Pawnshop loans can be an intriguing option for people looking to come up with cash quickly or with less-than-ideal credit.

If you take out a pawnshop loan, though, will it hurt your credit score? Will your credit be damaged if you don't pay a pawn shop loan back?

While there are definitely some reasons to be wary of pawn shop loans, one good thing about them is that they won't hurt your credit score. Pawnbrokers won't report your payment history to the credit bureaus, and the loan won't appear on your credit report.

While there are definitely some reasons to be wary of pawn shop loans, one good thing about them is that they won't hurt your credit score. Pawnbrokers won't report your payment history to the credit bureaus, and the loan won't appear on your credit report.Before you grab your grandmother's antique jewelry or your flat-screen TV and start driving to the local pawn shop, you'll want to learn a little bit more about these loans and explore some of your other options.

Also known as a pawnbroker loan, a pawnshop loan is a type of secured, short-term loan. These can be obtained either at brick-and-mortar pawn shops or online pawn shops.

A secured loan is a type of loan where the debt is backed by collateral. In the case of a pawn shop loan, the asset backing the loan is the item of value you leave with the pawnbroker.

If you agree to the loan, you'll leave the item with the pawnbroker. The catch is that they can keep and resell your item if you don't pay the loan back within the time period that was agreed upon.

Pawnshop owners will typically offer a loan that is somewhere between 25% and 60% of the estimated resale value of the item. This will usually be a lot lower than the price you originally purchased the item for.

Not only do pawn shop loans put you at risk of losing a potentially valuable and maybe even sentimental item if you aren't able to repay the loan, but it's also important to note that this type of loan isn't usually very cheap.

Before taking out a loan like this, it's a good idea to assess your other options and make sure you're not going to end up in a worse financial position than where you started.

Though there are definitely some pros and cons to weigh out when it comes to taking out a pawnshop loan (which we'll take a closer look at in the next section,) one advantage is that it won't hurt your credit score.

When you take out a pawnshop loan, your payment history won't be reported to the credit bureaus by the pawnbroker. This means that whether or not you repay the loan won't have any impact on your credit. At the same time, making timely payments toward a pawnshop loan won't help you rebuild your credit.

If you're hoping that all of your pawnshop loan repayments will help you improve your credit score, you're, unfortunately, out of luck. On the other hand, if you're worried that your pawn shop loan is going to ding your credit, you'll be glad to know that pawn shop loans won't end up on your credit report.

Beyond that, pawn shop loans won't end up with you being harassed by debt collectors if you fail to pay them back. If you don't pay back the loan within the stated period of time, the pawnbroker will keep the item that you left as collateral and resell it.

Is it a good idea to borrow money using a pawnshop loan? While there are definitely some appealing things about these loans, including the fact that they don't impact your credit score and you can get cash quickly, there are also a number of drawbacks to consider.

Pawn shop loans can be attractive when you don't have great credit and when you're looking to get a quick loan.

Here are some of the ways that pawnshop loans can be beneficial to borrowers:

On the other hand, borrowing money from a pawnshop can be risky in a number of ways.

Here are some of the negative aspects you'll want to keep in mind before pawning your valuables for a loan:

If you need quick access to cash, but you're worried about the risks of taking out a pawnshop loan, there are other options that you can look into. You'll notice that we don't include high-interest payday loans or title loans on this list-- both of these loan types come with high costs and high risks that make them generally a bad idea.

What are some alternatives to pawnshop loans when it comes to borrowing money? Here are some other options to keep in mind.

If you have a credit card with a credit available, you can either use the card to make a purchase or even consider a cash advance. However, you'll want to look at the interest rate for cash advances, as the interest rates are often higher than for standard purchases.

That being said, the APR for a purchase or cash advance using a credit card will most likely be significantly lower than the APR you would receive if you took out a pawnshop loan. Of course, you don't want to spend money that you don't think you'll be able to pay back, as this can continue the cycle of debt.

If you have decent credit, you also might be able to qualify for a promotional 0% APR credit card. This means that you won't have to pay interest for a set period of time.

A number of big banks and online lenders will offer small-dollar loans to existing customers.

These are short-term loans that will have much more favorable interest rates than pawnshop loans. These do, however, usually require a credit check.

Personal loans are typically unsecured loans, meaning that you don't have to put down collateral. Even though the interest rates for personal loans are higher than many types of secured loans (auto loans, home loans, etc.), they will usually be lower than the APR you'd find at a pawn shop.

Even if you have bad credit, you might be able to find a lender that offers loans specifically for people in your situation. Additionally, some offer emergency loans. It's always important to check out the terms of a loan before signing on and shop around to compare interest rates and terms.

Payday loans are an incredibly expensive way to borrow money. On the other hand, payday alternative loans (PALs) have a lower interest rate. These are offered by federal credit unions specifically as an alternative that is more affordable to payday loans.

Another option is an online lending platform. The rates and terms can vary quite a bit, but the credit requirements might not be as strict as they are for a more standard personal loan.

There might be local nonprofits, religious groups, or organizations in your community that offer help to people that are dealing with short-term financial problems. There are also a number of federal, state, and local programs that out there to help people with utilities, groceries, medical bills, and other essential expenses.

Though it can be hard to ask someone close to you for financial help, this can help you avoid costly interest charges and other fees. Mixing personal relationships and money can be tricky, so it's important to come up with a clear agreement about how and when the money will be repaid.

Wondering how else you can come up with cash quickly without getting a loan? Here are some ideas to consider.

The same item you're thinking about pawning could be better put to use by simply selling it yourself. If you're ready to let go of some of your valuable items and you want to turn them into cash, consider selling them through platforms like Craigslist, eBay, or Facebook Marketplace.

There are a lot of side gigs out there you can pick up quickly, such as food delivery, ride-sharing, online tutoring, babysitting, pet sitting, or part-time freelance work. A little bit can go a long way when you're trying to get out of a financial rut, and a side gig might be just what you need.

If you simply need a little extra cash to get through to next week, you might be able to ask your boss or HR department if you can get an advance on your paycheck. This isn't something you want to do all the time, but as a one-time thing, your company might be understanding and willing to help you out.

There are a number of apps that you can use to receive an advance on your paycheck if you'd rather not ask your boss for a favor. When searching for a cash-advance app, make sure you take a close look at the interest and fees charged.

Have an extra room in your home that you don't use? You might consider renting it out short-term using a service like Airbnb or long-term and taking on a new roommate. There are obviously pros and cons to these options, but it's worth considering if you're strapped for cash.

Even if you don't have anything of value that you want to sell, you might be able to find items on sites like Craigslist or Facebook Marketplace that you can clean up and flip for a profit. You can also check out thrift stores, estate sales, and free piles.

If you live near a college or university, it's possible they offer paid research studies that you could participate in. There are almost always parameters you have to meet to participate, and some will pay in gift cards rather than cash. According to Miami Clinical Research, most studies pay between $50 and $300 per day.

Have a big jar of coins sitting on your dresser? If you're coming up short this week, you might be surprised how much cash is hidden in that jar. You're not going to find enough to buy a new car, but you might be able to scrounge together some extra cash to put toward your bills or buy some groceries.

If you're considering a pawnshop loan because you're having a hard time paying your bills, here are a few more things you might consider:

If your credit has seen better days, all hope isn't lost. You can rebuild! Check out our guides to credit repair hacks, removing derogatory marks, and removing evictions, late payments, collections, and hard inquiries from your credit report.

Finally, let's answer a few other common questions about pawn shop loans.

To get a pawn shop loan you'll need to show proof of your identity and be 18 years old or older. Sometimes you'll also need proof of ownership or purchase of the item. No credit check is required.

Though there are rules at both the federal and state level that regulate pawnshops, that doesn't mean that all pawnshop owners are following the rules. It's possible that a pawnbroker could charge a higher APR than what is technically allowed by the state or otherwise engage in predatory lending practices.

There have been a number of lawsuits filed against specific pawn shops by the Consumer Financial Protection Bureau (CFPB) due to their illegal practices.

Taking out a pawnshop loan certainly comes with its fair share of risks, including losing the item you put up as collateral, paying high-interest rates and fees, and even the potential to be a victim of predatory lending. At the same time, pawnshop loans are typically considered a less harmful way to borrow money compared to other options like payday loans or auto title loans.

If you don't repay a pawnshop loan, you'll lose the item, as the pawnbroker will resell it. You won't get the money back that you put toward the loan, and you won't receive any of the profit the pawnbroker made when they sold it.

If you repay a pawnshop loan within the time specified in the loan terms, you can retrieve the item you put up as collateral. There are often options for extending loans at pawnshops, but you'll have to pay additional interest and probably storage fees, too.

According to data from the National Pawnbrokers Association, the average size of a loan received from a pawnshop in the U.S. is $150. Some shops might have set minimums and maximums for loans, and some states might regulate how much money a pawn shop can loan out and the length of the loan term.

The terms for pawn shop loans can vary quite a bit, though they typically involve a high-interest rate. In a number of states, legislators have stepped in to try and regulate pawnshop loans. This means that some states will have laws that will dictate how long you can take to pay back a pawnshop loan.

For example:

Interest rates for pawnshop loans are commonly between 5% and 25% a month, typically closer to the 20% to 25% range. There are also sometimes additional fees for storage, insurance, and other costs. This makes it a costly way to borrow money.

You can pawn just about anything at a pawnshop that has value. At the same time, not all pawnshops will accept specific items as collateral for a loan.

Some of the most popular pawned items include:

Running out to the pawn shop (or finding one online) to take out a loan might not be the absolute worst way to borrow money, but it really isn't the best, either. Though a pawn shop loan won't harm your credit score, it's definitely an expensive way to borrow money and comes with a number of unpleasant risks.

Luckily, there are a number of other things you can do if you need quick access to cash, are having trouble paying your bills, or are trying to borrow money with poor credit.

Though you might have short-term financial woes right now, it's a good idea to start thinking about the big picture. With some attention and dedication, you can work to rebuild your credit over time so that funds are much easier to obtain the next time you need to borrow money.

Is it time for you to start working on your credit to help you gain access to better financial opportunities? If so, make sure you check out our Credit Building Tips blog.

Around the world, more than 150 million users have booked over one billion reservations through Airbnb. Every second, six guests check into an Airbnb somewhere on the planet.

Though booking an Airbnb short-term rental isn't always the best deal for short stays or small groups, you can save some money compared to hotels for longer trips or stays with larger groups.

It's a good idea to book your Airbnb well in advance, but you might be hesitant to book a stay if you're concerned about when they will charge your credit card. The payment will be charged when the reservation is confirmed, even when you use Instant Book.

It's a good idea to book your Airbnb well in advance, but you might be hesitant to book a stay if you're concerned about when they will charge your credit card. The payment will be charged when the reservation is confirmed, even when you use Instant Book.How much you will be charged depends on whether or not you've chosen to pay in a one-time payment or in installments. Long-term rentals of more than 28 days will require an initial one-month payment and then will be charged monthly after that.

Airbnb will charge you once your reservation is confirmed. This isn't just the case for regular bookings but also for Instant Book, which is a listing that lets you reserve a place immediately without having to wait for approval from the host.

Hosts won't receive payment until 24 hours after you've checked in, no matter how far in advance you book your accommodations.

As we'll discuss in the next section, if you choose to pay in installments rather than in a one-time payment, you will be charged an initial deposit upon confirmation of your booking. Then the subsequent payment dates will be listed during the checkout process and can also later be found in your Airbnb account.

Once your accommodation has been booked, there are two primary ways that you can pay:

You will find that you can use a payment plan on most listings. This means that you can pay an upfront deposit and then make the rest of the payments on dates down the road. These days will be listed as a part of the checkout process.

If you decide to pay for the whole thing in one payment, the full balance of the booking will be charged once the host confirms your stay.

Even though the booking will be charged upon confirmation by the host, it's worth noting that the host actually doesn't receive the funds until 24 hours after check-in. This helps to ensure that guests have the opportunity to resolve issues once they are there. Basically, both guests and hosts have the chance to make sure that everything pans out as expected before money exchanges hands.

AirBnB accepts a number of different payment methods in the United States, including:

Accepted payment methods are going to depend on the country where you are booking a stay. If you're booking outside of the United States, you'll want to check on the AirBnB site to learn about the acceptable forms of payment.

It violates Airbnb's terms of service to pay in cash, offline, or off-platform (after all, they want to get their cut, right?) You can end up being removed as a user from the site if you violate their terms of service.

Did you choose to pay with a payment plan, and you're wondering how to find out when your card will be charged?

Here are the steps you'll want to take:

Are you planning on booking a rental through Airbnb for more than 28 months? If so, the payment process is a little bit different. Stays of this length are considered long-term reservations.

For extended getaways, the first payment will be made at the same time as the confirmation is processed. This means that you'll want to be ready for your card to be charged as soon as you make the booking. The following payments will be made monthly after the initial month's rent has been made.

Now let's look at some of the most common questions we receive about Airbnb and credit cards to help you plan your next trip.

If you're planning on staying at an Airbnb for an upcoming trip and you've stacked up some credit card points recently, you might be wondering if you can use them toward your stay.

There are three ways that you can cover your next Airbnb booking with credit card points:

If your credit card offers cash-back rewards, you can use your rewards points to get cash sent back to your card or to your bank account. It's also possible that your rewards program will let you buy a specific Airbnb gift card as one of the redemption options.

It's worth noting that there can be some restrictions with Airbnb gift cards. For example, you can't use these gift cards to cover long-term reservations (meaning longer than 28 days.) You also can't use them as second payments if you're paying in two installments or to make changes to existing reservations.

Before you go this route, it's worth looking into how many cents you're receiving per point or mile. This is because turning your points into gift cards or cash back isn't always the best way to get the most bang for your buck, particularly with some of the big travel cards. You might find that there is a better way to use your points or miles to pay for a booking.

That being said, if you don't have travel plans anytime soon and your points are going to expire, spending them on a gift card now can let you take advantage of them before they disappear.

If you have a credit card that is a co-branded hotel card, you will usually only be able to redeem them with a specific hotel chain. However, there are also more general travel cards that come with a lot more flexibility.

While the details are going to vary depending on the card that you have, there are many travel cards that let you redeem miles or points for credit that can end up being put toward a wide range of travel purchases, including Airbnb bookings. This is because payment networks categorize Airbnb payments in the same way they classify hotel purchases.

If you have one of the fancier credit cards out there, it's possible that you will be able to use your annual travel credit in order to save some money on your next Airbnb stay.

For example, the Chase Sapphire Reserve card comes with a travel statement credit of $300 which renews every year on your account anniversary. This is a benefit that cardholders receive automatically and can use on lots of different travel expenses, including Airbnb.

Another instance of this possibility is the U.S. Bank Altitude Reserve Visa Infinite Card, which comes with a $325 annual travel credit. According to U.S. Bank, this credit can be used at Airbnb so long as the purchases are classified as hotel purchases.

The card also comes with an enrollment bonus that is worth $750 in travel expenses if cardholders spend $4,500 in the first 90 days of opening the account.

Both of these cards come at a price, of course-- the Chase Sapphire Reserve has a $550 annual fee, while the U.S. Bank Altitude Reserve Visa Infinite has a $400 annual fee.

In addition to the Chase Sapphire Reserve card discussed in the previous section, there are a number of cards that let you earn extra rewards on Airbnb stays. With some of these points cards, you can even redeem the same rewards you earned using Airbnb to purchase more bookings at Airbnb!

Every dollar you spend on all purchases, including Airbnb purchases, will give you two miles back. You can also redeem your points at Airbnb at the rate of one cent per mile through redemption as a travel statement credit. This is true for Airbnb purchases as well as other travel purchases that qualify.

Here are some more benefits of this card:

On the flip side, here are some of the less desirable features:

You can use the Chase Sapphire Preferred on Airbnb purchases and other travel expenses and earn two points back for every dollar spent. You can pay for Airbnb bookings with points by redeeming the points as cash back, which come in at a rate of one cent per mile.

Some great things about this card include:

Cons include:

Some other cards you'll want to explore if you're planning on staying at a lot of Airbnb's include:

Do you want to clean up your credit report to work towards eligibility for some of these cards with great rewards? Make sure you check out our guides to removing collections, hard inquiries, dispute comments, charge-offs, evictions, and late payments if you are ready to improve your credit.

Managing the calendar of payments for your credit cards and other bills can be a challenge, but when you put in the time and effort to keep your credit file clean it can be a major benefit to your financial life. Using a credit card for things like Airbnb stays can help you build up a positive payment history if you pay your bills on time. This shows creditors and lenders that you are a responsible borrower who will likely pay back your debts.

If you have a thin credit profile, though, or less-than-ideal credit, it can feel overwhelming to achieve a great credit score. Though cleaning up your credit report and building credit might not be anyone's idea of a great time, it's well worth the effort. Over your lifetime, having an excellent credit score can save you tens of thousands of dollars, if not more.

Are you searching for more resources to help you build your credit? If so, make sure you check out our Credit Building Tips blog.

There are few things more unnerving than realizing that someone has stolen your credit card or your financial information. If someone committed credit card fraud using your card number or info, what happens to them?

Is credit card fraud a felony? What punishment does a fraudster receive?

Credit card fraud is a serious crime, but whether or not an individual is charged with a felony or a misdemeanor will first depend on where the crime was committed and whether the crime is being prosecuted at the state or federal level. Though punishments can vary depending on the jurisdiction, punishments can include lengthy jail time and hefty fines.

Credit card fraud is a serious crime, but whether or not an individual is charged with a felony or a misdemeanor will first depend on where the crime was committed and whether the crime is being prosecuted at the state or federal level. Though punishments can vary depending on the jurisdiction, punishments can include lengthy jail time and hefty fines.If someone stole your credit card and racked up charges, it's natural to want to know what will happen to them. Let's take a look at what you need to know about the credit card fraud laws in the United States at both the federal and state levels.

When a person takes information from another individual's credit card or debit card with the intent to remove funds or charge purchases to the card, it is considered a form of identity theft.

There are a number of ways that an identity thief can obtain information from a credit card, including:

There are a few different ways that credit card fraud can be committed. Some common examples include:

Fraudsters use a wide variety of scams to open new accounts in someone else's name or to get card info illicitly.

Here are some common fraud methods:

Has your credit report seen better days? Start cleaning it up with the help of our guides to removing late payments, evictions, charge offs, collections, and hard inquiries.

There are laws at both the state and federal levels addressing the rising threat of credit card fraud and debit card fraud. Whether or not credit card fraud is considered a felony or a misdemeanor depends on a number of different factors. Still, it is primarily determined by the laws in the jurisdiction where the fraud is committed.

Some factors that can influence whether this type of fraud is considered a felony at the state level include:

The laws regarding credit card fraud at the federal level focus on commerce that occurs between states or internationally. Using a credit or debit card that is stolen or was obtained fraudulently is a federal crime.

Most credit card fraud cases are prosecuted at the state level. However, under 18 U.S.C. § 1029, they can also be charged as a federal crime. At the federal level, credit card fraud is often referred to as access device fraud.

It is a felony at the federal level to use, produce, or traffic in "unauthorized access devices" or "counterfeit access devices." Access devices are any tool that are used to gain access to another individuals personal information or financial accounts and include credit cards, gift cards, and debit cards.

Federal credit card fraud might sound like something only big-wig criminals are guilty of, but it's actually not as complex as you might think. If someone uses another individual's credit card to purchase something online or uses someone else's card that was issued in a different state, it becomes a federal crime.

It's also worth noting that someone who has committed credit card fraud at the federal level could also be charged with a number of other related federal crimes, including:

Credit card fraud laws in every state in the U.S. make it illegal to possess and use a credit card illegally. If you're interested in learning the laws in your state, you'll want to look at the specific statutes on the books.

Let's look at a few U.S. states' credit card fraud laws.

As an example, let's look at the credit card fraud laws in Texas, the second most populous state in the country.

In the next section, we'll look at what the punishment is for committing this crime in Texas.

Looking at the laws in Ohio regarding credit card fraud, we see that credit card fraud is a 1st-degree misdemeanor if the total value of the property, services, and debt is less than $1,000.

First and second offenses for credit card fraud in Florida, so long as the amount is $100 or less, is considered a misdemeanor. Any fraud involving a value of more than $100 is considered a felony, as well as third offenses of any amount.

Using a revoked or canceled credit card knowingly is considered a misdemeanor in New York. However, it's a felony to be in possession of a stolen card.

The state of California typically prosecutes credit card fraud as theft. Whether the charge against the fraudster is a misdemeanor or a felony has to do with how severe the crime was.

Ready to rebuild your credit? Take a look at our list of credit score hacks and our guide to removing derogatory marks from your credit report.

What type of punishment does a credit card fraudster receive? Though it can vary depending on a number of factors, the consequences of this type of crime can be as severe as serving substantial time in prison and large fines.

People that are convicted under the federal statute for access device fraud, which includes credit card fraud, can face up to 10-20 years in prison. Beyond that, they can also be required to forfeit items or money that they acquired illegally and pay a fine of up to $250,000. Restitution is also a possible outcome of credit card fraud at the federal level.

Being found guilty of related crimes such as mail fraud, financial institution fraud, computer fraud, or wire fraud can result in up to thirty years in prison.

The punishments for credit card fraud at the state level are going to vary depending on the state where the crime was committed and is being prosecuted.

Earlier in the article, we discussed the Texas laws regarding credit card fraud and the fact that they are all charged as felonies.

Here are the potential punishments for committing credit card fraud in Texas:

In California, penalties range from spending six months in jail and paying a $1,000 fine to being sentenced to three years in prison. The criminal can also be ordered to pay restitution.

The state of Florida offers severe punishments to credit card fraudsters as they are often classified as third-degree felonies unless the value is less than $100 and it is only a first or second offense. This can result in up to five years in prison and up to $5,000 in fines. For crimes that exceed $300 or involve more than one victim, criminals can be given up to fifteen years in prison and up to $10,000 in fines.

According to the Federal Trade Commission, credit card fraud has been the most common type of identity theft since 2017, except for a couple of months when there was a rise in unemployment benefits and relief program fraud during the height of the pandemic.

A survey released by the Federal Reserve helps to give more clarity to the scope of credit card fraud in the US, with the Survey of Consumer Payment Choice finding that 3.5% of credit card holders stated that they experienced theft, loss, or fraud related to a credit card in the previous year. The percentage of people that report this type of issue varies a bit from year to year, but the average is roughly 4.7%.

Another survey conducted by Security.org discovered that 58% of respondents had, at some point in their lives, experienced credit card fraud. For 9% of these respondents they had dealt with credit card fraud four or more times.

As you can see, credit card fraud is not, by any means, rare, and you certainly shouldn't assume that it just won't happen to you.

What can you do to keep yourself safe from credit card fraud?

Here are some tips:

If you think someone has been fraudulently using your credit card information, what should you do?

Here are some steps you can take:

Credit card theft isn't always considered a felony, but it is pretty much always treated as a serious crime. Whether it occurs at the federal level or the state level, knowingly using someone else's credit card information can result in lengthy prison or jail sentences as well as large fines.

If you are curious to know what the laws are in your state, you'll want to take a closer look at your state's penal codes. These will outline how fraud is defined, what constitutes each level of misdemeanor and felony, if applicable, and the potential punishments for individuals found guilty.

Dealing with credit card fraud can be truly overwhelming. Still, it's important to know that there are steps you can take when you discover fraud, ways to protect yourself in the future, and strategies you can use to clean up your credit so you can increase your access to financial opportunities down the road.

Are you on a quest to improve your credit? If so, make sure you check out our Credit Building Tips blog for more valuable resources.

Most of us are happy when our credit cards offer us some cash back rewards or airline miles. For the lucky few that are in possession of the hardest credit card to obtain in the world, though, the perks go far beyond these basic benefits.

The average Joe or Jane isn't going to be able to even apply for one of the most exclusive credit cards, though. These are typically invite-only and are reserved for the planet's most affluent individuals.

There are several cards in the running for being the most difficult to obtain-- including the Amex Centurion Card, the Dubai First Royal MasterCard, the Stratus Rewards Visa White Card, and the Coutts World Silk Card.

There are several cards in the running for being the most difficult to obtain-- including the Amex Centurion Card, the Dubai First Royal MasterCard, the Stratus Rewards Visa White Card, and the Coutts World Silk Card.Are you curious about how the other half lives? If so, stick with me while I take us on a journey through the luxurious perks of the world's most prestigious credit cards.

It's hard to pin down precisely which card is the hardest to get in the world. That doesn't mean, though, that there isn't impressive competition for the title.

One reason it's hard to pick one card as the most difficult to obtain is that the card issuers are very tight-lipped about the qualifications for these status symbols. Instead, curious consumers have to rely on rumors in many cases to learn what is required to have one of these exclusive cards in their wallets.

Let's take a look at some of the contenders when it comes to the hardest credit card to get in the entire world.

If the Centurion Card doesn't sound familiar to you, maybe you've heard of this exclusive American Express charge card by its colloquial name-- the Black Card.

Reserved for only the wealthiest clients of Amex. In order to qualify, individuals must have a certain network and credit quality. Beyond that, they have to have met certain spending criteria on the Platinum Card, which is considered its gateway card.

Minted out of anodized titanium, accented with stainless steel, and laser-engraved, this card weighs about half an ounce. With its distinctive black color, this card is recognizable around the world.

Considering this is one of the most exclusive cards in the world, it should come as no surprise that there's no easy way to apply. Though the requirements for receiving a private invite for this card aren't officially released by Amex, the rumor is that you will need to spend and pay off a certain amount of money across all Amex accounts in one year-- potentially as much as $350k and $500k.

Joining this exclusive club isn't free either-- there's an initiation fee of $10k, and the annual fee will run you $5k.

Are you on a mission to improve your credit so you can qualify for credit cards with better interest rates, better terms, and better perks? Take a look at our guides to credit repair hacks and removing derogatory marks from your credit report.

Though the Black Card (aka the Centurion Card) is definitely a major status symbol, it also offers some serious benefits:

Looking for an American Express card that's a bit more accessible to a regular Joe? Check out our guide to the easiest Amex card to get.

Some of the biggest named celebrities carry around a Black Card in their wallet.

They include:

Another contender for the title of the hardest credit card to get is the JP Morgan Reserve Credit Card. This is another invite-only card, you'll need to already be a J.P. Morgan Private Bank member in order to be considered.

Once known as the Chase Palladium Card, the card is made out of palladium, a rare chemical element.

The JP Morgan Reserve Card's annual fee sounds like a steal compared to the cost of some of the other cards on this list-- only $595 a year.

What can you expect once you're invited into this exclusive club and receive your card?

The perks associated with this card aren't actually that incredible when you consider that many of them are very similar to a much more accessible card: the Chase Sapphire Reserve.

In this way, you could say that this card is more of a status symbol than anything else.

That being said, cardholders enjoy the following perks:

It's hard to say which credit card is the most selective, but the Dubai First Royale Card is definitely in the running. This is another invite-only card, and Dubai First will literally scout out potential clients. You probably shouldn't hold your breath waiting for an invite, though-- most cardholders are members of the Saudi or Dubai royal families or at least have an exorbitantly high net worth.

According to a 2011 statement from the senior vice president of Dubai First, there are only a few hundred cardholders in the entire world.

Made with gold edges and a white diamond, this card has no purchase restrictions or credit limits. If you find yourself one of the lucky few that have this card in hand, you won't have to worry about the embarrassment of your gold-and-diamond card being declined at checkout.

Some of the benefits of this outrageously hard-to-get card include the following:

If you need any convincing that the Coutts Silk Card is exclusive, you'll likely be persuaded by the fact that the British Royal family are known to be cardholders. Offering both charge cards and credit cards, this is considered one of the hardest cards to get in the world.

In order to be considered for this card, individuals must already be Coutts clients. Though companies are famous for being tight-lipped about the requirements for these elite cards, rumor has it that potential cardholders need to have the ability to deposit something around one million pounds into their account.

Only the wealthiest clients have access to this card, which comes with a number of perks:

Searching for more information about credit cards? Check out our guides to CareCredit credit cards, what happens if a credit card is closed with a balance, guaranteed approval credit cards, and credit card nicknames.

When you hear the term "gold card," you probably think of a gold colored card that's supposed to help regular old consumers feel kind of fancy. This isn't the case with the Sberbank Visa Infinite Gold Card-- this card that is only offered to Sberbank's top clients is said to be made of pure gold. If that isn't enough, it also has twenty-six diamonds and a mother of pearl.

Getting this card will cost cardholders $100,000-- while $35k gets credited to the client's account, the other $65k goes toward actually making the card. Oh, and there's a $2k annual fee on top of that.

Some of the perks of this card include:

Not quite ready to apply for one of the most exclusive credit cards in the entire world? No problem. If you're looking for something a little more accessible, check out our post about the best department store credit cards for bad credit.

You may have heard this card referred to as "The White Card." Incredibly exclusive, there is very little public information about this card beyond the $1.5k annual fee.

In order to get one of these exclusive cards, you have to be either:

Wealthy cardholders can enjoy the following benefits:

If you're chomping at the bit to get your hands on the Amex Centurion, Dubai First Royale Card, or another one of the hardest credit cards to get, you likely have a long road ahead of you unless you're already a multimillionaire.

At the same time, the journey of a thousand miles starts with a single step! If you're ready to build wealth and ensure that you have access to the best financial opportunities out there, one of your first tasks is going to be to check in on your credit report and score.

If your credit score has seen better days, don't fret! With some time and dedication, you can clean up your credit report and increase your credit score so you start qualifying for better cards with more impressive rates, terms, and, of course, perks!

Are you ready to begin your journey to a better financial life? If so, head over to our Credit Building Tips blog for tons of resources to help you along the way.

Did you open a new credit account only to find that your new Capital One credit card is restricted?

There are a number of reasons this could have occurred, and in many cases, there are easy steps you can take to ensure you can use your card.

Your Capital One credit card might be restricted because you haven't yet activated it, or it could be due to late payments, going over the credit limit, or suspicious activity.

Your Capital One credit card might be restricted because you haven't yet activated it, or it could be due to late payments, going over the credit limit, or suspicious activity.Let's take a closer look at the reasons why your card might be restricted and some common solutions that could help you regain access to your credit account.

Getting a new credit card can be exciting, but seeing that your card is restricted can be quite concerning. When it says that your account is restricted it means that it is suspended.

Before you start to panic, it's important to recognize that a suspended or restricted account doesn't mean that your account is closed. It just means that you won't be able to use the card or account until the restriction is lifted.

Are you thinking about applying for a new credit card? Make sure you look at our posts about getting a credit card before applying for a home loan and how a new card impacts your credit score.

Credit card restriction or suspension isn't something that just happens with Capital One cards. It can happen with any credit card issuer.

Some of the most common reasons for a restricted card include:

If you haven't used your card at all yet, though, none of these should apply to you. In that case, it might be that your account isn't yet activated or that there is a technical problem happening on Capital One's side of things.

If your Capital One card is brand new and your account is restricted, there's a good chance that this is simply because your card is new.

Capital One can restrict accounts until new credit cards are activated as a way to protect your account from fraudulent activity. For example, if someone else got a hold of the card Capital One sent you in the mail, without restricting your account it's possible that an identity thief could start making charges to your account.

If you just recently received your Capital One credit card and you haven't yet activated it, there's a good chance that activating the card will remove the restricted status from your account. If you activate the card and it is still restricted, you'll want to contact Capital One customer service.

Another possible explanation for a new Capital One card that is restricted could be that Capital One is dealing with a system error or a network outage. If you are sure that your account is in good standing and that there shouldn't be any signs of suspicious activity, there's a chance it's just a problem on Capital One's end.

Before trying to troubleshoot other issues, you can give Capital One a call and try and determine if they are dealing with technical problems. It's possible that solving the problem is just a matter of waiting for them to resolve the issue.

Is Capital One showing up on your credit report and you're not sure why? Check out our guide to what COAF means on your credit report.

If you've been using your new card for some time and all of a sudden, your account is restricted, another possible explanation is that Capital One has flagged purchases that they find suspicious. Suspicious activity can include purchasing activity that isn't in sync with your normal spending patterns.

For example, if there are several unusual transactions on your account in a short period of time, a very high-dollar amount purchase, or a purchase overseas, Capital One might restrict your account out of concern that your credit card information has been obtained by a fraudster.

If you're traveling abroad and your card is restricted all of a sudden, it might be that Capital One is concerned that someone has gained possession of your card or your information. You'll want to contact them to let them know that you're traveling and that the purchases are being made by you so you can regain access to your account. A particularly prudent move would be to call them before you leave town so you can give them a head's up that you'll be traveling.

Have you missed payments, made late payments, or gone way over the credit limit of your new card since you've been using it? If so, it's possible that these repeated violations of the credit card's terms have resulted in your account being restricted.

There are a number of different ways you can violate the terms of your agreement, but regardless of the cause, you'll want to try and determine the specific cause and rectify it right away. If you've missed a bunch of payments, for example, Capital One could eventually charge off your account. This means that the account is closed and passed off to a debt collector, both of which are going to be harmful to your credit.

When it comes to spending more money than your credit limit, it's worth noting that many card issuers will let you spend a certain amount more than your limit and maybe charge you a fee when this occurs. If you do this over and over again, they might restrict your account.

Have you been dealing with financial problems that led to less than ideal credit? Start cleaning up your credit report with our guides to removing collections, evictions, hard inquiries, and charge offs from your credit report.

Whether or not you can reactivate a restricted card or a suspended card depends on the credit card company, the circumstances that led to the restriction or suspension, and other factors.

You might want to take a look at your credit report to take a look at the status of your account and what's been reported. You can receive free copies of your credit reports through AnnualCreditReport.com, which is the site created by Experian, Equifax, and TransUnion and authorized by Federal law.

What should you do if your account is restricted? Here are the steps you'll want to take.

If your card is literally brand new and you haven't used it yet or even activated it, try to activate your card using the information on the sticker on your card. If you haven't received your card yet, you'll need to wait until you receive it to activate it. After all, you wouldn't want your activated card out there in the mail before it's in your possession.

If your card is already activated or activating it doesn't seem to help, the next step is to call Capital One customer service.

The customer service number for Capital One is 1-800-CAPITAL (1-800-227-4825). A representative will be able to inform you as to why your account has a restricted status and what steps you need to take to remove the restriction.

Once you give the customer service agent your information and verify your identity, they will be able to give you more information about your specific account. Make sure you confirm with them the actions you'll need to take in order to have your account restored before getting off the phone.

For example, if the restriction is due to having a balance that is over the credit limit, they might state that you need to pay off enough of the card so that what you owe is less than your total credit limit. Once you do that, your account will likely no longer be restricted.

If the restriction was caused by late payments, you might be able to make a specific minimum payment in order to have the restriction removed. No matter what the reason behind the restriction is, ask the representative about the time frame regarding when your account will be back to normal.

Dealing with a restricted card can be pretty frustrating, particularly if you're trying to make a purchase. Luckily, there are a number of things you can do to reduce the likelihood of ever having to deal with an account restriction.

If you end up spending more money than you are allowed via your credit limit, it could result in your account becoming restricted.

To avoid this outcome, make sure you regularly monitor your credit card spending as well as your balance. You can easily see how much money you have left before reaching your credit limit.

If you expect that you're going to need to spend more than the credit limit and you have had a good history with your issuer, you might consider asking for a credit limit increase. This can result in a slight ding to your credit if they run a hard inquiry to make sure you meet the standards. However, inquiries usually only negligibly impact your credit in the long run.

A number of credit card issuers offer fraud and security notification services. This means they will send you a notification or a message if any account activity comes across as suspicious.

Capital One and other card companies might restrict or suspend an account if they think it might be being used fraudulently. For example, if there are unusual purchases or large purchases made that are out of the ordinary for the account, they might freeze it to ensure no further fraudulent activity occurs.

Signing up for one of these services can help you know as soon as possible if Capital One thinks that activity on your account is suspicious. This can allow you to contact the card issuer and sort the situation out if it was, in fact, you who made the purchases. If it wasn't you, you'd want to know so that you can take the necessary steps to avoid further fraudulent activity.

If you miss too many payments, your Capital One account (or any other credit card account) could be permanently suspended.

It's essential to make payments on time if you're going to have credit cards, as missing payments can absolutely wreak havoc on your credit score. A certain number of missed payments in a row can result in your account being charged off and passed to a debt collector. To keep your credit report and score in good standing, make sure you're always keeping up with your payments.

Credit card companies might also restrict an account if purchases are all of a sudden being made in a different country than where you live or a place that is otherwise far from your home. This is a fraud prevention technique, but it can be frustrating and stressful if you're actually just on vacation trying to use your card.

Many credit card companies allow you to give travel notice using their website on mobile app if you're planning on taking a trip far from home. This can ensure your card won't be declined when you try to use it in a different state or country.

While you aren't required to tell your credit card company if you're traveling, it can help save you some hassle to alert your card issuer about your plans.

If you're traveling to a different city not terribly far from where you live, you probably don't need to set a travel notification with your issuer. However, if you're traveling out of the state or out of the country, there's a chance your card could be declined unless you let them know ahead of time.

You can also call up Capital One to let them know if you're planning on making an unusually large purchase. The same goes for any other card issuer-- Capital One isn't the only company that restricts accounts.

For example, maybe you have always only used your card to buy gas for your car. This month, though, you're planning on using it to buy new appliances for your kitchen, all on the same day.

Consider giving your credit card issuer a head's up when you're planning on making an unusually large purchase. This can help ensure that your card isn't restricted due to being flagged for suspicious activity.

When your account is restricted or suspended, it can be pretty inconvenient. At the same time, you might worry that it's going to destroy your credit score. Will it have any impact on your score?

The answer to this has to do with the reason for the restriction and whether or not you will be able to reopen your account. If your account is permanently suspended, there's a possibility this could lead to the account being closed completely.

Having a credit card account closed can impact your credit score in two primary ways:

Beyond that, if your account was restricted or suspended because you stacked up a number of late payments, it will also have a negative effect on your score. This is because payment history is a big part of your credit score. Additionally, any missed or late payments are going to show up as derogatory marks on your credit report for up to seven years.

All that being said, if your account wasn't restricted because of late payments or isn't going to be closed for good, a restricted card shouldn't hurt your credit.

Getting a new credit card only to find that it's restricted is pretty frustrating. If you've never used the card, it's possible that you just need to activate it. If you have used the card already, reasons for a restricted status include a balance that's over the credit limit, suspicious activity on your account, several late payments, or a technical problem on the part of Capital One.

Either way, though, the best course of action is to call the card company to try and figure out what's going on. There's a good chance there is a quick fix to the problem-- whether that's activating your account, paying down a high balance, or something else-- so that you can start using your card again.

Are you on a mission to improve your credit so you can have lots more financial opportunities in the future? If so, make sure you take a look at our Credit Building Tips blog for tons of resources that will help you get in great financial shape.

Mobile homes can be an affordable and accessible way to become a homeowner, but they are usually still costly enough that buyers want to finance the purchase.

In general, it can be a bit more difficult to find financing for a manufactured home than it is for a traditional home because they tend to depreciate over time. That being said, that doesn't mean there aren't plenty of loan options for people that want to buy a mobile or manufactured home.

Your credit score is going to have a big impact on whether you're approved for a loan as well as the rates and terms you're offered. The minimum credit score necessary to buy a mobile home is going to depend on the type of loan you apply for and the lender. While Fannie Mae and Freddie Mac have a 620 minimum, other options like FHA loans, personal loans, and chattel loans can help people with less-than-ideal credit purchase a home.

Your credit score is going to have a big impact on whether you're approved for a loan as well as the rates and terms you're offered. The minimum credit score necessary to buy a mobile home is going to depend on the type of loan you apply for and the lender. While Fannie Mae and Freddie Mac have a 620 minimum, other options like FHA loans, personal loans, and chattel loans can help people with less-than-ideal credit purchase a home.Let's take a look at what you need to know about financing a mobile home or manufactured home and how your credit score will impact your chances for approval.

When you decide to start shopping for a mobile home, one of the first questions on your mind is likely how you're going to pay for it. Considering that even the most affordable used mobile homes usually cost at least $10,000 and new manufactured homes cost more than $125,000 on average, there's a good chance you're thinking about finding financing for the purchase.

Once you start talking about taking out a loan for a big purchase, the next question that crops up is usually:

"What credit score am I going to need?"

The truth is, there is no set credit score minimum for financing a mobile home because it's going to depend on the type of loan and the lender you choose. That being said, the better your credit score, the better chance you'll be approved and the more appealing rates and terms you'll be offered.

Here's a general sense of what you can expect as far as minimum credit scores go, depending on the loan type you apply for:

Do you have bad credit but you want to buy a mobile or manufactured home? Make sure you check out our guide to buying a mobile home with bad credit.

Mobile homes, modular homes, and manufactured homes are all built in a factory and then shipped to the location where they will be set up.

Mobile homes are built in a factory and then transported to a place where the house will be set up. In some cases, metal tie-downs will be used instead of a foundation.

Mobile homes:

- Were built before June 15, 1976

- Often don't have a basement or crawlspace and instead are usually built on a metal frame

- Were built in a factory and delivered fully constructed to a location

- Might have tie downs rather than a permanent foundation

- Cost, on average, between $10k and $50k

So far, this description also fits manufactured homes. The distinction between the two has to do with when the home was constructed.

Mobile homes can be single wide (500-1000 square feet) or double wide (1,000 to 2,200 square feet)

Technically, mobile homes were built in a factory before June 15, 1976. At this point, the National Manufactured Housing Construction and Safety Standards Act was put in place by the U.S. Department of Housing and Urban Development, which changed the name of this type of home going forward and put new safety standards in place.

If you're looking for a pre-existing home that will come at a lower price than newly manufactured homes, a mobile home can be a good option.

The simplest way to understand what manufactured homes are is to see them as mobile homes that were built after June 15, 1976. Just like mobile homes, they are built in a factory and then delivered fully constructed to the location where they will be set up.

One key distinction between manufactured and mobile homes, though, other than the date of construction, is that manufactured homes aren't built with the intention of being moved once they have been put in place.

Manufactured homes:

- Were built after June 15, 1976

- Often don't have a basement or crawlspace and instead are usually built on a metal frame

- Were built in a factory and delivered fully constructed to a location

- Might have tie downs rather than a permanent foundation

- Cost, on average, $87,600

The construction of manufactured homes is highly regulated under the HUD Code, known as the Manufactured Home Construction and Safety Standards. Manufactured homes also need to meet the local building standards for the place where they will be set up, and designs for these homes have to be approved by a HUD-approved Design Approval Primary Inspection Agency.

Manufactured homes can be single wide (500-1000 square feet) or double wide (1,000 to 2,200 square feet)

Manufactured homes can be a good option for people that are looking for a home that is new but isn't as expensive as a traditional home, while also requiring no building on site.

Modular homes are also built in a factory and delivered to their final location, much like mobile and manufactured homes. However, they are a lot more like a regular home, using a traditional foundation and including either basements or crawlspaces.

Modular homes:

- Usually require some construction on site

- Are typically delivered in multiple pieces to the property

- Are more similar in size and features to traditional homes

- Usually have a traditional foundation and a basement or crawl space

- Cost, on average, $270k

Rather than appearing on the site in one piece, modular homes will usually arrive in one or more pieces and then be constructed on location by a local contractor. These homes must meet the same building codes as any other home in the same area.

Modular homes are often between 900 square feet and 2,000 square feet

Pricier than mobile and manufactured homes but still more affordable than other new construction homes, modular homes can be a good choice for people that want a new home with customizable features for a lower total cost than a traditional home.

Let's take a quick look at some of the financing options you'll want to explore when considering buying a manufactured or mobile home.

Fannie Mae has a specific program for purchasing manufactured homes known as the MH Advantage program.

In order to qualify, there are a number of qualifications you'll need to meet, including:

You might be able to put as little down as 3% for these 30-year loans.

The Freddie Mac Home Possible mortgage program could help you buy a manufactured home so long as you qualify. You can choose between fixed-rate and adjustable-rate loans, and you might be able to put as little as 3% down.

Both Title I and Title II FHA loans can be used to purchase manufactured homes. Though there are a number of requirements one must meet to qualify. This can be a great option for people that have a lower credit score but the ability to put 10% down.

Members of the military community might qualify for a VA loan for a manufactured home. With these loans backed by the Department of Veterans Affairs, lenders can sometimes offer up to 100 percent financing.

This is a particular type of personal property loan that is designed to finance pricey vehicles like boats, planes, farm equipment, and mobile homes.

This is a secured loan where the vehicle serves as collateral. This means that you can get a lower interest rate with a chattel loan than a personal loan, but it also means you can lose your mobile home if you default on the loan.

Depending on the price of your mobile home, a personal loan might cover the cost. These tend to have higher interest rates because they are unsecured loans. At the same time, there aren't costly appraisal, escrow, and title fees that are often involved when getting a secured loan for a mobile home or traditional home.

Personal loans are a type of installment loan, meaning that you borrow money from a lender and pay it back over time at a fixed interest rate in equal monthly payments.

What are the steps you'll need to take to get financing for a mobile home? Let's take a look.

One of the first things you'll want to do when you decide that you want to buy a mobile or manufactured home using financing is to take a look at your credit report.

As a part of your loan application, the lender is going to consider your credit score and file. Having a strong credit score as well as a clean credit history will make it much more likely that you will have your application accepted. Beyond that, the better your credit is, the better rates and terms you will be offered.

When you look at your credit reports-- which you'll want to pull from all three major credit bureaus-- you should keep an eye out for any inaccuracies or errors. If you find mistakes, you'll want to start the dispute process to ensure that your credit report is all cleaned up before lenders take a look at it.

Has your credit report seen better days? Check out our guides to removing evictions, 30 day late payments, charge offs, collections, and hard inquiries to help you clean up your credit file.

Buying a mobile or manufactured home means that you're also going to need a piece of land to put it on. Some people might choose to buy their own land or use a piece of land they already own, while others might plan to rent the property.

The reality is that there will be fewer loan options if you are thinking about renting land rather than buying it or using a piece of land you already own. In general, lenders are going to be more open to offering financing if you will own the land it is on, particularly if there are no wheels and axles on the home.

The type of loan you will be eligible for will be impacted by the type of home you're thinking of buying. Purchasing a manufactured home that costs more than $100k, for example, will mean that you won't qualify for an FHA loan.

If you're looking for an actual mobile home that was built before 1976, you are likely going to struggle to find financing. These older, used homes do come at a cheaper price tag, though, meaning that you might be able to make it work using a personal loan or another type of loan.

Making decisions about the type of home you're going to buy can help you get a better sense of what your loan options are.

Now that you know whether you're buying or renting land and what type of factory-built home you want to buy, it's time to take a closer look at what your financing options are.

When you're exploring your options, there's a good chance that you'll encounter a pretty big range of loan rates and fees. It's a good idea to shop around, as you might be able to save yourself a lot of money over the life of the loan.

It's generally a good idea to start looking into your financing options as soon as you know that you're planning on purchasing a mobile or manufactured loan down the road. This can give you the space to find the best rates and terms and also make an offer on the right home in a timely manner.

Finally, it's time to apply for the loans you've decided are worth pursuing. You'll want to make sure that your application is as complete as possible, as this will help boost the odds of qualifying.

Additionally, you'll want to be prepared to put down a down payment once you're accepted to help the process continue to move forward.

There are more factors than you might think that you'll want to consider when buying a mobile or manufactured home. Let's take a look at some of the most important questions you should ask yourself as you start exploring your options.

Mobile homes are, by definition, not going to be new as they were made in a factory before the summer of 1976. Beyond that, unless a home you've found has been stored in a warehouse somewhere since the day it was built, you're unlikely to come across a mobile home that's never been lived in.

When you shop around for used homes, you'll find that they are quite a bit more affordable than new homes. Unless they have been well-maintained, though, they will likely show signs of age and the wear and tear of being lived in.

You'll also want to take a close look at any rules and regulations for the location where you're planning on putting your home, as some of them won't allow manufactured homes that were built before a specific date. The last thing you want is to buy a home that you aren't allowed to set up on the land that you're renting.

Finally, it can be tempting to try and buy the cheapest mobile home that you can find when you're shopping around. However, it's important to think about the maintenance costs that you will need to cover over the life of living in the home. In some cases, paying a bit more upfront can ultimately save you more money in the long term.

Mobile and manufactured homes are typically classified based on their width. You'll usually see the following terms used to describe the size of these homes:

The size of the mobile home you choose will impact the size of the lot you need and also tend to be more expensive. This means that you will need a larger loan both for the home and for the land if you want to go with a double-wide.

Another important consideration is that some cities don't allow single-wide mobile homes. For this reason, it's essential to take a close look at the rules in your area before you start seeking financing or making a purchase.

One of the great things about mobile and manufactured homes is that you don't only get to choose the home you want, but you can also pick where you put it, too. With traditional homes, you have to find a house that you love in a location you love. When you buy a manufactured or mobile home, you can create the setting you want.

So, where will your mobile home go? Your options are:

One popular option is to rent land in a mobile home community. This means paying a monthly rental fee but also saving you money upfront since you don't have to buy raw land.

If you choose to put your home in one of these communities, make sure you check out any and all regulations and restrictions to make sure that the home you're buying will be allowed in terms of its size and features.

Though mobile and manufactured homes can be an affordable living solution, there are always going to be additional costs to ownership.

Some of the costs you'll want to consider when thinking about your budget overtime include:

In general, the better your credit score, the easier it will be to be approved for a loan with great rates and terms. Depending on the type of loan you're applying for and the lender you're working with, the minimum credit score is going to vary.

If you know that you're going to be buying a mobile or manufactured home in the future, it's a good idea to start working on boosting your credit score and cleaning up your credit report now. With some time and attention, you can improve the odds of approval and help yourself save tons of money over the life of the loan.

For more information about how to boost your credit to help you qualify for the home of your dreams or any other financial opportunities, make sure you check out our Credit Building Tips blog for more resources.

If you own a small business and a customer owes you money, you might be wondering whether or not you can report them to the credit bureaus. Even if you don't own a business, you might be curious to know if you have the right to report someone that owes you money to the major credit reporting agencies.

The reality is that reporting to the credit bureaus isn't something you can do in a one-off way. In fact, there really isn't any way that an individual can report to the credit agencies.

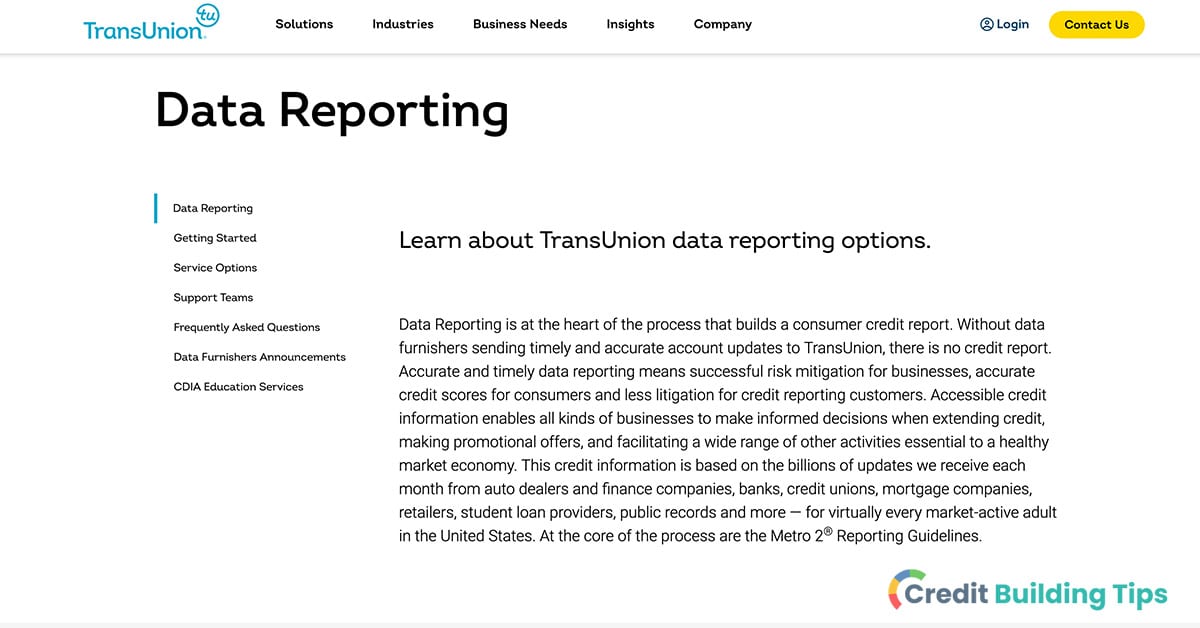

Small business owners that allow customers to pay for things in installments or offer lines of credit, though, can choose to apply to become data furnishers for one or more of the major credit bureaus. As data furnishers, these businesses are required to send accurate information monthly about their consumer accounts. An alternative option is hiring a debt collection agency to try and recoup the debt and report to the credit bureaus.

Small business owners that allow customers to pay for things in installments or offer lines of credit, though, can choose to apply to become data furnishers for one or more of the major credit bureaus. As data furnishers, these businesses are required to send accurate information monthly about their consumer accounts. An alternative option is hiring a debt collection agency to try and recoup the debt and report to the credit bureaus.If you're considering starting to send customer account information to the credit bureaus, stick with us while we go over everything you need to know.

Only officially approved data furnishers can report information to the credit bureaus about a consumer. Individuals aren't authorized to apply to be data furnishers.

Even small businesses, though, can report to the credit bureaus if they are accepted into their data furnisher programs.

If you want to report someone to the credit bureau, you will first need to become an approved data furnisher for the credit reporting agency where you want to send your information.

In order to become a data furnisher, you'll need to:

You can find more information about the specific requirements and application instructions for each credit bureau using the following links:

Once you have been approved as a data furnisher for your selected credit bureaus, you'll want to follow the following steps to report consumer information:

In order to maintain your ability to regularly report consumer information, you'll need to update the required software on a regular basis. Each credit bureau has its own standards that must be maintained in order to continue qualifying as an official data furnisher.

Here are a few additional tips for small businesses that want to report consumer information to the credit bureaus:

If you're not a large lender and aren't interested in becoming a data furnisher with one or more of the major credit bureaus, another option is to hire a collection agency.

Collection agencies are companies that will attempt to collect the debt that you are owed. This can be a reasonable route to take if you only have a few unpaid customer debts.

When choosing a collection agency, you'll want to consider the following:

The three major credit bureaus will not accept information from just any old consumer. If someone owes you money or has been repeatedly late in paying back a private, non-official loan, you're not going to have luck trying to add this information to their credit file.

In order to contribute information to the credit bureaus, you have to become a data furnisher.

Businesses must apply and be accepted as data furnishers at each individual credit reporting agency (or whichever credit bureau they wish to work with) in order to report consumer information. This is not a free service and requires that businesses adhere to and abide by the Fair Credit Reporting Act and all other applicable federal laws.

However, this does mean that small businesses that allow customers to make purchases on credit or pay using installment plans can become data furnishers if they want to make monthly payment reports on their customers.

To become a data furnisher, businesses need to choose the credit bureaus they want to report to and then apply for membership in their business reporting programs. Companies that want to make reports to all three credit bureaus will need to be separately approved by each agency.

Creditors, lenders, and small business owners that offer lines of credit or installment payment plans aren't required to report to credit bureaus by law.

Even though this isn't a requirement, many businesses choose to report information about consumer accounts to the credit bureaus, such as:

It is with this type of information that credit reporting agencies are able to generate consumer credit reports and calculate credit scores.

Other major events will also often be reported to the credit bureaus such as charge-offs and account closures.

You might wonder why businesses and creditors would bother reporting to the credit bureaus, particularly because it is a service that costs them money. There are ultimately a number of reasons why companies might be motivated to become data furnishers, including:

Unfortunately, you are not able to directly report your own financial activity to the credit reporting agencies. Even if you have bills that you regularly pay on time that aren't showing up on your credit report, Equifax, TransUnion, and Experian won't accept information from an individual consumer in this way.

The reason for this is that you have to become a "data furnisher" in order to report information to the major credit bureaus, which is an officially recognized status.

If you own a small business that lets people pay in installments or carry lines of credit, though, it's possible for you to become a data furnisher and report information regarding account payment histories to credit reporting agencies.

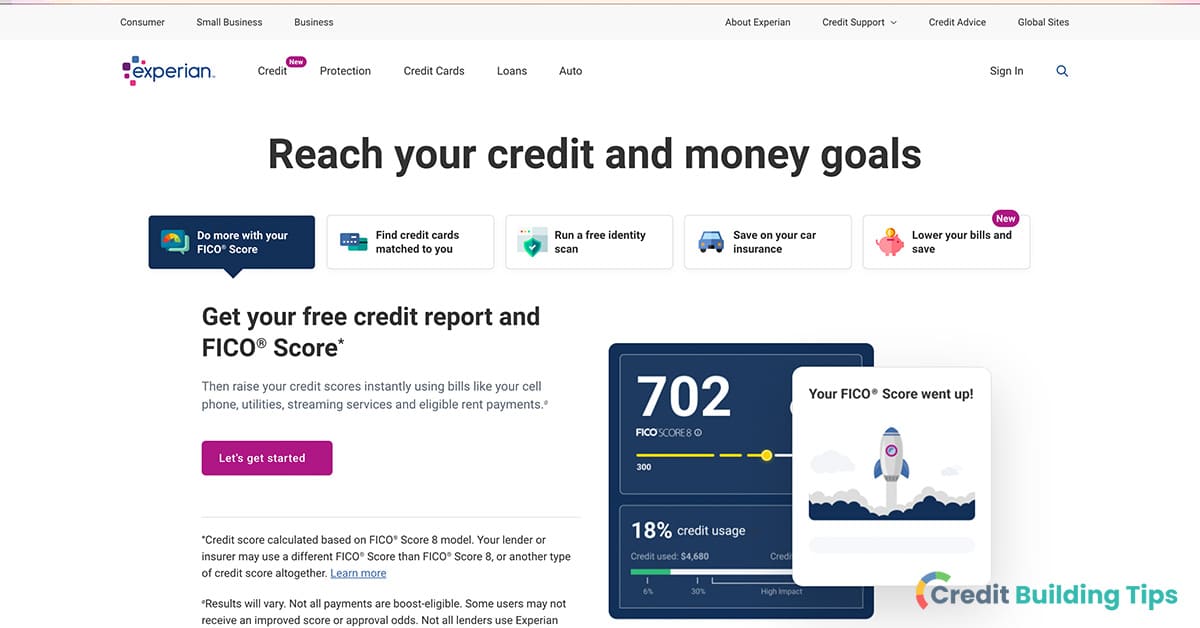

There are a number of third-party services you can use as well as services offered by Experian and FICO to add positive information to your credit report. These services will usually require that you turn over private financial and account information.

That being said, there are a number of ways that you can indirectly self-report your own positive financial habits to Experian, Equifax, and TransUnion. There are a number of third-party services you can use, like RentTrack and PayYourRent, which will help you gain positive marks on your credit for on-time rent payments. You can also use Experian Boost to add utility bills and phone bills to your Experian credit report.

Another new service is UltraFICO, which lets you add the balances in your bank account into the mix when calculating your credit score. This can help lenders understand that you have responsibly managed your bank balance (not frequently overdrawing your account) and have cash in your account.

The credit reporting process isn't as straightforward as one might expect, and you can't just report someone to the credit bureau as a regular Joe. To report to the major credit bureaus, businesses and lenders must apply and be accepted as data furnishers.

Yes, landlords and property managers can report information about a tenant's rental payments to the credit bureaus by signing up for a rent reporting service.

All three credit reporting agencies will display rental payment information if they receive it. Of course, landlords and property managers need to be accepted as data furnishers in order to contribute this information.

If your landlord or property manager doesn't report your rent to the credit bureaus, there are a number of reporting services that one can sign up for to have rent contribute to your positive payment history. These include:

Individuals cannot report information to the credit bureaus. Only businesses that have applied and been accepted to the respective data-furnishing programs for credit reporting agencies can send information. There are strict requirements and rules that govern reporting, and data furnishers that don't send regular or accurate reports can have their agreement terminated.

Some credit reporting agencies also maintain credit reports for businesses in addition to consumers. These reports will include the credit accounts owned by a given business, their payment history, the amount owed, any collection activity, and more.

In order to report information regarding another business to the credit bureaus, a company needs to apply and pay for the business credit reporting service at the credit bureau they want to report to. This is a separate service from the consumer credit reporting service.

It's easy to never give much thought to the world of credit reporting until it's something that impacts you directly. After all, the activity of the major credit reporting bureaus can seem pretty out of reach, and understanding how and why our credit reports look as they do can feel cryptic, to say the least.