. They will, therefore, likely want the comment to be removed before making a decision about your loan so that they know they are viewing an accurate credit score.

Dispute comments will usually stay on your credit report until the investigation has been completed and the dispute has been resolved. At the point that the dispute is resolved, the information on your credit report will be updated accordingly if necessary.

That being said, sometimes a credit report will indicate in a comment that there had been a dispute in the past and the dispute has been resolved. In this case, these comments won't mask the account for the purposes of calculating your FICO score.

How long it takes to remove a dispute comment from your credit report is going to vary. If you are able to talk to a representative from the credit bureaus on the phone, you might find that the dispute comment has been removed in as little as four business days. If you choose to contact the credit bureaus via fax or snail mail, it might take as long as thirty days.

Anytime you find inaccurate information on your credit report, you can dispute it with the credit bureau. All of the credit bureaus have online portals that you can use to dispute information, making the process simple and easy to get started.

It's worth noting that there are certain items on your credit report that aren't disputable. Though it is within your legal rights to dispute credit report information, some info is maintained "as a matter of factual record." Though it is possible under some circumstances, you usually cannot remove information that is factually correct.

The outcome of a dispute could impact your credit, but the dispute itself should have no effect on your credit.

For example, let's say a late payment showed up on your credit report, but you did actually pay on time. If you dispute the information and it is corrected, it will probably help your credit score.

If you are disputing personal information such as the name or address that appears, though, this won't impact your credit score.

The nature of the information that is being disputed will impact the results of the dispute. Once the dispute has been resolved, an outcome description might be added to your credit report.

If you are filing a dispute that is related to your personal information, it can result in:

If you are filing a dispute that is related to accounts, inquiries, or bankruptcy, it can result in the following:

Improving and building your credit might not sound like your idea of a good time, but you might get a bit more excited about it when you realize how much money it could save you and the financial opportunities it can open up for you.

Cleaning up your credit report and boosting your credit score can end up saving you tens of thousands of dollars in interest over your lifetime, as you'll end up receiving much more favorable rates and terms when you borrow money.

Beyond that, credit scores and reports can be taken into account when you apply for an apartment, a job, or insurance. When you consider just how impactful your credit is on the practical realities of your life, it's worth taking the time and putting in the effort to improve your credit.

Are you ready to begin the journey of cleaning up your credit report and boosting your credit score? Make sure you take a look at all of the resources on our Credit Building Tips blog.

It's easy to not think about your credit score until your gearing up to apply for a loan.

There are a number of loan options for mobile homes for people that have bad credit-- for example, people with a credit score of 500 can qualify for an FHA loan if they are able to put 10% down. Beyond that, there are some alternative methods you can explore, including finding a seller that is willing to finance, lease-to-own opportunities, finding a co-signer, and more.

There are a number of loan options for mobile homes for people that have bad credit-- for example, people with a credit score of 500 can qualify for an FHA loan if they are able to put 10% down. Beyond that, there are some alternative methods you can explore, including finding a seller that is willing to finance, lease-to-own opportunities, finding a co-signer, and more.In most cases, you will find that lenders typically require a minimum credit score of at least 580-620 in order to receive a mobile home loan.

That being said, it is possible to receive financing with a lower credit score. There are a number of loans you can apply for when buying a mobile home, many of which will require that you make a larger-than-usual down payment if your credit score is less than ideal.

A minimum credit score of 580-620 is often required in order to receive a loan for a mobile home.

What this means is that you might find that you qualify for a mobile home loan even if you do have bad credit, depending on which credit scoring model is being used and depending on what you mean by bad credit.

The lowest category of FICO credit scores is "poor," with scores ranging from 300-579. The lowest category of VantageScore credit scores is "very poor," ranging from 300-499.

For FICO scores, a "bad" score is typically considered below 670. Under this number, a credit score falls into the ranges of "fair" or "poor."

For VantageScore models, a score of less than 661 means that your credit score is "fair," "poor," or "very poor."

When you are at the point where you know what type of mobile home you're looking for, and you know where you want to put it, the next step is to determine how you will finance the purchase.

There are a number of different loan types available for buying mobile homes. It is worth taking a look at each one, as they have different requirements for qualifications, including different minimum credit scores.

Individuals can receive mobile home loans offered by the Department of Housing and Urban Development through the Federal Housing Administration loan program.

This includes:

The primary difference between these two loan types is that your mobile or manufactured home does not need to be attached to the land when you apply and receive an FHA Title I loan. On the other hand, the home needs to be attached permanently to land owned by the borrower.

FHA loan programs work with borrowers that have credit scores that are as low as 500.

If you have less-than-ideal credit, a Title I FHA loan might be a good place to start looking for a mortgage.

With a 10% down payment, they accept credit scores as low as 500 to 579. If you have a credit score above 580, you can make a down payment as low as 3.5%.

There are a number of ways that a Title I loan can be used when it comes to mobile homes, including:

Even if the buyer isn't planning on purchasing the land where the mobile home will go or doesn't already own this land, lenders can offer Title I loans for mobile homes.

Borrowers that don't own the land and aren't planning on buying the land where the mobile home is going to stand will need to submit a signed lease with an initial term of three years or more for the mobile home plot.

It's common for mobile homes to be placed in mobile home parks or manufactured home communities, where residents can lease rather than own the land their home is on.

There are a number of requirements you'll want to be aware of when applying for this loan program.

When it comes to the maximum loan amount, the following requirements must be met to qualify:

The maximum loan term required for one of these mobile home loans are:

Title II loans can be used to purchase a manufactured or mobile home along with the land that the home will stand on. This is the case as long as you meet all of the requirements of the loan.

The minimum required credit score for Title II loans are the same as those for Title I: scores of 500-579 must put 10% down and scores of 580 or higher can put 3.5% down.

Real estate investors aren't allowed to get this type of loan-- it's only for people that are using the mobile home as a primary residence.

The other requirements for qualification include the following:

All of this means that this type of loan can't be used for mobile homes in mobile home parks or manufactured home communities.

Before you start looking down obscure paths for your mobile home financing, the easiest answer might be right under your nose.

You will need to have a minimum credit score of 620 to qualify for a loan through the Freddie Mac Home Possible mortgage program. There are a variety of options to choose from if you are able to go this route:

Depending on your credit score, it's possible to put as little as 3% down for one of these loans. It's also possible in some instances to use grant money or gifted money toward your down payment.

Are you thinking about opening a new credit card but you aren't sure whether you should wait until after you buy your house? Check out our article about how opening a new account will impact your ability to buy a house.

There are some lenders that offer Fannie Mae mortgages to individuals that want to purchase a mobile home. This occurs through what is known as the MH Advantage program.

A minimum credit score of 620 is required to qualify for the MH Advantage program.

You will need to satisfy a variety of criteria, including:

Certain architectural design, construction, and energy efficiency standards also need to be met to qualify for the MH Advantage program.

Here are a few other key points about these loans you'll want to know:

It's possible that you could qualify for a loan that is insured by the Department of Veteran Affairs if you belong to the military community.

There are no minimum credit score requirements for VA loans.

When it comes to mobile homes, you can use a VA loan to:

If you qualify for a VA loan, you might be able to receive 100% financing for your mobile home.

Are you trying to improve your credit? Take a look out our guides to credit repair hacks, removing derogatory marks from your credit report, and deleting collections in exchange for payment.

If you are worried that you aren't going to be able to qualify for a traditional home loan to purchase your mobile home, or you don't want to deal with the often arduous mortgaging process, you could also consider a personal loan.

There are a number of pros and cons to using personal loans rather than traditional mortgages to purchase a mobile home.

Some of the advantages include:

On the other hand, the major drawback of using a personal loan for purchasing a mobile home is that the interest rates will likely be higher than those of a traditional mortgage. This is precisely because the home isn't used as collateral for a personal loan the way it is for a home loan.

Are you on a mission to learn more about improving your credit? Take a look at our guides to how long tradelines stay on your credit report, using installment loans to rebuild bad credit, and writing hardship letters to credit card companies.

Finally, you might also choose to apply for a chattel loan, which is a special kind of personal property loan that could be a good choice for a person with bad credit.

These loans are designed for the specific purpose of purchasing expensive vehicles, including:

Chattel mortgage lenders will often only require a minimum credit score of around 575, which is quite a bit lower than the minimum credit score for many other loan types.

With chattel loans, the property being financed serves as collateral for the loan. You can typically get a chattel loan even if you don't own (and don't plan to purchase) the land where the mobile home will stand. For this reason, chattel loans are popular choices for individuals that are expecting to lease a lot in a mobile home park.

There are some lenders that offer mobile home chattel loans that are government insured by:

There are a few important differences between chattel loans and traditional mortgages:

Chattel loans will commonly come with higher interest rates than traditional mortgages-- typically they are 0.5 to 5 percentage points higher.

When you have bad credit, and you're motivated to buy a mobile home, it's a good idea to have some tips and tricks up your sleeve. This can help you save money during the process and make the financing process easier.

It's important to remember the old adage-- when there's a will, there's a way. The worse your credit is, the more creative you might have to get. That doesn't mean you are completely out of luck when it comes to buying a mobile home.

In addition to our extensive list of loan options that you can apply for even when your credit is subpar, here are some alternative methods you can try:

Is it time to clean up your credit report? Check out these guides to removing charge offs, collections, and hard inquiries from your credit file.

If you are interested in buying a mobile home with bad credit, you are not entirely out of luck. However, the options available to you are going to depend on just how bad your credit is, how much money you are planning on spending on a mobile home, the amount you can put down for a down payment, and more.

Sometimes, time is of the essence when you are trying to get a loan. On the other hand, if you aren't in a rush to buy a mobile home, it might be worth taking the time to improve your credit before you start shopping around and filling out applications.

Even though mobile homes are quite a bit cheaper than traditional homes, you will still be able to save a significant amount of money over the life of the loan if you are able to lock in the best interest rates.

Are you ready to start improving your credit so you can purchase a mobile home easily and with the best loan rates and terms? If so, make sure you check out the rest of our Credit Building Tips blog for tons more information about boosting your credit, cleaning up your credit report, and improving your financial health.

If a credit card company has been unable to recover the money that they lent you, there is a certain period of time (known as the statute of limitations) during which they can bring a lawsuit against you.

If they obtain a judgment from a court of law, they can use a number of methods in accordance with state law to try and collect on the judgment. These methods might include garnishing your wages, filing a lien against your real estate, executing against personal property, and more.

There are several periods of time to be concerned with when it comes to credit card judgments-- the statute of limitations in each state, laws about judgment expiration and renewal in each state, and the length of time a judgment remains on your credit report.

There are several periods of time to be concerned with when it comes to credit card judgments-- the statute of limitations in each state, laws about judgment expiration and renewal in each state, and the length of time a judgment remains on your credit report.Credit card companies can file a lawsuit in order to try and get a credit card debt judgment against you if you're account is in default.

If the judgment is awarded to them, then they can use a wide variety of collection methods against you in order to get the money they are owed.

A judgment is an order that is entered by a court of law. This order indicates the findings of the court.

When you borrow money from a credit card company, you are legally obligated to pay the debt back to the creditor. This is the case when you have a credit card account, receive financing for a large purchase, or get a line of credit from a bank.

When a creditor receives a judgment, they are extended the right to use collection methods above and beyond what is allowed without a judgment in order to collect their debt.

The first step in obtaining a judgment is to file a lawsuit against a borrower. They do this in a civil court and will file a document known as a complaint. This complaint will also be delivered to you.

There are a handful of ways that credit card companies can achieve judgments after they have filed their lawsuit, including:

There are a number of methods that credit card companies can use once they obtain a judgment in order to try and collect the debt they are owed. Without a judgment, credit card companies can not use these tactics.

The following methods may be allowed under state law:

If a credit card company has obtained a judgment against you, how long that judgment will last before expiration depends on state law. When a judgment expires and is no longer renewable or revivable, it means that the creditor can no longer use the methods afforded to them under the judgment to collect on the debt.

Let's look at the laws in all 50 states. However, it's important to note that laws are subject to change, and certain exceptions may apply. If you have questions about how long a credit card judgment lasts, it's a good idea to get in touch with an attorney in your state.

Are you trying to improve your credit and you're wondering whether you should pay for a credit repair company to help fix your credit? Check out our guide to the cost of credit repair services.

It's worth noting that there is a statute of limitations for credit card debt in each state, which sets a limit on how long lenders and collection agencies have to sue an individual over debt.

Basically, there is only a limited period of time in which debt collectors can file a lawsuit against you. How long this time frame is depends on both the specific type of debt and the state, you live in. However, in many cases, it ranges from three to six years.

Debt collectors no longer have the right to sue you in an attempt to collect on the debt after the statute of limitation has passed.

Even though you can't be sued after the statute of limitations has passed, that doesn't mean that you're entirely off the hook. They can continue to try and collect on the debt, but they must stay within the bounds of the law in these attempts.

Credit card debt is considered an "open-ended account" as opposed to a written contract, oral contract, or promissory note. The type of debt and the state you live in determines the statute of limitations.

Has your credit report seen better days? This article looks at four simple ways to remove derogatory marks on your credit.

The following states have a three-year statute of limitations for open-ended accounts:

The following states have a four-year statute of limitations on open-ended accounts:

The following states have a five-year statute of limitations on open-ended accounts:

The following states have a six-year statute of limitations on open-ended accounts:

Rhode Island is an outlier, with a ten-year statute of limitations on open-ended accounts.

Do you have a debt currently in collections? To avoid an outcome where a judgment is made against you, consider striking a deal with the debt collector.

If a lender has successfully taken you to court in order to try and recover funds that they lent to you, it historically would have appeared on your credit report. The reason this information used to show up on your credit report is that potential lenders want to know that it could be risky to loan you money.

In the past, even if you paid back the money you owed or they recouped their money through other means (aka, the judgment has been "satisfied"), it would still appear on your credit report.

Judgments used to stay on your credit report for seven years starting from the filing date until the credit bureaus stopped recording judgments in April 2018.

However, all of this changed once the credit bureaus decided to stop reporting judgments as of April 2018. This means that judgments no longer impact your credit score and do not appear on your credit report.

That being said, there are a few ways that judgments (which are public records, by the way) can still impact your finances:

Are you on a mission to improve your credit? Check out our posts about credit repair hacks to increase your credit score, bank overdrafts and credit scores, repairing credit after identity theft, and removing charge-offs from your credit report.

Even though having a judgment against you won't show up on your credit report, it's really not a situation you want to be in. Creditors can garnish your wages, file a lien against your real estate, execute against your personal property, or levy your bank account, for example, in order to recoup their funds if they win a judgment against you.

If you are behind on your credit card debt, it's best to try and get on top of it right away. You might find that you can reach an agreement with the creditor using a hardship letter if you have a strong argument for why you are behind on your debt. Though it can be tempting to avoid thinking about your debt after your first 30-day late payment mark, it's really best to avoid an outcome where the credit card company is able to garnish your wages or otherwise threaten you financially.

Are you ready to improve your credit score and get on top of your debt? Make sure you check out the rest of our blog for more useful resources and informative articles.

Mercedes Benz is one of the most aspirational auto brands out there-- when you own a Mercedes, it's a sign that you've made it in life.

Only the most affluent of car owners, though, can afford the steep price for these vehicles out of pocket.

If you are planning on financing a Mercedes-Benz through their own lending service, you will need a credit score of at least 680. However, you can also obtain a loan from another lender or take out a personal loan, which can allow you to receive financing with a lower credit score.

If you are planning on financing a Mercedes-Benz through their own lending service, you will need a credit score of at least 680. However, you can also obtain a loan from another lender or take out a personal loan, which can allow you to receive financing with a lower credit score.Of course, your credit score and credit report will have an impact on the loan terms you are offered. In order to qualify for a traditional auto loan, you typically need a credit score of at least 600. If your credit score is lower than 600, it's possible to locate a bad credit car loan with much less favorable rates and terms.

There is no standard minimum credit score that you will need in order to apply for a car loan. That being said, each lender will have their own minimum standards that they will apply when they review auto loan applications.

- In general, you will be charged more interest on your loan the lower your credit score. You will typically need to have at least prime credit in order to get a good interest rate on an auto loan. A credit score of 661 or up is considered prime credit in some credit scoring models, while 680 and up is favorable for others.

There are two primary factors that will inform the minimum credit score you need in order to qualify for a car loan:

If a lender advertises a minimum credit score, it doesn't necessarily mean you're out of luck if your credit score is below the listed number. The following conditions might allow you to receive an auto loan from a lender even if your score doesn't meet their minimum:

There are a number of factors that will be taken into account beyond your credit score when you apply for a car loan. In order to determine whether you will be approved and what interest rate you will be offered, lenders will likely evaluate the following:

Though several factors are taken into account when determining whether or not you will be approved for a car loan, your credit score is one of the major factors.

The minimum credit score required for buying a Mercedes Benz with financing is going to depend on the lender that you use. We will go into details about financing using Mercedes-Benz Financial Services a bit later on in the article, but first, let's discuss what you need to know about getting a car loan from any lender for a Benz.

The average cost of a new Mercedes-Benz reached $76,590 in 2022, which is a 43% increase over the average for 2019. This increase has aligned with rising car prices as well as the carmaker's push to focus on top-end models in recent years.

The average cost of a new Mercedes is more than $76,000.